Blank Affidavit of Death Form for California

When a loved one passes away, navigating the process of transferring or reassigning their assets can be a daunting and intricate task. In California, one crucial step in this process involves the use of the Affidavit of Death form. This legal document serves to formally notify interested parties and legal entities of a person's passing, thereby enabling the transfer of ownership of properties, titles, or other assets as per the deceased's wishes or legal requirements. The form itself is a vital tool within the estate management and probate avoidance strategies, streamlining the process for executors and beneficiaries alike by providing a clear, legal declaration of death. It's essential for anyone dealing with the assets of someone who has passed away in California to understand not only the form's implications but also the right way to fill it out and the specific situations in which its use is appropriate. By doing so, individuals can ensure a smoother transition during these emotionally challenging times, adhering to legal standards and minimizing potential complications that might arise during the asset transfer process.

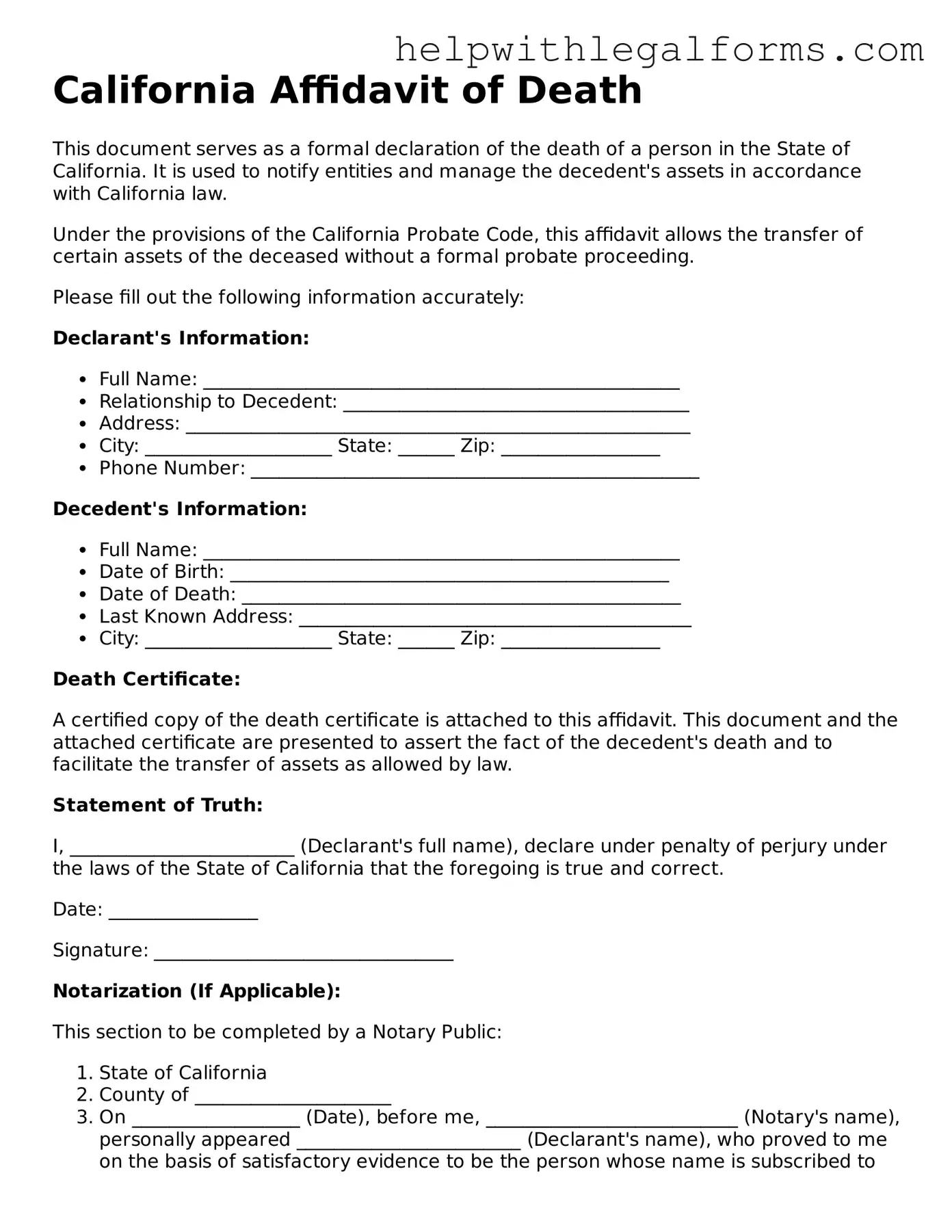

Example - California Affidavit of Death Form

California Affidavit of Death

This document serves as a formal declaration of the death of a person in the State of California. It is used to notify entities and manage the decedent's assets in accordance with California law.

Under the provisions of the California Probate Code, this affidavit allows the transfer of certain assets of the deceased without a formal probate proceeding.

Please fill out the following information accurately:

Declarant's Information:

- Full Name: ___________________________________________________

- Relationship to Decedent: _____________________________________

- Address: ______________________________________________________

- City: ____________________ State: ______ Zip: _________________

- Phone Number: ________________________________________________

Decedent's Information:

- Full Name: ___________________________________________________

- Date of Birth: _______________________________________________

- Date of Death: _______________________________________________

- Last Known Address: __________________________________________

- City: ____________________ State: ______ Zip: _________________

Death Certificate:

A certified copy of the death certificate is attached to this affidavit. This document and the attached certificate are presented to assert the fact of the decedent's death and to facilitate the transfer of assets as allowed by law.

Statement of Truth:

I, ________________________ (Declarant's full name), declare under penalty of perjury under the laws of the State of California that the foregoing is true and correct.

Date: ________________

Signature: ________________________________

Notarization (If Applicable):

This section to be completed by a Notary Public:

- State of California

- County of _____________________

- On __________________ (Date), before me, ___________________________ (Notary's name), personally appeared ________________________ (Declarant's name), who proved to me on the basis of satisfactory evidence to be the person whose name is subscribed to this instrument, and acknowledged to me that he/she executed the same in his/her authorized capacity and that by his/her signature on this instrument, the person, or the entity upon behalf of which the person acted, executed the instrument.

- Witness my hand and official seal:

Signature of Notary: ______________________________

Seal:

PDF Form Attributes

| Fact | Detail |

|---|---|

| Purpose | Used to legally confirm a person's death, often in matters related to transferring or releasing property titles. |

| Governing Law | California Probate Code, specifically sections that deal with the transfer of property and recording of deaths. |

| Required Information | Includes the deceased's full name, date of death, and details about the property being transferred or affected. |

| Filing | Must be filed with the local county recorder's office where the property is located. |

| Associated Forms | May need to be filed alongside other documents, such as a death certificate or proof of ownership. |

| Timeframe | There is no statewide mandated timeframe, but prompt filing is encouraged to ensure timely transfer of property rights. |

| Public Record | Once filed, it becomes a public record and is accessible to individuals conducting title searches or estate planning. |

| Processing Fee | Varies by county; it is advisable to contact the local county recorder for the exact fee. |

Instructions on How to Fill Out California Affidavit of Death

Completing the California Affidavit of Death form is a necessary step for individuals seeking to assert their rights or fulfill their obligations concerning the property of a decedent. This document acts as an official declaration that a person has passed away and serves various legal and property transfer functions. The process involves a series of precise steps to ensure the form is properly filled out and legally valid. It is crucial for individuals to pay close attention to detail and provide accurate information to avoid any potential issues that could arise from incorrect or incomplete submissions.

- Obtain the correct form. Ensure that you have the latest version of the California Affidavit of Death form. It can typically be found online on the website of the California Secretary of State or county recorder's office.

- Gather necessary documents. Before you start filling out the form, collect all required documents such as the death certificate of the decedent and legal proof of your relationship to them or your interest in the property.

- Fill out the top section. Start by entering the county where the property is located, followed by your personal information as the affiant (the person filling out the affidavit), including your full legal name and address.

- Enter the decedent’s information. Provide the full legal name of the deceased, including any aliases or other names they were known by, as well as the date of their death.

- Describe your relationship to the decedent. Clearly state your relationship to the deceased or your interest in the property that makes you eligible to fill out the affidavit.

- Include property information. If the affidavit pertains to real estate, describe the property in detail, including the legal description and address. This information can usually be found on a deed or tax bill.

- Attach the death certificate. A certified copy of the death certificate must be attached to the affidavit to provide legal proof of death.

- Statement of facts. Draft a paragraph that includes all relevant facts that support your claim and connect your relationship to the decedent to the property in question.

- Sign the affidavit. You must sign the affidavit in the presence of a notary public. This step officially authenticates the document.

- File the form. Submit the completed affidavit along with any required filing fees to the appropriate county recorder's office where the property is located. Check with the office ahead of time to confirm any specific filing requirements.

Once submitted, the Affidavit of Death will undergo a review process by county officials. If everything is in order, it will be recorded, effectively updating the public records to reflect the transfer of interest in the property as specified in the affidavit. This is a critical step in managing the deceased’s assets and ensuring that property ownership is accurately reflected in official records. Be mindful to follow up with the county recorder's office to confirm the document has been recorded and to address any potential issues they may identify during their review.

Crucial Points on This Form

What is an Affidavit of Death form in California?

An Affidavit of Death form in California is a legal document used to formally declare the death of an individual. It serves to notify courts, businesses, and government agencies of the person's passing, primarily for the purpose of transferring assets or fulfilling legal obligations.

Who should file an Affidavit of Death form?

Typically, the executor of the deceased's estate or a close family member fills out the Affidavit of Death form. It's vital for individuals who are responsible for managing the deceased's affairs or assets to complete this process.

What documents are needed to accompany the Affidavit of Death?

Along with the Affidavit of Death, a certified copy of the death certificate is usually required. Additional documentation may be needed based on the specific circumstances or the assets in question.

Where is the Affidavit of Death form filed in California?

The filing location depends on what the affidavit pertains to. For real estate, it's typically filed with the County Recorder’s Office where the property is located. For other assets, the affidavit may be filed with the bank, brokerage, or agency holding the asset.

Is there a fee to file an Affidavit of Death form?

Yes, most County Recorder’s Offices charge a fee to file an Affidavit of Death. The fee can vary depending on the county. It's advisable to check with the specific office where you plan to file for the current fee schedule.

How long does it take for an Affidavit of Death to be processed in California?

The processing time can vary widely depending on the specific agency or office where the affidavit is filed. For County Recorder’s Offices, processing times can range from a few days to several weeks.

Can an Affidavit of Death form be filed electronically in California?

Some counties in California may offer electronic filing options for Affidavit of Death forms. However, it's important to verify with the specific County Recorder’s Office whether they accept electronic submissions and what the process entails.

What happens if an Affidavit of Death form is filled out incorrectly?

If the form contains errors or inaccuracies, it may be rejected or require correction and resubmission. Rectifying mistakes often involves completing a new form and, potentially, paying additional filing fees.

Are there legal penalties for not filing an Affidavit of Death in California?

While not filing an Affidavit of Death does not typically result in legal penalties, failing to do so can complicate or delay the process of settling the deceased's estate and transferring assets to their beneficiaries.

Common mistakes

Filling out the California Affidavit of Death form is a crucial step in managing the legal and property affairs that follow a person's passing. While it may seem straightforward, several common mistakes can complicate the process. Being aware of these can save time, energy, and possibly even legal complications down the road.

-

Not verifying the document's version: The state of California occasionally updates legal forms to reflect changes in law or procedure. Using an outdated form can lead to the rejection of the affidavit, delaying the necessary legal processes. Always check for the most current version before submission.

-

Incorrect or incomplete information about the decedent: This includes spelling names incorrectly, providing an incorrect date of birth, or failing to include the decedent's Social Security number if required. The details on the affidavit must precisely match those on official documents and records. Discrepancies can cause significant delays.

-

Failure to provide necessary attachments: Depending on the situation, you may need to attach additional documents to the affidavit, such as a certified copy of the death certificate. Skipping this step can result in the form being considered incomplete. Understanding the specific requirements for your affidavit is essential.

-

Not having the affidavit notarized: Many people overlook the necessity of notarization for the Affidavit of Death to be legally valid. While it might seem like a minor detail, failing to have the document notarized can render it invalid, necessitating a complete redo of the process.

By paying close attention to these common pitfalls, individuals can ensure their Affidavit of Death for the state of California is correctly completed and accepted without unnecessary delay. Keeping informed and prepared can make a significant difference in managing the affairs of a deceased loved one.

Documents used along the form

When dealing with the passing of a loved one, the complexity and emotional weight of the necessary legal paperwork can be overwhelming. One essential document often required in California is the Affidavit of Death form. This document serves to legally confirm the death of an individual, often used to facilitate the transfer of property or to claim benefits. However, it's seldom the only document needed. Let’s explore a few other forms and documents that are commonly used in conjunction with the California Affidavit of Death to ensure all matters regarding the deceased's estate and other affairs are properly handled.

- Death Certificate: This is a government-issued document that officially records the date, location, and cause of a person's death. It is often required to accompany the affidavit for various legal purposes such as settling estates, claiming life insurance, and handling the deceased's finances.

- Last Will and Testament: This document outlines the deceased’s wishes for how their estate should be distributed among heirs and beneficiaries. It’s crucial for the probate process and may be referenced in the Affidavit of Death.

- Probate Petition: Filed in court, this document requests the official appointment of an executor or administrator to oversee the estate's distribution according to the Last Will or, if there's no will, according to state law.

- Letter of Testamentary: Issued by the court, it grants the executor the authority to act on behalf of the deceased’s estate, allowing them to collect assets, pay debts, and distribute inheritance.

- Trust Document: If the deceased established any kind of trust, this document outlines instructions for managing and distributing the assets in the trust, bypassing the probate process.

- Change of Ownership Form: Specifically in real estate, this form notifies property assessment offices of a change in ownership due to the owner’s death, which can affect property taxes.

- Bank and Brokerage Account Forms: These are needed to access, close, or transfer the deceased’s accounts. Each institution has its process and requirements, which may include the Affidavit of Death.

Gathering and managing these documents is a pivotal step in effectively finalizing the affairs of someone who has passed away. While the process can seem daunting, understanding what each document is for and how they interrelate helps in navigating through these responsibilities with clarity and purpose. Working alongside legal or financial professionals can also provide invaluable guidance during such a challenging time.

Similar forms

Death Certificate: Similar to an Affidavit of Death, a Death Certificate is an official document that confirms the death of an individual. It's typically required for the same purposes, such as settling estates and accessing benefits. While a Death Certificate is issued by a government body, an Affidavit of Death is a sworn statement by an individual.

Last Will and Testament: This is a legal document that outlines how a person wants their property and assets distributed after their death. Like an Affidavit of Death, it comes into play after someone passes away and is crucial for the probate process, helping executors and courts understand the decedent's wishes.

Power of Attorney: Although it deals with living affairs, a Power of Attorney (POA) complements an Affidavit of Death by having previously granted someone the authority to manage affairs and decisions on another's behalf, which ceases upon the death confirmed by the affidavit.

Medical Records: Similar to the Affidavit of Death, medical records can serve as evidence in legal and personal matters following someone's death, providing important information about the decedent's health history and the circumstances surrounding their death.

Life Insurance Policy: This document is akin to the Affidavit of Death as it becomes relevant after someone's passing. The affidavit often accompanies a life insurance claim to prove the policyholder's death, facilitating the disbursement of benefits to beneficiaries.

Beneficiary Designations: These are documents where individuals specify who will receive benefits from accounts like retirement plans, insurance policies, and trusts after their death. They work in tandem with the Affidavit of Death to ensure that assets are transferred to the right people.

Trust Documents: Like an Affidavit of Death, trust documents play a pivotal role in managing and distributing a deceased person's assets. A trust can outline detailed instructions for asset distribution, similar to a will, but often without the need for probate, with the affidavit serving to notify the trust of the death.

Dos and Don'ts

Filling out the California Affidavit of Death form is a critical step in managing the legal affairs after someone has passed away. This document is used to legally acknowledge the death of an individual and is often required to transfer or establish ownership of property. To ensure that you complete the form accurately and respectfully, here are some dos and don'ts to keep in mind:

Do's

- Double-check the deceased's personal information to ensure accuracy. This includes their full name, date of birth, and date of death.

- Have the death certificate handy for reference. You'll need information from this document to complete the affidavit.

- Fill out the form completely. Don't leave any fields blank unless the form specifically instructs you to do so.

- Sign the affidavit in the presence of a notary public. This step is essential for the document to be legally binding.

- Keep a copy of the affidavit for your records. After submitting the original to the necessary institutions, having a copy will be helpful for future reference.

Don'ts

- Don't guess on any details. If you're unsure of the information, verify it before submitting the form.

- Don't use a nickname or shortened version of the deceased's name. Always use the full, legal name as it appears on official documents.

- Don't fill out the form in a hurry. Take your time to ensure that all information is accurate and complete.

- Don't forget to notify all relevant parties. This includes financial institutions, government agencies, and any other entities that need to know about the death.

Taking the time to accurately complete the California Affidavit of Death form is a crucial step in settling the deceased's affairs. By following these guidelines, you can help to streamline the process and ensure that everything is handled respectfully and legally.

Misconceptions

Many misconceptions circulate about the California Affidavit of Death form, leading to confusion and misinformation. Understanding these can help in correctly utilizing the form, ensuring legal procedures are accurately followed. Here are five common misunderstands rectified for clarity.

It is only used to transfer real estate. While the Affidavit of Death is often used in the context of transferring property rights upon an owner's death, its use is not limited to real estate transactions. It can also be necessary for claiming assets, such as bank accounts and stocks, depending on the institution's requirements.

Anyone can file it. The reality is that only authorized individuals, typically the successor trustee, executor of the estate, or a close relative directly inheriting under state law, are eligible to file an Affidavit of Death. This ensures that the claim to the deceased's property is legitimate and that the transfer of assets is lawful.

A lawyer is required to prepare it. While legal advice is invaluable, especially in complex cases, the form itself is designed to be straightforward and can be completed by the individuals involved. However, seeking legal counsel can ensure that all aspects of the estate and potential implications are considered.

The form immediately transfers property. Filing the Affidavit of Death is a critical step in the process, but it does not by itself transfer property. The actual change of title or account ownership typically involves additional steps and documentation as required by law or the institution holding the asset.

It overrides a will or trust. A common misunderstanding is that this affidavit can override the directives in a will or trust. However, it is a document used to confirm death and start the process of transferring assets in accordance with already established legal documents, like wills and trusts, not to supersede them.

Clearing up these misconceptions aids in the smooth processing of legal affairs after a loved one's passing, ensuring that rights and procedures are properly observed.

Key takeaways

When dealing with the passing of a property owner in California, the Affidavit of Death form is a crucial document. It helps in the official transfer of real estate property title from the deceased to their heirs or beneficiaries. Here are five key takeaways to understand when filling out and using this form:

- It's essential to ensure all information is accurate and complete. Any mistakes on the Affidavit of Death can cause delays or complications in transferring the property title. This document requires details such as the deceased's full name, the date of death, and the legal description of the property.

- The form must be notarized. This means it needs to be signed in front of a notary public who will verify the identity of the signer. The notarization process adds a layer of legal certification to the document, making it officially recognized for processing by county recorders.

- Supporting documents are required. Alongside the Affidavit of Death, a certified copy of the death certificate should be submitted. This serves as a legal proof of death and is necessary for the affidavit to be accepted and processed.

- Recording the document is a critical step. Once filled out and notarized, the Affidavit of Death needs to be recorded with the County Recorder's Office in the county where the property is located. This public recording legally changes the title of the property.

- Consultation with a legal professional is advised. While the form may seem straightforward, navigating inheritance laws and ensuring compliance with all legal requirements can be complex. A lawyer specialized in estate planning or real estate can provide valuable guidance and help avoid potential legal issues.

Create Other Affidavit of Death Forms for US States

Free Affidavit of Death Form - It can expedite the legal proceedings related to inheritance, reducing the administrative burden on the bereaved family.