Blank Affidavit of Death Form for Texas

When a loved one passes away, navigating the complexities of estate management while grieving can be a daunting task. In the Lone Star State, a crucial step in this process involves the use of the Texas Affidavit of Death form. This legal document serves multiple purposes: it formally declares the death of an individual, aids in the seamless transfer of property to beneficiaries, and ensures that the deceased's assets are correctly distributed in accordance with their wishes or state law. Crafted to streamline the transition of ownership and to clarify the legal standing of real estate and other assets, the form stands as a testament to the meticulous procedures required to uphold the intentions of the deceased. It negates the need for a protracted probate process in certain circumstances, offering a semblance of solace to those left behind by simplifying at least one aspect of the intricate journey that is estate management. As such, the Texas Affidavit of Death form is not just a document but a beacon guiding families through the fog of legal obligations that accompany the loss of a loved one. Understanding its significance, functionality, and the right way to utilize it is paramount for anyone embroiled in settling an estate in Texas.

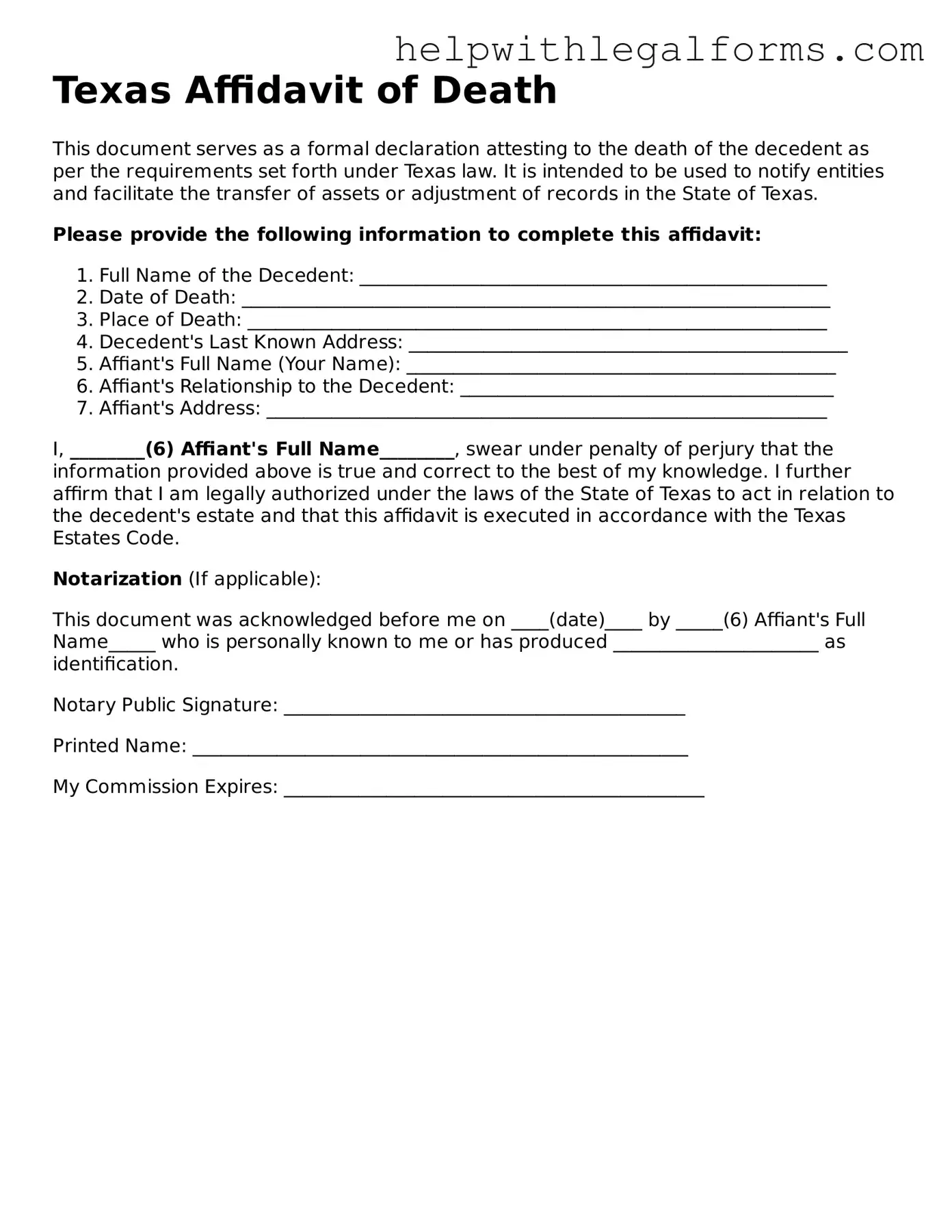

Example - Texas Affidavit of Death Form

Texas Affidavit of Death

This document serves as a formal declaration attesting to the death of the decedent as per the requirements set forth under Texas law. It is intended to be used to notify entities and facilitate the transfer of assets or adjustment of records in the State of Texas.

Please provide the following information to complete this affidavit:

- Full Name of the Decedent: __________________________________________________

- Date of Death: _______________________________________________________________

- Place of Death: ______________________________________________________________

- Decedent's Last Known Address: _______________________________________________

- Affiant's Full Name (Your Name): ______________________________________________

- Affiant's Relationship to the Decedent: ________________________________________

- Affiant's Address: ____________________________________________________________

I, ________(6) Affiant's Full Name________, swear under penalty of perjury that the information provided above is true and correct to the best of my knowledge. I further affirm that I am legally authorized under the laws of the State of Texas to act in relation to the decedent's estate and that this affidavit is executed in accordance with the Texas Estates Code.

Notarization (If applicable):

This document was acknowledged before me on ____(date)____ by _____(6) Affiant's Full Name_____ who is personally known to me or has produced ______________________ as identification.

Notary Public Signature: ___________________________________________

Printed Name: _____________________________________________________

My Commission Expires: _____________________________________________

PDF Form Attributes

| Fact | Description |

|---|---|

| Definition | The Texas Affidavit of Death form is a legal document that formally records the death of an individual, primarily used to clear title of real property. |

| Primary Use | It is most commonly utilized to transfer real estate property ownership without the need for a formal probate process, in circumstances where the deceased had established a clear chain of survivorship. |

| Governing Law | This form is governed by the laws of the State of Texas, specifically falling under the Texas Estates Code, which outlines procedures for the transfer of assets upon death. |

| Requirements | The affidavit must be filed in the county where the property is located, accompanied by a certified death certificate of the deceased. |

| Signatory Requirements | It must be signed by a person with direct knowledge of the decedent’s death and their interest in the estate, and it typically requires notarization. |

Instructions on How to Fill Out Texas Affidavit of Death

After a loved one passes away, handling their affairs can be a challenging task, filled with legal documents and processes that might not be familiar. One of the forms often required is the Texas Affidavit of Death. This document serves to legally assert the death of a person, which is crucial for various matters, including settling estates, claiming life insurance, and transferring property. To ease the process, the following steps outline how to properly fill out this form. It's important to complete the form accurately to avoid delays or issues in managing the deceased's affairs.

- Begin by gathering all necessary information about the deceased, including their full legal name, date of birth, date of death, and the county in which the death occurred. Having a copy of the death certificate handy can help ensure accuracy.

- Locate the section at the top of the form titled "Deceased Information." Here, enter the deceased's full name, including any middle names or suffixes.

- In the next section, labeled "Date of Death," provide the date on which the deceased passed away. This date should be in month/day/year format.

- Proceed to the "County of Death" field and fill in the name of the county where the death occurred. If the death happened out of state but involves Texas legal matters, consult with a legal advisor on how to proceed.

- Look for the section titled "Affiant Information." The "affiant" is you, the person filling out the form. Enter your full legal name, address, and relationship to the deceased. This establishes your connection to the deceased and your standing to complete the form.

- In the part of the form dedicated to the declaration or statement, there might be a section where you affirm your knowledge of the deceased's death and possibly their estate matters. Read this portion carefully and provide any additional information required. This might include stating that you're aware there is no will, or that you're not personally benefitting from the deceased's estate.

- Most affidavits, including the Texas Affidavit of Death, will require a notary public to witness the signing. Find the section reserved for the notary's information, but do not sign the document yet.

- Once all other sections are completed, bring the form to a notary public. Sign the document in the presence of the notary. The notary will fill in their section, which typically includes the date, their signature, their seal, and sometimes the expiration date of their commission.

- Review the form one last time to ensure all information is correct and that no sections have been missed.

After the form is filled out and notarized, it's ready for submission to the relevant authority or institution, such as the county recorder's office, a financial institution, or a life insurance company. The submission process may vary depending on the entity’s requirements, so it's wise to contact them ahead of time to confirm any specific directions. Successfully submitting the Texas Affidavit of Death helps to formalize the death in legal and financial contexts, allowing for a smoother transition as you manage the deceased's affairs.

Crucial Points on This Form

What is an Affidavit of Death Form in Texas?

An Affidavit of Death form in Texas is a legal document that formally recognizes the death of an individual. It is often used by family members or inheritors to establish their legal rights or to manage the deceased's assets and liabilities. This document is commonly required to update property records, claim benefits, or to execute the deceased person's will.

Who can file an Affidavit of Death in Texas?

In Texas, typically, a close relative, an heir, or an executor of the deceased’s estate can file an Affidavit of Death. This individual must be over 18 years of age, have knowledge about the decedent's death, and be directly affected by the death regarding property or assets that require the affidavit for legal changes.

What information is needed for the Affidavit of Death?

To complete an Affidavit of Death, you need several key pieces of information including the full name of the deceased, their date of birth, and date of death. Information about the property or assets in question, such as legal descriptions of real estate, vehicle identification numbers, or account numbers, may also be required. Furthermore, the affiant (the person filing the affidavit) must provide their relationship to the deceased and their reason for filing the affidavit.

Where do I file an Affidavit of Death in Texas?

An Affidavit of Death should be filed in the county where the property or assets are located. For real estate, this would be the County Clerk’s office in the county where the property resides. For assets like bank accounts or vehicles, the affidavit may need to be presented to the bank or the Texas Department of Motor Vehicles respectively.

Is there a fee to file an Affidavit of Death in Texas?

Fees for filing an Affidavit of Death can vary by county and type of asset. It's advisable to contact the local County Clerk’s office or the relevant agency handling the asset in question to inquire about the current filing fees. Some offices may accept various payment methods, including cash, checks, or credit cards.

How long does it take for an Affidavit of Death to be processed?

The processing time for an Affidavit of Death can vary widely depending on the county and the complexity of the estate. Generally, once filed, it may take a few days to a few weeks for the document to be officially recorded. However, being in touch with the specific office where you file can provide a more accurate timeline.

Do I need a lawyer to file an Affidavit of Death in Texas?

While it is not required to have a lawyer to file an Affidavit of Death in Texas, consulting with an estate attorney can be beneficial. Legal advice is especially helpful for complex situations, such as large estates, disputes among heirs, or if the deceased did not leave a will. A lawyer can guide you through the process and help ensure that all legal requirements are met.

What happens after the Affidavit of Death is filed?

After the Affidavit of Death is filed, it becomes a part of the public record, and the necessary changes regarding the deceased’s assets can proceed. This might include transferring property titles, accessing bank accounts, or finalizing other financial affairs. It is essential to follow up with the respective agencies or offices to ensure that all actions required after filing the affidavit are completed and that all legal and financial matters are resolved.

Common mistakes

Filling out the Texas Affidavit of Death form is a crucial step in various legal processes following the death of an individual. However, errors in completing this document can lead to delays and additional complications. Here are ten common mistakes people make when filling out this form:

Not verifying the correct version of the form is being used. Laws and requirements can change, and using an outdated form may cause the affidavit to be rejected.

Missing information about the decedent, such as their full legal name, date of birth, and date of death. Each detail is critical for accurately identifying the individual.

Failing to include the decedent’s last known address, which is essential for locating estate records and other related legal documents.

Inaccuracies in describing the relationship of the affiant to the decedent can lead to questions regarding the affiant’s legal standing and rights.

Omitting details about the property or assets in question, if applicable. Specific information helps in the proper administration of the estate.

Incorrect or missing information regarding witnesses. Most states require the affidavit to be witnessed, and failing to comply with this requirement can invalidate the document.

Not having the affidavit notarized, which is a frequent oversight. A notarized affidavit is often necessary for the document to be legally recognized.

Forgetting to sign the document. An unsigned affidavit is like an unsigned check – it has no legal standing.

Improper filing of the affidavit with the relevant county or state office. Knowing where and how to file is just as important as filling out the document correctly.

Misunderstanding the form's purpose and using it inappropriately. The Affidavit of Death is meant for specific circumstances, mainly related to estate and property issues following a death.

To avoid these mistakes, it is advisable to read the instructions for the Texas Affidavit of Death form carefully, seek clarification on any confusing sections, and, if possible, consult with a legal professional. Ensuring accuracy and completeness in this affidavit is crucial for a smooth legal process following a loved one’s death.

Documents used along the form

Completing the legal formalities after a person's death often requires more than just an Affidavit of Death. This document is vital for officially declaring the death of an individual, which is necessary for various legal processes. However, to comprehensively address the decedent's affairs, several other documents are frequently utilized alongside the Texas Affidavit of Death. These documents help in ensuring that all assets are correctly transferred and that the estate is properly administered according to the decedent's wishes or the law.

- Certificate of Death: This government-issued document officially records the death. It provides vital statistics, including the date, location, and cause of death. This certificate is a primary necessity for the Texas Affidavit of Death and must be filed with the affidavit in many legal procedures.

- Will: A will is a legal document that outlines the decedent’s wishes regarding the distribution of their assets and the care of any minors. It is essential for guiding the probate process, determining beneficiaries, and resolving any potential disputes over the estate.

- Letters Testamentary or Letters of Administration: These documents are issued by a court to authorize an individual (an executor or administrator) to act on behalf of the decedent's estate. It gives the appointed person the legal authority to manage the estate's assets, pay debts, and distribute the estate to the rightful heirs.

- Trust Documents: If the decedent had established a trust, its documents are crucial for administering the trust’s assets. A trust might be used instead of or in addition to a will, providing instructions for handling specific assets without going through probate.

- Estate Tax Returns: Depending on the value of the estate and the laws in effect at the time of death, estate tax returns may need to be filed. These documents are necessary for reporting the estate's value to the appropriate tax authorities and for settling any owed estate taxes.

While the Affidavit of Death is a key document for asserting the fact of someone's passing, it is often just one part of a series of steps needed to settle a person's affairs after death. Proper completion and submission of all relevant documents ensure that the decedent's assets are distributed according to their wishes or the law, that debts are paid, and that all legal requirements are satisfied. Handling these matters with care and completeness is crucial for the smooth execution of the decedent’s final affairs.

Similar forms

Certificate of Title: Like an Affidavit of Death, a Certificate of Title proves ownership, but in the context of real estate or vehicles. It serves as the official document showing who owns the property or vehicle. An Affidavit of Death is necessary to transfer ownership upon the owner's death, indicating a change in legal title.

Last Will and Testament: This document details an individual’s wishes regarding asset distribution and care for minors upon their death, similar to an Affidavit of Death, which is used to formalize the transfer of assets as dictated by the deceased’s will or state law.

Transfer on Death Deed (TODD): A TODD allows a property owner to designate a beneficiary to inherit property upon their death, bypassing the probate process. Both this and an Affidavit of Death facilitate the transfer of assets upon death, although the TODD is arranged before death, and the affidavit is a post-death document.

Death Certificate: This is an official government-issued document that certifies the details of a person's death. An Affidavit of Death, while also certifying death, is used specifically to claim assets or benefits or execute transfers of ownership based on the deceased’s condition.

Power of Attorney (POA): Although a POA is primarily used to grant someone authority to make decisions on another’s behalf while they are alive, it is similar in its function of allowing someone to manage or transfer assets. However, its power typically ends upon the death of the individual, at which point documents like an Affidavit of Death become necessary.

Beneficiary Designations: Forms that specify who will inherit an account or asset upon the account holder's death, such as retirement accounts and life insurance policies. Similar to an Affidavit of Death, these designations help streamline the process of transferring assets outside of probate.

Dos and Don'ts

Filling out the Texas Affidavit of Death form requires careful attention to detail and completeness. To ensure the process goes smoothly, there are specific actions you should take and others you should avoid. Below are essential guidelines to help you accurately complete the form:

Do:- Review the entire form before starting to understand all the required information.

- Ensure all information is accurate, especially names, dates, and identification numbers, as these are crucial for the record.

- Use black ink for clarity and legibility, which is important for official documents.

- Include the decedent’s full legal name and any other names they were known by to avoid any confusion or misidentification.

- Attach a certified copy of the death certificate, as this is a mandatory requirement for the affidavit to be processed.

- Have the affidavit notarized, as this is a legal document and must be officially certified.

- Keep a copy of the completed affidavit and all attachments for your records.

- Rush through filling out the form, as missing or incorrect information can lead to delays or rejections.

- Use pencil or colored inks, as these might not be accepted or could fade over time, making the document illegible.

- Guess details. If unsure about specific information, verify it before including it on the form to maintain accuracy.

- Leave sections blank. If a section does not apply, write “N/A” to indicate that it is not applicable.

- Omit the signature and date, as the affidavit is not valid without the executor's signature and the date signed.

- Forget to provide your contact information in case there are questions or the need for additional information arises.

- Overlook the requirement to file the completed affidavit in the appropriate Texas county, as filing requirements may vary.

By following these guidelines, you can fill out the Texas Affidavit of Death form correctly and efficiently, ensuring a smoother legal process.

Misconceptions

When it comes to handling the affairs of a loved one who has passed away in Texas, the Affidavit of Death form is a document that often comes into play. However, there are several common misconceptions regarding this form. Here are six of those misunderstandings explained:

The Affidavit of Death form serves as an official death certificate. This is incorrect. The form is used primarily to notify interested entities, such as banks or title companies, about the death. An official death certificate, on the other hand, is issued by the state and serves as a legal record of death.

Any family member can complete the Affidavit of Death. In reality, the individual completing the form must have sufficient knowledge of the deceased's estate and be able to swear, under penalty of perjury, that the information provided is true. While family members often meet these criteria, it's not a blanket requirement for all family members.

The form automatically transfers property to the heir(s). This is a misconception. While the Affidavit of Death can be used to notify parties about the death of a property owner, it does not by itself transfer property. Legal transfer of property requires additional steps and documentation, depending on the situation.

Filing the Affidavit of Death with the county clerk is always required. This isn't always the case. The necessity to file the document depends on the specific requirements of the institution or entity requesting it, and the laws of the state of Texas regarding the deceased's property.

There is a statewide standard form for all Affidavit of Death documents. This is not true. While the information required is generally similar, the format and specific content of the form can vary by county. It's important to use the form that meets the requirements of the local jurisdiction where it will be filed or used.

The form alone is enough to settle a deceased person's estate. This is a significant misunderstanding. Settling an estate typically involves many steps, including but not limited to, paying debts, distributing assets according to the will or state law, and filing taxes. An Affidavit of Death is just one component of the process and does not suffice on its own to complete all necessary legal obligations.

Key takeaways

The Texas Affidavit of Death form is a legal document used to certify a person’s death, often critical in the process of transferring property or settling estates. Understanding how to correctly fill out and utilize this form is essential for those handling affairs after a loved one has passed away. Here are key takeaways about the process:

- The form must be completed with accurate information about the deceased, including full legal name, date of death, and county of death. This ensures that records are accurately updated.

- It's necessary for the affidavit to be signed in front of a notary public to validate the identity of the person filing the document. This step is critical for the document to be legally recognized.

- Documentation proving the death, such as a death certificate, typically needs to be attached to the affidavit. This provides official verification of the death.

- The form is used to notify relevant entities, such as banks, creditors, and government agencies, of the person’s death. Often, it is required for the transfer of assets or to claim benefits.

- Filing the affidavit in the county where the property is located, if the deceased owned real estate, is often necessary. This action updates property records and is essential for any transfer of ownership.

- The person filing the affidavit should retain copies for their records and any future legal or financial dealings. Having access to these documents can streamline various processes.

- Consulting with a legal professional can provide clarification and ensure that the affidavit is correctly filled out and filed, especially in situations involving significant assets or complicated estates.

- Timing can be important; some institutions may require the submission of the affidavit within a specific timeframe after the person's death. Understanding and adhering to these deadlines can avoid complications.

Proper handling of the Texas Affidavit of Death form is a critical step in managing the affairs of someone who has passed away. It provides a formal means to acknowledge death legally and is instrumental in facilitating the resolution of the deceased's estate.

Create Other Affidavit of Death Forms for US States

Affidavit of Death of Joint Tenant California - Legal representatives may guide the completion of this affidavit to ensure compliance with relevant state laws.