Blank Self-Proving Affidavit Form for Texas

In the vast landscape of legal documentation, the Texas Self-Proving Affidavit form emerges as a significant tool, especially in the context of estate planning. This form simplifies the probate process, a feature incredibly beneficial to anyone preparing a will. It serves as a testament that the will was signed and witnessed under all legal formalities, making it an invaluable asset for streamlining posthumous legal proceedings. With the affidavit, the necessity for witnesses to physically appear in court to verify a will's authenticity is eliminated, thus reducing potential stress and complications for loved ones during a time of mourning. The use of the Self-Proving Affidavit in Texas highlights the state's commitment to efficiency and convenience in legal affairs, providing peace of mind to individuals as they plan for the future. Understanding the major aspects of this form and its proper use can empower Texas residents, ensuring their final wishes are honored without undue burden on their families.

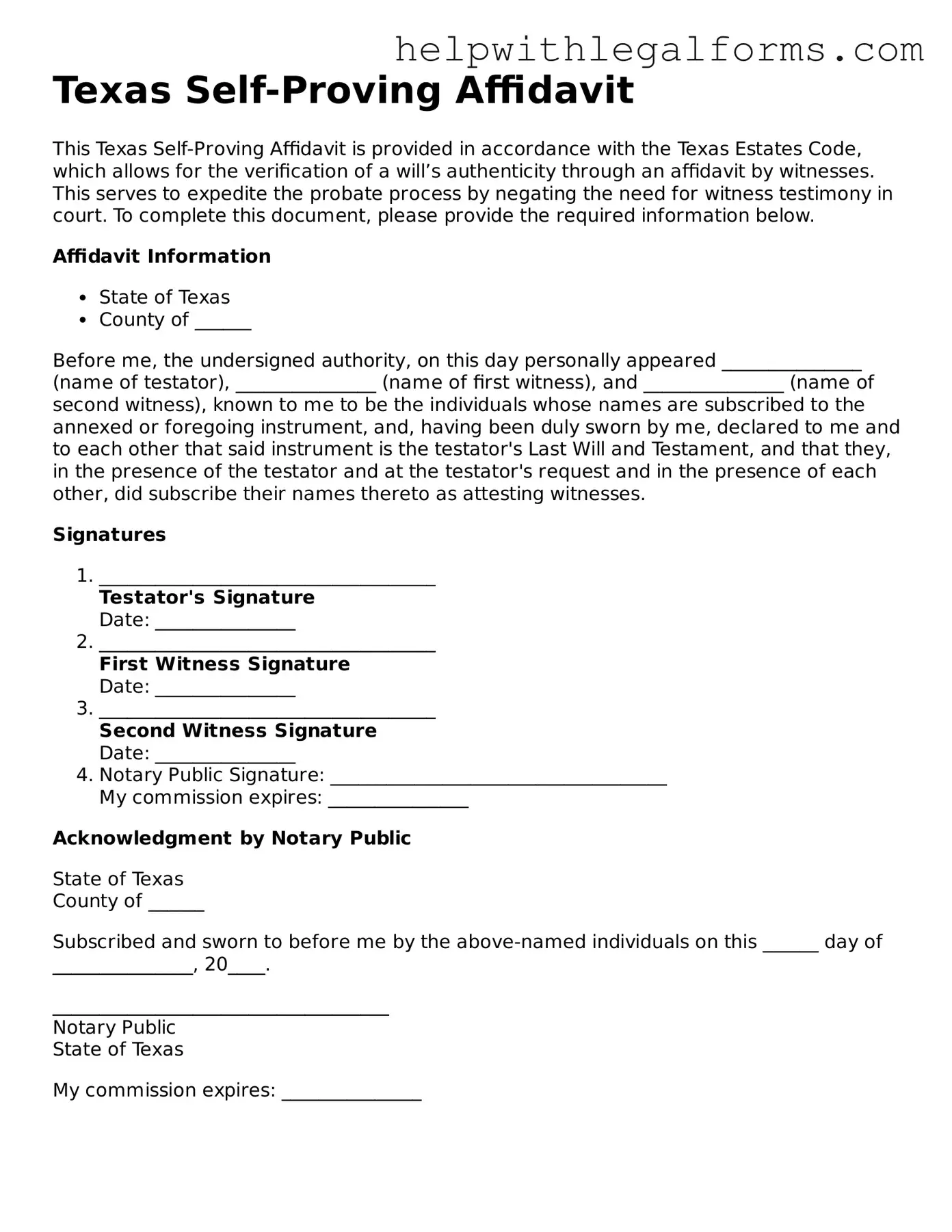

Example - Texas Self-Proving Affidavit Form

Texas Self-Proving Affidavit

This Texas Self-Proving Affidavit is provided in accordance with the Texas Estates Code, which allows for the verification of a will’s authenticity through an affidavit by witnesses. This serves to expedite the probate process by negating the need for witness testimony in court. To complete this document, please provide the required information below.

Affidavit Information

- State of Texas

- County of ______

Before me, the undersigned authority, on this day personally appeared _______________ (name of testator), _______________ (name of first witness), and _______________ (name of second witness), known to me to be the individuals whose names are subscribed to the annexed or foregoing instrument, and, having been duly sworn by me, declared to me and to each other that said instrument is the testator's Last Will and Testament, and that they, in the presence of the testator and at the testator's request and in the presence of each other, did subscribe their names thereto as attesting witnesses.

Signatures

- ____________________________________

Testator's Signature

Date: _______________ - ____________________________________

First Witness Signature

Date: _______________ - ____________________________________

Second Witness Signature

Date: _______________ - Notary Public Signature: ____________________________________

My commission expires: _______________

Acknowledgment by Notary Public

State of Texas

County of ______

Subscribed and sworn to before me by the above-named individuals on this ______ day of _______________, 20____.

____________________________________

Notary Public

State of Texas

My commission expires: _______________

PDF Form Attributes

| Fact Number | Details |

|---|---|

| 1 | The Texas Self-Proving Affidavit is governed by the Texas Estates Code, specifically Section 251.104. |

| 2 | This affidavit allows for a will to be admitted to probate without the testimony of a witness. |

| 3 | It must be signed by the testator (the person creating the will) and two witnesses. |

| 4 | The two witnesses must be competent and at least 14 years old. |

| 5 | Witnesses cannot be beneficiaries of the will to maintain impartiality. |

| 6 | The document requires notarization to be considered valid. |

| 7 | Signing a Self-Proving Affidavit speeds up the probate process, as it pre-verifies the will's authenticity. |

| 8 | It is not mandatory to have a Self-Proving Affidavit, but it is highly recommended. |

| 9 | The affidavit can be made at the time of will creation or added to an existing will later. |

| 10 | If not used, proving the validity of a will may require contact with all signing witnesses, which can be cumbersome or impossible if they are unavailable or deceased. |

Instructions on How to Fill Out Texas Self-Proving Affidavit

When you're in the process of creating a will in Texas, one document that can streamline the process later on is the Self-Proving Affidavit. This form, when properly completed and attached to your will, helps confirm the validity of the will without the need for witnesses to be present in court. It's a helpful step in ensuring your will can be executed smoothly, reducing stress for your loved ones during a difficult time. Here's how to fill it out:

- Gather the full names and addresses of the two witnesses who will be present when you sign your will. These should be individuals who are not beneficiaries in the will.

- Have your identification and the witnesses' identifications ready for verification.

- Obtain the current version of the Texas Self-Proving Affidavit form. This can typically be found online through legal resources or an attorney's office.

- Enter your full legal name at the top of the form where indicated.

- Review the affidavit to ensure it corresponds with the legal requirements of Texas. It should already be formatted correctly, but it's good to double-check.

- Sign the form in the presence of a Notary Public and your two witnesses. It is crucial that the notary witnesses you signing the document.

- Your witnesses must then sign the form, attesting that they witnessed your signature and are not beneficiaries of the will. Ensure they print their names, sign, and provide their addresses as required on the form.

- The Notary Public will fill out their section, certifying that you and the witnesses appeared before them and signed the document. The notary will also seal the affidavit.

- Attach the completed Self-Proving Affidavit to your will. Make sure it is securely fastened and kept in a safe place with your will.

After completing these steps, your Self-Proving Affidavit will be ready. This document simplifies the probate process for your will, helping to ensure that your final wishes are respected and carried out without unnecessary delay or legal hurdles. If you have questions or feel unsure about any part of this process, consider reaching out to a legal professional for guidance.

Crucial Points on This Form

What is a Texas Self-Proving Affidavit Form?

A Texas Self-Proving Affidavit Form is a legal document that accompanies a last will and testament. It verifies that the will is genuine and was signed freely by the testator, the person making the will, in the presence of witnesses. This form, once signed and notarized, can speed up the probate process after the testator's death by eliminating the need for witnesses to testify in court about the validity of the will.

Who needs to sign the Texas Self-Proving Affidavit Form?

The testator and two witnesses must sign the Texas Self-Proving Affidavit Form. It is also required to be notarized, which means a notary public will sign it as well, confirming the identities of everyone signing. The witnesses should be people who are not beneficiaries in the will to avoid potential conflicts of interest.

Can I add a Self-Proving Affidavit to an existing will?

Yes, a Self-Proving Affidavit can be added to an existing will. Doing so involves creating the affidavit that complies with Texas law, then having it signed by the testator and the witnesses in the presence of a notary public. This addition can be made at any time after the will has been created as long as the testator is legally competent.

Does adding a Self-Proving Affidavit to my will eliminate the need for probate?

No, adding a Self-Proving Affidavit to your will does not eliminate the need for probate. However, it simplifies the process. The affidavit makes it easier for the court to accept the will as valid without the necessity of witness testimony about the circumstances of its signing. This can significantly shorten the probate process and reduce its complexity.

Is there a specific format required for a Texas Self-Proving Affidavit?

Yes, Texas law requires that the Self-Proving Affidavit follow a specific format. It must include certain statements that are sworn by the testator and the witnesses before a notary public. While the substance of these statements is prescribed by law, using a form that is specifically designed to meet Texas legal requirements is highly recommended to ensure that the affidavit is valid.

What happens if my will does not have a Self-Proving Affidavit?

If your will does not have a Self-Proving Affidavit, it can still be admitted to probate, but the process may be more complicated and time-consuming. Witnesses may need to be located and brought to court to testify about the validity of the will. If witnesses are unavailable, it could raise challenges to the will's validation process. Including a Self-Proving Affidavit with your will significantly simplifies these proceedings.

Common mistakes

Filling out legal documents can seem straightforward but often involves intricate details that can lead to mistakes. The Texas Self-Proving Affidavit is no exception. This document, typically attached to a will, aims to streamline probate by verifying the will’s authenticity and the testator's (the person who made the will) sound mind and lack of undue influence at the signing. Despite its utility, errors in completing this form are common. Here are ten mistakes people frequently make:

Not including the affidavit with the will. A self-proving affidavit needs to be attached to or included within the will to serve its purpose during probate proceedings.

Incorrectly identifying the parties. It's essential to clearly and correctly identify the testator and the witnesses to avoid confusion or questioning of the document's validity.

Failing to use the correct form that adheres to Texas law. Each state has its own requirements for these affidavits, and using the wrong form can invalidate the document.

Omitting necessary signatures. The affidavit must be signed by the testator and the witnesses, often in the presence of a notary. Missing signatures can render the affidavit ineffective.

Not having the document notarized. In Texas, the self-proving affidavit must be notarized to confirm the identity of the signers and their understanding of the document's contents.

Using incorrect witnessing procedures. Witnesses must meet certain criteria (e.g., not being beneficiaries of the will) and must observe the signing process properly to make their testimony valid.

Forgetting to date the affidavit. The date can be crucial in establishing the timeline and validity of the will, especially if its content is contested.

Not revising the affidavit when updating the will. Changes to the will may require a new affidavit to confirm that the alterations were also properly witnessed and agreed upon.

Misunderstanding the purpose of the document. Some may think it substitutes for a will, but its only role is to help validate the existing will’s signatures and testamentary intent.

Assuming all states require a self-proving affidavit. While many states recognize its use, not all require it. However, in Texas, it is a good practice to include one to facilitate the probate process.

Making mistakes on a Self-Proving Affidavit can significantly affect the probate process, possibly leading to delays or challenges to the will. It is advisable for individuals to seek legal guidance when preparing this document to ensure its accuracy and compliance with Texas law. Attention to detail and adherence to the correct procedures can ease the process for all involved, fulfilling the testator's wishes as intended.

Documents used along the form

In Texas, the process of managing and validating a will can be streamlined with a Self-Proving Affidavit. This critical document accompanies a will, certifying that it was voluntarily signed by the testator, thus helping to expedite the probate process. To further reinforce the integrity and intent behind a last will and testament, several other forms and documents are often used in conjunction. Each serves its unique purpose in ensuring the will’s directives are honored precisely.

- Will: The foundational document articulating the testator's wishes regarding the distribution of their estate upon death. It specifies beneficiaries and outlines how assets are to be allocated.

- Medical Power of Attorney: This legal document grants a designated individual the authority to make healthcare decisions on behalf of the testator, should they become unable to do so themselves.

- Durable Power of Attorney: Unlike the Medical Power of Attorney, this document empowers a trusted person to manage financial and legal matters for the testator, effective immediately or upon the occurrence of a future event, typically the testator’s incapacity.

- Declaration of Guardian: Should a guardian need to be appointed due to the testator's incapacitation, this document outlines the testator’s preferences for who should assume this responsibility for them or their minor children.

- Directive to Physicians and Family or Surrogates: Commonly known as a “living will,” this document specifies the testator's wishes regarding life-sustaining treatments if they become terminally ill or permanently unconscious.

To ensure a comprehensive approach to estate planning, these documents should be prepared with great care and in compliance with Texas law. Consulting with a legal professional can provide essential guidance in navigating these matters, ensuring that one's final wishes are clearly articulated and legally enforceable. Using the Self-Proving Affidavit in conjunction with these documents can significantly simplify the probate process, offering peace of mind to all parties involved.

Similar forms

A Notarized Letter: Similar to a self-proving affidavit, a notarized letter involves a signer declaring the contents of the letter to be true in front of a notary public. The notary's stamp and signature certify the authenticity of the signer's identity and their acknowledgment of the letter's contents.

A Witness Statement: This document is akin to a self-proving affidavit because it contains an individual's detailed account regarding specific events or situations, often signed in the presence of legal authorities or notarized to add a layer of verification and trustworthiness to the declaration.

A Power of Attorney: Similar because it often includes a self-proving affidavit to verify the identity of the parties involved and confirm their voluntary participation in granting and receiving the authority, thereby ensuring the document’s quick acceptance and reducing challenges in legal contexts.

A Living Will: A legal document that expresses an individual's wishes regarding medical treatment in circumstances where they're unable to communicate. Like a self-proving affidavit, a living will often needs to be witnessed and notarized to confirm the authenticity of the signature and the cogency of the document.

A Last Will and Testament: This is a direct comparison where a self-proving affidavit is frequently attached to a will to expedite the probate process. The affidavit serves as evidence that the will was signed voluntarily and witnessed, thereby underscoring the document's validity without requiring witnesses to testify in court.

A Trust Document: Like a self-proving affidavit, trust documents are formal arrangements that specify how assets are to be handled and distributed. They often require notarization or witnessing to certify that the document reflects the true intentions of the person creating the trust.

A Real Estate Deed: Upon transfer of property, deeds are often accompanied by a self-proving affidavit to verify the signer’s identity and intention. This process ensures that the transfer is recognized as legitimate and binding, mirroring the affidavit's role in confirming the veracity of statements and signatures.

A Medical Directive: Similar to a self-proving affidavit, a medical directive, which outlines a person's wishes regarding health care if they become incapable of making decisions themselves, often requires notarization or witnessing. This similarity underscores the importance of verifying the document's authenticity and the declarant’s consent.

Dos and Don'ts

When setting out to complete the Texas Self-Proving Affidavit form, certain steps and precautions should be meticulously followed. This document, significant in validating a will, ensures that the will stands unquestioned in terms of authenticity. Below, find a disciplined approach to streamline this process.

Do:

- Ensure that all parties involved - the testator (the person whose will it is) and the witnesses - are present together when filling out and signing the affidavit. This collective presence underscores the validity of the document.

- Use black ink for clarity and permanence, to avoid any issues of legibility or fading over time.

- Review the entire affidavit carefully before signing, to ensure all information is accurate and complete. Accuracy is crucial in legal documentation.

- Seek the services of a Notary Public for the final sign-off, as their stamp and signature are key to the affidavit's validity.

- Keep the completed affidavit with the will. Their combined presence strengthens the will's legal stance.

Don't:

- Leave any blanks on the form. Incomplete forms may lead to unnecessary delays or complications in validating the will.

- Rush through the signing process without understanding every segment of the document. It's essential that everyone signing knows what they're agreeing to.

- Forget to check the specific requirements your county in Texas may have, as local nuances could impact the form's acceptance.

Adhering to these guidelines not only aids in the seamless acceptance of the will but also minimizes the potential for disputes among beneficiaries. Ensuring accuracy, legality, and completeness in filling out the Texas Self-Proving Affidavit form is a step towards safeguarding one’s final wishes.

Misconceptions

When it comes to finalizing a will in Texas, the Self-Proving Affidavit is a document often misunderstood. Here, we address 10 common misconceptions:

It’s mandatory for a will to be valid. Contrary to what many believe, a will doesn't need a Self-Proving Affidavit to be considered valid in Texas. This affidavit simply speeds up the probate process by verifying the will's authenticity without requiring witness testimony in court.

Any notary public can officiate the document. While it’s true that a notary is needed to make the affidavit legally binding, Texas law specifies that the notary cannot be a beneficiary of the will. This ensures the notary's impartiality.

It replaces the need for witnesses. The presence of a Self-Proving Affidavit does not eliminate the requirement for witnesses at the signing of the will. The affidavit is meant to affirm the authenticity of the witnesses' signatures after the fact, not replace their physical presence during the will's execution.

It is only for the wealthy or those with complex estates. Regardless of the estate's size or complexity, any testator can benefit from adding a Self-Proving Affidavit to their will. Its main advantage is simplifying the probate process, which can be convenient for any estate.

Witnesses’ addresses must be included in the affidavit. Although including the witnesses' addresses might be common practice for additional identification purposes, Texas law does not specifically require this detail in the affidavit.

It must be filed separately from the will. This document is typically attached directly to the will, not filed separately. Keeping the affidavit with the will ensures that the probate court can easily verify the will’s legitimacy.

Creating a Self-Proving Affidavit makes the will irrevocable. A will remains revocable up until the testator’s death, irrespective of whether it has a Self-Proving Affidavit attached. The testator can alter or revoke their will at any time before passing.

A Self-Proving Affidavit can validate an improperly signed will. The affidavit certifies that the will was executed properly, including being signed by the testator and witnesses as required. It cannot, however, remedy a fundamentally improperly executed will.

It’s only beneficial for the testator. While it’s true the affidavit simplifies the probate process for the executor, it also benefits the beneficiaries by potentially speeding up the distribution of the estate.

Once attached, it never needs to be updated. If significant changes are made to the will or if the document is re-executed, it’s prudent to update the Self-Proving Affidavit to reflect these changes, ensuring a smooth probate process.

Key takeaways

When dealing with the Texas Self-Proving Affidavit form, individuals are often seeking to streamline the process of having their will validated by the court after their death. This form, when properly completed and attached to a will, can save loved ones time and stress during the probate process. Here are four key takeaways to understand when filling out and using the Texas Self-Proving Affidavit form:

- It must be signed in the presence of a notary public: For the affidavit to be considered valid, the testator (the person creating the will) and the witnesses must sign the document in front of a notary public. This step is crucial for ensuring the document’s legitimacy and is a legal requirement in Texas. The notary public will also sign and seal the affidavit, further solidifying its validity.

- Two witnesses are required: In addition to the notary public, Texas law requires the presence of two competent witnesses during the signing of the Self-Proving Affidavit. These witnesses must be individuals who do not stand to inherit anything from the will. Their role is to verify the testator’s identity and mentally competent state at the time of signing.

- Attaching it to your will: Once completed, the Self-Proving Affidavit should be attached to the will. This makes the will "self-proving," meaning that the probate court can accept the document without needing to call the witnesses to testify to the authenticity of the will. This can significantly expedite the probate process, making it simpler and faster for your loved ones to carry out your wishes.

- It's advisable to seek legal advice: While filling out the Self-Proving Affidavit form might seem straightforward, it's wise to consult with a legal professional. This ensures that the form is completed correctly and in accordance with Texas law. A legal professional can also offer advice on other aspects of estate planning, ensuring that your assets are distributed according to your wishes with minimal complications.

Create Other Self-Proving Affidavit Forms for US States

What Is a Self-proving Affidavit - This affidavit provides a safeguard, protecting the intentions of the deceased by reinforcing the will’s legitimacy and the circumstances of its signing.

Oath of Witness to Will Florida Form - Failure to include a Self-Proving Affidavit can result in a more cumbersome probate process, with increased cost and time delays.

What Is Required for a Will to Be Valid - It can save significant time and legal expense by simplifying the administration of an estate in the probate process.

Georgia Affidavit Requirements - Choosing to include a Self-Proving Affidavit is a measure of foresight, anticipating and mitigating future legal complexities.