Legal Articles of Incorporation Form

Embarking on the journey of establishing a corporation is an exciting venture, yet it's fraught with numerous legal considerations that one must navigate with care. At the heart of this process lies the Articles of Incorporation form – a document of paramount importance that marks the birth of a corporation. It's a cornerstone, serving not only as a formal declaration of a corporation’s existence but also as a crucial compliance document that satisfies state laws. This form, detailed yet straightforward, requires specific information about the corporation including its name, purpose, incorporator information, registered agent, and share structure, among others. It’s the first step in a series of legal requirements that pave the way for the corporation to legally operate, issue stock, and enjoy the benefits of corporate status such as limited liability and potential tax advantages. Understanding the ins and outs of this form, ensuring accuracy in its completion, and knowing its significance in the wider context of corporate law can strongly influence the foundational strength and legal standing of a corporation.

State-specific Articles of Incorporation Forms

Example - Articles of Incorporation Form

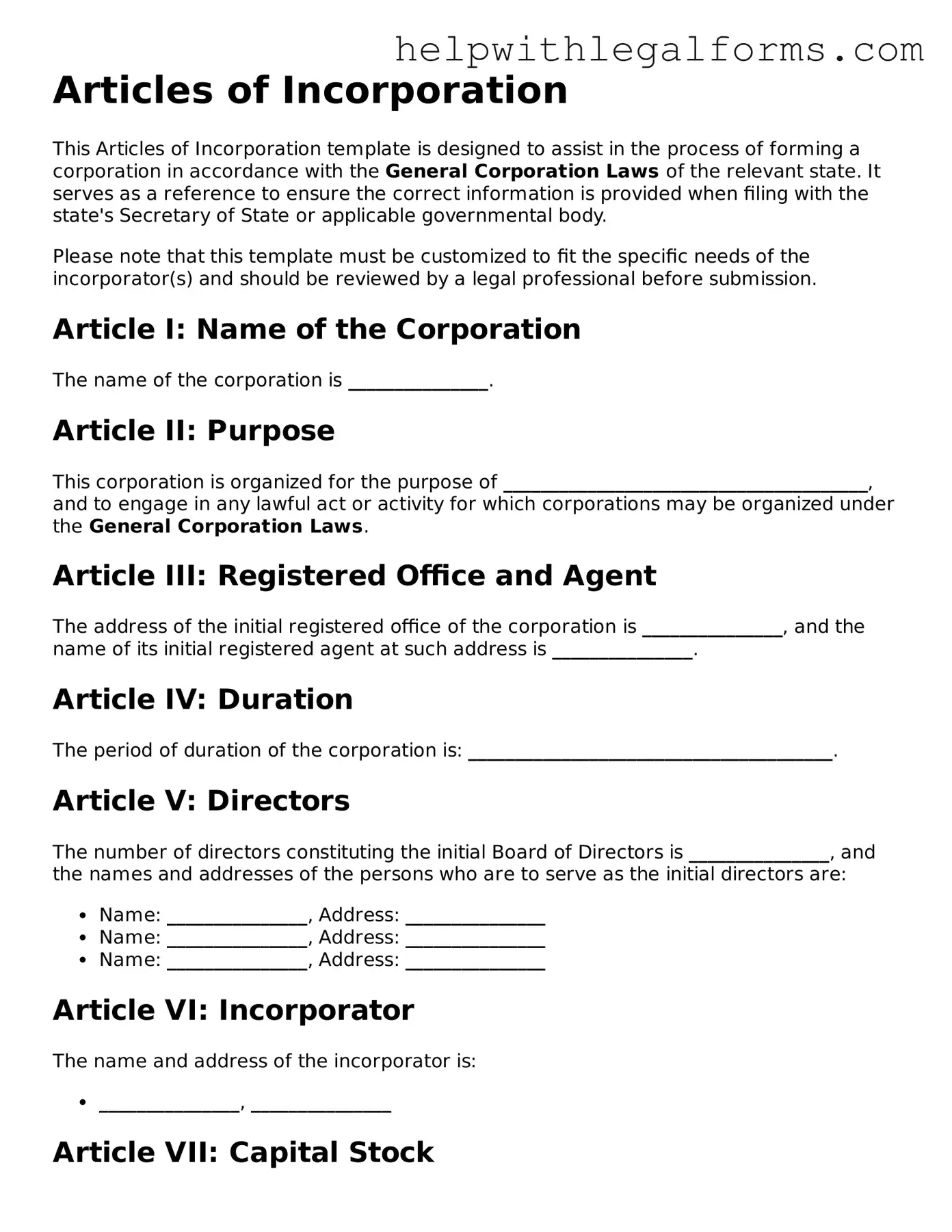

Articles of Incorporation

This Articles of Incorporation template is designed to assist in the process of forming a corporation in accordance with the General Corporation Laws of the relevant state. It serves as a reference to ensure the correct information is provided when filing with the state's Secretary of State or applicable governmental body.

Please note that this template must be customized to fit the specific needs of the incorporator(s) and should be reviewed by a legal professional before submission.

Article I: Name of the Corporation

The name of the corporation is _______________.

Article II: Purpose

This corporation is organized for the purpose of _______________________________________, and to engage in any lawful act or activity for which corporations may be organized under the General Corporation Laws.

Article III: Registered Office and Agent

The address of the initial registered office of the corporation is _______________, and the name of its initial registered agent at such address is _______________.

Article IV: Duration

The period of duration of the corporation is: _______________________________________.

Article V: Directors

The number of directors constituting the initial Board of Directors is _______________, and the names and addresses of the persons who are to serve as the initial directors are:

- Name: _______________, Address: _______________

- Name: _______________, Address: _______________

- Name: _______________, Address: _______________

Article VI: Incorporator

The name and address of the incorporator is:

- _______________, _______________

Article VII: Capital Stock

The corporation is authorized to issue a total of _______________ shares of capital stock, divided into classes as follows:

- Class _______________: _______________ shares

- Class _______________: _______________ shares

The rights, preferences, privileges, and restrictions granted to or imposed on each class of shares shall be as follows:

- _______________________________________

- _______________________________________

Article VIII: Bylaws

The initial bylaws of the corporation shall be adopted by the Board of Directors and may be amended or repealed as provided therein.

Article IX: Indemnification

The corporation shall indemnify any director, officer, employee, or agent of the corporation to the fullest extent permitted by the General Corporation Laws of the state or as provided in the bylaws.

Article X: Amendment of Articles

The Articles of Incorporation may be amended at any time in any manner provided by law.

In witness whereof, the undersigned incorporator has executed these Articles of Incorporation on this _____ day of _________________, 20_____.

_______________________________________

Signature of Incorporator

Printed Name: _______________

Date: _______________

PDF Form Attributes

| Fact | Description |

|---|---|

| Definition | Articles of Incorporation form a document that establishes a corporation's existence within its state of filing. |

| Primary Purpose | This document serves to outline the corporation's fundamental aspects, including its name, purpose, and the structure of its stock. |

| State-Specific Variance | While all states require the filing of Articles of Incorporation to create a corporation, the specific requirements and details included in the form can vary significantly from one state to another. |

| Governing Laws | Each state has its own set of statutes that govern the creation, organization, and dissolution of corporations, impacting how Articles of Incorporation must be prepared and filed. |

| Filing Office | In most states, the Articles of Incorporation are filed with the Secretary of State's office or a similar state agency responsible for business filings. |

| Public Record | Once filed, the Articles of Incorporation become a public record, providing transparency about the corporation's legal structure and foundational information. |

Instructions on How to Fill Out Articles of Incorporation

Embarking on the adventure of incorporating a business is both exhilarating and daunting. Before your corporate entity can officially take off, the Articles of Incorporation must be filed with your state's Secretary of State office or equivalent agency. This document lays the foundation for your corporation, detailing its structure, purpose, and compliance with state regulations. The process may seem overwhelming, but with a step-by-step guide, you'll find it more manageable than anticipated. Here’s how to get your corporation started on solid footing:

- Gather Required Information: Before diving into the form, collect all necessary information about your corporation, including the proposed name, principal office address, purpose of the corporation, names and addresses of the incorporators, and information about the initial board of directors.

- Name Your Corporation: Choose a name that complies with your state's naming requirements. It typically must be distinguishable from other names on file and include a corporate designator such as "Inc.," "Corporation," or an abbreviation. Check with your state's Secretary of State office or website to ensure the name is available.

- Designate a Registered Agent: Identify a registered agent for the corporation. This agent must have a physical address in the state of incorporation and be available during business hours to accept legal and official documents on behalf of the corporation.

- Specify Corporate Purpose: Describe the purpose of your corporation. Some states allow for a broad, general purpose statement, while others require a more specific explanation of your business activities.

- Determine Share Structure: Decide on the number and types of shares the corporation is authorized to issue. This information will determine the ownership structure of the corporation.

- Prepare and Sign the Articles: With all the required information at hand, fill out the Articles of Incorporation form. Make sure it's signed by the incorporator(s), who are the individual(s) preparing and filing the document.

- File the Articles with the State: Submit the completed Articles of Incorporation to the state's Secretary of State office, either online, by mail, or in person, depending on the state's filing options. Include the required filing fee, which varies by state.

Once the Articles of Incorporation are successfully filed, the state will issue a certificate of incorporation, officially marking the birth of your corporation. With this certificate in hand, you can proceed to obtain any necessary business licenses, open a corporate bank account, and begin operations. Remember, the journey of incorporating a business is unique, and specific requirements may vary by state. However, the fundamental steps provided here will guide you through the critical phase of legally establishing your corporation.

Crucial Points on This Form

What are the Articles of Incorporation?

The Articles of Incorporation is a document that is essential for forming a corporation. It serves as a formal application to the government to recognize a business as a corporation. By filing this document, the business owners provide necessary information about the corporation, such as its name, purpose, the number of shares it is authorized to issue, and the details of the incorporator(s).

Why do I need to file the Articles of Incorporation?

Filing the Articles of Incorporation is a legal requirement for establishing a corporation in the United States. This process officially registers your business as a corporation with the state, providing benefits such as personal liability protection for the owners, potential tax advantages, and greater credibility with customers and suppliers.

Where do I file the Articles of Incorporation?

The Articles of Incorporation are filed with the Secretary of State or an equivalent state agency that handles business filings in the state where you plan to incorporate your business. Each state has its own filing requirements and fees, so it's important to consult the specific agency's website or contact them directly for guidance.

Can anyone file the Articles of Incorporation?

The ability to file the Articles of Incorporation typically rests with the incorporator(s) who may be one or more individuals, or an entity. The incorporator(s) is responsible for signing the Articles and ensuring they are correctly filed with the appropriate state agency. After the corporation is formed, the incorporator's role usually ends, and control of the corporation is handed over to the board of directors.

What information is required in the Articles of Incorporation?

While the specific requirements can vary by state, most Articles of Incorporation will include the corporation's name, its purpose, the corporation's principal place of business, the number of shares the corporation is authorized to issue, the name and address of the incorporator(s), and the name and address of the registered agent who will receive legal documents on behalf of the corporation.

How much does it cost to file the Articles of Incorporation?

The filing fee for the Articles of Incorporation varies from state to state. Costs can range from as little as $50 to several hundred dollars. It's advisable to check with the specific state agency where you plan to file for the exact fee structure. Additionally, expedited services may be available for an additional charge if you need your corporation to be established more quickly.

How long does it take for the Articles of Incorporation to be approved?

The processing time for the Articles of Incorporation can differ greatly depending on the state. Some states may process your filing in a matter of days, especially if you pay for expedited service, while other states may take several weeks under standard processing times. It's important to plan accordingly and check with the state agency for an estimated timeline.

What happens after the Articles of Incorporation are filed?

Once the Articles of Incorporation are filed and approved, the state will issue a certificate of incorporation or a similar document, confirming the corporation's legal existence. After this, the newly formed corporation must comply with other state requirements such as holding an organizational meeting, issuing stock certificates, and obtaining any necessary business licenses and permits.

Is it necessary to hire a lawyer to file the Articles of Incorporation?

While it's not a legal requirement to hire a lawyer to file the Articles of Incorporation, consulting with one can be very helpful, especially if your corporation will have a complex ownership structure or you're unfamiliar with state laws. A lawyer can provide valuable advice and ensure that your documents are filed correctly and efficiently.

Can the Articles of Incorporation be changed after they are filed?

Yes, the Articles of Incorporation can be amended after they are filed. To make changes, the corporation must file an Articles of Amendment with the same state agency where the original Articles were filed. This process is used to update information such as the corporation's name, its purpose, or the number of authorized shares. Like the original filing, this process involves a filing fee and must be approved by the state.

Common mistakes

Filling out the Articles of Incorporation is a pivotal step in establishing a corporation in the United States. This document lays the groundwork for your business's legal structure, operational guidelines, and compliance with state laws. However, during this process, people often make mistakes that can lead to delays, additional expenses, or complications down the line. To ensure a smooth filing process, let's take a look at six common missteps to avoid.

Not Checking Name Availability: Before you decide on a name for your corporation, it’s crucial to ensure that the name is not already in use or too similar to another name in the state you are incorporating. Failing to do so can result in your Articles of Incorporation being rejected.

Incorrectly Stating the Purpose of the Corporation: Each state has different requirements for what needs to be included about the corporation's purpose. Some require a specific purpose, while others accept a general purpose clause. Misrepresenting the purpose, or being too vague or too specific when it is not required, can create issues.

Overlooking Shares and Par Value: If your corporation is authorized to issue shares, it's important to correctly state the number of shares and, if applicable, their par value. Getting this wrong can affect your corporation's financial and legal standing.

Errors in the Registered Agent's Information: The registered agent acts as your corporation's official point of contact and must be available during business hours. Providing incorrect information about the registered agent can lead to missed critical legal documents or notices.

Missing Signatures and Dates: It might seem obvious, but forgetting to sign the document or include the date can invalidate your submission. Every state requires an incorporator’s signature, and some states may require additional signatures.

Not Adhering to State-specific Requirements: Each state has unique requirements for the Articles of Incorporation. These can include specific disclosures, additional forms, or initial reports that need to be filed along with the Articles. Ignoring these specifics can lead to the rejection of your filing.

Steering clear of these mistakes not only streamlines the process but also sets a strong foundation for your corporation. If you’re unsure about any part of the filing process, it may be helpful to consult with a legal advisor. This extra step can save you a significant amount of time and money in the long run by ensuring that your Articles of Incorporation are completed accurately and comply with all state requirements.

Documents used along the form

When setting up a corporation, the Articles of Incorporation form is just the beginning. This essential document legally establishes the corporation, but several other forms and documents are crucial for fully setting up and operating a new business entity. These documents complement the Articles of Incorporation, helping in various aspects such as defining the operational structure, complying with legal requirements, and establishing agreements among founders. Below is a list of six commonly used documents alongside the Articles of Incorporation.

- Bylaws: This document outlines the rules and procedures for the internal governance of the corporation. It includes details on shareholder meetings, the board of directors' powers and duties, and the process for amending the bylaws or articles.

- Operating Agreement: Primarily used by LLCs, an Operating Agreement is crucial for multi-member LLCs and is advisable even for single-member LLCs. It details the members' rights, responsibilities, and profit-sharing ratios, similar to bylaws but for an LLC.

- Shareholder Agreement: A contract among the shareholders of a corporation that outlines additional rights and obligations. It may include provisions for buying and selling shares, dispute resolution methods, and how decisions are made.

- Employer Identification Number (EIN) Application: Necessary for almost all businesses, the EIN is a federal tax identification number issued by the Internal Revenue Service (IRS). It's needed for tax filing and reporting, as well as opening business bank accounts.

- Business Licenses and Permits: Depending on the business activities and its location, various federal, state, and local licenses and permits may be required to legally operate the business.

- Stock Certificates: For corporations issuing stock, these certificates represent the ownership of shares in the company. They include information such as the name of the shareholder, number of shares, and date of issuance.

Collectively, these documents, along with the Articles of Incorporation, create a framework for the smooth operation and legal compliance of your corporation. Each plays a significant role in defining how the business functions, from internal management to compliance with tax laws. Ensuring that these documents are correctly prepared and filed is foundational to setting your corporation up for success.

Similar forms

Bylaws: Like the Articles of Incorporation, bylaws provide a detailed framework for how a corporation operates, outlining procedures, rights, and duties of members and directors. While the Articles of Incorporation establish the legal existence of the corporation, bylaws address the internal management structure and procedures, making both documents foundational to the corporate structure.

Operating Agreement: This document is to LLCs (Limited Liability Companies) what the Articles of Incorporation are to corporations. It details the operational guidelines, financial decisions, and roles of members within an LLC, offering a parallel to how the Articles set forth the basic framework for corporations. Both serve as primary organizational documents for their respective entity types.

Partnership Agreement: Similar to the Articles of Incorporation, a Partnership Agreement outlines the foundation of a partnership, detailing the relationship between partners, their obligations, and how profits and losses are shared. Although tailored to partnerships rather than corporations, it serves a comparable role in establishing the entity’s operational guidelines and structure.

Corporate Charter: In many jurisdictions, the term 'corporate charter' is used interchangeably with the Articles of Incorporation. Thus, they are not just similar—they are essentially the same document but with different titles, both signifying the legal birth of the corporation, dictating its name, purpose, stock structure, and other fundamental characteristics.

Shareholder Agreement: Shareholder agreements complement the Articles of Incorporation by outlining the rights, responsibilities, and relationships among the shareholders themselves and between shareholders and management. While the Articles of Incorporation initiate the corporation's existence under law, shareholder agreements detail the governance practices and expectations among the owners, tying into the corporation’s operational and governance structure.

Dos and Don'ts

Completing the Articles of Incorporation is a key step in the process of incorporating your business. This document will formalize your company's existence under the law. To ensure accuracy and compliance, here are some do’s and don’ts to consider:

Do's:

- Check your state's requirements – Every state has different requirements for the Articles of Incorporation, so make sure you are following your state's specific guidelines.

- Use the correct form – Make sure you're filling out the latest version of the form provided by your state.

- Include all required information – Common requirements include the name of the corporation, principal place of business, purpose of the corporation, duration, incorporator information, and details about the shares of stock the corporation is authorized to issue.

- Be clear and concise – Use clear language to avoid confusion or misunderstandings. Avoid unnecessary legal jargon.

- Proofread – Review your form for any errors or omissions. Spelling mistakes or incorrect information can lead to delays.

- Sign and date the form – Ensure that the form is signed by the appropriate party, usually the incorporator or an authorized agent.

- Keep a copy – Once the form is filled out and submitted, keep a copy for your records.

- Know the filing fee – Be aware of the necessary filing fee and make sure it is paid with your submission to avoid delays.

- Consider seeking legal advice – If you have any doubts or questions, consulting with a legal professional can help ensure that the form is filled out correctly.

- Submit in a timely manner – Be aware of any deadlines for filing the Articles of Incorporation to avoid late fees or penalties.

Don'ts:

- Don’t use a generic template without verifying that it meets your state’s requirements.

- Don’t leave sections blank – If a section does not apply, denote that with “N/A” or “Not Applicable” instead of leaving it blank.

- Don’t guess on details – If you’re unsure about an aspect of the form, it’s better to seek clarification than to guess and make a mistake.

- Don’t use vague language in the purpose clause – Be specific about the nature of the business to avoid broad or undefined purposes.

- Don’t forget to check for name availability – Ensure that the corporation’s name is not already in use or too similar to existing entity names.

- Don’t provide personal information unless required – Only include personal details if explicitly asked for in the form.

- Don’t ignore state-specific addendums or requirements – Some states may have additional forms or information requirements.

- Don’t file without double-checking all information – A second review can catch mistakes you might have missed on the first pass.

- Don’t underestimate the importance of the registered agent section – This entity or person will receive important legal and tax documents on behalf of the corporation.

- Don’t neglect to keep up with annual requirements – After filing, remember that most states require annual reports and updates to keep the corporation in good standing.

Misconceptions

The process of starting a corporation often involves filing an Articles of Incorporation form. This document plays a crucial role in establishing a company’s legal identity. However, there are several misconceptions about this form that can lead to confusion. Here are four common misunderstandings and explanations to clear them up:

They are the same in every state: One common misconception is that the Articles of Incorporation form is uniform across all states. In reality, the requirements can vary significantly from state to state. While there are common elements, such as the corporation's name, purpose, and registered agent, specific requirements and additional sections may differ. It's essential for businesses to review the guidelines provided by the state where they are incorporating to ensure they meet all legal prerequisites.

Filing them once is enough: Another misconception is that once the Articles of Incorporation are filed, there's no need to update them. However, if there are changes in the corporation’s operational scope, directors, or other significant aspects, it may be necessary to file amended articles. Staying compliant involves not just a one-time filing but ongoing updates to reflect the current status of the corporation.

They cover all legal requirements for starting a corporation: Some people believe that filing the Articles of Incorporation is all that’s required to legally start operating. This overlooks other important steps such as obtaining necessary local, state, or federal licenses and permits, creating corporate bylaws, and holding initial board meetings. The Articles of Incorporation are crucial, but they represent just the beginning of the compliance journey for a new corporation.

The process is too complicated for non-lawyers: While legal documents can be intimidating, the process of filing Articles of Incorporation doesn’t have to be overly complicated. Many states provide templates or simple online forms to help simplify the process. Understandably, the details matter and mistakes can have implications, but with careful attention to detail and possibly seeking some professional advice, filling out and filing these articles is achievable for most people.

Understanding the true nature and requirements of the Articles of Incorporation can save new business owners time and protect them from unforeseen legal complications. It’s about getting the right start and maintaining a compliant, well-structured business for the future.

Key takeaways

Filling out the Articles of Incorporation is a crucial step in forming a corporation. This document serves as a formal declaration to the state, detailing key aspects of the corporation. To ensure that individuals approach this process with clarity and precision, here are ten essential takeaways:

Understanding the purpose of the Articles of Incorporation is fundamental. They legally establish a corporation's existence under state law.

Details matter. Information such as the corporation's name, purpose, duration, and the information regarding incorporators must be accurately provided.

Selecting a corporate name requires careful consideration. It must comply with state regulations and must be distinguishable from names already in use.

The choice of corporate address is not trivial. This address will serve as the official place of business and will receive legal and official correspondence.

Designating a registered agent is mandatory. This agent acts as the corporation’s official point of contact for legal notifications.

Specifying the corporation’s share structure is a critical component. The types and number of shares the corporation is authorized to issue should be clearly defined.

Clarification of directors’ roles and responsibilities at the outset can prevent confusion and conflicts later on. Though not always required in the Articles, it's an important consideration.

Understanding the legal obligations in your state is crucial. Each state has its own set of rules governing the content and filing process of the Articles of Incorporation.

The necessity of precision cannot be overstated. Errors or omissions in the Articles can delay the process or affect the corporation’s legal status.

Lastly, maintaining a copy of the filed Articles of Incorporation is indispensable for corporate records and future reference.

When approached with careful attention to detail and a thorough understanding of the requirements, the process of filling out and using the Articles of Incorporation form is straightforward but significant. Complying with these guidelines ensures a smooth journey toward establishing a corporation’s legal foundation.

Other Forms

How Long Does a Quit Claim Deed Take to Process - Its simplicity makes it an effective tool for quick property transfers, though it comes with certain risks.

Dnr Medical - Provides clear guidance to emergency responders and hospital staff during a health crisis.

Free Printable Mobile Home Bill of Sale - It acts as an official record for insurance claims, providing insurers with detailed information about the transaction and property.