Blank Articles of Incorporation Form for California

Starting a corporation in California is a significant step towards turning entrepreneurial visions into reality, and the cornerstone of this process is the submission of the Articles of Incorporation. This essential document, tailored to meet the specific legal requirements of the state, acts as the birth certificate for a corporation. It includes crucial information about the business, such as its name, purpose, the type of corporation it will be, the address of its principal office, the number of shares the corporation is authorized to issue, and the information about its agent for service of process. Completing this form accurately and comprehensively is vital, as it not only ensures compliance with California state law but also lays the groundwork for the corporation's legal identity, governance, and operational framework. Furthermore, it serves as a public record, establishing the corporation's existence and legitimacy to stakeholders and regulatory bodies. Understanding each segment's requirements and implications can smooth the pathway to incorporating a business, making informed planning and precise execution paramount.

Example - California Articles of Incorporation Form

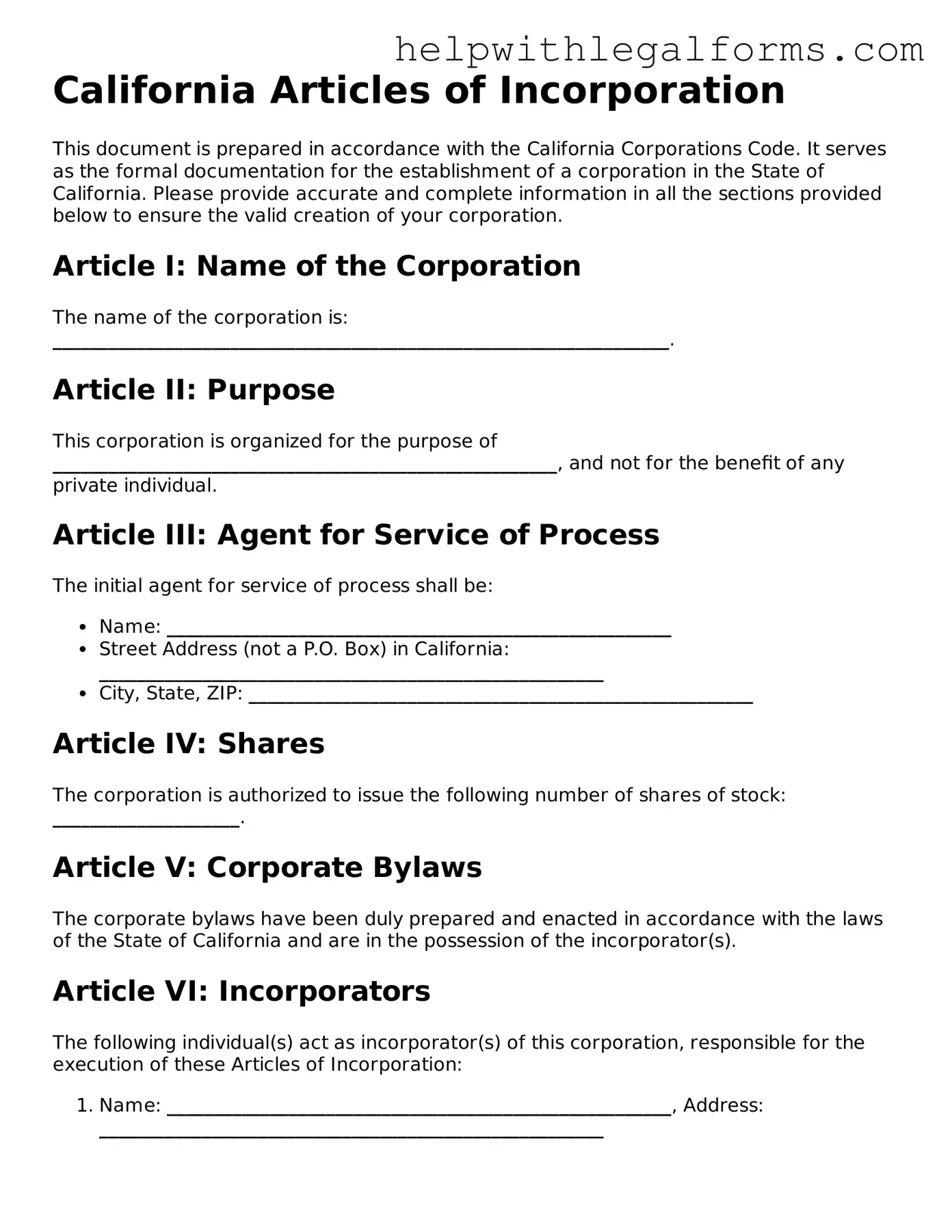

California Articles of Incorporation

This document is prepared in accordance with the California Corporations Code. It serves as the formal documentation for the establishment of a corporation in the State of California. Please provide accurate and complete information in all the sections provided below to ensure the valid creation of your corporation.

Article I: Name of the Corporation

The name of the corporation is: __________________________________________________________________.

Article II: Purpose

This corporation is organized for the purpose of ______________________________________________________, and not for the benefit of any private individual.

Article III: Agent for Service of Process

The initial agent for service of process shall be:

- Name: ______________________________________________________

- Street Address (not a P.O. Box) in California: ______________________________________________________

- City, State, ZIP: ______________________________________________________

Article IV: Shares

The corporation is authorized to issue the following number of shares of stock: ____________________.

Article V: Corporate Bylaws

The corporate bylaws have been duly prepared and enacted in accordance with the laws of the State of California and are in the possession of the incorporator(s).

Article VI: Incorporators

The following individual(s) act as incorporator(s) of this corporation, responsible for the execution of these Articles of Incorporation:

- Name: ______________________________________________________, Address: ______________________________________________________

Article VII: Principal Office

The principal office of the corporation in the State of California shall be located at:

- Street Address: ______________________________________________________

- City, State, ZIP: ______________________________________________________

Additional Provisions

Additional provisions regarding the management and operation of the corporation may be attached as an appendix to this document.

Declaration

The undersigned incorporator(s) declare(s) under penalty of perjury under the laws of the State of California that the statements made in this document are true and correct.

Date: ____________________

Signature of Incorporator(s): _________________________________________________

Please review all provided information before submitting this document to the California Secretary of State for filing.

PDF Form Attributes

| Fact Number | Fact Detail |

|---|---|

| 1 | The California Articles of Incorporation form is used to officially register a corporation in the state of California. |

| 2 | This form must be filed with the California Secretary of State. |

| 3 | Governing law for this form includes the California Corporations Code. |

| 4 | The form requires information about the corporation, including its name, purpose, agent for service of process, and share structure. |

| 5 | Filing fees must be paid when submitting the form, and these fees can vary. |

Instructions on How to Fill Out California Articles of Incorporation

Filling out the Articles of Incorporation for the state of California is a critical step in establishing your business as a legal entity. This document serves as a charter to recognize your business within the state and outlines essential information about your corporation. It's important to complete this form accurately and thoroughly to ensure that your business starts on solid legal footing. Below is a step-by-step guide to help you navigate this process smoothly.

- Begin by obtaining the correct form from the California Secretary of State's website. Ensure you select the form specific to the type of corporation you are establishing (e.g., general stock, no stock, close, professional).

- Fill in the name of your corporation exactly as you want it registered, including any required legal designators like "Inc." or "Corp." Ensure the name complies with California naming requirements.

- Specify the purpose of your corporation. While some states require a detailed description, California allows for a general statement indicating that the corporation engages in any lawful act or activity for which a corporation may be organized under the General Corporation Law, except as otherwise specified.

- Provide the name and physical street address (no P.O. Boxes) of the corporation's initial agent for service of process. This can be an individual residing in California or an active corporation that has filed an agent for service of process form with the state.

- State the number of shares the corporation is authorized to issue. This information is essential for determining your company's stock structure and investment potential.

- Include additional provisions or information needed for the specific type of corporation being formed, such as details about stock classes or voting rights, if applicable.

- If required for your corporation type, list the names and addresses of the initial directors who will serve on the board until the first annual meeting of shareholders or until their successors are elected and qualified.

- Have the incorporator(s) sign and date the form. The incorporator(s) is the person(s) preparing and filing the Articles of Incorporation.

- Review the form carefully to ensure all information is accurate and complete. Make a copy for your records.

- Submit the form along with the necessary filing fee to the California Secretary of State's office. You can do this via mail, in person, or, for some entities, online.

After submitting your Articles of Incorporation, your work isn't quite finished. You'll need to wait for the state to review and approve your form. This can take several weeks. Once approved, you'll receive a certified copy of your Articles of Incorporation, marking the official beginning of your corporation's existence under California law. At this point, you'll be ready to take the next steps in establishing your business, like drafting bylaws, issuing stock, and applying for any necessary licenses and permits.

Crucial Points on This Form

What are the Articles of Incorporation in California?

The Articles of Incorporation are a document required by the state of California for the establishment of a corporation. This document formally registers the corporation with the California Secretary of State and outlines key information, such as the corporation's name, purpose, agent for service of process, and shares structure. Its completion is a pivotal step in ensuring a corporation's legal foundation within the state.

Who needs to file the Articles of Incorporation?

Any individual or group wishing to establish a corporation in the state of California must file the Articles of Incorporation. This requirement spans various types of corporations, from non-profits to business entities, aiming to operate and be recognized legally within the state.

What information is required on the California Articles of Incorporation form?

The form for the Articles of Incorporation in California typically requires detailed information including the corporation's name, specific purpose for which the corporation is established, the name and address of the initial agent for service of process, and the number and type of shares the corporation is authorized to issue. Additionally, it must specify the corporation's principal office address, if available at the time of filing.

Where can one obtain and file the Articles of Incorporation in California?

Prospective incorporators can obtain the Articles of Incorporation form from the California Secretary of State's official website or office. The completed form can be submitted either through mail or in person at the Secretary of State's office. Some services offer to file electronically for an additional fee.

What are the filing fees for the Articles of Incorporation in California?

The filing fee for the Articles of Incorporation in California varies depending on the type of corporation being established. As of the latest update, the fee for most general stock corporations is set at a standard rate, with different rates applicable for non-profit entities and professional corporations. The California Secretary of State's website provides a current schedule of fees.

How long does it take to process the Articles of Incorporation in California?

The processing time for Articles of Incorporation in California can vary based on the filing method and the current workload of the Secretary of State's office. Typically, filings submitted in person or electronically may be processed quicker than those sent via mail. Expedited processing services are available for an additional fee, offering a range of turnaround times from same-day to 24-hour processing.

Are there annual requirements for corporations in California after filing the Articles of Incorporation?

Yes, California corporations must meet several annual requirements to remain in good standing. These include filing an annual report (also known as a Statement of Information), maintaining an agent for service of process, and paying the annual franchise tax. Failure to comply with these requirements can lead to penalties or the suspension of corporate powers by the state.

Common mistakes

-

Many people incorrectly assume all sections of the form apply to their specific type of corporation. This often leads to unnecessary or incorrect information being provided. For example, nonprofit corporations should not fill out sections intended for professional corporations.

-

Choosing an improper business name is a common mistake. The name must be unique and meet California's requirements, including certain legal suffixes. People often forget to check whether their desired business name is available and compliant.

-

Failing to properly designate the agent for service of process. Corporations must designate either an individual residing in California or an active corporate agent registered with the California Secretary of State. Mistakes in this section can lead to issues with legal notices.

-

Not specifying the correct number of shares the corporation is authorized to issue can be problematic. This number influences various aspects of the corporation, including its ability to raise capital and distribute ownership.

-

Skipping the initial corporate address fields. Although it may seem minor, the initial address is crucial for receiving official governmental correspondence and notices.

-

Misunderstanding the purpose of the Articles of Incorporation leads some to place inappropriate information within the document, such as business plans or detailed descriptions of services, which do not belong in this filing.

-

Overlooking the requirement for signatures. All relevant parties must sign the Articles of Incorporation. Sometimes, individuals forget to sign, or the signature does not match the person authorized to act on behalf of the corporation.

-

Ignoring the need to file additional forms that may be required for specific types of corporations, like professional corporations, which need to meet additional requirements beyond the basic Articles of Incorporation.

Addressing these common mistakes ensures a smoother filing process and helps establish the legal foundation of a corporation correctly.

Documents used along the form

When incorporating a business in California, the Articles of Incorporation form serves as the foundational document, formally establishing the entity within the state. However, to ensure the proper functioning and legal compliance of your newly formed corporation, several other forms and documents are typically required during and after the filing process. These documents cover a range of purposes, from specifying the operational guidelines of your business to ensuring tax compliance. Below is a brief overview of some of these crucial documents that are often used in conjunction with the California Articles of Incorporation.

- Bylaws: This internal document outlines the rules and procedures for the operation of the corporation. It covers areas such as the process for electing directors, the roles and responsibilities of officers, and how meetings are conducted. Although bylaws are not filed with the state, they are a crucial part of establishing your corporation's governance structure.

- Statement of Information: After filing the Articles of Incorporation, corporations are required to file an initial Statement of Information with the California Secretary of State. This form provides essential details about the corporation, including the names and addresses of its directors, the chief executive officer, and the street address of its principal executive office. Subsequent filings are required periodically to update the state on any changes.

- Stock Certificates: Although not a formal filing, corporations that issue stock will need to provide stock certificates to their shareholders. These certificates serve as a physical representation of ownership in the company. The specifics regarding the issuance of stock certificates should be detailed in the corporation's bylaws.

- Employer Identification Number (EIN): An EIN, obtained from the Internal Revenue Service (IRS), is essentially a social security number for your corporation. It is required for tax purposes, opening a bank account in the name of the corporation, and for hiring employees. Obtaining an EIN is a critical step following the approval of your Articles of Incorporation.

Incorporating a business in California involves more than just filling out and filing the Articles of Incorporation. The associated documents, from bylaws and stock certificates to tax identification, play vital roles in the operational setup and legal compliance of the corporation. Together, they form a comprehensive framework that supports the structure and facilitates the smooth functioning of the organization. It's essential for business owners to understand the importance of each document and ensure that they are correctly completed and maintained.

Similar forms

Bylaws: The bylaws of a corporation work hand in hand with the Articles of Incorporation but focus more on the internal regulations governing the management of the corporation. While Articles of Incorporation establish the corporation’s existence, bylaws detail the rules for the corporation's daily operations, including the organization of the board of directors and shareholder meetings.

Operating Agreement: This document is similar to the Articles of Incorporation for limited liability companies (LLCs). An Operating Agreement outlines the LLC's financial and functional decisions, including rules, regulations, and provisions for the operation. It governs the internal operations in a way that suits the interests of its members, comparable to how the Articles set the foundational structure for a corporation.

Partnership Agreement: For businesses that operate as partnerships, the Partnership Agreement plays a similar role to the Articles of Incorporation. This document outlines the details about the business partnership, including the responsibilities of each partner, profit distribution, and the rules for resolving disputes. It provides a formal structure for the partnership's operation and management.

DBA Registration Forms: “Doing Business As” (DBA) registration forms are important for businesses that operate under a trade name that is different from their legal names, paralleling the Articles of Incorporation's role in legally establishing a business entity. DBA forms don't create a separate legal entity but are essential for compliance and brand identity.

Shareholder Agreement: Similar to the Articles of Incorporation, which outline the issuance of shares, a Shareholder Agreement sets out the rights and obligations of shareholders. It includes provisions for the protection of shareholders' rights, the regulation of share transfers, and the overall governance structure of the corporation.

Certificate of Formation: Used primarily by limited liability companies, the Certificate of Formation is akin to the Articles of Incorporation for corporations. It formally establishes the LLC's existence under state law and includes fundamental information such as the company's name, purpose, duration, and management structure.

Business License Application: While regulating different aspects of a business’s operation, obtaining a business license is mandatory for a business to legally operate, similar to how filing Articles of Incorporation is required to legally form a corporation. The business license application provides the necessary information for local or state authorities to regulate the business activity.

Employer Identification Number (EIN) Application: Although serving different administrative functions, applying for an EIN from the IRS is similar in its foundational necessity for new businesses as incorporating. The EIN is required for tax reporting purposes, just as the Articles of Incorporation are needed to legally define the business as a corporation.

Trademark Registration Forms: Filing for a trademark is similar to the Articles of Incorporation in that it establishes a legal claim to a specific name or symbol associated with the business. Like the Articles designate the unique identity of a corporation, trademark registration protects the brand’s unique symbols, logos, or phrases at a state or federal level.

Dos and Don'ts

Filling out the California Articles of Incorporation form correctly is crucial for starting your corporation on solid legal footing. Below, find key dos and don'ts to guide you through the process.

Things You Should Do:

- Carefully read all instructions provided with the form to ensure you understand the requirements.

- Provide accurate and complete information for each section to avoid delays or rejection.

- Ensure the corporation's name complies with California state law, includes a corporate designator such as "Inc." or "Corporation," and is distinguishable from existing names on the California Secretary of State's records.

- Specify the purpose of the corporation clearly and concisely, adhering to legal requirements.

- Appoint a registered agent with a physical address in California who is available during normal business hours to receive legal documents.

- Include the correct number of authorized shares of stock the corporation is allowed to issue, if applicable.

- Sign and date the form as required, ensuring all necessary parties are included.

Things You Shouldn't Do:

- Don't leave required fields blank; incomplete forms will not be processed.

- Don't use a PO Box as the address for the registered agent; a physical address in California is required.

- Don't forget to specify the type of corporation (e.g., general stock, no stock, close, etc.) as this affects your legal and tax treatment.

- Don't neglect to check the availability of your desired corporation name before submitting; this can save time and avoid rejection.

- Don't omit the signature of the incorporator or authorized representative; unsigned forms are invalid.

- Don't disregard the need for bylaws which, while not filed with the Articles of Incorporation, are crucial for outlining the corporation's internal rules and procedures.

- Don't ignore the requirement for initial corporate filings beyond the Articles of Incorporation, such as the Statement of Information, which must be filed shortly after the articles.

By following these guidelines, you'll be better prepared to submit your Articles of Incorporation in California successfully. Remember, accuracy and attention to detail are your allies in this process.

Misconceptions

Many people, when deciding to form a corporation in California, encounter misconceptions about the California Articles of Incorporation. Understanding these common misunderstandings can help streamline the process of forming a corporation and ensure compliance with state regulations.

- They Are the Only Document Needed to Start a Corporation

This is a common misconception. The Articles of Incorporation are crucial for establishing a corporation's legal existence under state law. However, they are just the beginning. Corporate bylaws, which are not filed with the state, must also be drafted to outline the corporation's internal operating rules. Additionally, corporations are required to obtain necessary licenses and permits, file for an EIN, and fulfill other regulatory requirements.

- Details About Shares Must Be Extensively Detailed

While the Articles of Incorporation do require information about the corporation's authorized shares, the level of detail needed is often overestimated. The form requires basic information, such as the number of shares the corporation is authorized to issue and, if applicable, the classes of shares. There's no need to detail the rights and preferences of each share class in this document; such details are typically reserved for the corporate bylaws or a shareholder agreement.

- Filing Is Complex and Requires Legal Assistance

Filing the Articles of Incorporation can be straightforward and doesn't necessarily require legal assistance. The California Secretary of State provides resources and a standard form that simplifies the process. Individuals can complete and submit this form themselves. However, seeking advice from a legal professional can ensure that all aspects of incorporation align with the business's goals and comply with state law.

- Any Mistake Is Permanent and Cannot Be Corrected

This belief can cause unnecessary anxiety. While accuracy is important when filing any legal document, mistakes in the Articles of Incorporation can often be corrected by filing a Certificate of Amendment with the Secretary of State. This process allows for corrections or changes to information previously submitted.

- Personal Information Is Made Public

Some individuals worry about the privacy implications of filing the Articles of Incorporation. It is true that this document requires the name and address of the corporation's registered agent, and this information becomes part of the public record. However, other personal information, such as the names and addresses of the corporation's directors or officers, is not required on the initial filing document in California, thus offering a degree of privacy protection.

Dispelling these misconceptions can demystify the process of incorporating a business in California, encouraging a more informed approach to this important step in a business's development.

Key takeaways

Filing the California Articles of Incorporation is a foundational step for establishing a corporation within the state. This legal document marks the beginning of your corporate entity's existence under California law. Grasping the essentials will facilitate a smooth filing process and ensure compliance with state regulations. Below are key takeaways vital for anyone looking to incorporate in California.

- Detailed Information Required: The form calls for precise information about the corporation, including the corporate name, purpose, agent for service of process, and shares information. It is imperative to double-check details for accuracy to prevent any processing delays or legal complications.

- Choosing a Corporate Name: Your corporation's name must be distinguishable from other entities registered in California and must include a corporate designator, such as "Corporation," "Incorporated," or an abbreviation. A name availability check is highly advisable prior to filing.

- Agent for Service of Process: Your corporation must designate an agent for service of process in California. This can be either an individual residing in California or a registered corporate agent approved by the state. The agent's role is crucial for receiving legal and official documents on behalf of the corporation.

- Statement of Purpose: While the form may provide a general purpose clause, specifying the nature of your corporation's business activities might be required under certain circumstances. It is important to articulate the corporation's purpose clearly and accurately.

- Share Structure: The form will ask for details about the corporation's share structure, including the number of shares authorized for issuance. Thoughtfully considering the structure and type of shares is essential for the future governance and financial architecture of your corporation.

Note: After filing, keeping a copy of the Articles of Incorporation for your records is recommended. This document serves as a critical element of your corporate formation documents and may be required for certain business activities, including banking and compliance filings.

Create Other Articles of Incorporation Forms for US States

Article of Incorporation Texas - The filing process can be completed electronically in many states, simplifying submission.

Florida State Corporation Commission - Through this form, corporations declare their intent to establish a legal business entity.

Document Retrieval Center - Filing the Articles of Incorporation is the first legal step in creating a corporation, followed by other requirements such as holding organizational meetings and issuing stock.

Corporate Formation - In certain jurisdictions, the Articles must declare if the corporation elects to be an S Corporation for tax purposes, impacting taxation.