Blank Articles of Incorporation Form for Colorado

Embarking on the journey of establishing a corporation in Colorado commences with a pivotal step: the completion and submission of the Articles of Incorporation form. This foundational legal document serves as the official notice of the creation of a corporation, laying the groundwork for its legal identity, operational framework, and governance. It outlines several critical elements, including the corporation's name, its principal place of business, the type of corporation it wishes to be recognized as (e.g., nonprofit, for-profit), and the details regarding its shares (if applicable). Furthermore, the form requires the designation of a registered agent, an individual or company appointed to receive legal documents on behalf of the corporation. The filling out of this form demands meticulous attention to detail and an understanding of its implications on the corporation's future, including taxation, legal responsibilities, and regulatory compliance. In Colorado, the Secretary of State's office is the centralized hub for filing and maintaining these documents, offering both paper-based and online submission options to accommodate the diverse needs of budding corporations.

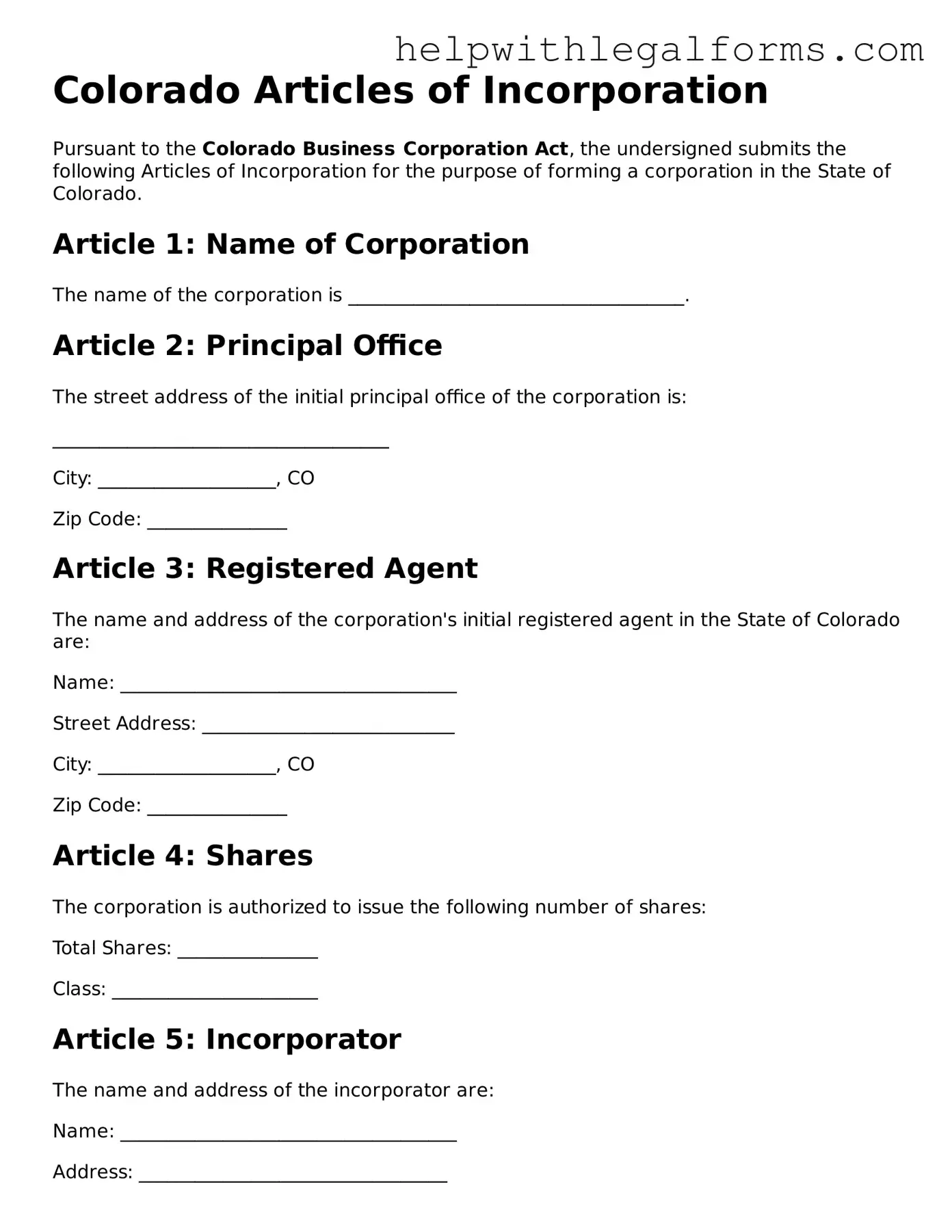

Example - Colorado Articles of Incorporation Form

Colorado Articles of Incorporation

Pursuant to the Colorado Business Corporation Act, the undersigned submits the following Articles of Incorporation for the purpose of forming a corporation in the State of Colorado.

Article 1: Name of Corporation

The name of the corporation is ____________________________________.

Article 2: Principal Office

The street address of the initial principal office of the corporation is:

____________________________________

City: ___________________, CO

Zip Code: _______________

Article 3: Registered Agent

The name and address of the corporation's initial registered agent in the State of Colorado are:

Name: ____________________________________

Street Address: ___________________________

City: ___________________, CO

Zip Code: _______________

Article 4: Shares

The corporation is authorized to issue the following number of shares:

Total Shares: _______________

Class: ______________________

Article 5: Incorporator

The name and address of the incorporator are:

Name: ____________________________________

Address: _________________________________

City: ___________________, CO

Zip Code: _______________

Article 6: Duration

The corporation shall have perpetual existence unless dissolved according to law.

Article 7: Purpose

The purpose for which the corporation is organized is:

__________________________________________

Article 8: Directors

The number of directors constituting the initial Board of Directors and the names and addresses of the persons who are to serve as directors until the first annual meeting of shareholders or until their successors are elected and qualify are:

- Name: ___________________, Address: ________________________________

- Name: ___________________, Address: ________________________________

- Name: ___________________, Address: ________________________________

Article 9: Indemnification

The corporation shall indemnify any director, officer, employee, or agent who was or is a party to any proceeding because of their position within the corporation, as permitted by the Colorado Business Corporation Act.

Article 10: Incorporator's Statement

I, ________________________, being the incorporator, certify that the information provided in these Articles of Incorporation is true to the best of my knowledge and belief. Executed on this ____ day of __________, 20__.

Signature: ______________________

Name (Print): ___________________

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Document Purpose | Used to formally establish a corporation in the state of Colorado. |

| Governing Law(s) | Regulated under the Colorado Business Corporation Act. |

| Minimum Requirements | Includes the corporation's name, principal office address, registered agent information, and incorporator details. |

| Filing Method | Can be filed online through the Colorado Secretary of State's website or by mail. |

| Filing Fee | There is a nominal filing fee, subject to change, required with submission. |

Instructions on How to Fill Out Colorado Articles of Incorporation

Submitting the Articles of Incorporation is a pivotal step for individuals who are looking to establish a corporation in Colorado. This document formalizes the creation of a corporation and includes crucial details about the business such as its name, purpose, and the structure of its shares. Once successfully filed, the corporation gains legal recognition, allowing it to operate within the state. The process involves accurately completing a form, which can be done with careful attention to detail and adherence to the state's requirements. Below are the steps to properly fill out the Colorado Articles of Incorporation form to ensure a smooth filing process.

- Determine the corporate name and ensure it adheres to Colorado's naming requirements. The name must be distinguishable from other entities registered in the state.

- Specify the corporate purpose, unless you opt for a broad purpose clause allowed under Colorado law, which enables the corporation to engage in any lawful activity.

- Designate the initial registered agent. This entity or individual must have a physical address in Colorado and agrees to accept legal papers on behalf of the corporation.

- State the number of shares the corporation is authorized to issue. This detail is vital as it impacts the corporation's ability to raise capital and distribute ownership.

- Provide information about the incorporator(s)—the individual(s) completing and signing the form. This includes their names and addresses.

- Specify whether the corporation will have a board of directors or be managed by its shareholders. This decision affects the governance structure of the business.

- Decide on the par value of the shares, if applicable. Par value is the minimum price at which shares can be issued, and not all shares have a par value.

- Include any additional provisions that are not covered by the standard form but are important for your corporation's operation. These may relate to director liability, shareholder rights, etc.

- Review the form for accuracy and completeness. Mistakes or omissions can lead to delays in the corporation's formation.

- Submit the form and the appropriate filing fee to the Colorado Secretary of State. This can usually be done online, by mail, or in person.

After the Articles of Incorporation are filed and approved by the Secretary of State, the corporation will officially exist. It's important to then comply with other regulatory requirements, such as obtaining any necessary business licenses and permits, creating bylaws, issuing stock, and applying for an Employer Identification Number (EIN) from the IRS. Filing the Articles of Incorporation is just the beginning of creating a structured and legally recognized corporation in Colorado.

Crucial Points on This Form

What is the purpose of the Colorado Articles of Incorporation form?

The Colorado Articles of Incorporation form is used to legally establish a corporation within the state. This document outlines the primary details of the company, including its name, purpose, and structure. It must be filed with the Colorado Secretary of State to formalize the business's existence under state law.

Who needs to file the Colorado Articles of Incorporation?

Any group or individual wishing to form a corporation in Colorado must file the Articles of Incorporation. This applies to both profit and nonprofit entities planning to operate within the state. It's a critical step for formalizing the business structure and obtaining the legal protections that come with corporate status.

What information is required to complete the form?

The form typically requires information such as the corporation's name, principal office address, registered agent information, the number of shares the corporation is authorized to issue, and the names and addresses of the incorporators. Additional details might involve the corporation's specific purpose, the duration of the corporation (if not perpetual), and any preferred stock details, if applicable.

Is there a filing fee for the Colorado Articles of Incorporation?

Yes, there is a filing fee required to submit the Articles of Incorporation in Colorado. The fee amount may vary depending on whether the corporation is for-profit or nonprofit, among other factors. It is advisable to check the most current fee schedule on the Colorado Secretary of State's website or contact their office directly for up-to-date information.

How can someone file the Colorado Articles of Incorporation?

The Articles of Incorporation can be filed online through the Colorado Secretary of State's website or by mailing a paper form to their office. Online filing is generally faster and more convenient, allowing for immediate processing and confirmation of the submission.

How long does it take to process the Colorado Articles of Incorporation?

The processing time can vary. Online submissions are typically processed immediately, while mailed forms may take several weeks. The exact processing time can also depend on the current workload of the Secretary of State's office and the time of year.

Can the Articles of Incorporation be amended after filing?

Yes, corporations can amend their Articles of Incorporation after the initial filing. Amendments might be necessary to reflect changes in the corporation’s name, purpose, authorized shares, or other details. To amend the articles, the corporation must file an Articles of Amendment form with the Colorado Secretary of State, accompanied by the appropriate fee.

What happens if the Articles of Incorporation are not filed?

If the Articles of Incorporation are not filed, the business cannot legally operate as a corporation in Colorado. This means the business owners might not benefit from limited liability protection, and the business might not be able to access corporate funding, enter into certain contracts, or comply with state tax requirements.

Where can I find more information or get help with the Colorado Articles of Incorporation?

For more information or assistance, you can visit the Colorado Secretary of State's website. They offer detailed instructions, resources, and contact information for further support. Additionally, consulting with a legal professional or a business advisor familiar with Colorado corporate law may provide valuable guidance through the incorporation process.

Common mistakes

Filling out the Colorado Articles of Incorporation is an essential step in forming a corporation in the state. However, mistakes can lead to delays or even rejection of your application. Below are some common errors to avoid:

- Not checking the availability of the company name. Before submitting your Articles of Incorporation, ensure the name you have chosen is not already in use by conducting a search on the Colorado Secretary of State's website.

- Leaving required fields blank. Every field on the form has a purpose. Missing information can result in processing delays or outright rejection.

- Incorrect or unclear statement of purpose. The statement of purpose should be clear and comply with Colorado regulations. Vague or overly broad purposes may not be accepted.

- Omitting the registered agent information. A registered agent must be named, along with their address within Colorado. This agent is your corporation's point of contact for legal and government correspondence.

- Failure to include the necessary number of incorporators' signatures. The Articles of Incorporation require signatures from all the incorporators. Forgetting to include all required signatures can invalidate your submission.

- Using incorrect fees. Ensure you attach the correct filing fee. Fees may change, so it's important to check the current rate on the Secretary of State's website to avoid processing delays.

Documents used along the form

When forming a corporation in Colorado, the Articles of Incorporation is the primary document filed with the Colorado Secretary of State. However, to fully establish the corporation and ensure its legal operation, various other forms and documents are typically required as part of the incorporation process or immediately thereafter. These documents complement the Articles of Incorporation, addressing different legal, operational, and administrative aspects of the newly formed corporation.

- Bylaws: This document outlines the corporation's internal management structure and operational rules, including the roles of directors and officers, meeting procedures, and shareholder rights.

- Initial Report: Often required shortly after incorporation, this report provides the state with initial details about the corporation, including its address and the names of directors and officers.

- Shareholder Agreement: A contract among the corporation's shareholders that specifies their rights, privileges, and obligations, this document can also outline how shares can be bought, sold, or transferred.

- Federal Employer Identification Number (EIN) Application: Corporations need an EIN for tax purposes, obtained by filing an application with the Internal Revenue Service (IRS).

- Registered Agent Consent Form: This form confirms that the corporation's chosen registered agent consents to serve in that capacity, accepting legal documents on behalf of the corporation.

- Stock Certificates: These documents represent the ownership of shares in the corporation and are issued to shareholders as proof of their investment.

- Trade Name Registration: If the corporation intends to conduct business under a name different from its legal name, it must file a trade name registration with the state.

- Business Licenses and Permits: Depending on its type of business and location, the corporation may need to obtain specific licenses and permits from local, state, and federal agencies.

To ensure the successful establishment and longstanding operation of a corporation in Colorado, it's crucial to accurately complete and file not only the Articles of Incorporation but also these additional documents as appropriate. Each document plays a significant role in the corporation's legal and operational framework, contributing to its compliance with state and federal laws. Careful attention to the preparation and filing of these documents can help pave the way for a corporation's smooth and lawful operation.

Similar forms

-

Bylaws: The Articles of Incorporation lay the foundation for a corporation's legal existence, while the bylaws detail the internal rules governing the management of the organization. Both are essential for the structuring and governance of the corporation but serve complementary roles. The Articles establish the corporation with the state and outline basic structural information, such as the corporation's name, purpose, and stock details. Bylaws, conversely, provide in-depth procedures for electing directors, conducting meetings, and other corporate functions.

-

Operating Agreement: Similar to the Articles of Incorporation for corporations, an Operating Agreement fulfills a parallel purpose for limited liability companies (LLCs). It sets forth the members' financial and managerial rights and duties, operating procedures, and the distribution of profits and losses. While the Articles of Incorporation register the entity with the state and signify its corporate existence, the Operating Agreement outlines the internal functioning and governance of an LLC, albeit in a more flexible and customizable manner than corporate bylaws.

-

Partnership Agreement: This document outlines the arrangement between partners in a business partnership, similar to how the Articles of Incorporation establish a corporation’s foundational legal aspects. A Partnership Agreement details the partners' contributions, the distribution of profits and losses, and the procedures for resolving disputes and managing the partnership. Although serving different types of business entities, both documents are critical for setting the initial terms and structure of the business arrangement.

-

Certificate of Formation: For limited liability companies, the Certificate of Formation plays a role analogous to the Articles of Incorporation for corporations. It officially forms the LLC and includes essential information such as the LLC's name, duration, purpose, and the name and address of the registered agent. Both documents are filed with the state to legally establish the respective business entity, marking its official entry into the legal business registry and enabling it to engage in business operations.

Dos and Don'ts

When embarking on the journey of filling out the Colorado Articles of Incorporation form, careful attention to detail can make a significant difference in the process. The form is a foundational document for any corporation in Colorado, setting the stage for its legal and operational structure. Here are 10 do’s and don'ts to consider:

- Do:

- Ensure that the name of the corporation is unique and adheres to Colorado state requirements, including the use of corporate designators such as "Inc." or "Corporation."

- Accurately list the corporation’s initial registered agent and registered office address, as this individual or entity will be responsible for receiving legal and tax documents on behalf of the corporation.

- Specify the number of shares the corporation is authorized to issue, considering the corporation’s future growth and potential investment needs.

- Include any preferred stock rights, preferences, and limitations if the corporation is authorizing preferred shares, ensuring clarity and legal compliance.

- Clarify the incorporator’s information, providing full names and addresses, to establish who is responsible for the incorporation process.

- Don't:

- Omit any required fields on the form, as incomplete submissions can lead to delays or rejections of the incorporation process.

- Use vague or ambiguous language when defining the corporation’s purpose; although a broad purpose is generally acceptable, specificity can prevent future legal or operational challenges.

- Forget to sign and date the form, as the lack of an incorporator’s signature can invalidate the submission.

- Ignore the need for additional filings or notices that might be required based on the corporation’s specific circumstances, such as permits, licenses, or specific tax registrations.

- Assume the process ends with the submission of the Articles of Incorporation; maintaining corporate compliance involves ongoing obligations, such as annual reporting and maintaining good standing with the Colorado Secretary of State.

By adhering to these guidelines, individuals can navigate the incorporation process with greater confidence and legal accuracy, laying a strong foundation for their corporation’s future in Colorado.

Misconceptions

The Colorado Articles of Incorporation form is a significant document for anyone looking to establish a corporation within the state. However, there are several misconceptions about this form that can lead to confusion. It's vital to understand these misconceptions to ensure a smooth process in forming a corporation. Here are eight common misunderstandings:

- It's the only document needed to start a corporation: While the Articles of Incorporation are crucial, they are just the beginning. Other documents, like bylaws and an EIN, are also necessary.

- Filing the form automatically provides trademark protection: Filing Articles of Incorporation does not protect a business name or brand outside of preventing other entities from registering a corporation with the same name in Colorado.

- The process is the same in every state: Each state has its own set of rules and requirements. The Colorado Articles of Incorporation form is tailored to meet Colorado's specific legal requirements, which may differ from those in other states.

- There is no deadline for filing: Depending on the situation, there may be time-sensitive considerations. For example, if incorporating around the end of the tax year, timing could impact financial and tax obligations.

- Personal information is always kept confidential: Some information submitted on the Articles of Incorporation becomes public record, including names and addresses of the incorporators or directors.

- Anybody can file the form: While it's true that you don't need to be a legal professional to file, the person submitting must have the authority to do so on behalf of the forming corporation.

- The form covers all types of corporations: Colorado has different forms for different types of corporations, such as nonprofit or professional corporations. Make sure to use the correct form for your specific type of corporation.

- Amendments can't be made once filed: It is possible to amend the Articles of Incorporation if needed. The process involves filing an Articles of Amendment form with the Colorado Secretary of State.

Understanding these misconceptions about the Colorado Articles of Incorporation can help individuals navigate the process more effectively, avoiding common pitfalls and ensuring that their corporation is set up in accordance with state law.

Key takeaways

The Colorado Articles of Incorporation form is a crucial document for anyone looking to establish a corporation within the state of Colorado. Understanding the proper way to fill out and use this form is important for ensuring the legal establishment and operation of your corporation. Here are seven key takeaways to consider:

- Know the Type of Corporation: It's important to identify the specific type of corporation you are planning to form. Colorado allows for the incorporation of various types, including for-profit, nonprofit, and professional corporations. Each type has its own set of requirements and applicable laws.

- Choose a Unique Name: Your corporation needs a unique name that is not already in use by another business in Colorado. The name must end with an appropriate corporate designator, such as "Incorporated," "Corporation," or an abbreviation like "Inc." or "Corp." Checking the availability of your desired name before filing is recommended.

- Appoint a Registered Agent: A registered agent must be named in your Articles of Incorporation. This agent is responsible for receiving legal documents on behalf of the corporation. The agent must have a physical address in Colorado and be available during normal business hours.

- Include Required Information: The Articles of Incorporation must include specific information, such as the corporate name, principal office address, registered agent's name and address, the number of shares the corporation is authorized to issue, and the name(s) and address(es) of the incorporator(s).

- Share Structure: Clearly defining the share structure is crucial, especially if the corporation will have more than one class of shares. The rights, preferences, privileges, and restrictions of each class should be outlined in the Articles of Incorporation or an attached exhibit if necessary.

- Filing the Document: Once the Articles of Incorporation are completed, they must be filed with the Colorado Secretary of State. This can typically be done online, and a filing fee will be required. Ensure all information is accurate and complete before submitting to avoid delays.

- Understanding the Legal Obligations: Filing the Articles of Incorporation is just the first step in establishing your corporation. You must also comply with other legal requirements, such as holding organizational meetings, issuing stock, adopting bylaws, and obtaining any necessary licenses or permits.

By carefully following these guidelines, you can ensure a smoother process for incorporating your business in Colorado, setting a strong legal foundation for your corporation's future activities.

Create Other Articles of Incorporation Forms for US States

California Company Registration - Filing fees for Articles of Incorporation vary by state, so be sure to check with your state's secretary of state office or similar agency to understand the costs involved.

Georgia Secretary of State Forms - The compulsory paperwork for establishing a corporate entity, involving key information about the business.

Document Retrieval Center - The document may detail the rights and preferences of different classes of shares, if the corporation is authorized to issue more than one class.