Blank Articles of Incorporation Form for Connecticut

When aspiring entrepreneurs in Connecticut set their sights on establishing a corporation, navigating the initial legal requirements is a pivotal step toward bringing their business vision to life. Among these foundational steps, the completion of the Connecticut Articles of Incorporation form stands out as a critical procedure. This document, essential for the formal recognition of a corporation within the state, outlines key details about the business, including its name, purpose, stock structure, and legal address. Furthermore, it designates the appointment of a registered agent, responsible for handling important legal and tax documents. The form not only serves to officially register the entity with the Connecticut Secretary of State but also marks the beginning of compliance with state regulations, setting the stage for future operational and financial activities. As a gateway to legal business establishment, understanding, and accurately completing the Articles of Incorporation is indispensable for guaranteeing a smooth transition from concept to functional business entity.

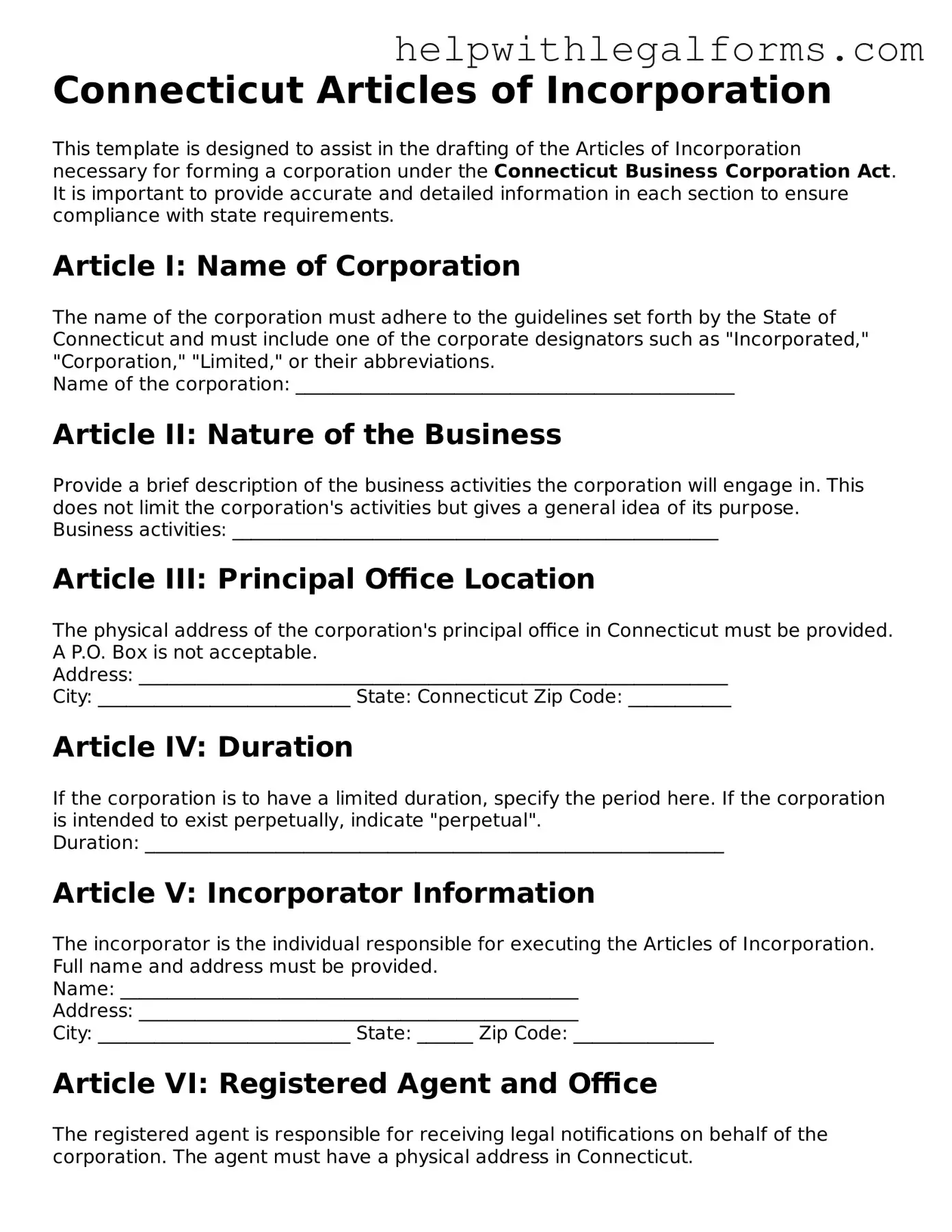

Example - Connecticut Articles of Incorporation Form

Connecticut Articles of Incorporation

This template is designed to assist in the drafting of the Articles of Incorporation necessary for forming a corporation under the Connecticut Business Corporation Act. It is important to provide accurate and detailed information in each section to ensure compliance with state requirements.

Article I: Name of Corporation

The name of the corporation must adhere to the guidelines set forth by the State of Connecticut and must include one of the corporate designators such as "Incorporated," "Corporation," "Limited," or their abbreviations.

Name of the corporation: _______________________________________________

Article II: Nature of the Business

Provide a brief description of the business activities the corporation will engage in. This does not limit the corporation's activities but gives a general idea of its purpose.

Business activities: ____________________________________________________

Article III: Principal Office Location

The physical address of the corporation's principal office in Connecticut must be provided. A P.O. Box is not acceptable.

Address: _______________________________________________________________

City: ___________________________ State: Connecticut Zip Code: ___________

Article IV: Duration

If the corporation is to have a limited duration, specify the period here. If the corporation is intended to exist perpetually, indicate "perpetual".

Duration: ______________________________________________________________

Article V: Incorporator Information

The incorporator is the individual responsible for executing the Articles of Incorporation. Full name and address must be provided.

Name: _________________________________________________

Address: _______________________________________________

City: ___________________________ State: ______ Zip Code: _______________

Article VI: Registered Agent and Office

The registered agent is responsible for receiving legal notifications on behalf of the corporation. The agent must have a physical address in Connecticut.

Name of registered agent: _______________________________________________

Office address: ________________________________________________________

City: ___________________________ State: Connecticut Zip Code: ___________

Article VII: Number of Shares

The corporation must authorize a certain number of shares. Specify both the total number of shares the corporation is authorized to issue and, if applicable, the classification of shares.

Total authorized shares: ________________________________________________

Classifications (if any): ________________________________________________

Article VIII: Directors

List the names and addresses of the initial directors who will serve until the first annual meeting of shareholders or until their successors are elected.

- Name: _____________________ Address: ____________________________

- Name: _____________________ Address: ____________________________

- Name: _____________________ Address: ____________________________

Article IX: Additional Provisions

Include any additional clauses here, such as indemnification of officers and directors, initial bylaws, or any restrictions on activities.

Additional provisions: __________________________________________________

Article X: Declaration

The incorporator must declare that the information provided in the Articles of Incorporation is accurate and submit the document to the Connecticut Secretary of State for approval. A statement such as "I, the undersigned, as incorporator, hereby declare that this document and the information contained therein is accurate and complies with the Connecticut Business Corporation Act." followed by a space for the date and signature.

Date: _____________________ Signature: ___________________________________

PDF Form Attributes

| Fact | Description |

|---|---|

| Legal Requirement | The Connecticut Articles of Incorporation form must be filed by entities wishing to form a corporation in Connecticut. |

| Governing Law | The form is governed by the Connecticut Business Corporation Act. |

| Filing Method | Entities can file the form online or mail it to the Connecticut Secretary of State. |

| Required Information | Filers must provide the corporation’s name, purpose, shares information, principal office address, and incorporator details. |

| Processing Time | Processing times may vary, but online filings are generally processed faster than mailed submissions. |

| Filing Fee | There is a filing fee that must be paid with the submission of the form. This fee is subject to change. |

| Annual Requirements | After filing, corporations must comply with annual reporting and fee requirements to maintain good standing. |

Instructions on How to Fill Out Connecticut Articles of Incorporation

After deciding to incorporate a business in Connecticut, one crucial step is to file the Articles of Incorporation with the Connecticut Secretary of State. This document lays the foundation for your corporation, establishing its legal identity, structure, and capability to conduct business within the state. The process involves filling out a form with specific information about your corporation. Making sure the form is complete and accurate is vital to avoid any setbacks. Below is a simplified guide to help you navigate through the process of filling out the Connecticut Articles of Incorporation form.

- Start by locating the most current version of the Articles of Incorporation form on the Connecticut Secretary of State’s website.

- Fill in the name of the corporation. Make sure it complies with Connecticut naming requirements and is distinguishable from other business names on record.

- Specify the corporation's purpose. This should be a brief statement about the nature of the business or activities the corporation will engage in.

- Indicate the total number of authorized shares the corporation is allowed to issue. This detail is crucial for defining the ownership structure of the corporation.

- Provide the name and address of the incorporator(s). The incorporator is the person(s) responsible for executing the Articles of Incorporation.

- Enter the name and address of the initial registered agent. The registered agent is responsible for receiving legal documents on behalf of the corporation.

- List the name(s) and address(es) of the initial director(s). Directors are tasked with overseeing the corporation’s major decisions and policies.

- Specify any additional provisions. These may include specific rules, regulations, or rights particular to the corporation being formed.

- Conclude by having the incorporator(s) sign and date the form. This act formalizes the intent to create the corporation according to the stipulated details.

- Review the form for accuracy and completeness. Any mistakes or omissions might delay the process.

- Submit the completed form along with the required filing fee to the Connecticut Secretary of State. This can typically be done online, by mail, or in person, depending on the available options.

After submitting the Articles of Incorporation, anticipate a confirmation that your corporation has been officially registered in Connecticut. The time it takes can vary, so it’s wise to check the current processing times. Once approved, your corporation will be legally recognized, allowing you to move forward with obtaining any necessary licenses or permits, opening bank accounts, and starting your business operations. Remember, this is just the beginning. Maintaining your corporation involves ongoing compliance with state regulations, including periodic filings and maintaining good standing with the Secretary of State’s office.

Crucial Points on This Form

What are the Connecticut Articles of Incorporation?

The Connecticut Articles of Incorporation is a legal document required to formally establish a corporation within the state. This document outlines the primary details of the corporation, including its name, purpose, incorporators, registered agent, and the number of shares the corporation is authorized to issue.

Who needs to file the Connecticut Articles of Incorporation?

Any group seeking to form a corporation in Connecticut must file the Articles of Incorporation with the Connecticut Secretary of State. This step is essential for legal recognition and to commence business operations under a corporate structure.

What information is required to complete the form?

To complete the form, you'll need to provide the corporation's name, the specific purpose for which it is formed, the name and address of its registered agent, the number of authorized shares, the par value of these shares (if applicable), and the information of the incorporators. Additional details might be required depending on the specific nature of your corporation.

How do I file the Articles of Incorporation in Connecticut?

You can file the Articles of Incorporation online through the Connecticut Secretary of State's website or by mailing a printed form. Online filing is generally faster and allows for immediate processing, while mailed applications may experience longer processing times.

Is there a fee to file the Articles of Incorporation in Connecticut?

Yes, there is a filing fee required when submitting your Articles of Incorporation. The fee can vary, so it's important to check the most current fee schedule on the Connecticut Secretary of State's website to determine the exact cost at the time of your filing.

Can I file the Articles of Incorporation without an attorney?

While it is possible to prepare and file the Articles of Incorporation without an attorney, it's advisable to consult with one. An attorney can provide guidance on the legal requirements and ensure that all pertinent information is correctly included, potentially avoiding costly mistakes.

How long does it take for the Articles of Incorporation to be processed in Connecticut?

The processing time can vary depending on the filing method. Online submissions are typically processed quicker than paper submissions. It's advisable to check the current processing times on the Connecticut Secretary of State's website or contact their office for the most up-to-date information.

What happens after the Articles of Incorporation are filed?

Once filed and approved, the corporation is legally formed and can begin operating. It's important to comply with any additional requirements, such as obtaining necessary licenses or permits, creating bylaws, and holding an initial meeting of the board of directors.

Can the Articles of Incorporation be amended?

Yes, the Articles of Incorporation can be amended. To do so, the corporation must file an Articles of Amendment form with the Connecticut Secretary of State, detailing the changes. There is also a filing fee for this process.

Common mistakes

When filling out the Connecticut Articles of Incorporation form, accuracy and thoroughness are essential. A number of common mistakes can lead to delays or even the rejection of your application. It is crucial to take the time to review and double-check each item to ensure compliance with Connecticut's legal requirements for incorporating a business. Here are nine mistakes to avoid:

Not checking the availability of the business name: Before filling out the form, it's important to ensure that the chosen business name is not already in use. Connecticut requires that your corporation's name be distinguishable from other names on record.

Incorrect registered agent information: The registered agent acts as the primary point of contact with the state, and must have a physical address in Connecticut. Providing incorrect or incomplete information here can lead to significant complications.

Omitting the required number of incorporators: Connecticut law requires at least one incorporator to sign the Articles of Incorporation. Failing to include this information may result in an incomplete application.

Misclassifying shares: A critical step in filling out the Articles is delineating the number and type of shares the corporation is authorized to issue. Errors here can affect the company's financial structure.

Forgetting to specify the purpose of the corporation: While it might seem sufficient to say a corporation is formed to conduct "any lawful business," Connecticut may require more specific information depending on the nature of your business.

Leaving out necessary attachments: Sometimes, additional documentation is required. This can include consents, approvals, or other legal documents. Failing to attach these can stall the process.

Neglecting the incorporation bylaws and minutes: While not necessarily part of the Articles of Incorporation, having your bylaws and organizational minutes ready is crucial. Oversight in preparing these documents can lead to operational issues later.

Inaccurate business address: This should be the address where the business will operate unless there's a specific reason to list another. An incorrect address can lead to misdirected official correspondence.

Failure to sign and date the form: It may seem obvious, but the excitement and stresses of starting a new business can lead to such oversights. Without the necessary signatures, the state will not process the form.

By avoiding these common mistakes, you can help ensure a smoother incorporation process for your business in Connecticut. Remember, this legal step is foundational to your business's successful start and compliance with state laws.

Documents used along the form

When incorporating a business in Connecticut, the Articles of Incorporation form serves as a foundational document. However, this form is typically accompanied by several other forms and documents during the incorporation process. These documents are necessary for various reasons, including compliance with state regulations, tax purposes, and to facilitate the smooth operation of the business. Below is a list and brief description of up to nine other forms and documents commonly used in conjunction with the Connecticut Articles of Incorporation form.

- Corporate Bylaws: Outline the internal rules governing the management of the corporation. Bylaws specify the roles and duties of directors and officers, meeting procedures, and other essential operational guidelines.

- SS-4 Form (Application for Employer Identification Number): Filed with the IRS to obtain an Employer Identification Number (EIN), which is necessary for tax identification purposes and to open a business bank account.

- Incorporator’s Statement: A document that records the names of the initial directors who were appointed until the first board meeting. It is kept internally and not filed with the state.

- Share Certificates: Physical evidence representing ownership in the corporation. These certificates specify the number of shares owned by a shareholder.

- Initial Report: Some states require an initial report to be filed shortly after the corporation is formed, detailing basic information about the corporation, such as the names and addresses of directors and officers.

- Operating Agreement: Although more common for LLCs, corporations, especially those with multiple shareholders, might opt to create an operating agreement to specify the financial and operational arrangements among the owners.

- Stock Ledger: A record of the corporation’s stock transactions, including the issuance and transfer of shares. It serves as the official record of who owns the corporation.

- Registration of Trade Name: If the corporation operates under a name different from its legal name, a trade name registration form must be filed with the state.

- Bank Resolution: A document needed to open a bank account under the corporation’s name, indicating who has the authority to conduct financial transactions on behalf of the corporation.

Each of these documents plays a specific role in the lifecycle of a corporation, from its inception through its operational existence. Ensuring that these documents are properly prepared and filed, where applicable, is crucial for legal and operational efficiency. This comprehensive approach to documentation helps in establishing a strong foundation for the business and facilitates compliance with legal obligations and procedures.

Similar forms

Bylaws: Similar to the Articles of Incorporation, bylaws outline the rules and regulations that govern a corporation. While the Articles of Incorporation establish the corporation's existence, bylaws detail the internal operational guidelines, including the roles of directors and officers, meeting conduct, and shareholder communication procedures.

Operating Agreement: Usually associated with Limited Liability Companies (LLCs), an operating agreement serves a purpose similar to bylaws for corporations. It outlines the business's financial and functional decisions, including rules, regulations, and provisions. The document sets the stage for the business's internal affairs and the management's financial arrangements, akin to how the Articles of Incorporation organize a corporation.

Business Plan: Though not a legal document, a business plan shares similarities with the Articles of Incorporation in its foundational role for an organization. It outlines the company's objectives, strategies, market analysis, and financial forecasts, providing a roadmap for the company's future operations. The Articles of Incorporation, meanwhile, lay the legal groundwork for the company’s formation.

Certificate of Formation: Common in LLCs, a Certificate of Formation is to an LLC what the Articles of Incorporation are to a corporation. This document officially forms the LLC and includes essential information such as the business name, purpose, duration, and the address of the registered agent, setting the legal frame for the company's existence.

Shareholder Agreement: This agreement outlines the rights and obligations of the shareholders within a corporation, similar to how the Articles of Incorporation detail the overarching structure and purpose of the company. A shareholder agreement focuses more on the shareholders' relationships, share ownership, and how decisions are made, providing guidance on the internal governance beyond the Articles of Incorporation.

Employment Agreement: Employment agreements outline the duties, expectations, and obligations between an employer and an employee. Though more specific in nature, these agreements are foundational for the employment relationship, just as the Articles of Incorporation are foundational for the corporate entity's structure and legal recognition.

Partnership Agreement: For businesses operated by two or more individuals who share profits and losses, a partnership agreement plays a crucial role similar to the Articles of Incorporation for corporations. It specifies the business's operational aspects, partner responsibilities, and financial arrangements, foundational to the partnership's functioning and strategy.

Corporate Resolution: A corporate resolution documents decisions made by a corporation's board of directors. This document supports the Articles of Incorporation by detailing specific authorizations given by the board, such as opening bank accounts or making significant purchases, thereby enacting the directors’ powers as outlined in the corporation’s foundational documents.

Stock Certificate: A stock certificate is a physical document that represents ownership of shares in a corporation. It complements the Articles of Incorporation by providing evidence of the equity piece owned by the shareholders, thereby giving form to one aspect of the corporation's structure that the Articles of Incorporation legally establish.

Annual Report: An annual report is a comprehensive document that details a corporation's activities throughout the preceding year. It supports the Articles of Incorporation by offering a yearly snapshot of the company's operations, financial status, and progress, serving to inform shareholders and relevant regulatory bodies about its performance and governance.

Dos and Don'ts

When filling out the Connecticut Articles of Incorporation form, it's important to follow specific guidelines to ensure the process runs smoothly and your submission is successful. Below are eight things you should and shouldn't do during this process.

- Do ensure all the information provided is accurate and up-to-date. Mistakes or outdated information can delay the registration process.

- Do check the Connecticut Secretary of State's website for the most current form and instructions, as requirements may change.

- Do use black ink or type the information to ensure legibility. This makes it easier to read and process your submission.

- Do include all required attachments and supporting documents. Missing documents can lead to your application being deemed incomplete.

- Don't leave any required fields blank. If a section does not apply, indicate this with "N/A" or "None," as appropriate.

- Don't sign the document in the wrong place or forget to sign it altogether. The signature certifies the truthfulness of the information provided.

- Don't use correction fluid or tape on the form. If you make a mistake, it's best to start with a new form to maintain a clean and professional appearance.

- Don't ignore the need for legal advice. While the process may seem straightforward, consulting with a legal professional can help avoid common pitfalls.

Misconceptions

When it comes to forming a corporation in Connecticut, the Articles of Incorporation play a critical role. However, there are several misconceptions about this vital document that can lead to confusion. Let’s clarify some of these misunderstandings to ensure a smoother process for all involved.

It's just a formality. Some believe that filling out the Articles of Incorporation is merely a bureaucratic step without much importance. In reality, this document lays the foundational legal structure of the corporation, delineating key details such as the business name, purpose, stock details, and information about the incorporator and initial directors. Thus, it's a crucial step in establishing a company's legal identity.

It doesn’t need to be updated. Once filed, people often think that the Articles of Incorporation are set in stone. However, changes in the corporation, such as amendments to the company name, purpose, or stock structure, require updates to this document. Keeping it current is essential for legal compliance and accurate public record.

Any mistakes can lead to immediate rejection. The fear of making an error on the Articles of Incorporation can be overwhelming. While accuracy is important, minor mistakes typically don’t lead to outright rejection. The state provides an opportunity to correct errors, although it’s best to strive for accuracy to avoid delays.

The process is the same for all types of businesses. Not all businesses file the same type of Articles of Incorporation. The document varies significantly depending on whether you’re establishing a nonprofit, a stock corporation, or another type of entity. It’s crucial to use the correct form that aligns with your specific business structure.

Legal assistance is not necessary. While it's possible to prepare and file the Articles of Incorporation on your own, seeking legal advice can be invaluable. Lawyers can provide insights into complex legal language and ensure that the document accurately reflects the intentions for your corporation, potentially saving time and resources in the long run.

Instant approval is guaranteed. Some assume that once the Articles of Incorporation are submitted, the approval process is immediate. In practice, the processing time can vary based on several factors, including the volume of filings the state is handling and the accuracy of the submitted documents. Patience and accurate completion can expedite this process.

Understanding these misconceptions can significantly impact the successful filing of the Articles of Incorporation in Connecticut. This document not only has legal implications but also serves as a critical step in establishing the identity and structure of your corporation. As with any legal process, attention to detail and a clear understanding of the requirements are crucial.

Key takeaways

When embarking on the journey of establishing a corporation in Connecticut, individuals must navigate the process of filling out and submitting the Articles of Incorporation. This legal document is the foundation of any corporation's legal standing and operational guideline within the state. For those preparing to undertake this process, the following key takeaways offer a helpful guide to ensure clarity, compliance, and correctness.

- Familiarize yourself with the requirements: Before filling out the form, it's crucial to understand the specific requirements that Connecticut mandates for the Articles of Incorporation. These requirements include details such as the name of the corporation, its purpose, the number of authorized shares, the incorporation duration, information about the incorporator, and the name and address of the corporation’s registered agent.

- Choose a distinctive name: The corporation's name must be distinguishable from other business entities already registered in Connecticut. A name availability search through the Connecticut Secretary of State's website is advisable before filing.

- Designate a registered agent: Every corporation must appoint a registered agent with a physical address in Connecticut. This agent is responsible for receiving legal paperwork and government correspondence on behalf of the corporation.

- Determine the share structure: Decide on the number and type of shares the corporation is authorized to issue. This will have implications for the company’s ownership structure and potential investment.

- Specify the corporation’s purpose: Connecticut requires that corporations explicitly state their purpose, though it can be as broad as engaging in any lawful activity for which corporations may be organized under Connecticut law.

- Identify the incorporator(s): The incorporator(s) are the individual(s) responsible for executing the Articles of Incorporation. They must provide their name(s) and address(es) on the document.

- Include necessary clauses: Depending on the corporation’s operations, it may be essential to include specific clauses related to stock classes, shareholder rights, and director liability.

- Ensure proper execution: The Articles of Incorporation must be signed by the incorporator(s) and, in some cases, may require additional signatures. Ensure all necessary parties have reviewed and approved the document before submission.

- File with the Connecticut Secretary of State: Once completed, the document must be filed with the Connecticut Secretary of State. This can often be done online or through mail, accompanied by the required filing fee. After approval, the corporation becomes officially recognized by the state of Connecticut.

Adhering to these guidelines not only facilitates a smoother filing process but also helps in establishing a solid legal framework for the corporation's operation within Connecticut. Ensuring that all information is accurate and complete before submission can save time and prevent potential issues with state regulatory compliance.

Create Other Articles of Incorporation Forms for US States

Maryland State Assessment - The form serves as a public record of the corporation, ensuring transparency and accountability in its operations.

Colorado Secretary of State Business - The Articles of Incorporation may specify whether the corporation will be managed by its directors or by its shareholders, defining its management structure.

Oklahoma Llc Application - Offers a point of reference for internal policies and bylaws, guiding the corporation's internal operations and management.

Georgia Secretary of State Forms - A document filed with the state to establish a corporation, laying out its organizational structure and objectives.