Blank Articles of Incorporation Form for Florida

In the journey to establish a corporation in Florida, entrepreneurs are required to navigate through several important steps, with one of the most crucial being the completion and submission of the Florida Articles of Incorporation form. This document serves as a foundation for any corporation’s legal existence within the state, encapsulating core information about the business, including its name, purpose, principal place of business, and details about its shares and initial officers/directors. The form meticulously outlines the responsibilities and rights of the corporation under Florida law, ensuring that both the state's regulatory requirements are met and that the corporation itself is structured for future governance and operations. Completing this form accurately is essential, not only to comply with state legislation but also to secure the advantages of corporate status, such as limited liability for its owners and potential tax benefits. Furthermore, the information provided on the form is made public, helping to maintain transparency and trust with both the market and regulators, thereby setting the stage for the corporation's operational and financial journey ahead.

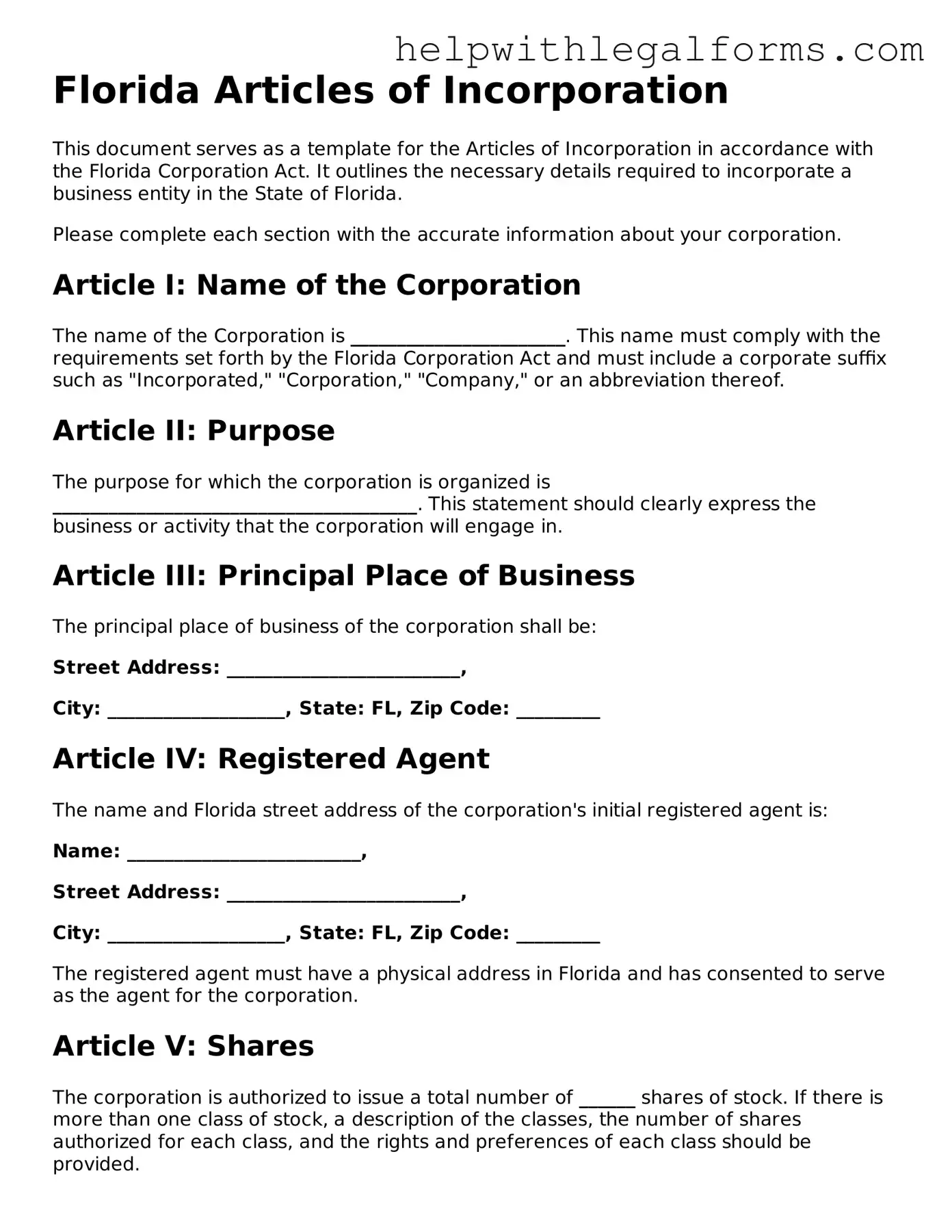

Example - Florida Articles of Incorporation Form

Florida Articles of Incorporation

This document serves as a template for the Articles of Incorporation in accordance with the Florida Corporation Act. It outlines the necessary details required to incorporate a business entity in the State of Florida.

Please complete each section with the accurate information about your corporation.

Article I: Name of the Corporation

The name of the Corporation is _______________________. This name must comply with the requirements set forth by the Florida Corporation Act and must include a corporate suffix such as "Incorporated," "Corporation," "Company," or an abbreviation thereof.

Article II: Purpose

The purpose for which the corporation is organized is _______________________________________. This statement should clearly express the business or activity that the corporation will engage in.

Article III: Principal Place of Business

The principal place of business of the corporation shall be:

Street Address: _________________________,

City: ___________________, State: FL, Zip Code: _________

Article IV: Registered Agent

The name and Florida street address of the corporation's initial registered agent is:

Name: _________________________,

Street Address: _________________________,

City: ___________________, State: FL, Zip Code: _________

The registered agent must have a physical address in Florida and has consented to serve as the agent for the corporation.

Article V: Shares

The corporation is authorized to issue a total number of ______ shares of stock. If there is more than one class of stock, a description of the classes, the number of shares authorized for each class, and the rights and preferences of each class should be provided.

Article VI: Incorporators

The name(s) and address(es) of the initial incorporator(s) responsible for executing these Articles of Incorporation are:

- Name: ___________________, Address: ___________________________________

- Name: ___________________, Address: ___________________________________

Article VII: Duration

The corporation shall exist perpetually unless dissolved according to law.

Article VIII: Directors

The number of directors constituting the initial Board of Directors and the names and addresses of the persons who are to serve as directors until the first annual meeting of shareholders or until their successors are elected and qualify are:

- Name: ___________________, Address: ___________________________________

- Name: ___________________, Address: ___________________________________

Article IX: Indemnification

The corporation shall indemnify its officers, directors, employees, and agents to the fullest extent permitted by the Florida Corporation Act, against liabilities, costs, penalties, and expenses incurred in the administration of their corporate duties.

Additional Provisions

Additional provisions regarding the governance of the corporation, beyond what is required by state law, may be included here. This could cover topics such as shareholder rights, meetings, and how corporate officers are elected.

________________________________________________________________

________________________________________________________________

Execution

In witness whereof, the undersigned incorporator(s) have executed these Articles of Incorporation on this ______ day of _______________, _______.

__________________________________

Signature of Incorporator

__________________________________

Printed Name of Incorporator

__________________________________

Date

PDF Form Attributes

| Fact | Description |

|---|---|

| Naming Requirements | The corporation's name must be distinguishable from other entities registered with the Florida Department of State and must include an appropriate corporate suffix. |

| Registered Agent Requirement | The corporation must appoint a Florida registered agent who agrees to accept legal papers on the corporation's behalf. |

| Principal Office Address | The Articles must include a street address for the corporation’s principal office. |

| Mailing Address | If different from the principal office, a mailing address for the corporation must be provided. |

| Shares Authority | The document must specify the number of shares the corporation is authorized to issue. |

| Directors Information | The names and addresses of the initial directors must be included in the filing. |

| Incorporator Information | The Articles require the name and address of the incorporator(s) filing the document. |

| Governing Law | The Articles of Incorporation are governed by Chapter 607 of the Florida Statutes, specifically the Florida Business Corporation Act. |

Instructions on How to Fill Out Florida Articles of Incorporation

Once you've decided to form a corporation in Florida, one key step is filling out the Articles of Incorporation. This document is essential as it officially registers your business with the state. The process might seem daunting, but by following these instructions step by step, you can complete it with confidence. Knowing all the required details beforehand can make the process smoother. After this form is submitted and approved by the State of Florida, your corporation will be legally recognized, allowing you to move forward with business operations.

- Gather necessary information, including the corporation name, principal office address, mailing address (if different), and the name and address of each incorporator.

- Decide on the number of shares the corporation is authorized to issue and the class of shares.

- Identify the registered agent who will be responsible for receiving legal documents on behalf of the corporation. Have the registered agent's address and written consent ready, as their agreement to serve in this capacity must be confirmed in the document.

- Provide the name and address of the initial directors of the corporation. If only incorporators are known at this time, list their information instead.

- Include the name, address, and signature of each incorporator. An incorporator is someone involved in the formation of the corporation.

- Check if the corporation will have a specific effective date other than the filing date. If so, specify the effective date of these articles, which cannot be more than five business days prior to the filing date or 90 days after the filing date.

- Review all entered information for accuracy.

- Calculate and prepare the filing fee, which is based on the type and number of shares the corporation is authorized to issue. Payment instructions and options should be clearly outlined in the form instructions.

- Submit the completed form along with the appropriate filing fee to the Florida Department of State. This can typically be done online, by mail, or in person, depending on the options provided by the state.

- Wait for confirmation from the Florida Department of State. This confirmation will be your official acknowledgment that the corporation exists under Florida law. Keep this document safe, as you will need it for various purposes such as opening bank accounts or applying for loans.

By following these steps carefully and ensuring all information is correct, you'll be on your way to officially establishing your corporation in Florida. It's a significant step toward making your business dreams a reality, so take the time to complete each step thoughtfully and thoroughly. Remember, this form is just the beginning of maintaining your business's compliance with state laws, so stay informed about your ongoing obligations to keep your corporation in good standing.

Crucial Points on This Form

What are the Articles of Incorporation?

The Articles of Incorporation represent a crucial document required to legally establish a corporation in Florida. This document outlines basic information about the corporation, including its name, purpose, principal place of business, details about its shares and stock, the names and addresses of the initial officers and directors, and the name and address of the registered agent who has agreed to accept legal papers on behalf of the corporation. Once filed with the Florida Department of State, the corporation officially comes into existence.

How do I file the Articles of Incorporation in Florida?

Filing the Articles of Incorporation in Florida can typically be done online through the Florida Department of State's website or by mailing a hard copy to their office. The process involves completing the form with the required information about your corporation, including selecting a unique name that complies with Florida state regulations. It's important to ensure all information is accurate and complete before filing. Additionally, there is a filing fee that must be paid at the time of submission. The state provides detailed instructions and support for filers who require assistance.

What information is needed to complete the Articles of Incorporation?

To complete the Articles of Incorporation in Florida, the following information is typically required: the corporation's proposed name, its specific purpose, the street address for its principal office and its mailing address if different, the number of shares the corporation is authorized to issue, and the par value of those shares if applicable. The document must also include the names and addresses of the initial officers and directors, the name and physical address in Florida of the registered agent, and the signature of the incorporator(s). Ensuring accurate and thorough information is crucial for a successful filing.

Who can act as a Registered Agent for a corporation in Florida?

In Florida, a registered agent acts as the corporation’s official liaison with the state, responsible for receiving legal and official documents, including lawsuit notices and other correspondence from the Secretary of State. The registered agent must have a physical address in Florida (a P.O. Box is not acceptable). This role can be filled by an individual, such as an attorney or a member of the company, or by a business entity that provides registered agent services. The key requirement is that the agent must be available at the registered address during normal business hours to receive documents.

Can I change the Articles of Incorporation after they are filed?

Yes, corporations in Florida can change their Articles of Incorporation after they have been filed. This is typically done through the filing of an amendment with the Florida Department of State. Amendments might be necessary to change the corporation's name, its business activities, the number of authorized shares, or other details originally filed. A filing fee is required to register these changes. It's important to follow the specific procedures set forth by the state to ensure that amendments are properly recorded.

What are the consequences of not filing the Articles of Incorporation correctly?

Failing to correctly file the Articles of Incorporation in Florida can lead to significant consequences for a corporation. Incorrect or incomplete filings can delay the official formation of the corporation, impacting its ability to legally conduct business, enter into contracts, or open bank accounts in the corporation's name. Additionally, there may be fines or penalties imposed by the state for non-compliance. It’s critical to review the form carefully, follow all state guidelines for submission, and correct any errors promptly if identified after filing.

Common mistakes

Starting a new business in Florida is exciting, but it's crucial to get the paperwork right from the get-go. When entrepreneurs set their sights on incorporating their business, they must file the Florida Articles of Incorporation. This document is foundational, acting as the official beginning of your corporate existence in the Sunshine State. However, amidst the excitement and the flurry of activity, it's not uncommon for new business owners to slip up on the details. Here are ten mistakes often made when filling out this important form:

- Not double-checking the business name availability: Before you get too attached to a name, make sure it's not already in use. Florida requires your business name to be unique and not too similar to existing names.

- Overlooking the need for a Registered Agent: A Registered Agent acts as your corporation's point of contact for legal documents. Failing to designate one, or choosing an agent that doesn’t meet state requirements, can land you in hot water.

- Misunderstanding the different roles: Mixing up members, managers, officers, and directors can cause confusion. Each role has specific duties and responsibilities, and knowing who does what is crucial for your Articles of Incorporation.

- Filling out the form with incomplete information: Rushing through the form and leaving fields blank is a common pitfall. Every section of the Articles of Incorporation serves a purpose and requires attention.

- Ignoring the specifics of share structure: If your corporation is issuing stock, you must specify the types and numbers of shares. An unclear share structure can lead to issues with investors and tax implications down the line.

- Failing to obtain necessary signatures: Forgetting to sign the document or missing signatures from required parties can result in an incomplete filing. Attention to detail here is key.

- Overlooking the importance of the business purpose: Being too vague or overly specific about your business's purpose can limit your corporation’s operations or confuse the state about what your corporation actually does.

- Not selecting the right corporate tax status: Understanding the differences between an S-Corp and a C-Corp tax designation is vital. This decision will affect your fiscal obligations to the state and the IRS.

- Ignoring filing deadlines: Procrastination can lead to missed deadlines, resulting in fines or delays in starting your business. Keeping track of your filing schedule is a must.

- Neglecting to keep a copy for your records: Once you've submitted your Articles of Incorporation, securing a copy for your own records is essential. This document is foundational for your business and you'll refer to it often.

When embarking on the journey of incorporating your business in Florida, being mindful of these common missteps can pave the way for a smoother process. Each detail on the Articles of Incorporation form plays a vital role in defining your business's operational blueprint, legal structure, and identity. Taking the time to review and complete each section with accuracy and care will not only fulfill state requirements but also support the long-term success of your corporate venture.

Documents used along the form

When establishing a corporation in Florida, the Articles of Incorporation form marks a critical first step, serving as the official foundation of your business in the eyes of the state. However, it's essential to note that this form is just the beginning; a suite of supplementary documents and forms often accompany it to ensure full compliance and protection for your enterprise. This array of documentation encompasses various legal, operational, and financial aspects, each playing a pivotal role in establishing the corporation's legal identity, outlining its governance structures, and laying the groundwork for its operational strategies. Below is a comprehensive list, along with brief descriptions of each document.

- Bylaws: An internal document that spells out the rules and procedures for conducting corporate affairs, including the organization of meetings, voting procedures, and roles of officers and directors. It defines the governance structure of the corporation.

- IRS Form SS-4: Used to apply for an Employer Identification Number (EIN). This identification number is essential for tax purposes, hiring employees, opening business bank accounts, and conducting other financial activities.

- Shareholder Agreement: A contract among shareholders detailing the rights and obligations of the shareholders, the management of the company, and provisions for the transfer of shares. It's crucial for preventing disputes among shareholders.

- Corporate Resolution: Documents specific decisions and actions approved by the corporation’s board of directors. This can range from opening bank accounts to authorizing transactions and outlining the powers granted to certain officers.

- Stock Certificates: Paper evidence of ownership in the corporation. These certificates detail the number of shares owned by a shareholder and are important for both the corporation's records and the shareholders' rights.

- Annual Report: Required by the Florida Department of State, this report updates or confirms the company's information, including addresses and officers. It's essential for maintaining good standing with the state.

- Trademark Registration: Not always mandatory, but highly recommended for protecting the company’s name, logo, and other unique brand elements at both the state and federal levels. It secures the brand's exclusive rights.

The process doesn't end with the filing of the Articles of Incorporation; it's just the beginning. Successfully establishing a corporation involves meticulous attention to detail and ensuring all auxiliary documents are accurately completed and filed. These documents collectively safeguard the corporation's interests, facilitate its operations, and ensure regulatory compliance. They form the backbone of a corporation's legal and operational structure, making it imperative for prospective business owners to understand and correctly handle each element.

Similar forms

The Bylaws of a corporation are similar to the Articles of Incorporation, as both provide guidelines for managing the business. The Articles establish the corporation's existence, while Bylaws detail the rules for the corporation's day-to-day operations.

The Partnership Agreement in a partnership plays a role similar to the Articles of Incorporation in a corporation. It outlines the terms and conditions under which the partnership will operate, just as the Articles lay the foundational legal framework for a corporation.

Operating Agreement for a Limited Liability Company (LLC) is akin to the Articles of Incorporation for a corporation. It serves as the legal document that governs the LLC's operations and member relations, similar to how the Articles establish a corporation's structure and governance.

A Business Plan shares similarities with the Articles of Incorporation, as both are foundational documents. While the Business Plan outlines a company’s strategic outlook, the Articles of Incorporation establish its legal identity and structure.

The DBA Registration Form (Doing Business As), similar to the Articles of Incorporation, is a declaration of a business name. However, the DBA is for individuals or entities wishing to conduct business under a name different from their legal name, whereas the Articles create a separate legal entity.

Certificate of Formation for an LLC is almost identical in purpose to the Articles of Incorporation for a corporation. It officially forms the LLC with the state, similar to how the Articles incorporate a business.

The Trademark Application form, while unique in its purpose of protecting a brand or mark, shares the formal declaration aspect with the Articles of Incorporation, designating a specific identity to be recognized and protected under law.

Non-Disclosure Agreement (NDA) and the Articles of Incorporation both establish vital parameters for the entities involved; however, their focus differs. An NDA is for confidentiality, while the Articles are for the corporation's structural and operational foundation.

The Shareholder Agreement among shareholders in a corporation relates to the Articles of Incorporation as both define relationships and governance within the corporation. The Articles may outline the basic structure, while shareholder agreements detail the rights and obligations of shareholders.

Dos and Don'ts

Filling out the Florida Articles of Incorporation form is a crucial step toward establishing a corporation within the state. Making sure the form is completed correctly and thoroughly can smooth the path for your business's legal foundation. Here is a comprehensive guide highlighting the do's and don'ts to be mindful of during this process:

Things You Should Do

- Ensure all required information is complete and accurate. The form asks for details such as the corporation's name, principal office address, registered agent, and initial officers or directors. Mistakes or omissions can delay the process.

- Use the exact corporate name, including a corporate suffix (e.g., Inc., Corp.). The name should be clearly distinguishable from other entities already registered with the Florida Division of Corporations to avoid rejection.

- Appoint a registered agent who has a physical address in Florida. This agent must be available during normal business hours to accept legal documents on behalf of the corporation.

- Specify the number of shares the corporation is authorized to issue. This should reflect your business needs and potential for growth.

- File the form electronically on the Florida Division of Corporations' website for expedited processing. A prompt and correct filing ensures that your corporation is legally constituted without unnecessary delays.

Things You Shouldn't Do

- Don't leave any required fields blank. Incomplete forms are likely to be returned or rejected, causing delays in the incorporation process.

- Don't use a P.O. Box for the principal office address or the registered agent's address. A physical address in Florida is necessary for official and legal correspondence.

- Don't forget to include the required filing fee or submit an incorrect amount. This could lead to your application being put on hold or rejected outright.

- Don't neglect to review and double-check the entire form for accuracy and completeness before submission. Even minor errors can complicate or delay your corporation's establishment.

- Don't disregard the need for additional permits or licenses that may be required depending on your corporation's business activities. Filing the Articles of Incorporation is just the first step; obtaining the necessary operational licenses is equally important.

Misconceptions

Filing the Articles of Incorporation in Florida is an essential step in creating a corporation, but there are misconceptions that often confuse or mislead individuals during this process. Understanding these misconceptions can help ensure that the process is completed accurately and efficiently.

One-page simplicity: Many believe that the Florida Articles of Incorporation form is just a simple, one-page document. However, depending on the type of corporation and the specific requirements, the document can be more extensive and requires detailed information about the corporation.

Instant approval: Another common misconception is that the Articles of Incorporation are approved immediately upon submission. While Florida's processing times can be fast, especially if filed online, approval can take several days, and additional information may sometimes be requested, further delaying approval.

No need for legal advice: Some may think that they don't need legal advice to complete the Articles of Incorporation. Although the process might seem straightforward, seeking legal counsel can help avoid mistakes that could lead to compliance issues or other legal problems down the line.

One-time fee covers everything: Filing the Articles of Incorporation involves a fee, but it's a misconception that this one-time fee covers all future costs associated with maintaining a corporation in Florida. There are annual report fees and potential other costs to keep the corporation in good standing.

Personal information remains private: Some believe that the information provided in the Articles of Incorporation is kept private. However, the documents filed with the Florida Division of Corporations are public records, meaning that the information can be accessed by the public.

No distinction between corporation types: It's a misconception that the Articles of Incorporation for all types of corporations are the same. Florida requires different information for non-profit corporations versus for-profit corporations, as well as other distinctions based on the specific character of the corporation.

Filing confirms a unique name: Simply filing the Articles of Incorporation does not guarantee the corporation's name is unique or reserved. A name must be checked for availability and, if necessary, reserved prior to filing the Articles of Incorporation to ensure it’s not already in use.

Only for Florida-based businesses: There's a belief that the Florida Articles of Incorporation are only for businesses based in Florida. While it’s true that this document formally establishes a corporation within Florida, out-of-state and even international businesses can file if they intend to do business in Florida, though additional registrations may be needed.

By understanding and addressing these misconceptions, individuals can navigate the incorporation process in Florida with greater accuracy and confidence.

Key takeaways

Filing the Florida Articles of Incorporation is a significant step in forming a corporation in the state. This document serves as a formal declaration of your business's existence under state law. To ensure a smooth and successful filing, it's important to pay attention to the following key takeaways:

- Ensure accuracy in all provided information. The Florida Articles of Incorporation form requires precise details, including the corporation's name, which must include a corporate suffix such as "Inc." or "Corporation."

- Choose a registered agent wisely. The appointed registered agent must have a physical address in Florida and be available during normal business hours to receive legal documents on behalf of the corporation.

- Decide on the stock structure carefully. The form will ask for details about the number and type of shares the corporation is authorized to issue. This decision will have implications for future fundraising efforts and ownership structure.

- Understand the roles and responsibilities of incorporators and directors. Incorporators are responsible for signing and filing the Articles of Incorporation, while directors manage the corporation's affairs.

- Prepare for filing fees. The State of Florida requires a fee to file the Articles of Incorporation. Make sure to check the current fee schedule and prepare to pay the necessary amount.

- Know the filing options. The Florida Articles of Incorporation can typically be filed online or by mail. Choosing the online option can expedite the process.

- Keep records. After filing, make sure to keep a copy of the filed Articles of Incorporation for your records, along with the receipt of filing and any correspondence from the state.

- Understand the importance of the document. Once filed and approved, the Articles of Incorporation legally establish your corporation's existence and outline its structure and governance. Treat this document with the care and attention it deserves.

By following these key points, you can navigate the process of filing your Florida Articles of Incorporation with confidence, paving the way for a solid legal foundation for your corporation.

Create Other Articles of Incorporation Forms for US States

Certificate of Incorporation Ct - The form is a public record, offering transparency about the corporation's key aspects to investors, regulators, and the public.

Oklahoma Llc Application - Documents the initial board of directors who will oversee the corporation's early operations and governance.

Georgia Secretary of State Forms - The initial step in creating a corporation, involving submission to the state's relevant authority.

Article of Incorporation Texas - The document may specify how disputes among shareholders or directors are resolved.