Blank Articles of Incorporation Form for Georgia

Embarking on the journey of establishing a corporation in Georgia begins with a crucial step: completing the Georgia Articles of Incorporation form. This document serves as the birth certificate for your business, marking its legal commencement in the eyes of the state. The Articles of Incorporation form is imbued with significant details, such as the name of the corporation, its intended purpose, the address where it will operate, and the details concerning its shares and initial stock offerings. Moreover, it introduces the appointees who will steer the corporation in its infancy - the initial directors and incorporators. This form is not merely paperwork; it's a foundational stone that supports the structure of your corporate entity, ensuring compliance with Georgia's state laws and regulations. The process might seem daunting at first, but understanding each component of the form can make this initial step towards incorporation a smooth and informative journey.

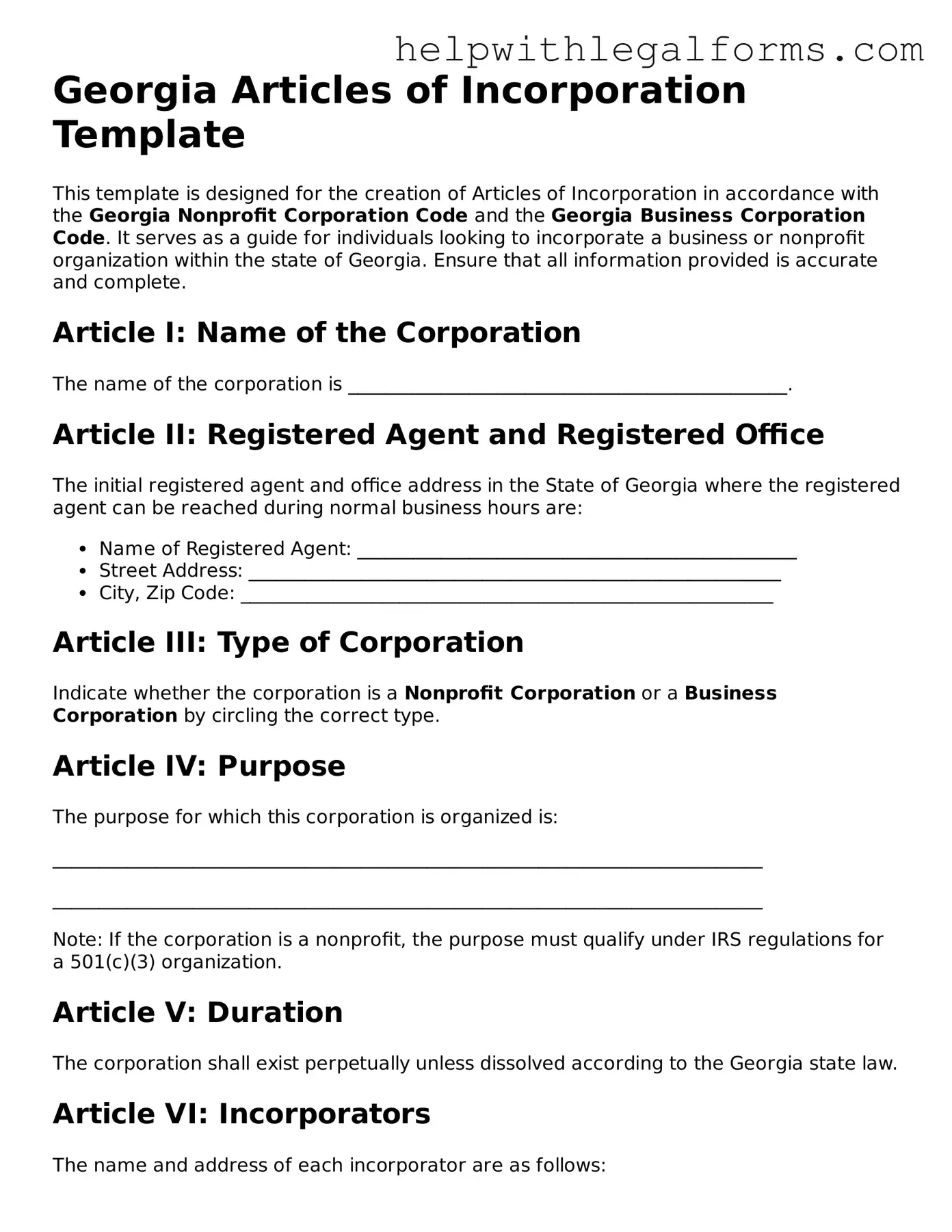

Example - Georgia Articles of Incorporation Form

Georgia Articles of Incorporation Template

This template is designed for the creation of Articles of Incorporation in accordance with the Georgia Nonprofit Corporation Code and the Georgia Business Corporation Code. It serves as a guide for individuals looking to incorporate a business or nonprofit organization within the state of Georgia. Ensure that all information provided is accurate and complete.

Article I: Name of the Corporation

The name of the corporation is _______________________________________________.

Article II: Registered Agent and Registered Office

The initial registered agent and office address in the State of Georgia where the registered agent can be reached during normal business hours are:

- Name of Registered Agent: _______________________________________________

- Street Address: _________________________________________________________

- City, Zip Code: _________________________________________________________

Article III: Type of Corporation

Indicate whether the corporation is a Nonprofit Corporation or a Business Corporation by circling the correct type.

Article IV: Purpose

The purpose for which this corporation is organized is:

____________________________________________________________________________

____________________________________________________________________________

Note: If the corporation is a nonprofit, the purpose must qualify under IRS regulations for a 501(c)(3) organization.

Article V: Duration

The corporation shall exist perpetually unless dissolved according to the Georgia state law.

Article VI: Incorporators

The name and address of each incorporator are as follows:

- Name: ____________________________________________ Address: ________________________________________________________

- Name: ____________________________________________ Address: ________________________________________________________

Article VII: Initial Directors

The initial board of directors shall consist of the following individuals, who shall serve until the first annual meeting of shareholders or until their successors are elected and qualified:

- Name: ____________________________________________ Address: ________________________________________________________

- Name: ____________________________________________ Address: ________________________________________________________

- Name: ____________________________________________ Address: ________________________________________________________

Article VIII: Shares (For Business Corporations Only)

The corporation is authorized to issue the following number of shares of stock: ____________.

If there are to be one or more classes of shares, or any series within a class, then state the details and any preferences, rights, and restrictions granted to or imposed upon each class or series. If additional space is needed, attach additional pages.

Article IX: Other Provisions

Include any other provisions not inconsistent with state law regarding the management and regulation of the affairs of the corporation:

____________________________________________________________________________

____________________________________________________________________________

Article X: Incorporator’s Statement

I, the undersigned, being the incorporator herein named, do execute these Articles of Incorporation on this ___ day of _________________, 20____ and affirm under penalty of perjury that the facts stated herein are true.

- Incorporator’s Signature: __________________________________________________

- Printed Name: _____________________________________________________________

- Date: ____________________________________________________________________

This template is provided as a general guide. It is recommended that you consult with a legal professional to ensure compliance with all applicable Georgia laws and regulations.

PDF Form Attributes

| Fact | Detail |

|---|---|

| Name of the Form | Georgia Articles of Incorporation |

| Purpose | Used to incorporate a business in the state of Georgia |

| Governing Law | Georgia Business Corporation Code |

| Filing Office | Georgia Secretary of State |

| Online Filing Available | Yes, through the Georgia Corporations Division website |

| Filing Fee | Subject to change, check the Georgia Secretary of State website for current fees |

| Processing Time | Varies; expedited service is available for an additional fee |

| Annual Requirements | Annual registration with a fee is required to maintain good standing |

Instructions on How to Fill Out Georgia Articles of Incorporation

Filing the Articles of Incorporation is a crucial step for anyone looking to form a corporation in the state of Georgia. This document officially registers the corporation with the Georgia Secretary of State and outlines basic information about the corporation, such as its name, type, address, and incorporators. Proper completion and submission of this form are essential for the corporation to be legally recognized and to commence its operations. Following the outlined steps carefully will help ensure the process goes smoothly and your corporation is established according to state requirements.

- Check the availability of your corporation name through the Georgia Secretary of State’s website to ensure it's unique and complies with state naming requirements.

- Download the Articles of Incorporation form from the Georgia Secretary of State's website or obtain a paper copy from their office.

- Fill in the corporate name exactly as you want it to appear on all official documents, including the specific corporate designator such as "Inc." or "Corporation".

- Specify the corporation type (profit, nonprofit, professional, etc.) in the designated section.

- Enter the principal office address, including street address, city, state, and zip code where the main office of the corporation is located.

- If the corporation has an initial registered agent (someone authorized to receive legal documents on behalf of the corporation), enter their name and physical street address in Georgia; PO boxes are not acceptable.

- Specify the number of shares the corporation is authorized to issue, if applicable. This section is typically relevant for profit corporations.

- List the names and addresses of the incorporators—the individuals or entities responsible for completing and filing the Articles of Incorporation.

- Review the form for accuracy and completeness. Make sure all required sections are filled out.

- Sign and date the form as required. The signature may need to be notarized, depending on the specific requirements mentioned in the form.

- Pay the filing fee. The required fee can vary, so check the current amount with the Georgia Secretary of State's office. Payment methods such as check, credit card, or online payment options may be available.

- Submit the completed form and payment to the Georgia Secretary of State’s office, either by mail or through their online filing system, if available.

After submission, it usually takes a few business days for the Georgia Secretary of State to process and approve the Articles of Incorporation. Once approved, your corporation will be officially registered in Georgia, and you'll receive a confirmation or a certificate of incorporation. This document is important and should be kept safely, as it will be needed for various legal and business processes. Remember, filing the Articles of Incorporation is just the first of many steps in establishing and running your corporation legally and successfully.

Crucial Points on This Form

What is the Georgia Articles of Incorporation form?

The Georgia Articles of Incorporation form is a legal document required for establishing a corporation in Georgia. It outlines the essential details of the corporation, including the name, purpose, registered agent, directors, and incorporators. This form must be filed with the Georgia Secretary of State to officially register and recognize the corporation within the state.

Who needs to file the Georgia Articles of Incorporation?

Any individual or group wishing to form a corporation in Georgia needs to file the Articles of Incorporation. This applies to both for-profit and non-profit organizations looking to operate within the state's legal framework.

Where can I find the Georgia Articles of Incorporation form?

The form can be obtained from the Georgia Secretary of State’s website. It's available for download in a format that can be filled out electronically or printed and filled out by hand.

What information is required to complete the form?

When filling out the Georgia Articles of Incorporation, you'll need to provide the corporate name, the nature of the business, the registered agent’s name and address, names and addresses of the initial directors, the incorporator's information, and the corporation's mailing address. Additionally, you must specify the number of shares the corporation is authorized to issue, if applicable.

Can the Articles of Incorporation be filed online?

Yes, the Georgia Secretary of State offers an online filing option. This can be a faster and more convenient way to submit your Articles of Incorporation. You'll need to create an account on their website and follow the instructions for online submission.

Is there a filing fee?

Yes, there is a filing fee for submitting the Articles of Incorporation in Georgia. The fee can vary depending on whether the corporation is for-profit or non-profit, and it may change, so it's important to check the current fee structure on the Secretary of State's website or call their office for the most accurate information.

How long does it take for the Articles of Incorporation to be processed?

The processing time can vary depending on the volume of filings and the method of submission (online or by mail). Generally, online filings are processed more quickly than those submitted by mail. It's advisable to check with the Secretary of State for current processing times.

Do I need an attorney to file the Georgia Articles of Incorporation?

While it's not legally required to have an attorney to file the Articles of Incorporation, consulting with a legal professional can provide valuable guidance. An attorney can help ensure that all legal requirements are met and that the form is filled out correctly, reducing the risk of errors or delays.

What happens after filing the Articles of Incorporation?

Once the Articles of Incorporation are filed and approved, your corporation will be officially registered in Georgia. You will receive a certificate of incorporation from the Secretary of State. After that, you can proceed with other necessary steps, such as obtaining business licenses, setting up a corporate bank account, and holding your first board of directors meeting.

Is it possible to amend the Articles of Incorporation?

Yes, amendments to the Articles of Incorporation can be made after the initial filing. To amend the documents, you'll need to file an Articles of Amendment form with the Georgia Secretary of State, along with the appropriate filing fee. This process allows a corporation to update information such as the corporate name, address, or the number of authorized shares.

Common mistakes

Filling out the Georgia Articles of Incorporation form is a crucial step in establishing a corporation within the state. While straightforward at first glance, some common mistakes can complicate the process and lead to potential delays. Attention to detail can save much time and effort, ensuring the smooth creation of your corporation. Here's a look at nine common errors to avoid:

Not checking the availability of the corporation name: Before filling out the form, it's essential to ensure the corporation name you've chosen is not already in use by another entity within Georgia. Failing to do so can result in the rejection of your application.

Omitting the required suffix in the corporation name: Georgia law requires that corporation names include a corporate suffix such as "Incorporated," "Corporation," "Inc.," or "Corp." Leaving out these suffixes can lead to the rejection of your filing.

Insufficient information on the registered agent: The registered agent plays a critical role, acting as the corporation's official in-state contact. Providing incomplete information about your registered agent, or failing to ensure they have agreed to serve in this role, can stall your filing process.

Mistakes in listing the number of authorized shares: Detailing the number of shares your corporation is authorized to issue is a requirement. Incorrectly listing this information can affect your corporation's structure and its operations down the line.

Overlooking the principal office address: Forgetting to include the principal office address, or providing a P.O. Box instead of a physical address, can be problematic. This address is crucial for official communications and legal process serving.

Forgetting to sign the form: It may seem obvious, but forgetting to sign the Articles of Incorporation before submission is a common oversight that will result in the document being returned to you.

Neglecting to include the required filing fee: Submission without the appropriate filing fee, or with an incorrect amount, will lead to delays. It is important to check the current filing fee and include it with your submission.

Using outdated forms: The Secretary of State occasionally updates the Articles of Incorporation form. Using an outdated version can lead to the rejection of your application. Always download the latest version from the Georgia Secretary of State's website.

Erroneous information or typographical errors: Even minor spelling mistakes or inaccuracies in the entered information can create significant disruptions in the incorporation process. Thoroughly review your completed form for errors before submitting.

Avoiding these common errors can significantly enhance the efficiency of the incorporation process, allowing you to focus on the exciting aspects of building and growing your business in Georgia. Attention to detail and careful preparation are your best tools in this endeavor.

Documents used along the form

When filing the Georgia Articles of Incorporation, individuals are embarking on the formal process of establishing a corporation within the state. However, this form is just one of several documents that may be necessary to fully comply with state regulations and establish operational, legal, and fiscal frameworks for the new entity. To ensure a thorough understanding of the documentation requirements, we will explore four additional forms and documents often utilized alongside the Georgia Articles of Incorporation.

- Bylaws: This internal document delineates the rules under which the corporation will operate, including the structure of the corporation, the roles and responsibilities of directors and officers, and the procedures for holding meetings and executing company decisions. While not filed with the state, bylaws are crucial for internal governance and compliance.

- Initial Corporate Minutes: Initial corporate minutes record the first meeting of the corporation's board of directors. They cover the adoption of bylaws, the election of corporate officers, and other crucial initial decisions. These minutes serve as the official record of these foundational actions but are kept internally.

- IRS Form SS-4: To obtain an Employer Identification Number (EIN), corporations file IRS Form SS-4. This federal tax ID number is necessary for various purposes, including opening a bank account, hiring employees, and complying with IRS tax requirements.

- Georgia State Tax Identification Number Application: Similar to the federal EIN, corporations operating in Georgia may also need to obtain a state tax identification number to comply with state tax obligations. This includes withholding and remitting state income taxes for employees.

Understanding and preparing the necessary documents for incorporation in Georgia is a crucial step toward establishing a successful corporation. The Georgia Articles of Incorporation, accompanied by the right set of additional documents, such as corporate bylaws, initial corporate minutes, and both federal and state tax ID number applications, set the foundation for a company's legal and operational structure. Compliance with state and federal documentation requirements ensures that the corporation remains in good standing and is able to operate smoothly within the legal framework of Georgia and the United States.

Similar forms

The Bylaws of a corporation are similar to the Articles of Incorporation in that they establish the rules and procedures for the internal governance of the corporation. While the Articles of Incorporation serve as a corporation's charter from the state, bylaws focus on the operations, including procedures for meetings, voting, and the roles of directors and officers. Both documents are essential for the structured and legal operation of a corporation.

The Operating Agreement of a Limited Liability Company (LLC) is analogous to the Articles of Incorporation for a corporation. It outlines the LLC's financial and functional decisions, including rules, regulations, and provisions for running the company. The Operating Agreement serves a similar purpose by providing a framework for the business's internal operations, despite being used by a different type of business entity.

A Partnership Agreement plays a comparable role in a partnership as the Articles of Incorporation do in a corporation. This agreement details the relationship between partners, their obligations, and how decisions are made within the partnership. It serves to organize and dictate the operation of the partnership, akin to how the Articles of Incorporation establish the foundational legal structure for corporations.

The Certificate of Formation for LLCs, known in some states, parallels the Articles of Incorporation. This document is necessary for the legal creation of an LLC and includes fundamental information about the company, such as its name, purpose, and the details of its registered agent. Like the Articles of Incorporation, the Certificate of Formation is a critical document filed with a state authority to recognize the entity's legal existence.

Dos and Don'ts

When filling out the Georgia Articles of Incorporation form, there are specific steps you should follow to ensure the process goes smoothly, as well as pitfalls to avoid. Below, you will find a concise guide to help you navigate the filing process correctly.

Things You Should Do:

- Ensure all the required information is accurate and complete. This includes the corporate name, registered agent information, and the incorporators' details.

- Check the corporate name’s availability to make sure it's not already in use or too similar to another name on record with the State of Georgia. This helps to avoid delays in processing your form.

- Include the necessary filing fee with your submission. The correct amount should be verified on the website of the Georgia Secretary of State to avoid underpayment or overpayment.

- Keep a copy of the filed Articles of Incorporation for your records. After approval, this document serves as legal proof of the corporation's existence.

Things You Shouldn't Do:

- Don’t leave any required fields blank. Incomplete forms can lead to delays or rejection of your filing.

- Avoid neglecting to designate a registered agent or providing incorrect information for your agent. The registered agent is critical for receiving legal documents and must have a physical address in Georgia.

- Don’t forget to check the form for any updates or changes in requirements before submission. This can include checking the official Secretary of State website for any recent updates.

- Avoid using unauthorized signatures. The form needs to be signed by a person authorized to do so by the incorporating entity. Using an unauthorized signature can invalidate your filing.

Misconceptions

The Georgia Articles of Incorporation form is a critical document for businesses looking to become a corporation within the state. However, there are several misconceptions about this form and its purpose. Understanding these misconceptions is key to ensuring a successful filing.

It's Only for Large Businesses: Some people think that the Articles of Incorporation are only for large businesses. In fact, this form is necessary for any business that wants to be legally recognized as a corporation in Georgia, regardless of its size.

One Size Fits All: Another common misunderstanding is that there is a one-size-fits-all approach to the Articles of Incorporation. The truth is, the form needs to be completed based on the specific needs and details of the business, including its structure and governance.

Only for Profit-Making Businesses: Some believe that these articles are exclusively for businesses that operate for profit. This is not true. Non-profit organizations must also file Articles of Incorporation to be recognized as legal entities in Georgia.

Attorney Representation Is Required: While it's beneficial to have legal guidance, it's a misconception that businesses are required to have an attorney to file the Articles of Incorporation. Businesses can prepare and file this document without legal representation, although seeking professional advice can help avoid mistakes.

Approval Guarantees Business Success: Some people mistakenly believe that once the Articles of Incorporation are approved, it guarantees business success and compliance with all laws. Approval simply means the business is legally formed as a corporation; it must still comply with all relevant laws and regulations.

The Process Is Instant: The idea that filing the Articles of Incorporation results in an instant corporation is incorrect. The Secretary of State's office must review the submission, which can take some time, especially during peak periods.

No Annual Requirements: There's a belief that once a business files its Articles of Incorporation, there are no further annual requirements. In reality, most corporations must file an annual registration with the Secretary of State and meet other annual requirements to maintain good standing.

It's the Same as Registering a Business Name: Filing the Articles of Incorporation is often confused with registering a business name. Registering a business name reserves the name and prevents others from using it, whereas filing Articles of Incorporation legally establishes the corporation.

It Offers Complete Liability Protection: Finally, the belief that incorporating a business provides complete personal liability protection for its owners and officers is misguided. While it offers significant protection, there are cases where individuals could still be held personally liable.

Understanding and debunking these misconceptions about the Georgia Articles of Incorporation form ensures that business owners can correctly navigate the process of legally forming a corporation in the state.

Key takeaways

Filing the Georgia Articles of Incorporation is a fundamental step for establishing a corporation in the state. It marks the legal birth of the corporation and sets the framework within which it operates. The process, while straightforward, requires attention to detail and an understanding of the implications each section has for your business. Below are key takeaways to ensure the process is handled efficiently and effectively:

- Choose a unique name for your corporation that complies with Georgia’s naming requirements. It must be distinguishable from other names on record and end with a corporate designator like "Inc.," "Corporation," or an abbreviation thereof.

- Appoint a registered agent who has a physical address in Georgia. This agent acts as the corporation's official liaison for legal and state communications.

- Specify the number of shares the corporation is authorized to issue. This decision impacts your funding strategies and shareholder structure.

- Include the names and addresses of the incorporators who are filing the Articles of Incorporation. These are the individuals responsible for completing and filing the document.

- The Articles must be filed with the Georgia Secretary of State, either online or by mail. Online filing is generally faster and allows for easier tracking.

- Pay the filing fee, which is required to process the Articles of Incorporation. The fee structure can vary, so it's essential to check the current rates.

- After filing, it's crucial to create and maintain corporate bylaws, even though they are not submitted with the Articles. Bylaws govern the corporation's operations and outline the roles and responsibilities of directors and officers.

- Keep in mind the annual requirements, like filing an annual report and maintaining a registered agent. These are ongoing obligations for keeping your corporation in good standing.

Adhering to these guidelines will help ensure that your corporation is established properly and remains compliant with Georgia state law. It's a process that lays the groundwork for your corporation's legal and operational structure, paving the way for future success.

Create Other Articles of Incorporation Forms for US States

Certificate of Incorporation Ct - The Articles of Incorporation form is a crucial document filed with a state government to legally establish a corporation within that state, detailing the primary characteristics of the business.

Maryland State Assessment - This form is a vital record for any corporation, encapsulating the essence of its legal and operational framework.

Oklahoma Llc Application - Identifies the incorporators responsible for the corporation's formation, including their names and addresses.

Florida State Corporation Commission - The form may designate a registered agent responsible for legal correspondences.