Blank Articles of Incorporation Form for Maryland

When embarking on the journey of forming a corporation in Maryland, one critical step involves the completion and submission of the Maryland Articles of Incorporation. This document serves as a formal declaration of a corporation's existence to the state and lays the foundation for its legal operations. It captures essential details including the corporation's name, its purpose, the total amount of stock it is authorized to issue, the address of its principal office, and information about its registered agent. The form also requires details about the incorporator(s) – the individual(s) or entities initiating the incorporation process. Completing this form accurately is crucial, as it affects aspects like regulatory compliance, governance structure, and the ability to issue shares. Additionally, the process brings to light the importance of understanding state-specific requirements, as Maryland has its own set of rules governing the incorporation process. As such, this early step is not only about legal formalities but also sets the stage for a corporation’s future operations and management.

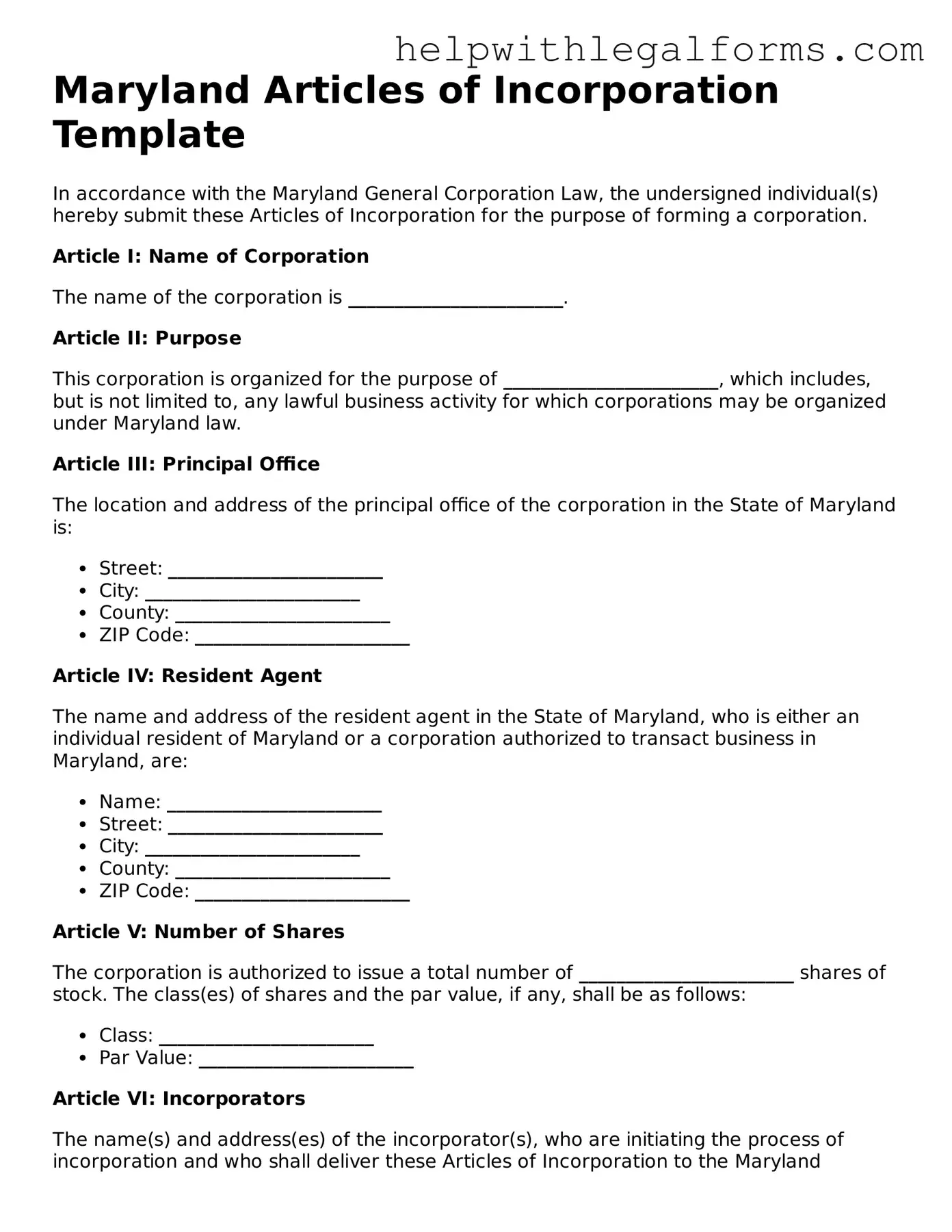

Example - Maryland Articles of Incorporation Form

Maryland Articles of Incorporation Template

In accordance with the Maryland General Corporation Law, the undersigned individual(s) hereby submit these Articles of Incorporation for the purpose of forming a corporation.

Article I: Name of Corporation

The name of the corporation is _______________________.

Article II: Purpose

This corporation is organized for the purpose of _______________________, which includes, but is not limited to, any lawful business activity for which corporations may be organized under Maryland law.

Article III: Principal Office

The location and address of the principal office of the corporation in the State of Maryland is:

- Street: _______________________

- City: _______________________

- County: _______________________

- ZIP Code: _______________________

Article IV: Resident Agent

The name and address of the resident agent in the State of Maryland, who is either an individual resident of Maryland or a corporation authorized to transact business in Maryland, are:

- Name: _______________________

- Street: _______________________

- City: _______________________

- County: _______________________

- ZIP Code: _______________________

Article V: Number of Shares

The corporation is authorized to issue a total number of _______________________ shares of stock. The class(es) of shares and the par value, if any, shall be as follows:

- Class: _______________________

- Par Value: _______________________

Article VI: Incorporators

The name(s) and address(es) of the incorporator(s), who are initiating the process of incorporation and who shall deliver these Articles of Incorporation to the Maryland Department of Assessments and Taxation, are:

- Name: _______________________

- Address: _______________________, _______________________, _______________________, _______________________

Article VII: Duration

The duration of the corporation is ( ) perpetual or ( ) until a specific date: _______________________.

Article VIII: Board of Directors

The initial board of directors shall consist of _______________________ director(s) until the first annual meeting of shareholders, or until their successors are elected and qualify. The name(s) and address(es) of the person(s) who are to serve as the initial director(s) until the first annual meeting or until their successor is elected and qualify are:

- Name: _______________________; Address: _______________________

Article IX: Additional Provisions

Additional provisions regarding the management of the corporation, restrictions on transfer of shares, and other preferences, rights, or limitations are as follows: _______________________.

Article X: Incorporator Signature

The undersigned incorporator hereby acknowledges that they are signing these Articles of Incorporation on behalf of the corporation being formed, affirming that the information provided herein is accurate to the best of their knowledge.

Signature: _______________________

Date: _______________________

PDF Form Attributes

| Fact | Description |

|---|---|

| Purpose | The Maryland Articles of Incorporation form is used to legally establish a corporation in the state of Maryland. |

| Governing Law | The form and its process are governed by the Maryland Corporations and Associations Article. |

| Filing Agency | It is filed with the Maryland Department of Assessments and Taxation. |

| Filing Fee | There is a filing fee that must be paid upon submission, which varies depending on the type of corporation being established. |

| Required Information | Information such as the corporation's name, purpose, principal office address, registered agent, and initial directors must be included in the form. |

| Corporate Name Requirements | The corporation's name must be distinguishable from other entities registered in Maryland and meet state-specific requirements. |

| Registered Agent | The form must designate a registered agent with a physical address in Maryland, responsible for receiving legal documents. |

| Annual Requirements | Corporations in Maryland must file an annual report and personal property return to maintain good standing. |

| Digital Submission | The form can be filed online through the Maryland Business Express website, offering a convenient way to incorporate. |

| Approval Time | Processing times can vary, but expedited services are available for an additional fee. |

Instructions on How to Fill Out Maryland Articles of Incorporation

Filling out the Maryland Articles of Incorporation is a necessary step for individuals seeking to establish a new corporation within the state. This form is crucial because it officially registers the corporation with the Maryland State Department of Assessments and Taxation. Completing this document involves providing comprehensive details about your corporation, including its name, purpose, stock information, and registered agent. Ensuring accuracy and completeness in this process is vital for a smooth registration and to comply with state laws. The instructions below guide you through each step to fill out the form effectively.

- Determine and enter the name of the corporation, ensuring it adheres to Maryland’s naming requirements and does not conflict with the name of an existing entity within the state.

- Specify the purpose for which the corporation is formed, providing a clear and concise statement of the business activities your corporation will engage in.

- Indicate the total number of authorized shares the corporation is allowed to issue, and if applicable, the classes and series of these shares. Detail the rights and preferences of each class or series, if more than one exists.

- Designate the corporation's principal office address, including the street, city, county, and zip code, where the primary business activities will take place or where the business records will be kept.

- Name and detail the registered agent who will act on behalf of the corporation. This must be an individual or a corporation authorized to conduct business in Maryland, available during normal business hours to receive legal documents.

- Provide the name, address, and signature of each incorporator. An incorporator is anyone involved in the completion and submission of the Articles of Incorporation.

- If there are any additional provisions that need to be included regarding the corporation’s internal operations or other organizational matters, attach these as an addendum.

- Review the form for completeness and accuracy. Mistakes or omissions can result in processing delays or even the rejection of your filing.

- Submit the form along with the required filing fee to the Maryland State Department of Assessments and Taxation. The submission can usually be made online, by mail, or in person, depending on the preferred or available method.

By closely following these steps, you ensure that the Maryland Articles of Incorporation is filled out accurately and comprehensively, laying a strong foundation for your corporation’s activities in Maryland. Attention to detail during this initial phase guarantees compliance with state regulations and a smoother transition into operational status.

Crucial Points on This Form

What are the Articles of Incorporation in Maryland?

The Articles of Incorporation is a legal document that must be filed with the Maryland State Department of Assessments and Taxation (SDAT) to formally create a corporation. This document outlines the basic information about the corporation, such as its name, purpose, stock structure, and the details of its incorporator(s).

Who needs to file the Articles of Incorporation in Maryland?

Anyone looking to form a corporation in the state of Maryland must file the Articles of Incorporation. This applies to both profit and non-profit organizations that wish to be legally recognized as corporations within Maryland.

What information is required to complete the Articles of Incorporation form?

When completing the Articles of Incorporation for Maryland, the following information must be included: the name of the corporation, its purpose, the address of its principal office, the name and address of its registered agent, the number and type of shares the corporation is authorized to issue, and the name and address of each incorporator.

How can one file the Articles of Incorporation in Maryland?

The Articles of Incorporation can be filed online through the Maryland Business Express website, by mail, or in person. When filing, the appropriate filing fee must be included. Online filing is the fastest method, but mail or in-person submissions are also accepted.

Is there a filing fee for the Articles of Incorporation in Maryland?

Yes, there is a filing fee for submitting the Articles of Incorporation in Maryland. The fee can vary depending on whether the corporation is for-profit or non-profit. The current fee schedule can be found on the SDAT’s website or by contacting them directly.

How long does it take to process the Articles of Incorporation in Maryland?

The processing time for the Articles of Incorporation in Maryland can vary. Online filings may be processed more quickly, often within seven business days, while mailed submissions may take several weeks. Expedited service is available for an additional fee if faster processing is needed.

Common mistakes

When filling out the Maryland Articles of Incorporation, applicants frequently face challenges that could hinder the successful creation of their corporation. Avoiding common mistakes can streamline the process, ensuring the business gets off on the right foot. Here's a closer look at six common errors to avoid.

Not checking name availability: Many people forget to verify if their desired corporation name is available and distinguishable from other names on record with the Maryland State Department of Assessments and Taxation. This oversight can lead to a rejected filing.

Ignoring the need for a resident agent: A resident agent must be named in the Articles of Incorporation. This agent acts as the corporation's official point of contact for legal documents. Omitting this information or providing incorrect details can create legal complications.

Incomplete addresses: Both the principal place of business and the resident agent's address need to be complete and accurate. Using a P.O. Box, when a physical address is required, or leaving the address section incomplete, can delay the approval process.

Overlooking stock information: If the corporation intends to issue stock, the Articles must specify the number of shares the corporation is authorized to issue. Not providing detailed stock information can lead to problems with the issuance of shares.

Failure to specify the corporation's purpose: Maryland requires corporations to state their purpose, even if it is as broad as "for any lawful activity." Neglecting to include a purpose, or being too vague, can raise questions about the corporation's intentions.

Skimping on signatures: All required signatures must be present on the submission. Sometimes, incorporators forget to sign the document or fail to gather all necessary signatures, leading to the rejection of the application.

By carefully avoiding these common errors, applicants can improve their chances of a smooth and successful incorporation process in Maryland.

Documents used along the form

When forming a corporation in Maryland, the Articles of Incorporation form is a fundamental document. However, several other forms and documents are often utilized alongside it to ensure compliance with state laws and to facilitate the efficient establishment and operation of the corporation. These documents vary based on the specific needs of the business, its structure, and the legal requirements at the time of filing. The following list highlights some of the most commonly used forms and documents that accompany the Maryland Articles of Incorporation.

- Operating Agreement: Although more common for LLCs, corporations may also use an operating agreement to outline the internal operations and procedures, which helps in governing the corporation's affairs.

- Bylaws: This document details the rules by which the corporation will operate. Bylaws cover topics such as the structure of the company, the duties of directors and officers, and how meetings are held.

- Organizational Meeting Minutes: Minutes from the initial meeting of the corporation's board of directors are often required. These minutes officially record the establishment of the corporation, election of directors and officers, and any initial resolutions passed.

- IRS Form SS-4: To apply for an Employer Identification Number (EIN), corporations must complete IRS Form SS-4. An EIN is necessary for tax purposes and to open a bank account in the corporation's name.

- Form 2553 Election by a Small Business Corporation: If the corporation wants to be treated as an S corporation for tax purposes, it must file Form 2553 with the IRS. This status can offer tax advantages under certain conditions.

- Foreign Qualification Documents: Corporations based in Maryland but planning to do business in other states must file for foreign qualification in those states. This process typically requires a certificate of authority or similar document.

- Annual Report: While not immediately required with the Articles of Incorporation, corporations in Maryland must file an annual report with the State Department of Assessments and Taxation to maintain good standing.

These documents, in conjunction with the Maryland Articles of Incorporation, are crucial for properly establishing a corporation in Maryland. Each serves specific legal or operational purposes, helping to lay down the foundation for a legally compliant and efficient business structure. Depending on the corporation's unique needs and goals, additional forms and documents may also be necessary throughout its operation.

Similar forms

-

Bylaws for Corporations: Much like the Articles of Incorporation, Bylaws for Corporations serve as an internal rule book for managing the corporation. While the Articles of Incorporation establish the corporation’s existence under state law, the bylaws outline the governance structure, decision-making processes, and operational guidelines that will be followed internally. Both documents are foundational to the structure and function of a corporation, setting the stage for its operations and management.

-

Operating Agreement for LLCs: Similar to the Articles of Incorporation for corporations, the Operating Agreement serves Limited Liability Companies (LLCs). This document outlines the ownership percentages, members' rights, responsibilities, and the procedural aspects of running the LLC. It’s essential for defining the internal workings of the LLC, mirroring how the Articles of Incorporation outline the basic framework for corporations, albeit tailored to the unique structure of LLCs.

-

Partnership Agreement: This document is akin to the Articles of Incorporation but for partnerships. It details the arrangements between partners, including contributions, profit sharing, and management duties. While not establishing a separate legal entity as the Articles of Incorporation do, the Partnership Agreement is crucial for outlining the operation and management of the partnership, emphasizing the importance of clear agreements in any business format.

-

Certificate of Limited Partnership: Filed by limited partnerships, this document parallels the Articles of Incorporation for corporations. It officially registers the partnership with the state, detailing the partnership's structure, partners' roles, and other essential information. It's a foundational document that, similar to the Articles of Incorporation, provides the legal basis for the entity's existence within a regulatory framework.

-

DBA Registration Forms: "Doing Business As" (DBA) forms might not create a separate legal entity like the Articles of Incorporation, but they're similar in that they allow business operations under a specific name. Whether a corporation, LLC, partnership, or sole proprietorship needs to operate under a name different from the one registered, DBA registration makes this legally possible, showing the importance of formal documentation in establishing and managing a business's identity.

Dos and Don'ts

When filling out the Maryland Articles of Incorporation form, following guidelines ensures the process is conducted accurately and effectively. These guidelines are crucial for anyone looking to incorporate a business in Maryland. Below is a list of dos and don'ts to consider.

Do:Ensure all information provided is accurate and current. Inaccuracies can lead to delays or rejection of the application.

Include the complete legal name of the corporation, making sure it complies with Maryland's naming requirements.

Specify the purpose of the corporation. Maryland allows a broad purpose statement, but clarity helps in the long-term.

List the name and address of the resident agent. The resident agent must be available during business hours to receive legal documents.

State the total number of shares the corporation is authorized to issue. This affects the corporation's ability to raise capital.

Provide the names and addresses of all incorporators. Maryland requires this information to be on file.

Sign and date the Articles of Incorporation. Without the appropriate signatures, the document is not valid.

Check for any specific county requirements. Some counties in Maryland might have additional requirements.

Review the entire document before submission. This helps catch any errors or omissions.

Submit the necessary filing fee. Fees must be accurate and payable to the right state department.

Overlook the need for a registered agent. Every corporation in Maryland must have a resident agent.

Ignore the specific naming conventions required by Maryland law. Avoid using prohibited words without the necessary approvals.

Be vague in the stated purpose of the corporation. While Maryland law is flexible, a clear purpose aids in clear operations.

Forget to specify the type of stock (i.e., common or preferred) the corporation is authorized to issue, if applicable.

Omit any required signatures. Every incorporator must sign the document.

Assume all information is accurate without double-checking. Mistakes can be costly in time and money.

Misplace the filed copy of the Articles. Keep a copy for your records.

Underestimate the importance of compliance with state laws and regulations. Compliance is critical for the corporation's legitimacy.

Delay in filing the necessary documents. Timely submission avoids unnecessary complications.

Attempt to file without understanding all the requirements. Seek assistance if the process is unclear.

Misconceptions

When it comes to forming a corporation in Maryland, the Articles of Incorporation serve as a critical foundation. However, several misconceptions often arise regarding this document. Understanding the truths behind these misconceptions is essential for anyone looking to incorporate a business in Maryland. Here are ten common misunderstandings and the facts that correct them:

- Filing is optional for conducting business. Many believe they can operate a business in Maryland without filing the Articles of Incorporation. However, to legally form a corporation and enjoy the benefits thereof, such as liability protection and tax advantages, this document must be filed with the Maryland State Department of Assessments and Taxation.

- The process is too complex for individuals. While it's true that the process involves legal documentation, it's designed to be accessible. With clear instructions and support available, individuals can complete and file their Articles of Incorporation without necessarily needing a lawyer.

- All businesses file the same form. Maryland offers different forms depending on the type of corporation being established (e.g., stock, non-stock, professional). Each form has specific requirements relevant to the corporation's structure.

- There's a one-time filing fee. The initial filing fee is just the beginning. Corporations may also be subject to annual report fees and taxes that require regular attention beyond the initial setup.

- Personal information is always made public. While certain information must be disclosed for the public record (e.g., names of incorporators, principal office address), sensitive personal information is not required on the Articles of Incorporation.

- Articles of Incorporation include detailed business plans. This document is not the place for in-depth business plans or operations details. It primarily covers foundational and legal aspects of the corporation, including its name, purpose, and basic organizational structure.

- Any name can be chosen for the corporation. The corporation's name must be distinguishable from other business names registered in Maryland and comply with state naming requirements, including certain restricted words.

- Amendments are rare and discouraged. On the contrary, corporations may need to amend their Articles of Incorporation from time to time as the business evolves. The state provides a process for making these amendments officially.

- The process is the same in every state. Each state has its own set of rules and forms for incorporating a business. The Maryland Articles of Incorporation form is specific to Maryland and may differ significantly from forms in other states.

- Electronic filing isn't allowed. Maryland permits and even encourages electronic filing for the Articles of Incorporation, offering a streamlined and efficient process for those who prefer online submissions over paper filings.

Key takeaways

Filing the Articles of Incorporation is a critical step for forming a corporation in Maryland. It marks the official creation of your corporation under state law. Understandably, this process may appear daunting at first glance. However, with a clear understanding of the requirements and implications, you can navigate this process more effectively. Here are some key takeaways to consider:

- The Maryland Articles of Incorporation form requires specific information about your corporation, including its name, purpose, principal office address, number of shares the corporation is authorized to issue, and information regarding its incorporators and initial directors. Being accurate and thorough in providing this information is crucial.

- Choosing the right corporate name is essential. The name must be distinguishable from other business entities already registered in Maryland. It should also comply with Maryland's naming requirements, ensuring it includes an identifier such as "Incorporated," "Corporation," "Limited," or an appropriate abbreviation.

- The Articles must include a statement of purpose. This is a brief description of the corporation's business activities. While it can be as broad as "to engage in any lawful activity," specificity can sometimes be advantageous, depending on the corporation's strategic goals.

- Filling out the form accurately is just the first step; submitting it correctly is equally important. The form must be filed with the Maryland State Department of Assessments and Taxation (SDAT). This can typically be done online or by mail, accompanied by the required filing fee. The amount of the fee can vary, so verifying the current cost before submission is advisable.

- Once filed and approved, the Articles of Incorporation have significant legal implications. They formally establish your corporation's existence, providing a basis for opening bank accounts, entering into contracts, and complying with state regulations. They also set the foundation for your corporation's internal governance, including shareholder rights, director responsibilities, and how decisions are made.

Fulfilling your legal obligations by properly completing and filing the Maryland Articles of Incorporation is not just a procedural step; it’s an integral part of laying a solid foundation for your business's future. Seeking legal advice or guidance from a professional experienced in Maryland corporate law can help ensure that this process is handled accurately and efficiently.

Create Other Articles of Incorporation Forms for US States

Certificate of Incorporation Ct - For multinational corporations, separate Articles of Incorporation may be necessary for each state or country of operation, adhering to local laws and regulations.

California Company Registration - The Articles of Incorporation form varies from state to state, so it's important to obtain and complete the version specific to the state where you plan to incorporate your business.

Document Retrieval Center - The form may also outline how the corporation will be managed, whether through a centralized management structure or a more distributed model.

Florida State Corporation Commission - The Articles of Incorporation serve as a public record of the corporation's formation.