Blank Articles of Incorporation Form for New Jersey

In the realm of formal business establishment in New Jersey, the Articles of Incorporation stand as a fundamental document, navigating the inception of corporations with a structured approach. This document not only signifies the birth of a corporation but also lays down the legal foundation for its identity, operational scope, and governance structure. The submission of this form to the New Jersey Department of State is a critical step for entrepreneurs, marking the transition from a conceptual business idea to a legally recognized entity. With sections delineating the corporation's name, the nature of its business activities, the details of its authorized stock, the name and address of its registered agent, along with the names of the incorporators, the form is comprehensive. It serves multiple purposes: ensuring compliance with state legal requirements, providing clarity on the corporation's organizational structure, and facilitating the corporation's ability to engage in legal agreements, acquire assets, and fulfill its tax-related obligations. The precision and accuracy of the information provided in this document are imperative, as it lays the groundwork for the corporation’s legal and operational framework, potentially influencing its success and sustainability in the dynamic business environment of New Jersey.

Example - New Jersey Articles of Incorporation Form

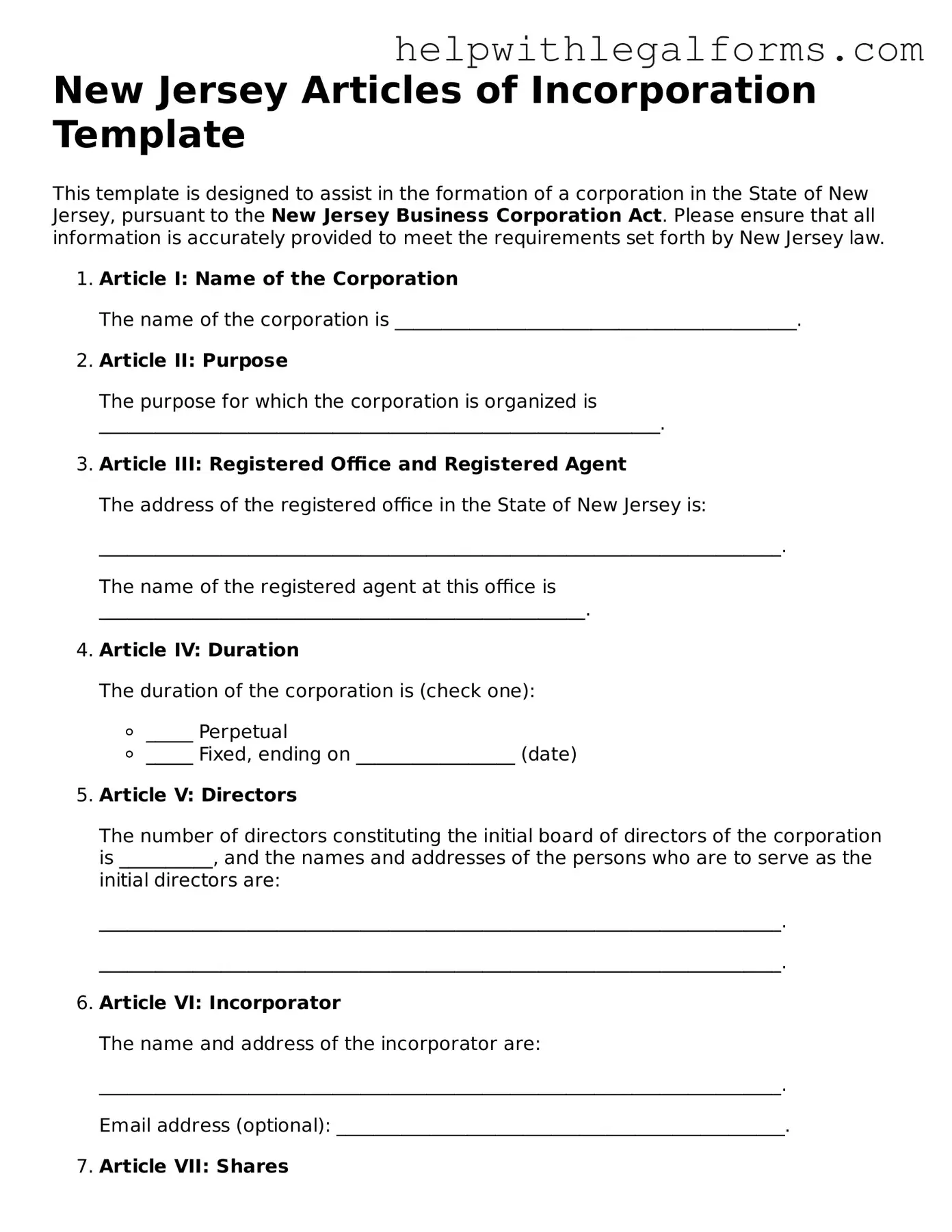

New Jersey Articles of Incorporation Template

This template is designed to assist in the formation of a corporation in the State of New Jersey, pursuant to the New Jersey Business Corporation Act. Please ensure that all information is accurately provided to meet the requirements set forth by New Jersey law.

Article I: Name of the Corporation

The name of the corporation is ___________________________________________.

Article II: Purpose

The purpose for which the corporation is organized is ____________________________________________________________.

Article III: Registered Office and Registered Agent

The address of the registered office in the State of New Jersey is:

_________________________________________________________________________.

The name of the registered agent at this office is ____________________________________________________.

Article IV: Duration

The duration of the corporation is (check one):

- _____ Perpetual

- _____ Fixed, ending on _________________ (date)

Article V: Directors

The number of directors constituting the initial board of directors of the corporation is __________, and the names and addresses of the persons who are to serve as the initial directors are:

_________________________________________________________________________.

_________________________________________________________________________.

Article VI: Incorporator

The name and address of the incorporator are:

_________________________________________________________________________.

Email address (optional): ________________________________________________.

Article VII: Shares

The corporation is authorized to issue the following number of shares of stock: ______________.

If more than one class of shares is authorized, for each class of shares, state the class and the number of shares of each class:

_________________________________________________________________________.

Article VIII: Principal Office

The address of the principal office of the corporation is:

_________________________________________________________________________.

Article IX: Fiscal Year

The fiscal year of the corporation shall end on the ______ day of _______________, ____________.

Article X: Compliance with New Jersey Law

By signing below, the incorporator acknowledges that the corporation shall comply with the provisions of the New Jersey Business Corporation Act and all other applicable state laws and regulations.

Signature of Incorporator: _______________________ Date: ________________

This document is a template intended for general guidance and must be tailored to the specific needs of the entity being formed. Before finalizing, it may be advisable to seek legal counsel to ensure compliance with current New Jersey laws and regulations.

PDF Form Attributes

| Fact Number | Description |

|---|---|

| 1 | The New Jersey Articles of Incorporation form is the initial document required to establish a corporation within the state. |

| 2 | This form is submitted to the New Jersey Division of Revenue and Enterprise Services. |

| 3 | Governing laws for the form include the New Jersey Business Corporation Act, primarily under Title 14A. |

| 4 | The form requires basic information about the corporation including the corporate name, purpose, registered agent, and office address. |

| 5 | The corporate name must be distinguishable from other entities registered in New Jersey and comply with state naming requirements. |

| 6 | Specifying a registered agent and office is mandatory; the agent acts as the corporation's legal representative in the state. |

| 7 | Details regarding stock structure must be included if the corporation intends to issue shares. |

| 8 | Consent from the chosen registered agent must be obtained but is not always required to be filed with the Articles of Incorporation. |

| 9 | Filing the form incurs a fee, which varies based on the corporation's authorized share capital and other factors. |

| 10 | Once filed and approved, the Articles of Incorporation officially create the corporation and allow it to begin operations under New Jersey law. |

Instructions on How to Fill Out New Jersey Articles of Incorporation

Filing articles of incorporation is a pivotal step for those intending to form a corporation in New Jersey. This legal requirement not only registers the corporation with the state but also outlines the fundamental aspects of the corporation, such as its name, purpose, stock information, and more. Completing this form carefully and correctly is important to ensure compliance with state laws and to secure the advantages of incorporating. Below are the steps needed to fill out the New Jersey Articles of Incorporation form.

- Enter the name of the corporation, ensuring it meets New Jersey naming requirements and includes an appropriate corporate designator like "Incorporated," "Corporation," "Limited," or an abbreviation of one of these.

- Specify the purpose for which the corporation is being formed. This should be a brief but clear statement defining what the business will do.

- List the total number of shares the corporation is authorized to issue. Remember, the value and classes of these shares can affect both the company's structure and tax status.

- Provide the street address of the corporation's initial registered office and the name of the initial registered agent at that office. The agent must be authorized to receive legal documents on behalf of the corporation.

- Include the name and address of each incorporator. Incorporators are the individuals responsible for completing and filing the Articles of Incorporation.

- If the corporation will have a board of directors, list the names and addresses of the initial directors. Their responsibilities will include making major corporate decisions and overseeing the general affairs of the corporation.

- Specify any additional provisions or information required by New Jersey law or deemed necessary. This could include statements about the corporation's duration, management structure, or stock preferences.

- Ensure that an incorporator or an authorized representative signs the form, indicating that the information provided is accurate to the best of their knowledge.

- Review the form for accuracy and completeness. Missing or incorrect information can lead to delays or rejection of the application.

- Finally, submit the form along with the required filing fee to the New Jersey Department of State. The submission can usually be made online, by mail, or in person, depending on the state's current filing options.

After submitting the articles of incorporation, the next steps typically involve waiting for approval from the New Jersey Department of State. Upon acceptance, the corporation will be officially registered and recognized by the state, allowing it to begin operating. This registration also triggers other requirements such as obtaining necessary licenses or permits, creating bylaws, and holding organizational meetings. While the process may seem complex, careful attention to each step can smooth the path toward successful incorporation and the benefits it brings.

Crucial Points on This Form

What are the New Jersey Articles of Incorporation?

The New Jersey Articles of Incorporation is a document that formally establishes a corporation's existence within the state of New Jersey. This critical document outlines essential details about the corporation, such as its name, purpose, registered agent, and information about its shares and incorporators.

Who needs to file the New Jersey Articles of Incorporation?

Any group or individual wishing to create a corporation in the state of New Jersey must file the Articles of Incorporation. This applies to both for-profit and nonprofit organizations looking to gain legal recognition as a corporate entity.

How can I file the New Jersey Articles of Incorporation?

Filing can be done online through the New Jersey Division of Revenue and Enterprise Services website or by mailing a completed form to their office. Online filing is generally faster and allows for the tracking of your submission’s status.

What information is required to complete the form?

To fill out the Articles of Incorporation, you'll need to provide the corporation's name, the purpose for which the corporation is being formed, information about its stock (if applicable), the name and address of the registered agent, and the names and addresses of the incorporators.

Is there a filing fee for the Articles of Incorporation in New Jersey?

Yes, there is a filing fee required when submitting your Articles of Incorporation. The amount may vary depending on the type of corporation you’re establishing (e.g., for-profit vs. nonprofit). Check the latest fees on the New Jersey Division of Revenue and Enterprise Services website.

How long does the filing process take?

The duration from filing to approval can vary. Online submissions might be processed quicker, often within a few business days, whereas mailed applications could take weeks. It is advisable to check the current processing times on the state website or contact their office directly.

Will I receive a confirmation that my Articles of Incorporation have been filed?

Yes, once your Articles of Incorporation are filed and approved, you will receive a confirmation. This confirmation might be sent via email for online filings or by mail if the application was submitted through the postal service.

Can I amend the Articles of Incorporation once they are filed?

You can amend your Articles of Incorporation after they've been filed. Amendments often require the submission of an additional form and a possible fee. This process is used for changes such as altering the corporation name, its purpose, or the number of authorized shares.

What happens if I don’t file the Articles of Incorporation for my business?

Without filing the Articles of Incorporation, your business will not be legally recognized as a corporation in New Jersey. This impacts many aspects of the business, including your ability to enter into contracts, secure loans, and your liability protection. Filing is a critical step for any business wishing to operate as a corporation.

Common mistakes

-

Not Checking Name Availability: Before filling out the New Jersey Articles of Incorporation, it’s crucial to ensure the name chosen for the corporation is available. Many individuals forget to check this, only to find out later that the name is already in use by another entity. This can lead to delays and the need to submit amendments.

-

Omitting Necessary Information: Skipping sections or not providing all the required details in the Articles of Incorporation can result in the rejection of the filing. Important details include the names and addresses of incorporators, the registered agent’s information, and the corporation’s purpose. Each piece of information plays a key role in the legal formation of the corporation.

-

Incorrectly Stating Shares Information: A common mistake is improperly detailing the corporation’s share structure. It’s vital to specify the number and type of shares the corporation is authorized to issue, as this affects voting rights, ownership limits, and investment potential. Errors here can complicate or invalidate future financing efforts.

-

Using Vague Language: The purpose of the corporation must be described clearly and precisely in the Articles of Incorporation. Vague or overly broad descriptions of the corporation’s purpose can lead to issues with state acceptance and can also affect future business licenses and permits.

-

Failing to Sign and Date the Document: An easily overlooked but critical step is signing and dating the Articles of Incorporation. This formalizes the intent to create the corporation under New Jersey law. Unsigned or undated documents are not valid and will be returned, delaying the incorporation process.

Documents used along the form

When forming a corporation in New Jersey, the Articles of Incorporation form is a crucial first step. This document officially registers your business as a corporation within the state. However, the process doesn't stop there. Several other forms and documents must be prepared and submitted to ensure compliance with New Jersey's corporate regulations and to facilitate the smooth operation of your business from a legal and administrative perspective.

- Bylaws: These internal documents outline the corporation's basic management structure and operational procedures. While not filed with the state, bylaws are essential for governance, dictating the roles of directors and officers, and setting the rules and protocols for meetings and corporate decisions.

- Initial Report: Often required shortly after the corporation is formed, the initial report provides the state with relevant information about the corporation, such as the names and addresses of directors and registered agents. This helps keep the state records up to date.

- Operating Agreement: Although more commonly associated with Limited Liability Companies (LLCs), corporations, especially those with multiple founders, can benefit from an operating agreement to detail the ownership percentages, dividend distribution rules, and procedures for handling the departure or addition of shareholders.

- Employer Identification Number (EIN) Application: Completed through the IRS, this application is necessary for tax purposes. The EIN, essentially a social security number for your corporation, is required for opening bank accounts, hiring employees, and filing tax returns.

Together, these documents make up the backbone of your corporate records and help in establishing the legal and operational framework of your corporation. Keeping these documents up-to-date and in compliance with both federal and state laws is essential for protecting your business and its owners from legal issues and ensuring the corporation's long-term success.

Similar forms

The Operating Agreement for an LLC (Limited Liability Company) shares similarities with the Articles of Incorporation as both provide a structural framework for the organization. While the Articles of Incorporation are used for corporations, the Operating Agreement serves a similar purpose for LLCs, outlining member roles, ownership percentages, and operating procedures.

The Bylaws of a corporation are another document similar to the Articles of Incorporation. While the Articles establish the corporation’s existence and its basic structural elements, the Bylaws go further to detail the internal rules governing the corporation. This includes procedures for meetings, elections of officers, and other essential corporate governance protocols.

A Partnership Agreement is akin to the Articles of Incorporation but for partnerships. This agreement sets out the terms of the partnership, such as the distribution of profits and losses, decision-making processes, and procedures for bringing in new partners or handling the departure of existing ones. It defines the relationship between the partners and the structure of the partnership, similar to how Articles of Incorporation define the corporation's structure and governance.

The Business Plan of a company, while not a legal document, shares the forward-looking nature of the Articles of Incorporation. Both documents are foundational to the establishment and future direction of an entity. A business plan outlines the company’s strategic direction, operational strategies, financial goals, and market analysis. Though not similar in legal standing, they are both essential in guiding a company from inception to growth.

Dos and Don'ts

Completing the New Jersey Articles of Incorporation is a foundational step in establishing a corporation in the state. As you undertake this important process, here are essential do’s and don’ts to guide you, ensuring accuracy and compliance with state requirements.

- Do thoroughly review the form instructions before beginning. This initial step can save time and help avoid common mistakes.

- Do ensure the corporate name you choose is unique and follows New Jersey’s naming requirements. You can verify name availability through the New Jersey Division of Revenue and Enterprise Services website.

- Do specify the purpose of your corporation clearly and concisely. A well-defined purpose can provide clarity for both the corporation’s management and its stakeholders.

- Do include the complete and accurate names and addresses of all incorporators. This information is crucial for both state records and future correspondence.

- Don’t leave any required fields blank. Incomplete forms can lead to processing delays or outright rejection.

- Don’t guess on details. If you are unsure about any part of the form, seek clarification from the New Jersey Division of Revenue or consult with a legal professional.

- Don’t use unofficial forms. Always download the latest Articles of Incorporation form directly from the New Jersey Division of Revenue’s official website to ensure you are using the correct version.

- Don’t overlook the filing fee. Be prepared to submit the appropriate fee with your Articles of Incorporation, as failure to do so can result in processing delays.

Fulfilling these requirements thoughtfully positions your corporation for a smoother start. While the process may seem daunting, each step is designed to establish a firm foundation for your business endeavors in New Jersey.

Misconceptions

When forming a corporation in New Jersey, many individuals encounter misconceptions about the Articles of Incorporation. It's essential to address and clarify these common misunderstandings to ensure a smooth process for new entities.

You can file the Articles of Incorporation without a business name. This is a significant misconception. The state of New Jersey requires every corporation to have a unique name that is distinguishable from other business entities already registered. Hence, selecting an appropriate name and ensuring its availability is a critical step before filing.

The Articles of Incorporation is the only document you need to start your business. While filing the Articles of Incorporation with the State of New Jersey is a crucial step in forming your corporation, it is not the only requirement. Businesses also need to obtain the necessary licenses or permits, create bylaws, and apply for an Employer Identification Number (EIN) from the IRS.

There is no need to renew the Articles of Incorporation. Generally, once the Articles of Incorporation are filed and approved, they do not need to be renewed. However, corporations are required to file annual reports and pay a fee to remain in good standing. This annual requirement is often mistaken for a renewal of the Articles themselves.

Electronic filing is optional. In today's digital age, New Jersey strongly encourages electronic filing for the Articles of Incorporation. It's faster, more efficient, and reduces the risk of errors. While paper filing is still an option, the advantages of electronic submission cannot be overstated, making it practically indispensable for most businesses.

Key takeaways

Starting a business in New Jersey involves several steps, one of which is filling out the Articles of Incorporation. This document is crucial as it formally establishes a company within the state. Below are key takeaways to consider when preparing and utilizing the New Jersey Articles of Incorporation form:

- Understand the requirements: The form requires specific information, including the corporation's name, its purpose, the total number of authorized shares, the name and address of the registered agent, and the names and addresses of the incorporators. Ensure all information is accurate and complete.

- Choose a unique name: Your corporation's name must be distinguishable from other business names already on file with the New Jersey Division of Revenue and Enterprise Services. Perform a name search beforehand to avoid rejections.

- Designate a registered agent: A registered agent is required for receiving legal documents on behalf of the corporation. The agent must have a physical address in New Jersey (P.O. Boxes are not acceptable).

- Decide on stock details early: The form asks for details about the number and types of shares the corporation is authorized to issue. Consider this carefully as it impacts your company's structure and financing options.

- Signatures are mandatory: The form must be signed by the incorporator(s), who are the individual(s) filling out the form. If the form is completed incorrectly or signatures are missing, it will be returned.

- File with the fee: There is a filing fee associated with the Articles of Incorporation. Check the current fees on the New Jersey Division of Revenue's website, as they can change. The form, along with the appropriate fee, must be submitted for processing.

Following these guidelines can ease the process of incorporating in New Jersey, laying a solid foundation for your business's legal structure and operational legitimacy. Remember, once filed, the Articles of Incorporation become a public record, signifying your business's official commencement in the state.

Create Other Articles of Incorporation Forms for US States

Corporate Formation - Key provisions within the form address the corporation's purpose, laying the groundwork for the business's objectives and scope of operations.

Georgia Secretary of State Forms - The formal notice to the state to create a corporation, including necessary details for legal recognition.

Florida State Corporation Commission - Precise and strategic drafting is necessary to encapsulate the corporation’s intended operational scope.

Colorado Secretary of State Business - After filing, the state government issues a certificate of incorporation, officially recognizing the corporation's legal existence.