Blank Articles of Incorporation Form for New York

Filing the New York Articles of Incorporation is a crucial step for any individual or group looking to establish a corporation within the state. This form serves as the official document that legally brings a corporation into existence. It requires detailed information about the corporation, including its name, purpose, office location, and information about its incorporators and directors. Additionally, the form asks for the designation of a registered agent responsible for legal notices. Understanding the requirements and accurately completing this form ensures compliance with state law, setting the foundation for a corporation's legal and financial structure. It marks the beginning of a corporation's journey, necessitating attention to detail and a thorough understanding of the implications each section carries for the business's future.

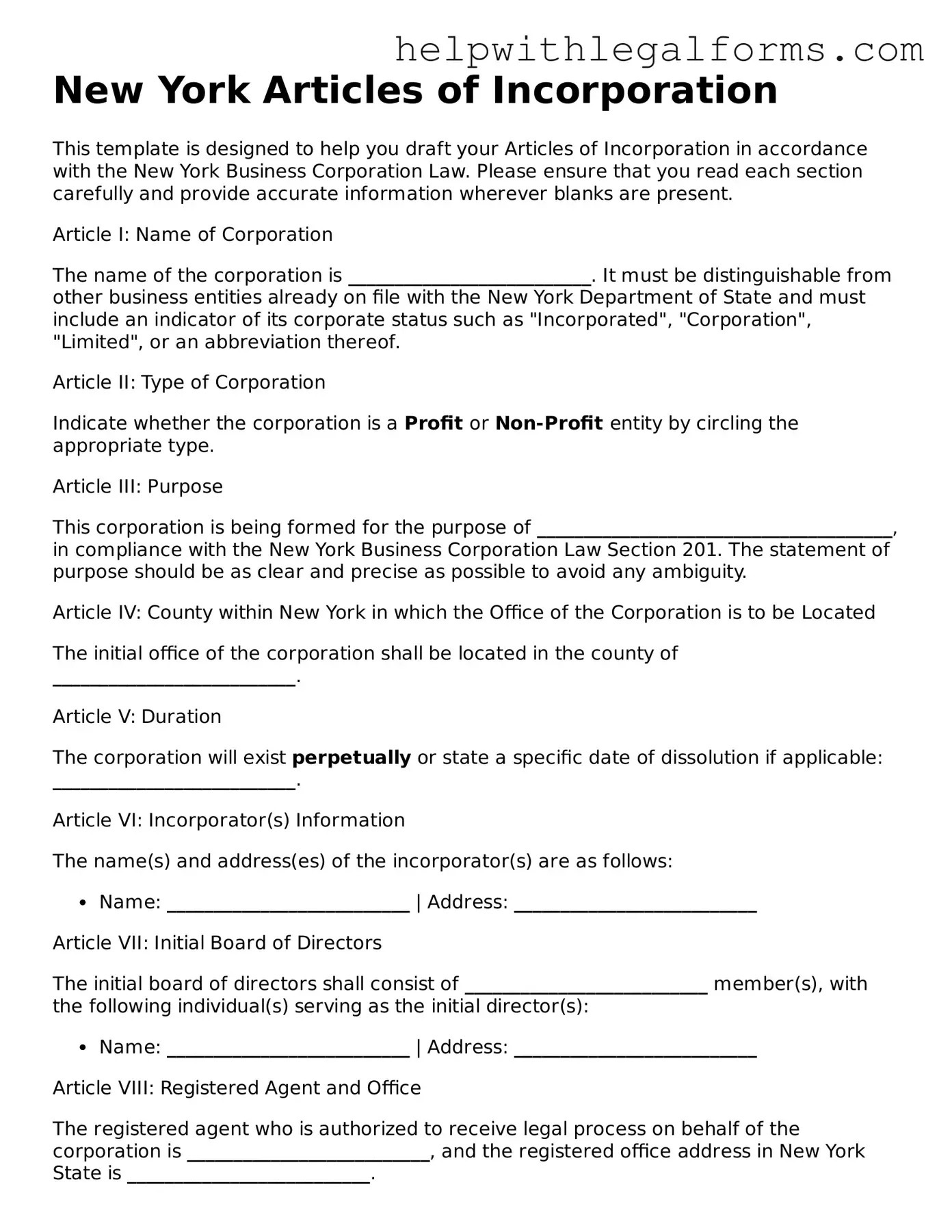

Example - New York Articles of Incorporation Form

New York Articles of Incorporation

This template is designed to help you draft your Articles of Incorporation in accordance with the New York Business Corporation Law. Please ensure that you read each section carefully and provide accurate information wherever blanks are present.

Article I: Name of Corporation

The name of the corporation is __________________________. It must be distinguishable from other business entities already on file with the New York Department of State and must include an indicator of its corporate status such as "Incorporated", "Corporation", "Limited", or an abbreviation thereof.

Article II: Type of Corporation

Indicate whether the corporation is a Profit or Non-Profit entity by circling the appropriate type.

Article III: Purpose

This corporation is being formed for the purpose of ______________________________________, in compliance with the New York Business Corporation Law Section 201. The statement of purpose should be as clear and precise as possible to avoid any ambiguity.

Article IV: County within New York in which the Office of the Corporation is to be Located

The initial office of the corporation shall be located in the county of __________________________.

Article V: Duration

The corporation will exist perpetually or state a specific date of dissolution if applicable: __________________________.

Article VI: Incorporator(s) Information

The name(s) and address(es) of the incorporator(s) are as follows:

- Name: __________________________ | Address: __________________________

Article VII: Initial Board of Directors

The initial board of directors shall consist of __________________________ member(s), with the following individual(s) serving as the initial director(s):

- Name: __________________________ | Address: __________________________

Article VIII: Registered Agent and Office

The registered agent who is authorized to receive legal process on behalf of the corporation is __________________________, and the registered office address in New York State is __________________________.

Article IX: Share Structure

(If applicable) The corporation is authorized to issue __________________________ shares of stock. If more than one class of stock is authorized, then the preferences, limitations, and relative rights of each class should also be described here.

Article X: Additional Provisions

Include any additional provisions that the corporation wishes to include in the Articles of Incorporation that are compliant with New York state law. These may relate to management, shareholder rights, or any other lawful matter.

Article XI: Incorporator Signature

The undersigned incorporator hereby affirms that the information provided in these Articles of Incorporation is true to the best of their knowledge.

Signature: __________________________ | Date: __________________________

PDF Form Attributes

| Fact | Detail |

|---|---|

| Governing Law | The Articles of Incorporation in New York are governed by the New York Business Corporation Law. |

| File With | The form must be filed with the New York State Department of State, Division of Corporations. |

| Filing Fee | There is a mandatory filing fee, which varies depending on the type of corporation being formed and other variables. |

| Required Information | Information required includes the corporation’s name, purpose, county in New York where it will be based, the stock structure, and the name and address of the registered agent. |

| Corporate Name Requirements | The corporate name must be distinguishable from other names on record and must include a corporate designator such as "Incorporated," "Corporation," or an abbreviation. |

| Duration of Incorporation | Unless stated otherwise within the Articles of Incorporation, the duration of the corporation is assumed to be perpetual. |

| Professional Services Requirement | If the corporation is formed to provide professional services (e.g., legal, medical), additional details and certifications may be required. |

Instructions on How to Fill Out New York Articles of Incorporation

Starting a corporation in New York State is an exciting venture, marking the beginning of a new era for business owners. The process commences with the filing of the Articles of Incorporation, a crucial step that legally establishes your corporation. This document outlines key details about your company, such as its name, purpose, and structure, laying a strong foundation for its operation and governance. Completing this form accurately is essential, as it impacts various aspects of your business, including taxation, liability, and regulatory compliance. Below is a step-by-step guide to help you navigate through this important process.

- Identify the corporate name: Ensure the name adheres to New York State’s naming requirements and is distinguishable from other business names on record.

- Designate the county within New York State where the corporation will be located: This is typically where the principal office is, or where the majority of business activities take place.

- Specify the corporation's purpose: Clearly state the nature of the business or activities the corporation intends to engage in, adhering to state regulations and guidelines for corporate purposes.

- Assign a registered agent: This is the individual or business entity authorized to receive legal documents on behalf of the corporation. Ensure the agent has a physical address (not a P.O. Box) within New York State.

- Detail the number of shares the corporation is authorized to issue: This includes the types of shares (if more than one class is authorized) and their relative rights and preferences.

- Provide incorporator information: List the name and address of the person(s) or entity filing the Articles of Incorporation. The incorporator is responsible for executing the document.

- Indicate the duration of the corporation: If the corporation is not intended to exist perpetually, specify the planned duration.

- List the names and addresses of the initial directors: While not all states require this information, it’s best to check New York State’s specific requirements regarding directors in the formation documents.

- Include any additional provisions or statements required by New York State law or necessary for your specific type of corporation.

- Execute the document: The incorporator(s) must sign the Articles of Incorporation, declaring under penalty of perjury that the information provided is correct. If applicable, include the date of execution.

After you have completed the form, review it thoroughly to ensure all information is accurate and complies with state requirements. The next step involves submitting the form to the New York State Department of State, along with the required filing fee. The method of submission (online, by mail, or in person) and the fee amount can vary, so it’s important to check the latest guidelines provided by the state. Filing the Articles of Incorporation is a significant milestone in your business journey, paving the way for successful operations and growth.

Crucial Points on This Form

What is the purpose of the New York Articles of Incorporation?

The New York Articles of Incorporation form is a critical document used to officially establish a corporation within the state. It serves as a formal application to register the company with the New York State Department of State, outlining essential information about the business, such as its name, purpose, office location, and details regarding its shares of stock and incorporators. Once filed and approved, it recognizably confirms the existence of the corporation under New York law, granting it the rights to operate, enter into contracts, and enjoy legal protections.

Who needs to file the New York Articles of Incorporation?

Any group or individual wishing to form a corporation in New York State must file the Articles of Incorporation. It is a necessary step for creating a legal entity distinct from its owners, providing them with limited liability protections. This requirement applies to both profit and non-profit organizations planning to conduct business within New York state boundaries.

Where can one obtain the New York Articles of Incorporation form?

The form can be obtained from the New York State Department of State's website. It's available for download in a PDF format, allowing potential filers to access it easily from anywhere. Additionally, printed copies can be requested or received in person at the department's office or through various legal assistance services and online platforms specializing in corporate filings.

What information must be included in the New York Articles of Incorporation?

The form requires several pieces of information to be provided, including the corporation’s name, which must adhere to specific naming conventions; the corporation's purpose, outlined with sufficient detail; the county within New York state where the corporation will be based; the total number of shares the corporation is authorized to issue, plus some details regarding these shares; the name and address of the incorporator(s); and the name and address of the designated service of process agent.

Are there legal requirements for the corporation's name included in the Articles of Incorporation?

Yes, New York law mandates specific requirements for a corporation's name. It must be unique and distinguishable from the names of existing entities registered with the state. The name must include designators such as “Incorporated,” “Corporation,” “Limited,” or their respective abbreviations. The state provides resources to check the availability of a name prior to filing the Articles of Incorporation, avoiding potential conflicts and rejections.

What is the filing fee for the New York Articles of Incorporation?

The filing fee varies depending on the type of corporation being established and other factors. As of the last update, the base fee for filing the Articles of Incorporation for a business corporation is generally set by the New York State Department of State. Non-profit organizations may have a different fee schedule. Updated fee schedules can be found on the Department of State’s website or by contacting the Department directly.

After filing, how long does it take to receive approval for the New York Articles of Incorporation?

The processing time can vary depending on the current workload of the New York State Department of State and the filing method used (online, mail, in person). Generally, online filings can be processed more quickly than those submitted through mail or in person. Filers can often expect to receive official approval or any requests for additional information within a few weeks of submission. Expedited services are available for an additional fee for those requiring a faster response.

What happens if there are errors in the Articles of Incorporation?

If errors are detected in the Articles of Incorporation, the New York State Department of State will typically notify the filer and provide an opportunity to amend the document. It is crucial to address and correct any mistakes promptly to avoid hindrances in officially establishing the corporation. Depending on the nature of the error, a simple amendment may suffice, or a more detailed refiling may be required. Guidance and instructions for making corrections are available from the Department.

Common mistakes

Filling out the New York Articles of Incorporation is a critical step for those looking to formalize their business in the state. However, it's common for individuals to encounter errors during this process. Recognizing and avoiding these mistakes is imperative for a smooth registration of your entity. Here are four common errors:

-

Not checking for name availability: Before filling out the form, it’s essential to ensure that your chosen business name is available and complies with New York’s naming requirements. Failing to do so can result in the rejection of your Articles of Incorporation.

-

Omitting required information: Every field in the Articles of Incorporation serves a purpose and requires attention. Neglecting to provide necessary details, such as the county in which your business will operate or the specific nature of your business, can lead to delays or outright denial of your filing.

-

Inaccurate registered agent information: The registered agent acts as the business’s legal representative, responsible for receiving important documents on behalf of the company. Entering incorrect registered agent information can lead to significant legal and operational issues down the line.

-

Misspecifying share structure: If your corporation will have shares, it’s crucial to accurately define the share structure in the Articles of Incorporation. Misunderstanding or incorrectly specifying the types and amounts of shares can affect your company’s ownership and tax statuses.

Avoiding these mistakes not only expedites the incorporation process but also ensures that your business complies with New York State's legal requirements from the get-go. Taking the time to review and properly complete the Articles of Incorporation can save you from potential hurdles in the future.

Documents used along the form

Starting a new business in New York is an exciting venture. While filing the Articles of Incorporation is a key step for incorporating a business, there are several other documents and forms that are commonly used alongside it. These documents facilitate various business functions, from tax registration to internal governance. Understanding each of these can make the incorporation process smoother and ensure that your business is compliant from the start.

- Bylaws: These are the rules that govern the internal management of the company. Bylaws outline procedures for holding meetings, electing officers and directors, and handling other corporate formalities.

- IRS Form SS-4 (Application for Employer Identification Number): This form is used to apply for an Employer Identification Number (EIN), which is necessary for tax purposes, opening a bank account, and hiring employees.

- Operating Agreement: Although more often used by LLCs, corporations might also use an operating agreement to specify the rights, powers, and duties of the corporation's members, managers, and officers.

- Shareholders’ Agreement: This document outlines the rights and obligations of the shareholders, including how shares can be bought, sold, or transferred. It might also detail how decisions are made.

- Stock Certificates: Physical documents that represent ownership of shares in the corporation. They include details such as the name of the owner and the number of shares owned.

- Initial Report: Some states require corporations to file an initial report after incorporation. This report typically includes basic information about the corporation, such as the names and addresses of directors and officers.

- Business Plan: While not a formal legal document, a business plan is crucial for planning the strategic direction of the corporation and is often required by lenders and investors.

- DBA Filing (Doing Business As): If the corporation operates under a name different from its legal name, a DBA filing may be required. This allows the public to know the true owner of a business.

- Zoning Compliance Documents: Before commencing operations, it's important to ensure the business location complies with local zoning laws. These documents prove that your business is allowed to operate in its chosen location.

The process of incorporating in New York involves multiple steps and documentation to ensure compliance with state laws and regulations. Carefully preparing and organizing these documents will not only help in establishing the foundation of your business but also simplify future legal and operational procedures. Remember, the requirements can vary depending on the specific type of business and where it's located, so it's always a good idea to consult with a professional or conduct thorough research.

Similar forms

-

Bylaws: Similar to the Articles of Incorporation, bylaws establish the internal rules and procedures for running a corporation. While the Articles of Incorporation register the corporation with the state, bylaws detail how the corporation is governed and operated.

-

Operating Agreement: Used by Limited Liability Companies (LLCs), an Operating Agreement serves a similar purpose to the Articles of Incorporation but for LLCs. It outlines the business' financial and functional decisions including rules, regulations, and provisions.

-

Business Plan: Although more detailed and comprehensive, a business plan shares a common goal with the Articles of Incorporation: to define the company's purpose, operations, and strategy. Both documents are essential in establishing the foundation of a company.

-

Partnership Agreement: This document outlines the responsibilities, profit share, and other obligations of each partner in a business partnership. Like the Articles of Incorporation, it is critical in establishing the framework and governance of the business entity, but tailored for partnerships rather than corporations.

-

Shareholder Agreement: A shareholder agreement details the rights and responsibilities of shareholders within a corporation. It complements the Articles of Incorporation by providing in-depth governance structures and operational guidelines specific to shareholders.

-

Stock Certificate: Issued to shareholders, a stock certificate represents ownership in a corporation. It is a follow-up document to the Articles of Incorporation, signifying the allocation of ownership after the corporation’s formation.

-

Employment Agreement: While an employment agreement details the terms of employment between a company and its employees, it similarly establishes terms and conditions but in the context of employment, reflecting the company's structure as outlined in the Articles of Incorporation.

-

Non-Disclosure Agreement (NDA): NDAs protect confidential company information. While not specific to the formation of a company like the Articles of Incorporation, NDAs support the company’s operational security, often necessary from the outset.

-

Trademark Application: Filing for a trademark is a process for protecting a company's brand and identity, just as the Articles of Incorporation protect the company's legal standing. Both processes are crucial for establishing a company's legal and market identity.

-

Certificate of Good Standing: This certificate proves that a company is authorized to do business in a state and has complied with all state-required formalities, including the filing of Articles of Incorporation. It’s a document that often follows the incorporation process.

Dos and Don'ts

Filling out the New York Articles of Incorporation requires attention to detail and a clear understanding of what is required. To help navigate this process, here are essential dos and don'ts to consider:

What to Do

- Ensure all information is accurate and current. Double-check names, addresses, and other details to avoid processing delays.

- Include a specific business purpose. Be clear and concise about the nature of the business to meet state requirements.

- Appoint a registered agent with a New York physical address. This agent will receive legal and tax documents on behalf of the corporation.

- Sign and date the form. An authorized person must complete this step to validate the document.

What Not to Do

- Don’t leave any required fields blank. Incomplete forms can be rejected, leading to unnecessary delays.

- Don’t guess on details or provide inaccurate information. This can lead to legal issues or the need to submit corrections later.

- Don’t use a post office box for the registered agent’s address. A physical address in New York is required by law.

- Don’t forget to pay the filing fee. The submission will not be processed without the appropriate fee.

Misconceptions

Filing the New York Articles of Incorporation is a critical step for businesses wishing to formalize their presence in the state. However, several misconceptions can lead to misunderstandings or errors in the process. Addressing these misconceptions ensures businesses are better informed and can navigate the process more smoothly.

Misconception 1: Any business can file the Articles of Incorporation to become incorporated in New York. In reality, this process is specifically designed for corporations. Other business types, such as sole proprietorships, partnerships, and limited liability companies (LLCs), have different filing requirements. Each business type has a distinct form and process that reflects its unique structure and needs.

Misconception 2: The filing of the Articles of Incorporation instantly protects the business name in New York. While filing does provide a level of protection, it's important to conduct a thorough name availability search beforehand. This ensures the chosen name is not only available but also not too similar to existing names, which could lead to legal disputes. Furthermore, businesses seeking stronger name protection should consider trademark registration.

Misconception 3: The information filed in the Articles of Incorporation is set in stone. Changes in business circumstances, such as address, directorship, or share structure, can necessitate updates to the filed information. New York state allows for amendments to the Articles of Incorporation. This flexibility ensures that businesses can update their records with the state to reflect current operational realities accurately.

Misconception 4: Filing the Articles of Incorporation is the final step in starting a corporation. While it's a significant step, it's far from the last. After filing, businesses must comply with other state and federal requirements, such as obtaining necessary permits and licenses, filing for an Employer Identification Number (EIN), and holding an initial meeting of the board of directors. Additionally, corporations are required to adhere to ongoing compliance obligations, such as annual reporting and tax filings.

Understanding and demystifying these common misconceptions can streamline the incorporation process. It can also help businesses in New York set realistic expectations and properly prepare for the responsibilities and requirements of operating a corporation.

Key takeaways

When it comes to establishing a corporation in New York, the Articles of Incorporation form plays a pivotal role. This document not only officially forms your corporation but also outlines its foundational aspects to the New York State Department of State. Here are key takeaways for correctly filling out and using this document.

- Understand the purpose: The Articles of Incorporation legally establish your corporation's existence under New York State law. It's the first step in ensuring your business is recognized as a legal entity.

- Know the required information: Typically, this form requires basic information about your corporation, including the corporate name, principal office address, registered agent information, purpose of the corporation, number of shares the corporation is authorized to issue, and the names and addresses of the incorporators.

- Select a corporate name carefully: Your corporate name must be unique and not too similar to any existing entity registered in New York. It's advisable to check the New York State Corporation and Business Entity Database for name availability.

- Designate a registered agent: A registered agent is crucial as they will receive legal papers and government correspondences on behalf of your corporation. Ensure this agent has a physical address in New York.

- Specify your corporate purpose: While some states allow a broad purpose clause, New York requires a specific business purpose to be listed in the Articles of Incorporation, detailing the nature of the business or activities your corporation will undertake.

- Determine shareholder details early: Deciding on the number of shares and classification early can help avoid amendments to the Articles of Incorporation later. This impacts your corporation's structure, voting rights, and how profits are distributed.

- File with the Department of State: Once filled out, the form must be submitted to the New York State Department of State, Division of Corporations. This can usually be done online, by mail, or in person, along with the required filing fee.

- Keep a copy for your records: After filing, ensure you keep a copy of the Articles of Incorporation with your corporate records. This document is often required for various business operations, such as opening a bank account or applying for business licenses.

Filling out the Articles of Incorporation accurately is a foundational step for your corporation in New York. It establishes your business as a legal entity and sets the stage for its future governance and operational structure. Be sure to review the form thoroughly, consult any necessary legal or financial advisers, and double-check all entered information before submission.

Create Other Articles of Incorporation Forms for US States

Document Retrieval Center - While online services exist to assist in preparing and filing Articles of Incorporation, legal consultation is advisable to navigate state-specific requirements and implications.

Certificate of Incorporation Ct - It establishes the legal entity of the corporation, separating the business entity from its owners and protecting them through limited liability.