Blank Articles of Incorporation Form for Oklahoma

The initiation of a corporation in Oklahoma necessitates meticulous attention to legal requirements, one of which involves the completion of the Articles of Incorporation form. This document stands as a foundational pillar for any corporation, serving to officially introduce the entity into the legal framework of the state. The process encompasses specifying essential details such as the corporation's name, its purpose, the duration for which it is established, the address of its principal office, the number and type of shares the corporation is authorized to issue, and the information regarding its registered agent. Additionally, it outlines the structure of governance by delineating the powers and responsibilities of its directors and officers. This form not only solidifies the legal stance of a corporation but also provides public transparency concerning its operations. Ensuring accuracy and compliance in filling out this form is crucial, as it affects the corporation's legal identity, its operational legitimacy, and its ability to engage in business activities within Oklahoma and beyond. The completion of the Articles of Incorporation form is a significant step towards achieving legal recognition and is subject to review by the Oklahoma Secretary of State to ensure it meets all statutory requirements.

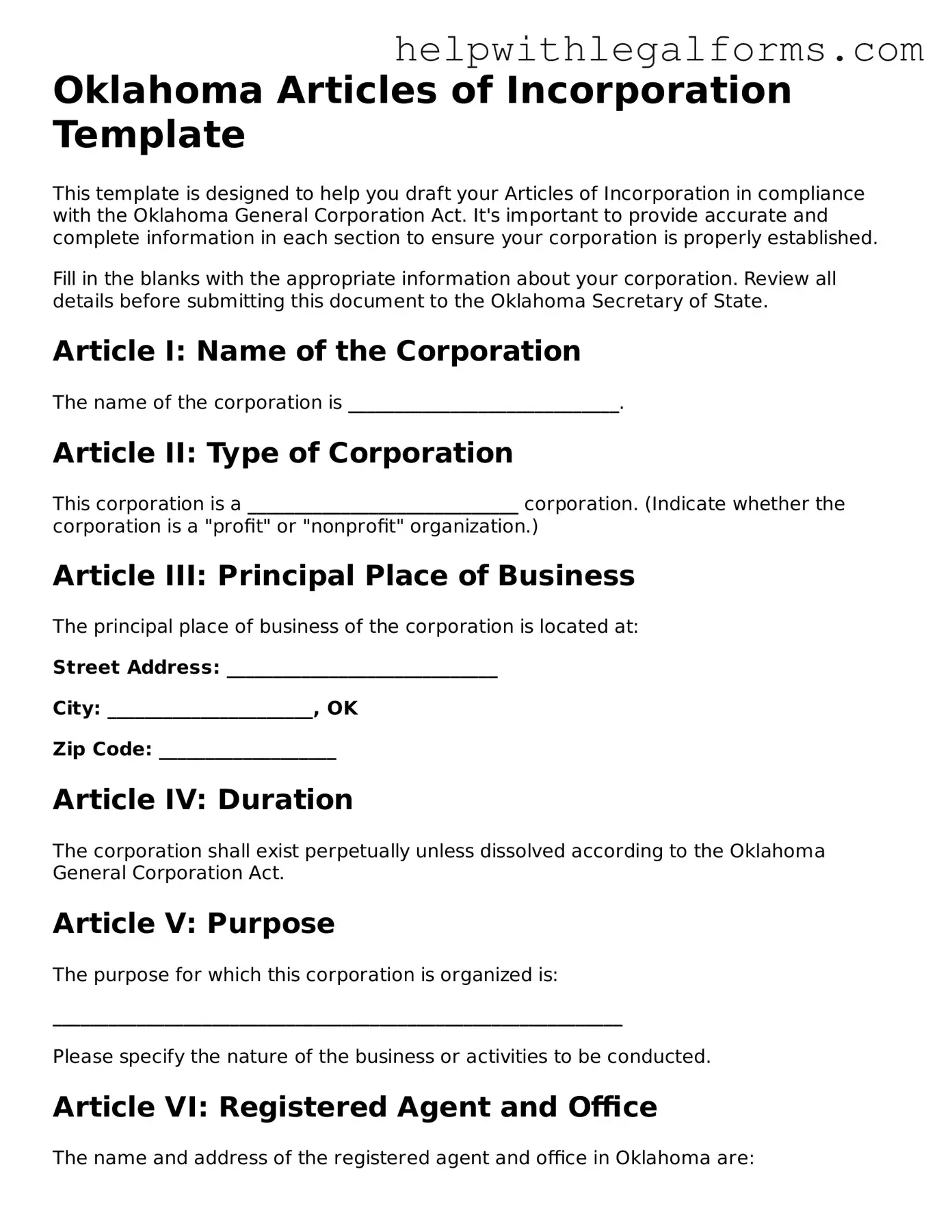

Example - Oklahoma Articles of Incorporation Form

Oklahoma Articles of Incorporation Template

This template is designed to help you draft your Articles of Incorporation in compliance with the Oklahoma General Corporation Act. It's important to provide accurate and complete information in each section to ensure your corporation is properly established.

Fill in the blanks with the appropriate information about your corporation. Review all details before submitting this document to the Oklahoma Secretary of State.

Article I: Name of the Corporation

The name of the corporation is _____________________________.

Article II: Type of Corporation

This corporation is a _____________________________ corporation. (Indicate whether the corporation is a "profit" or "nonprofit" organization.)

Article III: Principal Place of Business

The principal place of business of the corporation is located at:

Street Address: _____________________________

City: ______________________, OK

Zip Code: ___________________

Article IV: Duration

The corporation shall exist perpetually unless dissolved according to the Oklahoma General Corporation Act.

Article V: Purpose

The purpose for which this corporation is organized is:

_____________________________________________________________

Please specify the nature of the business or activities to be conducted.

Article VI: Registered Agent and Office

The name and address of the registered agent and office in Oklahoma are:

Name: ___________________________________

Street Address: _____________________________

City: ______________________, OK

Zip Code: ___________________

Article VII: Incorporators

The name(s) and address(es) of the incorporator(s) are as follows:

- Name: _____________________________, Address: _____________________________

- Name: _____________________________, Address: _____________________________

Article VIII: Initial Board of Directors

The names and addresses of the initial board of directors are:

- Name: _____________________________, Address: _____________________________

- Name: _____________________________, Address: _____________________________

- Name: _____________________________, Address: _____________________________

Article IX: Shares

If the corporation is authorized to issue only one class of shares, the total number of shares authorized to be issued is _________________________.

If there are multiple classes of shares, detail the classes and the number of shares authorized for each class.

Article X: Additional Provisions

In this section, include any other provisions, including but not limited to, indemnification of directors and officers, and any limitations on corporate powers. Please attach additional pages if necessary.

_____________________________________________________________

Article XI: Incorporator Signature(s)

The undersigned incorporator(s) agrees to the above-stated Articles of Incorporation on this day of __________, 20__.

Signature: _____________________________, Name: _____________________________

Signature: _____________________________, Name: _____________________________

This document is intended to serve as a guide. Depending on the specific needs and circumstances of your corporation, you may need to consult with a legal professional to ensure all legal requirements are met.

PDF Form Attributes

| Fact | Detail |

|---|---|

| State-Specific Form | The Oklahoma Articles of Incorporation form is specific to entities wishing to incorporate within the state of Oklahoma. |

| Governing Law | It is governed by Title 18 of the Oklahoma Statutes, which provides the legal framework for the formation, operation, and dissolution of corporations in Oklahoma. |

| Filing Requirement | To legally establish a corporation in Oklahoma, this form must be filed with the Oklahoma Secretary of State. |

| Information Required | The form requires detailed information, including the corporation's name, principal place of business, registered agent, incorporator(s), and the type and number of shares the corporation is authorized to issue. |

| Filing Fee | There is a filing fee associated with the submission of the form, which varies depending on the type and specifics of the corporation being established. |

| Online Submission | In many cases, the form can be submitted online through the Oklahoma Secretary of State's website, streamlining the incorporation process. |

Instructions on How to Fill Out Oklahoma Articles of Incorporation

When setting up a corporation in Oklahoma, the first legal step involves filling out the Articles of Incorporation form. This document is crucial as it registers the corporation with the state, making it a legal entity. The process may seem daunting at first, but by breaking it down into manageable steps, it can be completed accurately and efficiently. Following these steps ensures that the corporation complies with Oklahoma state laws from the outset, facilitating a smooth start to business operations.

- Gather all necessary information before starting, including the corporation's name, principal place of business, registered agent's name and address, incorporator(s) details, and stock information.

- Enter the complete and exact name of the corporation, ensuring it meets Oklahoma's naming requirements and does not conflict with an existing entity's name.

- Specify the principal place of business, including the street address, city, state, and zip code. This location will serve as the corporation's official business address.

- Detail the name and physical Oklahoma address of the registered agent. The registered agent is responsible for receiving legal documents on behalf of the corporation.

- Provide the names and addresses of the incorporator(s). Incorporators are individuals or entities responsible for executing the Articles of Incorporation.

- List the number of shares the corporation is authorized to issue, indicating if the shares will have a par value or not.

- Include any additional provisions or articles that the corporation wishes to disclose. This may relate to the management structure, shareholder rights, or other corporate governance matters.

- Sign and date the form. The incorporator(s) must provide a signature(s), attesting to the accuracy of the information provided and the intent to form the corporation.

- Review the completed form for accuracy and completeness. Ensure that all required fields are filled out and that there are no errors.

- Submit the form along with the necessary filing fee to the Oklahoma Secretary of State. The submission can typically be made online, by mail, or in-person, depending on the preferred method.

After the Articles of Incorporation are filed and approved, the corporation will receive an official certificate from the Oklahoma Secretary of State. This certificate is confirmation that the corporation is legally recognized in Oklahoma. Following this, the corporation should take further steps to comply with all other state and federal requirements, such as obtaining an Employer Identification Number (EIN), opening a bank account, and applying for any necessary licenses and permits.

Crucial Points on This Form

What are the Oklahoma Articles of Incorporation?

The Oklahoma Articles of Incorporation is a legal document required by the state of Oklahoma to formally establish a corporation within its jurisdiction. This document outlines essential details about the corporation, including its name, purpose, registered agent, incorporator(s), and stock structure, among other things. Filing this document with the Oklahoma Secretary of State officially registers the corporation, granting it the legal recognition needed to conduct business.

Who needs to file the Oklahoma Articles of Incorporation?

Any group or individual wishing to form a corporation in Oklahoma must file the Articles of Incorporation with the Oklahoma Secretary of State. This applies to both for-profit and nonprofit organizations seeking to operate as corporations. It is a critical first step for new businesses that choose the corporate structure for the legal and financial protections it offers.

What is the process for filing the Articles of Incorporation in Oklahoma?

The process typically involves completing the Articles of Incorporation form with accurate and comprehensive details about the corporation. Once filled, the form must be submitted to the Oklahoma Secretary of State's office along with the appropriate filing fee. Submitters can choose to file either online through the Secretary of State's website or mail in a hard copy. After the document is filed and approved, the state will officially recognize the corporation as a legal entity.

What information is required on the Oklahoma Articles of Incorporation form?

The form requires several pieces of information about the corporation, including its official name, the purpose for which it is being formed, the name and address of its registered agent in Oklahoma, the names of the incorporators, and details about the corporation's stock, such as the number of shares authorized to be issued and their par value. Additional information may be required depending on the specific type of corporation being formed.

How much does it cost to file the Oklahoma Articles of Incorporation?

The filing fee for the Oklahoma Articles of Incorporation varies. For for-profit corporations, the fee is generally based on the authorized capital (the number and par value of shares the corporation is authorized to issue). For nonprofit corporations, there is typically a fixed fee that is more nominal. It's important to consult the current fee schedule posted on the Oklahoma Secretary of State's website or contact their office for the most accurate and up-to-date fee information.

How long does it take for the Articles of Incorporation to be processed in Oklahoma?

The processing time can vary based on the current workload of the Oklahoma Secretary of State's office and the submission method. Electronic filings are often processed quicker than paper filings, with some being processed in as little as a few business days. However, for paper filings or during peak filing periods, the process might take several weeks. It's advisable to check with the Secretary of State for the most current processing times.

Can I file the Oklahoma Articles of Incorporation online?

Yes, you can file the Articles of Incorporation online through the Oklahoma Secretary of State's website. This is the most efficient method and often results in quicker processing times. The website also provides guidelines and additional resources to assist you in completing the form accurately.

What happens if I make a mistake on the Articles of Incorporation?

If a mistake is made on the form, it may be possible to correct it by filing an amendment with the Secretary of State. There is typically a fee associated with filing an amendment. It’s important to carefully review the form before submission to minimize the need for amendments. If you're unsure about any part of the form, consulting with a legal professional can help prevent mistakes.

Are there ongoing requirements after filing the Oklahoma Articles of Incorporation?

Yes, after a corporation is formed, there are ongoing requirements to maintain good standing in the state of Oklahoma. These include filing annual reports, maintaining a registered agent, and complying with tax obligations. Failure to meet these requirements can result in penalties or even revocation of the corporation’s legal status. Being aware of and adhering to these ongoing obligations is essential for the continued success and legality of the corporation.

Common mistakes

-

One common mistake is not providing a specific enough purpose for the corporation. The Articles of Incorporation require a detailed description of the company's primary business activities. However, people often write a vague or overly broad statement, which can cause delays or even rejection of the application.

-

Another error involves the registered agent information. Some people mistakenly list the corporation itself or an unqualified individual as the registered agent. The registered agent must be an individual resident of Oklahoma or a corporation authorized to do business in Oklahoma willing and able to accept legal papers on behalf of the corporation.

-

Incorrect share information is a frequent mistake. When filling out the form, specific details regarding the number of shares the corporation is authorized to issue and, if applicable, the different classes of shares, must be included. Missing or inaccurate share information can lead to significant issues down the line.

-

Failing to include all the required signatures is another common oversight. The Articles of Incorporation must be signed by the incorporator(s), and if it appoints the initial board of directors, their consent should also be included. Sometimes, people submit the form without all necessary signatures, leading to its rejection.

-

Some people overlook the need to check name availability before filing. The corporation's name must be distinguishable from other registered entities in Oklahoma. Failure to verify name availability can result in the refusal of the Articles of Incorporation.

-

There is also the mistake of providing inadequate information on the duration of the corporation. If the corporation is not intended to be perpetual, a specific dissolution date needs to be stated. Omitting this information when a limited duration is intended complicates the incorporation process.

-

Last but not least, inaccuracies in the principal office address are also a typical mistake. The Articles of Incorporation require the physical address of the corporation’s principal office. Sometimes, a P.O. Box is erroneously listed, or the address is not complete. This can cause issues in official communications and legal proceedings.

People who are preparing to fill out the Oklahoma Articles of Incorporation form should pay close attention to these common mistakes to ensure a smoother filing process.

Documents used along the form

Starting a business in Oklahoma is an exciting venture. The Articles of Incorporation form is a critical step in forming a corporation, but it is just one of several important documents and forms that may be required during the incorporation process or shortly thereafter. Understanding these documents can help ensure a smooth start and compliance with state laws and regulations.

- Registered Agent Consent Form: This document is necessary for designating a registered agent for the corporation, which is a requirement. It confirms the agent’s willingness to act in this capacity.

- Bylaws: While not filed with the state, bylaws are essential as they outline the corporation's internal operating rules. Every corporation needs bylaws to dictate how it will be governed and run.

- Initial Report: Depending on the timing of the incorporation, an initial report may need to be filed with the Oklahoma Secretary of State. This report typically includes basic information about the corporation, such as its officers and address.

- Employer Identification Number (EIN) Application: Obtained from the IRS, this number is crucial for tax purposes. It acts as the corporation’s social security number for opening bank accounts, hiring employees, and filing taxes.

- Shareholder Agreement: Particularly for corporations with multiple owners, this agreement outlines the rights and obligations of the shareholders and describes how shares can be bought, sold, or transferred.

- Stock Certificates: These certificates represent ownership in the corporation. They include details such as the number of shares owned and the date of issue.

- Corporate Seal: While not a document, a corporate seal is a tool used to stamp official documents and signifies the corporation's approval of the document. It is traditional but not legally required.

- Business Licenses and Permits: Depending on the type of business and its location, various local, state, and federal licenses and permits may be required to lawfully operate.

- Operating Agreement: Relevant for LLCs that may decide to incorporate, this document outlines the financial and managerial rights and duties of the members. It becomes unnecessary if the LLC converts into a corporation but is critical for understanding the business's initial structure.

Completing and submitting the Articles of Incorporation is a significant step, yet it is only the beginning of maintaining a corporation's legal standing. Attending to the subsequent and parallel requirements, such as those listed above, furthers a corporation's legitimacy and operational capability. Ensuring that these documents are correctly prepared and utilized can protect the corporation and its owners from future legal complications and support the business’s growth and success.

Similar forms

Bylaws: Bylaws provide the internal operating rules for a corporation, whereas the Articles of Incorporation serve as the foundational document that brings a corporation into being. Both are essential for a corporation’s structure and governance but serve complementary roles. The Articles establish the corporation's existence legally, and the bylaws detail how the corporation will run, including how decisions are made, meetings are held, and officers are elected.

Operating Agreement: Similar to the Articles of Incorporation for corporations, an Operating Agreement is for Limited Liability Companies (LLCs). While the Articles of Incorporation outline the basic information required to register a corporation with the state, an LLC's Operating Agreement details the ownership structure, member roles, and operational procedures. Both documents are vital for defining the framework within which the entity operates and ensuring legal compliance.

Partnership Agreement: Partnership Agreements govern the operations of a partnership, defining roles, responsibilities, profit sharing, and dispute resolution among partners. Although partnership agreements serve a similar purpose to the Articles of Incorporation by providing a framework for the operation of the business entity, they are used for partnerships rather than corporations. The Articles of Incorporation formally register the corporation with the state, while the Partnership Agreement outlines the internal management and operational guidelines.

Certificate of Formation: Also known as the Articles of Organization in some jurisdictions, the Certificate of Formation is for LLCs what the Articles of Incorporation are for corporations. It is the legal document filed with the state to formally establish an LLC. Both documents serve the fundamental purpose of legally recognizing the entity within the respective state, containing basic information about the entity, such as its name, purpose, and the names of its principals.

Dos and Don'ts

Filling out the Oklahoma Articles of Incorporation form is a pivotal step for anyone looking to establish a corporation in the state. Doing it correctly ensures a smooth start to your business. Below are essential do's and don'ts to guide you through the process:

Do's- Verify the name availability: Before you fill out the form, ensure that your desired corporate name is available and complies with Oklahoma's naming requirements. This can prevent rejection and additional paperwork.

- Provide accurate information: Ensure all information entered on the form is accurate and complete. Inaccuracies can lead to delays or denial of your application.

- Include a detailed business purpose: Clearly define the purpose of your corporation. A well-defined purpose can facilitate the acceptance of your Articles of Incorporation.

- Attach required documents: Some situations may require additional documentation. If applicable, make sure these are complete and attached to your filing.

- Determine the initial registered agent: Identify an initial registered agent who is authorized to receive legal and tax documents on behalf of the corporation.

- Sign and date the form: The form must be signed by an incorporator or authorized officer. Remember to check if a notary public must witness the signing.

- Overlook filing fees: Failing to include the correct filing fee can result in your application not being processed. Verify the current fee to ensure correct payment.

- Use pencil to fill out the form: Always use black or blue ink when filling out the form. Entries made in pencil may not be accepted.

- Ignore state-specific requirements: Each state, including Oklahoma, has unique requirements for incorporation. Avoid using a generic form or following guidelines meant for another state.

- Forget to specify share structure: If your corporation will issue stock, make sure to outline the structure and the types of shares to be issued. Omitting this information can create legal and operational issues later.

- Misidentify the incorporator(s): The incorporator(s) play a crucial role in the establishment of your corporation. Ensure that the correct person(s) are listed and their information is accurate.

- Neglect to keep a copy: After submitting your Articles of Incorporation, always keep a copy for your records. This document is essential for legal and administrative reasons.

Misconceptions

When tackling the Oklahoma Articles of Incorporation form, several misconceptions commonly arise. While individuals or entities look to establish a corporation within Oklahoma, understanding the intricacies of this form is crucial. The following points aim to clarify common mistaken beliefs and provide a straightforward outlook on the incorporation process.

It's all you need to start your business: A common misconception is that filing the Articles of Incorporation with the Oklahoma Secretary of State is the sole step required to start a business. In reality, this is just the beginning. Businesses must obtain necessary permits, licenses, and comply with registration requirements for tax purposes both at the state and federal levels.

One size fits all: Many assume that the form is a universal document that does not require customization. On the contrary, the Articles must be tailored to meet the specific needs of the corporation, including the designation of the type of corporation, stock information, and provisions about the management structure. These elements are crucial for legal and operational clarity.

Immediate approval is guaranteed: The assumption that submission leads to immediate approval is incorrect. The Oklahoma Secretary of State reviews each submission for compliance with state laws and regulations. This process takes time, and if the submitted Articles do not meet the state's requirements, they will be returned for corrections and resubmission.

No legal advice is necessary: There's a prevailing belief that the process is straightforward and doesn't require legal consultation. However, considering the potential complexities and legal ramifications associated with the structure and governance of the corporation, consulting with a lawyer can be invaluable. Legal advice can ensure that the Articles of Incorporation fully comply with Oklahoma laws and serve the best interests of the corporation.

Key takeaways

Filing the Articles of Incorporation is a pivotal step in forming a corporation in Oklahoma. This document establishes the legal existence of your business within the state. The process can be straightforward, but it's important to understand its key aspects to ensure success and compliance with state law. Here are some essential takeaways to consider when filling out and using the Oklahoma Articles of Incorporation form.

- Complete and accurate information is crucial. The form requires details about your corporation, including its name, principal place of business, registered agent, incorporator(s), and the number of shares the corporation is authorized to issue. Mistakes or incomplete information can delay the process or impact your business's legal status.

- Choosing a corporate name requires thought and research. Your corporation's name must be distinguishable from other business names registered in Oklahoma. It's advisable to search the Oklahoma Secretary of State's business database to ensure your chosen name is available. Additionally, the name must include a corporate identifier such as "Incorporated," "Corporation," "Company," or an abbreviation thereof.

- Selecting a registered agent is a strategic decision. The registered agent acts as the corporation’s representative for legal documents. This agent can be an individual resident in Oklahoma or a corporation authorized to do business in Oklahoma. The choice of registered agent affects how quickly and reliably you receive legal and tax documents.

- Understanding the share structure is fundamental. When filling out the form, you'll indicate the number of shares the corporation is authorized to issue. This decision influences potential investment in your corporation, the structure of ownership, and how profits and losses are divided among shareholders.

- There may be additional rules for certain types of corporations. Depending on your corporation's purpose and structure, there might be specific provisions or additional forms required. For example, non-profit corporations have different requirements and must include statements regarding the distribution of assets upon dissolution.

- Filing the form is just the beginning. Once the Articles of Incorporation are filed and approved, there are further responsibilities to uphold. These include holding organizational meetings, adopting corporate bylaws, issuing stock, and complying with state and federal regulatory requirements. Timely annual reports and fee payments are also necessary to maintain good standing.

Correctly filing the Articles of Incorporation is key to laying the proper foundation for your corporation in Oklahoma. Taking the time to understand and accurately complete this form can save substantial time and resources, helping ensure your corporation's long-term success and compliance.

Create Other Articles of Incorporation Forms for US States

Certificate of Incorporation Ct - It signifies the acceptance of the corporation’s obligations under state law, including tax responsibilities and regulatory compliance.

Corporate Formation - Special considerations for professional corporations, which offer services requiring licenses, can also be addressed in the Articles.