Blank Articles of Incorporation Form for Texas

Embarking on the journey of incorporating a business in Texas marks a pivotal step toward laying its formal foundation and ensuring its legal recognition within the state. The Texas Articles of Incorporation form serves as the cornerstone of this process, a crucial document that must be meticulously completed and submitted to the Texas Secretary of State. This form encapsulates key details about the business, including its name, type, duration, purposes, initial registered office and agent, as well as information about the incorporators and the initial board of directors if applicable. Its completion is not just a mere procedural step; it represents the legal birth of a corporation, ensuring that it complies with state laws and regulations. Moreover, the filing of the Texas Articles of Incorporation is instrumental in establishing the corporation’s identity, which further aids in matters such as obtaining a tax ID, opening bank accounts, and securing necessary licenses and permits. Thus, understanding and accurately completing this form is imperative for entrepreneurs who are vested in not only launching their ventures on solid legal footing but also in safeguarding their interests and facilitating their business’s long-term growth and success.

Example - Texas Articles of Incorporation Form

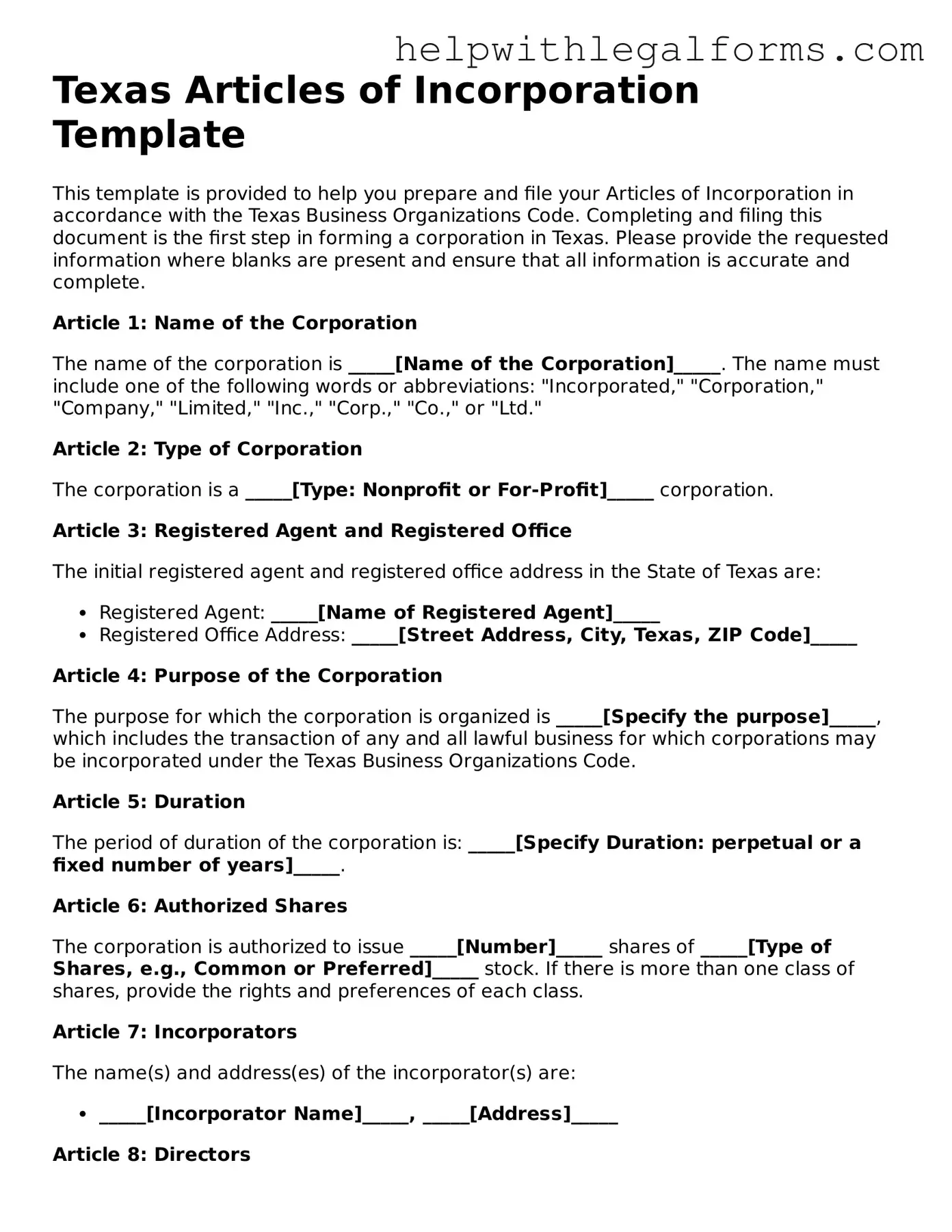

Texas Articles of Incorporation Template

This template is provided to help you prepare and file your Articles of Incorporation in accordance with the Texas Business Organizations Code. Completing and filing this document is the first step in forming a corporation in Texas. Please provide the requested information where blanks are present and ensure that all information is accurate and complete.

Article 1: Name of the Corporation

The name of the corporation is _____[Name of the Corporation]_____. The name must include one of the following words or abbreviations: "Incorporated," "Corporation," "Company," "Limited," "Inc.," "Corp.," "Co.," or "Ltd."

Article 2: Type of Corporation

The corporation is a _____[Type: Nonprofit or For-Profit]_____ corporation.

Article 3: Registered Agent and Registered Office

The initial registered agent and registered office address in the State of Texas are:

- Registered Agent: _____[Name of Registered Agent]_____

- Registered Office Address: _____[Street Address, City, Texas, ZIP Code]_____

Article 4: Purpose of the Corporation

The purpose for which the corporation is organized is _____[Specify the purpose]_____, which includes the transaction of any and all lawful business for which corporations may be incorporated under the Texas Business Organizations Code.

Article 5: Duration

The period of duration of the corporation is: _____[Specify Duration: perpetual or a fixed number of years]_____.

Article 6: Authorized Shares

The corporation is authorized to issue _____[Number]_____ shares of _____[Type of Shares, e.g., Common or Preferred]_____ stock. If there is more than one class of shares, provide the rights and preferences of each class.

Article 7: Incorporators

The name(s) and address(es) of the incorporator(s) are:

- _____[Incorporator Name]_____, _____[Address]_____

Article 8: Directors

The initial board of directors shall consist of _____[Number]_____ director(s). The name(s) and address(es) of the person(s) who are to serve as the initial director(s) until the first annual meeting of shareholders or until their successors are elected and qualify are:

- _____[Director Name]_____, _____[Address]_____

Article 9: Additional Provisions

Additional provisions, including any limitations or restrictions on the business of the corporation, are provided below:

_____[Insert additional provisions here.]_____

Article 10: Effective Date

The corporation will begin its existence on the date these Articles of Incorporation are filed with the Texas Secretary of State unless a later date, not more than ninety days from the filing date, is specified: _____[Specify Date, if applicable]_____.

Execution

In witness whereof, the undersigned incorporator(s) have executed these Articles of Incorporation on _____[Date]_____.

- Signature: ___________________________

- Name: _____[Incorporator's Name]_____

- Date: _____[Date]_____

PDF Form Attributes

| Fact | Description |

|---|---|

| Governing Law | The Texas Business Organizations Code (BOC) governs the creation and operation of corporations in Texas. |

| Filing Organization | Articles of Incorporation are filed with the Texas Secretary of State. |

| Document Purpose | The document formally creates a corporation under Texas law. |

| Required Information | Incorporators must provide the corporation's name, purpose, duration, registered agent information, initial board of directors, and organizer signatures. |

| Corporate Name Restrictions | The corporation's name must be distinguishable from existing entities and include a corporate suffix. |

| Public Accessibility | Once filed, Articles of Incorporation become public records. |

| Filing Fee | There is a statutory fee for filing, which may vary based on the corporation type. |

| Processing Time | Processing times can vary, but expedited services are available for additional fees. |

Instructions on How to Fill Out Texas Articles of Incorporation

When starting a corporation in Texas, one critical step is completing the Articles of Incorporation form. This document officially registers your corporation with the state, marking the legal beginning of your business entity. Filling out this form accurately is crucial, as it provides the Texas Secretary of State with essential information about your corporation, such as its name, purpose, duration, shares, and registered agent. After submission, you should anticipate a review period where the state will verify the information provided. Ensuring all details are correct and submitting any required fees will streamline this process.

Here's a step-by-step guide to help you fill out the Texas Articles of Incorporation form:

- Identify the corporation name: Ensure the name is unique and adheres to Texas state requirements. It should include a corporate indicator such as "Inc." or "Corporation".

- Determine the type of corporation: Specify if your corporation will be a for-profit or nonprofit entity, as the form and relevant details will differ.

- Declare the corporate purpose: While some states require a detailed explanation, Texas allows broad purpose statements. A simple declaration of intent to conduct lawful business is sufficient unless specific state or federal licensing is necessary for your business.

- Detail the duration: Indicate if your corporation will exist perpetually or if there’s a set dissolution date.

- Specify the number of authorized shares: This number is crucial for defining ownership. Include the class of shares and any rights or preferences associated with them.

- Provide information on the registered agent and office: Your corporation must have a registered agent and office in Texas to receive legal and official documents. Include the name and physical Texas address of the agent.

- Name the initial board of directors: List the directors who will serve until the first annual meeting or until successors are elected. At least one director is required.

- Include the incorporator's information: The incorporator is the person completing the form. Include the name and address. The incorporator does not need to be part of the corporation.

- Attach any additional articles: If your corporation has unique attributes that require additional stipulations or articles, attach these documents.

- Sign and date the form: The incorporator must sign the form, indicating that all information provided is accurate and true. This also includes a commitment to comply with Texas state laws.

- Review and submit: Double-check all the information for accuracy. Submit the form along with the necessary filing fee to the Texas Secretary of State.

After submission, patience is key. The state will need time to process your Articles of Incorporation. Once approved, your corporation will receive an official certificate, marking its formal creation. You can then proceed with other necessary legal and financial setups, like obtaining an Employer Identification Number (EIN) from the IRS, opening a bank account, and acquiring any required licenses or permits. Starting your corporation on solid legal footing is pivotal to your business’s success.

Crucial Points on This Form

What are the Texas Articles of Incorporation?

The Texas Articles of Incorporation is a document that is filed with the Texas Secretary of State to legally form a corporation. It outlines the basic structure of the corporation, including its name, purpose, initial directors, and the type of corporation it will be. This document is essential for businesses wanting to operate as a corporation within Texas.

How do I file the Texas Articles of Incorporation?

To file the Texas Articles of Incorporation, you must complete the form with accurate information about your corporation and submit it to the Texas Secretary of State. This can be done online through the state's website or by mailing a physical copy. A filing fee is required, and the amount may vary depending on the type of corporation being formed.

What information do I need to provide in the form?

The form requires you to provide information such as the corporate name, the purpose of the corporation, the address of the registered office and the name of the registered agent, the number of shares the corporation is authorized to issue, and the names and addresses of the directors.

Can I file the Texas Articles of Incorporation without a lawyer?

Yes, it is possible to file the Texas Articles of Incorporation without legal assistance. However, it is recommended to consult with a lawyer or a legal professional to ensure that all the requirements are met correctly and that the form is filled out accurately to avoid delays or issues.

What is the difference between a 'for-profit' and 'non-profit' corporation on the form?

A 'for-profit' corporation is created with the intent to make a profit and distribute earnings to its shareholders. Conversely, a 'non-profit' corporation is established for charitable, educational, religious, or other activities that serve the public interest, where profits are not distributed to any private individual.

How long does it take to process the Texas Articles of Incorporation?

The processing time can vary depending on the method of submission and the current workload of the Secretary of State's office. Generally, online filings are processed quicker than paper submissions. It’s advisable to check the official website or contact the office directly for the most current processing times.

What are the benefits of incorporating in Texas?

Incorporating in Texas offers numerous benefits including limited liability protection for the owners, potential tax advantages, increased credibility with customers and suppliers, and the ability to raise capital more easily through the sale of shares.

Is it necessary to renew the Texas Articles of Incorporation annually?

No, once the Articles of Incorporation are filed and the corporation is formed, there is no need to renew the document annually. However, corporations are required to file an annual report and pay the franchise tax to maintain good standing with the state.

Common mistakes

When forming a corporation in Texas, the Articles of Incorporation serve as a crucial foundational document filed with the state. This document outlines the basic details about your corporation, necessary for legal recognition. Unfortunately, errors in filling out this form can lead to delays or rejection of the application, complicating the process of establishing your business. Here are six common mistakes people make when completing the Texas Articles of Incorporation:

Not providing a distinct name: The corporation's name must be unique and not too similar to any other business name registered in Texas. Ensuring uniqueness helps avoid confusion and legal complications down the line.

Neglecting to specify the type of corporation: Texas law allows for various types of corporations (for-profit, non-profit, professional, etc.). Failing to clearly indicate the specific type for your business can lead to processing delays.

Omitting the registered agent information: A registered agent must be named as the person or entity authorized to receive legal documents on behalf of the corporation. This role is critical for maintaining good standing with the state.

Incorrectly stating the share structure: For corporations intending to issue stock, accurately detailing the number and types of shares is essential. Errors here can affect the corporation's funding and ownership structure.

Skipping necessary clauses: Depending on the corporation's purpose and structure, certain specific clauses need to be included, such as those related to nonprofit status or specific business functions. Omitting these can lead to legal issues.

Leaving out the duration of the corporation: While many corporations are intended to exist perpetually, some may have a specified end date. Not stating this duration, if applicable, can create confusion about the corporation's longevity.

To avoid these and other mistakes, it's advisable to review the completed Articles of Incorporation form meticulously before submission. Consulting with legal counsel or utilizing resources offered by the Texas Secretary of State can also ensure the process moves smoothly and your corporation is set up correctly from the start.

Documents used along the form

When forming a corporation in Texas, the Articles of Incorporation form is just the beginning. To successfully establish and operate your new business entity, several additional forms and documents are usually needed. These materials serve various purposes, from tax registration to operational agreements. Understanding each one ensures your corporation meets all legal requirements and is positioned for success.

- Bylaws: Detail the rules governing the operation of the corporation. They outline the structure of the organization, including the roles of directors and officers, meeting procedures, and other operational guidelines.

- IRS Form SS-4: Used to apply for an Employer Identification Number (EIN). This number is essential for tax purposes, hiring employees, opening bank accounts, and more.

- Texas Franchise Tax Registration: Required for corporations to legally operate in Texas. This registration is necessary for the state tax obligations.

- Initial Report: Some states require corporations to file an initial report a few months after incorporation, providing basic information about the corporation and its business activities.

- Shareholder Agreement: A document that outlines the rights and obligations of the shareholders. It includes details on share transfer restrictions, voting rights, and dividend policies.

- Corporate Resolution: A formal document that records the decisions made by the board of directors or shareholders. It can cover a wide range of actions, from authorizing a loan to adopting new policies.

- Stock Certificates: Physical or digital certificates representing ownership in the corporation. They detail the number of shares owned by a shareholder.

- Registered Agent Consent Form: A document confirming that the person or entity appointed as the registered agent agrees to act in that capacity. In Texas, corporations must maintain a registered agent to receive official correspondence.

Gathering and completing these documents in conjunction with the Articles of Incorporation form is crucial for the legal and operational foundation of your corporation in Texas. Each document has its specific function and importance in ensuring compliance with state and federal laws, facilitating effective management, and safeguarding the interests of owners and shareholders.

Similar forms

LLC Operating Agreement: This document is similar to the Articles of Incorporation as it outlines the structure and operating procedures of a Limited Liability Company (LLC). While Articles of Incorporation are used to formally establish a corporation with the state, an LLC Operating Agreement details the rules for ownership and operation within the LLC itself. Both serve as foundational documents that guide the entity’s internal management and operations.

Partnership Agreement: Similar to the Articles of Incorporation, a Partnership Agreement establishes the arrangements between partners of a business, including their responsibilities, profit distribution, and rules for adding or removing partners. While the Articles of Incorporation are specific to corporations, a Partnership Agreement performs a similar function for partnerships, laying the groundwork for how the entity will be run.

Bylaws: Bylaws are similar to the Articles of Incorporation in that they provide a framework for the company’s governance. However, bylaws are more detailed, covering aspects such as the board of directors' roles, meeting guidelines, and the types of officers the corporation will have. While the Articles of Incorporation establish the corporation’s existence, bylaws offer detailed instructions on how it will operate internally.

Business Plan: Although not a legal document, a Business Plan shares similarities with the Articles of Incorporation by outlining the strategic direction of the business. It includes information on the business model, market analysis, and financial projections. Like the Articles of Incorporation that declare the business’s legal structure to the state, a Business Plan presents the company’s blueprint for success to stakeholders.

Dos and Don'ts

Filling out the Texas Articles of Incorporation is a crucial step in establishing your business as a legal entity in the state. While the form may seem straightforward, attention to detail is essential to ensure its accuracy and completeness. Here's a helpful guide of dos and don'ts to assist you through the process:

Do:

- Read the instructions provided by the Texas Secretary of State thoroughly before beginning to fill out the form. This ensures you understand each requirement and its purpose.

- Use the legal name of the corporation exactly as you wish it to appear on all official documents, including the appropriate corporate identifier like "Inc.", "Corporation", or "Limited".

- Provide a valid registered agent and registered office address within Texas. The registered agent must be authorized to receive legal documents on behalf of the corporation.

- Clearly define the purpose of the corporation to ensure compliance with state laws and regulations. Being specific can prevent unnecessary delays.

- Include the number of shares the corporation is authorized to issue, which outlines the ownership structure.

- Attach additional pages if you need more space to include any of the required information, making sure these pages are clearly marked and referenced in the form.

- Verify all information for accuracy before submission, including spelling, addresses, and legal codes.

- Sign and date the form where required, acknowledging that you are legally authorized to do so and that the information is correct to the best of your knowledge.

- Keep a copy of the completed form and any correspondence for your records.

- Use the Secretary of State’s online filing system if available. It can expedite the process and help prevent errors.

Don't:

- Skip sections or leave blanks unless the form instructs you to do so. Incomplete forms may result in processing delays or rejections.

- Use a P.O. Box for the registered office address. A physical address in Texas where the registered agent can be reached during normal business hours is required.

- Forget to include the filing fee, which is necessary to process your application. Check the latest fees on the Texas Secretary of State's website.

- Assume you need to include extensive detail about the corporation’s operations. Stick to the required information to avoid complications.

- Use informal or nicknames for the corporation or registered agent. Always use legal names as they appear in official documents.

- Attempt to file the form without reviewing the latest requirements and guidelines provided by the Texas Secretary of State.

- Misstate the number of shares or par value as this can have legal and financial implications for the corporation.

- Sign the form without the authority or proper representation from the corporation. This could lead to legal issues.

- Ignore follow-up correspondence from the Secretary of State, as it may request additional information or clarification.

- Forget that filing the Articles of Incorporation is just one step in establishing a corporation. Further legal and tax obligations will follow.

Misconceptions

Filing the Texas Articles of Incorporation can often be met with misconceptions by those looking to establish their business entity. Here, misconceptions are addressed to ensure clarity and understanding throughout the process.

They are only for corporations: A common misconception is that the Articles of Incorporation are exclusively for the creation of corporations. In truth, while they are crucial for incorporating a business, similar documents, like Articles of Organization, are used for forming Limited Liability Companies (LLCs) in Texas. Each type of entity requires its specific form, tailored to its structure and legal requirements.

One-size-fits-all: Some entrepreneurs might think that the form is a standard document that doesn't need customization. However, each business may have unique needs and goals that necessitate customized provisions within their Articles of Incorporation. These may include the nature of the business, share structure, or specific governance rules that are not covered by the standard form.

Immediate processing: There’s an expectation that once the Articles of Incorporation are filed, the entity is instantly recognized. The reality is that the processing times can vary based on the method of submission and the current workload of the Texas Secretary of State's office. Electronic filings are generally faster, but it's important to anticipate some wait time.

Legal protection is automatic: Some may assume that filing the Articles of Incorporation provides immediate legal protection for personal assets against the business's debts and liabilities. While incorporating does create a legal separation between the person and the business entity, further steps such as properly maintaining corporate formalities, holding regular meetings, and keeping detailed records are essential to ensure this protection is upheld.

Addressing these misconceptions is vital for any entrepreneur aiming to establish a business entity in Texas. By understanding the nuances of the Articles of Incorporation, individuals can navigate the process more effectively, ensuring their business complies with state regulations and is positioned for success.

Key takeaways

Filling out and using the Texas Articles of Incorporation form marks a pivotal moment for business owners aiming to establish a corporation within the state. This legal document, essential for officially forming a corporation, lays the groundwork for a business's legal structure, tax obligations, and compliance requirements. By understanding the key takeaways related to this document, individuals can navigate the incorporation process with greater confidence and precision.

- Understand the purpose: The Texas Articles of Incorporation form serves as a formal declaration to the state, outlining the intent to establish a corporation. It sets forth the business name, purpose, duration, initial directors, and share structure, among other vital details.

- Choose a distinctive name: It's crucial to select a unique name for the corporation that meets Texas state requirements. The name must be distinguishable from other business entities registered in the state to avoid confusion and potential legal issues.

- Specify the type of corporation: Decide whether the corporation will be for-profit or nonprofit, as the form caters to both, each with distinct obligations and benefits. This decision impacts tax status, eligibility for grants, and compliance requirements.

- Designate a registered agent: A key requirement is nominating a registered agent who resides in Texas, responsible for receiving legal and tax documents on behalf of the corporation. This role is crucial for maintaining good standing with the state.

- Detail shares and structure: For-profit corporations must specify the number and type of shares they are authorized to issue. This information delineates the ownership structure and investor rights within the corporation.

- Include mandatory clauses: Certain clauses are mandatory for inclusion, such as the corporate purpose, which must be clearly articulated, and the duration, if not perpetual. Compliance with these stipulations ensures the validity of the form.

- Adhere to submission guidelines: The completed form requires submission to the Texas Secretary of State, accompanied by the appropriate filing fee. Timeliness and accuracy in this step are paramount to avoid delays.

- Keep accurate records: Once filed, maintain a copy of the Articles of Incorporation among the corporation's official records. This document is often requested for various legal, tax, and business transactions.

By meticulously addressing these points, business owners can ensure their corporation is correctly established within the legal framework of Texas. This foundation facilitates future operations, compliance, and potential growth opportunities.

Create Other Articles of Incorporation Forms for US States

Document Retrieval Center - It must be submitted with the appropriate filing fee, which varies by state and the type of corporation being established.

Florida State Corporation Commission - Future modifications to the Articles require adherence to statutory procedures and may involve fees.

Certificate of Incorporation Ct - It forms the foundation for internal documents like bylaws, which further govern the corporation's internal operations and management.