Legal Business Bill of Sale Form

Embarking on the sale or purchase of a business represents a significant milestone, with the transaction's formalities embodying both opportunity and complexity. Central to these proceedings is the Business Bill of Sale, a critical document that functions to transfer ownership of the business from the seller to the buyer. This form not only certifies the sale but also itemizes the assets included in the transaction, distinguishing between tangible and intangible assets such as property, equipment, and intellectual property. Its execution requires meticulous attention to detail, ensuring that all information is accurately represented to prevent future disputes. Furthermore, the Business Bill of Sale serves as a definitive record of the transaction's financial aspects, laying out the purchase price alongside the terms of payment. As such, it carries legal weight, becoming an essential piece of evidence that the buyer can rely on to assert ownership and the seller to confirm the transfer of liabilities. Essential for both parties, the form acts as a safeguard, providing clarity and legal protection throughout the transition period and beyond.

Example - Business Bill of Sale Form

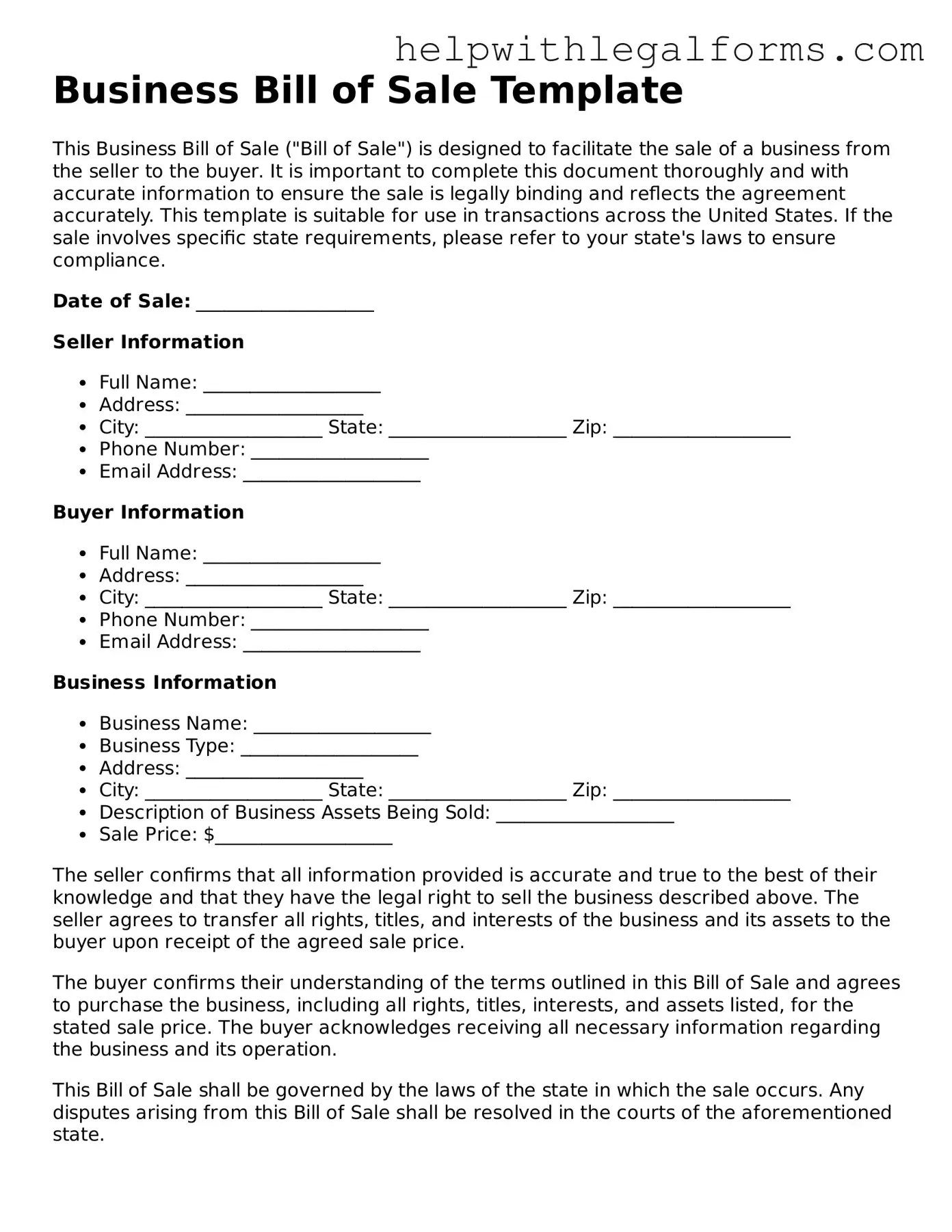

Business Bill of Sale Template

This Business Bill of Sale ("Bill of Sale") is designed to facilitate the sale of a business from the seller to the buyer. It is important to complete this document thoroughly and with accurate information to ensure the sale is legally binding and reflects the agreement accurately. This template is suitable for use in transactions across the United States. If the sale involves specific state requirements, please refer to your state's laws to ensure compliance.

Date of Sale: ___________________

Seller Information

- Full Name: ___________________

- Address: ___________________

- City: ___________________ State: ___________________ Zip: ___________________

- Phone Number: ___________________

- Email Address: ___________________

Buyer Information

- Full Name: ___________________

- Address: ___________________

- City: ___________________ State: ___________________ Zip: ___________________

- Phone Number: ___________________

- Email Address: ___________________

Business Information

- Business Name: ___________________

- Business Type: ___________________

- Address: ___________________

- City: ___________________ State: ___________________ Zip: ___________________

- Description of Business Assets Being Sold: ___________________

- Sale Price: $___________________

The seller confirms that all information provided is accurate and true to the best of their knowledge and that they have the legal right to sell the business described above. The seller agrees to transfer all rights, titles, and interests of the business and its assets to the buyer upon receipt of the agreed sale price.

The buyer confirms their understanding of the terms outlined in this Bill of Sale and agrees to purchase the business, including all rights, titles, interests, and assets listed, for the stated sale price. The buyer acknowledges receiving all necessary information regarding the business and its operation.

This Bill of Sale shall be governed by the laws of the state in which the sale occurs. Any disputes arising from this Bill of Sale shall be resolved in the courts of the aforementioned state.

Both the seller and the buyer agree to the terms described in this Bill of Sale and indicate their agreement with their signatures below.

Seller's Signature: ___________________ Date: ___________________

Buyer's Signature: ___________________ Date: ___________________

This document was prepared on ___________________ (Date).

PDF Form Attributes

| Fact | Description |

|---|---|

| Definition | A Business Bill of Sale form is a legal document that records the sale of a business from one party to another, transferring ownership. |

| Function | It serves as a receipt for the transaction and includes details of the sale, including the purchase price and a description of the assets transferred. |

| Components | Typically includes the business name, buyer and seller information, sale date, purchase price, and a description of assets and liabilities. |

| Significance | Provides proof of purchase and can help in resolving disputes that may arise about the sale terms. |

| Legal Requirement | May be required by state law to complete the sale and transfer of a business legally. |

| Witnesses and Notarization | Depending on the state, the form might need to be witnessed or notarized to be considered legally binding. |

| State-Specific Forms | Some states have specific forms and requirements for the Business Bill of Sale, often influenced by local commercial codes. |

| Additional Documents | The sale might also require additional documents, such as warranties, non-competition agreements, and lease agreements. |

| Post-Sale Obligations | Buyers and sellers may have obligations following the sale, such as inventory adjustment or notifying creditors. |

| Governing Laws | The form is governed by the Uniform Commercial Code (UCC) and specific state laws where the sale occurs. |

Instructions on How to Fill Out Business Bill of Sale

Once an agreement has been reached for the sale of a business, it is crucial to formally document the transaction through a Business Bill of Sale form. This document ensures the transfer of ownership from the seller to the buyer is legally recorded. It outlines the details of the sale, including the payment amount and any conditions attached to the sale. To accurately complete this form, it is essential to follow each step carefully. This not only safeguards the interests of both parties involved but also serves as an official record of the sale for tax and regulatory purposes.

- Gather all necessary information about the business being sold, including its legal name, any trade names, physical address, and a detailed description of what the sale includes (assets, inventory, equipment, etc.).

- Identify the seller and buyer by their full legal names and contact information. If either party is a business entity, include the type of business structure (e.g., LLC, corporation) and the state of incorporation.

- Specify the sale date and the total purchase price. Break down the payment method, whether it is a lump sum or installment payments, including dates and amounts for each installment if applicable.

- List any conditions precedent to the sale, such as obtaining financing, inspections, or approvals required before completing the transaction.

- Include warranties or representations made by the seller about the condition of the business and its assets. Clearly state if the sale is being made "as is" or if specific guarantees are being provided.

- Determine how operational liabilities, if any, will be handled post-sale. Specify which liabilities (if any) are being assumed by the buyer and which remain the responsibility of the seller.

- Ensure both parties review the document thoroughly. It is advisable to have legal counsel review the form to ensure all legal requirements are met and that it accurately reflects the agreement between the buyer and seller.

- Have both the buyer and seller sign and date the Bill of Sale. Depending on the jurisdiction, witness signatures and/or notarization may also be required to authenticate the document.

- Keep copies of the completed form for both the buyer and the seller’s records. It is important to have this document readily available for future reference, tax purposes, or regulatory compliance.

Following these steps will help in completing the Business Bill of Sale form accurately. It is essential for both parties to retain a copy of the document as it serves as proof of sale and ownership transfer. Properly documenting the sale of a business through this form is a fundamental part of the transaction that provides legal protection for both the buyer and seller.

Crucial Points on This Form

What is a Business Bill of Sale?

A Business Bill of Sale is a legal document that records the sale of a business from one party to another. It serves as proof of purchase and transfers ownership of the business's assets from the seller to the buyer. This document usually includes details about the sale, such as descriptions of the assets being sold, the sale price, and the date of the transaction.

Why do I need a Business Bill of Sale?

Having a Business Bill of Sale is crucial because it officially documents the transaction and transfer of ownership. This form can be important for tax purposes, securing financing, and protecting both parties in case of future disputes. It ensures there is a clear record of what was agreed upon at the time of sale.

What is included in a Business Bill of Sale form?

A typical Business Bill of Sale will include information such as the names and addresses of the buyer and seller, a detailed description of the business assets being sold, the sale price, the date of sale, and any warranties or representations. It may also include terms and conditions related to the sale.

How is a Business Bill of Sale different from a Purchase Agreement?

While both documents are used in the sale of a business, a Purchase Agreement is broader and outlines the terms and conditions of the sale before it is finalized. A Business Bill of Sale is used to document the completion of the transaction and the transfer of ownership after the terms have been met. Think of the Purchase Agreement as the promise to sell and the Business Bill of Sale as the proof that the sale has occurred.

Does a Business Bill of Sale need to be notarized?

The requirement for notarization can vary depending on the jurisdiction. However, having the document notarized can add an extra layer of legitimacy and may help in the enforcement of its terms if disputes arise. It's always a good idea to check local laws or consult with a legal professional in your area.

Can I write my own Business Bill of Sale?

Yes, you can draft your own Business Bill of Sale. Make sure to include all necessary details, such as the buyer and seller information, a comprehensive list of the assets being sold, the sale price, and the date. It's beneficial to use templates or consult legal resources to ensure the document meets all legal requirements.

What happens after the Business Bill of Sale is signed?

After the Business Bill of Sale is signed, the ownership of the business assets officially transfers from the seller to the buyer. The buyer may need to present this document to banks, government agencies, or vendors to prove their new ownership status. Both parties should keep copies of the document for their records.

Is a Business Bill of Sale legally binding?

Yes, once it is signed by both parties, the Business Bill of Sale is a legally binding document. It enforces the terms of the sale and the transfer of ownership as agreed upon by both the buyer and the seller. Disregarding the terms of a Business Bill of Sale can lead to legal consequences.

Do I need a lawyer to prepare a Business Bill of Sale?

While it's not strictly necessary to have a lawyer prepare a Business Bill of Sale, consulting a legal professional can be very helpful. A lawyer can ensure that the document complies with all legal requirements and adequately protects your interests. They can also provide advice specific to your situation.

Can a Business Bill of Sale be amended?

Yes, a Business Bill of Sale can be amended, but any changes must be agreed upon by both the buyer and the seller. The amendment should be made in writing, signed by both parties, and attached to the original document. This helps maintain a clear, accurate, and up-to-date record of the agreement.

Common mistakes

When transferring ownership of a business, the Business Bill of Sale form is a crucial document that formalizes the details of the transaction. However, the process can be intricate, and mistakes are common. These errors can range from simple oversights to significant legal blunders, potentially leading to disputes or complications down the line. It’s important to approach the completion of this form with care and attention to detail to ensure a smooth and legally sound transaction. Here are some of the most common mistakes people make:

Not Verifying Buyer or Seller Information: Ensuring that all parties' details are accurate and complete is critical. Mistakes in names, addresses, or other vital information can invalidate the document or cause legal headaches later.

Omitting a Detailed Description of the Business: The document should include a comprehensive description of the business being sold. This encompasses not just the name and location, but also detailed lists of assets, inventory, and any liabilities.

Forgetting to Specify Payment Details: The terms of the payment—such as the amount, method, and schedule—should be clearly outlined. Neglecting to specify these details can lead to disputes and misunderstandings.

Lack of Clarity on Assumed Liabilities: It is crucial to explicitly state which, if any, liabilities the buyer will assume from the seller. Failure to do this can result in the buyer unknowingly taking on unwanted debts or obligations.

Failing to Include Warranty Information: Whether the sale is as-is or includes certain warranties should be clearly stated. Without this information, the buyer may have unrealistic expectations about the condition or value of the business.

Not Obtaining Professional Advice: Many individuals attempt to complete the form without seeking legal or financial counsel. This oversight can lead to errors in how the agreement is structured, potentially costing much more in the long run.

Skipping the Signatures: The document must be signed by all parties involved and, in some cases, witnessed to be legally binding. Overlooking this step can render the entire bill of sale invalid.

The importance of filling out a Business Bill of Sale form accurately cannot be overstated. A misstep in any of the following areas can result in significant legal and financial repercussions. Therefore, individuals are strongly encouraged to proceed with diligence, double-checking every detail and consulting with professionals where necessary. By avoiding these common mistakes, parties can ensure a legally sound and effective transfer of business ownership.

Documents used along the form

When transferring business ownership or assets, a Business Bill of Sale form is crucial. It documents the sale and transfer of business assets from one party to another, ensuring a legal record of the transaction. Alongside this document, several others are often used to complete the transaction smoothly and ensure all legal, financial, and operational aspects are covered.

- Promissory Note: This document outlines the terms under which one party promises to pay a specified sum to another. It is commonly used when the purchase price is not fully paid upfront and some amount is financed.

- Asset Purchase Agreement: This comprehensive document details the specifics of which business assets are being bought and sold. It includes information on tangible and intangible assets and is used to ensure a clear understanding of what is included in the sale.

- Non-Disclosure Agreement (NDA): To protect confidential business information during and after the sale, an NDA is used. It ensures that sensitive information is not disclosed to third parties.

- Non-Compete Agreement: This contract restricts the seller from starting a new, competing business within a certain geographic area for a specified period. It's used to protect the buyer’s investment in the purchased business.

- Closing Statement: Detailed in this document are the final transaction details, including the sale price, adjustments, and closing costs. It is used to ensure both parties have a clear record of the financial aspects of the deal.

Together with the Business Bill of Sale, these documents form a comprehensive package that addresses the legal, financial, and operational considerations of transferring business ownership. Using these documents ensures clarity and protection for both parties involved in the transaction.

Similar forms

Asset Purchase Agreement: Similar to the Business Bill of Sale, this document outlines the terms and conditions under which business assets are sold and transferred from the seller to the buyer. It provides a comprehensive list of assets involved, including tangible and intangible assets, but offers a more detailed legal framework around the sale.

Commercial Invoice: This document is used in the sale of goods and services across international borders. It is similar to the Business Bill of Sale in that it lists the items being sold, their price, and the parties involved. The commercial invoice is essential for customs clearance in international trade.

Warranty Deed: Used primarily in real estate transactions, a Warranty Deed guarantees that the property title is clear and the seller has the right to sell the property. Like the Business Bill of Sale, it provides legal protection to the buyer but focuses on real estate.

Quitclaim Deed: This document transfers ownership of property without any guarantee that the property title is clear, similar to how a Business Bill of Sale transfers ownership of business assets. The Quitclaim Deed, however, carries no warranties or guarantees regarding the property's title.

Bill of Lading: A document used in shipping, the Bill of Lading lists the goods being transported, their destination, and the terms of delivery. It serves as a receipt and a contract, akin to the Business Bill of Sale, which confirms the sale and transfer of assets.

Promissory Note: This is a written promise to pay a specified amount of money at a certain time or on demand to a specified person or the bearer of the note. It is related to the Business Bill of Sale as it often accompanies sales to outline payment terms for the transaction.

Sales and Purchase Agreement (SPA): Similar to a Business Bill of Sale, an SPA is a binding legal contract that obligates a buyer to buy and a seller to sell products or services. SPAs are used in both real estate deals and business sales, providing detailed transaction terms and conditions.

Vehicle Title Transfer Form: This form is used to transfer the title of a vehicle from the seller to the buyer, analogously to how a Business Bill of Sale is used to transfer business assets. It serves as an official record of ownership transfer.

Stock Purchase Agreement: In situations where the sale involves shares of a company, this document plays a similar role to the Business Bill of Sale by outlining the sale of stock from one party to another, detailing the number of shares, price per share, and other conditions.

Receipt of Sale: Often simpler than a Business Bill of Sale, a Receipt of Sale acts as proof that a transaction took place. It typically lists the items sold, their price, and the parties involved, serving as a record of the transaction for both buyer and seller.

Dos and Don'ts

When filling out a Business Bill of Sale form, it is crucial to ensure accuracy and clarity to prevent any misunderstandings or legal issues down the line. This document serves as a record of the transaction, transferring ownership of business assets from the seller to the buyer. To help guide you through this process, here is a list of things you should and shouldn't do:

What You Should Do:- Verify the accuracy of all details, including the names and addresses of both parties involved in the transaction.

- Clearly describe the assets being sold, including any identifying numbers or features (e.g., serial numbers for equipment).

- State the total purchase price and the payment method. If the transaction includes installment payments, be sure to outline the terms clearly.

- Include any warranties or representations regarding the business assets. Clearly specify if the assets are being sold "as is" or if there are specific warranties being transferred.

- Ensure both the buyer and seller sign and date the form. In some cases, witnesses or notarization may be required for additional legal validity.

- Retain a copy of the signed document for your records. Both the buyer and seller should keep a copy.

- Consult with a legal professional if there are any doubts about the form or the transaction to ensure all legal requirements are met and to protect your interests.

- Do not leave any blanks. If a section does not apply, indicate this with "N/A" (not applicable) rather than leaving the space empty.

- Avoid using vague descriptions of the business assets being sold. Specificity is key to avoiding future disputes.

- Do not forget to specify any exceptions or exclusions to the sale. If certain assets are not included in the sale, these should be clearly noted.

- Never sign the Business Bill of Sale before all terms are finalized and agreed upon. Signing the document makes it legally binding.

- Do not rely solely on verbal agreements or understandings. Everything should be put in writing on the Business Bill of Sale form.

- Refrain from disregarding state-specific requirements. Some states have unique requirements for business sales, which should be followed to ensure the transaction is legally valid.

- Do not forget to notify the necessary governmental agencies or parties as required by law after the sale. This step is often overlooked but can be critical for tax purposes and the transfer of liabilities.

Misconceptions

A Business Bill of Sale is only for the sale of physical goods: Contrary to this common perception, a Business Bill of Sale covers not just the sale of physical assets but also intangible ones. These can include goodwill, intellectual property, and client lists, which are often critical assets of a business.

It's the same as a Business Purchase Agreement: While both documents are used in the sale of a business, they serve different functions. A Business Bill of Sale is a receipt, indicating the transfer of ownership. A Business Purchase Agreement outlines the terms of the sale, including payment agreements, warranties, and the closing date, often executed prior to the Bill of Sale.

One size fits all: Some may think a standard form can work for every business sale. However, the complexity and unique features of each business necessitate a tailored Bill of Sale that addresses specific assets, liabilities, and conditions of the sale.

It's only necessary for large transactions: Regardless of size, documenting the sale or purchase of a business through a Bill of Sale is crucial. It provides legal proof of the transaction, protecting both parties if disputes arise later.

The signing process is complicated: The perception that the signing process involves complex legal verification can deter some. In reality, while notary acknowledgment can add validity, the essential requirement is the agreement and signatures of both buyer and seller, making it less burdensome than assumed.

No need for a witness or notary: While it's true that not all jurisdictions require a witness or notary for a Business Bill of Sale, having these can add a layer of protection against claims of forgery or disputes over the validity of the document.

It's equivalent to transferring ownership: Actually, the Bill of Sale is one of several documents needed to fully transfer a business. Others might include transfer documents for real estate, vehicle titles, and agreements assigning contracts or leases.

It's only beneficial for the buyer: This document benefits both parties; it provides the seller with proof of divestiture of assets and liabilities, and the buyer with evidence of ownership rights, facilitating a smoother transition.

It must be filed with the state: Unlike some business documents, a Business Bill of Sale does not generally need to be filed with the state. However, it's a crucial internal document that should be kept with business records for both parties.

Legal advice is not necessary: While small transactions might seem straightforward, consulting with a legal professional can help tailor the Bill of Sale to the specific transaction, ensuring all legal bases are covered and potentially preventing future disputes.

Key takeaways

The Business Bill of Sale form is an important legal document that records the sale of a business from one party to another, transferring ownership of assets in a formal, documented manner. These documents serve as proof of the transaction and hold several significant aspects that are integral to both the buyer and the seller. Here are key takeaways about filling out and using the Business Bill of Sale form:

- Accuracy of Information: Ensure all the data entered on the form is accurate and complete. This includes the full details of both the buyer and the seller (names, addresses, and contact information), along with a comprehensive description of the business being sold.

- Detailing Assets: Clearly list and describe all assets being transferred as part of the sale. This can include physical assets, intellectual property, and any other tangible or intangible assets that are part of the business.

- Agreement on Terms: The form should clearly state the terms of the sale, including the sale price, payment plan (if any), and the date of the sale. It ensures that both parties have a mutual understanding of the terms of the transaction.

- Legal Compliance: Verify that the sale and the Business Bill of Sale form comply with state and local regulations. This may involve registering the sale with relevant authorities or obtaining certain approvals.

- Witnesses and Notarization: Depending on the jurisdiction, having the document witnessed or notarized can add a layer of legal validity and protection, ensuring that the signatures are verifiable and that the document is more challenging to contest.

- Preservation of Records: Both the buyer and the seller should keep copies of the fully executed Business Bill of Sale for their records. These documents can be critical for tax purposes, future legal questions, or business evaluations.

- Professional Advice: Considering the complexity and the legal importance of the transaction, consulting with a legal professional or a business advisor is advised to ensure that all parties' rights are protected and that the document complies with the applicable laws.

By carefully preparing and understanding the Business Bill of Sale, all parties can ensure a smoother transition of ownership, minimize potential disputes, and provide a solid legal foundation for the new ownership.

Discover Other Types of Business Bill of Sale Documents

Buying Motorcycle Without Title - The Dirt Bike Bill of Sale should be signed by both the seller and the buyer to validate the agreement and sale.