Blank Bill of Sale Form for California

In California, when individuals decide to sell or purchase personal property, they often use a document known as the Bill of Sale form. This important piece of paperwork serves as a record of the transaction between the seller and the buyer, outlining the specifics of the sale such as the description of the item sold, the sale amount, and the date of the transaction. Not only does it provide proof of ownership transfer, but it also offers legal protection to both parties involved. While it is most commonly associated with the sale of vehicles, it is versatile and can be used for a variety of personal property sales including furniture, electronics, and more. The form is straightforward, designed to ensure clarity and prevent potential disputes by clearly stating the terms and conditions of the sale. Completing this form properly is a crucial step in any private sale, ensuring that the transaction is recognized as legitimate and binding.

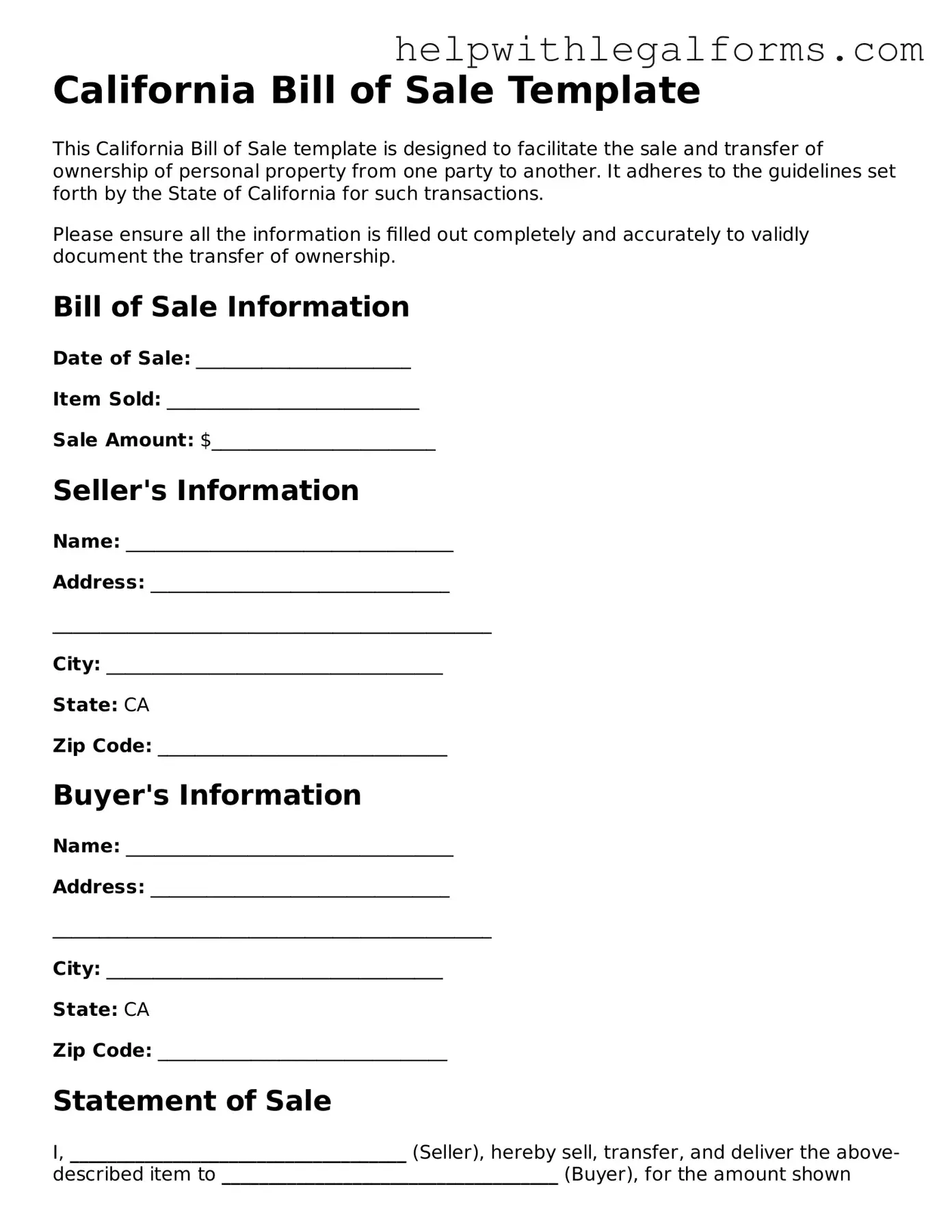

Example - California Bill of Sale Form

California Bill of Sale Template

This California Bill of Sale template is designed to facilitate the sale and transfer of ownership of personal property from one party to another. It adheres to the guidelines set forth by the State of California for such transactions.

Please ensure all the information is filled out completely and accurately to validly document the transfer of ownership.

Bill of Sale Information

Date of Sale: _______________________

Item Sold: ___________________________

Sale Amount: $________________________

Seller's Information

Name: ___________________________________

Address: ________________________________

_______________________________________________

City: ____________________________________

State: CA

Zip Code: _______________________________

Buyer's Information

Name: ___________________________________

Address: ________________________________

_______________________________________________

City: ____________________________________

State: CA

Zip Code: _______________________________

Statement of Sale

I, ____________________________________ (Seller), hereby sell, transfer, and deliver the above-described item to ____________________________________ (Buyer), for the amount shown above, acknowledging receipt of payment. By signing below, both parties confirm their understanding and acceptance of the sale, under the terms and conditions described herein.

Signatures

Seller's Signature: ____________________________ Date: _________

Buyer's Signature: _____________________________ Date: _________

Witness (Optional)

Witness's Signature: ___________________________ Date: _________

Note: It is recommended to keep a copy of this document for your records, as it proves the transfer of ownership. Check with the California Department of Motor Vehicles (DMV) if registering a vehicle or with local authorities for other types of property to ensure all legal requirements are met.

PDF Form Attributes

| Fact | Description |

|---|---|

| Definition | A California Bill of Sale form is a legal document that records the transfer of ownership of personal property from a seller to a buyer within the state of California. |

| Required for Registration | For certain types of personal property such as vehicles, a Bill of Sale is required by the California Department of Motor Vehicles (DMV) for registration and titling of the vehicle. |

| Notarization | Notarization is not a state-wide requirement for a Bill of Sale to be considered valid in California, although it's recommended for the protection of both parties. |

| Key Components | It should include the date of sale, detailed information about the item sold, purchase price, and the printed names and signatures of both the seller and buyer. |

| Governing Law | The form and its execution are governed by the California Civil Code. Specific provisions may also come into play depending on the nature of the transaction. |

| Use in Disputes | In legal disputes, a Bill of Sale can serve as evidence of ownership and the terms of the sale agreement. |

| Writing Requirement | Though verbal agreements can be legally binding, a written Bill of Sale is crucial for providing proof of the transaction and the transfer of ownership. |

Instructions on How to Fill Out California Bill of Sale

Completing a Bill of Sale form in California is a critical step in the process of buying or selling personal property, such as a vehicle. This form officially records the transaction, providing proof of the change in ownership. To ensure the process is handled correctly, it's important to fill out the form accurately and completely. Follow the instructions below to correctly prepare your California Bill of Sale form. Note that the content in the actual form isn't provided here, but these steps offer a general guide suitable for most Bill of Sale forms used in California.

- Begin by entering the date of the sale at the top of the form. Make sure the date reflects when the transaction actually occurs.

- Next, write down the full legal names and addresses of both the seller and the buyer. Include any necessary contact information such as phone numbers or email addresses.

- Describe the item being sold. Include as many details as possible, such as make, model, year, color, size, and any identifying numbers (like VIN for vehicles, serial numbers for electronics, etc.).

- State the sale price of the item in words and then in numeric form to ensure clarity about the amount agreed upon.

- If there are any terms and conditions associated with the sale (such as warranties or "as is" status), clearly list them on the form. This step is crucial to ensure both parties understand the condition of the item and any guarantees or lack thereof.

- Both the buyer and the seller should sign and print their names at the bottom of the form to validate the transaction. The signatures officially confirm the agreement and the transfer of ownership.

- For added protection, it's recommended to have the form notarized, although this step is not mandatory in California. If you choose to get the form notarized, a notary public must witness the signing.

After completing these steps, both the buyer and the seller should keep a copy of the Bill of Sale for their records. This document serves as legal proof of the transaction and may be needed for registration, tax purposes, or any future disputes concerning the sale. Remember, a thorough and accurately completed Bill of Sale protects both parties' interests and helps ensure the transaction's success.

Crucial Points on This Form

What is a California Bill of Sale form?

A California Bill of Sale form is a legal document that records the transfer of ownership of personal property from a seller to a buyer. It captures essential details about the transaction, such as a description of the item sold, the sale price, and the date of sale, along with the names and signatures of both parties involved.

Is a California Bill of Sale form necessary for all sales?

Not for all sales, but it is strongly recommended for the sale of valuable items like vehicles, boats, and large pieces of equipment. It serves as proof of purchase and can protect both the buyer and seller in case disputes arise after the transaction.

Does a California Bill of Sale form need to be notarized?

Generally, a California Bill of Sale form does not require notarization. However, for transactions involving high-value items or when mandated by local laws, getting the document notarized can add an extra layer of legal protection.

What information should be included in a California Bill of Sale form?

A comprehensive California Bill of Sale form should include the full names and addresses of both the seller and the buyer, a thorough description of the item being sold (including serial numbers or identification numbers, if applicable), the sale price, the date of sale, and signatures of both parties.

Can a California Bill of Sale form be used for gifting an item?

Yes, a California Bill of Sale form can be used when gifting an item. In the sale price section, it should be clearly indicated that the item is a gift and the monetary value should be marked as $0.

How does a buyer benefit from a California Bill of Sale form?

For buyers, a California Bill of Sale form serves as tangible evidence of ownership and can be crucial for registering and insuring the purchased item. It also ensures that the terms of the sale are clearly documented, reducing the risk of future disputes.

What is the significance of the sale date on a California Bill of Sale form?

The sale date confirms when the ownership of the item was transferred from the seller to the buyer. It’s important for warranty purposes, return deadlines, and for determining the start of any applicable grace period for the buyer to inspect the item.

Is a digital California Bill of Sale form valid?

Yes, a digital California Bill of Sale form is considered valid as long as it contains all the necessary information and is signed by both parties. Electronic signatures are recognized under California law, but ensure that the digital document can be verified for authenticity.

What happens if I lose my California Bill of Sale form?

If you lose your California Bill of Sale form, it's advisable to contact the other party involved in the transaction and request a copy. If that’s not possible, drafting a new bill of sale that both parties sign can serve as a replacement. Documenting the loss and the steps taken to replace the bill of sale is also recommended for your records.

Common mistakes

When completing the California Bill of Sale form, it's essential for individuals to proceed with precision and a full understanding of what information is required. Mistakes can lead to complications, ranging from delays in the transfer process to legal discrepancies. Here are nine common errors that are often made:

Not verifying the accuracy of all names and addresses listed on the form. This can lead to issues in the legal ownership documentation.

Failing to include a detailed description of the item being sold. A clear and comprehensive description prevents future disputes about what was agreed upon.

Omitting the date of sale. The sale date is crucial for record-keeping and in some cases, for legal reasons.

Forgetting to specify the sale price or providing an inaccurate sale price. This detail is essential for tax purposes and for confirming the agreement between buyer and seller.

Leaving out warranty information. Whether the item is sold as is or with a warranty should be explicitly stated to avoid misunderstandings.

Not obtaining the signatures of all parties involved. The signatures legally bind the agreement, making the document enforceable.

Skipping the step of making copies of the signed form. Both the buyer and the seller should have a copy of the Bill of Sale for their records.

Ignoring the requirement for a notary's signature, if applicable. While not always necessary, some situations require notarization for added legal validation.

Using incorrect or outdated forms. Always ensure to use the most current version of the form to comply with the latest state requirements.

To avoid these mistakes, individuals should thoroughly review the Bill of Sale form before and after filling it out, ensuring all provided information is complete and accurate. It's advisable to consult with a legal professional if there are any uncertainties about the process or the form's requirements.

Documents used along the form

When conducting transactions that involve the transfer of ownership, especially in California, the Bill of Sale form plays a pivotal role. However, it's usually not the only document you'll need to effectively finalize the transaction. There are several other forms and documents that are often used in conjunction with the Bill of Sale to ensure everything is legally binding and accurate. Here's a look at some of these essential documents.

- Title Transfer Form: Required for the legal transfer of the vehicle's title from the seller to the buyer, ensuring the new ownership is recognized by the state.

- Odometer Disclosure Statement: This document is necessary for vehicles less than ten years old, detailing the vehicle's mileage at the time of sale to prevent odometer fraud.

- Release of Liability Form: Sellers use this form to notify the Department of Motor Vehicles (DMV) that the vehicle has been sold, protecting them from liabilities the new owner may incur with the vehicle.

- Smog Certification: Required in certain California counties, this certifies that the vehicle has passed the necessary smog tests according to state standards.

- Vehicle Registration Form: Needed to register the vehicle in the buyer’s name at the DMV, which is essential for legally driving the vehicle on public roads.

- Loan Agreement: If the vehicle is being purchased with a loan, this document outlines the terms of the loan, including repayment schedule, interest rates, and terms of default.

- Warranty Document: If applicable, this document details the warranty coverage on the vehicle, including what is covered, duration, and conditions.

- As-Is Acknowledgment: A document that signifies the buyer's acceptance of the vehicle in its current state, acknowledging that the seller will not be liable for future issues.

- Insurance Proof: Proof of insurance is often required to be presented at the time of sale to ensure that the vehicle is covered under a policy as per state laws.

Understanding these documents and ensuring they are properly filled out and filed can be just as important as the Bill of Sale itself in a vehicle transaction. They collectively provide a comprehensive record of the sale, help in adhering to state laws, and protect the interests of both the buyer and seller. Being well-prepared with all necessary paperwork can make the process smoother and more efficient for everyone involved.

Similar forms

Warranty Deed: Like a Bill of Sale, a Warranty Deed is used in property transactions to legally transfer ownership. However, it specifically applies to real estate and provides guarantees about the title's status, ensuring it's free from liens or other encumbrances.

Promissory Note: A Promissory Note is similar to a Bill of Sale in that it represents an agreement between parties. While a Bill of Sale acknowledges the sale and transfer of personal or real property, a Promissory Note details the borrower's promise to pay back a debt to the lender under agreed-upon terms.

Quitclaim Deed: This document, akin to a Bill of Sale, is used in transferring property rights from one party to another. However, unlike a Bill of Sale, a Quitclaim Deed does not guarantee that the property is free of claims or encumbrances. It transfers ownership interest without making any warranties about the title's clearness.

Receipt: A receipt, much like a Bill of Sale, serves as a proof of a transaction. It details the exchange of goods or services for a specified amount of money but is generally used for smaller, everyday transactions, whereas a Bill of Sale is more formal and often used for significant purchases like vehicles or large pieces of equipment.

Title: The term "Title" refers to a legal document proving ownership of an asset, similar to a Bill of Sale. Titles are specifically used in real estate and vehicles, providing a detailed history of ownership, but a Bill of Sale is used more broadly for various types of personal property.

Dos and Don'ts

When filling out the California Bill of Sale form, it's important to follow certain guidelines to ensure the document is legally binding and accurately reflects the transaction. Here are eight dos and don'ts to consider:

- Do verify the accuracy of all the information provided by both parties. This includes names, addresses, and the description of the item being sold.

- Do make sure the item's description is detailed, including make, model, year, and serial number if applicable. This helps in identifying the specific item being sold.

- Do ensure that the form includes the date of the sale and the sale amount. This information is crucial for legal and tax purposes.

- Do sign and date the form in the presence of a notary public if required. Some sales may require notarization for additional legal validation.

- Don't leave any fields blank. If a section does not apply, mark it with “N/A” (not applicable) instead of leaving it empty.

- Don't forget to provide a copy of the Bill of Sale to both the buyer and the seller. Keeping a copy is important for record-keeping and any future disputes.

- Don't ignore local and state requirements. While the California Bill of Sale form is a general document, specific localities may have additional requirements or forms.

- Don't use unclear or ambiguous language. The terms of sale should be clearly stated to avoid any misunderstandings between the buyer and the seller.

Misconceptions

When it comes to transferring ownership of personal property, such as cars, boats, or equipment in California, a Bill of Sale form often comes into play. However, there are several misconceptions about the California Bill of Sale form that need to be clarified to ensure that both buyers and sellers navigate their transactions effectively. Let's debunk some of these myths:

- A Bill of Sale is not necessary if you have other sales documentation. This is a common misunderstanding. While other sales documents, including titles and deeds, play critical roles in the sale of property, a Bill of Sale serves as a legal record of the transaction and the transfer of ownership from the seller to the buyer. It is particularly important as it provides proof of purchase and can be used for legal and tax purposes.

- The California Bill of Sale form is the same for all types of property. Contrary to what some believe, California does not have a universal Bill of Sale form that applies to all types of personal property. The form may vary depending on the item being sold. For example, selling a vehicle requires specific information that might not be necessary when selling a piece of equipment or furniture.

- You can only use the official California Bill of Sale form. While California provides specific Bill of Sale forms for certain types of sales, such as vehicles, individuals can actually draft their own Bill of Sale. The key is to include all necessary information such as the names of the buyer and seller, a description of the item, the sale price, and the date of sale.

- A Bill of Sale must be notarized in California. This is not always true. Notarization is not a requirement for all Bill of Sale forms in California. However, having a Bill of Sale notarized can add a level of legitimacy to the document and can be particularly useful if a legal dispute arises.

- The seller is the only party that needs a copy of the Bill of Sale. In reality, both the buyer and the seller should keep a copy of the Bill of Sale. This document serves as a receipt and a legal record for both parties and can be crucial for tax purposes, warranty claims, or if any questions arise about the transaction.

- If you don't register the item sold, a Bill of Sale is useless. This is not correct. Even if an item, such as a vehicle, is not immediately registered, a Bill of Sale still acts as a binding document indicating the transfer of ownership. Registration is a separate process from proving ownership.

- All items sold require a Bill of Sale in California. While it's a good practice to create a Bill of Sale for the sale of any item, not all sales legally require one. Generally, high-value items and motor vehicles are the types of property for which a Bill of Sale is strongly recommended or required.

- A Bill of Sale does not need to include the price of the item sold. This misconception could lead to future disputes. Including the sale price on the Bill of Sale is essential as it provides evidence of the transaction value, which is important for tax and legal purposes.

- Electronic signatures are not accepted on a California Bill of Sale. In today's digital age, this statement is no longer true. Electronic signatures are recognized as legally binding in California, just like traditional handwritten signatures, as long as they are executed in compliance with applicable laws.

Cleaning up these misconceptions can help ensure that when you're either buying or selling personal property in California, you do it with the right knowledge and documentation. A well-prepared Bill of Sale not only provides peace of mind but also serves as an important tool in the legal protection of both parties involved in the transaction.

Key takeaways

When it comes to drafting and utilizing a California Bill of Sale form, there are several essential points to keep in mind. This document is not just a simple form; it's a binding legal tool that records the transfer of ownership of an item from a seller to a buyer. Understanding its importance and how to correctly complete it ensures that the transaction is recorded accurately and both parties are protected.

- The California Bill of Sale must include accurate information about both the buyer and the seller, such as full names, addresses, and contact information.

- Details about the item being sold, including make, model, year, and identification number (if applicable), are crucial for a clear understanding of what is being transferred.

- It is important to specify the sale price on the form. This amount should be agreed upon by both parties ahead of time.

- The form should also clearly indicate the date of sale. This is necessary for legal and registration purposes.

- Including the payment method (e.g., cash, check, transfer) provides clarity and helps to prevent any misunderstandings about the transaction terms.

- Signature of both the seller and buyer is a critical requirement. Their signatures legalize the document, making the sale officially recognized.

- For items that require registration, such as vehicles, the California Bill of Sale can facilitate the process, serving as proof of ownership transfer.

- Keeping a copy of the bill of sale is important for both parties. It acts as a receipt and may be required for tax assessment, registration, or legal purposes.

- Although not always mandated by law, notarization of the bill of sale can add an extra layer of legal protection and authenticity to the document.

Adhering to these guidelines when filling out and using a California Bill of Sale form ensures that the transaction is conducted smoothly and that both buyer and seller are safeguarded. It also guarantees that the document fulfills its role as a clear and enforceable record of the sale.

Create Other Bill of Sale Forms for US States

Vehicle Bill of Sale Maryland - This form ensures a smooth handover of property, detailing the agreement's specifics and maintaining transparency.

How to Sell a Car in Colorado - For sellers, it releases them from liability by proving they have transferred the item legally and in its described condition.

How to Privately Sell a Car - A foundational document establishing the facts of a sale, often required for future transactions or registrations.