Blank Bill of Sale Form for Colorado

When engaging in private sales of personal property in Colorado, individuals are often advised to complete a Colorado Bill of Sale form. This document not only facilitates the transition of ownership from one party to another but also serves as a critical record for both buyer and seller. It can significantly streamline the process for registering and titling certain items, such as vehicles, in the new owner's name. What sets this form apart in Colorado is its ability to provide legal protection in the event of disputes or whenever proof of ownership and the details of the transaction need to be verified. Moreover, the Colorado Bill of Sale form is a straightforward document, capturing essential information like the description of the item being sold, the purchase price, and the parties' signatures. While it's not always mandatory for all types of personal property sales, using this form can offer peace of mind and clarity about the transaction's specifics.

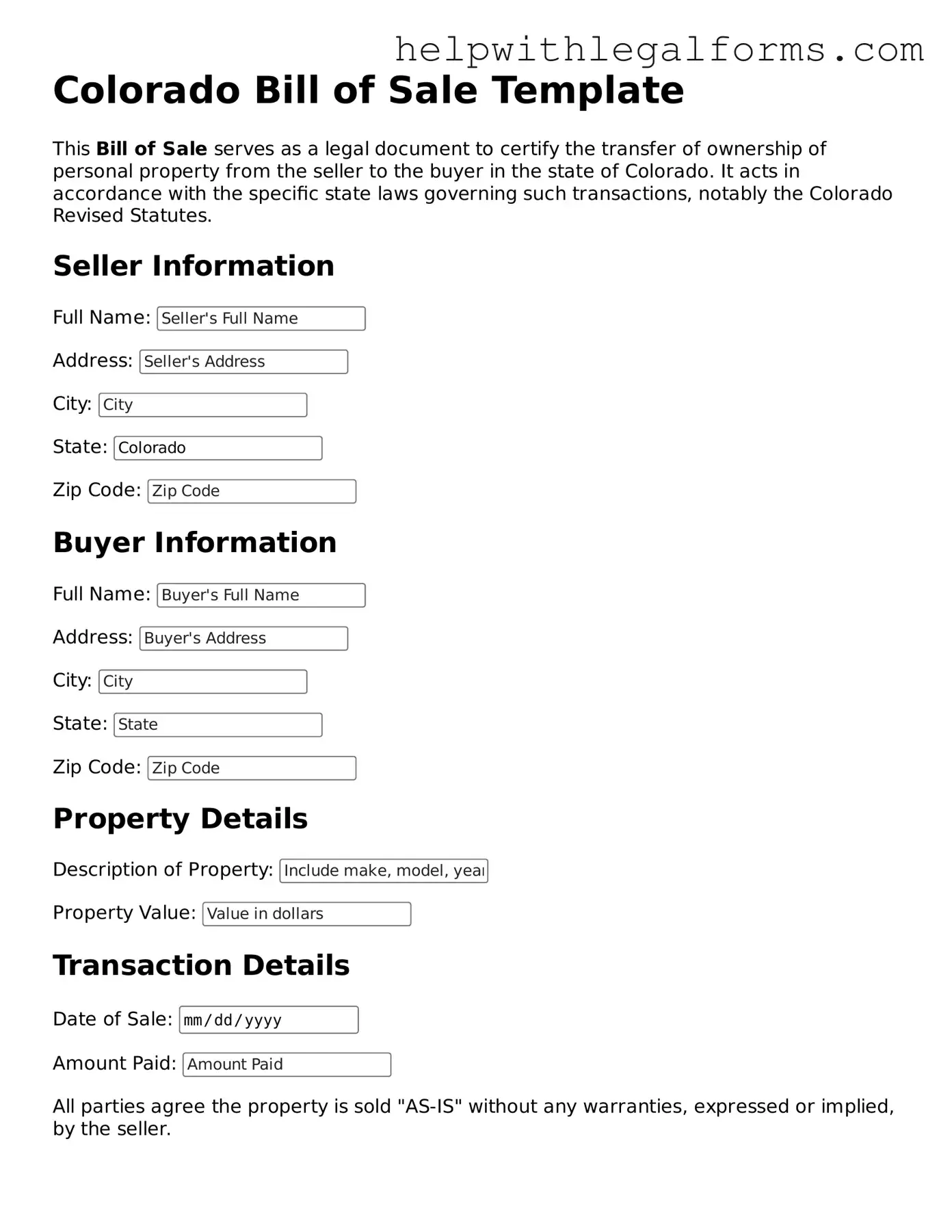

Example - Colorado Bill of Sale Form

Colorado Bill of Sale Template

This Bill of Sale serves as a legal document to certify the transfer of ownership of personal property from the seller to the buyer in the state of Colorado. It acts in accordance with the specific state laws governing such transactions, notably the Colorado Revised Statutes.

Seller Information

Buyer Information

Property Details

Transaction Details

All parties agree the property is sold "AS-IS" without any warranties, expressed or implied, by the seller.

Signatures

This document is executed on the understanding that it is in compliance with Colorado regulations governing such transactions. It is advised to retain a copy of this document for personal records and, if necessary, for future legal reference.

PDF Form Attributes

| Fact | Detail |

|---|---|

| Definition | A Colorado Bill of Sale form is a legal document that records the sale and transfer of ownership of a personal property from a seller to a buyer in the state of Colorado. |

| Purpose | It serves as proof of purchase and establishes the terms and conditions of the sale. |

| Types | Common types include vehicle, boat, firearm, and general personal property Bills of Sale. |

| Key Components | These forms typically include the seller's and buyer's information, description of the item sold, sale date, and purchase price. |

| Notarization | Notarization is not mandatory for the form to be legal, but it's recommended for added legal protection. |

| Governing Law | Colorado Revised Statutes govern the Bill of Sale requirements and elements in Colorado. |

| Importance for Vehicle Sales | Particularly important for vehicle sales as it is often required for registration and titling of the vehicle with the Colorado Department of Motor Vehicles (DMV). |

| Use in Disputes | Can be used as evidence in disputes related to the sale or ownership of the property. |

| Record Keeping | Both the buyer and seller should keep copies of the Bill of Sale for their records and future reference. |

| Fraud Prevention | Helps prevent fraud by providing a documented history of ownership transfer. |

Instructions on How to Fill Out Colorado Bill of Sale

Filling out a Bill of Sale in Colorado is a straightforward process that ensures both the seller and buyer have a formal record of the sale. This document is necessary for the transfer of ownership and might be required for registration or tax purposes. To make things easier for you, we have outlined the steps to correctly fill out this document. Follow these steps to ensure your Bill of Sale is completed accurately and efficiently.

- Start by writing the date of the sale at the top of the document.

- Enter the full legal name and address of the seller(s).

- Enter the full legal name and address of the buyer(s).

- Describe the item being sold. Include make, model, year, and any identification number or serial number associated with it.

- State the selling price of the item in dollars.

- If applicable, mention any specific conditions of the sale. For example, if the item is being sold "as is" or if there is a warranty period.

- Both the buyer and seller should sign and print their names at the bottom of the document. If the document requires witnesses, ensure they do the same.

- Make copies of the completed Bill of Sale. Give one to the buyer, keep one for your records, and, if necessary, submit a copy to the relevant local authority or agency.

After filling out the Bill of Sale, the next steps involve the actual transfer of the item and possibly the registration or updating of records with local departments. If you're selling or buying a vehicle, for instance, you may need to visit your local Department of Motor Vehicles (DMV) to update the vehicle’s registration and title. Also, don't forget the importance of securing insurance for items that require it, such as vehicles or boats. Carefully follow through with these steps to ensure a smooth transition and compliance with Colorado laws.

Crucial Points on This Form

What is a Colorado Bill of Sale form?

A Colorado Bill of Sale form is a legal document used to record the transfer of ownership of personal property, such as a vehicle, boat, firearm, or any other item of value, from a seller to a buyer. This document includes important information such as the details of the property being sold, the sale price, and the names and addresses of both the seller and the buyer. It serves as proof of purchase and can be used for legal and tax purposes.

Is a Bill of Sale legally required in Colorado?

In Colorado, a Bill of Sale is not always legally required but is strongly recommended, especially when buying or selling a vehicle or other high-value items. For vehicles, it is an important part of the documentation needed to transfer ownership and register the vehicle with the Colorado Department of Motor Vehicles (DMV).

What information is typically included in a Colorado Bill of Sale?

A standard Colorado Bill of Sale typically includes the seller's and buyer's names and addresses, a detailed description of the item being sold (including make, model, year, and serial number, if applicable), the sale date, the purchase price, and signatures of both parties involved. Some forms may also require a witness's signature or a notary public's seal.

Do both parties need to sign the Bill of Sale in Colorado?

Yes, both the seller and the buyer must sign the Bill of Sale in Colorado. This ensures that there is mutual agreement about the details of the transaction and provides legal protection for both parties.

Does a Colorado Bill of Sale need to be notarized?

While notarization is not mandatory for a Bill of Sale in Colorado, having the document notarized can add an extra layer of legal validity. Especially for transactions involving high-value items, notarization can serve as an official verification of the identities of the parties involved and the truthfulness of their signatures.

How can one obtain a Colorado Bill of Sale form?

A Colorado Bill of Sale form can be obtained through the Colorado Department of Revenue's website, at a local DMV office, or from various online resources that provide legal forms. Ensure that the form complies with Colorado laws and includes all required information.

Why is it important to keep a copy of the Bill of Sale?

Keeping a copy of the Bill of Sale is important for both the buyer and the seller as it serves as a receipt of the transaction and a record of the transfer of ownership. It may be required for tax purposes or as evidence in case of disputes, insurance claims, or warranty issues.

Can a Bill of Sale be used for vehicles bought or sold in other states?

A Colorado Bill of Sale can be used for transactions involving vehicles from other states, but it must meet the legal requirements of the state in which the vehicle will be registered. It's crucial to check with the local DMV for specific requirements, such as emissions testing or vehicle inspections, that may apply.

What happens if a Bill of Sale is not provided during a transaction?

If a Bill of Sale is not provided during a transaction, it can lead to complications in proving ownership or transferring the item's title. This can affect the buyer's ability to register or insure the item and may also complicate legal matters in disputes.

Is there a difference between a Bill of Sale and a title for vehicles?

Yes, there is a significant difference between a Bill of Sale and a title for vehicles. A Bill of Sale serves as evidence of the transaction between the seller and the buyer, detailing the sale's terms. A title, on the other hand, is a legal document issued by the state that officially signifies an individual's ownership of the vehicle. For vehicle transactions, both documents are important and serve different legal purposes.

Common mistakes

When individuals fill out the Colorado Bill of Sale form, several common mistakes can occur. These errors may potentially complicate the transaction process or lead to issues in the future. Awareness and avoidance of these mistakes are crucial for a smooth and legally sound transaction.

Not including a detailed description of the item being sold: A comprehensive description ensures clarity about what is being transferred from the seller to the buyer. Omission of details such as the make, model, year, and condition can lead to misunderstandings.

Forgetting to specify the sale date: The exact date of the transaction provides a timeline and legal standing. Lack of this information might result in legal ambiguities.

Leaving out the purchase price or not specifying if it’s a gift: Clearly stating the sale price or indicating a gift is essential for tax and legal purposes. It verifies the terms of the deal between the parties.

Failing to include the buyer's and seller's full information: Full names, addresses, and signatures of all parties are mandatory. This information confirms the identities of the involved parties and their agreement to the terms.

Not obtaining a witness or notary signature when required: Depending on the item's nature and value, a third-party verification might be necessary. Its absence could question the document's validity.

Ignoring the need for duplicate copies: Both the buyer and the seller should have a copy of the completed form. Without a copy, disputes could arise, with one party having no proof of the agreement’s terms.

By paying close attention to these areas, individuals can better ensure that their Colorado Bill of Sale forms are accurately and fully completed. These steps help protect all parties involved and provide a solid foundation for the transaction.

Documents used along the form

When engaging in transactions involving the sale of goods or personal property in Colorado, a Bill of Sale form is often just the starting point. This legal document, serving as a proof of purchase and transfer of ownership, is typically accompanied by additional records and forms. These documents help ensure a smooth, legally sound transfer process. Below is a list of some other forms and documents frequently used along with the Colorado Bill of Sale, each playing its unique role in the context of a sale or purchase.

- Title Transfer Form: Vital for transactions involving vehicles, this form is submitted to the Colorado Department of Motor Vehicles (DMV) to officially transfer the title of the vehicle from seller to buyer. It's a crucial step for the buyer to acquire legal ownership.

- Odometer Disclosure Statement: The Federal Law requires this statement for any vehicle sale to accurately disclose the vehicle's mileage. In Colorado, it's typically required for vehicles less than ten years old, ensuring that the buyer is aware of the vehicle's exact mileage.

- Sales Tax Receipt: This serves as proof that the sales tax on the transaction has been paid. In Colorado, the responsibility for paying sales tax can depend on the type of item sold and the sale's location, and this document is often necessary for the buyer to register or use the item legally.

- Warranty Document: If the item sold comes with a warranty, a separate document detailing the warranty terms, conditions, and period is typically provided. This ensures that the buyer is informed about the protection and remedies available should the item not perform as expected.

- Notice of Sale Form: For transactions involving vehicles, Colorado requires a notice of sale form to be submitted to the DMV. This form, filed by the seller, provides official notice of the transaction and helps protect the seller from liability for any subsequent actions involving the vehicle.

- Loan Document: If the purchase is being financed, a loan document or financing agreement will likely be included. This outlines the terms of the loan, including interest rate, repayment schedule, and any collateral used, ensuring both parties are clear about the financial obligations.

Each of these documents plays a significant role in complementing the Colorado Bill of Sale form, ensuring that all aspects of the transaction are legally accounted for and clearly understood by both parties involved. Having these documents in order can provide peace of mind by offering legal protection and clarity, making any sale or purchase transaction smoother and more transparent.

Similar forms

Warranty Deed: Both the Bill of Sale and a Warranty Deed serve as legal documents that transfer ownership rights. While the Bill of Sale applies to personal property, the Warranty Deed is used for real estate transactions. They both provide a guarantee about the legal status of the title being transferred.

Quitclaim Deed: Similar to the Bill of Sale, a Quitclaim Deed is involved in transferring property rights. The key difference is that a Quitclaim Deed transfers any ownership interest the grantor may have without guaranteeing that the title is clear of claims.

Title Certificate: This document is akin to a Bill of Sale in that it proves ownership of an asset, such as a vehicle. Both documents are crucial when the ownership of the property changes hands.

Sales Agreement: A Sales Agreement and a Bill of Sale are closely related; both outline the conditions of a sale between two parties. However, the Sales Agreement is more comprehensive, detailing the agreement terms before the sale is finalized, while the Bill of Sale confirms that the transaction has occurred.

Receipt: Receipts and Bills of Sale serve as proof of purchase but vary in detail and formality. A Bill of Sale will often include detailed information about the transaction and legal guarantees, which a receipt might not.

Loan Agreement: Although primarily used for setting the terms of a loan between a lender and borrower, a Loan Agreement, like a Bill of Sale, establishes the conditions under which property (in this case, money) changes hands, including repayment terms and security interests.

Promissory Note: This is a written promise to pay a specified sum of money to another party under agreed terms. It is similar to a Bill of Sale in that it documents a transaction between two parties, focusing on the promise of payment for received goods.

Consignment Agreement: It outlines the terms under which one party (the consignor) agrees to sell goods on behalf of another party (the consignee). The similarity to a Bill of Sale lies in the handling and transfer of property, albeit through a third party.

Security Agreement: Like a Bill of Sale, a Security Agreement is used to signify a change in ownership rights, with a focus on securing a loan. The property is used as collateral in the event of default. Both documents solidify the terms under which property is transferred or handled.

Dos and Don'ts

When completing the Colorado Bill of Sale form, it’s essential to approach this document with careful attention to detail to ensure a valid and effective transfer of property. Here are things you should do and shouldn't do to help guide you through this process.

What You Should Do:Use clear and concise language to describe the item being sold. Including model, make, year, and any identifying numbers or features will avoid any confusion.

Ensure all parties involved provide their complete and accurate information, including names, addresses, and signatures. This information is crucial for the document's legality and future reference.

Confirm the date of sale and the agreed-upon price. Both elements should be prominently displayed on the form to solidify the terms of the agreement.

Keep a copy of the fully executed document for your records. Having this document readily available can be incredibly important for legal or tax purposes.

Consult with or hire a professional if you're unsure about how to properly fill out the form. This can prevent mistakes that could invalidate the form.

Verify that the form complies with all local and state requirements for a Bill of Sale in Colorado. Regulations can vary, and ensuring compliance is critical.

Rush through filling out the form without verifying all the information. Mistakes or omissions can complicate the process later on.

Leave any sections of the form blank. If a section does not apply, mark it with “N/A” instead of leaving it empty.

Forget to specify any conditions of the sale, including as-is condition or warranties. This information can protect the seller and inform the buyer.

Sign the document without ensuring that all parties understand the terms completely. Misunderstandings can lead to disputes or legal issues down the line.

Use an outdated form that may not include recent legal requirements. Always check for the most current form available from a reliable source.

Overlook the requirement for notarization if applicable. Some sales might require the Bill of Sale to be notarized to be considered valid.

Misconceptions

When discussing the Colorado Bill of Sale form, several misconceptions frequently arise. Understanding the truth behind these can help individuals navigate their obligations and rights more clearly during the process of buying or selling personal property in Colorado.

It's only needed for the sale of motor vehicles: A common misconception is that the Bill of Sale form is exclusively for the transaction of motor vehicles. In reality, this form is versatile and used in the sale of various types of personal property, including boats, firearms, and even livestock, thus providing a legal record that the item has been transferred from one party to another.

A verbal agreement is just as valid: Although verbal agreements can be legally binding, the lack of a written document like a Bill of Sale can make it much harder to prove the specifics of the agreement if a dispute arises. Having a Bill of Sale provides concrete evidence of the agreement's terms and conditions.

The Bill of Sale has to be notarized in Colorado: While notarization can add an extra layer of legitimacy to the document, Colorado law does not require the Bill of Sale to be notarized. However, completing this step can help protect against fraud and ensure the document's acceptance in legal disputes.

Only the buyer needs to keep a copy: Both the buyer and the seller should keep a copy of the Bill of Sale. For the seller, it's proof that they no longer own the item and have transferred responsibility to the buyer. For the buyer, it's evidence of ownership and can be necessary for registration or insurance purposes.

All fields in the form are required: While it's essential to provide detailed information to make the Bill of Sale valid, not all fields may apply to every transaction. The key is to include enough detail to clearly identify the parties involved, the item being sold, the sale price, and the sale date.

It serves as a warranty: A Bill of Sale does not inherently guarantee the condition of the item sold. Unless explicitly stated within the document, it simply records the transaction and sale price. If a warranty is a part of the agreement, it should be detailed in the Bill of Sale.

Any template will suffice: While many templates are available, using one specifically designed for Colorado is important to ensure it meets state requirements. A generic template might omit crucial elements required for a valid transaction within the state.

Understanding these misconceptions and the actual requirements can help make the sale or purchase of personal property smoother and legally sound. Always consider using the correct form and consult with legal professionals if in doubt about the specific requirements in Colorado.

Key takeaways

Understanding the Colorado Bill of Sale form is critical for anyone buying or selling a vehicle or other high-value items within the state. This document serves as a legal record of the transaction, offering protection and clarity for both parties involved. Here are key takeaways for successfully filling out and using this important form:

- Complete Information is Mandatory: Ensuring that all sections of the Bill of Sale form are filled out accurately is crucial. This includes the full names and addresses of both the buyer and seller, detailed description of the item being sold, and the sale amount. Inaccuracies or missing information can invalidate the document.

- Exact Description of the Item: For vehicles, this includes the make, model, year, and Vehicle Identification Number (VIN). For other items, a detailed description along with any identifying numbers or features is necessary. This specificity helps prevent disputes about what was sold.

- Confirmation of Payment Method: Whether the transaction is made in cash, check, or through a trade, documenting the payment method on the Bill of Sale verifies the financial arrangement agreed upon by both parties.

- Date of Sale: Recording the exact date when the sale occurs establishes a timeline, which is important for legal and registration purposes.

- Signatures Are Essential: The Bill of Sale must be signed by both the buyer and the seller. In some cases, witness signatures or notarization may also be required to authenticate the document further.

- Keep Copies for Records: Both the buyer and seller should keep copies of the Bill of Sale for their records. This document serves as a receipt and may be needed for tax calculations, registration, or legal disputes in the future.

- Understand State Requirements: Colorado may have specific requirements or additional forms that need to be completed alongside the Bill of Sale. It's important to be aware of and comply with these regulations to ensure the validity of the sale.

Properly executing the Colorado Bill of Sale form is instrumental in safeguarding the rights and interests of both the buyer and seller. It not only acts as proof of ownership transfer but also serves as a vital legal document in the event of disputes or for official purposes. Paying careful attention to the details and making sure that all information is current and complete will help smooth the transaction process for all parties involved.

Create Other Bill of Sale Forms for US States

Free Bill of Sale for Car New Jersey - It might also include terms of payment, such as installments or trade-ins, if applicable.

Simple Bill of Sale Oklahoma - In real estate transactions involving fixtures or non-titled property, a Bill of Sale can clarify what is included in the sale.

Bill of Sale Car Texas - The proactive use of a Bill of Sale can mitigate future legal challenges, anchoring the sale in a legally recognized framework.