Blank Bill of Sale Form for Connecticut

In the landscape of private sales and purchases in Connecticut, the Bill of Sale form emerges as a pivotal document, serving multiple critical functions. Key among its uses, this document acts as a concrete proof of the transfer of ownership of an item—be it a vehicle, boat, or any personal property—from one party to another. Beyond its role in establishing ownership, it also provides a documented history of the item's sale price, which proves invaluable for both tax reporting purposes and ensuring a fair and transparent transaction. The importance of the Connecticut Bill of Sale form extends further, offering protection for the seller by releasing them from liability once the item is officially in the buyer's possession. It is not merely a receipt but a legal document that, depending on the item sold, may need to be notarized to confirm its authenticity and the identity of the signatories. Given its significance, the proper completion and understanding of the Connecticut Bill of Sale form are vital for both parties involved in the transaction, ensuring that the process adheres to legal standards and contributes to a smooth transfer of ownership.

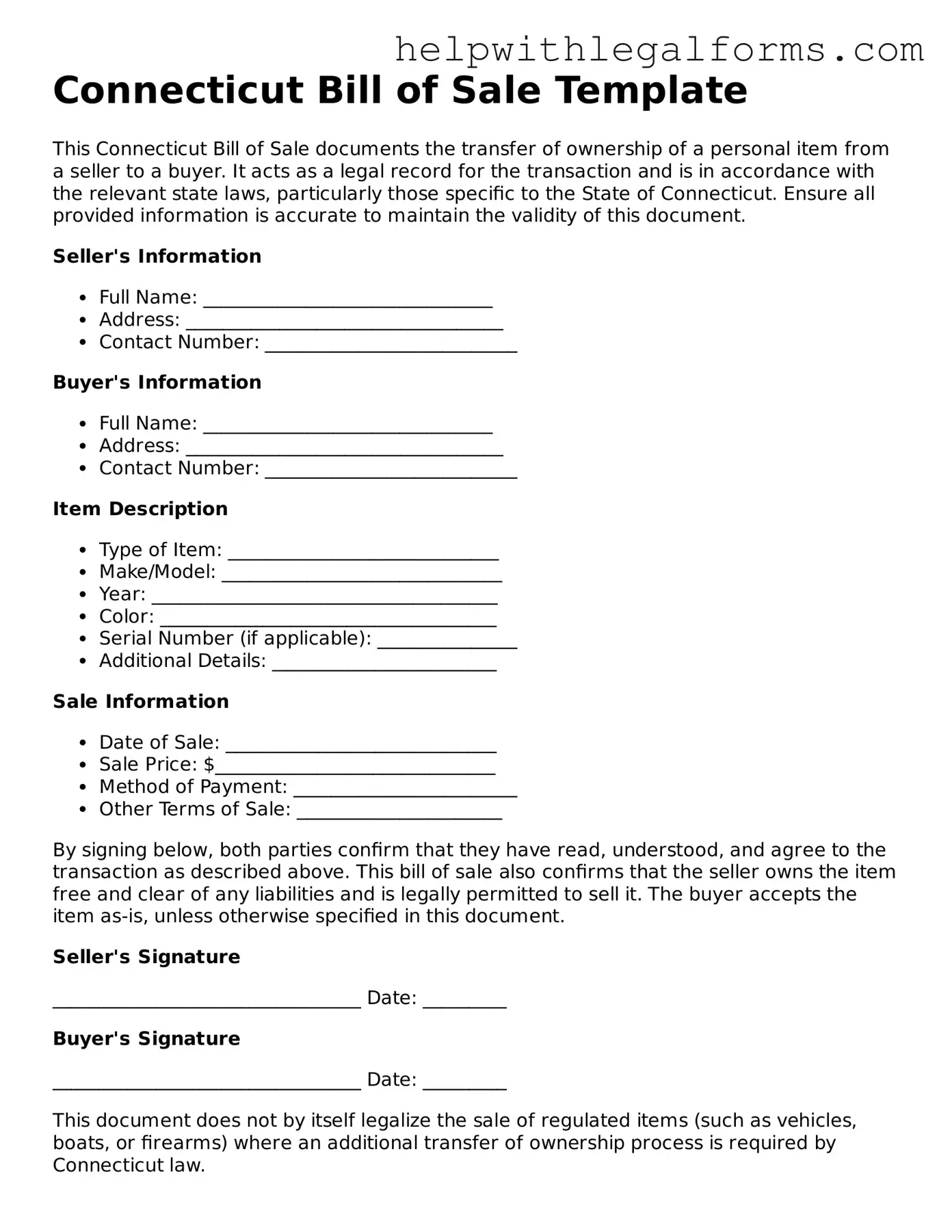

Example - Connecticut Bill of Sale Form

Connecticut Bill of Sale Template

This Connecticut Bill of Sale documents the transfer of ownership of a personal item from a seller to a buyer. It acts as a legal record for the transaction and is in accordance with the relevant state laws, particularly those specific to the State of Connecticut. Ensure all provided information is accurate to maintain the validity of this document.

Seller's Information

- Full Name: _______________________________

- Address: __________________________________

- Contact Number: ___________________________

Buyer's Information

- Full Name: _______________________________

- Address: __________________________________

- Contact Number: ___________________________

Item Description

- Type of Item: _____________________________

- Make/Model: ______________________________

- Year: _____________________________________

- Color: ____________________________________

- Serial Number (if applicable): _______________

- Additional Details: ________________________

Sale Information

- Date of Sale: _____________________________

- Sale Price: $______________________________

- Method of Payment: ________________________

- Other Terms of Sale: ______________________

By signing below, both parties confirm that they have read, understood, and agree to the transaction as described above. This bill of sale also confirms that the seller owns the item free and clear of any liabilities and is legally permitted to sell it. The buyer accepts the item as-is, unless otherwise specified in this document.

Seller's Signature

_________________________________ Date: _________

Buyer's Signature

_________________________________ Date: _________

This document does not by itself legalize the sale of regulated items (such as vehicles, boats, or firearms) where an additional transfer of ownership process is required by Connecticut law.

PDF Form Attributes

| Fact Number | Description |

|---|---|

| 1 | A Connecticut Bill of Sale form is a legal document that records the sale of personal property from one person to another within the state of Connecticut. |

| 2 | This document provides evidence of the transfer of ownership and details about the item sold, the sale price, and the parties involved. |

| 3 | The Connecticut Bill of Sale can be used for various transactions, including the sale of vehicles, boats, and other personal items. |

| 4 | For vehicle sales, the Connecticut Department of Motor Vehicles (DMV) requires a Bill of Sale to be completed and submitted alongside other required documentation for the vehicle's registration. |

| 5 | Legally, the Connecticut Bill of Sale must include the date of the sale, a description of the item sold, the sale price, and the printed names and signatures of both the buyer and the seller. |

| 6 | The form serves not only as a proof of purchase but also can be used for tax purposes and as protection against any future disputes regarding the sale. |

| 7 | While a Bill of Sale is a vital document, it's important to note that it does not serve as a title transfer document. For vehicles, the title transfer must be completed separately according to Connecticut state law. |

| 8 | It is recommended, though not always required, to have the Bill of Sale notarized in Connecticut. This adds a layer of authenticity and may help in preventing legal issues in the future. |

| 9 | After the sale, both the buyer and the seller should keep copies of the Bill of Sale for their records as it serves as proof of the transaction and ownership change. |

| 10 | There are specific versions of the Bill of Sale form for different types of sales, such as motor vehicles, boats, or general property, each tailored to include relevant details for the transaction type. |

Instructions on How to Fill Out Connecticut Bill of Sale

When completing a transaction for the sale of certain items in Connecticut, a Bill of Sale form serves as an official record, detailing the agreement between the buyer and seller. It not only provides proof of ownership transfer but also ensures the legality and transparency of the transaction. The form usually requires specific information about the item being sold, along with the details of both parties involved. Crafting this document meticulously is essential for it to serve its purpose effectively. Here are the detailed steps necessary to fill out the Connecticut Bill of Sale form correctly.

- Begin by downloading the official Connecticut Bill of Sale form from the state’s Department of Motor Vehicles (DMV) website or a reputable legal documents provider.

- Clearly print the full legal names of both the seller and the buyer at the top of the form.

- Enter the complete address, including city, state, and zip code, for both the seller and the buyer.

- Specify the detailed description of the item being sold. This should include make, model, year, color, condition, and any identifying numbers (such as a VIN for vehicles or serial numbers for electronics).

- Record the sale date and the total purchase price. It's crucial to accurately state this amount as it might be used to calculate sales tax or for valuation in the event of a dispute.

- If applicable, include any warranty information or indicate "as is" to note that the item is being sold in its current state without any guarantees.

- Both parties should carefully read the provided declaration statement that often highlights the legal implications of the transaction, ensuring understanding and agreement.

- Have both the seller and buyer sign and date the form. The signatures are essential, as they legally bind the parties to the terms outlined in the document.

- Some forms may require a witness or notary public to sign, validating the identities of the seller and buyer. If so, ensure this section is completed accordingly.

- Finally, distribute copies of the signed form to all parties involved, including the buyer, the seller, and any required state department. It's recommended to keep a copy for your records for a minimum of several years in case any disputes or legal questions arise.

After completing these steps, the Connecticut Bill of Sale form will be fully executed, providing a legal acknowledgment of the sale and transfer of ownership. This document is critical for both parties' protection, as it can be used as evidence in legal proceedings, should any issues or misunderstandings regarding the sale arise in the future. Always ensure the information provided on the form is accurate and comprehensive to avoid potential legal complications.

Crucial Points on This Form

What is a Connecticut Bill of Sale form?

A Connecticut Bill of Sale form is a legal document used to record the transfer of ownership of personal property from a seller to a buyer. It acts as evidence of the transaction and includes important details such as the description of the item being sold, the sale price, and the date of sale. This form is often used for the sale of vehicles, boats, and other significant items. It serves not only as proof of purchase but also helps in the registration process of the item when required by Connecticut law.

Do I need to notarize a Connecticut Bill of Sale?

In Connecticut, not all Bill of Sale forms need to be notarized. However, for certain transactions, like the sale of a motor vehicle, it is recommended to have the document notarized. Notarization adds an extra layer of legal protection by verifying the identity of the parties involved and confirming their signatures on the document. Although not always mandatory, checking with the relevant local authority or consulting with a legal expert can provide guidance on whether notarization is necessary for your specific situation.

Is a Bill of Sale enough for registering a vehicle in Connecticut?

A Bill of Sale by itself is not sufficient for registering a vehicle in Connecticut. The Connecticut Department of Motor Vehicles (DMV) requires additional documents for vehicle registration. These include a completed registration application, proof of insurance, a valid identification, and payment of all applicable fees. The Bill of Sale is an important part of these documents as it provides proof of the transaction and the sale price but must be accompanied by the other required documents for successful vehicle registration.

How can I obtain a Connecticut Bill of Sale form?

A Connecticut Bill of Sale form can be obtained from several sources. The Connecticut Department of Motor Vehicles offers specific forms online that can be downloaded and printed. Legal document websites also provide customizable Bill of Sale forms that are compliant with Connecticut laws. Additionally, generic Bill of Sale forms are available but should be carefully reviewed to ensure they meet all state-specific requirements. When in doubt, consulting with a legal professional can help ensure that the form you use is appropriate and legally binding.

Common mistakes

When completing a Connecticut Bill of Sale form, accuracy and attention to detail are paramount. This document is essential for recording the sale of various items, such as vehicles, boats, or personal property, ensuring legal protection for both the buyer and the seller. However, errors can occur, leading to potential complications. Here are six common mistakes people make:

Not checking for completeness. All fields on the form should be filled out. Leaving sections blank can lead to misunderstandings or legal issues.

Failing to provide detailed descriptions of the item being sold. Including specifics such as make, model, year, and condition helps avoid disputes over what was agreed upon in the sale.

Not verifying the accuracy of the vehicle identification number (VIN) or serial number. Errors in recording these identifiers can cause significant issues in the registration or titling process.

Omitting the date of the sale or entering it incorrectly. This detail is crucial for establishing when the ownership officially changed hands.

Forgetting to include both the buyer's and seller's full names and addresses. This information is necessary for legal protection and contact purposes.

Skipping the signatures. Both parties must sign the Bill of Sale to validate the document. Without these signatures, the document may not be legally binding.

To ensure a smooth and legally secure transaction, it's important for both buyers and sellers to double-check the Bill of Sale before considering the deal final. Taking the time to review and correct any errors can prevent future legal complications and misunderstandings, safeguarding the interests of all parties involved.

Documents used along the form

When buying or selling items in Connecticut, a Bill of Sale form represents just one piece of the paperwork puzzle. This form, certifying the transfer of property from seller to buyer, is vital, but it works best when accompanied by other documents. Each of these documents serves its own purpose, ensuring the transaction is transparent, legal, and comprehensively documented. Let's take a look at some of the additional forms often used alongside the Connecticut Bill of Sale.

- Title Transfer Form: This is crucial when selling vehicles, boats, or any asset that has a title. It officially transfers ownership from the seller to the buyer and is usually filed with the state's department responsible for vehicle registration or similar registries.

- Odometer Disclosure Statement: Required when selling a vehicle, this document records the vehicle's mileage at the time of sale. It's a way to ensure the buyer is aware of the vehicle's condition and to prevent odometer fraud.

- Sales and Use Tax Return: If the item being sold is subject to sales tax in Connecticut, this form must be completed. It calculates the tax owed based on the sale's value, ensuring that state tax laws are followed.

- Promissory Note: For transactions where the buyer will be making payments over time, a promissory note outlines the details of the repayment plan. It includes the interest rate, repayment schedule, and what happens if the buyer fails to make payments.

- Release of Liability Form: This form absolves the seller from liability if the item sold causes harm or damages after the sale. It's particularly important for vehicles and other high-risk items.

In every transaction, clarity and protection are key for both buyer and seller. Supplementing a Connecticut Bill of Sale with these additional documents can solidify the transaction's terms, provide legal protections, and ensure compliance with state laws. Each form contributes to a fully documented and legal sale, making the process smoother and more transparent for everyone involved.

Similar forms

Sales Agreement: Similar to a Bill of Sale, a Sales Agreement outlines the terms and conditions of a sale but is more detailed, often including warranties, specific obligations of the buyer and seller, and future payment terms. Both documents are used to record and formalize the transfer of goods or property from one party to another.

Deed: Like a Bill of Sale, a Deed is a legal document that transfers ownership, but it specifically pertains to real estate. While a Bill of Sale covers personal property (such as vehicles, equipment, and other tangible goods), a Deed is used to transfer ownership of real property from the seller to the buyer, often including a description of the property and any conditions.

Warranty Certificate: This document guarantees the condition of an item, similar to how a Bill of Sale might include warranties or "as-is" statements about the property being sold. While a Warranty Certificate specifically focuses on the quality and functionality of a product, a Bill of Sale serves as proof of the transaction and, in some cases, includes warranty information.

Title: A Title, especially in the context of vehicles, is closely related to a Bill of Sale in that it signifies ownership. However, a Title is primarily a legal document that shows who legally owns the vehicle. A Bill of Sale often accompanies the transfer of the Title to document the sale and transfer of ownership from the seller to the buyer.

Dos and Don'ts

When filling out the Connecticut Bill of Sale form, it's important to approach the document with attention and care. The Bill of Sale is a crucial document that serves as evidence of the transfer of ownership from the seller to the buyer. To ensure the process goes smoothly and both parties are protected, follow these do's and don'ts:

Do:Verify the form's requirements with your local Department of Motor Vehicles (DMV) to ensure you're using the correct version and including all necessary information.

Include complete and accurate information for both the seller and the buyer, such as full names, addresses, and contact information.

Provide a detailed description of the item being sold, including make, model, year, and vehicle identification number (VIN) if applicable.

List the sale price clearly and accurately, ensuring both parties agree on the amount.

Specify the date of the sale to establish an official transfer timeline.

Ensure both the buyer and the seller sign and date the form to validate the agreement legally.

Keep a copy of the completed Bill of Sale for your records, maintaining proof of the transaction and ownership transfer.

Confirm that the form complies with state regulations, including any requirements for notarization or additional documentation.

Use clear, legible handwriting or, if possible, fill out the form digitally to minimize errors or misunderstandings.

Consult with a legal professional if you have questions or concerns about the Bill of Sale or the sale process in general.

Leave any fields blank, as incomplete forms may be considered invalid or cause delays in the transaction process.

Falsify any information, which can lead to legal repercussions for both the buyer and the seller.

Overlook the need for a witness or notarization, if state law requires either for the Bill of Sale to be legally binding.

Forget to verify the buyer's or seller's identity to prevent fraud and ensure the legitimacy of the transaction.

Dismiss the importance of reviewing the entire document before signing to confirm that all information is correct and complete.

Delay the transfer of title (if applicable) beyond the sale, as this could complicate matters for the buyer in the future.

Ignore applicable laws on sales tax, registration, or other fees that may be necessary to complete the transaction legally.

Rely solely on verbal agreements, as the Bill of Sale serves as a legally binding document that outlines the terms of the sale.

Skip the step of providing or requesting a receipt of sale, which can serve as additional proof of the transaction.

Underestimate the value of keeping a digital copy of the Bill of Sale for easy access and backup.

Misconceptions

When dealing with the Connecticut Bill of Sale form, people often fall prey to misconceptions that can cloud their understanding and use of this important document. To clarify, let’s debunk some common myths:

It’s only needed for vehicles: While it's true that this form is frequently used in the sale of motor vehicles, it’s also required for other transactions like boats and even personal property items to ensure a legal transfer of ownership.

The form is overly complicated: This misconception might scare people away. In reality, the Connecticut Bill of Sale is straightforward and designed to be accessible, requiring just the basic details of the sale and the parties involved.

A lawyer must prepare it: It's a common belief that you need a lawyer to prepare a Bill of Sale. However, anyone can complete it as long as all the required information is included and accurate.

It’s the same as a title: Another misunderstanding is equating the Bill of Sale with a title. The Bill of Sale documents the transaction and transfer of ownership, while the title is the official document proving ownership.

Electronic versions aren’t valid: With the advancement of digital solutions, an electronically completed and signed Bill of Sale is just as valid as its paper counterpart, given that it contains all necessary information and signatures.

It serves as a warranty: Some people mistakenly believe that a Bill of Sale provides a warranty on the item sold. It actually records a transaction and does not guarantee the condition of the item, unless explicitly stated.

Notarization is always required: There’s a common belief that for a Bill of Sale to be valid, it must be notarized. While notarization can add an extra layer of authenticity, it's not always a requirement for the document to be legally binding in Connecticut.

Understanding these misconceptions can help individuals navigate their transactions with more confidence, knowing the true purpose and requirements of the Connecticut Bill of Sale form.

Key takeaways

When dealing with the Connecticut Bill of Sale form, it's important to pay close attention to various key aspects to ensure the document serves its purpose effectively and legally. Below are 10 key takeaways to guide you through filling out and using this form:

- Complete Information: All parties involved should provide complete and accurate information. This includes names, addresses, and identification details.

- Specific Details of the Sale Item: Clearly describe the item being sold. Include make, model, year, and serial number if applicable, to avoid any misunderstandings.

- Payment Information: Document the sale price, payment method, and any other terms related to the transaction. Indicating whether the amount is paid in full or in installments can help prevent disputes.

- Warranty Information: State clearly if the item is being sold "as is" or if there is a warranty. If a warranty is included, specify its duration and coverage details.

- Signatures: Ensure all parties sign the form. Signatures are crucial for the document's validity.

- Date of Sale: Include the exact date of the transaction. This can be important for both legal and record-keeping purposes.

- Additional Documentation: Attach any additional documents that support the sale, such as a certificate of authenticity for collectibles or a maintenance record for vehicles.

- Keep Copies: All parties should keep copies of the Bill of Sale. This is necessary for personal records and future reference.

- Notarization: While not always mandatory, getting the document notarized can add a layer of legal protection and authenticity.

- Legal Requirements: Understand Connecticut's specific requirements for a Bill of Sale. Some items, like vehicles, may have additional requirements such as a title transfer.

Adhering to these guidelines can help ensure the Connecticut Bill of Sale form is filled out and used correctly, providing a clear record of the transaction for all parties involved.

Create Other Bill of Sale Forms for US States

Bill of Sale Car Texas - For vehicles, a Bill of Sale is often required to document the sale price, which can influence registration fees and taxes.

How to Privately Sell a Car - An easy-to-understand document that confirms the terms of a deal have been met by all parties.

Vehicle Bill of Sale Maryland - A Bill of Sale form is an essential tool in safeguarding your transaction through a legally binding document.

Can I Sell a Car With a Lien - Assists in clarifying the specifics of the sale, preventing misunderstandings and ensuring mutual agreement.