Blank Dirt Bike Bill of Sale Form for Oklahoma

When buying or selling a dirt bike in Oklahoma, engaging in a transaction with confidence and legal assurance is crucial. This is where the Oklahoma Dirt Bike Bill of Sale form comes into the picture, serving a pivotal role in making the exchange legal and binding for both parties involved. This document not only substantiates the sale but also provides a detailed record of the transaction, including the sale date, the specifics of the dirt bike, and the agreed-upon price. Furthermore, it outlines the responsibilities and guarantees—if any—provided by the seller, ensuring the buyer is aware of the condition and history of the dirt bike. The inclusion of both parties' signatures finally cements the deal, offering a layer of protection and recourse should any disputes arise in the future. For residents of Oklahoma, this form not only facilitates a smoother transaction process but also adheres to local regulations, securing peace of mind for all individuals involved.

Example - Oklahoma Dirt Bike Bill of Sale Form

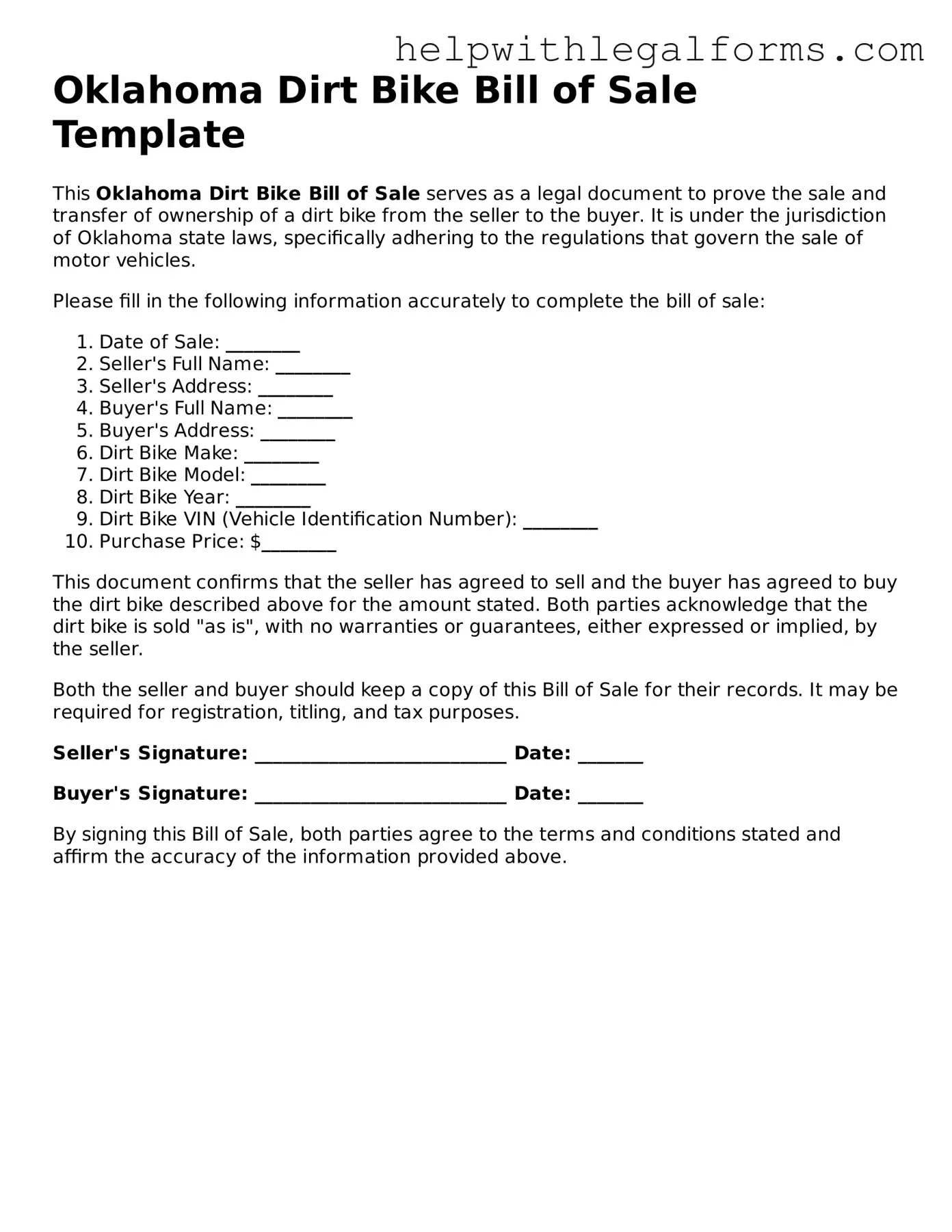

Oklahoma Dirt Bike Bill of Sale Template

This Oklahoma Dirt Bike Bill of Sale serves as a legal document to prove the sale and transfer of ownership of a dirt bike from the seller to the buyer. It is under the jurisdiction of Oklahoma state laws, specifically adhering to the regulations that govern the sale of motor vehicles.

Please fill in the following information accurately to complete the bill of sale:

- Date of Sale: ________

- Seller's Full Name: ________

- Seller's Address: ________

- Buyer's Full Name: ________

- Buyer's Address: ________

- Dirt Bike Make: ________

- Dirt Bike Model: ________

- Dirt Bike Year: ________

- Dirt Bike VIN (Vehicle Identification Number): ________

- Purchase Price: $________

This document confirms that the seller has agreed to sell and the buyer has agreed to buy the dirt bike described above for the amount stated. Both parties acknowledge that the dirt bike is sold "as is", with no warranties or guarantees, either expressed or implied, by the seller.

Both the seller and buyer should keep a copy of this Bill of Sale for their records. It may be required for registration, titling, and tax purposes.

Seller's Signature: ___________________________ Date: _______

Buyer's Signature: ___________________________ Date: _______

By signing this Bill of Sale, both parties agree to the terms and conditions stated and affirm the accuracy of the information provided above.

PDF Form Attributes

| Name of Fact | Detail |

|---|---|

| Purpose | The Oklahoma Dirt Bike Bill of Sale form is used to document the transfer of ownership of a dirt bike from the seller to the buyer. |

| Legal Requirement | In Oklahoma, a bill of sale is not mandatory for dirt bikes, but it is highly recommended as it provides a legal record of the transaction. |

| Governing Laws | The form and its usage are governed by Oklahoma's general laws regarding personal property sales, found within the state statutes. |

| Key Components | The form typically includes details such as the make, model, year, and VIN of the dirt bike, as well as the names and signatures of both parties involved in the sale. |

Instructions on How to Fill Out Oklahoma Dirt Bike Bill of Sale

In the process of buying or selling a dirt bike in Oklahoma, completing a Dirt Bike Bill of Sale form is a key step. This document serves to officially transfer ownership from the seller to the buyer, ensuring a legal and transparent transaction. Properly filling out this form not only provides proof of purchase but also helps in the registration process of the vehicle. It is essential for both parties to accurately and thoroughly complete the form to avoid any potential legal or administrative issues. Following a straightforward series of steps can simplify this process.

- Begin by entering the date of the sale. This should be the exact date when the transaction is completed.

- Write down the full names and addresses of both the seller and the buyer. Ensure the information is clear and accurate for future reference.

- Describe the dirt bike in detail. Include the make, model, year, color, and vehicle identification number (VIN). This information is crucial for identifying the specific vehicle involved in the transaction.

- Specify the sale price of the dirt bike. It's important to agree upon this amount beforehand and document it clearly to avoid misunderstandings.

- State any additional terms or conditions of the sale. If there are no extra conditions, note that the sale is under a 'as is' basis, which means the buyer accepts the dirt bike in its current condition.

- The payment method should be recorded next. Whether the transaction is through cash, check, or another form, detailing this helps maintain a clear financial record.

- Both the buyer and the seller must sign and print their names on the form. These signatures are essential for the document to be legally binding.

Once the Dirt Bike Bill of Sale form is fully completed, it's important to make copies for both parties. This ensures that the buyer and seller each have a record of the transaction. The next steps typically involve the buyer registering the dirt bike with the Oklahoma Department of Motor Vehicles (DMV). Having this bill of sale will facilitate the registration process, proving ownership of the vehicle. Remember, it's essential to keep this document in a safe place, as it may be required for future reference, such as for insurance purposes or reselling the vehicle.

Crucial Points on This Form

What is an Oklahoma Dirt Bike Bill of Sale?

An Oklahoma Dirt Bike Bill of Sale is a written document that records the transaction details when buying or selling a dirt bike within Oklahoma. It serves as proof of purchase and documents the transfer of ownership from the seller to the buyer.

Why is it important to have a Dirt Bike Bill of Sale in Oklahoma?

Having a Bill of Sale is important because it legally documents the transaction, helping to protect both the buyer and seller. It verifies the transfer of ownership and can be used for registration, tax purposes, and as evidence in case of disputes.

What information should be included in the Bill of Sale?

The Bill of Sale should include the names and addresses of both the buyer and seller, a description of the dirt bike (including make, model, year, and VIN), the sale date, purchase price, and signatures of both parties involved.

Do I need to notarize my Oklahoma Dirt Bike Bill of Sale?

Notarization is not a legal requirement for a Dirt Bike Bill of Sale in Oklahoma, but it can add an extra layer of legal protection and authenticity to the document.

Can I write my own Bill of Sale for a dirt bike in Oklahoma?

Yes, you can write your own Bill of Sale. It must include all required information to be considered valid. However, using a template or professional service can help ensure that all necessary details are included.

Is a Bill of Sale enough to prove ownership of a dirt bike in Oklahoma?

While a Bill of Sale is an important document for proving a transaction occurred, the title of the dirt bike is the official document for proving ownership. If the bike is not titled, the Bill of Sale becomes crucial as proof of ownership transfer.

What if the dirt bike does not have a title?

If the dirt bike does not have a title, the Bill of Sale becomes even more important as it is the primary document proving ownership and the transaction. Ensure all details are accurately filled out to offer protection for both parties.

How does the buyer register a dirt bike in Oklahoma with a Bill of Sale?

To register a dirt bike in Oklahoma, the buyer must submit the Bill of Sale along with any other required documents by the Oklahoma Tax Commission or local Department of Motor Vehicles. It's important to check with these agencies for specific registration requirements.

Can a Bill of Sale be used for tax purposes?

Yes, a Bill of Sale can be used for tax purposes. It provides the necessary documentation of the purchase price, which can be used for sales tax calculation and proving the value at the time of the transaction.

What happens if I lose my Bill of Sale?

If you lose your Bill of Sale, it’s recommended to contact the other party involved in the transaction to request a copy. If that’s not possible, legal advice may be needed to explore other ways to prove ownership or the details of the transaction.

Common mistakes

Filling out an Oklahoma Dirt Bike Bill of Sale form is an important step when engaged in the private sale of a dirt bike. It serves as a legal record of the transaction, providing proof of the transfer of ownership from the seller to the buyer. However, individuals often make mistakes in this process, which can lead to complications down the line. Here are ten common errors people make:

Not Verifying the Details: One common mistake is not verifying the accuracy of the information entered on the form. This can include misspelled names, incorrect addresses, or inaccurate descriptions of the dirt bike.

Skipping the Vehicle Identification Number (VIN): Failing to include the dirt bike’s VIN can create problems in verifying the vehicle's legal status and history.

Omitting the Sale Date: The date of sale is crucial for legal and tax purposes. An incorrect or missing date may affect the validity of the document.

Ignoring the Need for Witness Signatures: While not always mandatory, having witness signatures can add an extra layer of legality and proof to the transaction, especially in dispute cases.

Neglecting to Specify Payment Details: Clear terms of payment ensure both parties understand whether it's a full payment, a down payment, or installments, including any agreed-upon amount.

Forgetting to Complete a Bill of Sale for Each Party: Each party should have a completed and signed copy of the bill of sale for their records. This is often overlooked.

Leaving Out Conditions of Sale: Any conditions or agreements beyond the basic sale (like accessories included, or "as is" condition) should be documented to avoid future disputes.

Not Providing a Comprehensive Description of the Dirt Bike: A detailed description including make, model, year, and any modifications or damage is essential for clarity on what is being sold.

Failure to Report the Sale: Depending on local laws, the completion of a bill of sale may not finalize the legal requirements. The sale might also need to be reported to a state or local agency.

Handwriting That Is Difficult to Read: Illegible handwriting can lead to misunderstandings or discrepancies in the information recorded, which might complicate future verification.

Being cautious and thorough when filling out an Oklahoma Dirt Bike Bill of Sale form is vital to ensure the legality of the transaction and to avoid potential legal and administrative headaches in the future.

Documents used along the form

When buying or selling a dirt bike in Oklahoma, the Bill of Sale form is just the starting point. This document acts as evidence of the transaction, detailing the sale's specifics, such as price, date, and identifying information about the dirt bike. However, several other forms and documents often accompany this form to ensure a legally sound and smooth process. Understanding these forms can help both parties secure a thorough and transparent transaction.

- Oklahoma Title Transfer Form: This form is essential for officially transferring ownership of the dirt bike from the seller to the buyer. It's a crucial step to validate the sale and update the state's records with the new owner’s information.

- Release of Liability Form: After the sale, this document protects the seller by notifying the state that they are no longer responsible for the dirt bike. It helps in case the new owner incurs parking violations, accidents, or other liabilities.

- Oklahoma Registration Application: New owners need to register their dirt bike with the state. This form initiates the registration process, which may include paying fees and taxes, depending on the specifics of the transaction and local laws.

- Odometer Disclosure Statement: While not always applicable to dirt bike transactions, if the bike has an odometer, this federal requirement form discloses the mileage at the time of sale. It prevents odometer tampering and ensures the buyer knows the exact use of the bike.

- Notarization: While the bill of sale itself may not require notarization in Oklahoma, having the signatures notarized adds a layer of authenticity and may protect against future disputes. This isn’t a separate form but an official acknowledgment that the seller and buyer signed the document in the presence of a notary.

Each of these documents plays a significant role in ensuring that the sale adheres to legal standards and protects both parties involved in the transaction. While the process may seem cumbersome, understanding and preparing these documents ahead of time can streamline the sale and provide peace of mind. By completing these additional steps, sellers and buyers can enjoy a clear, legally sound transfer of ownership that acknowledges the responsibilities and rights of each party.

Similar forms

A Vehicle Bill of Sale: Similar to the Dirt Bike Bill of Sale, this document acts as a proof of purchase and transfer of ownership for a vehicle. It typically includes the vehicle’s make, model, year, VIN (Vehicle Identification Number), and the sale price. Both forms serve to protect the buyer and the seller legally, documenting the agreement and terms of the sale.

A Boat Bill of Sale: This document is akin to the Dirt Bike Bill of Sale in its function as a legal agreement between a buyer and a seller for the purchase of a boat. It records details about the boat, such as its type, size, make, model, and any identification numbers. It also outlines the sale price and specific terms agreed upon, ensuring a clear transfer of ownership.

Firearm Bill of Sale: Serving a similar purpose, this form documents the sale and transfer of ownership of a firearm from one party to another. Key information includes the make, model, caliber, and serial number of the firearm, alongside the particulars of the buyer and seller. Like the Dirt Bike Bill of Sale, it provides a record that can protect both parties legally and confirm the change of ownership.

A General Bill of Sale: This more versatile document can be used to transfer the ownership of personal property from one individual to another, not limited to specific items such as vehicles or boats. It includes details about the item being sold, the sale price, and both parties' details. The Dirt Bike Bill of Sale is a specialized version of this form, tailored specifically for the sale of a dirt bike.

Dos and Don'ts

When completing the Oklahoma Dirt Bike Bill of Sale form, certain practices should be followed to ensure the process is handled both accurately and legally. This document serves as a critical record of the transaction, providing proof of the buyer's ownership and releasing the seller from future liabilities associated with the dirt bike. The following guidelines are designed to navigate this process smoothly.

Do:

- Provide complete and accurate information for both the buyer and the seller, including full names, addresses, and contact details. This ensures that all parties involved can be contacted if any issues arise after the sale.

- Include a detailed description of the dirt bike. Mention the make, model, year, color, and vehicle identification number (VIN). Accurate descriptions help prevent misunderstandings about what is being sold.

- State the sale price clearly on the form. This is crucial for tax purposes and to prevent any disputes over the agreed amount.

- Make sure both the buyer and seller sign and date the bill of sale. These signatures formally execute the agreement, making it legally binding and effective.

Don't:

- Leave any sections of the form blank. Unfilled spaces can lead to legal complications, making it seem as though there might have been an attempt to hide information or deceive.

- Forget to check the dirt bike for any liens or encumbrances. Selling a bike that has an outstanding loan or lien can result in legal issues for the new owner.

- Overlook the importance of creating copies of the completed bill of sale. Both the buyer and the seller should keep a copy for their records to protect their interests in case of disputes or claims.

- Assume that the bill of sale alone transfers ownership. In Oklahoma, the title of the dirt bike must also be legally transferred to the new owner to complete the transaction officially.

Misconceptions

When it comes to documenting the sale of a dirt bike in Oklahoma, a Bill of Sale form plays a significant role. However, there are several misconceptions about this document that can lead to confusion. Let's address some common misunderstandings:

- It needs notarization to be valid. Contrary to popular belief, an Oklahoma Dirt Bike Bill of Sale does not require notarization to be legally binding. Both parties' signatures suffice for its legitimacy.

- It's optional for private sales. Many assume that this form is not mandatory for private transactions. However, it's essential for legal protection and to ensure a smooth transfer of ownership.

- It must be created by a lawyer. There's no need for legal assistance to draft this document. Individuals can prepare it, provided it contains all necessary details about the sale and the parties involved.

- One copy is enough for both parties. Both the buyer and the seller should retain a copy of the Bill of Sale for their records. This practice helps in addressing any future disputes or claims.

- All dirt bikes are covered under one form. The Bill of Sale should be specific to the transaction. If multiple bikes are sold, details about each one should be individually listed to avoid confusion.

- Only the seller needs to sign the form. Signatures from both the seller and the buyer are required to confirm the agreement and authenticate the document.

- It's similar to a title. A Bill of Sale is not a replacement for a title. It serves as proof of transaction, while a title is a legal document that proves ownership.

- Personal information is not necessary. Including personal information of both the seller and the buyer, such as addresses and contact details, is crucial for identification purposes and future communication needs.

- Any template can be used for the form. While various templates are available, it's important to use one that meets Oklahoma state requirements to ensure all relevant information is captured.

- It's only for use within Oklahoma. Although designed to comply with Oklahoma laws, a Bill of Sale may also serve as a valid document in other states, depending on their regulations and requirements.

Understanding these misconceptions about the Oklahoma Dirt Bike Bill of Sale form can help sellers and buyers navigate the sale process more effectively, ensuring that all legal protections are in place.

Key takeaways

When dealing with the transaction of a dirt bike in Oklahoma, utilizing a Bill of Sale form is crucial for both the buyer and the seller. This document serves as a proof of purchase and can significantly streamline the process of transferring ownership. Here are ten key takeaways that should be considered:

- Legal requirement: In Oklahoma, a Bill of Sale for a dirt bike is considered a legal requirement for the registration process. It acts as a verifiable document that a sale occurred.

- Details of the parties involved: The form should include the full names and addresses of both the buyer and the seller for identification purposes.

- VIN (Vehicle Identification Number): It is mandatory to clearly list the VIN of the dirt bike on the Bill of Sale to ensure the specific vehicle is accurately identified.

- Sale date and price: The exact sale date and the total purchase price of the dirt bike must be explicitly stated on the form. This information is important for tax and registration purposes.

- Condition of the bike: The condition of the dirt bike at the time of the sale, whether new or used, should be mentioned. This can help in clarifying any future disputes regarding warranties or expectations.

- Warranty details: If the seller is providing any warranty on the dirt bike, the specifics of this warranty should be thoroughly documented in the Bill of Sale.

- Signatures: Both the buyer and the seller are required to sign the Bill of Sale. These signatures officially validate the transaction and agreement.

- Notarization: While not always required, getting the document notarized can add an extra layer of legal protection and authenticity to the transaction.

- Keep copies: It is highly recommended that both the buyer and seller retain copies of the Bill of Sale for their records. This document can serve as proof of the transaction, ownership, and can be vital for registration or if any disputes arise.

- Additional documents: Sometimes, further documentation may be needed for registration or insurance purposes. Being prepared with the Bill of Sale and any other requested documents can simplify these processes.

Adhering to these guidelines when filling out and using an Oklahoma Dirt Bike Bill of Sale can protect all parties involved, ensure the legality of the transaction, and facilitate a smoother transfer of ownership.

Create Other Dirt Bike Bill of Sale Forms for US States

Ny Dmv Title Replacement Cost - As an important part of due diligence, the form reassures lenders and insurers about the legitimacy of the dirt bike's sale and ownership.

Dirtbike Bill of Sale - Reduces the risk of misunderstandings by clearly defining the sale terms, bike condition, and expectations.

Dirt Bike Bill of Sale - By clearly listing sale conditions and the dirt bike’s details, a Bill of Sale mitigates risks of post-sale disputes.

Can a Bill of Sale Be Handwritten in Georgia - The form typically includes the names and addresses of both the buyer and seller, alongside the make, model, and VIN (Vehicle Identification Number) of the dirt bike.