Blank Bill of Sale Form for Georgia

In the heart of every transaction lies the essential document that acts as a pivotal point for the exchange of goods and services, especially in Georgia where the Bill of Sale form plays a critical role. This form, though often overlooked, serves as a powerful testament to the completion of a sale, offering peace of mind and legal protection to both buyers and sellers involved. Whether it's for the sale of a vehicle, a piece of personal property, or any other significant asset, the Georgia Bill of Sale form encapsulates the details of the transaction, providing a record that outlines the item sold, the sale price, and the parties involved. Its importance cannot be understated, as it not only signifies the transfer of ownership but also acts as a safeguard against future disputes. Within its framework, it encompasses the essential legalities, ensuring that all aspects of the sale are transparent and above board, thereby instilling a sense of trust and security for all parties involved. Understanding the major aspects of this form is critical for anyone engaged in private sales within the state, ensuring that their transactions are conducted smoothly and with full legal compliance.

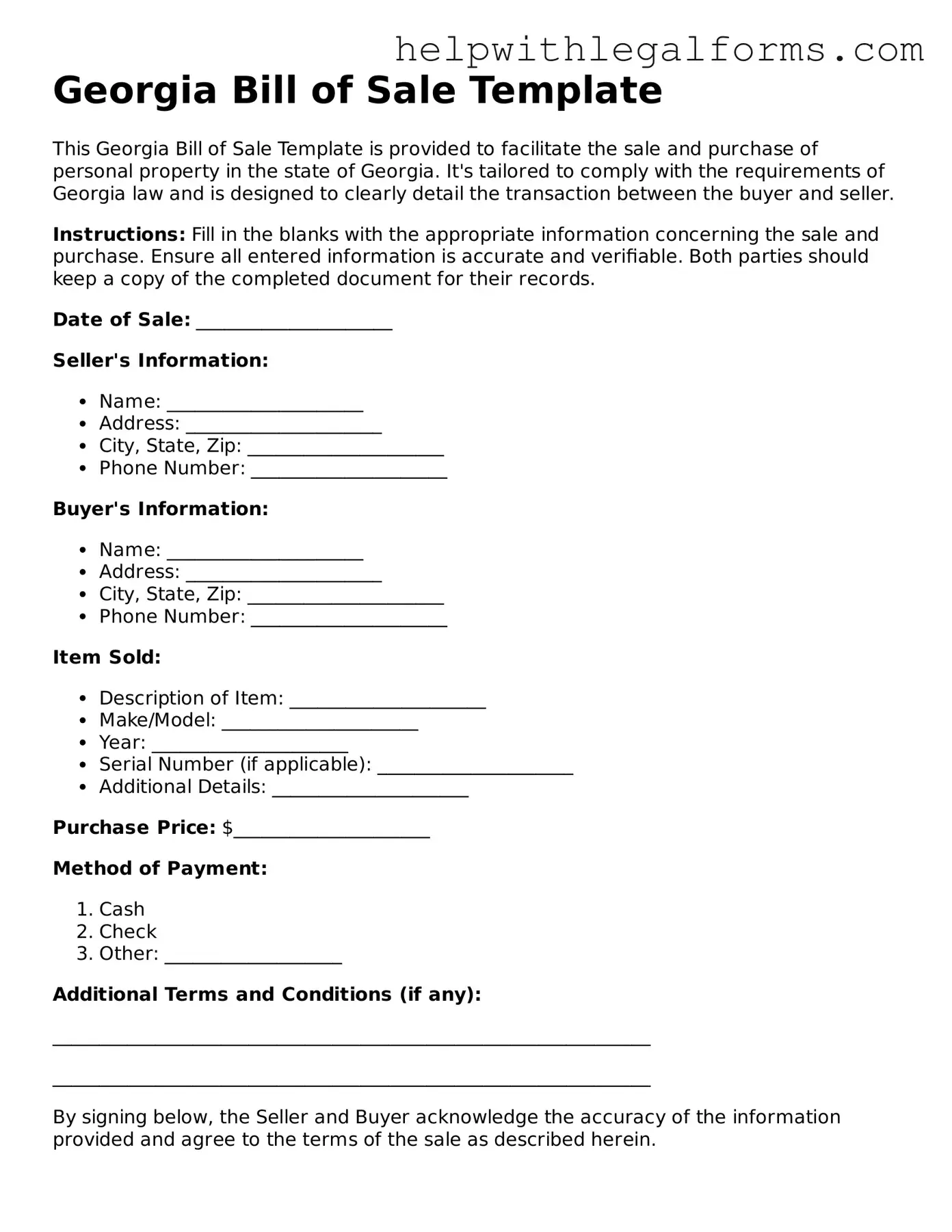

Example - Georgia Bill of Sale Form

Georgia Bill of Sale Template

This Georgia Bill of Sale Template is provided to facilitate the sale and purchase of personal property in the state of Georgia. It's tailored to comply with the requirements of Georgia law and is designed to clearly detail the transaction between the buyer and seller.

Instructions: Fill in the blanks with the appropriate information concerning the sale and purchase. Ensure all entered information is accurate and verifiable. Both parties should keep a copy of the completed document for their records.

Date of Sale: _____________________

Seller's Information:

- Name: _____________________

- Address: _____________________

- City, State, Zip: _____________________

- Phone Number: _____________________

Buyer's Information:

- Name: _____________________

- Address: _____________________

- City, State, Zip: _____________________

- Phone Number: _____________________

Item Sold:

- Description of Item: _____________________

- Make/Model: _____________________

- Year: _____________________

- Serial Number (if applicable): _____________________

- Additional Details: _____________________

Purchase Price: $_____________________

Method of Payment:

- Cash

- Check

- Other: ___________________

Additional Terms and Conditions (if any):

________________________________________________________________

________________________________________________________________

By signing below, the Seller and Buyer acknowledge the accuracy of the information provided and agree to the terms of the sale as described herein.

Seller's Signature: _____________________ Date: _____________________

Buyer's Signature: _____________________ Date: _____________________

This document is not valid unless all designated areas are completed and signatures are provided by both parties involved in the transaction.

This form does not necessarily constitute legal proof of ownership. It is advised to check Georgia state laws for any additional requirements or steps to finalize the sale and transfer of property.

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Purpose | Used to document and validate the private sale of various items between two parties in Georgia, including vehicles, boats, and personal property. |

| Governing Law | The form follows the guidelines set forth under Georgia's Uniform Commercial Code. |

| Notarization Requirement | For vehicles, Georgia law requires that the Bill of Sale be notarized. However, notarization is not mandatory for other types of personal property. |

| Additional Documentation | For vehicles, a completed Bill of Sale must be accompanied by a Certificate of Title at the time of registration. |

Instructions on How to Fill Out Georgia Bill of Sale

When you're involved in the buying or selling of a vehicle in Georgia, a crucial step is documenting the transaction accurately. A Bill of Sale form serves this purpose, providing a record that details the agreement between buyer and seller. This document is essential for the buyer's registration and titling process, and it may also serve as a valuable record for tax computation and legal proof of ownership. Understanding how to fill this form correctly is key to ensuring the transaction proceeds smoothly. Below are the detailed steps to complete the Georgia Bill of Sale form efficiently and accurately.

- Date of Sale: At the top of the form, enter the date the sale is taking place.

- Seller’s Information: Fill in the seller's full name, complete address (including city, state, and zip code), and phone number.

- Buyer’s Information: Provide the buyer's full name, complete address (including city, state, and zip code), and phone number.

- VIN (Vehicle Identification Number): Enter the unique VIN of the vehicle being sold.

- Make, Model, and Year: Detail the make, model, and year of manufacture of the vehicle.

- Odometer Reading: Provide the vehicle's current mileage, as shown on the odometer. Also, indicate whether the mileage is actual, not actual, or exceeds the mechanical limits.

- Sale Price: Specify the total amount agreed upon for the sale of the vehicle.

- Warranty Information: State whether the vehicle is being sold with a warranty or "as is." If there's a warranty, include the specifics.

- Signatures: The form must be signed by both the seller and the buyer. Include the date next to each signature for verification purposes. Additionally, the form may require notarization depending on local laws, so be prepared to have it notarized if necessary.

Filling out the Georgia Bill of Sale form with accurate and detailed information is critical. Once completed, the form acts as proof of purchase and sale, helping to protect both the buyer and seller. Remember to keep a copy of the filled-out document for your records. This form not only facilitates the vehicle registration process but also serves as a safeguard against potential legal disputes in the future.

Crucial Points on This Form

What is a Georgia Bill of Sale form?

A Georgia Bill of Sale form is a legal document used during the sale of personal items, vehicles, or other property between two parties in the state of Georgia. It records the transaction in detail, providing proof of the change in ownership. This form typically includes information such as the description of the item sold, the sale price, and the names and signatures of both the seller and the buyer.

Is a Bill of Sale required in Georgia for all sales transactions?

No, a Bill of Sale is not required for all sales transactions in Georgia. However, it is crucial for the sale of motor vehicles, boats, and other significant assets. It serves as a receipt for the transaction and can be required for registration and tax purposes. For personal property transactions, it is advisable but not legally mandated.

Does a Georgia Bill of Sale form need to be notarized?

In Georgia, not all Bill of Sale forms need to be notarized. Specifically, when a Bill of Sale is used for the purchase or sale of a motor vehicle, it does not require notarization. However, notarizing the document, even when not required, adds an extra layer of legal protection by verifying the identity of the signatories and the authenticity of their signatures.

What information is required on a Georgia Bill of Sale form?

A Georgia Bill of Sale form should include detailed information to be considered valid. Essential details are the full names and addresses of both the seller and the buyer, a comprehensive description of the item being sold (including model, make, year, and serial number, if applicable), the sale date, the purchase price, and the signatures of both parties involved in the transaction.

Can a Bill of Sale be used as proof of ownership in Georgia?

Yes, a Bill of Sale can be used as proof of ownership in Georgia, especially for personal property and vehicles. It acts as a receipt for the transaction and can be instrumental during the registration process or when required to show proof of ownership in legal situations.

What happens if I lose my Georgia Bill of Sale?

If you lose your Georgia Bill of Sale, it is recommended to promptly contact the other party involved in the transaction to secure a copy. If this is not possible, drafting a new document that includes all the original information, getting it signed by both parties, and, if applicable, having it notarized, can serve as a substitute. Although it’s a complication, maintaining accurate records can prevent or solve potential legal issues.

Can a Georgia Bill of Sale be completed and signed digitally?

Yes, a Georgia Bill of Sale can be completed and signed digitally, as long as it adheres to the same requirements as a handwritten document. Electronic signatures are legally recognized in Georgia. However, ensure that the digital platform used complies with the federal Electronic Signatures in Global and National Commerce Act (ESIGN Act) to guarantee the document's validity.

Are there any special considerations for completing a Bill of Sale for a motor vehicle in Georgia?

When completing a Bill of Sale for a motor vehicle in Georgia, specific additional details are needed for it to be recognized as valid. This includes the vehicle identification number (VIN), the odometer reading at the time of sale, and adherence to the Georgia Department of Revenue’s specific requirements for vehicle transactions. Furthermore, filing this Bill of Sale with the local tax commissioner's office might be necessary for vehicle registration or title transfer purposes.

Common mistakes

-

Not providing complete details of both parties involved can lead to issues. A full name, address, and contact information for both the seller and the buyer are crucial. Leaving out any of these details may make the document less credible or invalid.

-

Forgetting to include a thorough description of the item being sold is a common mistake. It’s important to list the make, model, year, and any identifying numbers (like a vehicle identification number for cars or serial number for other items) to ensure the exact item is recognized in the sale.

-

Not specifying the sale conditions can lead to future disputes. Whether the item is being sold "as is" or with a warranty should be clearly stated to set the right expectations and obligations for both parties.

-

Omitting the sale date or putting an incorrect date can create confusion about when the transaction officially took place. This detail is especially important for record-keeping and for any potential legal or warranty claims.

-

Failing to mention the payment details is another oversight. Whether the payment is made in full, in installments, or if a trade is involved, including the total sale amount and the payment method is fundamental for a complete bill of sale.

-

Skipping the signatures or not having the document notarized if required. The buyer's and seller's signatures make the document legally binding, and some states may require notarization for the bill of sale to be valid.

-

It’s essential to check if Georgia mandates notarization for the type of sale being documented.

-

Documents used along the form

When completing a transaction that requires a Georgia Bill of Sale form, several additional forms and documents are commonly used to ensure the process is thorough and legally compliant. These forms serve various functions, from verifying personal information to ensuring the item being sold is free of liens. Understanding these documents can streamline the transaction process, making it smoother and more secure for all parties involved.

- Odometer Disclosure Statement: This document is crucial when selling a vehicle. It records the vehicle's mileage at the time of sale and helps to confirm the accuracy of the vehicle’s mileage for the buyer.

- Title Certificate: The Title Certificate is necessary whenever a vehicle or boat is being sold. It proves ownership of the item and is required to be transferred to the new owner upon sale.

- Warranty of Fitness: This form is particularly relevant for sales of items that are expected to meet certain performance standards, indicating whether the item is being sold as-is or with a warranty.

- Release of Liability: This release form is important for the seller to protect themselves from legal responsibility for any accidents or injuries that may occur with the item after the sale.

- Loan Payoff Letter: If the item being sold has a lien against it, this document from the lender stating the amount required to pay off the loan in full is crucial. It ensures that the lien can be removed.

- Registration Documents: For vehicles, boats, or other registrable items, these documents confirm that the item is registered in the state and provide proof of the item's legal status.

- Bill of Sale - Personal Property: Similar to the Georgia Bill of Sale form, but used for the sale of personal items such as furniture, electronics, or tools, indicating the transfer of ownership.

- Power of Attorney: This legal document may be necessary if one party is acting on behalf of another in the sale, granting them the authority to sign documents and make decisions regarding the sale.

Together, these documents help to create a clear and lawful agreement between the buyer and seller, laying the groundwork for a successful and dispute-free transaction. By familiarizing oneself with these documents, individuals can better prepare for the complexities of buying or selling valuable items, ensuring that all legal obligations are met and that the transaction proceeds smoothly.

Similar forms

Warranty Deed: Just like a Bill of Sale, a Warranty Deed is used to transfer ownership, but it specifically relates to real estate. Both documents provide guarantees about the seller's right to transfer the title and declare that the property is free from liens.

Quitclaim Deed: This document also deals with the transfer of property rights, similar to a Bill of Sale. However, a Quitclaim Deed does not guarantee that the property is lien-free or that the grantor holds clear ownership, marking a key difference in the level of protection offered.

Vehicle Title: Similar to a Bill of Sale, a Vehicle Title is essential for proving ownership of a vehicle. When a vehicle is sold, the Bill of Sale complements the Vehicle Title by recording the transaction details and acting as proof of the transfer agreement.

Promissory Note: While a Promissory Note outlines the terms for repaying a debt, it shares common ground with a Bill of Sale in that both can include specific details about the transaction and the agreement between the parties involved.

Sales Agreement: Both a Sales Agreement and a Bill of Sale are used to document the sale of goods. However, a Sales Agreement often provides more detailed terms and conditions of the sale, while a Bill of Sale serves as conclusive evidence that the property has changed hands.

Receipt: A receipt is a simple document acknowledging that a payment has been made. It is similar to a Bill of Sale in the sense that both confirm a transaction has occurred, but a Bill of Sale usually includes more detailed information about the sale and the items sold.

Loan Agreement: Although primarily used for outlining the terms of a loan between a borrower and lender, a Loan Agreement shares similarities with a Bill of Sale as it lays down the specific obligations of each party involved in the transaction.

Transfer of Business Ownership Agreement: This document is used when the ownership of a business changes hands. Like a Bill of Sale, it records the details of the transaction, ensuring that the transfer is legally documented and agreed upon by both parties.

Dos and Don'ts

In the state of Georgia, completing a Bill of Sale form is a critical step in the process of buying or selling a vehicle, firearm, boat, or other large-ticket items. For such transactions to be legally recognized, paying close attention to how you fill out this document is essential. To assist you, here’s a compiled list of dos and don'ts you should consider to ensure the form is completed accurately and effectively.

Do:Ensure all information is complete and accurate: Double-check names, addresses, descriptions of the item being sold, and the sale price.

Include detailed descriptions: For vehicles, boats, or firearms, include make, model, year, color, identification numbers, and any other identifying features.

Verify the identity of both parties: Make sure you confirm the identity of the buyer and seller to prevent fraud.

Sign and date the form in the presence of a notary public: Georgia law may require a Bill of Sale to be notarized, depending on the item being sold.

Keep multiple copies: Both the buyer and seller should keep a copy of the Bill of Sale for their records and any future disputes that may arise.

Report the sale to the appropriate state agency: If the sale involves a vehicle, boat, or firearm, you may need to report the transaction to the respective state department.

Rush through the process: Taking your time to fill out the form correctly is vital to prevent mistakes that could nullify the sale.

Leave blank spaces: If certain sections do not apply, write ‘N/A’ (not applicable) instead of leaving them blank to avoid fraudulent alterations.

Forget to specify payment details: Clearly state the amount paid and whether the transaction was completed with cash, check, or another method.

Ignore legal requirements for specific items: Some sales, like those of firearms, may have additional legal requirements. Make sure these are thoroughly addressed.

Dispose of your copy too soon: Keeping a record of the Bill of Sale protects you if questions or legal issues regarding the transaction arise later.

Overlook the importance of a witness or notarization: While not always required, having a witness or notarization can add an extra layer of legality and protection.

Misconceptions

When it comes to transferring the ownership of property or vehicles in Georgia, the Bill of Sale form is a crucial document. However, several misconceptions surround its use and requirements. Understanding these misconceptions is essential for a smooth transaction process. Here are five common misunderstandings about the Georgia Bill of Sale form:

- It's only for Motor Vehicles: Many people believe that the Bill of Sale form is exclusively used for motor vehicle transactions. In reality, this document is versatile and can be used for the sale of various types of personal property, including boats, firearms, and even animals.

- Notarization is Always Required: Another common misconception is that the Bill of Sale form must be notarized to be valid. While notarization provides an extra layer of legality and protection, Georgia law does not require every Bill of Sale to be notarized. The need for notarization can depend on the type of transaction and the specific requirements of the local county.

- A Bill of Sale is the Only Document Needed: Some people might think that a Bill of Sale is the only necessary document for transferring ownership. However, depending on the nature of the transaction, other paperwork such as a title transfer or registration documents may also be required. It's crucial to check the specific requirements in your area.

- There is a Standard State-Issued Form: While some states might provide a standard Bill of Sale form, Georgia does not have a universal state-issued template. Individuals are usually responsible for drafting their own form or using a template that meets all legal criteria and clearly outlines the terms of the sale.

- Verbal Agreements are Just as Binding: Relying on verbal agreements during significant transactions is a common pitfall. A verbal agreement might seem convenient, but without a written Bill of Sale, enforcing the terms or proving the details of the transaction can be challenging. A written and signed Bill of Sale provides a tangible record that is crucial for protection and legal purposes.

By dispelling these misconceptions, individuals can ensure that they are properly prepared and protected during the sale or purchase of goods in Georgia. Remember, understanding your obligations and the legal requirements is the first step toward a successful transaction.

Key takeaways

When dealing with the Georgia Bill of Sale form, understanding its purpose and how to properly fill it out is crucial. This document serves as a vital record of the transaction between a buyer and a seller. Here are key takeaways for efficiently handling this form:

- It acts as proof of purchase: This form provides evidence that a transaction took place, noting the transfer of ownership of an item, such as a vehicle, from one party to another.

- Completion is straightforward: While filling out the form, specifics such as the buyer's and seller's names, addresses, the sale date, and the item's details (e.g., make, model, year, and VIN for vehicles) are required. Ensuring accuracy in these details is crucial.

- Verification is key: Both the buyer and the seller should verify the information on the form. This act minimizes future disputes by ensuring that all details are accurate and agreed upon.

- Notarization may be necessary: Depending on the circumstances of the sale, notarizing the document might be required. Although not always a legal necessity in Georgia, notarization adds an extra layer of authenticity to the transaction.

- Record keeping is essential: Both parties should keep copies of the completed form. This documentation can be vital for tax purposes, future disputes, or as a record of ownership for the buyer.

Understanding these key aspects of the Georgia Bill of Sale form can significantly streamline the sales process, while also providing necessary legal protections for both buyer and seller.

Create Other Bill of Sale Forms for US States

Free Bill of Sale for Car New Jersey - It includes critical information such as the names of the buyer and seller, description of the item, and the sale price.

Can I Sell a Car With a Lien - Acts as a receipt for the transaction, specifying the goods or property sold and the compensation received.