Blank Golf Cart Bill of Sale Form for Georgia

When engaging in the sale or purchase of a golf cart in Georgia, a crucial document that facilitates the process is the Georgia Golf Cart Bill of Sale form. This form not only records the transaction in a formal and legal manner but also offers protection and clarity for both the buyer and the seller. By meticulously documenting the key details of the transaction, such as the date of sale, purchase price, and descriptions of the golf cart, this document ensures that there is a mutual understanding and agreement between the two parties involved. Moreover, the inclusion of both parties' personal information, along with signatures, empowers this document to serve as a binding contract. This form holds significant value as it can be used for registration purposes and may also be required for insurance. Understanding the components and importance of the Georgia Golf Cart Bill of Sale form is essential for anyone looking to engage in the private sale of a golf cart within the state, providing a structured and secure approach to what might otherwise be an informal and potentially problematic transaction.

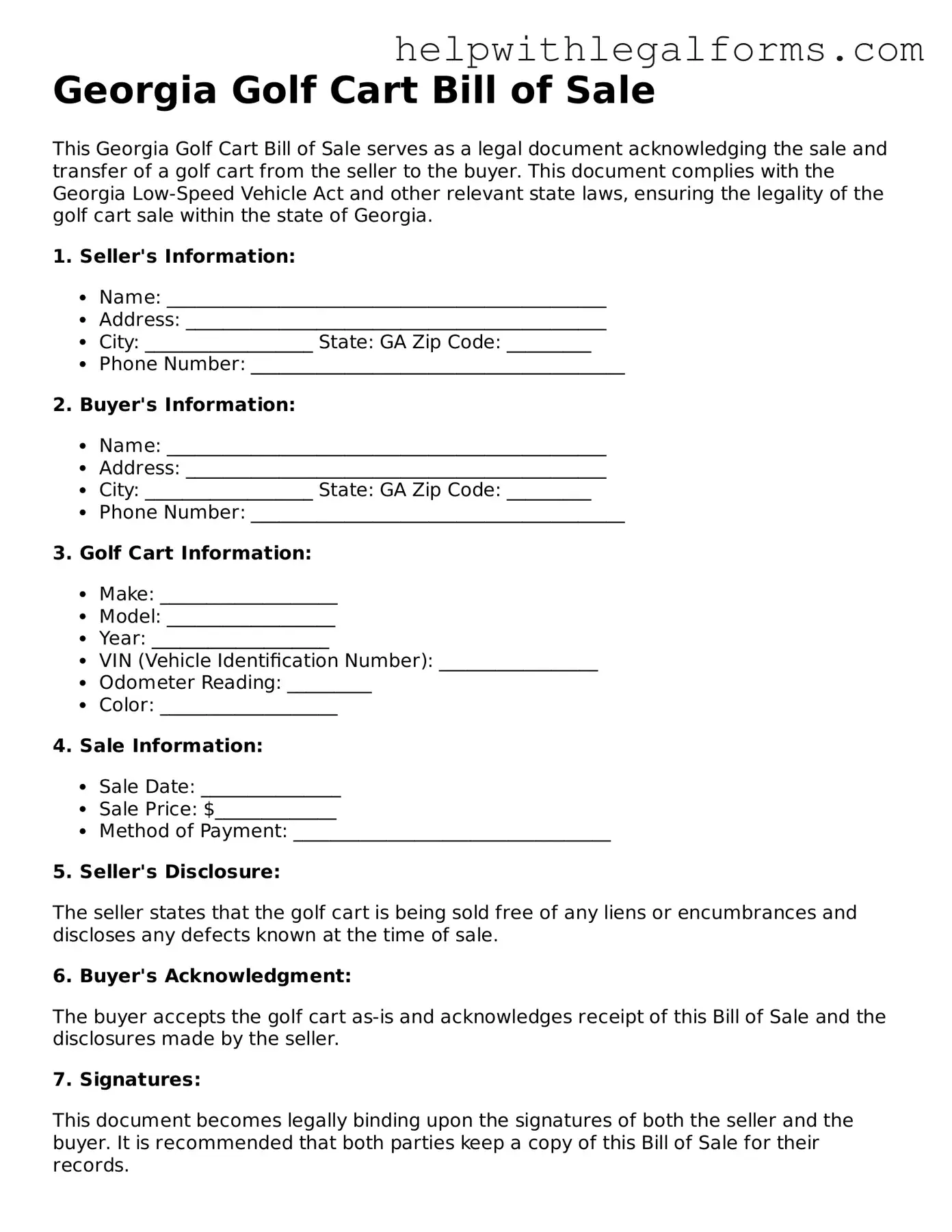

Example - Georgia Golf Cart Bill of Sale Form

Georgia Golf Cart Bill of Sale

This Georgia Golf Cart Bill of Sale serves as a legal document acknowledging the sale and transfer of a golf cart from the seller to the buyer. This document complies with the Georgia Low-Speed Vehicle Act and other relevant state laws, ensuring the legality of the golf cart sale within the state of Georgia.

1. Seller's Information:

- Name: _______________________________________________

- Address: _____________________________________________

- City: __________________ State: GA Zip Code: _________

- Phone Number: ________________________________________

2. Buyer's Information:

- Name: _______________________________________________

- Address: _____________________________________________

- City: __________________ State: GA Zip Code: _________

- Phone Number: ________________________________________

3. Golf Cart Information:

- Make: ___________________

- Model: __________________

- Year: ___________________

- VIN (Vehicle Identification Number): _________________

- Odometer Reading: _________

- Color: ___________________

4. Sale Information:

- Sale Date: _______________

- Sale Price: $_____________

- Method of Payment: __________________________________

5. Seller's Disclosure:

The seller states that the golf cart is being sold free of any liens or encumbrances and discloses any defects known at the time of sale.

6. Buyer's Acknowledgment:

The buyer accepts the golf cart as-is and acknowledges receipt of this Bill of Sale and the disclosures made by the seller.

7. Signatures:

This document becomes legally binding upon the signatures of both the seller and the buyer. It is recommended that both parties keep a copy of this Bill of Sale for their records.

- Seller's Signature: ________________________ Date: ___________

- Buyer's Signature: _________________________ Date: ___________

8. Notary Public (if applicable):

This section is to be completed by a Notary Public if required by local law or for additional legal assurance.

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Definition | A Georgia Golf Cart Bill of Sale form is a legal document that records the sale and purchase of a golf cart in Georgia, outlining the details of the transaction between the buyer and seller. |

| Primary Use | It serves as proof of ownership transfer and is used for the registration of the golf cart with local authorities, if required. |

| Key Components | This form typically includes information such as the make, model, year, serial number of the golf cart, as well as the names, addresses, and signatures of both the buyer and seller. |

| Governing Law | In Georgia, golf carts are regulated under the Official Code of Georgia Annotated (O.C.G.A.) § 40-6-331, which outlines the operation and equipment requirements for personal transportation vehicles. |

| Requirements | While not specifically mandated by state law, a Bill of Sale is strongly recommended as it provides a record of the sale and can be beneficial for tax and legal purposes. |

| Local Regulation Compliance | Some localities may have additional requirements or restrictions regarding the use and registration of golf carts, which should be verified by the buyer and seller. |

| Importance of Accuracy | Ensuring the accuracy of all information on the bill of sale is crucial, as it protects both parties in case of disputes and is essential for any potential registration or insurance needs. |

| Additional Documentation | While the bill of sale is critical, additional documents, such as the title or a manufacturer’s certificate of origin, may be required for registration purposes depending on local regulations. |

Instructions on How to Fill Out Georgia Golf Cart Bill of Sale

When transferring ownership of a golf cart in Georgia, both the seller and the buyer must document the transaction to ensure it's legally recognized. The Golf Cart Bill of Sale form plays a crucial role in this process, providing a record that includes details about the golf cart, the sale price, and both parties involved. Once filled, it serves as evidence of the transaction, which can be vital for registration, tax purposes, and protecting both parties against future disputes. The following instructions will guide you through each step to accurately complete the form.

- Start by entering the date of sale at the top of the form.

- Write the full name and address of the seller in the space provided.

- Next, fill in the full name and address of the buyer.

- Describe the golf cart, including its make, model, year, and serial number.

- Specify the sale price of the golf cart in US dollars.

- Both the buyer and seller must read the statements regarding the accuracy of the information provided and any warranty conditions. If the golf cart is sold "as is," this should be clearly indicated.

- Have the seller sign and date the form, confirming their intention to sell the golf cart under the stated terms.

- The buyer should then sign and date the form, acknowledging their agreement to the terms and receipt of the golf cart.

- It is highly recommended to have the signatures notarized, though not mandatory, to add an extra layer of legal protection.

Completing the Georgia Golf Cart Bill of Sale form correctly is a straightforward yet important step in the transaction process. It formalizes the transfer of ownership and provides a written record of the sale, which can be instrumental in avoiding misunderstandings or legal issues down the line. Both parties should keep a copy of the signed document for their records. Following these steps ensures that the legality of the golf cart sale is properly documented, securing peace of mind for everyone involved.

Crucial Points on This Form

What is a Georgia Golf Cart Bill of Sale form?

A Georgia Golf Cart Bill of Sale form is a document that records the sale and transfer of ownership of a golf cart from the seller to the buyer within the state of Georgia. This document not only provides proof of purchase but also details the agreement between both parties, including the sale price, date of sale, and identifying information about the golf cart and the parties involved.

Why do I need a Golf Cart Bill of Sale in Georgia?

Having a Golf Cart Bill of Sale in Georgia is crucial for several reasons. It serves as a legal record of the transaction, which can be used for registration purposes, resolving disputes, and as evidence for tax purposes. Additionally, it protects both the buyer and the seller in case any questions or issues about the golf cart's ownership or condition arise after the sale.

What information should be included in a Golf Cart Bill of Sale?

A comprehensive Golf Cart Bill of Sale should include: the date of the sale, full names and addresses of the buyer and seller, a detailed description of the golf cart (including make, model, year, and serial number), the sale price, payment terms, and signatures of both parties involved. Including an acknowledgment of the golf cart's condition at the time of sale is also advisable.

Is notarization required for a Golf Cart Bill of Sale in Georgia?

While not always required, getting the Bill of Sale notarized can add an extra layer of authenticity and legal protection to the transaction. Notarization ensures that the signatures on the document are legitimate, significantly reducing the risk of fraud.

Can I use a Bill of Sale template found online for a golf cart sale in Georgia?

Yes, you can use a template found online for a golf cart sale in Georgia. However, it is important to ensure that the template includes all necessary details specific to the transaction and complies with Georgia state laws. It may be beneficial to consult legal advice to ensure the document meets all legal requirements.

How do I register a golf cart in Georgia after the sale?

Registration requirements for golf carts vary by county and city within Georgia. Generally, you should contact your local Department of Motor Vehicles (DMV) or similar agency to find out specific requirements, which may include submitting the Bill of Sale, proof of insurance, and paying a registration fee. Ensure to check local ordinances as some areas have specific rules regarding golf cart usage on public roads.

Do I need to keep a copy of the Golf Cart Bill of Sale?

Yes, both the buyer and the seller should keep a copy of the Golf Cart Bill of Sale. This document serves as a receipt for the buyer and a record of the sale for the seller. It is essential for future reference, especially in disputes or when required to prove ownership or the terms of the sale.

What happens if I lose my Golf Cart Bill of Sale?

If you lose your Golf Cart Bill of Sale, it is advisable to contact the other party involved in the transaction and request a copy. If that’s not possible, drafting a new document detailing the transaction and having it signed again by both parties may be necessary. Note, however, that without the original document, proving the specifics of the original agreement may be challenging.

Can a Golf Cart Bill of Sale be used for tax purposes?

Yes, a Golf Cart Bill of Sale can be used for tax purposes. It provides proof of the purchase price, which may be needed for sales tax reporting or property tax assessments. Always retain a copy for your records to have it available for tax filings and any questions from tax authorities.

What to do if there are mistakes in the Golf Cart Bill of Sale?

If there are mistakes in the Golf Cart Bill of Sale, it's important to correct them as soon as they are discovered. Both parties should agree on the corrections, initial any changes, and if necessary, create a new Bill of Sale with the correct information. To avoid disputes, keep a record of all amendments made to the original document.

Common mistakes

Filling out the Georgia Golf Cart Bill of Sale form requires attention to detail. Common mistakes can create delays and even legal issues down the line. To ensure a smooth transaction, it's important to be mindful of these pitfalls.

Not double-checking the vehicle identification number (VIN) - The VIN is crucial for identifying the golf cart. A single mistake in this series of numbers and letters can lead to incorrect registration and legal complications.

Omitting the make, model, and year - Providing complete details about the golf cart, such as its make, model, and year of manufacture, is essential for both buyer and seller records. This information also aids in the valuation of the cart.

Skipping the sale date - The transaction date is often overlooked but is important for record-keeping and sometimes tax purposes. It's vital to accurately record when the sale occurred.

Failing to specify the sale amount - Being clear about the sale price in the document ensures transparency and can prevent disputes. It also is critical for taxation assessment for both parties.

Leaving out buyer and seller information - Complete names and addresses of both the buyer and seller should be clearly stated. This is not only a requirement but also beneficial should any contact need to be made in the future.

Not securing a signature from both parties - The bill of sale is not legally binding without the signatures of both the buyer and seller. This oversight can invalidate the document.

Ignoring the need for witness signatures or a notary - Depending on local laws, having a witness or notarizing the bill of sale can add an extra layer of legal security to the transaction.

Forgetting to verify the form's compliance with local laws - Laws governing the sale of golf carts can vary significantly from one place to another. Ensuring that the bill of sale complies with Georgia's specific regulations is crucial.

Using an incorrect form - Sometimes, individuals mistakenly use a generic bill of sale form that may not cover specific details relevant to a golf cart. Always use the correct, vehicle-specific form.

Misunderstanding the purpose of the document - It's not uncommon for people to confuse a bill of sale with a title or registration document. Understanding its role as a record of sale and transfer of ownership can prevent this mistake.

When completing the Georgia Golf Cart Bill of Sale, taking the time to avoid these common mistakes can ensure a legitimate and trouble-free transaction. Remember, the details matter and getting them right the first time is invaluable.

Documents used along the form

When buying or selling a golf cart in Georgia, the Golf Cart Bill of Sale form is crucial. However, to ensure a smooth and legally binding transaction, other documents often accompany this bill of sale. These documents not only provide additional legal protection but also help both parties understand the full scope of their agreement. Here's a look at some of these important forms and documents that are typically used in the process.

- Certificate of Title: This document proves ownership of the golf cart. It's transferred from the seller to the buyer and is necessary for legal recognition of the new owner.

- Registration Form: Required for golf carts that will be driven on public roads. In Georgia, registering a golf cart helps in identifying the vehicle and owner, similar to a car registration process.

- Proof of Insurance: Although not always mandatory for golf carts, having insurance can protect against liability in case of accidents. Proof of insurance should be obtained prior to completing the sale.

- Warranty Document: If the golf cart is still under warranty, transferring this document to the new owner ensures they can avail of any remaining coverage.

- Service Records: Shows the maintenance history of the golf cart, giving the buyer insights into its condition and any potential future issues.

- Odometer Disclosure Statement: Even though this is more common with motor vehicles, an odometer statement for golf carts can help verify the usage and condition of the cart.

- Release of Liability: Releases the seller from any future claims of damage or injury that may occur with the golf cart after the sale.

- Notarized Letter of Permission: If applicable, this letter is needed when a minor is buying a golf cart, giving them the legal right to enter into a contract under the supervision of a guardian or parent.

Together, these documents create a comprehensive package that facilitates a legally sound and hassle-free transaction for a golf cart sale in Georgia. They not only safeguard the interests of both the buyer and seller but also help in adhering to state laws and regulations. Remember to always check the most current requirements in your locality as laws and regulations can change.

Similar forms

The Vehicle Bill of Sale form shares a fundamental similarity with the Golf Cart Bill of Sale in that both serve as legal documents to prove the transfer of ownership from seller to buyer. They detail the transaction specifics, including the sale price, date, and identifying information of the property (golf cart or vehicle), ensuring that the buyer has a record affirming their new ownership.

Akin to the Golf Cart Bill of Sale, the Boat Bill of Sale documents the sale and transfer of ownership of a watercraft from one party to another. It contains information about the boat, the sale transaction, the parties involved, and any warranties or agreements. This form is crucial for the registration process of the boat in the buyer's name and for legal protection in the event of future disputes.

Similarly, the Firearm Bill of Sale is a document used to record the sale or transfer of a gun from a seller to a buyer. It includes detailed information about the firearm, the identities of the buyer and seller, and the transfer date. This document provides evidence of ownership and is important for compliance with state and federal regulations governing firearm sales and ownership.

The Business Bill of Sale also parallels the Golf Cart Bill of Sale in its function to document the sale and transfer of ownership of a business entity or its assets. It outlines the terms of the sale, identifies the parties, and lists the assets being transferred (which could include tangible and intangible assets). This document is vital for the legal transfer of business properties and to assist in the valuation and taxation processes post-sale.

Dos and Don'ts

When you're filling out a Georgia Golf Cart Bill of Sale form, it's crucial to be thorough and accurate. This document serves as a legal record of the transaction and can protect both the buyer and seller if disputes arise. Below are 10 essential dos and don'ts to guide you through the process:

Dos:- Verify the buyer's and seller's information: Ensure names, addresses, and contact information are correct.

- Describe the golf cart accurately: Include the make, model, year, and any identifying details like the serial number.

- State the sale price clearly: Make sure to write the amount in both words and figures for clarity.

- Include the sale date: This is crucial for both parties to know the effective date of the sale.

- Mention any included warranties or "as-is" condition: Be clear if the golf cart comes with a warranty or if it's being sold in its current condition without guarantees.

- Sign and date the form: Both the buyer and seller must sign the form to make it legally binding.

- Keep copies for your records: Both parties should keep a copy of the signed bill of sale for future reference.

- Verify that all information is legible: Ensure the handwriting or typed information is clear and easy to read.

- Consult legal advice if unsure: If you have any doubts about the form or process, seek guidance from a legal professional.

- Follow Georgia's local laws: Ensure the bill of sale meets all local Georgia requirements for such a transaction.

- Avoid leaving blank spaces: Instead of leaving blanks, write "N/A" for not applicable sections to prevent alterations after signing.

- Don't forget to check identification: Confirm the identity of the buyer and seller to prevent fraud.

- Don't skip details about the transaction: Omitting details can lead to misunderstandings or disputes later.

- Don't use unclear terms: Avoid using jargon or ambiguous language that could be misinterpreted.

- Don't rely solely on verbal agreements: Verbal promises should be written into the bill of sale to ensure they are legally binding.

- Don't sign without reading: Ensure you fully understand all aspects of the bill of sale before signing it.

- Don't forget to date the signatures: Unsigned documents or those without a date may not be considered valid.

- Don't ignore discrepancies: If any information doesn't match up, address it before completing the sale.

- Don't fail to specify payment details: Clearly outline the payment method, whether it’s cash, check, or another form.

- Don't withhold information: Being transparent about the golf cart's condition is essential for a fair transaction.

Misconceptions

When discussing the Georgia Golf Cart Bill of Sale form, there are several misconceptions that frequently surface. Addressing these misunderstandings is vital for a clear and accurate interpretation of the requirements for such transactions in the state of Georgia. Let's clarify some of the most common misconceptions.

- It's not necessary for private sales. A common misconception is that a Bill of Sale is only required for dealerships or commercial transactions. However, Georgia law requires a Bill of Sale for private sales as well, including those for golf carts. This document plays a critical role in establishing proof of purchase and the transfer of ownership.

- Any form will suffice. Some might believe that any handwritten note or generic form is acceptable as a Bill of Sale. However, the state of Georgia has specific information that must be included for the document to be legally binding. This includes details on the buyer and seller, the sale amount, and the golf cart’s description.

- There’s no need to notarize. While not every state requires a Bill of Sale to be notarized, it is a recommended practice in Georgia. Notarization adds a layer of legal protection and authenticity to the document, though it's not mandated by law for it to be effective regarding golf carts.

- Only the buyer needs a copy. It's a frequent misunderstanding that once the sale is completed, only the buyer requires a copy of the Bill of Sale. Both the buyer and the seller should keep a copy for their records. This document serves as proof of transfer of ownership and can be crucial for tax reporting and resolving any future disputes.

- Bill of Sale is sufficient for registration. Some individuals assume that presenting the Bill of Sale is all that’s needed to register a golf cart in Georgia. However, registration may require additional documentation, such as proof of insurance and a serial number verification. The Bill of Sale is an important part of this process but not the sole requirement.

- The form replaces a title. Another mistake is thinking the Bill of Sale functions as a title for a golf cart. In Georgia, golf carts typically do not have titles, but the Bill of Sale does not substitute for a title. It's a transaction record, not proof of ownership validated by the state.

- There's no consequence for not having one. Some may neglect the importance of having a Bill of Sale, believing there are no ramifications if the document is not provided during a sale. However, lacking a Bill of Sale can lead to complications in establishing ownership, securing insurance, and potential legal disputes concerning the golf cart’s history or ownership.

Understanding and correcting these misconceptions are essential steps toward ensuring that the sale process is compliant with Georgia law. Both buyers and sellers benefit from a well-prepared and accurate Bill of Sale, safeguarding their interests and facilitating a transparent and effective transfer of property.

Key takeaways

When participating in the transfer of ownership of a golf cart in Georgia, the Golf Cart Bill of Sale form plays a critical role. This document not only serves as a legal record of the sale but also provides vital information that protects both the buyer and the seller. Here are six key takeaways to keep in mind when filling out and using the Georgia Golf Cart Bill of Sale form:

- Complete Accuracy is Essential: Both parties should ensure that all information on the Bill of Sale is accurate and fully detailed. This includes the make, model, year, serial number, and any additional identifying details of the golf cart, along with the agreed-upon sale price.

- Identification of Parties: The full names, addresses, and contact information of both the seller and the buyer must be clearly stated. This identification aids in the event of any disputes or legal requirements that may arise post-sale.

- Signature Requirements: The Georgia Golf Cart Bill of Sale form must be signed by both the seller and the buyer. In some instances, it may also require a witness or notarization to further validate the document.

- The document acts as a Receipt: It serves as a proof of purchase for the buyer, which is particularly important for registration, insurance, and in case of any legal inquiries regarding the ownership of the golf cart.

- Registration Purposes: The Bill of Sale may be necessary for the buyer to register the golf cart with the local authorities, especially if the golf cart is to be used on public roads where such registration is a legal requirement.

- It's a Legal Document: The Bill of Sale serves as a binding legal document that confirms the transfer of ownership and can be used in court if any disputes over the golf cart arise in the future.

It is advisable for both parties to keep a copy of the Bill of Sale for their records, ensuring that they have proof of the transaction and the terms of the sale, should they need to reference it at a later date.

Create Other Golf Cart Bill of Sale Forms for US States

Golf Cart Bill of Sale Pdf - A meticulously prepared form that legitimizes the sale and purchase of a golf cart, specifying terms and verifying the deal.

Bill of Sale Golf Cart - In it, the seller declares that the golf cart is free of liens and encumbrances.