Blank Golf Cart Bill of Sale Form for Texas

When engaging in the sale of a golf cart in Texas, both the buyer and the seller are presented with a crucial step to ensure the transaction is recognized officially: completing a Texas Golf Cart Bill of Sale form. This document serves as a proof of purchase, detailing the transaction between the two parties involved. It usually includes important information such as the make, model, year, and serial number of the golf cart, alongside the selling price and the date of sale. The form not only provides legal protection for both the seller and the buyer but also facilitates the transfer of ownership in compliance with Texas state regulations. Its importance cannot be understated, as it also plays a role in the registration process, especially in communities where golf carts are a common mode of transportation. Beyond its immediate practicalities, the form acts as a record for tax purposes and could be vital in disputes or for warranty claims. Therefore, understanding the components and the significance of the Texas Golf Cart Bill of Sale is essential for anyone looking to conduct such a transaction within the state.

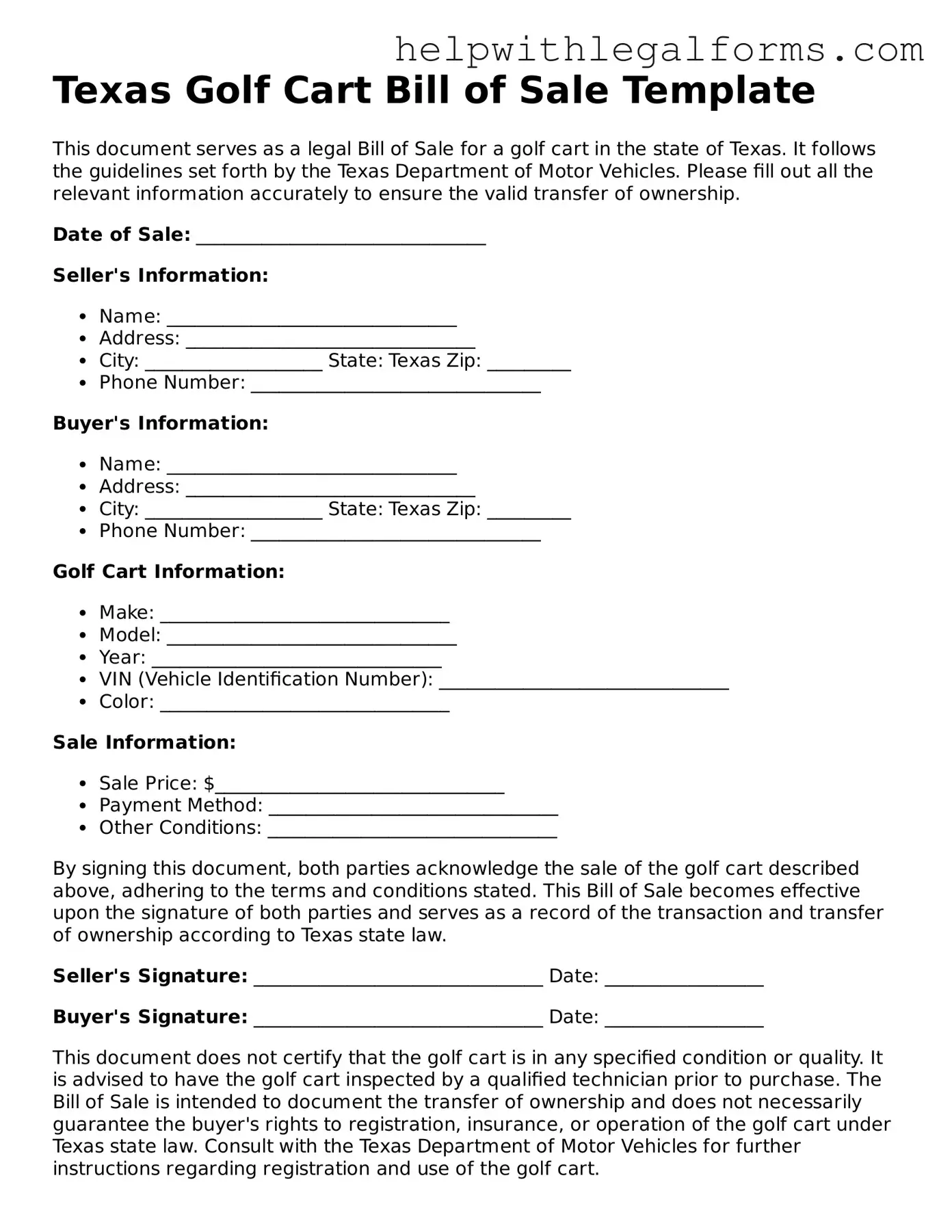

Example - Texas Golf Cart Bill of Sale Form

Texas Golf Cart Bill of Sale Template

This document serves as a legal Bill of Sale for a golf cart in the state of Texas. It follows the guidelines set forth by the Texas Department of Motor Vehicles. Please fill out all the relevant information accurately to ensure the valid transfer of ownership.

Date of Sale: _______________________________

Seller's Information:

- Name: _______________________________

- Address: _______________________________

- City: ___________________ State: Texas Zip: _________

- Phone Number: _______________________________

Buyer's Information:

- Name: _______________________________

- Address: _______________________________

- City: ___________________ State: Texas Zip: _________

- Phone Number: _______________________________

Golf Cart Information:

- Make: _______________________________

- Model: _______________________________

- Year: _______________________________

- VIN (Vehicle Identification Number): _______________________________

- Color: _______________________________

Sale Information:

- Sale Price: $_______________________________

- Payment Method: _______________________________

- Other Conditions: _______________________________

By signing this document, both parties acknowledge the sale of the golf cart described above, adhering to the terms and conditions stated. This Bill of Sale becomes effective upon the signature of both parties and serves as a record of the transaction and transfer of ownership according to Texas state law.

Seller's Signature: _______________________________ Date: _________________

Buyer's Signature: _______________________________ Date: _________________

This document does not certify that the golf cart is in any specified condition or quality. It is advised to have the golf cart inspected by a qualified technician prior to purchase. The Bill of Sale is intended to document the transfer of ownership and does not necessarily guarantee the buyer's rights to registration, insurance, or operation of the golf cart under Texas state law. Consult with the Texas Department of Motor Vehicles for further instructions regarding registration and use of the golf cart.

PDF Form Attributes

| Fact Number | Description |

|---|---|

| 1 | The Texas Golf Cart Bill of Sale form is a legal document that records the sale and transfer of a golf cart from one party to another within the state of Texas. |

| 2 | This form serves as a proof of purchase and includes details such as the date of sale, purchase price, and information about the buyer and seller. |

| 3 | In Texas, the Bill of Sale for a golf cart is not always mandated by law for the transfer process, but it is highly recommended for the protection of both parties. |

| 4 | Though not always mandatory, the form might be required by the Texas Department of Motor Vehicles (DMV) for registration and titling purposes, if applicable, to the golf cart in question. |

| 5 | The document should clearly identify the golf cart being sold, including make, model, year, and serial number or VIN (Vehicle Identification Number), if available. |

| 6 | It is essential to accurately specify the sale amount and any other terms or conditions related to the sale. This helps avoid potential disputes in the future about the sale terms. |

| 7 | Signing the Texas Golf Cart Bill of Sale form makes it legally binding. It’s advisable for both the buyer and the seller to retain a signed copy of the document. |

| 8 | To further ensure the validity of the transaction, it may be beneficial to have the signatures on the Bill of Sale notarized, although this is not a legal requirement in Texas. |

| 9 | Operating a golf cart within Texas follows specific state and local regulations, including where and how a golf cart can be legally used on public roads and spaces. |

| 10 | The Bill of Sale form does not replace the need for a title if one is required for the golf cart; it simply documents the transaction between the buyer and seller. |

Instructions on How to Fill Out Texas Golf Cart Bill of Sale

When selling or buying a golf cart in Texas, it's essential to document the transaction with a Golf Cart Bill of Sale form. This document not only provides proof of purchase but also ensures that the details of the agreement are clearly stated, protecting both parties involved in the transaction. The process of filling out the form is straightforward, but it requires attention to detail to ensure all the necessary information is accurately recorded.

- Begin by entering the date of the sale at the top of the form.

- Next, fill in the seller's full name and address, including the city, state, and ZIP code.

- Proceed by entering the buyer's full name and address, making sure to include the city, state, and ZIP code.

- Indicate the sale price of the golf cart in the space provided.

- Describe the golf cart, including the make, model, year, and vehicle identification number (VIN).

- State any additional terms and conditions of the sale that both the buyer and seller agree upon.

- Both the seller and the buyer must sign and print their names at the bottom of the form to validate the document.

- Finally, it's recommended to have the form notarized, though it's not a mandatory step, to provide an extra layer of security and verification for both parties.

Once the Golf Cart Bill of Sale form is filled out and signed, it serves as a legal document that confirms the transfer of ownership of the golf cart from the seller to the buyer. It's crucial for both parties to keep a copy of this form for their records, as it may be required for registration purposes or in the event of any disputes related to the sale in the future.

Crucial Points on This Form

What is a Texas Golf Cart Bill of Sale form?

A Texas Golf Cart Bill of Sale form is a legal document used to record the sale of a golf cart from the seller to the buyer in the state of Texas. This document includes details such as the date of sale, purchase price, and information about the golf cart, including the make, model, and serial number. It serves as proof of purchase and transfer of ownership.

Why do I need a Golf Cart Bill of Sale in Texas?

In Texas, a Golf Cart Bill of Sale is important for several reasons. It provides legal proof that the sale and purchase of the golf cart took place, which is useful for both personal record-keeping and legal protection. Additionally, this document is necessary for the buyer to register the golf cart with the appropriate local authorities, if required, and may also be needed for tax assessment purposes.

What information is required on a Texas Golf Cart Bill of Sale form?

The form typically requires details such as the names and addresses of the buyer and seller, the sale date, the sale price, and specific information about the golf cart (make, model, year, and serial number). Also, it should include any warranties or disclosures related to the condition of the golf cart. Signatures from both the buyer and seller are also necessary to validate the form.

Is notarization required for a Golf Cart Bill of Sale in Texas?

Notarization is not a legal requirement for a Golf Cart Bill of Sale in Texas. However, having the document notarized can add a layer of legal protection, verify the identities of the parties involved, and deter potential fraud. It is recommended but not mandatory.

Can I create a Golf Cart Bill of Sale form myself?

Yes, individuals are allowed to create their own Golf Cart Bill of Sale form as long as it contains all the necessary information required by law. There are also templates available online that can be used as a guideline. Nonetheless, it is advisable to ensure the form meets all state-specific requirements.

What should I do after completing the Golf Cart Bill of Sale?

After completing the Golf Cart Bill of Sale, both the buyer and seller should keep a copy for their records. The buyer may need to present this document when registering the golf cart or for taxation purposes. It is also wise to store the document securely in case any disputes or questions regarding the sale or ownership arise in the future.

Does the Golf Cart Bill of Sale transfer the title of the golf cart?

In Texas, the Golf Cart Bill of Sale itself does not transfer the title; it merely documents the transaction. If the golf cart has a title, a separate transfer of title form may need to be filled out and submitted to the appropriate state agency. The Bill of Sale is a necessary document that complements the process.

Do I need to register my golf cart after purchasing it in Texas?

The requirement for registering a golf cart depends on its use and the local ordinances within Texas. Some jurisdictions may require registration, especially if the golf cart is to be used on public roads under specific conditions. It is best to check with local authorities to understand the registration requirements in your area.

Can a Golf Cart Bill of Sale be used for disputes?

A Golf Cart Bill of Sale can be an important piece of evidence if there are any disputes regarding the sale or ownership of the golf cart. It provides a written record of the transaction, including the terms agreed upon by the buyer and seller, which can be useful for resolving disputes in a legal setting.

Common mistakes

Not verifying the buyer's or seller's information: Ensuring that all personal details are accurate and match legal documents is crucial. Mistakes here can lead to confusion or disputes about ownership.

Skipping the vehicle identification number (VIN): The VIN is essential for identifying the golf cart and verifying that it matches the one being sold. Omitting this detail can complicate future registrations or legal actions.

Failing to include the sale date and price: Without a clear record of when the sale occurred and for how much, both parties lack proof of the transaction's terms. This can lead to misunderstandings or tax issues.

Ignoring the need for witness signatures: While not always legally required, having a witness sign the bill of sale adds a layer of validity. It can serve as important evidence if disputes about the sale's authenticity arise.

Forgetting to detail the golf cart's condition: A thorough description of the cart’s condition, including any defects or modifications, protects both parties. It helps avoid disputes over its state at the time of sale.

Omitting a disclosure about the golf cart's legal status: If the golf cart has any liens against it or is subject to specific legal conditions (like restrictions on use), failing to disclose this information could result in legal complications for the buyer.

Not retaining a copy of the bill of sale: Both the buyer and seller should keep a copy of the signed bill of sale. It's their proof of transfer of ownership and can be crucial for registration, insurance, or legal reasons.

By steering clear of these errors, buyers and sellers can ensure a seamless transaction and protect their interests. It's always smart to review the document thoroughly before signing. When in doubt, consulting with a legal expert can help clarify any confusion, ensuring that the bill of sale meets all legal requirements in Texas.

Documents used along the form

When engaging in the purchase or sale of a golf cart in Texas, the Golf Cart Bill of Sale form serves as a crucial document for establishing a legal record of the transaction. However, to ensure a comprehensive and legally sound transaction, several other forms and documents are often used in conjunction with this bill of sale. These additional documents play vital roles in facilitating a smooth transfer of ownership, ensuring compliance with local regulations, and providing protection for both the buyer and seller.

- Title Transfer Form: This form is necessary to officially transfer the title of the golf cart from the seller to the buyer, recognizing the buyer as the new legal owner.

- Odometer Disclosure Statement: This document is important for confirming the mileage on the golf cart at the time of sale, ensuring accuracy in representation and preventing fraud.

- Warranty Document: If applicable, a warranty document outlines the seller's guarantee concerning the condition of the golf cart, specifying any coverage for repair or maintenance.

- Registration Forms: These are required to register the golf cart with local authorities, a process that may involve the submission of specific forms to a designated department or agency.

- Proof of Insurance: This document verifies that the golf cart is insured, which is often a requirement for registration and operation in certain areas.

- Sales Receipt: In addition to the bill of sale, a detailed sales receipt can provide a comprehensive overview of the transaction, including the price, date of sale, and any other agreed-upon conditions.

- As-Is Agreement: This form clarifies that the golf cart is being sold in its present condition, with the buyer accepting any faults or issues that may not be immediately apparent.

- Release of Liability: Upon completion of the sale, this form releases the seller from any future claims or liability related to the golf cart’s use or performance.

- Personal Identification: Both parties may be required to show government-issued identification to verify their identities during the sale and title transfer process.

To guarantee that the sale adheres to all legal requirements and that both parties have clear expectations, utilizing these documents in conjunction with the Texas Golf Cart Bill of Sale is advisable. Altogether, these forms contribute to a transparent, secure, and efficient transaction, minimizing potential disputes and ensuring compliance with state regulations. For buyers and sellers alike, understanding and preparing these documents before finalizing a sale can significantly enhance the experience, offering peace of mind throughout the process.

Similar forms

Vehicle Bill of Sale: Similar to a Golf Cart Bill of Sale, a Vehicle Bill of Sale is used during the purchase or sale of a car or truck. It documents the transfer of ownership from the seller to the buyer and typically includes details such as the make, model, year, VIN (Vehicle Identification Number), and the purchase price. This document ensures that the transaction is officially recorded.

Boat Bill of Sale: This document functions like the Golf Cart Bill of Sale but for watercraft transactions. It records the sale of boats, yachts, or any marine vessels, detailing the vessel's description, hull identification number (HIN), make, model, year, and any other pertinent information that verifies the transfer of ownership.

Firearm Bill of Sale: While dealing with an entirely different type of item, a Firearm Bill of Sale shares the same purpose of documenting the transfer of ownership. It includes specific details about the firearm being sold, such as the make, model, caliber, and serial number, along with the buyer's and seller's information, ensuring a legal exchange.

Equipment Bill of Sale: This document is used in the sale of machinery or heavy equipment. Like the Golf Cart Bill of Sale, it serves to officially document the transaction and details about the equipment (e.g., make, model, condition, serial number) alongside the terms of the sale, protecting both parties involved in the transaction.

Pet Bill of Sale: Although it involves living animals, the structure and function of a Pet Bill of Sale are similar. It documents the sale of pets, such as dogs, cats, horses, providing details like breed, age, health information, and any other relevant details. This helps in ensuring that the transaction is clear and agreed upon by both parties.

Dos and Don'ts

When filling out the Texas Golf Cart Bill of Sale form, it's important to ensure the process is handled properly to avoid future disputes or issues. Here are essential do's and don'ts to guide you:

Do:- Provide accurate details of both the buyer and seller, including full names, addresses, and contact information.

- Include a complete description of the golf cart being sold, such as make, model, year, and Vehicle Identification Number (VIN) if available.

- State the sale price clearly and indicate the form of payment (e.g., cash, check, bank transfer).

- Verify the golf cart's condition and note any existing damages or alterations, to ensure transparency.

- Sign and date the bill of sale on the day the transaction is finalized.

- Keep a copy of the filled-out form for both the buyer’s and seller’s records.

- Check for any specific requirements your local Texas county may have regarding the sale and use of golf carts.

- Leave blank spaces where important information is requested. If an item does not apply, write “N/A” (not applicable).

- Forget to specify any special terms or conditions that both parties have agreed upon regarding the sale.

- Omit the inclusion of any warranties or, if the golf cart is being sold as is, clearly state this to avoid future liability.

- Sign the bill of sale before all details are accurately filled in and agreed upon.

- Assume verbal agreements are sufficient. Ensure all agreements and promises are documented in the bill of sale.

- Ignore the requirement for a witness or notarization, if it is required by Texas law or your local jurisdiction.

- Dispose of your copy of the bill of sale. It’s important to keep it as a record of the transaction.

Misconceptions

When it comes to selling or buying a golf cart in Texas, a Bill of Sale is a crucial document. However, there are several misconceptions about the Texas Golf Cart Bill of Sale form that need to be clarified:

It's the same as a car Bill of Sale: Some people think the Texas Golf Cart Bill of Sale is identical to the one used for cars. While they serve similar purposes in transferring ownership, the specific details and requirements can differ, reflecting the distinct nature of golf carts versus automobiles.

It must be notarized: There's a common belief that the golf cart Bill of Sale must be notarized to be valid in Texas. Although notarization can add an extra layer of verification, it is not a legal requirement for the validity of the document within the state.

Any template will do: Many people assume they can use any generic form they find online. While a generic form might cover basic information, Texas may have specific requirements or recommended formats, so it's advisable to use one tailored for Texas or checked against state-specific guidelines.

Legal representation is required for completion: Some believe that a lawyer must complete or review the golf cart Bill of Sale. While legal advice can be beneficial, especially in complex transactions, individuals can complete the form themselves. However, clarity and correctness in the information provided are crucial.

It only needs the buyer's and seller's signatures: While the buyer's and seller's signatures are essential, simply having these does not make the document complete. Accurate descriptions of the golf cart, such as make, model, year, serial number, and an acknowledgment of the sale condition (as-is or otherwise), are also necessary.

A Bill of Sale is the final step in the sales process: Some think the transaction is fully complete once the Bill of Sale is signed and exchanged. However, the buyer might also need to register the golf cart with the local Texas authorities, especially if it will be used on public roads or areas where registration is required.

Understanding these misconceptions can help sellers and buyers navigate the process more effectively, ensuring a smoother transaction and adherence to Texas laws.

Key takeaways

When dealing with the Texas Golf Cart Bill of Sale form, several key takeaways are essential for a smooth transaction. This document is pivotal in the transfer of ownership of a golf cart from seller to buyer within Texas. Understanding its components and requirements can help facilitate a legal and efficient sale process.

- Verification of Information: It's crucial for both parties to verify all the information included in the bill of sale. This includes the make, model, year, and serial number of the golf cart, along with the personal details of both the seller and the buyer.

- Legal Requirements: The Texas Golf Cart Bill of Sale form must comply with state laws, including any specific requirements that pertain to the sale of motor vehicles or golf carts in particular. This ensure the legality of the document for registration or usage purposes.

- Signature and Date: The signatures of both the buyer and the seller, accompanied by the date of the transaction, are mandatory. These components validate the bill of sale, acting as a legal agreement between the two parties involved.

- Witness or Notary Public: Though not always a requirement, having the document witnessed or notarized can add an extra layer of authenticity and may be necessary in certain scenarios or requested by the buyer or seller for added legal protection.

- Keep Copies: Both the buyer and the seller should keep a copy of the bill of sale for their records. This is important for tax purposes, future disputes, or as proof of ownership until the title transfer is completed.

- Disclosure of Condition: The bill of sale should clearly state the condition of the golf cart, including any known defects or issues. This transparency helps avoid future disputes and ensures both parties are aware of the item's condition at the time of sale.

- Additional Documents: Aside from the bill of sale, other documents may be required for a complete transfer of ownership. This could include a title transfer document, if applicable, and any other paperwork mandated by local or state laws for the operation of a golf cart on public roads or properties.

Properly filling out and utilizing the Texas Golf Cart Bill of Sale form is a key component of the transaction process. It not only facilitates a smoother sale but also ensures that both parties are protected under Texas law. Attention to detail and adherence to legal requirements are paramount in making the transaction valid and binding.

Create Other Golf Cart Bill of Sale Forms for US States

Bill of Sale Golf Cart - Signing this document may be required to show proof of ownership during DMV registration.