Blank Bill of Sale Form for Maryland

In the state of Maryland, transactions involving the sale of personal property or vehicles are often formalized through a Bill of Sale, a document that plays a pivotal role in providing legal protection and clarity for both the buyer and the seller. This form not only acts as a receipt for the transaction but also serves as concrete evidence of the transfer of ownership, detailing the item or vehicle sold, the sale amount, and the parties involved. It's crucial in establishing a clear record that can be referenced in case of future disputes, questions of ownership, or for tax and registration purposes. For vehicle transactions, it is particularly important, as it may be required by the Maryland Vehicle Administration (MVA) for title transfers and registration. The form, while straightforward in layout, must be completed accurately to ensure it meets legal standards and adequately reflects the agreement between the parties. Understanding its components, the correct process for completion, and its significance in the broader legal and financial context is essential for anyone engaging in private sales within the state.

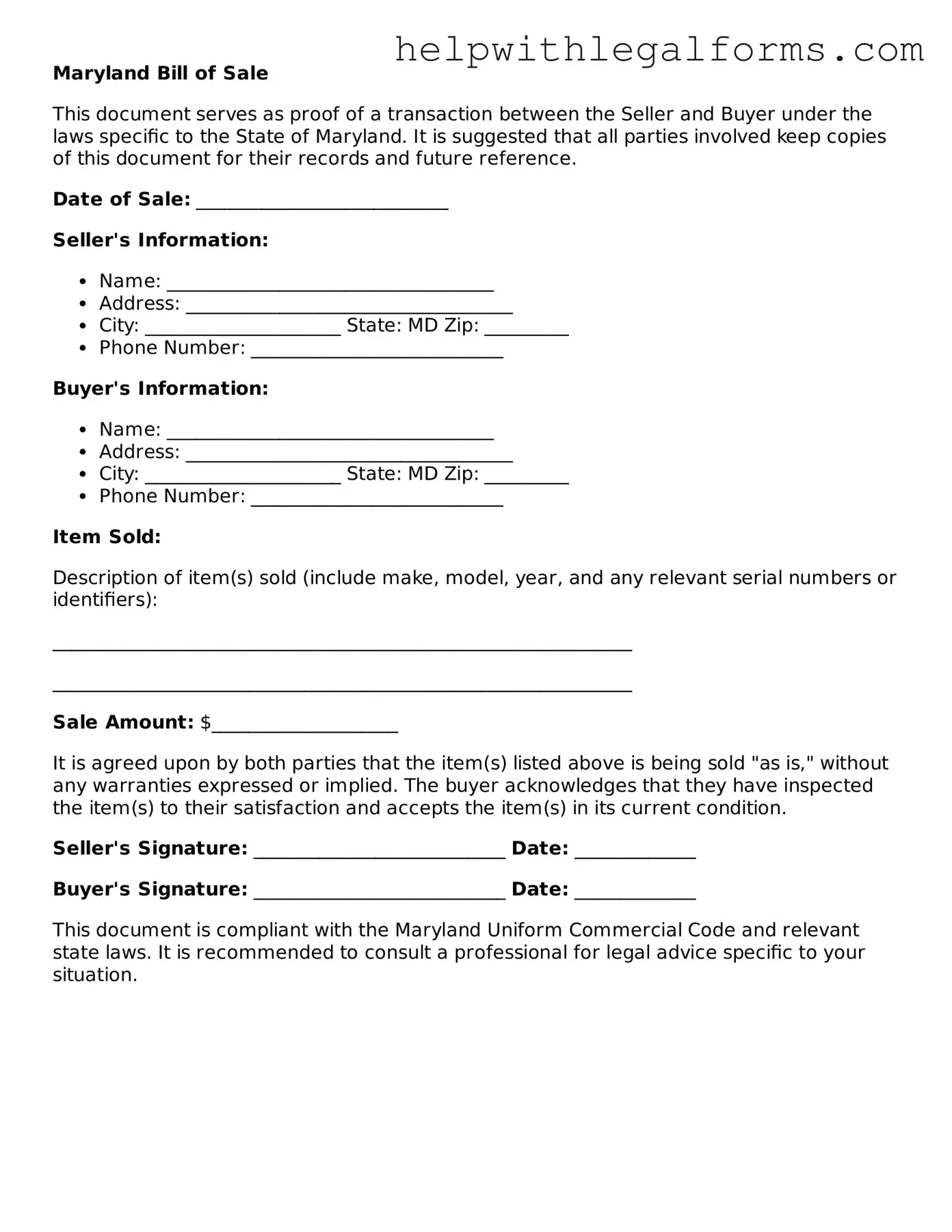

Example - Maryland Bill of Sale Form

Maryland Bill of Sale

This document serves as proof of a transaction between the Seller and Buyer under the laws specific to the State of Maryland. It is suggested that all parties involved keep copies of this document for their records and future reference.

Date of Sale: ___________________________

Seller's Information:

- Name: ___________________________________

- Address: ___________________________________

- City: _____________________ State: MD Zip: _________

- Phone Number: ___________________________

Buyer's Information:

- Name: ___________________________________

- Address: ___________________________________

- City: _____________________ State: MD Zip: _________

- Phone Number: ___________________________

Item Sold:

Description of item(s) sold (include make, model, year, and any relevant serial numbers or identifiers):

______________________________________________________________

______________________________________________________________

Sale Amount: $____________________

It is agreed upon by both parties that the item(s) listed above is being sold "as is," without any warranties expressed or implied. The buyer acknowledges that they have inspected the item(s) to their satisfaction and accepts the item(s) in its current condition.

Seller's Signature: ___________________________ Date: _____________

Buyer's Signature: ___________________________ Date: _____________

This document is compliant with the Maryland Uniform Commercial Code and relevant state laws. It is recommended to consult a professional for legal advice specific to your situation.

PDF Form Attributes

| Fact | Description |

|---|---|

| 1. Purpose | The Maryland Bill of Sale form is used to document the transfer of ownership of personal property from a seller to a buyer. |

| 2. Items covered | It can cover various types of personal property, including vehicles, boats, and equipment. |

| 3. Not Always Mandatory | While not always legally required for every transaction, it provides legal protection and proof of ownership. |

| 4. Components | The form typically includes details of the seller, buyer, the item sold, sale date, and sale amount. |

| 5. Legal Protection | It serves as a receipt and can protect both parties in case of disputes or claims. |

| 6. Governing Law | Governed by Maryland law, specifically applicable to the sale of personal property. |

| 7. Signing Requirements | Both the seller and buyer are usually required to sign the bill of sale, making it legally binding. |

| 8. Notarization | Notarization is not always required but is recommended for added legal validity. |

| 9. Additional Documentation | For vehicles, it is often used alongside the title transfer to complete the sale process. |

| 10. Record Keeping | Both parties should keep copies of the bill of sale for their records and future reference. |

Instructions on How to Fill Out Maryland Bill of Sale

Filling out a Maryland Bill of Sale form is a critical step in the process of buying or selling a valuable item, like a car or a boat. This form provides a written record of the transaction and can serve as proof of the transfer of ownership. It's important for both the buyer and seller to understand how to properly complete this form to ensure the sale is legally recognized. The following steps guide you through the process, making it smoother and helping to avoid common mistakes.

- Begin by writing the date of the sale at the top of the form.

- Next, enter the full names and addresses of both the seller and the buyer. Make sure these are accurate, as they identify the parties involved in the transaction.

- Describe the item being sold. Include any relevant details such as the make, model, year, and serial number. For vehicles, this would involve the VIN (Vehicle Identification Number).

- Record the sale price of the item. This should be the full amount agreed upon by both parties.

- If there are any additional terms and conditions of the sale, list them clearly. This could include warranties, return policies, or any other agreements made.

- Both the seller and the buyer must sign and date the form. This is a crucial step, as it signifies that both parties agree to the terms of the sale and acknowledge the transfer of ownership.

- It's also wise to include the contact information (phone numbers or email addresses) of both parties, in case there are any questions or issues that arise after the sale is complete.

After the Bill of Sale form is filled out, it's recommended that both parties keep a copy for their records. This document serves as a receipt for the buyer and proof of release of liability for the seller. If the item sold is a vehicle, remember that the buyer will likely need to present this form as part of the vehicle registration process in Maryland.

Crucial Points on This Form

What is a Maryland Bill of Sale form?

A Maryland Bill of Sale form is a legal document that records the transfer of ownership of personal property from one person to another. It is used in private sales transactions in Maryland, providing proof of purchase and details of the agreement between the buyer and the seller. This form typically includes information about the item being sold, the sale price, and the dates of the transaction. It serves as a receipt for the buyer and can protect both parties in case of future disputes.

Is a Bill of Sale required in Maryland for private vehicle sales?

Yes, for private vehicle sales in Maryland, a Bill of Sale is required by the Maryland Motor Vehicle Administration (MVA). This document should include specific information about the vehicle, such as make, model, year, VIN (Vehicle Identification Number), and the odometer reading at the time of sale. The Bill of Sale must be presented to the MVA during the title transfer process.

What information should be included in a Maryland Bill of Sale?

A Maryland Bill of Sale should contain the full names and addresses of both the buyer and the seller, a detailed description of the item being sold (including make, model, year, and serial number if applicable), the sale price, the date of sale, and signatures of both parties involved in the transaction. If the sale involves a vehicle, it should also include the vehicle's odometer reading.

Does a Maryland Bill of Sale need to be notarized?

No, a Maryland Bill of Sale does not need to be notarized to be considered valid. However, both buyer and seller must sign the document for it to be legally binding. It is crucial to ensure that all information included is accurate and complete to avoid future complications.

Can a Bill of Sale be used as proof of ownership in Maryland?

Yes, a Bill of Sale can be used as proof of ownership in Maryland, especially for personal property such as vehicles, boats, and motorcycles. When transferring a title or registering the item with the state, the Bill of Sale serves as evidence that a transaction took place and that the buyer is now the rightful owner.

What are the consequences of not using a Bill of Sale in Maryland?

Not using a Bill of Sale in Maryland can lead to potential legal disputes regarding the ownership and condition of the item sold. Without this document, there may be no formal record of the transaction, making it difficult to resolve issues such as warranty claims, liability disputes, or fraud allegations. It's also essential for tax and registration purposes.

How can I obtain a Maryland Bill of Sale form?

A Maryland Bill of Sale form can be obtained from several sources, including the Maryland Motor Vehicle Administration (MVA) website for vehicle sales. Generic forms are also available online through legal services and template providers. It is important to ensure that the form used complies with Maryland state laws and includes all required information to facilitate a smooth and legally binding transaction.

Common mistakes

Not checking the vehicle's identification number (VIN) accurately against the vehicle itself can lead to complications. It's crucial for the VIN on the form to match the vehicle exactly.

Forgetting to specify the sale date. The date of sale is important for both legal and tax purposes, and overlooking it can create unnecessary confusion.

Leaving the sale price blank or not clearly stating it. This is important for tax assessments and establishing the legal sale amount.

Failing to include a detailed description of the vehicle. This should cover make, model, year, and any other identifiers that distinguish the vehicle.

Not obtaining the buyer's signature. This confirms that the buyer agrees to the terms of the sale and acknowledges receipt of the vehicle.

Omitting seller information, including a contact address or phone number. This information is necessary for future communication or legal purposes.

Ignoring lien information, if applicable. If the vehicle is still under finance, this information must be disclosed to the buyer.

Misunderstanding the as-is clause. Without a clear statement, misunderstandings can occur regarding the vehicle's condition at the time of sale.

Skipping the notarization process if required. While not always mandatory, for some sales, having the document notarized can add an extra layer of legal protection.

Using a generic form that doesn’t comply with Maryland state requirements. Each state has specific requirements; using the wrong form can invalidate the sale.

In summary, when filling out a Maryland Bill of Sale form, it’s important to be meticulous and thorough. Every detail, from the VIN to the seller's contact information, plays a vital role in ensuring the legality and smooth execution of the vehicle transaction. Making sure all information is accurate and complete can prevent future legal complications and misunderstandings between buyer and seller.

Documents used along the form

When executing a transaction in Maryland, especially one involving the sale of personal property, vehicles, or other significant assets, a Bill of Sale form serves as a vital legal document. However, to enhance the security and completeness of the transaction, other forms and documents are often used in conjunction with the Maryland Bill of Sale. This accompanying documentation can help both parties ensure the legality of the sale and protect their rights. Here are six common forms and documents that are typically used alongside the Maryland Bill of Sale.

- Odometer Disclosure Statement: This document is crucial when selling a vehicle. It records the vehicle's actual mileage at the time of sale and helps to confirm the accuracy of the vehicle's odometer reading.

- Title Transfer Form: When ownership of a vehicle, boat, or another titled property changes, this form is filed with the appropriate state department to officially transfer the title to the new owner.

- Vehicle Registration Form: New owners must complete this form to register a vehicle in their name with the Maryland Motor Vehicle Administration, ensuring they have the legal right to operate the vehicle in the state.

- Release of Liability: This form is used to release the seller from liability if the property (particularly vehicles) is involved in an incident or incurs fines after the sale but before the new owner registers the property in their name.

- Loan Agreement: If the purchase involves financing or a loan between the buyer and the seller (or a third party), a loan agreement outlines the terms of repayment, interest rates, and the duration of the loan.

- Warranty Document: When applicable, this document provides the buyer with the terms of any warranty on the property, stating what is covered and for how long, giving the buyer confidence in their purchase.

Utilizing these forms and documents alongside the Maryland Bill of Sale not only amplifies the transaction's legality but also offers a comprehensive approach to protecting all parties involved. It is advisable for buyers and sellers to familiarize themselves with these documents to ensure a smooth and legally sound transaction.

Similar forms

Warranty Deed: Like a Bill of Sale, a Warranty Deed is used during the transaction of property, in this case, real estate. The key similarity lies in the guarantee that the seller holds the right to transfer ownership and that there are no hidden liens or encumbrances on the property.

Quitclaim Deed: Similar to a Bill of Sale, a Quitclaim Deed facilitates the transfer of ownership rights in property. However, unlike the Bill of Sale, it does not guarantee the quality of the title being transferred, offering no warranties against encumbrances.

Promissory Note: A Promissory Note, akin to a Bill of Sale, is a binding agreement, but focuses on the promise to pay a sum of money under specific terms, rather than the sale of tangible goods. It embodies the promise of payment rather than a transfer of ownership.

Security Agreement: This document is closely related to a Bill of Sale when financing is involved. A Security Agreement spells out the collateral for a loan, which could include the item sold in the Bill of Sale, thus providing the lender a claim to the asset if the loan defaults.

Vehicle Title: A Vehicle Title is directly related to a Bill of Sale for automobiles. The chief connection is its role in legally establishing one's ownership of a vehicle. The Bill of Sale is often required to transfer the Vehicle Title between owners.

Certificate of Title: This document, similar to a Bill of Sale, officially documents the ownership of an asset, such as real estate or a vehicle. It is the evidence of right that follows the transaction detailed in the Bill of Sale, serving as the official record of transfer.

Dos and Don'ts

Completing the Maryland Bill of Sale correctly is crucial for both the buyer and seller to ensure the transaction is legally binding and transparent. Here are some guidelines to help you accurately fill out the form:

Do:

- Verify all vehicle information, including make, model, year, and Vehicle Identification Number (VIN), to ensure accuracy.

- Clearly print the seller's and buyer's full names and addresses.

- Ensure the sale date and price are accurately reflected and match any verbal agreements.

- Have all parties sign and date the document to validate the transaction.

- Keep a copy of the bill of sale for your records and future reference.

- Record any specific terms or conditions of the sale that both parties have agreed upon.

- Check with the Maryland Motor Vehicle Administration (MVA) for any additional requirements specific to Maryland.

- Use a secure and legible method of writing, such as black ink, to ensure the document's longevity.

- Identify and include any warranties or "as is" sale conditions to protect both buyer and seller.

- Confirm that all information on the form is correct before signing.

Don't:

- Leave any fields blank; always answer every question, even if the response is "N/A" for not applicable.

- Forget to specify if there are any liens against the vehicle.

- Sign the bill of sale without ensuring that all information is accurate and reflects the terms agreed upon.

- Use pencil or any erasable writing tool which can be altered after the agreement.

- Ignore the requirement for witness signatures if mandated by state law or local practice.

- Rely solely on verbal agreements; make sure everything agreed upon is documented in the bill of sale.

- Overlook taking precautions if there is any mention of "as is" in the sale, understanding its implications.

- Delay filing the bill of sale with the Maryland MVA if required for registration and title transfer.

- Skip consulting a legal professional if there are uncertainties about the bill of sale process.

- Assume a bill of sale alone is sufficient for legal ownership; title transfer is necessary.

Misconceptions

When dealing with the Maryland Bill of Sale form, people often come across information that can be misleading or incorrect. To help clarify these misunderstandings, here are four common misconceptions:

Notarization is always required. Many believe that for a Bill of Sale to be valid in Maryland, it must be notarized. However, notarization is not a statewide requirement for all types of personal property. While it adds an extra layer of authenticity, for most personal property transactions, it is not a legal necessity unless specifically mandated by law for certain items, such as vehicles.

It serves as proof of ownership. Another common misconception is that the Bill of Sale by itself serves as an indisputable proof of ownership. In reality, it is a record of the transaction between the buyer and the seller, indicating the transfer of ownership. Actual ownership is typically proven by a title or other similar document, depending on the type of property.

One template fits all. It's often assumed that a single template can be used for any Bill of Sale in Maryland. However, the specifics of the form can vary depending on the nature of the item being sold. For example, the sale of a vehicle, firearms, or boats each may require additional information and certification to meet state or federal requirements.

All sales are final upon signing. Many believe that once a Bill of Sale is signed, the sale is final and cannot be disputed or returned. While the form does document the agreement to transfer property, the actual terms of sale, including return policies and warranties, are governed by the agreement between the buyer and the seller. Therefore, it's important for both parties to clearly outline these terms before completing the transaction.

Understanding these key points can help individuals navigate the process of buying or selling personal property in Maryland more effectively, ensuring a smoother transaction for both parties involved.

Key takeaways

When it comes to completing and utilizing the Maryland Bill of Sale form, it's essential to pay attention to detail and ensure all required information is accurately provided. This document plays a critical role in the sale and purchase of personal property in Maryland, providing a legal record of the transaction. Here are ten key takeaways to keep in mind:

- Ensure all parties involved in the transaction have a clear understanding of the form's purpose, which is to document the sale and transfer of ownership of personal property from the seller to the buyer.

- The Bill of Sale should include detailed information about the item being sold, such as make, model, year, and serial number if applicable. This aids in identifying the item and proving ownership.

- Both the seller's and buyer's full names, contact information, and signatures should be clearly written on the form to establish the identities of the parties involved in the transaction.

- Date the transaction accurately. The date on the Bill of Sale is when the legal transfer of ownership takes place.

- Price details are a must. Clearly state the sale price of the item being sold, as this information is crucial for tax and legal records.

- It's advisable to include any warranty information or "as-is" condition statements to clearly outline the terms of the sale regarding the item's condition.

- Having the Bill of Sale notarized, while not always a requirement, can add a layer of legal protection and authenticity to the document.

- Both the buyer and the seller should keep a copy of the Bill of Sale for their records. This document serves as a receipt and a legal record of the transaction.

- If the sale involves a vehicle, boat, or any other title-able property, make sure to check with Maryland's respective department (such as the Department of Motor Vehicles) for any additional requirements or forms that need to be completed.

- Utilize the Maryland Bill of Sale form to protect all parties involved in the transaction. It provides a clear, legal record of the sale, which can be important for tax purposes, legal liability, or dispute resolution.

Create Other Bill of Sale Forms for US States

Ga Trailer Bill of Sale - An official declaration of the sale of property, outlining the transaction in clear terms for legal purposes.

Dmv Bill of Sale Pdf - Some jurisdictions may require a notarized Bill of Sale for it to be considered valid and legally binding.

How to Sell a Car in Colorado - Having a Bill of Sale is crucial when registering or insuring a newly purchased vehicle or boat.