Blank Mobile Home Bill of Sale Form for Connecticut

When navigating the sale or purchase of a mobile home in Connecticut, the critical document that plays a pivotal role in this process is the Connecticut Mobile Home Bill of Sale form. This document is not merely a receipt but a comprehensive legal instrument that records the details of the transaction between the buyer and the seller, offering a layer of protection and clarity for both parties involved. It encompasses information such as the identification of the mobile home (including make, model, year, and VIN), the sale price, and the personal details of both the buyer and the seller. Furthermore, it lays out the terms and conditions of the sale, ensuring that all aspects are transparent and agreed upon. It's essential for the completion of the sale process, providing a clear record that aids in the transfer of ownership and may also be required for registration purposes or tax assessments. Understanding its importance, the form serves as a critical tool in cementing the legality of the transaction, making it an indispensable asset for both parties engaging in the sale or purchase of a mobile home in the state of Connecticut.

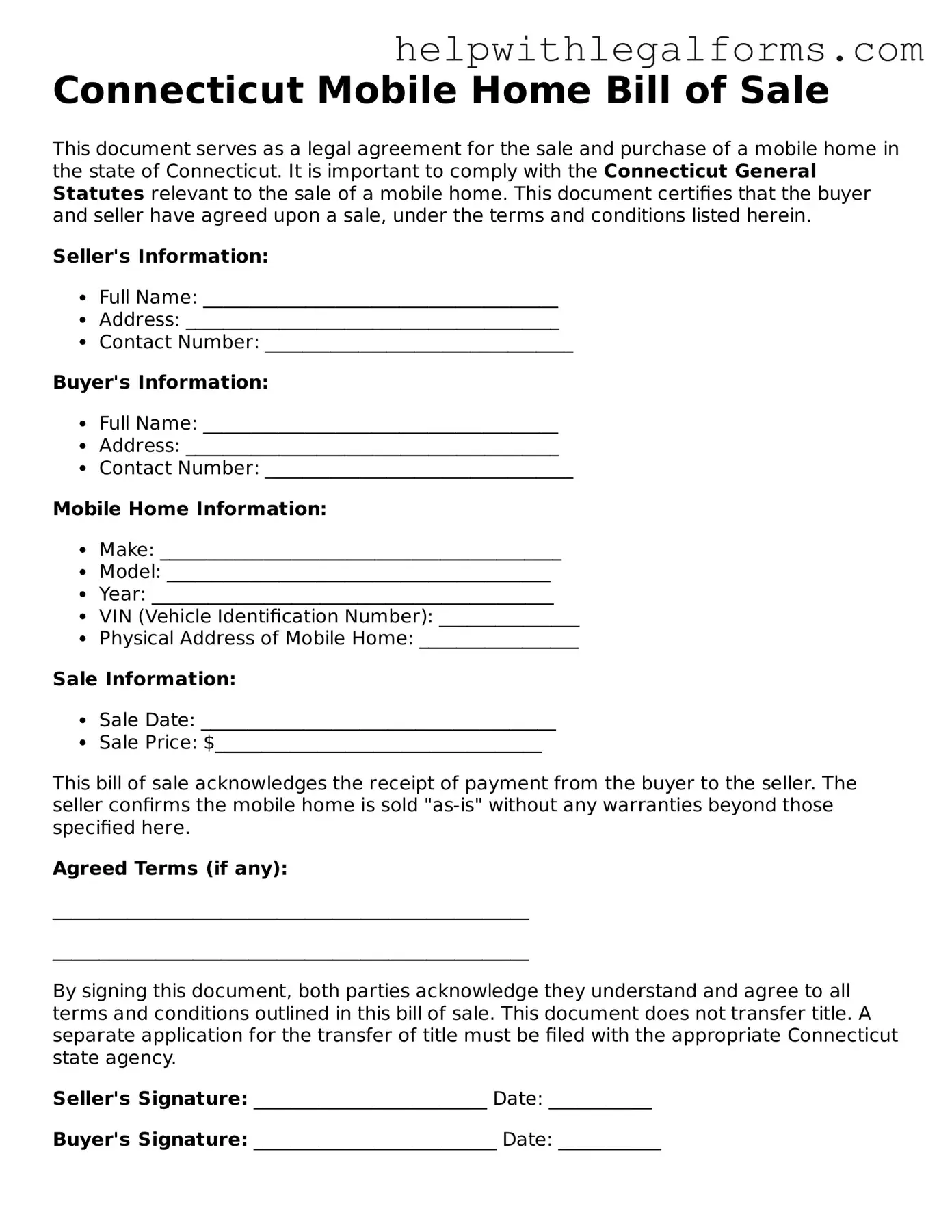

Example - Connecticut Mobile Home Bill of Sale Form

Connecticut Mobile Home Bill of Sale

This document serves as a legal agreement for the sale and purchase of a mobile home in the state of Connecticut. It is important to comply with the Connecticut General Statutes relevant to the sale of a mobile home. This document certifies that the buyer and seller have agreed upon a sale, under the terms and conditions listed herein.

Seller's Information:

- Full Name: ______________________________________

- Address: ________________________________________

- Contact Number: _________________________________

Buyer's Information:

- Full Name: ______________________________________

- Address: ________________________________________

- Contact Number: _________________________________

Mobile Home Information:

- Make: ___________________________________________

- Model: _________________________________________

- Year: ___________________________________________

- VIN (Vehicle Identification Number): _______________

- Physical Address of Mobile Home: _________________

Sale Information:

- Sale Date: ______________________________________

- Sale Price: $___________________________________

This bill of sale acknowledges the receipt of payment from the buyer to the seller. The seller confirms the mobile home is sold "as-is" without any warranties beyond those specified here.

Agreed Terms (if any):

___________________________________________________

___________________________________________________

By signing this document, both parties acknowledge they understand and agree to all terms and conditions outlined in this bill of sale. This document does not transfer title. A separate application for the transfer of title must be filed with the appropriate Connecticut state agency.

Seller's Signature: _________________________ Date: ___________

Buyer's Signature: __________________________ Date: ___________

This document was created on __________________ (date), and it is recommended to keep multiple copies for the records of both the buyer and the seller.

PDF Form Attributes

| Fact | Detail |

|---|---|

| 1. Purpose | The Connecticut Mobile Home Bill of Sale form is used to document the sale and transfer of ownership of a mobile home from the seller to the buyer in the state of Connecticut. |

| 2. Legally Binding Document | This form serves as a legally binding document that confirms and records the sale of the mobile home. |

| 3. Required Information | It includes details such as the names and addresses of the seller and buyer, a description of the mobile home, the sale price, and the date of sale. |

| 4. Signatures | Signatures from both the buyer and the seller are required to validate the form. |

| 5. Notarization | Depending on the local jurisdiction's requirements, notarization of the form may be necessary. |

| 6. Governing Law | The form is governed by Connecticut state laws applicable to the sale of mobile homes. |

| 7. Use for Registration | The completed bill of sale may be required for the buyer to register the mobile home in their name at a local DMV office or equivalent authority in Connecticut. |

| 8. Prevents Future Disputes | Having a filled-out and signed bill of sale helps in preventing future disputes regarding the mobile home's ownership and terms of sale. |

Instructions on How to Fill Out Connecticut Mobile Home Bill of Sale

When you're ready to buy or sell a mobile home in Connecticut, using a Mobile Home Bill of Sale form is a crucial step in the process. This document serves as a proof of purchase and sale, ensuring both parties agree on terms such as the sale amount, the description of the mobile home, and the date of sale. Filling out this form correctly is important for the legality of the transaction. Here are step-by-step instructions to guide you through completing the Connecticut Mobile Home Bill of Sale form.

- Start by entering the date of the sale at the top of the form.

- Write the full legal name of the seller(s) in the space provided.

- Fill in the full legal name of the buyer(s).

- Describe the mobile home, including the make, model, year, and vehicle identification number (VIN).

- Specify the sale amount in US dollars.

- Indicate whether there are any warranties or guarantees being provided by checking the appropriate box and providing additional details if necessary.

- If any additional terms and conditions are agreed upon, ensure they're clearly written in the provided space.

- Both the buyer(s) and seller(s) must sign and print their names at the bottom of the form.

- Date the signatures to finalize the document.

- Remember to exchange contact information between the buyer and seller for any future correspondence.

Once completed, it's advisable for both the buyer and seller to keep a copy of the Mobile Home Bill of Sale for their records. This document not only represents the proof of purchase but also serves as a valuable reference for the details of the transaction. Ensuring accuracy and completeness while filling out the form is key to the effectiveness of the bill of sale as a legal document.

Crucial Points on This Form

What is a Connecticut Mobile Home Bill of Sale form?

The Connecticut Mobile Home Bill of Sale form is a legal document that records the sale and transfer of a mobile home from one party to another within Connecticut. It serves as proof of purchase and outlines the details of the transaction, including information about the buyer, seller, mobile home, and the sale price.

Why do I need a Mobile Home Bill of Sale in Connecticut?

A Mobile Home Bill of Sale is necessary in Connecticut for several reasons. It acts as a receipt for the transaction, helps in the registration process of the mobile home with local authorities, and is required for tax assessment purposes. Additionally, it provides legal protection for both the buyer and the seller in case any disputes arise regarding the ownership or terms of the sale.

What information is required on a Connecticut Mobile Home Bill of Sale?

The form typically includes the names and addresses of the buyer and seller, a description of the mobile home (including make, model, year, and serial number), the sale price, the date of the sale, and signatures of both parties involved. It may also require notarization, depending on the local jurisdiction's requirements.

Is notarization required for the form to be legally binding in Connecticut?

In Connecticut, notarization of a Mobile Home Bill of Sale is not always mandatory for it to be legally binding. However, having the document notarized can add an extra layer of legality and may be beneficial in preventing disputes or fraud. It's advisable to check with local county officials or a legal advisor for specific requirements.

Can I create a Mobile Home Bill of Sale form myself?

Yes, you can create a Mobile Home Bill of Sale form yourself, provided it includes all the necessary information required by the state of Connecticut. It's important to ensure that the document accurately reflects the details of the sale and is clear and comprehensive. Online templates or guidelines can be used as a basis, but customization to fit the specifics of your transaction is recommended.

What happens if I don't use a Mobile Home Bill of Sale when selling or buying a mobile home in Connecticut?

Not using a Mobile Home Bill of Sale can lead to complications in establishing ownership, registering the mobile home, and could result in legal and tax-related issues. It may also make resolving disputes between the buyer and seller more challenging. Using a properly filled Bill of Sale safeguards the interests of both parties involved.

How do I register a mobile home in Connecticut after purchasing it?

To register a mobile home in Connecticut, you typically need to provide the completed Mobile Home Bill of Sale form, proof of residence, identification, and payment for registration fees at a local Department of Motor Vehicles (DMV) or appropriate governmental office. Specific requirements may vary, so checking with the local DMV or county office for the exact procedure is recommended.

Can a Mobile Home Bill of Sale be used for financing or insurance purposes?

Yes, a Mobile Home Bill of Sale can be utilized as part of the documentation required for financing or insuring the mobile home. It serves as proof of ownership and value, which is essential for both lenders and insurance companies in processing loans or insurance policies.

Are there any penalties for providing false information on a Connecticut Mobile Home Bill of Sale?

Providing false information on a Mobile Home Bill of Sale is considered fraudulent and can have severe legal consequences. Penalties can include fines, revocation of the mobile home's registration, and potential criminal charges, depending on the nature and extent of the fraud.

Where can I find a template for a Connecticut Mobile Home Bill of Sale?

Templates for a Connecticut Mobile Home Bill of Sale can be found online through legal document websites, state government resources, or by consulting a legal professional who can provide guidance or draft the document for you. Ensure that any template used complies with Connecticut state requirements to avoid future issues.

Common mistakes

When filling out the Connecticut Mobile Home Bill of Sale form, it's easy to overlook certain details or make mistakes. Here's a list of common errors to avoid:

Not Checking for Accurate Information: One common mistake is not verifying the accuracy of all information. This includes the buyer's and seller's names, addresses, and the description of the mobile home. It's crucial that all details match those on official documents.

Omitting the Serial Number or Vehicle Identification Number (VIN): Failing to include the mobile home's serial number or VIN can create issues. This number is essential for identifying the mobile home and must be accurately recorded on the form.

Forgetting to Specify the Sale Price and Date: It is vital to clearly state the sale price and the date of the sale. These details confirm the transaction occurred and at what value, which can be important for tax purposes and future disputes.

Skipping Signatures and Dates: Both the buyer and seller must sign and date the bill of sale. Failing to do so can lead to questions about the validity of the document. It’s a simple step, but crucial for the form to be legally binding.

Neglecting to Get a Witness or Notary Signature: Although not always mandatory, having the bill of sale witnessed or notarized adds an extra layer of legitimacy. This can be especially helpful if the transaction's validity is ever questioned.

By paying attention to these details, both buyers and sellers can ensure a smoother and more secure transaction process for a mobile home sale in Connecticut.

Documents used along the form

When a mobile home is sold or transferred in Connecticut, the Bill of Sale form is a crucial document. However, it's often just one piece of the puzzle. Several other documents are typically used in conjunction to ensure a smooth and legally compliant transaction. These documents can include titles, disclosure forms, and various permits, each serving its own purpose in the transaction process. Below is a list of forms and documents that are commonly used alongside the Connecticut Mobile Home Bill of Sale form.

- Certificate of Title: This document proves ownership of the mobile home. Both the seller and buyer need to ensure that the Certificate of Title is properly transferred to the new owner to establish legal ownership.

- Occupancy Agreement: If the mobile home resides in a park or leased land, an Occupancy Agreement is often required. This agreement outlines the terms under which the buyer is allowed to place their mobile home on the property.

- Seller’s Disclosure Statement: This form provides the buyer with detailed information about the condition of the mobile home, including any known defects or problems. It's a crucial document for transparency and helps protect the buyer’s interests.

- Application for Registration: In many cases, registering a mobile home is required by law. This document is filed with the state or local government to officially record the mobile home under the new owner’s name.

- Proof of Sales Tax Payment: This document is evidence that the buyer has paid the necessary sales tax on the purchase. It’s important for record-keeping and ensuring compliance with state tax laws.

Each of these documents plays a vital role in the process of selling or transferring a mobile home in Connecticut. They work together with the Bill of Sale to create a comprehensive record of the sale, protect all parties involved, and ensure compliance with local and state regulations. Ensuring that all the necessary paperwork is in order can help avoid legal issues and make the transition smoother for both the buyer and the seller.

Similar forms

Vehicle Bill of Sale: Similar to the Mobile Home Bill of Sale, a Vehicle Bill of Sale is used when buying or selling a car, motorcycle, or other types of vehicles. It documents the transaction and transfer of ownership from the seller to the buyer, providing legal proof of purchase and sale.

Boat Bill of Sale: Much like the Mobile Home Bill of Sale, the Boat Bill of Sale is a document that records the sale and purchase of a boat. It details the transaction between the buyer and the seller, including specifics about the boat, the sale price, and the terms of the transaction, ensuring the legality of the ownership transfer.

General Bill of Sale: This document is an all-encompassing version similar to a Mobile Home Bill of Sale but used for personal property transactions other than vehicles, boats, or homes. It serves as a receipt for items like furniture, electronics, or other personal possessions, marking the transfer of ownership.

Real Estate Bill of Sale: While typically, real estate transactions require more comprehensive contracts, a Real Estate Bill of Sale shares similarities with the Mobile Home Bill of Sale in terms of its function to document the transfer of tangible assets, although it's more commonly used for the sale of items inside a home rather than the property itself.

Firearm Bill of Sale: This specialized document is akin to the Mobile Home Bill of Sale but is specifically designed for the sale and purchase of firearms. It legally records the transaction, providing details about the buyer, seller, and firearm, along with stipulating conditions that may be required by law.

Business Bill of Sale: Similar to the Mobile Home Bill of Sale, a Business Bill of Sale records the transaction and transfer of a business from one owner to another. It includes details about the business being sold, the terms of the sale, and it also transfers ownership of the business's assets, providing a legal receipt for the transaction.

Aircraft Bill of Sale: Similar in purpose to the Mobile Home Bill of Sale, the Aircraft Bill of Sale documents the sale and purchase of an airplane, providing proof of the transaction and transferring ownership from seller to buyer. It includes specific information about the aircraft and terms of the sale, ensuring a legally binding agreement.

Dos and Don'ts

When filling out the Connecticut Mobile Home Bill of Sale form, it's essential to follow certain guidelines to ensure the document is completed accurately and legally. This form is crucial for the sale and purchase of a mobile home in Connecticut, serving as proof of the transaction and details of the agreement between the buyer and the seller. Here are seven things you should do and shouldn't do:

- Do ensure all parties (buyer and seller) have their information ready and accurately filled in. This includes full names, addresses, and contact information.

- Do not leave any sections blank. If a section does not apply, write "N/A" (not applicable) to indicate this.

- Do accurately describe the mobile home. Include make, model, year, serial number, and any other identifying information to ensure there's no confusion about what is being sold.

- Do not forget to specify the sale amount and the payment method. Clearly outline if the payment will be made in installments or a lump sum.

- Do make sure both the buyer and the seller sign and date the bill of sale. Their signatures legally bind the document.

- Do not neglect the requirement for witnesses or a notary public, if applicable. Some jurisdictions may require a witness or notarization for the document to be legally binding.

- Do keep copies of the completed bill of sale. Both the buyer and seller should retain a copy for their records and any future disputes or questions.

Properly filling out the Connecticut Mobile Home Bill of Sale form is a crucial step in the sale process, providing legal protection for both the buyer and seller. By following these do's and don'ts, you can help ensure the transaction proceeds smoothly and all legal requirements are met.

Misconceptions

When dealing with the sale of mobile homes in Connecticut, the Mobile Home Bill of Sale form plays a crucial role. However, several misconceptions surround its use and significance. Addressing these misconceptions can help both buyers and sellers navigate their transactions with better clarity and confidence.

It's just a formal receipt. A common misconception is that the Mobile Home Bill of Sale form merely serves as a receipt of the transaction. In reality, it is a legally binding document that provides proof of the transfer of ownership from the seller to the buyer. It contains crucial details about the transaction that can protect both parties in case of disputes.

Any generic form will do. While there are generic forms available, using a form specifically designed for Connecticut is important. State-specific forms ensure compliance with local laws and regulations concerning the sale of mobile homes, which can differ significantly from those of other types of property or locations.

Only the buyer needs to keep a copy. Both the buyer and the seller should keep a copy of the Mobile Home Bill of Sale. This document serves as a proof of purchase for the buyer and proof of sale for the seller, which can be essential for tax purposes, future disputes, or as records of ownership transfer.

It's not necessary if you're buying from a friend or family member. Regardless of the relationship between the buyer and the seller, a Mobile Home Bill of Sale form should always be completed. This ensures that the transaction is legally documented, which can prevent potential issues or misunderstandings in the future.

Signing the Bill of Sale transfers the title. Signing the Mobile Home Bill of Sale is an important step in the sale process, but it does not in itself transfer the title of the mobile home. The title transfer must be completed separately according to Connecticut's Department of Motor Vehicles (DMV) regulations or local housing authorities.

Notarization is always required. While notarization can add an extra layer of legal security, it is not always a requirement for the Mobile Home Bill of Sale in Connecticut. Parties should check the current state requirements or consult with a legal advisor to determine if notarization is necessary for their specific situation.

A Bill of Sale is all you need to prove ownership. Although the Mobile Home Bill of Sale is a critical document for proving the change of ownership, the actual legal proof of ownership is the mobile home's title. Buyers should ensure the title is transferred into their name following the sale.

There's no need to report the sale to any authorities. Depending on the location of the mobile home and local regulations, you may be required to report the sale to specific authorities, like the local housing department or the DMV. This step is crucial for the legal recognition of the ownership transfer and might be needed for tax purposes.

You can complete the form digitally without any signatures. While digital transactions are becoming more common, the Mobile Home Bill of Sale form typically requires the handwritten signatures of both the buyer and the seller to be considered valid. Electronic signatures may be accepted in some cases, but it's essential to verify this based on current laws and guidelines.

Key takeaways

When engaging in the process of buying or selling a mobile home in Connecticut, utilizing a Bill of Sale form is a critical step for both parties. This document not only provides legal proof of the transaction but also ensures clarity and protection for everyone involved. Here are 10 key takeaways to keep in mind when filling out and using the Connecticut Mobile Home Bill of Sale form:

- Accurate Information: Ensure that all provided information is accurate, including the names and addresses of both the buyer and the seller, to avoid any disputes or legal issues.

- Description of the Mobile Home: The form must include a detailed description of the mobile home, such as the make, model, year, size, and the vehicle identification number (VIN) to ensure the specific unit is correctly identified.

- Condition of Sale: Clearly state the condition of the mobile home at the time of sale, including any known defects or issues. This helps in preventing future disputes over the condition of the mobile home.

- Warranty Information: Specify if the mobile home is being sold with a warranty or "as-is". This clarifies the seller’s liability for any future repairs or problems that may arise.

- Price and Payment Terms: Include the sale price of the mobile home and the terms of payment. This should detail if the payment is to be made in full, in installments, or through a trade.

- Signature of Both Parties: The Bill of Sale must be signed by both the buyer and the seller. These signatures legally bind the parties to the terms of the sale and acknowledge their understanding and agreement.

- Date of Sale: The document should record the date when the sale is completed. This date is essential for record-keeping and any future reference to the sale.

- Notarization: While not always a requirement, getting the document notarized can add an extra layer of legal protection and validity to the Bill of Sale.

- Keep Copies: Both the buyer and the seller should keep copies of the finalized Bill of Sale. These copies serve as a receipt and proof of ownership until the title transfer is complete.

- Legal Advice: If there are any uncertainties or complexities in the sale, consulting with a legal advisor can help prevent future legal problems. They can offer guidance specific to Connecticut laws and ensure the Bill of Sale complies with all legal requirements.

Properly completing and using the Connecticut Mobile Home Bill of Sale form is essential for a smooth and legally sound transaction. It offers a sense of security and clarity for both parties, laying a solid foundation for the sale and future ownership of the mobile home.

Create Other Mobile Home Bill of Sale Forms for US States

Bill of Sale Simple - An indispensable document for completing a mobile home sale, capturing all relevant details to satisfy legal requirements.

Bill of Sale Mobile Home Florida - It's useful for updating records with local housing authorities or other regulatory bodies involved in mobile home residency.

Does a Bill of Sale Have to Be Notarized in Maryland - This form lays the groundwork for a smooth ownership transition, preventing potential legal complications in the future.