Blank Motor Vehicle Bill of Sale Form for Connecticut

When entering into a transaction involving the sale of a motor vehicle in Connecticut, the Motor Vehicle Bill of Sale form emerges as a crucial document that both parties—seller and buyer—should carefully consider. This form not only serves as a concrete record of the sale, establishing the transfer of ownership from one party to another, but it also plays a vital role in the registration and taxation processes of the vehicle. It outlines critical details such as the make, model, year, and VIN (Vehicle Identification Number), as well as the transaction date and the agreed-upon sale price. For both parties, the form acts as a safeguard, providing a layer of legal protection in case of disputes or discrepancies that might arise post-sale. Its significance extends beyond a mere receipt to a legally binding document that substantiates the terms and conditions of the vehicle sale, highlighting its foundational role in the facilitation of a smooth and transparent transaction.

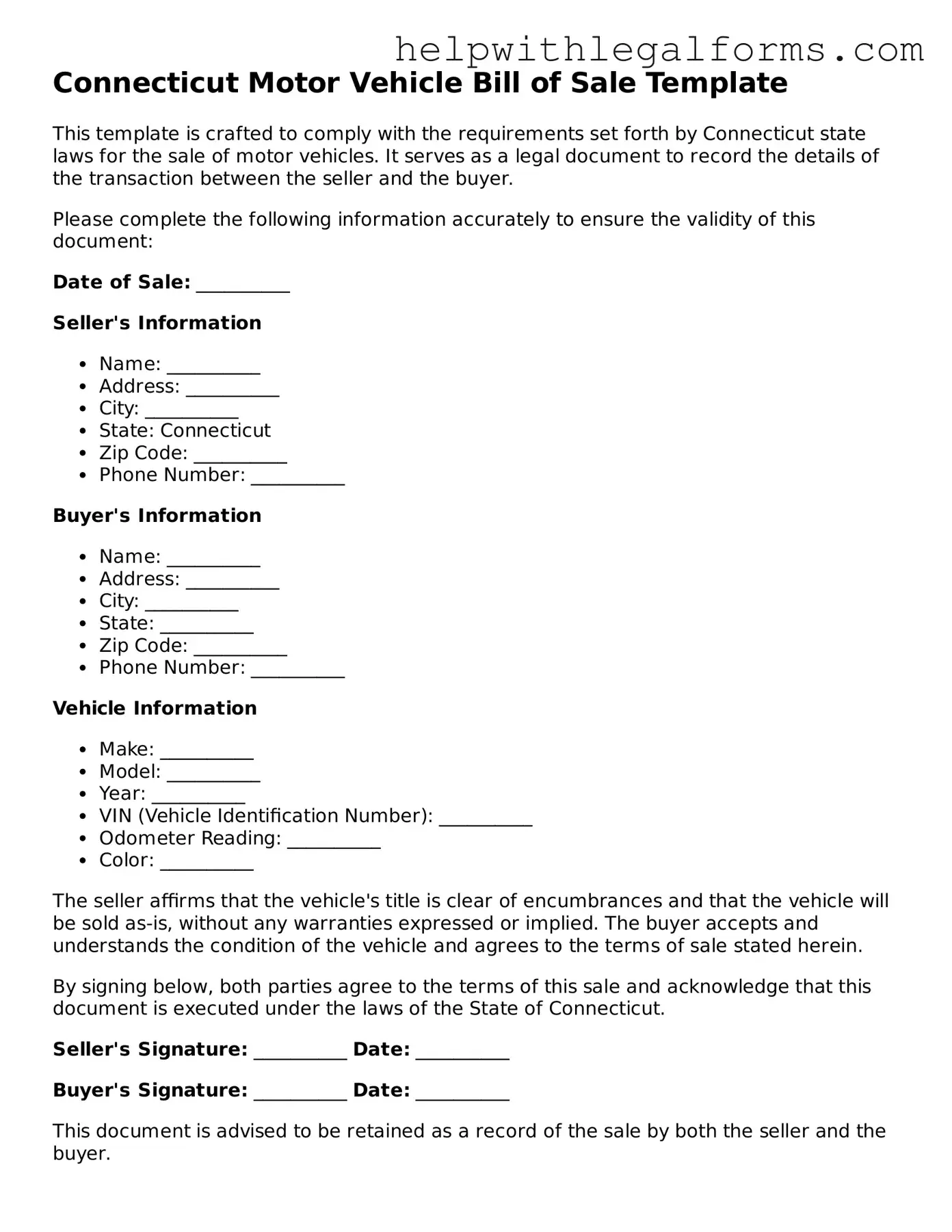

Example - Connecticut Motor Vehicle Bill of Sale Form

Connecticut Motor Vehicle Bill of Sale Template

This template is crafted to comply with the requirements set forth by Connecticut state laws for the sale of motor vehicles. It serves as a legal document to record the details of the transaction between the seller and the buyer.

Please complete the following information accurately to ensure the validity of this document:

Date of Sale: __________

Seller's Information

- Name: __________

- Address: __________

- City: __________

- State: Connecticut

- Zip Code: __________

- Phone Number: __________

Buyer's Information

- Name: __________

- Address: __________

- City: __________

- State: __________

- Zip Code: __________

- Phone Number: __________

Vehicle Information

- Make: __________

- Model: __________

- Year: __________

- VIN (Vehicle Identification Number): __________

- Odometer Reading: __________

- Color: __________

The seller affirms that the vehicle's title is clear of encumbrances and that the vehicle will be sold as-is, without any warranties expressed or implied. The buyer accepts and understands the condition of the vehicle and agrees to the terms of sale stated herein.

By signing below, both parties agree to the terms of this sale and acknowledge that this document is executed under the laws of the State of Connecticut.

Seller's Signature: __________ Date: __________

Buyer's Signature: __________ Date: __________

This document is advised to be retained as a record of the sale by both the seller and the buyer.

PDF Form Attributes

| Fact | Description |

|---|---|

| Purpose | The Connecticut Motor Vehicle Bill of Sale form is used to document the sale and transfer of ownership of a motor vehicle from the seller to the buyer. |

| Required Information | It typically includes details such as the make, model, year, and VIN of the vehicle, as well as the names and signatures of the seller and buyer. |

| Governing Law | In Connecticut, the Motor Vehicle Bill of Sale form is governed by the Department of Motor Vehicles (DMV) regulations. |

| Importance of Notarization | Notarization of the bill of sale is not required in Connecticut, but it's recommended to authenticate the document. |

| Link to Registration | The Bill of Sale is a crucial document needed when registering a vehicle in Connecticut, alongside other required documents. |

| Additional Requirements | In some cases, an odometer disclosure statement must accompany the Bill of Sale. |

| Free Templates | Free templates for the Connecticut Motor Vehicle Bill of Sale form can be found online or directly from the Connecticut DMV website. |

Instructions on How to Fill Out Connecticut Motor Vehicle Bill of Sale

When completing the Connecticut Motor Vehicle Bill of Sale form, the document plays a pivotal role in legally transferring ownership from the seller to the buyer. This form serves not only as a receipt for the transaction but also as a detailed record of the vehicle's sale, which is crucial for registration, tax purposes, and protecting both parties if disputes arise. Filling out the form accurately is paramount, as it provides a clear history of ownership and transaction details. The steps listed below will guide you through the process efficiently and ensure that all necessary information is well-documented.

- Gather the necessary information about the vehicle, including make, model, year, color, VIN (Vehicle Identification Number), and current mileage.

- Enter the full name (first, middle, last) and complete address of the seller in the designated area on the form.

- Fill in the buyer's full name and complete address in the corresponding section.

- Document the agreed-upon sale price of the vehicle in U.S. dollars.

- Provide a detailed description of the vehicle, including its make, model, year, color, body style, and VIN.

- Enter the date of the sale transaction.

- Both the buyer and seller must sign and date the form to acknowledge the accuracy of the information provided and the terms of the sale. Ensure that all signatures are original.

- If applicable, indicate any special terms or conditions of the sale that both parties agree upon.

After completing these steps, it's advisable for both the buyer and seller to keep a copy of the form for their records. It's also important to note that the buyer will need this document, among others, to register the vehicle in their name. Therefore, it should be filled out with care to ensure a smooth transition and legal compliance with Connecticut state laws regarding vehicle sales and registration.

Crucial Points on This Form

What is a Connecticut Motor Vehicle Bill of Sale?

A Connecticut Motor Vehicle Bill of Sale is a legal document that records the sale of a vehicle from one party to another in the state of Connecticut. It details the transaction and provides proof of the change in ownership, including information about the seller, buyer, and the vehicle itself.

Is a Connecticut Motor Vehicle Bill of Sale required for the sale of a vehicle?

Yes, it is highly recommended to complete a bill of sale when selling a vehicle in Connecticut. It serves as important evidence of the transaction for both the buyer and the seller and is required for the buyer to register the vehicle.

What information needs to be included in a Connecticut Motor Vehicle Bill of Sale?

The bill of sale must include the full names and addresses of both the buyer and the seller, the vehicle’s make, model, year, VIN (Vehicle Identification Number), the sale date, and the purchase price. Signatures of both parties are also needed to validate the document.

Do both parties need to sign the Connecticut Motor Vehicle Bill of Sale?

Yes, both the buyer and the seller must sign the bill of sale. Their signatures confirm that the information provided is accurate and that they agree to the terms of the sale.

Does the Connecticut Motor Vehicle Bill of Sale need to be notarized?

Notarization of the bill of sale is not a requirement in Connecticut for it to be considered valid. However, having it notarized can add an extra layer of legal protection and authenticity to the document.

How does a Connecticut Motor Vehicle Bill of Sale protect the buyer and seller?

For the seller, it provides proof that the vehicle was sold "as is," potentially limiting liability if problems arise with the vehicle after the sale. For the buyer, it serves as a receipt for the transaction and is needed to register the vehicle, proving ownership.

What happens if a Connecticut Motor Vehicle Bill of Sale is not used?

Not using a bill of sale can lead to complications in proving ownership of the vehicle, transferring the title, and registering the vehicle. It can also result in disputes or liability issues for both parties involved in the sale.

How can one obtain a Connecticut Motor Vehicle Bill of Sale form?

The form can be downloaded from the Connecticut Department of Motor Vehicles (DMV) website or acquired at a local DMV office. Ensure it is filled out correctly and retains a copy for your records.

Common mistakes

When filling out the Connecticut Motor Vehicle Bill of Sale form, it's crucial to pay careful attention to detail and accuracy. This document is a vital part of buying or selling a vehicle as it provides evidence of the transaction and can be important for title and registration purposes. People often overlook certain aspects when completing the form, leading to common mistakes that could potentially complicate the process.

-

Not checking for accuracy in vehicle details: It's essential to double-check that the vehicle identification number (VIN), make, model, and year are correctly recorded. Mistakes in these details can cause significant issues during the title transfer process.

-

Omitting the sale date or writing an incorrect date: The sale date must accurately reflect when the transaction took place. Falsifying or forgetting this date can lead to legal and taxation discrepancies.

-

Forgetting to include the sale price: Both parties must agree on the sale price, and it should be clearly stated in the bill of sale. This price is necessary for tax assessment and proving the terms of the deal.

-

Neglecting to enter buyer and seller information: Full names and addresses of both the buyer and seller are critical for identifying the parties involved in the transaction. Omitting this information can invalidate the document.

-

Skipping signatures and dates: The bill of sale needs to be signed and dated by both the buyer and the seller to be legally binding. Missing signatures or dates can lead to disputes about the transaction's validity.

-

Not specifying payment terms: If the payment for the vehicle is to be completed in installments, the specific terms need to be outlined in the bill of sale. Without this clarification, misunderstandings about the payment agreement may arise.

-

Failure to obtain a notary public's stamp, when necessary: While not always required, getting the bill of sale notarized can add a layer of legal protection and authenticity. Forgetting to do so, especially when intended, can compromise the document's integrity.

Avoiding these mistakes can help ensure a smoother and more straightforward motor vehicle transaction. Both buyer and seller must review the bill of sale carefully before finalizing. This meticulous attention to detail can prevent future complications and help protect the interests of all parties involved.

Documents used along the form

When processing the sale of a motor vehicle in Connecticut, the Motor Vehicle Bill of Sale form is a critical document. It serves as an official record of the transaction between the buyer and the seller, detailing the sale's specifics such as the date, price, and description of the vehicle. However, to ensure a seamless and legally compliant transfer of ownership, several additional forms and documents are commonly used alongside the Motor Vehicle Bill of Sale. Each document serves a specific purpose, contributing to the legality and completeness of the vehicle's sale and title transfer process.

- Odometer Disclosure Statement: This document is required to certify the accuracy of the vehicle’s mileage at the time of sale. It protects both the buyer and seller by providing a clear record of the vehicle's condition.

- Title Certificate: The legal document proving ownership of the vehicle. It must be transferred to the new owner upon the sale, with the relevant sections completed to record the transaction.

- Registration Application: New owners must submit this form to register the vehicle in their name. The process ensures that the vehicle is legally allowed to operate on state roads.

- Damage Disclosure Statement: This document is essential for informing the buyer of any significant damage the vehicle has sustained in the past, which could affect its value or safety.

- Emissions Testing Report: Depending on the vehicle's age and type, an emissions test might be required. This report verifies that the vehicle meets the state’s emissions standards.

- Sales Tax Form: To comply with state tax regulations, the buyer must submit this form to report and pay any sales tax due on the purchase of the vehicle.

- Release of Liability Form: The seller should file this form to inform the state that they have sold the vehicle and are no longer responsible for it, protecting them from future liabilities.

- Loan Payoff Documentation: If there was a lien on the vehicle, this documentation is necessary to prove that the loan has been paid off and the lien can be released.

In conclusion, the Connecticut Motor Vehicle Bill of Sale is just the starting point for transferring a vehicle's ownership. The additional documents listed are equally important, as they ensure compliance with state laws, provide protection for both parties involved in the transaction, and help facilitate a smooth transfer of the vehicle's title and registration. Paying attention to these documents can help avoid legal issues and ensure that all procedural requirements are met during the sale of a motor vehicle.

Similar forms

Warranty Deed: Like a Motor Vehicle Bill of Sale, a Warranty Deed is a document that transfers ownership. However, it is used for real estate transactions. Both provide a guarantee about the item's condition and assure the buyer that the seller has the legal right to transfer ownership.

Promissory Note: This document is similar because it represents a promise, in this case, to repay a debt. While the Motor Vehicle Bill of Sale records the sale of a vehicle, a Promissory Note records the details of a loan used to purchase something, potentially including a vehicle, documenting the agreement's terms just as precisely.

Receipt of Sale: This is a simple document acknowledging that a sale has occurred and the buyer has provided payment. Similar to a Motor Vehicle Bill of Sale, a Receipt of Sale is proof of transaction, but it is more general and can apply to various types of purchases beyond vehicles.

Warranty Certificate: A Warranty Certificate, much like a Motor Vehicle Bill of Sale, can contain clauses that assure the buyer of the item's condition. However, it specifically relates to the warranty terms for the item sold, offering guarantees and possibly including service conditions if the product fails.

Quitclaim Deed: This document is used to transfer property rights without any guarantees about the property title, contrasting with the Motor Vehicle Bill of Sale, which does imply a guarantee about the seller's right to sell the vehicle. Both are transfer documents, but they differ in the level of assurance provided about the title.

Boat Bill of Sale: Very similar to a Motor Vehicle Bill of Sale, this document is used specifically for the transfer of ownership of a boat. Both documents serve the same purpose for different types of vehicles, detailing the agreement between buyer and seller and including identifying information about the item sold.

Dos and Don'ts

When filling out the Connecticut Motor Vehicle Bill of Sale form, it's essential to approach it with care and attention. This document serves as a formal record of the transaction between the buyer and seller of a vehicle. It not only proves ownership transfer but also plays a crucial role in registration and taxation processes. To ensure accuracy and legality, here are some dos and don'ts to consider:

- Do verify the vehicle's information, including the make, model, year, VIN (Vehicle Identification Number), and mileage. Accuracy here is crucial for a legitimate transaction.

- Do include both the buyer's and the seller's full names and addresses. This information is necessary for any future communication or legal requirements.

- Do accurately state the sale price of the vehicle. It should reflect the true amount agreed upon by both parties.

- Do ensure that both the buyer and seller sign and date the form. These signatures legally bind the document.

- Do keep a copy of the bill of sale for personal records. Both the buyer and the seller should retain a copy in case of disputes or for personal records.

- Don't leave any sections incomplete. An incomplete form can lead to legal complications or the invalidation of the sale.

- Don't forget to check if additional documentation is required by Connecticut's DMV. Sometimes specific forms or inspections are needed beyond the bill of sale.

- Don't hesitate to verify the identity of the buyer or seller. This can prevent fraud and ensure that all parties are legally authorized to partake in the transaction.

- Don't neglect to report the sale to the DMV if required. Reporting the sale can absolve the seller from liability for what the buyer does with the vehicle after the sale.

By following these guidelines, you can ensure a smoother process for both parties involved. Remember, the Connecticut Motor Vehicle Bill of Sale is not just a formality but a binding document that protects the rights of everyone involved in the transaction.

Misconceptions

When dealing with the Connecticut Motor Vehicle Bill of Sale form, it's important to clear up some common misconceptions. This document is crucial for the legal transfer of a vehicle's ownership within the state. Misunderstandings can complicate what should be a straightforward process. Here are six common misconceptions explained:

- A Bill of Sale is the only document needed to transfer ownership. This is not the case. While the Bill of Sale is critical, it must be accompanied by other documents, such as the vehicle's title, a completed Application for Registration and Certificate of Title (Form H-13B), and proof of insurance, among others.

- The Bill of Sale needs to be notarized in Connecticut. Connecticut does not require the motor vehicle Bill of Sale to be notarized. However, ensuring that all information is correctly filled out and that both the buyer and seller sign it is crucial.

- There’s one standard form for all vehicles. While the state provides a generic Bill of Sale form, it’s important to note that certain types of vehicles may require additional information. It's always a good idea to check if there are specific requirements for the vehicle you're buying or selling.

- It serves as proof of payment only. The Bill of Sale serves multiple purposes beyond just proving payment. It includes important information about the transaction, such as a detailed description of the vehicle, the sale date, and the agreed-upon sale price, which is crucial for tax and registration purposes.

- Personal property included with the vehicle does not need to be listed. If personal property is included in the sale (e.g., a stereo system or GPS device), it should be listed on the Bill of Sale. This listing can prevent future disputes about what was included in the sale.

- Once signed, it cannot be amended. If both parties agree, amendments can be made to the Bill of Sale, though it’s often simpler to draft a new document. Any changes should be made before the new owner registers the vehicle, as inconsistencies can create complications.

Understanding these aspects of the Connecticut Motor Vehicle Bill of Sale can help both buyers and sellers navigate the sale process more smoothly, ensuring a legal and effective transfer of ownership.

Key takeaways

When completing or making use of the Connecticut Motor Vehicle Bill of Sale form, individuals can ensure a smoother transaction and legal compliance by keeping several key points in mind:

- Before filling out the form, gather all necessary information about the vehicle, including make, model, year, VIN (Vehicle Identification Number), and current mileage.

- Ensure that both the seller and the buyer provide accurate personal information such as full names, addresses, and contact details.

- The sale price should be clearly stated on the form. This should reflect the agreed amount between the buyer and the seller.

- It's vital to include the sale date on the form. This date indicates when the ownership of the vehicle is officially transferred.

- Both the seller and the buyer must sign the form. Their signatures are essential for the document to be legally binding.

- The form should also include any special terms or conditions of the sale. This might cover any warranties or as-is sale terms.

- After the Bill of Sale is completed and signed, both parties should keep a copy for their records. This document serves as a receipt and proof of ownership transfer.

- In Connecticut, the Bill of Sale must be notarized. This step verifies the authenticity of the document and the identity of the signers.

- Submitting the Connecticut Motor Vehicle Bill of Sale is a crucial step in the vehicle registration process. The buyer will need this document, among others, to register the vehicle in their name.

By understanding and following these guidelines, individuals can ensure the legality and validity of the vehicle sale, protecting the interests of both buyer and seller. Proper completion and use of the Connecticut Motor Vehicle Bill of Sale form are foundational to a successful and compliant vehicle transaction.

Create Other Motor Vehicle Bill of Sale Forms for US States

How to Write Up a Bill of Sale for a Car - The form can specify payment methods for the vehicle, including if a deposit was made and the balance of payment terms.

Maryland Bill of Sale Requirements - Utilizing a Motor Vehicle Bill of Sale is a best practice in private vehicle transactions, establishing a professional and credible agreement.

Florida Vehicle Bill of Sale Printable - Prepares the groundwork for a hassle-free registration process with the DMV, including necessary identifiers like the VIN.

Texas Vehicle Bill of Sale Word Doc - This document serves as proof of transaction and includes details such as the make, model, and VIN of the vehicle.