Blank Bill of Sale Form for New York

In the bustling markets and private sales across New York, from the towering cityscape of NYC to the serene landscapes of upstate, transactions big and small are sealed with a critical document: the New York Bill of Sale form. This form stands as a pivotal legal document, providing a written record of the transfer and purchase of an item, be it a vehicle, a work of art, or even a piece of antique furniture. For both buyers and sellers, this form not only signifies the completion of a sale but also serves to protect each party's interests, ensuring that the terms of their agreement are clearly outlined and legally acknowledged. It encompasses vital information such as the detailed description of the item sold, the sale price, and the parties' contact information. Additionally, it plays a significant role in various legal and tax-related scenarios, encapsulating the essence of transparency and accountability in private sales. For anyone navigating the waters of buying or selling valuable items in New York, understanding and utilizing the New York Bill of Sale form is an indispensable step in ensuring that the transaction is recognized and upheld by the law.

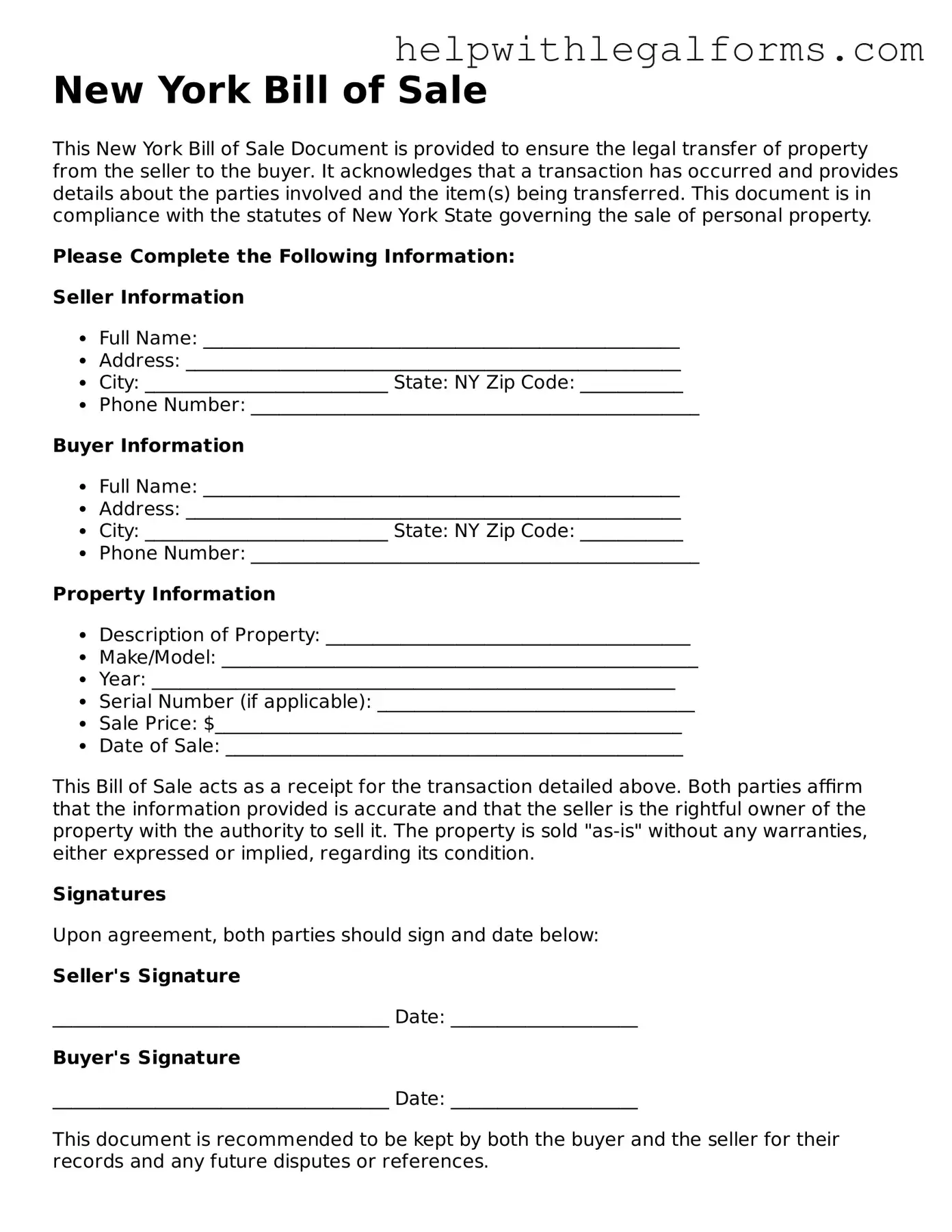

Example - New York Bill of Sale Form

New York Bill of Sale

This New York Bill of Sale Document is provided to ensure the legal transfer of property from the seller to the buyer. It acknowledges that a transaction has occurred and provides details about the parties involved and the item(s) being transferred. This document is in compliance with the statutes of New York State governing the sale of personal property.

Please Complete the Following Information:

Seller Information

- Full Name: ___________________________________________________

- Address: _____________________________________________________

- City: __________________________ State: NY Zip Code: ___________

- Phone Number: ________________________________________________

Buyer Information

- Full Name: ___________________________________________________

- Address: _____________________________________________________

- City: __________________________ State: NY Zip Code: ___________

- Phone Number: ________________________________________________

Property Information

- Description of Property: _______________________________________

- Make/Model: ___________________________________________________

- Year: ________________________________________________________

- Serial Number (if applicable): __________________________________

- Sale Price: $__________________________________________________

- Date of Sale: _________________________________________________

This Bill of Sale acts as a receipt for the transaction detailed above. Both parties affirm that the information provided is accurate and that the seller is the rightful owner of the property with the authority to sell it. The property is sold "as-is" without any warranties, either expressed or implied, regarding its condition.

Signatures

Upon agreement, both parties should sign and date below:

Seller's Signature

____________________________________ Date: ____________________

Buyer's Signature

____________________________________ Date: ____________________

This document is recommended to be kept by both the buyer and the seller for their records and any future disputes or references.

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Purpose | A New York Bill of Sale form is used as a legal document to record the transfer of ownership of personal property from a seller to a buyer. |

| Required Information | The form typically includes details such as the names and addresses of the seller and buyer, a description of the item being sold, the sale date, and the purchase price. |

| Governing Law | These transactions are governed by New York General Obligations Law, which sets the regulations for valid bills of sale in the state. |

| Uses | Besides its use in private sales, a Bill of Sale in New York serves as a critical piece of evidence for legal protections, tax purposes, and in certain cases, vehicle registration processes. |

| Notarization | While not always required, getting the document notarized may enhance its legal validity, especially for transactions involving high-value items. |

Instructions on How to Fill Out New York Bill of Sale

Once you've decided to buy or sell a personal item, such as a car or a piece of furniture, in New York, properly documenting the transaction becomes crucial. A Bill of Sale acts as a critical proof of purchase and can serve multiple purposes, including tax documentation and legal protection. Filling out a New York Bill of Sale correctly ensures that all parties are clear on the terms of the deal, protects the seller in case the item is later found in a condition not stated, and assures the buyer of the item's legitimacy. Below, you'll find straightforward steps to accurately complete a New York Bill of Sale form.

- Begin by filling in the date of the sale to officially mark when the transaction takes place.

- Next, write down the full names and addresses of both the seller and the buyer. This information is crucial for identifying the parties involved.

- Describe the item being sold. Include as many identifying details as possible, such as make, model, year, color, and serial number, if applicable. This specificity helps ensure the exact item is documented.

- State the sale price of the item. Be clear and precise, as this affects tax considerations and records.

- If any warranties or guarantees are included with the sale, detail them. If the item is being sold as-is, specify this to avoid future disputes.

- For motor vehicles or other items that require it, include the odometer reading or hours of use.

- Both the buyer and seller should sign and date the form. In some cases, witness signatures may also be required to add an extra layer of validity.

- Finally, make copies of the completed Bill of Sale. Provide one to each party involved for their records.

Filling out a Bill of Sale in New York is a straightforward process that provides essential protection and peace of mind for both the buyer and seller. By following these steps, you can ensure that the transaction is properly documented, legally binding, and clear to all parties involved. Remember, a well-completed Bill of Sale is a valuable asset in safeguarding your legal rights and can serve as an important piece of evidence in any future disputes or proceedings.

Crucial Points on This Form

What is a New York Bill of Sale form?

A New York Bill of Sale form serves as a legal document that records the sale and transfer of ownership of an item between a seller and a buyer. It acts as proof of purchase and can be used for vehicles, boats, furniture, or other personal property. The form typically includes details of the transaction such as the date of sale, purchase price, and descriptions of the item sold, along with the personal information of both the seller and the buyer.

Is a Bill of Sale required in New York?

In New York, a Bill of Sale is not mandatory for all transactions, but it is crucial for the sale of certain items like vehicles and boats. When it comes to vehicles, the New York Department of Motor Vehicles (DMV) requires a Bill of Sale for registering and titling the vehicle in the buyer's name. It provides an additional layer of security for both parties and can also serve as a needed documentation for personal records or potential legal disputes.

What information should be included in a New York Bill of Sale?

A comprehensive New York Bill of Sale should contain specific information to ensure it is valid and effective. This includes the names and addresses of both the seller and the buyer, a detailed description of the item being sold (including make, model, year, and serial number, if applicable), the sale date, the purchase price, and any warranties or conditions of the sale. The document should also be signed by both parties and, depending on the item being sold, notarization may be required for additional legal validity.

Do I need to have the Bill of Sale notarized in New York?

While notarization of a Bill of Sale in New York is not always a legal requirement, it is recommended for transactions involving high-value items such as cars and boats. Notarization adds a level of verification to the signatures on the document, confirming that both parties indeed agreed to the terms of the sale. This step can significantly increase the document's credibility and can be invaluable in the event of a dispute.

How can a New York Bill of Sale protect me?

A New York Bill of Sale can offer significant protection to both the buyer and the seller in a transaction. For the seller, it provides proof that the item was transferred to another individual, releasing them from liability associated with its future use. For the buyer, it acts as evidence of ownership and the terms of purchase, which can be crucial for warranty claims or if the legality of the ownership comes into question. Keeping a copy of the Bill of Sale can safeguard the interests of both parties against potential legal issues.

Common mistakes

Filling out a New York Bill of Sale form is an important step in the sale of any item, particularly when it comes to vehicles, boats, or other significant assets. Doing it correctly ensures that the transaction is recognized legally, providing protection for both the buyer and the seller. However, people often make mistakes during this process. Understanding and avoiding these common errors can help make the transaction smoother and more secure for all parties involved.

Not providing complete details of the item being sold can lead to problems down the line. It's crucial to include a full description that covers make, model, year, color, condition, and any identifying numbers (like serial or VIN numbers). This specificity helps in avoiding disputes about what was intended to be sold.

Forgetting to include either the buyer's or the seller's information can invalidate the document. Full legal names, addresses, and contact information are essential for both parties. This information ensures that everyone involved can be reached should any questions or issues arise post-sale.

Omitting the date of sale might seem like a small oversight, but it's significant. The sale date can affect warranty periods, tax obligations, and other time-sensitive matters. Always include the date when the transaction becomes official.

Failing to specify the sale price or misstating it, either intentionally or inadvertently, can have legal and tax implications. The price should be clearly listed and agreed upon by both parties to reflect the transaction accurately.

Skipping the declaration that the item is sold "as is" or failing to describe any warranties implies certain guarantees to the buyer that the seller may not have intended. If the item is being sold without any warranties (which is often the case in private sales), this should be explicitly stated to avoid future claims.

Not obtaining signatures from all parties involved is a critical error. The Bill of Sale should be signed by both the buyer and the seller to make it legally binding. In some cases, a witness or notarization may also be required to authenticate the document further.

Avoiding these mistakes can help ensure that the Bill of Sale for your New York transaction is complete, clear, and effective. This document is an important part of transferring ownership, so taking the time to fill it out properly is well worth the effort.

Documents used along the form

When participating in a transaction in New York, such as buying or selling a vehicle, the Bill of Sale form is crucial. However, this document does not stand alone. Several other forms and documents are often required to ensure the process adheres to legal standards and provides all parties with comprehensive records of the transaction. These forms offer protection, clarity, and peace of mind. Below is a list of other essential documents that are frequently used in conjunction with the New York Bill of Sale form.

- Title Certificate: This document proves ownership of the item (e.g., a vehicle) being sold. It's essential for the transfer of ownership and is needed to update records with the state.

- Odometer Disclosure Statement: For vehicle sales, this statement is required by federal law to ensure the buyer is aware of the accurate mileage of the vehicle. It helps prevent odometer fraud.

- Sales Tax Form: When a transaction occurs, sales tax may be applicable. This form helps calculate and report the sales tax due to the state.

- Vehicle Registration Forms: These forms are necessary for the buyer to register the vehicle in their name after the purchase. It's a critical step for legally driving the vehicle.

- Warranty Deed or Quitclaim Deed: In real estate transactions, this document is used to transfer property ownership. It guarantees that the seller holds clear title to the property or transfers it without such a guarantee, respectively.

- Loan Documents: If the purchase involves financing or a loan, these documents outline the terms and conditions, repayment schedule, and interest rates among other details.

- Insurance Documents: For items needing insurance, such as vehicles or real estate, proof of insurance is often required at the time of the sale to ensure coverage is in place.

- Inspection Certificates: Vehicles often require a recent inspection certificate to verify they meet safety and emissions standards. This is necessary for both the sale and the registration process.

- Release of Liability Form: This form protects the seller from liability for any accidents or incidents that occur with the item (e.g., a vehicle) after the sale has been completed.

Together, these documents help facilitate a smooth and legally compliant transaction process. They serve to protect the interests of both the buyer and the seller, ensuring that all aspects of the sale are transparent and legally sound. Whether selling a car, a piece of real estate, or any other significant item, it's important to understand and prepare the necessary paperwork to avoid future complications.

Similar forms

Sales Agreement: A Bill of Sale form and a Sales Agreement share a primary function—documenting the sale and transfer of personal property from a seller to a buyer. Both outline the agreed-upon conditions of the sale, including a description of the item being sold, the sale price, and the names of the parties involved. However, a Sales Agreement often includes detailed terms and conditions of the sale, such as warranties and delivery instructions, making it more comprehensive than a typical Bill of Sale, which is generally more straightforward and used at the point of sale.

Warranty Deed: Similar to a Bill of Sale, a Warranty Deed is used in real estate transactions to transfer ownership of property. While a Bill of Sale covers personal property like vehicles, equipment, or other tangible goods, a Warranty Deed is specifically for real property. Both documents serve to legally transfer ownership rights from one party to another and provide a record of the transaction, but a Warranty Deed also guarantees that the property is free from any liens or claims.

Receipt: A Receipt is akin to a Bill of Sale as both are proofs of transaction. However, a Receipt usually follows the exchange and serves as a simpler acknowledgment that the buyer has paid for the goods or services. Unlike a Bill of Sale, a Receipt typically includes less detail about the terms of the sale and focuses more on confirming the payment. Receipts are widely used in everyday transactions, from retail purchases to service contracts.

Title: In the context of vehicle ownership, a Title shares similarities with a Bill of Sale, as both are key documents used in the transfer of assets. The Title is a legal certificate that establishes a person or business as the legal owner of the vehicle. However, while the Bill of Sale documents the transaction and the terms of the sale, the Title specifically relates to the right of ownership and is necessary for registering the vehicle with state authorities. It is the definitive document proving ownership, whereas the Bill of Sale serves as evidence of the transaction.

Dos and Don'ts

When completing the New York Bill of Sale form, it's important to ensure accuracy and clarity to protect both the buyer and the seller involved in the transaction. Here are some essential dos and don'ts to keep in mind:

Do:

- Provide complete and accurate information for both the buyer and the seller, including names, addresses, and contact details. This aids in establishing a clear record of who is involved in the transaction.

- Include a detailed description of the item or items being sold. This should cover make, model, year, color, condition, and any identifying numbers (like a VIN for vehicles). It serves to identify unmistakably the item in question.

- Ensure the sale price is clearly stated and agreed upon by both parties. This is crucial for tax purposes and helps in preventing future disputes over payment.

- Sign and date the form in the presence of a notary, if applicable. Although not always required, having the bill of sale notarized can add an extra layer of legality and protection for both parties.

Don't:

- Forget to check if your specific sale item has additional requirements or forms that need to be completed. Some items, like vehicles or boats, may have extra steps for the transfer of ownership.

- Leave any sections of the bill of sale blank. Incomplete forms may be considered invalid or could lead to misunderstandings or legal issues in the future.

- Ignore the importance of obtaining a copy of the bill of sale for your records. Both the buyer and the seller should keep a copy as proof of the transaction and for their personal records.

- Rely on verbal agreements to supplement the bill of sale. All agreements and warranties should be written directly on the bill of sale to ensure that they are legally binding and enforceable.

Misconceptions

Many people have misconceptions about the New York Bill of Sale form. This document is crucial for various transactions, but misunderstandings can lead to mistakes in its use and implementation. Here are seven common misconceptions:

- It's only required for motor vehicle transactions. Although commonly used for buying and selling cars, the New York Bill of Sale form is also necessary for transferring ownership of other types of personal property, such as boats and firearms.

- A verbal agreement is just as good. Verbal agreements may seem convenient but lack the legal standing and detail of a written bill of sale. The form provides a written record that can protect both parties in the event of a dispute.

- It must be notarized to be valid. While notarization can add an extra layer of authenticity, New York does not typically require a bill of sale to be notarized. However, verifying this based on the specific transaction is crucial since requirements can vary.

- It's too complicated for the average person to complete without a lawyer. The form is designed to be straightforward and user-friendly. With clear instructions, most people can fill it out without legal assistance.

- The same form is used for all transactions. While a basic template can apply to different types of personal property, New York may have specific forms or requirements for particular items, such as motor vehicles or boats. Always double-check which form is appropriate for your transaction.

- Signing a Bill of Sale transfers the title automatically. Signing the form is a key step in the transaction process, but it doesn't automatically transfer the title. The seller must properly endorse the title over to the buyer, and the buyer typically must complete additional steps with the relevant state agency.

- You don't need a Bill of Sale if you're giving the item as a gift. Even if no money is exchanged, a Bill of Sale can still be important. It proves the transfer of ownership and can be crucial for the new owner's registration or insurance needs.

Understanding these misconceptions can help ensure that the use of a New York Bill of Sale form is both effective and compliant with state laws. This knowledge can facilitate smoother transactions and protect the interests of all parties involved.

Key takeaways

When completing and utilizing the New York Bill of Sale form, it's important to keep several key points in mind to ensure the process is conducted accurately and effectively. These takeaways will help guide parties involved in private sales of property or goods within New York State.

- Accuracy is essential: Ensure all information entered on the Bill of Sale is correct. This includes the full names and addresses of both the buyer and the seller, along with a detailed description of the item being sold, including make, model, year, and serial number, if applicable.

- Signature requirements: Both the buyer and the seller must sign the Bill of Sale. This act formally completes the transaction and provides a record that the sale has been agreed upon by both parties.

- Witness or Notarization: While not always mandatory, having the Bill of Sale witnessed or notarized can add an extra level of legal protection and authenticity to the document.

- Keep copies: Both the buyer and the seller should keep a copy of the Bill of Sale. This serves as a receipt for the buyer and a record of the sale for the seller.

- Specificity counts: The more specific you are in describing the item being sold, the better. Including details such as color, condition, and any identifying marks or features can help prevent disputes about the item’s identity in the future.

- Include a disclaimer: Selling items "as is" means the seller is not offering any warranties on the item. If this is the case, clearly state it on the Bill of Sale to protect the seller from future claims by the buyer about the item's condition.

- Personal identification information: It's prudent for both parties to verify each other's identity through government-issued IDs to prevent fraud and misunderstandings.

- Use the form appropriately: The Bill of Sale is specifically designed for the sale of personal property. It should not be used for real estate transactions or services.

By adhering to these guidelines, individuals can ensure that their transactions are more secure and reduce the likelihood of legal complications in the future. Taking these steps seriously safeguards both the buyer’s and seller’s interests during the exchange of goods.

Create Other Bill of Sale Forms for US States

Simple Bill of Sale Oklahoma - In agricultural sales, the document can record the sale of crops, equipment, or livestock, providing clear ownership transfer.

How to Sell a Car in Colorado - It includes terms and conditions of the sale to protect both the buyer and the seller from potential disputes.

Bill of Sale Car Texas - Often used when selling vehicles, electronics, or other valuable belongings, a Bill of Sale serves as a safeguard for both parties, documenting the sale's terms and conditions.