Blank Bill of Sale Form for Texas

In Texas, the Bill of Sale form serves as an important document for both buyers and sellers during the process of transferring ownership of various types of property, such as vehicles, boats, or even personal items. This form not only provides a legal record of the sale but also adds a layer of protection for both parties involved. It includes critical details such as the date of the sale, identification of the item sold, and the terms of the agreement, including the sale price. Proper completion and submission of this form are key in ensuring the transfer is recognized by legal and governmental agencies within the state. Additionally, the Texas Bill of Sale form can play a crucial role in registering and titling processes, especially in the case of vehicles, making it an essential piece of documentation that facilitates a smooth transition of ownership while adhering to state laws and regulations.

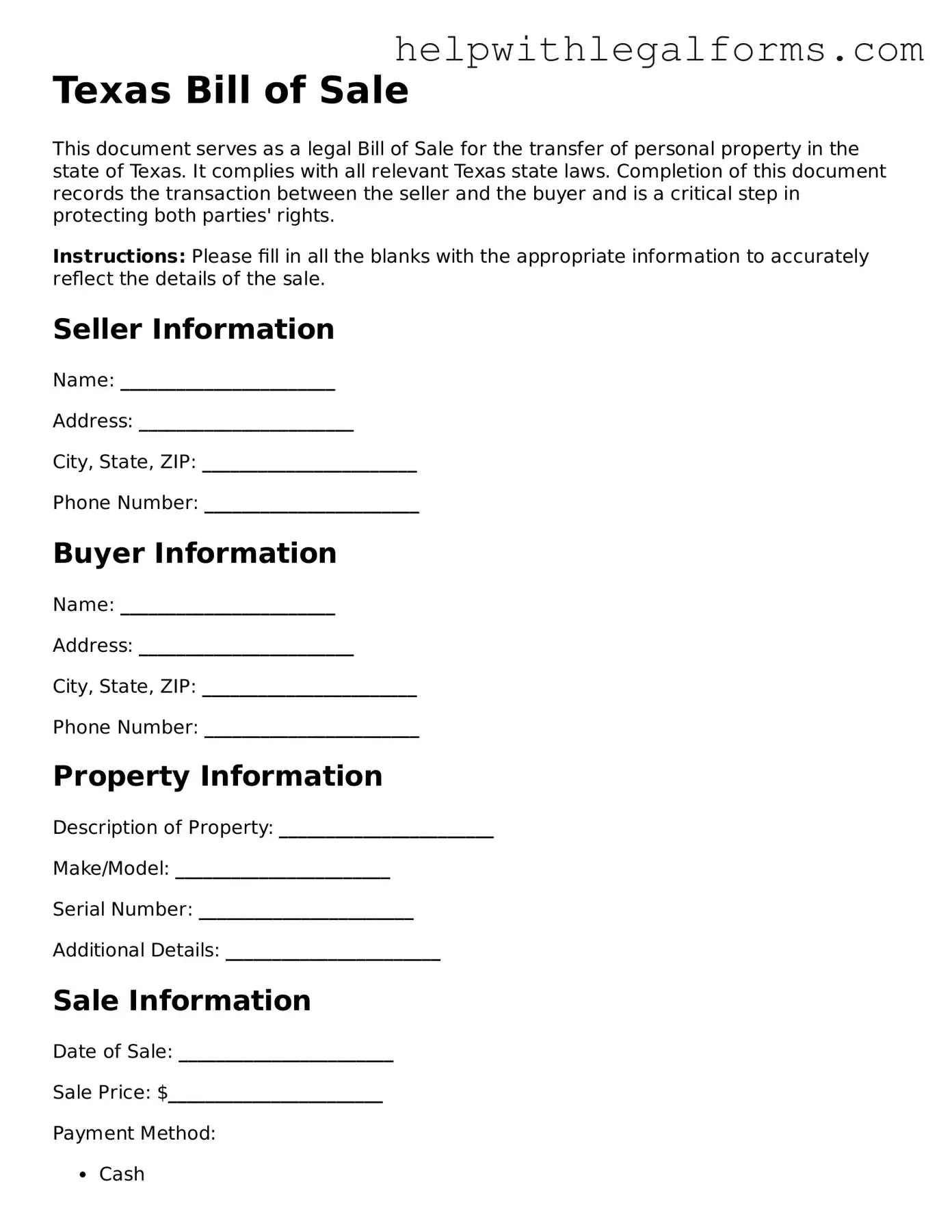

Example - Texas Bill of Sale Form

Texas Bill of Sale

This document serves as a legal Bill of Sale for the transfer of personal property in the state of Texas. It complies with all relevant Texas state laws. Completion of this document records the transaction between the seller and the buyer and is a critical step in protecting both parties' rights.

Instructions: Please fill in all the blanks with the appropriate information to accurately reflect the details of the sale.

Seller Information

Name: _______________________

Address: _______________________

City, State, ZIP: _______________________

Phone Number: _______________________

Buyer Information

Name: _______________________

Address: _______________________

City, State, ZIP: _______________________

Phone Number: _______________________

Property Information

Description of Property: _______________________

Make/Model: _______________________

Serial Number: _______________________

Additional Details: _______________________

Sale Information

Date of Sale: _______________________

Sale Price: $_______________________

Payment Method:

- Cash

- Check

- Other: _______________________

Additional Terms and Conditions

____________________________________________________________

____________________________________________________________

Signatures

This document is valid only if signed by both the buyer and the seller. It acts as a receipt and acknowledgment of the sale.

Seller's Signature: _______________________ Date: _______________________

Buyer's Signature: _______________________ Date: _______________________

Note: Both parties are encouraged to keep a copy of this document for their records.

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Definition | A Texas Bill of Sale is a form that documents the transfer of ownership of an item from one person to another in the state of Texas. |

| Primary Use | It is mainly used for the private sale of vehicles, boats, firearms, and personal items between individuals. |

| Required Information | The form typically includes details about the seller and the buyer, a description of the item being sold, the sale price, and the sale date. |

| Governing Law | It is governed under the Texas Uniform Commercial Code for most personal property sales. |

| Notarization | Notarization is not required by Texas law for the bill of sale to be considered legal and valid, but it is recommended for the protection of both parties. |

| Additional Requirements | For vehicle sales, the Texas Department of Motor Vehicles requires the title to be transferred using a title transfer form along with the Bill of Sale. |

Instructions on How to Fill Out Texas Bill of Sale

When individuals engage in the buying and selling of goods in Texas, a Texas Bill of Sale form often facilitates the process, serving as a receipt and providing proof of the transaction. This document, crucial for the legal transfer of ownership, contains specific details about the item sold and the terms agreed upon by both parties. Filling out this form accurately is essential for protecting the rights of both the buyer and the seller. The following steps are designed to guide you through the completion of the Texas Bill of Sale form, ensuring a smooth and legally compliant transaction.

- Begin by entering the date of the sale in the designated area at the top of the form. This date marks when the transaction officially takes place.

- Next, fill in the full legal names and contact information of both the seller and the buyer. This should include addresses, phone numbers, and email addresses to ensure both parties can be reached if needed.

- Describe the item being sold. Include relevant details such as make, model, year, color, size, and any other identifying features or serial numbers. This information helps clearly identify the item and reduce future disputes.

- Enter the sale price of the item in dollars. It's important to write out the amount in words and then again in numbers to confirm the agreed-upon price and to minimize confusion.

- If applicable, specify the method of payment (cash, check, money order, etc.) and outline any payment plan details, including down payment amounts and due dates for subsequent payments.

- Include any additional terms and conditions related to the sale. This may cover warranties, return policies, or "as is" sale stipulations, explicitly defining what is and isn’t covered post-transaction.

- Both the buyer and the seller must sign and date the form. In some cases, witnessing by a third party or notarization may be required to validate the signatures.

Upon completing the Texas Bill of Sale form, it’s advisable for both parties to keep a copy for their records. This document acts as a proof of purchase and ownership transfer, which can be immensely useful in resolving any future disputes or for tax and registration purposes. Familiarizing oneself with the steps to accurately fill out this form can contribute to a straightforward and transparent transaction, securing the interests of everyone involved.

Crucial Points on This Form

What is a Texas Bill of Sale form?

A Texas Bill of Sale form is a legal document used during the sale of personal items, such as vehicles, boats, or smaller items like furniture or electronics, within Texas. It records the transaction between the seller and the buyer, providing evidence of the transfer of ownership. This form typically includes details about the item sold, the sale amount, and the parties involved.

Do I need to notarize the Texas Bill of Sale form?

In Texas, not all Bill of Sale forms require notarization. However, for certain transactions, such as those involving a vehicle, the state does recommend notarization to add an extra layer of legal protection and authenticity. It's always advisable to check the specific requirements for your type of sale or consult a legal professional.

How can I obtain a Texas Bill of Sale form?

You can obtain a Texas Bill of Sale form through several means. The Texas Department of Motor Vehicles (DMV) website offers downloadable forms specific to vehicles. Additionally, generic Bill of Sale forms are available online or at office supply stores. For a form tailored to specific needs, consulting a legal professional is recommended.

Is a Bill of Sale form enough to legally transfer ownership of property in Texas?

While a Bill of Sale form is crucial in recording the transaction and transfer of ownership, it may not be the only document required. For vehicles, a title transfer form must also be completed and submitted to the Texas DMV. For other types of property, it's essential to check if additional forms or steps are necessary to legally complete the transfer of ownership.

Common mistakes

-

Not checking the vehicle identification number (VIN) carefully. The VIN must be accurate and match the vehicle being sold exactly. An incorrect VIN can create significant issues in the vehicle's registration and ownership transfer process.

-

Forgetting to include the date of sale. The sale date is essential for legal and record-keeping purposes. It confirms when the ownership transfer occurred.

-

Omitting important seller and buyer information. Full names, addresses, and contact details of both parties are crucial. This information ensures that both the seller and buyer can be contacted in case there are any post-sale issues or further verifications needed.

-

Leaving the sale price blank or not being specific. The actual sale price should be clearly stated. This helps in the calculation of any applicable taxes and establishes a clear transaction value.

-

Ignoring the necessity to describe the item in detail. Especially for vehicles, details such as make, model, year, and color should be explicitly mentioned. This helps in identifying the specific vehicle being sold.

-

Not specifying warranty information. It should be clear whether the vehicle is sold 'as is' or with a warranty. Failing to specify this can lead to misunderstandings and legal complications later.

-

Skipping the signature section. Both the seller and buyer must sign the Bill of Sale. Unsigned or improperly signed documents might not be legally binding.

-

Forgetting to make copies of the document. Both parties should have a copy of the Bill of Sale for their records. It serves as proof of purchase and ownership transfer.

-

Not getting the document notarized if required. While not always mandatory, having the Bill of Sale notarized can add an extra layer of legal protection and authenticity to the document.

-

Misunderstanding the legal requirements. Each state has its own requirements for a Bill of Sale. Ensuring that the form complies with Texas laws is necessary for it to be valid.

When selling or buying a vehicle in Texas, making sure that the Bill of Sale is filled out correctly and comprehensively is key. Avoiding the mistakes listed above can help streamline the sale process and prevent potential headaches down the line.

Documents used along the form

When transferring ownership of a vehicle or other valuable property in Texas, a Bill of Sale form is often instrumental in documenting the transaction. This key document is not the sole piece of paperwork involved in the process. Several other forms and documents frequently accompany the Texas Bill of Sale to ensure the transfer is conducted legally and thoroughly. These forms ensure compliance with all state requirements and provide protection for both the buyer and seller.

- Title Transfer Forms: Essential for vehicles, boats, and other titled property, this document officially transfers the title from the seller to the buyer, recording the change in ownership with the state.

- Odometer Disclosure Statement: Required for the sale of vehicles, this document records the odometer reading at the time of sale, ensuring the buyer is aware of the vehicle’s mileage.

- Release of Liability Form: This form protects the seller from liability for any damage or violations involving the vehicle or property from the moment of sale onwards.

- Warranty Documents: If the property is being sold with a warranty, these documents detail the warranty’s terms, ensuring both parties understand what is guaranteed about the condition of the property.

- Registration Documents: For items that require registration, such as vehicles or boats, the buyer will need these documents to register the property in their name under state law.

Together, these documents provide a comprehensive framework for the sale of personal property in Texas, safeguarding the legal rights and responsibilities of all parties involved. By preparing and utilizing this suite of documentation, individuals can facilitate smooth and legally sound transactions, minimizing potential disputes and ensuring compliance with state regulations.

Similar forms

Warranty Deed - Similar to a Bill of Sale, a Warranty Deed is used in real estate transactions to prove the transfer of ownership from the seller to the buyer. Both documents guarantee that the seller has the right to sell the property and ensure that the property is free from any debts or encumbrances not disclosed in the agreement.

Quitclaim Deed - Like a Bill of Sale, a Quitclaim Deed is used to transfer property rights, but without any warranties regarding the title of the property. It simply transfers whatever interest the seller has in the property, if any, to the buyer.

Title - A Title, especially in the context of vehicles, serves a similar purpose as a Bill of Sale in that it documents the ownership of the property (in this case, a vehicle) and is necessary for the legal transfer of ownership from the seller to the buyer.

Receipt - A Receipt is a simple form of a Bill of Sale that acknowledges the purchase and sale of goods between two parties. It typically includes the date of the transaction, the amount paid, and a description of the item(s) purchased.

Promissory Note - A Promissory Note is a written promise to pay a specified amount of money at a later date. Similar to a Bill of Sale, it outlines the terms of a transaction, but rather than confirming a sale, it confirms a commitment to pay.

Loan Agreement - A Loan Agreement is used when one party lends money to another. It is similar to a Bill of Sale in that it identifies the parties involved, the amount of money being exchanged, and any conditions attached to the transaction.

Security Agreement - A Security Agreement, like a Bill of Sale, is a legal document that outlines a transaction. In this case, it secures a loan on personal property. It details the property being used as security for a loan, ensuring the lender's interest in the property should the borrower default on their payments.

Dos and Don'ts

When filling out the Texas Bill of Sale form, it's crucial to ensure that the document accurately reflects the transaction and is filled out correctly to avoid any potential future disputes or legal issues. Here are essential do's and don'ts to keep in mind:

- Do verify the accuracy of all information, including the names, addresses, and identification details of both the buyer and the seller.

- Do include a detailed description of the item being sold, such as make, model, year, and serial number if applicable.

- Do ensure that the sale price is clearly stated and agreed upon by both the buyer and the seller.

- Do confirm that the form is signed and dated by both parties in the presence of a notary public if required.

- Do keep a copy of the completed form for your records, as it serves as proof of purchase or sale.

- Do check if additional documentation is required for the sale of specific items, such as vehicles, which may need a title transfer.

- Don't leave any sections of the form blank. If a section does not apply, indicate this with "N/A" (not applicable).

- Don't forget to disclose any important information that could affect the value or use of the item, such as damages or liens.

- Don't use unclear language or abbreviations that might make the terms of sale ambiguous.

- Don't rely solely on verbal agreements; ensure that all terms and conditions of the sale are documented on the form.

Misconceptions

When it comes to transferring ownership of personal property in Texas, a Bill of Sale form is often used. However, there are several misconceptions about the use and legal requirement of this document. Understanding these misconceptions is important for both buyers and sellers to ensure that their transactions are both legal and secure.

- A Bill of Sale is required for all sales transactions in Texas. - This is not entirely accurate. While a Bill of Sale serves as a valuable record of a transaction and can provide legal protection, not all sales in Texas legally require one. For instance, private sales of personal items may not necessitate a Bill of Sale, but it's often used for vehicles, boats, and firearms to provide proof of purchase and transfer of ownership.

- There is a standard, state-issued Bill of Sale form in Texas. - The state of Texas does not offer a standardized Bill of Sale form for all types of transactions. However, there are specific forms for certain types of sales, such as vehicle transfers. For other items, parties can create their own Bill of Sale, as long as it includes necessary details like a description of the item sold, the sale amount, and the parties' signatures.

- A Bill of Sale must be notarized in Texas. - Notarization is not a legal requirement for a Bill of Sale in Texas. However, having the document notarized can add an extra layer of authenticity and may be required by a lender if the item purchased is being financed.

- The Bill of Sale only benefits the seller. - This document is mutually beneficial. For the seller, it provides proof that the item was legally sold on a specific date. For the buyer, it serves as a receipt and may be needed for registration or insurance purposes, or to show proof of ownership if disputed.

- A Bill of Sale alone transfers ownership. - A Bill of Sale is an important document for recording the transaction, but additional steps may be necessary to legally transfer ownership. For vehicles, for example, the title must be formally transferred with the Texas Department of Motor Vehicles, and the Bill of Sale complements this process, not replaces it.

- If a Bill of Sale isn't filled out completely, it's legally void. - While it's crucial to fill out a Bill of Sale accurately and completely, minor omissions or errors don't automatically make it void. Significant inaccuracies or failures to disclose important information about the item sold, however, can lead to legal disputes or challenge the document's validity.

Certain myths and misunderstandings can complicate what should be a straightforward process. By clarifying these misconceptions, individuals can navigate the sale and purchase of goods with a clearer understanding of their rights and obligations. When in doubt, consulting with a legal professional can provide guidance tailored to the specific circumstances of a transaction.

Key takeaways

When dealing with the transfer of ownership for various items in Texas—vehicles, boats, or even personal property—a Bill of Sale form plays a critical role. This document not only serves as proof of purchase but also provides legal protection for both the buyer and the seller. To ensure that the process goes smoothly, here are key takeaways to consider when filling out and using the Texas Bill of Sale form:

- Ensure all parties have a clear understanding of the item being sold. This includes a full description of the item to avoid any ambiguities.

- Both the seller and buyer's complete information should be included. This entails full names, addresses, and contact details for future reference.

- The sale date and the total purchase price should be specified to maintain an accurate record of the transaction.

- Detail any specific terms or conditions related to the sale. This can cover payment plans, item condition at the time of sale, or any warranties offered.

- Verification of the item’s legal status, ensuring it's free from any liens or encumbrances, is crucial.

- The signatures of both the seller and buyer, along with the date of signing, legitimize the agreement and are essential for the form’s validity.

- A witness or notary public’s endorsement can provide additional legal security to the document, although this may not be mandatory.

- Keep multiple copies of the filled-out form. Both parties should keep a copy for their records to resolve any future disputes that may arise.

- Depending on the type of sale, additional documentation may be required by Texas law to complete the transaction, such as a title transfer for vehicles.

- Using a Texas Bill of Sale form specifically designed for the type of item being sold is advisable, as it may include relevant legal terms and protections.

Adhering to these guidelines can help ensure that the process of transferring ownership is done efficiently and with legal integrity. It’s always recommended to consult with a legal professional if there are any uncertainties or specific legal questions regarding the use of a Bill of Sale in Texas.

Create Other Bill of Sale Forms for US States

Simple Bill of Sale Oklahoma - Collectors of art, antiques, and other valuables frequently use Bills of Sale to establish provenance and value.

Dmv Bill of Sale Pdf - It includes specifics such as the date of the transaction, price, and signatures of both parties, ensuring a transparent agreement.

Ga Trailer Bill of Sale - A tool used to finalize sales transactions, capturing all necessary details about the sale and the parties involved.

Can I Sell a Car With a Lien - Helps prevent legal issues by clearly documenting the transaction's specifics, should disputes arise later.