Blank Tractor Bill of Sale Form for California

The purchasing and selling of agricultural equipment, particularly tractors, in California involves important legal documentation, one of which is the Tractor Bill of Sale form. This document serves as a critical evidence of transfer and agreement between the seller and the buyer, ensuring both parties have proof of the transaction for ownership, taxation, and registration purposes. The form documents essential information such as the make, model, year, and serial number of the tractor, alongside the sale price and the date of the transaction. It is also substantial for the buyer for purposes of obtaining insurance or financing. Furthermore, it indicates the seller's guarantee that the title is clear and the item is free from any undisclosed liens or encumbrances. For sellers, it provides a receipt of the transaction, potentially useful for tax accounting and as protection against any future claims of ownership or liability. In essence, the Tractor Bill of Sale form not only facilitates a smooth transaction but also serves to protect the legal interests of all parties involved in the sale of a tractor in California.

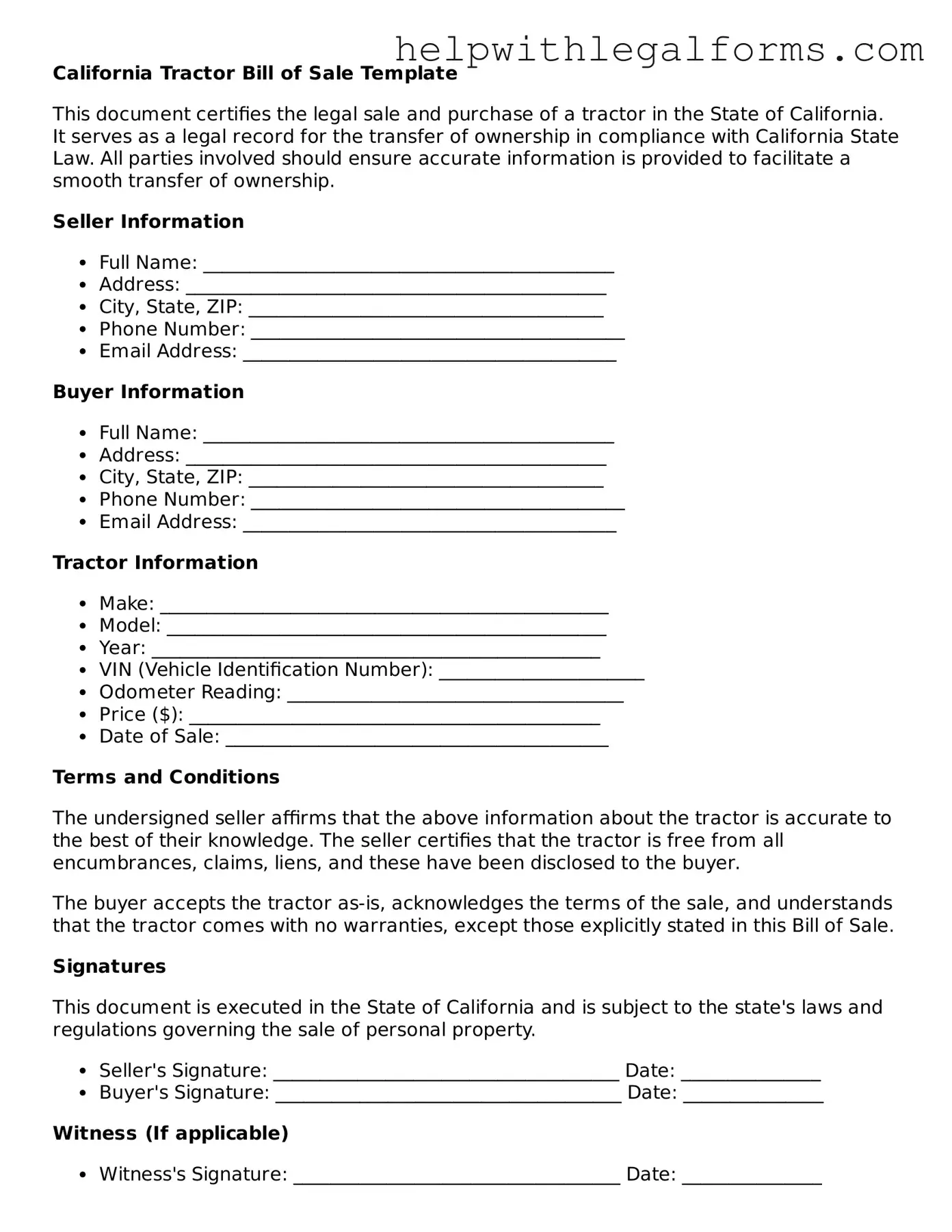

Example - California Tractor Bill of Sale Form

California Tractor Bill of Sale Template

This document certifies the legal sale and purchase of a tractor in the State of California. It serves as a legal record for the transfer of ownership in compliance with California State Law. All parties involved should ensure accurate information is provided to facilitate a smooth transfer of ownership.

Seller Information

- Full Name: ____________________________________________

- Address: _____________________________________________

- City, State, ZIP: ______________________________________

- Phone Number: ________________________________________

- Email Address: ________________________________________

Buyer Information

- Full Name: ____________________________________________

- Address: _____________________________________________

- City, State, ZIP: ______________________________________

- Phone Number: ________________________________________

- Email Address: ________________________________________

Tractor Information

- Make: ________________________________________________

- Model: _______________________________________________

- Year: ________________________________________________

- VIN (Vehicle Identification Number): ______________________

- Odometer Reading: ____________________________________

- Price ($): ____________________________________________

- Date of Sale: _________________________________________

Terms and Conditions

The undersigned seller affirms that the above information about the tractor is accurate to the best of their knowledge. The seller certifies that the tractor is free from all encumbrances, claims, liens, and these have been disclosed to the buyer.

The buyer accepts the tractor as-is, acknowledges the terms of the sale, and understands that the tractor comes with no warranties, except those explicitly stated in this Bill of Sale.

Signatures

This document is executed in the State of California and is subject to the state's laws and regulations governing the sale of personal property.

- Seller's Signature: _____________________________________ Date: _______________

- Buyer's Signature: _____________________________________ Date: _______________

Witness (If applicable)

- Witness's Signature: ___________________________________ Date: _______________

- Print Name: ___________________________________________

This form does not necessarily provide legal protection for either party. In the event of a dispute, it's recommended to seek the advice of a legal professional.

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Document Purpose | Used to legally document the sale and transfer of a tractor from the seller to the buyer in California. |

| Governing Law | Subject to California Vehicle Code and, if applicable, Uniform Commercial Code. |

| Required Information | Includes details such as the tractor make, model, year, VIN, purchase price, and the names and signatures of both the buyer and seller. |

| Notarization | In some cases, notarization may be required to validate the signatures on the form. |

Instructions on How to Fill Out California Tractor Bill of Sale

When you're ready to buy or sell a tractor in California, one document that helps make the transaction official is the California Tractor Bill of Sale form. This crucial piece of paper acts as a receipt, showing proof of purchase and transfer of ownership. Filling it out correctly is important for both parties to ensure the sale is documented accurately and legally. Below are the steps to properly complete this form, ensuring that all necessary details are covered, and both the buyer and the seller can proceed with peace of mind.

- Start by writing the date of the sale at the top of the form. Make sure this is the actual date when the transaction is being made.

- Next, fill in the full name and address of the seller in the designated area. This should include the street address, city, state, and zip code.

- Follow by entering the full name and address of the buyer, similar to the previous step, ensuring all contact details are accurately captured.

- Describe the tractor being sold. This should include the make, model, year, and VIN (Vehicle Identification Number). The more detailed the description, the better.

- Enter the selling price of the tractor. Make sure the amount is agreed upon by both parties and is clearly written in the form to avoid any future disputes.

- If there are any additional terms and conditions of the sale, mention them in the specified section. This could include information regarding warranties, "as is" condition statements, or any other agreements pertinent to the sale.

- Both the buyer and the seller should then sign the form. Their signatures officially document their agreement to the terms of the sale as described.

- For added precaution, both parties might decide to have the form notarized. While this is not a compulsory step, it adds an extra layer of verification to the document.

After the California Tractor Bill of Sale form is fully completed and signed, both the buyer and the seller should keep a copy for their records. This document serves as a legal record of the sale and transfer of ownership, providing essential protection for both parties involved in the transaction.

Crucial Points on This Form

What is a California Tractor Bill of Sale form?

A California Tractor Bill of Sale form is a document that records the sale of a tractor in California from one party to another. This form proves that the buyer has purchased the tractor and is now the legal owner. It includes key details like the purchase price, description of the tractor, and the date of sale. Both the seller and the buyer must sign this document to validate the sale.

Why is it important to have a Tractor Bill of Sale in California?

Having a Tractor Bill of Sale in California is crucial for several reasons. It serves as legal proof of purchase, which can protect both parties in case of disputes. For the buyer, it’s evidence of ownership, which is essential for registration purposes and potential future sale. For the seller, it provides a record that they have transferred ownership and responsibility to the buyer.

What information should be included in a Tractor Bill of Sale?

A comprehensive Tractor Bill of Sale should contain the following information: the names and addresses of both the seller and the buyer, a full description of the tractor (including make, model, year, and serial number), the sale price, payment method, the date of sale, and any warranties or "as is" statements. Both the seller's and the buyer's signatures need to be on the document to make it legally binding.

Do I need to notarize the Tractor Bill of Sale in California?

While notarization of the Tractor Bill of Sale in California is not a legal requirement, it is highly recommended. Notarization can add a layer of verification and formalization to the transaction, offering an extra level of legal protection for both parties involved in the sale. It essentially certifies that the signatures on the document are genuine.

How can I obtain a California Tractor Bill of Sale form?

You can obtain a California Tractor Bill of Sale form online from various legal forms websites or from the California Department of Motor Vehicles (DMV) website. It’s important to ensure that the form you use complies with the California state requirements for a tractor sale. Alternatively, you might choose to draft one yourself, following the guidelines provided for the information it must contain, or seek assistance from a legal professional to draft a customized Bill of Sale.

Common mistakes

When completing the California Tractor Bill of Sale form, individuals often overlook key details or make errors that can complicate the sale or transfer process. Here are ten common mistakes to watch out for:

- Not verifying the buyer's or seller's information: It's crucial to ensure the accuracy of names, addresses, and other personal details to avoid future disputes or legal issues.

- Omitting important details about the tractor: Including the make, model, year, and VIN (Vehicle Identification Number) accurately helps in identifying the specific tractor being sold.

- Forgetting to include the sale date: The sale date establishes when the transaction was legally agreed upon, which is important for both parties' records.

- Failing to specify the sale price: Clearly stating the sale price in the document is essential for tax and legal reasons.

- Ignoring lienholder information: If the tractor is not fully paid off, the details of the lienholder should be included to ensure that the buyer is aware of any obligations.

- Skipping the condition of the tractor: Accurately describing the condition of the tractor, including any known faults, helps in preventing future claims of misrepresentation.

- Not stating the sale is "as is": If no warranties are being provided, stating that the sale is "as is" clarifies that the buyer accepts the tractor in its current condition.

- Misunderstanding the requirement for notarization: Depending on the jurisdiction, having the document notarized may be necessary for it to be legally binding.

- Forgetting to include both parties' signatures: The signatures of the seller and the buyer are mandatory for the document to be considered valid and effective.

- Ignoring state-specific requirements: Each state, including California, may have unique requirements for a bill of sale to be considered valid. Overlooking these can invalidate the document.

Keeping these points in mind can greatly smooth the process of completing a Tractor Bill of Sale in California. It's always a good idea to double-check the form and possibly consult with a legal professional to ensure all legal requirements are met and the document accurately reflects the terms of the sale.

Documents used along the form

When it comes to selling or buying a tractor in California, the Tractor Bill of Sale form is crucial, but it's often not the only document involved in the transaction. The process usually requires several other forms and documents to ensure everything is legally binding and clear to all parties. Understanding these documents can help streamline the buying or selling process, making it more transparent and efficient. Here is a list of up to four other essential forms and documents frequently used alongside the Tractor Bill of Sale.

- Certificate of Title: This is an indispensable document that legally establishes the ownership of the tractor. When a tractor is sold, the title must be transferred to the new owner to formalize the change of ownership. It contains important details about the tractor, such as the make, model, year, and serial number.

- Odometer Disclosure Statement: For tractors that are equipped with an odometer, this statement is a necessary legal requirement. It records the actual mileage at the time of sale and helps to ensure that the new owner is aware of the tractor's condition and usage.

- Release of Liability: This form is used to notify the state’s department of motor vehicles (or equivalent agency) that a transaction has taken place. It protects the seller from liability for any accidents or violations involving the tractor that occur after the sale has been finalized.

- Warranty Document: If the tractor is being sold with a warranty, a separate warranty document should be provided. This document outlines the coverage of the warranty, including what defects or repairs are covered, the duration of the warranty, and any conditions that may void the warranty.

Each of these documents plays a vital role in ensuring the legality of the tractor sale, protecting both the seller and the buyer. Whether you’re the one waving goodbye to an old tractor or eagerly awaiting a new addition to your farm, having all the necessary paperwork in order can provide peace of mind and prevent future disputes. Remember, the specific requirements can vary by state, so it's always a good idea to consult with a professional or conduct thorough research to ensure compliance with local laws.

Similar forms

Vehicle Bill of Sale: Just like a Tractor Bill of Sale, this document is used when selling or buying vehicles. It serves as proof of transfer of ownership from the seller to the buyer. This includes key information like the VIN, make, model, and year of the vehicle, similar to what would be detailed for a tractor.

Boat Bill of Sale: This document parallels the Tractor Bill of Sale in its purpose for boats. It records the sale and transfer of ownership of a boat, often including specifics such as hull identification number, make, model, and year, akin to the details required for a tractor sale.

Firearm Bill of Sale: This form is used in the sale and purchase of firearms. It is similar to a Tractor Bill of Sale as it legally documents the transaction and transfers ownership from one party to another, including identification numbers and descriptions of the firearm.

General Bill of Sale: Broad and versatile, a General Bill of Sale is used for the purchase or sale of personal property, much like a Tractor Bill of Sale. The main difference is its general applicability to various items, whereas a Tractor Bill of Sale is specific to tractors.

Equipment Bill of Sale: Specifically tailored for the sale of machinery and equipment, this document closely resembles a Tractor Bill of Sale. It records the details of the transaction, ensuring the legal transfer of ownership for equipment, which includes tractors among other machinery.

Pet Bill of Sale: While distinct in its focus on animals, a Pet Bill of Sale shares similarities with a Tractor Bill of Sale by documenting the sale and change of ownership of a pet. It includes specifics such as breed, date of birth, and health information, paralleling the detailed information required for a tractor.

Business Bill of Sale: Used for the sale of a business, this document records the transfer of ownership of all or part of a business from one party to another. It is similar to a Tractor Bill of Sale in that it provides a legal record of the transaction and details about the items being transferred, such as assets and inventory, echoing the specificity needed for a tractor sale.

Dos and Don'ts

When filling out the California Tractor Bill of Sale form, it’s crucial to pay attention to both what should be done and what should be avoided to ensure the document is legally valid and reflects the transaction accurately. Here’s a comprehensive list of dos and don'ts:

Do:

- Check the form specifics for California. Before starting, verify that you're using the correct form tailored for California, as requirements may vary by state.

- Include detailed information about the tractor. Make sure to list all necessary details such as make, model, year, condition, and any identifying numbers.

- Provide accurate personal information. Both the seller and the buyer should ensure their personal information is correct and complete, including names and addresses.

- Agree on the price and payment terms. Clearly state the sale price of the tractor and the agreed payment terms between the seller and the buyer.

- Sign and date the form in front of a witness or notary. This adds another layer of validity to your document, although it's not always mandatory.

- Keep copies of the bill of sale. Both parties should keep a copy of the bill of sale for their records and any future disputes or for registration purposes.

- Review the form for errors. Before finalizing, double-check all entered information for accuracy and completeness to prevent any legal issues.

Don't:

- Leave blank spaces. If certain sections don’t apply, mark them as “N/A” instead of leaving them empty to avoid fraudulent alterations.

- Use pencil or erasable ink. Fill out the form in blue or black ink to ensure permanence and legibility.

- Forget to specify any included accessories or attachments. If the sale includes additional items, such as attachments or implements, list them on the form.

- Omit an odometer reading if applicable. For tractors that have an odometer, include the mileage, even if it's not mandatory.

- Overlook the need for a witness or notary. Even if not required by law, having a third-party witness can provide added security.

- Assume a handshake agreement is enough. Always formalize the sale with a bill of sale to protect both parties legally.

- Forget to check if local regulations require additional forms or steps. Some localities may have additional requirements for the sale of a tractor, so it's important to verify.

Misconceptions

When it comes to the sale of a tractor in California, certain misconceptions concerning the Bill of Sale form can lead to misunderstandings. It's important to clarify these points to ensure both sellers and buyers proceed with transactions in full knowledge of the legal and practical implications. Here are four common misconceptions:

- It's not necessary for private sales. Many people believe that a Bill of Sale form is only needed for sales conducted through dealerships or businesses. However, this document is crucial even for private transactions. It provides a formal record of the sale, detailing the agreement between buyer and seller, which is vital for legal protection and registration purposes.

- Any template will do. Though numerous templates are available online, not all cater to the specific requirements of a tractor sale in California. The state may have particular stipulations or information that must be included for the Bill of Sale to be valid. Always ensure the form complies with California state laws.

- It only benefits the buyer. While it's true that a Bill of Sale acts as proof of purchase for the buyer, it also benefits the seller. This document can help sellers demonstrate they have legally transferred ownership of the tractor, safeguarding them against potential future liabilities or disputes over the tractor's condition or ownership.

- The form doesn't need to be signed by a witness or notarized. A common misconception is that the Bill of Sale form only needs to be signed by the buyer and seller. While California law doesn’t always require a witness signature or notarization for a Bill of Sale to be legally binding, having these additional attestations can enhance the document’s credibility and enforceability, especially in cases of dispute.

Key takeaways

When filling out and using the California Tractor Bill of Sale form, it's important to ensure that all details are accurately documented to legitimize the sale and ownership transfer of a tractor. Here are seven key takeaways for those looking to complete this process:

- Complete Information is Crucial: All fields should be filled out with accurate information, including the make, model, year, and serial number of the tractor, as well as the personal details of both the buyer and the seller. Incomplete forms may not be considered legally binding.

- Verification of Ownership: The seller must verify their ownership of the tractor, ensuring there are no liens or encumbrances against it. This includes providing any relevant documents that support their claim to ownership.

- Price and Payment Details: Clearly state the sale price of the tractor and the terms of the payment. Include any details about down payments, installment plans, or trades, if applicable.

- As-Is Condition: It's common for tractors to be sold in "as-is" condition, meaning that the buyer accepts the tractor with all its current faults, without warranty. This should be explicitly stated in the bill of sale.

- Signatures: The bill of sale must be signed by both the seller and the buyer. In California, it's also recommended to have the signatures notarized, although this is not a legal requirement for all personal property sales, including tractors.

- Keep Copies: Both parties should keep a copy of the bill of sale for their records. This document serves as proof of purchase, ownership transfer, and may be needed for registration or tax purposes.

- Registration: The buyer may be required to register the tractor with the California Department of Motor Vehicles (DMV) or another appropriate state agency, depending on its use. The bill of sale will be needed to complete this registration.

By carefully adhering to these guidelines, both the buyer and the seller can ensure a smooth transaction and transfer of ownership for the tractor. It's also advisable to consult with a professional or legal expert when filling out any legal forms to ensure compliance with current California laws.

Create Other Tractor Bill of Sale Forms for US States

Farm Tractor Bill of Sale - It ensures that both parties have a clear understanding of the sale’s conditions, preventing misunderstandings and potential legal issues.

Bill of Sale for a Tractor - The document can also serve to reassure any lenders or financiers about the legality and fairness of the tractor’s sale.

How to Transfer Ownership of a Tractor - Important for tax purposes, documenting the sale price and date of the transaction.