Blank Tractor Bill of Sale Form for Colorado

In the picturesque landscapes of Colorado, where agriculture plays a pivotal role in the local economy, the transaction of farm machinery, particularly tractors, is common. It is within this context that the Colorado Tractor Bill of Sale form becomes an essential document, ensuring that the sale and purchase of tractors are conducted legally and transparently. This form serves as a formal record of the transaction, providing clear proof of ownership transfer from the seller to the buyer. It outlines crucial details such as the tractor’s description, the sale amount, and the parties involved, thus offering legal protection to both parties. Additionally, it is a necessary document for the registration and titling process, proving its importance beyond the initial sale. Understanding the major aspects of this form not only facilitates smooth agricultural commerce but also reinforces the legal frameworks that support the state's economy.

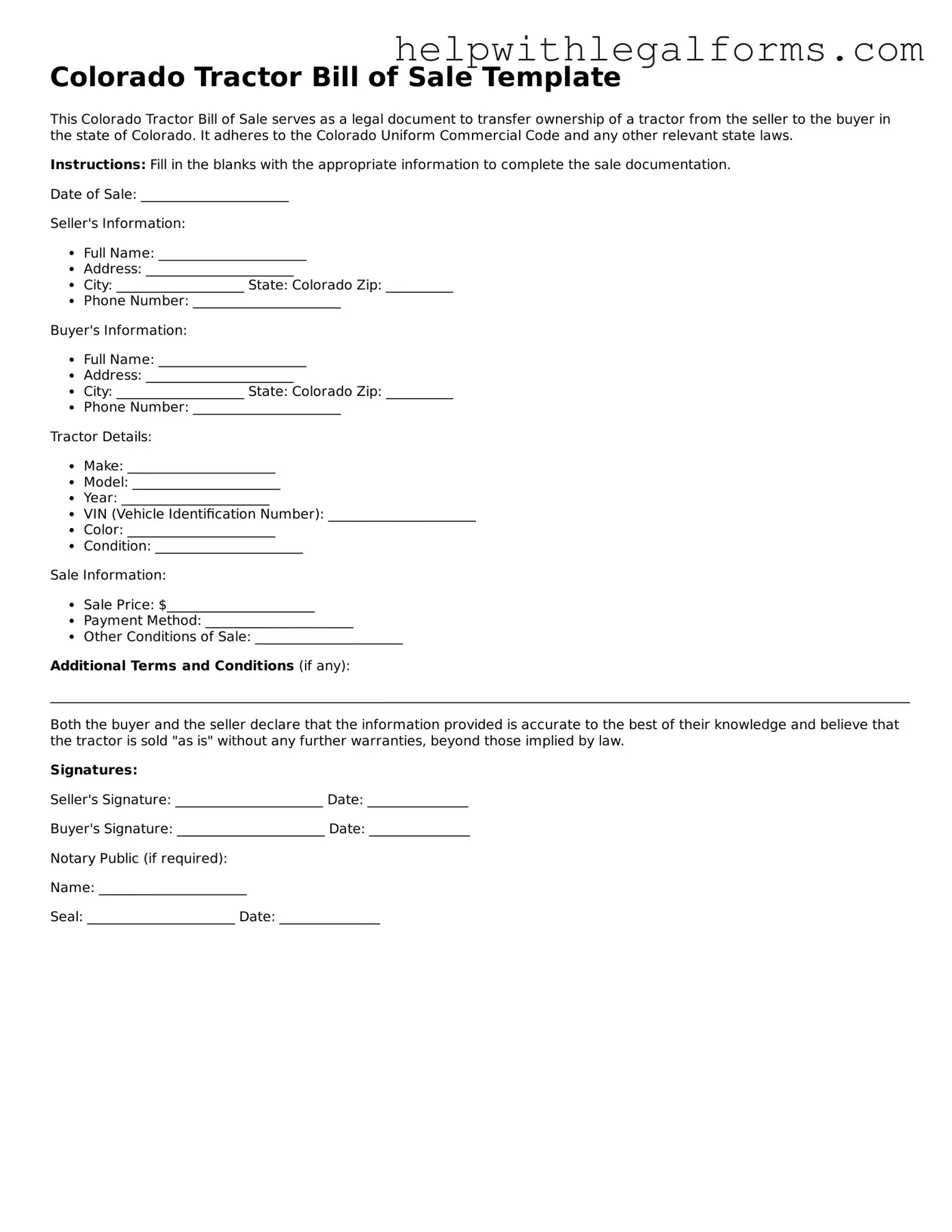

Example - Colorado Tractor Bill of Sale Form

Colorado Tractor Bill of Sale Template

This Colorado Tractor Bill of Sale serves as a legal document to transfer ownership of a tractor from the seller to the buyer in the state of Colorado. It adheres to the Colorado Uniform Commercial Code and any other relevant state laws.

Instructions: Fill in the blanks with the appropriate information to complete the sale documentation.

Date of Sale: ______________________

Seller's Information:

- Full Name: ______________________

- Address: ______________________

- City: ___________________ State: Colorado Zip: __________

- Phone Number: ______________________

Buyer's Information:

- Full Name: ______________________

- Address: ______________________

- City: ___________________ State: Colorado Zip: __________

- Phone Number: ______________________

Tractor Details:

- Make: ______________________

- Model: ______________________

- Year: ______________________

- VIN (Vehicle Identification Number): ______________________

- Color: ______________________

- Condition: ______________________

Sale Information:

- Sale Price: $______________________

- Payment Method: ______________________

- Other Conditions of Sale: ______________________

Additional Terms and Conditions (if any):

________________________________________________________________________________________________________________________________

Both the buyer and the seller declare that the information provided is accurate to the best of their knowledge and believe that the tractor is sold "as is" without any further warranties, beyond those implied by law.

Signatures:

Seller's Signature: ______________________ Date: _______________

Buyer's Signature: ______________________ Date: _______________

Notary Public (if required):

Name: ______________________

Seal: ______________________ Date: _______________

PDF Form Attributes

| Fact | Description |

|---|---|

| Purpose | The Colorado Tractor Bill of Sale form is used to document the sale and purchase of a tractor, ensuring a legal transfer of ownership from the seller to the buyer. |

| Key Components | This form typically includes details such as the make, model, year, serial number of the tractor, the sale price, and the names and signatures of both the seller and the buyer. |

| Governing Law | In Colorado, the Tractor Bill of Sale is governed by the general laws relevant to the sale of personal property and, when applicable, those regulating motor vehicles in the state. |

| Notarization | While not always mandatory, getting the form notarized can add a layer of legal protection and authenticity to the transaction. |

Instructions on How to Fill Out Colorado Tractor Bill of Sale

After finding the perfect tractor for your farming needs in Colorado, the next step is to complete a bill of sale. This document is vital as it provides evidence of the transaction between the buyer and the seller, indicating the transfer of ownership of the tractor. It's important to fill out this form accurately to ensure all parties are protected and to fulfill any legal requirements. Here are the steps needed to properly complete the Colorado Tractor Bill of Sale form.

- Gather all necessary information about the tractor, including make, model, year, VIN (Vehicle Identification Number), and any other pertinent details or specifications that identify the tractor.

- Write down the full legal names and contact information of both the buyer and the seller. Ensure that this information is accurate and matches any identification documents.

- Determine the sale price of the tractor and agree upon any other terms of the sale. This might include how and when the payment will be made.

- Fill in the tractor's details on the bill of sale form, including the make, model, year, VIN, and any additional information that may be required.

- Write the agreed sale price on the form and include any other purchase details or conditions that were agreed upon between the buyer and seller.

- Both the buyer and the seller should read the completed bill of sale carefully to ensure all the information is correct and reflects the terms of their agreement.

- Sign and date the bill of sale. Both the buyer and the seller should do this in the presence of a witness or notary, if required. It’s important to follow any specific legal requirements for a bill of sale to be considered valid in Colorado.

- Make copies of the signed bill of sale. Give one copy to the buyer, one to the seller, and keep any additional copies for records or legal purposes.

Once the bill of sale is filled out, signed, and copies are distributed, the transaction is documented. This documentation serves as important evidence of the sale and transfer of ownership. The next steps typically involve the buyer registering the tractor in their name with the local Colorado vehicle registration office, if required, and taking possession of the tractor. It’s important to check any additional requirements or steps with the local authorities to ensure compliance with all state regulations related to the purchase of a tractor.

Crucial Points on This Form

What is a Tractor Bill of Sale form in Colorado?

A Tractor Bill of Sale form in Colorado is a legal document that records the sale and purchase of a tractor within the state. It serves as proof that the buyer has taken possession and ownership of the tractor from the seller. This document typically includes details like the make, model, year, and serial number of the tractor, as well as the names and signatures of both the seller and the buyer. It's important for both parties to keep a copy of this form as it confirms the transfer of ownership and can be used for registration, insurance, and tax purposes.

Do I have to notarize the Tractor Bill of Sale in Colorado?

In Colorado, it is not mandatory to notarize the Tractor Bill of Sale for it to be considered valid. However, having the document notarized can add an extra layer of legality and authenticity, providing additional protection for both the buyer and seller. Notarization ensures that the signatures on the form are verified, making it harder for any party to dispute the transaction or signatures in the future.

Can I complete the Tractor Bill of Sale form online?

Yes, you can complete the Tractor Bill of Sale form online in Colorado. Many websites offer templates that can be filled out digitally. It's crucial, however, to ensure that the form you use complies with Colorado state law and includes all the necessary information such as the tractor's details and the transaction date. After completing the form online, it should be printed out so that both the buyer and seller can sign it, making the document legally binding.

What happens if I lose my Tractor Bill of Sale?

If you lose your Tractor Bill of Sale in Colorado, it's advisable to try and obtain a copy from the other party involved in the transaction. If that's not possible, drafting a new document that mirrors the original sale information is the next best step. This new document should then be signed by both the buyer and the seller again, if possible. For added protection, consider having the document notarized. Losing the original bill of sale can be inconvenient, but taking these steps ensures that the proof of transaction is maintained, which is important for registration, insurance, and legal purposes.

Common mistakes

Completing a Bill of Sale form is a critical step in the process of selling or buying a tractor in Colorado. Both the buyer and the seller need to ensure the accuracy and legality of this document, as it serves as a vital record of the transaction and can affect ownership rights, tax assessments, and potential liability. Unfortunately, many individuals make errors during this process. Here are eight common mistakes to avoid when filling out a Colorado Tractor Bill of Sale form:

Not verifying the accuracy of the tractor’s description—It’s essential to include detailed information about the tractor, such as the make, model, year, and serial number. Failing to accurately describe the tractor can lead to disputes or legal issues regarding the tractor’s condition or specification.

Overlooking the importance of the sale date—The date of sale is crucial for various reasons, including tax calculations and to ascertain the transition of ownership. Not correctly stating the sale date can lead to discrepancies in legal documents.

Omitting the sale price or inaccurately reporting it—The sale price must be clearly stated and should match the actual amount agreed upon by both parties. Misstating this figure can affect tax liabilities and may be perceived as an attempt to defraud.

Failure to disclose the tractor’s condition—Accurately disclosing the tractor's current condition, including any known faults or issues, is essential. This information helps protect the seller from future disputes about the tractor's state at the time of sale.

Leaving out warranties or “as is” statement—Clearly stating whether the tractor is being sold with a warranty or "as is" clarifies the parties’ expectations and responsibilities, reducing potential legal complications.

Forgetting to include buyer and seller signatures—Signatures are the most critical part of validating the Bill of Sale. Without both parties’ signatures, the document may not be legally binding.

Not making and keeping copies—Both the buyer and the seller should keep a copy of the Bill of Sale. It serves as a receipt, proof of transfer, and is necessary for the registration process. Not having a copy can create complications if any legal issues arise or for record-keeping purposes.

Ignoring state-specific requirements—Colorado may have unique requirements for a Tractor Bill of Sale that differ from other states. Failing to adhere to these specific requirements can result in a legally invalid document.

Mistakes in the preparation of a Bill of Sale can have serious consequences, affecting the legal standing of the sale and potentially leading to financial and legal ramifications. Paying close attention to detail and ensuring all required information is accurately and thoroughly documented will help avoid these common pitfalls.

Documents used along the form

Completing a tractor sale in Colorado involves more than just the bill of sale. While the Colorado Tractor Bill of Sale form is crucial as it officially documents the transaction, several other forms and documents are commonly utilized alongside it to ensure compliance with legal requirements and to protect both the buyer and the seller. These documents vary from proof of ownership to safety compliance. They play an integral role in transferring ownership, providing a history of the tractor, and ensuring the transaction adheres to state laws. Below is a list of up to ten other forms and documents often used together with the Colorado Tractor Bill of Sale form.

- Title Transfer Form: This form facilitates the official transfer of the tractor’s title from the seller to the buyer, a necessary step for legally changing ownership.

- Odometer Disclosure Statement: Required for tractors with odometers, this document reports the mileage at the time of sale to ensure accurate and truthful disclosure of the tractor's condition.

- Sales Tax Form: This form is used to report and pay any sales tax due on the transaction. In Colorado, the buyer typically pays the sales tax based on the purchase price of the tractor.

- Warranty Document: If the sale includes a warranty, specially prepared documents outline the warranty’s terms, duration, and what components are covered.

- Inspection Certificates: Some transactions might necessitate a safety or emissions inspection certificate, proving the tractor meets state regulatory requirements.

- Loan Agreement: If the tractor is being purchased with financing, a loan agreement specifies the loan's terms, including interest rate, repayment schedule, and any collateral securing the loan.

- Release of Liability: This document releases the seller from legal liability for any future claims or damages once the tractor is sold.

- Registration Application: Necessary for tractors that require registration, this form starts the process to get the tractor legally registered under the new owner’s name.

- Power of Attorney: If either party is acting through a representative, a power of attorney may be needed to authorize actions on their behalf regarding the sale.

- Personal Property Bill of Sale: For a combined sale that includes attachments or additional equipment not listed on the tractor bill of sale, this broader form documents the sale of these items.

Collecting and properly executing these documents, along with the Colorado Tractor Bill of Sale form, ensures a legally sound and transparent transaction. Both parties are advised to keep copies of all documents for their records and future reference. Understanding and utilizing these forms can help facilitate a smoother sale process and provide peace of mind by ensuring that all legal bases are covered.

Similar forms

Vehicle Bill of Sale Form: Just like the Tractor Bill of Sale, this document is used when selling a vehicle. It provides proof of the transaction and details about the vehicle and the terms of the sale.

Equipment Bill of Sale Form: Similar to the Tractor Bill of Sale, it is used for the sale of any type of equipment, detailing the sale terms and information about the equipment to transfer ownership.

Boat Bill of Sale Form: This document functions much like the Tractor Bill of Sale but is specifically for boats. It records the sale details and specifics about the boat to officially transfer ownership.

Livestock Bill of Sale Form: While focused on animals rather than machinery, this form shares the concept of transferring ownership, specifying details about the livestock and the terms of the sale.

Firearm Bill of Sale Form: This document, like the Tractor Bill of Sale, facilitates the sale of an item (in this case, a firearm), including detailed information on the item sold and ownership transfer terms.

Business Bill of Sale Form: It covers the sale of a business, not just a single item. This form includes details on the assets being transferred, similar to how a Tractor Bill of Sale would for a piece of equipment.

Property Bill of Sale Form: Used for real estate transactions, it's akin to the Tractor Bill of Sale by documenting the sale's terms and detailing the property being transferred.

Motorcycle Bill of Sale Form: Specific to motorcycles, it serves the same purpose as the Tractor Bill of Sale, recording the sale between two parties and detailing the motorcycle sold.

Dos and Don'ts

When you're filling out the Colorado Tractor Bill of Sale form, it's important to proceed carefully to ensure the sale is legally documented. This document is crucial not only for transferring ownership but also for registration and tax purposes. Below are five dos and don'ts to guide you through this process.

Do:

- Verify the accuracy of all information. Ensure that the details of the tractor, such as make, model, year, and serial number, are correctly entered. This prevents any discrepancies down the line.

- Include personal information for both the buyer and the seller, such as full names, addresses, and contact details, to confirm the identities of the parties involved.

- Agree on and clearly specify the sale price in the document. This is vital for tax reporting purposes and helps in avoiding any future disputes over the transaction.

- Sign and date the bill of sale on the day the transaction actually takes place. This establishes an official transfer date, which can be important for both parties in terms of liability and ownership.

- Keep a copy of the bill of sale for your records. Both the buyer and the seller should retain a copy for their personal records to protect their interests and for future reference.

Don't:

- Forget to check if a notary's signature is required. In some cases, Colorado law may require the bill of sale to be notarized for it to be considered valid.

- Omit any potential warranties or the indication of "as is" condition. This clarifies the agreement terms and the condition of the tractor at the time of sale.

- Fill in the form in a rush. Taking your time to accurately complete the form prevents errors that could complicate the sale or transfer.

- Use unclear language or abbreviations that could be misunderstood. Clarity in the document ensures that all parties have the same understanding of the sale terms.

- Ignore local regulations that might affect the sale. Always check for any local laws or requirements that might impact the tractor sale in Colorado.

Misconceptions

The Colorado Tractor Bill of Sale form is an essential document for many individuals engaging in the sale or purchase of a tractor in Colorado. However, several misconceptions about this form can lead to confusion or legal complications. Below are ten common misconceptions and the truths behind them:

It's the same as a car bill of sale: While both serve to document the sale and transfer of ownership, the Colorado Tractor Bill of Sale is specifically designed for the unique considerations involved in the sale of tractors, which might include details about the equipment's condition, hours of use, and specific attachments.

A verbal agreement is just as good: In Colorado, a written Bill of Sale serves as a legal document that confirms the transfer of ownership and details of the transaction. A verbal agreement does not provide the same level of legal protection or clarity.

You don't need it for family transactions: Regardless of the relationship between the buyer and seller, a Bill of Sale is crucial. It legally documents the transaction, which can be important for estate planning, tax purposes, or any subsequent disputes.

It only benefits the buyer: The Bill of Sale protects both the buyer and seller. For the seller, it provides proof that the legal responsibility for the tractor has been transferred. For the buyer, it confirms the details of the purchase.

Any form will do: Using a form specifically designed for Colorado ensures that all state-specific legal requirements are met. Generic forms might not include all necessary information, potentially leading to issues down the line.

It must be notarized to be valid: While having the form notarized can add an extra layer of authenticity, it is not a legal requirement for the Bill of Sale to be considered valid in Colorado.

It's unnecessary if you already have a title: The Bill of Sale serves a different purpose from the title. It provides detailed information about the sale, including the date, sale amount, and any conditions of the sale, which might not be reflected in the title.

It needs to be filed with the state: In Colorado, the Bill of Sale does not need to be filed with the state. However, it's crucial for both the buyer and seller to keep a copy as a record of the transaction.

It's the same regardless of the tractor's age or condition: The specifics of the tractor, such as its age, condition, and hours of use, should be accurately reflected in the Bill of Sale. This information can significantly affect the document's details and the tractor's perceived value.

It's not necessary if the tractor is given as a gift: Even if money isn't exchanged, a Bill of Sale can still be important. It can document the transfer of ownership as a gift, which might have tax implications and serves as proof of the new ownership.

Understanding these misconceptions about the Colorado Tractor Bill of Sale form can help ensure that the process of buying or selling a tractor is conducted smoothly and without legal issues.

Key takeaways

The Colorado Tractor Bill of Sale form is a critical document for both buyers and sellers during the transaction of a tractor. This document serves as evidence of the transaction and ensures that the transfer of ownership is legally recorded. Understanding the essential elements and the correct process for filling out and using this form is important for a smooth transaction. Below are key takeaways regarding the Colorado Tractor Bill of Sale form.

- The form must include detailed information about the tractor being sold, such as make, model, year, and VIN (Vehicle Identification Number). This ensures that the tractor is clearly identified and helps prevent any future disputes.

- Both the buyer's and seller's personal information, including names, addresses, and contact details, should be accurately filled out. This information is crucial for both parties in case there are any issues or need for communication after the sale.

- It is essential to specify the sale price on the form. This amount should be agreed upon by both parties before completing the form.

- The form should accurately reflect the date of the sale. This date is important for legal and record-keeping purposes.

- Signature fields for both the buyer and the seller must be completed. These signatures officially seal the agreement and confirm that both parties agree to the terms of the sale as outlined in the bill of sale.

- It is advisable for both the buyer and seller to keep a copy of the completed form. Having a copy is beneficial for record-keeping and can serve as proof of ownership transfer or purchase.

- In some cases, the bill of sale may need to be notarized. Whether this is required can vary, so it's important to check any specific requirements that may apply within Colorado or the local jurisdiction where the transaction takes place.

Taking the time to understand and correctly fill out the Colorado Tractor Bill of Sale form is crucial for a valid and enforceable transaction. Both parties should review the form in its entirety before signing to ensure that all information is accurate and complete.

Create Other Tractor Bill of Sale Forms for US States

Bill of Sale for a Tractor - Preparing a Tractor Bill of Sale is a proactive measure to document the specifics of a sale, safeguarding both buyer and seller against future disputes.

Tractor Bill of Sale - This form serves as proof of transaction and ownership for the buyer of the tractor.

Farm Tractor Bill of Sale - For the seller, it confirms the relinquishment of their rights to the tractor, legally transferring them to the buyer.

How to Transfer Ownership of a Tractor - Integral in maintaining an official ledger of business assets if the tractor is used commercially.