Blank Tractor Bill of Sale Form for Georgia

In the realm of agricultural business and personal transactions in Georgia, the Tractor Bill of Sale form serves as a crucial document, marking the transfer of ownership of a tractor from one party to another. This form not only provides legal proof of the sale but also details the agreement between the buyer and seller, capturing essential information such as the purchase price, description of the tractor, and any warranties or representations. Given the significant investment tractors represent, this document plays a key role in ensuring both parties’ interests are protected. It helps in preventing potential disputes by clarifying the terms of the sale and establishing a clear chain of ownership, which is particularly important for registration and taxation purposes. The Georgia Tractor Bill of Sale form, while not always mandated by law, is highly recommended for the peace of mind it offers to both buyers and sellers by documenting the transaction in a formal, recognized manner.

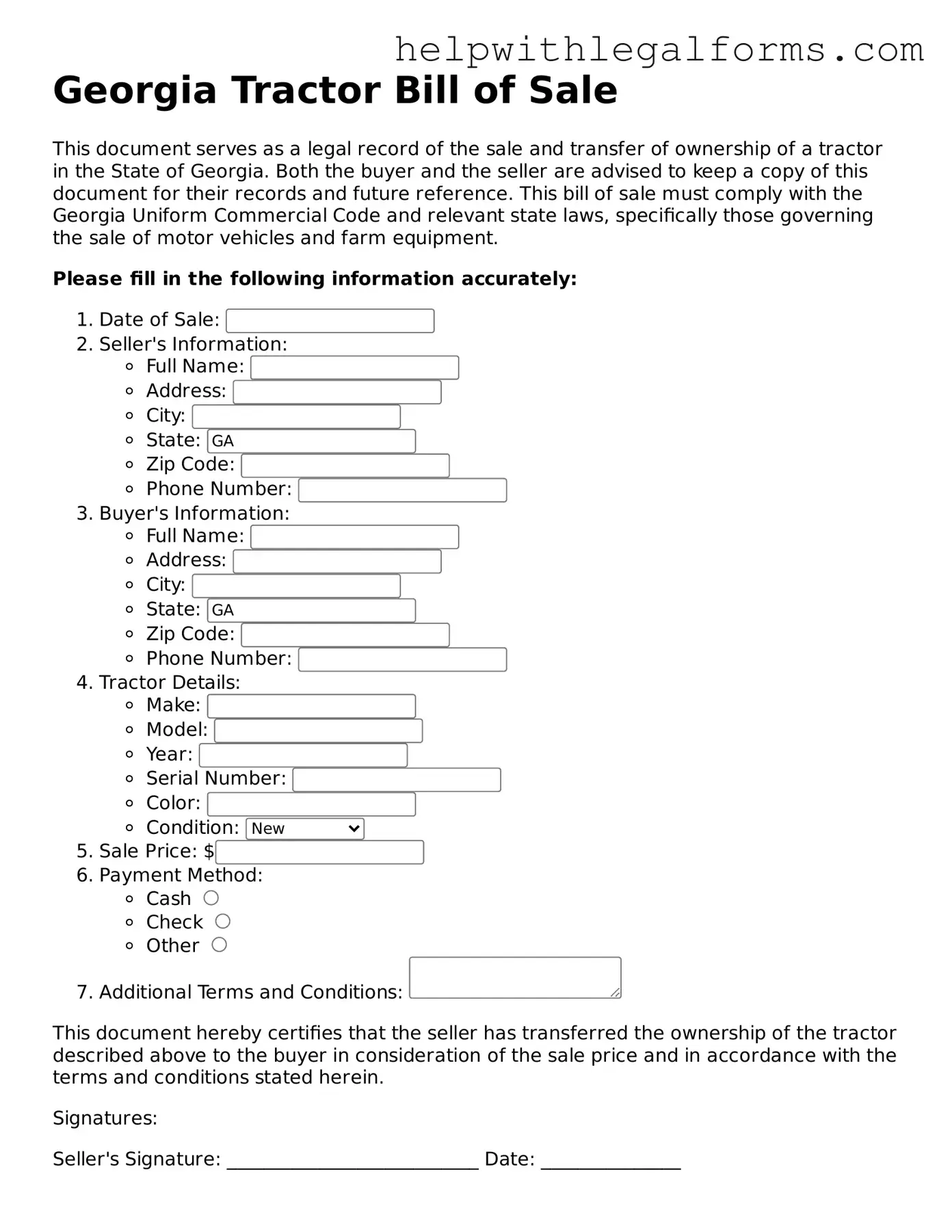

Example - Georgia Tractor Bill of Sale Form

Georgia Tractor Bill of Sale

This document serves as a legal record of the sale and transfer of ownership of a tractor in the State of Georgia. Both the buyer and the seller are advised to keep a copy of this document for their records and future reference. This bill of sale must comply with the Georgia Uniform Commercial Code and relevant state laws, specifically those governing the sale of motor vehicles and farm equipment.

Please fill in the following information accurately:

- Date of Sale:

- Seller's Information:

- Full Name:

- Address:

- City:

- State:

- Zip Code:

- Phone Number:

- Buyer's Information:

- Full Name:

- Address:

- City:

- State:

- Zip Code:

- Phone Number:

- Tractor Details:

- Make:

- Model:

- Year:

- Serial Number:

- Color:

- Condition:

- Sale Price: $

- Payment Method:

- Cash

- Check

- Other

- Additional Terms and Conditions:

This document hereby certifies that the seller has transferred the ownership of the tractor described above to the buyer in consideration of the sale price and in accordance with the terms and conditions stated herein.

Signatures:

Seller's Signature: ___________________________ Date: _______________

Buyer's Signature: ___________________________ Date: _______________

This document is executed under the penalties of perjury and serves as a legal testament to the sale and purchase of the described property in the state of Georgia.

PDF Form Attributes

| Fact Number | Fact Details |

|---|---|

| 1 | The Georgia Tractor Bill of Sale form is a document that proves the legal sale and purchase of a tractor in Georgia. |

| 2 | This form serves as legal evidence of the transaction, documenting necessary details such as the sale price, date, and information about the buyer and seller. |

| 3 | The Bill of Sale must include a thorough description of the tractor, including make, model, year, and serial number. |

| 4 | It is not mandatory to notarize the Georgia Tractor Bill of Sale, but having it notarized can add legal validation. |

| 5 | Upon completion, the Bill of Sale provides the buyer with proof of ownership, which is essential for registration and insurance purposes. |

| 6 | For tax purposes, the sale price listed on the Bill of Sale can be used to assess the sales tax liability. |

| 7 | This form is specifically regulated by Georgia law, ensuring that it meets all local legal requirements for the sale of a tractor. |

| 8 | Both parties should retain a copy of the Bill of Sale for their records and any future disputes or as part of their financial documents. |

| 9 | In some cases, the form may need to be presented to local authorities as part of the registration or transfer of title process. |

| 10 | Though primarily used for private sales, dealerships can also require a Bill of Sale for internal records and legal compliance. |

Instructions on How to Fill Out Georgia Tractor Bill of Sale

Completing a Georgia Tractor Bill of Sale form is an essential step in documenting the sale of a tractor from one party to another. This process not only provides a record of the sale but also ensures that the details of the transaction are clearly outlined for both the buyer and the seller. The form serves as a legal document that can protect the interests of both parties involved. In the paragraphs that follow, you will be guided through the steps necessary to accurately complete the form.

- Gather all necessary information, including the make, model, and serial number of the tractor, as well as personal details of both the buyer and the seller (names, addresses, and contact information).

- Enter the seller's name and address in the designated area on the form. Ensure the information is accurate and complete.

- Proceed to fill in the buyer's name and address in their respective fields. Double-check for any errors to make sure the details are correct.

- Input the tractor’s details, including its make, model, and serial number. It's important to verify these details to prevent any issues regarding the tractor's identification in the future.

- Specify the sale date. This date should reflect when the transaction is taking place or has taken place.

- Determine the sale price of the tractor and include this information on the form. This amount should be agreed upon by both parties prior to filling out the form.

- If there are any additional terms or conditions associated with the sale, make sure to detail these in the space provided. This could include warranties, return policies, or any other agreements relevant to the sale.

- Both the buyer and the seller must sign and date the form. These signatures are critical as they validate the document and signify agreement to the terms of the sale from both parties.

Once the form is fully completed and both parties have added their signatures, it is important to make copies for each party. Keeping a copy of the bill of sale is beneficial for record-keeping purposes and can serve as a proof of transaction in the event of any future disputes or inquiries. It’s beneficial for both the buyer and the seller to retain a copy for their records.

Crucial Points on This Form

What is a Georgia Tractor Bill of Sale form?

The Georgia Tractor Bill of Sale form is a legal document that records the sale or transfer of a tractor from a seller to a buyer within the state of Georgia. This form serves as evidence of the transaction and includes details like the make, model, year, and serial number of the tractor, as well as the names and signatures of both parties involved.

Why do I need a Tractor Bill of Sale in Georgia?

In Georgia, a Tractor Bill of Sale is crucial for several reasons. It is necessary for the buyer to register the tractor under their name, serves as proof of ownership, helps to protect both parties in case of disputes, and is required for legal or tax-related purposes. It provides a documented history of ownership which is important when selling the tractor in the future.

What information should be included in a Tractor Bill of Sale?

A comprehensive Tractor Bill of Sale should include the date of the sale, names and addresses of the seller and buyer, detailed description of the tractor (make, model, year, and serial number), sale price, payment method, warranty information (if any), and the signatures of both the seller and the buyer. Including the odometer reading of the tractor is also recommended if applicable.

Is notarization required for a Tractor Bill of Sale in Georgia?

While notarization is not a legal requirement for a Tractor Bill of Sale in Georgia, having the document notarized adds a layer of authenticity and can be beneficial in preventing legal disputes. It's advisable to check with local authorities or consult a professional for specific cases.

Can a Tractor Bill of Sale be handwritten?

Yes, a Tractor Bill of Sale can be handwritten, provided it contains all the necessary information and is legible. Both parties should have a signed copy of the document. However, utilizing a typed and professionally formatted document is often recommended for clarity and formality reasons.

How do I register a tractor in Georgia after purchasing it?

After purchasing a tractor, it is necessary to register it under your name with the local Department of Motor Vehicles (DMV) or relevant authority in Georgia. You should bring the completed Tractor Bill of Sale, proof of insurance (if required), and payment for any applicable registration fees. The requirements may vary slightly by county, so it's advisable to check with the local DMV.

Does the seller keep a copy of the Tractor Bill of Sale?

Yes, both the seller and the buyer should keep a copy of the Tractor Bill of Sale. Keeping a copy ensures that both parties have proof of the transaction details, which is essential for record-keeping purposes and may be needed for any future disputes, tax purposes, or as a reference for future sales.

What if the tractor is a gift? Do I still need a Bill of Sale?

Even if a tractor is given as a gift, it is still advisable to complete a Tractor Bill of Sale. This document should state that the tractor was gifted and list any payment as $0 or as a nominal amount. This helps establish a clear transfer of ownership and can be important for tax and legal reasons.

Can I use a generic Bill of Sale for a tractor sale in Georgia?

While a generic Bill of Sale can be used for documenting the sale of a tractor in Georgia, it's recommended to use a form that is specifically designed for tractors. This ensures that all pertinent information relevant to a tractor sale is properly captured and can help avoid potential issues with registration or disputes.

What should I do if there is a lien on the tractor I want to buy?

If there is a lien on the tractor you intend to buy, it's important to ensure that the lien is released before completing the purchase. The seller should provide you with documentation from the lienholder stating that the lien has been satisfied. Always verify this information with the lienholder directly to protect yourself from potential legal and financial issues.

Common mistakes

When completing the Georgia Tractor Bill of Sale form, several common mistakes can complicate the process and potentially invalidate the document. Attention to detail is critical in ensuring that the transaction is legally binding and recognized by all relevant parties. Below are ten common errors to avoid:

-

Not verifying the tractor’s identification number (VIN): Ensuring the tractor's VIN matches the number on the form is crucial. This mistake can lead to issues with ownership and registration.

-

Omitting the date of sale: The date of sale is a critical piece of information that validates the transaction. Forgetting to include it can cause discrepancies in ownership timelines.

-

Failing to specify the sale price: The sale price must be clearly stated to ensure transparency and for tax purposes. Vague or missing financial details can lead to legal complications.

-

Selling party not fully identified: Ensuring the seller's information is complete and accurate establishes their legal authority to sell the tractor, preventing fraudulent transactions.

-

Buyer’s information incompletely filled out: Similar to the seller's details, the buyer’s information must also be clear and complete to confirm their legal acquisition of the tractor.

-

Not detailing the condition of the tractor: A description of the tractor's condition, including any faults or damages, protects both parties from future disputes regarding the tractor’s state at the time of sale.

-

Forgetting to include a warranty clause: Whether the tractor is sold with or without warranty should be explicitly stated to avoid misunderstandings about the buyer's expectations and rights.

-

Lack of signatures: The absence of signatures from both parties compromises the legal standing of the document. Signatures confirm that both parties agree to the terms of the sale.

-

Not retaining a copy: Both the buyer and seller should keep a copy of the bill of sale for their records. Failing to do so can lead to complications in proving ownership or resolving disputes.

-

Ignoring state-specific requirements: Each state may have unique requirements for a bill of sale to be considered valid. Overlooking Georgia’s specific stipulations can result in an unenforceable document.

Avoiding these mistakes will help ensure that the Georgia Tractor Bill of Sale form accurately reflects the terms of the sale, protects both parties' rights, and meets all legal requirements.

Documents used along the form

When transferring ownership of a tractor in Georgia, the Bill of Sale form serves as a crucial document that officially documents the sale and transfer of ownership from one party to another. However, the process usually involves several other forms and documents to ensure the legality of the transaction and to fulfill state requirements. These supplementary documents help in establishing a clear history of the ownership, proving the seller’s right to sell, and securing the buyer’s rights as the new owner. Let's explore some of these key documents often used alongside the Georgia Tractor Bill of Sale form.

- Title Transfer Form: This is essential for transferring the title of the tractor from the seller to the buyer, indicating the change of ownership officially. In Georgia, this form is necessary for the Department of Motor Vehicles (DMV) to update their records.

- Odometer Disclosure Statement: Although more common for vehicles, if the tractor has an odometer, this document may be required to certify the accuracy of the mileage at the time of sale. It's a safeguard against odometer tampering.

- Sales Tax Form: In Georgia, the sale of a tractor may be subject to sales tax. This form records the tax collected on the sale for the state’s revenue service.

- Certificate of Inspection: Some tractors, depending on their use and age, might need a certificate of inspection. This document ensures that the tractor meets certain safety and operational standards.

- Proof of Insurance: For tractors that will be operated on public roads, proof of insurance is necessary. This document shows that the buyer has obtained insurance coverage for the tractor.

- Lien Release Form: If the tractor was financed or had any liens against it, this form is crucial. It proves that the tractor is free from liens and legally clear for sale.

- Warranty Document: If the seller is providing any warranty on the tractor, this document details the warranty’s terms and conditions, offering protection for the buyer.

- As-Is Sale Document: In instances where the sale is "as-is," meaning no warranty is implied or given, this document clarifies that the buyer accepts the tractor in its current condition.

- Registration Form: For tractors that need to be registered with the state for operation on public roads or for certain purposes, this form is the first step in that process.

Together, these forms and documents form a comprehensive package that ensures the legality and smooth transition of ownership of a tractor in Georgia. Each plays a unique role in protecting the interests of both the buyer and the seller, making the transaction transparent and legally sound. Proper completion and filing of these documents with the relevant authorities guarantee that all parties comply with state regulations and are shielded against future disputes.

Similar forms

-

Vehicle Bill of Sale: This document is similar to a Tractor Bill of Sale because it serves as a legal record of a transaction, specifically for the sale of a vehicle. Both documents contain details about the seller, buyer, and the item being sold (vehicle or tractor), including specifics like make, model, and identification numbers. They both prove ownership transfer from the seller to the buyer.

-

Boat Bill of Sale: Much like the Tractor Bill of Sale, this document records the sale and purchase of a boat. It includes identification details such as the hull ID, make, year, and any accessories included in the sale. Both documents serve to protect the rights of the buyer and seller, detail the agreed-upon price, and may be used for registration purposes.

-

Equipment Bill of Sale: Similar to the Tractor Bill of Sale, an Equipment Bill of Sale is used for the purchase or sale of any type of heavy or expensive equipment besides tractors, such as construction equipment. It includes information on the seller, buyer, and details of the equipment being sold. Both documents are essential for confirming the change of ownership and can also serve as proof of purchase for warranty and insurance purposes.

-

Firearm Bill of Sale: This document shares similarities with a Tractor Bill of Sale because it's an official record that documents the sale of a firearm from a seller to a buyer. It includes necessary details about the firearm, such as make, model, caliber, and serial number, mirroring the way a Tractor Bill of Sale lists information about the tractor. Both forms ensure a legal transfer of items and can be important for registration or licensing requirements.

-

General Bill of Sale: Acting as a catch-all, the General Bill of Sale can be used for transactions involving any items not specifically covered by more specialized forms. Like the Tractor Bill of Sale, it documents the transfer of ownership from one party to another and includes information about the seller, buyer, and the item sold. Both are crucial for legal protection and record-keeping.

Dos and Don'ts

Filling out the Georgia Tractor Bill of Sale form is a crucial step in the sale or purchase of a tractor. To ensure the process is completed accurately and effectively, here are lists of what you should and shouldn't do.

What You Should Do:Include all relevant details: Make sure to fill out the form with accurate information about the seller, the buyer, and the tractor itself, including make, model, year, and identification number.

Check for clarity: Ensure that the handwriting is clear and legible to avoid any misunderstandings or issues with processing the document.

Verify the information: Both the buyer and seller should double-check the filled information for accuracy before signing the document.

Sign and date the form: A signature from both parties on the form validates the transaction. Confirm that the date of the sale is correctly entered.

Keep copies of the document: Once the form is completed and signed, both the buyer and seller should keep a copy for their records.

Omit information: Missing details can invalidate the document or cause delays in the transaction process.

Use pencil: Filling out the form in pencil makes it easy to alter the information, which could lead to disputes or legal issues. Always use ink.

Sign without reviewing: Signing the form without thoroughly reviewing all the information can lead to unintentional agreements or discrepancies.

Forget to specify any included accessories or attachments: If the tractor sale includes additional items, be sure to list them on the form to avoid future disputes.

Wait to record the transaction: Delaying the documentation of the sale can lead to complications or uncertainties about the transaction date.

Misconceptions

When dealing with the Georgia Tractor Bill of Sale form, several misconceptions commonly arise. Understanding these misconceptions is crucial for anyone involved in the sale or purchase of a tractor in Georgia. Here are four common misconceptions explained:

The form is the only document needed for the sale. Many believe that the Georgia Tractor Bill of Sale form is the sole document required to complete the sale or purchase of a tractor. However, other documents, such as a title transfer form (if applicable), may also be necessary. The Bill of Sale serves as a record of the transaction but may not fulfill all legal requirements for transferring ownership.

It requires notarization to be valid. While having the form notarized can add an extra layer of validity, Georgia law does not require notarization for a Tractor Bill of Sale form to be considered valid. What is essential is that the form includes accurate information and is signed by both the buyer and the seller.

The same form is used for all types of equipment. People often think one form fits all types of agricultural equipment sales. However, the Georgia Tractor Bill of Sale is specifically designed for tractors, and using the correct form is critical. Other types of equipment may require different forms that cater to the specific details and requirements of those items.

It serves as proof of ownership. While the Bill of Sale is an important document that records the transaction between the buyer and the seller, it is not definitive proof of ownership. The actual title (if one exists for the tractor) is the legal document that proves ownership. In cases where titles are not issued, the Bill of Sale accompanied by other documentation, such as a manufacturer's statement of origin, can serve as proof of ownership.

Key takeaways

When dealing with the task of filling out or using a Georgia Tractor Bill of Sale form, it's vital to understand its key components and requirements. This document plays an essential role in the transfer of ownership and provides a record of the sale for both buyer and seller. The following points highlight the most important takeaways to ensure success in this process:

- Accurate Information is Crucial: Make sure that all the details provided on the form are accurate. This includes the names and addresses of both the buyer and seller, as well as specific information about the tractor, such as make, model, year, and serial number.

- Verification of the Tractor's Condition: The form should include a section that describes the condition of the tractor at the time of sale. Honest disclosure of the tractor’s condition can help avoid potential disputes or legal issues in the future.

- Price and Payment Details: Clearly state the sale price of the tractor and the terms of the payment. Indicate whether the payment is made in full at the time of sale or if there are installment plans agreed upon between the parties.

- Signature Requirement: Both the buyer and the seller must sign the Bill of Sale to validate the agreement. In some cases, witness signatures or notarization may also be required to add an extra layer of legal protection.

- Retention of Copies: Both parties should keep a copy of the signed Bill of Sale for their records. This document serves as a proof of ownership transfer and can be important for tax reporting, registration, and in case of any future disputes.

- Odometer Disclosure Statement: If the tractor is equipped with an odometer, the federal law (applicable to motor vehicles, but practiced for transparency in transactions involving vehicles like tractors) directs the seller to provide an accurate odometer reading to avoid odometer fraud.

- Legal Protection: The Bill of Sale serves as a legal contract between the buyer and seller. It should be detailed enough to protect the interests of both parties and ensure clarity regarding the terms of the sale.

- Georgia-Specific Requirements: Be aware of any state-specific requirements or forms that need to be attached or completed in addition to the Bill of Sale. While Georgia law does not require a Bill of Sale to be notarized, certain counties might have specific demands for the registration of the tractor.

Understanding these key aspects can significantly ease the process of transferring ownership of a tractor in Georgia, ensuring legal compliance and peace of mind for both parties involved.

Create Other Tractor Bill of Sale Forms for US States

Tractor Bill of Sale - It includes spaces for the signatures of both the seller and the buyer, making the sale legally binding and official.

How to Transfer Ownership of a Tractor - Clarifies the payment method, whether it’s a lump sum or installment plan, for the tractor’s purchase.

Farm Tractor Bill of Sale - A practical document designed to outline the specifics of a tractor sale, including conditions and sale price.

Bill of Sale for a Tractor - It can be kept as part of a legal record for years, helping to resolve any potential legal issues or claims about the tractor's ownership.