Blank Tractor Bill of Sale Form for New Jersey

When venturing into the sale or purchase of a tractor in New Jersey, the transaction's backbone often lies in a crucial document known as the Tractor Bill of Sale form. This form not only serves to legally document the transfer of ownership from one party to another but also plays a pivotal role in the smooth execution of the transaction. It outlines essential details such as the purchase price, specifics about the tractor (including make, model, and year), and the identities of both the buyer and the seller. By doing so, it offers a layer of protection for all parties involved by providing a legal record of the sale. Moreover, this document is integral for registration and taxation purposes, ensuring compliance with local laws and regulations. Understanding the nuances and the significance of this form is the first step toward a seamless and secure tractor transaction in New Jersey.

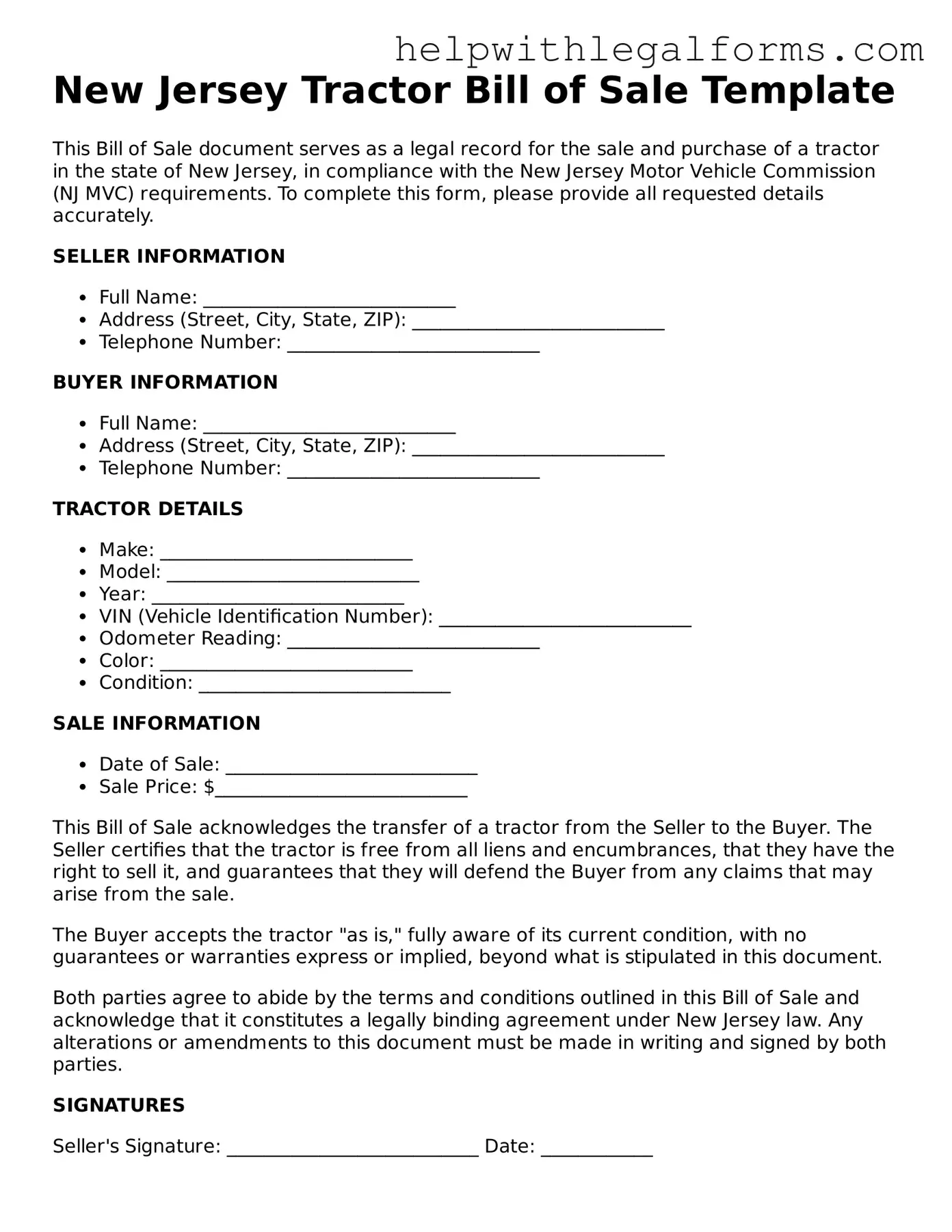

Example - New Jersey Tractor Bill of Sale Form

New Jersey Tractor Bill of Sale Template

This Bill of Sale document serves as a legal record for the sale and purchase of a tractor in the state of New Jersey, in compliance with the New Jersey Motor Vehicle Commission (NJ MVC) requirements. To complete this form, please provide all requested details accurately.

SELLER INFORMATION

- Full Name: ___________________________

- Address (Street, City, State, ZIP): ___________________________

- Telephone Number: ___________________________

BUYER INFORMATION

- Full Name: ___________________________

- Address (Street, City, State, ZIP): ___________________________

- Telephone Number: ___________________________

TRACTOR DETAILS

- Make: ___________________________

- Model: ___________________________

- Year: ___________________________

- VIN (Vehicle Identification Number): ___________________________

- Odometer Reading: ___________________________

- Color: ___________________________

- Condition: ___________________________

SALE INFORMATION

- Date of Sale: ___________________________

- Sale Price: $___________________________

This Bill of Sale acknowledges the transfer of a tractor from the Seller to the Buyer. The Seller certifies that the tractor is free from all liens and encumbrances, that they have the right to sell it, and guarantees that they will defend the Buyer from any claims that may arise from the sale.

The Buyer accepts the tractor "as is," fully aware of its current condition, with no guarantees or warranties express or implied, beyond what is stipulated in this document.

Both parties agree to abide by the terms and conditions outlined in this Bill of Sale and acknowledge that it constitutes a legally binding agreement under New Jersey law. Any alterations or amendments to this document must be made in writing and signed by both parties.

SIGNATURES

Seller's Signature: ___________________________ Date: ____________

Buyer's Signature: ___________________________ Date: ____________

Witness (Optional): ___________________________ Date: ____________

Note: It's recommended to make two copies of this document, one for the Seller and one for the Buyer, for record-keeping purposes.

PDF Form Attributes

| Fact | Description |

|---|---|

| Definition | A New Jersey Tractor Bill of Sale form is a legal document used in the sale and purchase of a tractor within the state of New Jersey, serving as proof of transfer of ownership from the seller to the buyer. |

| Required Information | The form typically requires details such as the buyer’s and seller’s names and addresses, a description of the tractor (including make, model, year, and VIN), the sale date, and the purchase price. |

| Governing Law | It is governed by the laws of the State of New Jersey, which dictate the requirements for a valid bill of sale and the subsequent registration of the tractor. |

| Use for Registration | The New Jersey Tractor Bill of Sale form is often required for the registration of the tractor with the New Jersey Motor Vehicle Commission, especially for private sales. |

| Notarization | While not always mandatory, having the document notarized can add a level of legal protection and authenticity to the transaction. |

| Additional Documentation | Alongside the bill of sale, additional documents such as a title transfer form may be necessary to complete the sale and registration process within the state. |

Instructions on How to Fill Out New Jersey Tractor Bill of Sale

When selling or buying a tractor in New Jersey, a Bill of Sale serves as a crucial document. It verifies the transaction between the buyer and the seller and may be required for registration purposes or tax assessments. It's essential for both parties to accurately fill out and retain a copy of this document. Below is a step-by-step guide on how to complete the New Jersey Tractor Bill of Sale form properly.

- Start by entering the date of the sale at the top of the form. This should include the month, day, and year the transaction is finalized.

- Next, fill in the seller's information. This section should include the seller's full name, address (including city, state, and zip code), and telephone number.

- Follow this by entering the buyer's information, mirroring the details required for the seller: full name, address (including city, state, and zip code), and telephone number.

- Proceed to describe the tractor. This description should include the make, model, year, and serial number or Vehicle Identification Number (VIN) if applicable. It's important to be as accurate and detailed as possible.

- Enter the sale price of the tractor. This should reflect the total amount agreed upon by both parties.

- If there are any additional terms of sale, such as warranties or conditions (for example, 'sold as is'), make sure to include those in the provided section. If no additional terms apply, you can write 'N/A' or 'None'.

- Both the buyer and the seller should sign the form. There should be a space for both signatures, along with printed names to verify the identity of each party. The date of signing should also be recorded next to or beneath the signatures.

After completing these steps, make sure both the buyer and seller retain a copy of the New Jersey Tractor Bill of Sale. This document might be needed for registration, tax purposes, or as proof of ownership in case of any disputes. It’s a good practice for both parties to review all the information on the form before signing to ensure its accuracy.

Crucial Points on This Form

What is a New Jersey Tractor Bill of Sale form?

A New Jersey Tractor Bill of Sale form is a legal document that records the sale of a tractor from a seller to a buyer within the state of New Jersey. This form serves as proof of purchase and documents the transfer of ownership. It typically includes important information such as the make, model, year of the tractor, the sale price, and the details of the buyer and seller. It's essential for record-keeping and may be required for registration purposes or tax assessments.

Is a Tractor Bill of Sale required in New Jersey?

In New Jersey, while not always mandatory, having a Tractor Bill of Sale is highly recommended when selling or buying a tractor. This document provides legal protection for both parties involved in the transaction and ensures that there is a formal record of the sale. It can also be crucial for registration, insurance purposes, and may be required by local tax authorities to assess any applicable sales tax or to adjust property records.

What information should be included in the form?

The New Jersey Tractor Bill of Sale form should include:

- The date of the sale

- The names and addresses of the seller and the buyer

- A detailed description of the tractor (make, model, year, identification number, and any other pertinent information)

- The sale price

- Any warranties or as-is statements regarding the tractor’s condition

- Signatures of both the seller and the buyer

How does one complete the Tractor Bill of Sale?

To complete the Tractor Bill of Sale, both the buyer and seller should first ensure they have all necessary information regarding the tractor and the terms of the sale. After filling out the form with detailed information about the tractor, sale conditions, and both parties' contact details, both should review the document for accuracy. Signing the document finalizes the sale. Having the signatures witnessed by a notary public is not required but is recommended to provide additional legal standing to the document. Once completed, both parties should keep a copy of the form for their records.

Common mistakes

When filling out a New Jersey Tractor Bill of Sale form, people often rush through the process, leading to errors that could affect the validity of the transaction. Here are nine common mistakes:

-

Not checking the form for accuracy before submission. It's crucial to review each entry for accuracy, ensuring that all information is correct and reflects the terms of the sale accurately.

-

Forgetting to include the tractor's make, model, and year. This detailed information is vital for identifying the specific tractor being sold.

-

Omitting the VIN (Vehicle Identification Number). The VIN is a unique identifier for the tractor and its inclusion is essential for the validation of the bill of sale.

-

Leaving out the sale date. The sale date establishes when the transaction occurred, which is important for both parties’ records and possible future disputes.

-

Incorrectly stating the sale price or not specifying the currency. Clearly stating the sale price avoids any confusion about the transaction amount. If the sale involves parties from different countries, the currency should also be specified.

-

Not including both parties' full names and addresses. Accurate identification of the buyer and seller is critical for the bill of sale to be legally binding.

-

Forgetting to sign and date the form. Without signatures from both parties, the document may not be considered legally valid.

-

Failing to acknowledge receipt of payment. Confirmation that the seller has received payment from the buyer secures the transaction and reduces disputes.

-

Not making copies of the bill of sale. Both the buyer and the seller should keep a copy of the signed bill of sale for their records. This is crucial for future reference and verification purposes.

By avoiding these common mistakes, parties can ensure a smoother and more secure tractor sale process, protecting both the buyer's and seller's interests.

Documents used along the form

When engaging in the sale of a tractor in New Jersey, the Tractor Bill of Sale form plays a crucial role in documenting the transaction between the seller and the buyer. However, this document does not stand alone. Several other forms and documents are often used alongside it to ensure a smooth and legally compliant transfer of ownership. By understanding and preparing these additional documents, both parties can facilitate a more secure and efficient transaction.

- Certificate of Title: This document is essential for proving ownership of the tractor. It contains vital information such as the make, model, year, and identification number of the vehicle. Transferring the title to the new owner formally completes the sale.

- Odometer Disclosure Statement: Required for tractors with odometers, this form records the mileage at the time of sale. It's designed to ensure transparency and prevent odometer fraud. Although more common in vehicle transactions, it applies to any tractor equipped with an odometer.

- Sale Receipt: Similar to the Bill of Sale, a Sale Receipt provides proof of transaction but in a more simplified form. It includes information about the buyer, the seller, the sale date, and the amount paid. This document can serve as a quick reference for the transaction's basic details.

- Release of Liability Form: This form releases the seller from legal responsibility concerning the tractor after the sale. It's crucial for the seller to submit this form to the appropriate state agency to prevent future liabilities associated with the tractor's operation.

- Warranty Document: If the tractor is sold with a warranty, this document outlines the terms and conditions of the warranty coverage. It specifies what defects or issues are covered and for how long, ensuring both parties understand the warranty's scope.

- Loan Agreement: Relevant if the tractor is purchased with financing, this document details the loan terms, including the loan amount, interest rate, repayment schedule, and collateral, if any. Both the lender and buyer should keep a copy for their records.

In conclusion, the New Jersey Tractor Bill of Sale form is a critical piece in the puzzle of tractor sales, but it's not the only one. The aforementioned documents complement the Bill of Sale, collectively working to protect the interests of both the buyer and the seller. Ensuring that all these documents are accurately completed and filed is key to a successful and legally sound transaction.

Similar forms

Vehicle Bill of Sale: Just like the Tractor Bill of Sale, a Vehicle Bill of Sale is crucial for transactions involving cars, boats, motorcycles, or any other type of vehicle. It serves as proof of the transfer of ownership from the seller to the buyer, typically including information on the make, model, year, and VIN of the vehicle, as well as the sales price and date.

Equipment Bill of Sale: Similar to the Tractor Bill of Sale, an Equipment Bill of Sale is used for the sale of machinery or heavy equipment. This document outlines the specifics of the item being sold (such as serial numbers and make/model), the sale price, and the parties involved, ensuring that the transaction is recorded and legally binding.

Firearm Bill of Sale: Though it deals with different items, a Firearm Bill of Sale operates under the same principle as the Tractor Bill of Sale. It documents the sale and transfer of ownership of a firearm from one party to another and typically includes details such as the make, model, caliber, and serial number of the firearm, alongside the personal details of the buyer and seller.

Business Bill of Sale: This document is used to transfer the ownership of a business from one person or entity to another. Like the Tractor Bill of Sale, it contains details about the sale, including the sale price and a description of what is being sold, but it also covers assets, liabilities, and terms of the business's transfer.

Pet Bill of Sale: Used for transactions involving animals, the Pet Bill of Sale shares similarities with the Tractor Bill of Sale by outlining the details of the animal being sold (such as breed, age, and health information), the sale price, and the agreement between buyer and seller to transfer ownership.

Boat Bill of Sale: This document functions similarly to the Tractor Bill of Sale but is specifically used for the purchase and sale of boats. It includes details like the boat’s make, model, year, and hull number, in addition to the buyer and seller's information, mirroring the structure and intent of machinery or vehicle sales documents.

Real Estate Bill of Sale: Though typically for the sale of tangible goods, a Real Estate Bill of Sale can be parallel to a Tractor Bill of Sale when dealing with items included in the sale of property such as appliances, furniture, or other personal property. It details the items being sold, the sale amount, and the parties involved.

Aircraft Bill of Sale: Similar to the Tractor Bill of Sale, an Aircraft Bill of Sale is specifically designed for the sale of airplanes and helicopters, detailing the aircraft's make, model, year, and registration number, alongside terms of sale, price, and both parties' signatures to mark the transfer of ownership.

Artwork Bill of Sale: This document is used for transactions involving pieces of art. Like the Tractor Bill of Sale, it includes a detailed description of the item being sold (the artwork), the sale price, and the signatures of both the buyer and seller, ensuring the legal transfer of ownership of the artwork.

Dos and Don'ts

When filling out a New Jersey Tractor Bill of Sale form, certain steps and precautions ensure the process is smooth and legally compliant. Below are the recommended dos and don'ts:

Do:

- Verify the accuracy of all written information, ensuring it reflects the tractor’s make, model, year, and serial number accurately.

- Include the full names and addresses of both the buyer and seller to avoid any confusion or legal issues.

- State the sale price clearly, both in writing and numerically, to confirm the agreed amount.

- Ensure the date of the sale is correctly listed, providing a clear record of when the transaction took place.

- Have both the buyer and seller sign the document to validate the sale and transfer of ownership.

- Retain a copy of the bill of sale for your records, as it serves as a receipt and may be required for future reference.

- Include any warranties or "as is" statements to clearly communicate the condition of the tractor at the time of sale.

- Check if notarization is required or recommended in New Jersey and proceed accordingly to add an extra layer of legitimacy.

- Disclose any liens or encumbrances on the tractor to ensure the buyer is fully informed.

- Use clear and concise language to avoid misunderstandings or ambiguity.

Don't:

- Leave any sections blank; this could lead to misinterpretations or legal issues down the road.

- Forget to check the buyer's or seller’s identity to avoid fraud or scams.

- Rush through filling out the form without double-checking details for accuracy.

- Omit important details about the tractor’s condition, which could be construed as deceptive.

- Sign the bill of sale without ensuring all information is complete and accurate.

- Forget to provide a description of the tractor, including any identifying marks or features.

- Ignore state-specific requirements or stipulations for a tractor sale in New Jersey.

- Assume a handshake deal is enough; always have a written and signed bill of sale for legal protection.

- Skip consulting a professional if there is any confusion or uncertainty about how to fill out the form correctly.

- Assume that a bill of sale alone always transfers the title; check New Jersey's specific requirements for title transfer of a tractor.

Misconceptions

When it comes to the New Jersey Tractor Bill of Sale form, it's not uncommon for both sellers and buyers to have misconceptions about its usage, requirements, and legal implications. Understanding these misconceptions is crucial for a smooth transaction and ensuring all legal bases are covered. Let's address and clarify some of the common misunderstandings.

A Notary Public must always notarize the form. It's a common belief that for a Tractor Bill of Sale to be valid in New Jersey, it must be notarized. While having the document notarized can add a layer of verification, New Jersey law does not strictly require notarization for the form to be considered legal and binding.

It serves as a title for the tractor. Another misconception is regarding the function of the bill of sale. It's important to understand that the Tractor Bill of Sale is a transaction document proving the purchase or sale, but it does not replace the title of the tractor. Owners must possess a separate title document that officially records ownership.

The Bill of Sale is only necessary if requested by the buyer. This misunderstanding could lead to future legal complications. Regardless of whether the buyer requests it, completing a Tractor Bill of Sale is beneficial for both parties. It acts as a receipt for the transaction and provides legal protection in case of disputes or claims.

Any Bill of Sale form will work for a tractor sale in New Jersey. It's easy to assume that any general Bill of Sale form would suffice for selling a tractor in New Jersey. However, using a form specifically designed for a tractor sale ensures that all relevant details, such as make, model, and serial number, are accurately recorded. This specificity can help to avoid issues or misunderstandings later on.

There's no need to report the sale to the state or local authorities. Finally, there's a misconception about the necessity of reporting the sale. While the Tractor Bill of Sale itself is a private document between buyer and seller, certain jurisdictions in New Jersey may require individuals to report the sale for tax purposes or for updating ownership records. It's crucial to check local regulations to ensure compliance.

Understanding and clarifying these misconceptions are vital steps in ensuring that the process of buying or selling a tractor in New Jersey is conducted legally and efficiently. Whether you're a buyer or a seller, being informed about the specifics can save time, prevent legal issues, and contribute to a smoother transaction.

Key takeaways

When it comes to selling or buying a tractor in New Jersey, the documentation of the transaction is a critical step that cannot be overlooked. Among the various documents required, the Tractor Bill of Sale form is paramount. This document not only serves as a receipt for the transaction but also plays a significant role in legal and tax-related matters. Here are four key takeaways about filling out and using the New Jersey Tractor Bill of Sale form.

- Accuracy is crucial: Every detail filled out on the form needs to be accurate and truthful. This includes the make, model, and year of the tractor, as well as the sale price and the personal information of both the buyer and seller. Incorrect information can lead to legal complications and may invalidate the document if discrepancies are discovered.

- Legal requirement: In New Jersey, having a completed Bill of Sale is a legal requirement for the sale of a tractor. This document serves as a legal record of the sale and transfer of ownership. It's important for both the buyer and the seller to keep a copy of the completed form for their records, as it may be needed for registration, tax purposes, or legal proceedings.

- Verification of ownership: The Tractor Bill of Sale form is also a crucial document for verifying the ownership of the tractor. This is particularly important for the buyer, as it serves as proof that the seller has transferred the ownership rights of the tractor to the buyer. Without this form, the buyer may have difficulty proving ownership or may run into issues when trying to register the tractor.

- Preparation for future disputes: While no one anticipates entering into a dispute after a sale, the Bill of Sale form can be an invaluable document if any disagreements or legal issues arise regarding the tractor. It can be used as evidence in court to establish the terms of the sale, including the agreed-upon sale price and the condition of the tractor at the time of sale.

Completing the New Jersey Tractor Bill of Sale form with diligence and care is not just about fulfilling a legal requirement; it's about protecting the rights and interests of both the buyer and the seller. Ensuring that every piece of information is accurately recorded will pave the way for a smoother transaction and help avoid potential legal hurdles in the future.

Create Other Tractor Bill of Sale Forms for US States

How to Transfer Ownership of a Tractor - May include conditions of sale like warranties or return policies related to the tractor’s condition.

Farm Tractor Bill of Sale - An agreement facilitating the lawful sale of a tractor, ensuring compliance with state regulations and tax requirements.