Blank Tractor Bill of Sale Form for Oklahoma

In Oklahoma, the transfer of tractor ownership is a significant transaction that requires meticulous documentation, ensuring both the seller and buyer are protected and the transfer is legally binding. A critical document in this process is the Tractor Bill of Sale form, tailored to encapsulate all the essential details of the sale and purchase of a tractor within the state's jurisdiction. This document serves as a tangible record of the transaction, capturing vital information such as the description of the tractor, the sale price, and the identities of the involved parties. Furthermore, it functions as a legal instrument for transferring ownership, fulfilling tax reporting requirements, and safeguarding the rights of both parties. The necessity of this form stems from its role in verifying the authenticity of the transaction, facilitating a smoother registration process, and providing a layer of legal protection in case disputes arise post-sale. Given its importance, understanding the prerequisites, stipulations, and the correct way to fill out and utilize the Oklahoma Tractor Bill of Sale form is indispensable for anyone involved in the buying or selling of a tractor.

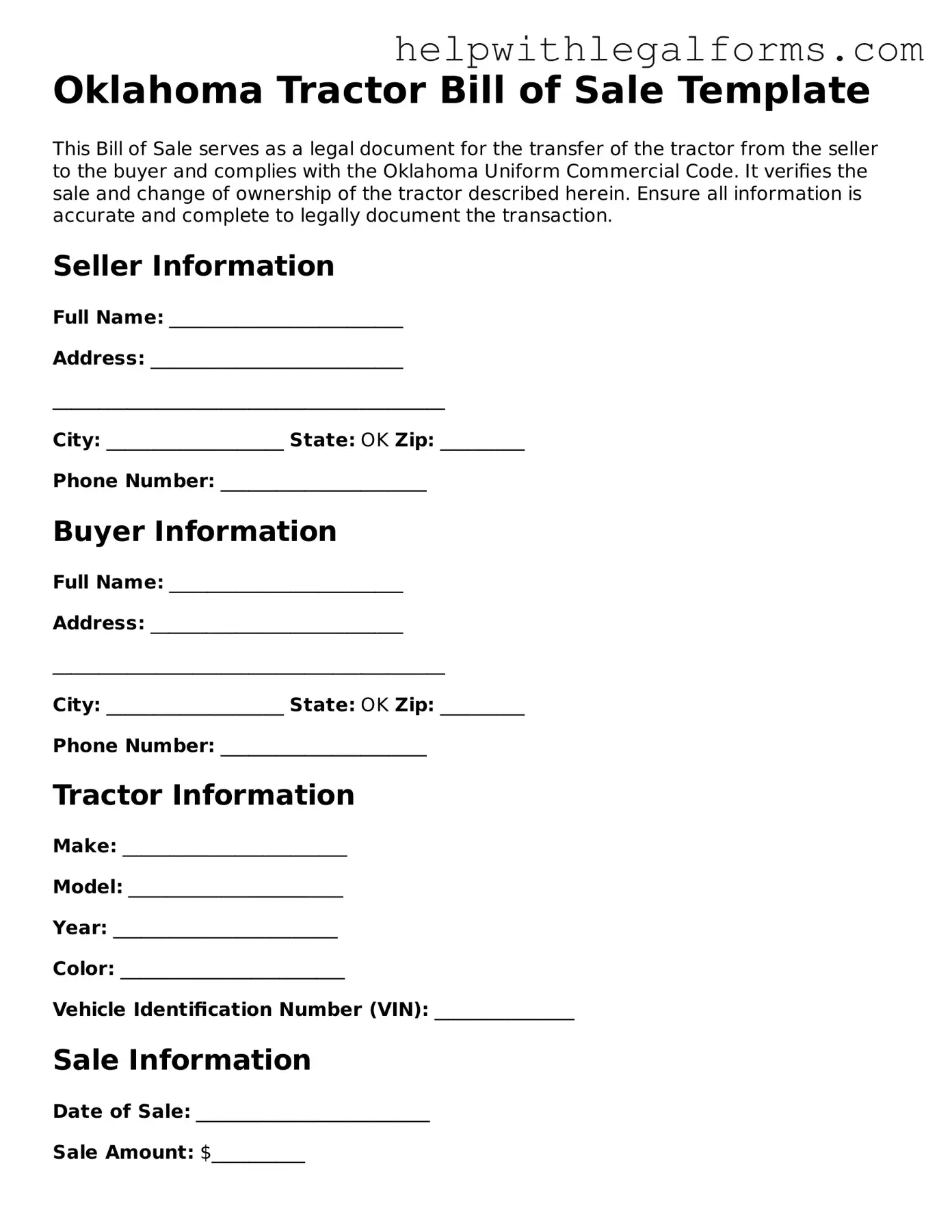

Example - Oklahoma Tractor Bill of Sale Form

Oklahoma Tractor Bill of Sale Template

This Bill of Sale serves as a legal document for the transfer of the tractor from the seller to the buyer and complies with the Oklahoma Uniform Commercial Code. It verifies the sale and change of ownership of the tractor described herein. Ensure all information is accurate and complete to legally document the transaction.

Seller Information

Full Name: _________________________

Address: ___________________________

__________________________________________

City: ___________________ State: OK Zip: _________

Phone Number: ______________________

Buyer Information

Full Name: _________________________

Address: ___________________________

__________________________________________

City: ___________________ State: OK Zip: _________

Phone Number: ______________________

Tractor Information

Make: ________________________

Model: _______________________

Year: ________________________

Color: ________________________

Vehicle Identification Number (VIN): _______________

Sale Information

Date of Sale: _________________________

Sale Amount: $__________

The seller confirms the tractor is sold as-is without any expressed or implied warranties or guarantees, aside from the seller's right to sell the tractor and affirming the tractor is not stolen.

The buyer accepts the tractor as-is and is aware of the sale's conditions, including the absence of warranties and guarantees.

Acknowledgments

By signing below, both parties acknowledge they have read and understand this Bill of Sale. Both parties agree to the terms and conditions as outlined and attest that the information provided is accurate to the best of their knowledge.

Signatures

Seller's Signature: ______________________ Date: __________

Buyer's Signature: ______________________ Date: __________

This document is executed on the date last signed above and is considered legal and binding under the laws of the State of Oklahoma.

PDF Form Attributes

| Fact Name | Detail |

|---|---|

| Purpose | The Oklahoma Tractor Bill of Sale form is used to document the sale and transfer of ownership of a tractor from a seller to a buyer. |

| Governing Law | This form is governed by Oklahoma state law, specifically by the statutes related to personal property sales and transfers. |

| Content Requirements | The form typically includes details like the tractor's make, model, year, identification number, the sale date, and the sale amount. It also includes personal information about the buyer and seller. |

| Signatures | Both the seller and the buyer are required to sign the form, making the sale legally binding and enforceable. |

| Additional Documentation | Submitting this form to the appropriate Oklahoma state agency might be necessary for registration or taxation purposes, depending on the tractor's intended use. |

Instructions on How to Fill Out Oklahoma Tractor Bill of Sale

Completing an Oklahoma Tractor Bill of Sale is a key step in the process of buying or selling a tractor within the state. This document serves as a straightforward record of the transaction, detailing the exchange between buyer and seller. It's essential for legal and tax purposes, providing proof of ownership and the terms of sale. Ensuring this form is filled out accurately protects both parties involved and helps to facilitate a smooth transfer of property. Follow the steps below to successfully complete the Oklahoma Tractor Bill of Sale.

- Start by entering the date of the sale at the top of the form. This establishes when the transaction took place.

- Write the full legal name of the seller(s) in the designated area.

- Next, fill in the full legal name of the buyer(s).

- Describe the tractor being sold. Include specifics such as the make, model, year, and serial number to accurately identify it.

- State the sale price of the tractor. This should reflect the total amount agreed upon by both the buyer and seller.

- If there are any additional terms or conditions of the sale, document them in the section provided. This could include warranties, disclosures, or other significant details both parties want on record.

- The seller must sign the form to officially transfer ownership of the tractor. Ensure the seller's signature is witnessed by an unbiased third party, if required by state law.

- Lastly, the buyer should sign the form, acknowledging the terms of the sale and receipt of the tractor. The buyer's signature may also need to be witnessed.

Once all steps have been completed, both the buyer and seller should keep a copy of the Oklahoma Tractor Bill of Sale for their records. This document will be essential for registering the tractor under the new owner's name, insurance purposes, or in the event of any future legal matters related to the sale. Proper completion and preservation of this form significantly contribute to the legitimacy and smooth execution of the transaction.

Crucial Points on This Form

What is the Oklahoma Tractor Bill of Sale?

The Oklahoma Tractor Bill of Sale is a legal document that records the transfer of ownership of a tractor from the seller to the buyer within the state of Oklahoma. It serves as proof of purchase and can be used for registration, taxation, and personal record purposes.

Is a Tractor Bill of Sale required in Oklahoma?

Yes, a Tractor Bill of Sale is required in Oklahoma for the legal transfer of ownership of a tractor. It ensures that the transaction is documented and both parties have evidence of the sale, which is useful for legal and registration procedures.

What information must be included in the form?

The form should include the following information: the date of the sale, the names and addresses of the seller and buyer, a description of the tractor (including the make, model, year, and serial number), the sale price, any warranty information, and the signatures of both the seller and the buyer.

Do both parties need to sign the Oklahoma Tractor Bill of Sale?

Yes, both the seller and the buyer need to sign the Oklahoma Tractor Bill of Sale. Their signatures confirm that they agree to the terms of the sale and that the information provided on the form is accurate.

Does the Bill of Sale need to be notarized?

No, the Oklahoma Tractor Bill of Sale does not need to be notarized. However, getting it notarized can add an extra layer of legal protection and authenticity to the document.

Can the Tractor Bill of Sale be used for registration purposes?

Yes, the Tractor Bill of Sale can be used for registration purposes in Oklahoma. It provides the necessary proof of ownership for the buyer to register the tractor under their name.

What happens if you lose your Bill of Sale?

If the Bill of Sale is lost, it is advisable to contact the seller to request a duplicate. Having a Bill of Sale is important for registration, taxation, and personal record-keeping.

Is the Bill of Sale valid for out-of-state purchases?

While the Oklahoma Tractor Bill of Sale is designed for transactions within the state, it might be accepted for an out-of-state purchase. However, it is recommended to check with the local authorities in the buyer's state to ensure compliance with their regulations.

Can a Bill of Sale be used to dispute ownership?

Yes, a Bill of Sale can be used to dispute ownership. It serves as a legal document that outlines the specifics of the transaction, including the transfer of ownership from the seller to the buyer.

Are there any specific requirements for a tractor to be sold in Oklahoma?

While the state of Oklahoma does not list specific requirements for a tractor to be sold, it is important that the tractor's description (make, model, year, and serial number) is accurately reflected in the Bill of Sale. Additionally, compliance with any applicable state laws and regulations related to the sale of vehicles and equipment should be observed.

Common mistakes

Filling out the Oklahoma Tractor Bill of Sale form is a crucial step in the process of buying or selling a tractor. This document not only serves as a receipt for the transaction but also provides legal proof of the change in ownership. However, mistakes can happen during this process. Below are six common errors individuals tend to make when completing this form:

Not verifying the accuracy of the tractor’s details: This includes the make, model, year, and serial number of the tractor. It's essential that these details are double-checked for accuracy to ensure the bill of sale reflects the correct tractor being bought or sold.

Failing to include both parties' full legal names and addresses: Both the buyer and the seller must have their complete information listed on the form. This includes their full legal names and current addresses. Omitting this information can result in complications with the transfer of ownership or legal disputes.

Skipping the date of the sale: The exact date of the sale provides a timestamp of the transaction and is critical for record-keeping and in cases where the timing of ownership transfer needs to be verified.

Not specifying the sale price: Clearly stating the sale price on the form is necessary for tax purposes and for both parties to have a record of the financial agreement.

Omitting signatures: Both the buyer and the seller must sign the bill of sale for it to be considered legally binding. Missing signatures can invalidate the document and complicate the ownership transfer.

Ignoring the need for a witness or notarization: Depending on the requirements in Oklahoma, having the bill of sale witnessed or notarized can add an extra layer of legality and protection for both parties involved. Overlooking this step can lead to disputes being harder to resolve.

When individuals avoid these mistakes, they help ensure the tractor sale process is smooth and legally sound. It's always recommended to review the completed form carefully and consult with a professional if there are any uncertainties.

Documents used along the form

When selling or purchasing a tractor in Oklahoma, several documents may accompany the Tractor Bill of Sale to ensure a smooth and legally compliant transaction. These documents not only help to establish the terms of the sale but also provide protections and fulfill state requirements. Here’s a list of common documents often used together with the Oklahoma Tractor Bill of Sale form.

- Certificate of Title: This document is crucial as it legally proves ownership of the tractor. It needs to be transferred to the new owner to complete the sale, ensuring that the ownership change is recognized by the state.

- Promissory Note (if applicable): If the buyer is financing the purchase, a promissory note might be necessary. This note details the repayment plan, interest rate, and any other terms related to the financing of the tractor purchase.

- Odometer Disclosure Statement: While mainly used for vehicles, if the tractor has an odometer, an Odometer Disclosure Statement may be required to certify the accuracy of the mileage stated, providing transparency for the buyer.

- Sales and Use Tax Form: This form is important for the calculation and payment of sales tax on the purchase. In Oklahoma, the sale of tangible personal property is subject to tax, and this form helps in complying with state tax regulations.

- Inspection Certificates: Depending on the condition and use of the tractor, an inspection certificate might be needed to certify its condition at the time of sale. This can include safety inspections or emissions tests, depending on the age and specifications of the tractor.

Combining the Oklahoma Tractor Bill of Sale with these documents helps to create a comprehensive record of the sale and ensures both the buyer and seller meet their legal obligations. It's always advisable to check current state requirements and consult with a professional when engaging in any legal transactions to ensure compliance with all local, state, and federal laws.

Similar forms

A Vehicle Bill of Sale - This document serves a similar purpose to the Tractor Bill of Sale, documenting the sale and transfer of ownership of a vehicle. Both forms typically include information about the seller, the buyer, the sale date, and the sale price, along with a detailed description of the vehicle or tractor.

A Boat Bill of Sale - Like the Tractor Bill of Sale, this document proves the transaction between a buyer and a seller but specifically pertains to boats. It may also require additional details regarding the boat's make, model, year, and hull identification number, similar to the identifying details needed for a tractor.

A Firearm Bill of Sale - This bill of sale documents the sale of a firearm. While the item being sold is different, the purpose is the same - to provide a legal record of the transaction, including information on the buyer, seller, and specifics about the firearm, paralleling the structure of a Tractor Bill of Sale.

A General Bill of Sale - Used for the sale of personal property items not specifically covered by other types of bills of sale. It's similar in function to the Tractor Bill of Sale as it provides a record of the sale and includes details about the item sold, the sale amount, and the parties involved.

A Equipment Bill of Sale - Specifically designed for the sale of equipment, this document is quite similar to a Tractor Bill of Sale. Both detail the equipment being sold, including any serial numbers or identification, and include the terms of the sale, seller and buyer information, and signatures for validation.

A Pet Bill of Sale - Although it covers the sale of animals, its structure mirrors that of a Tractor Bill of Sale by documenting the agreement details, including the seller’s and buyer’s information, description of the pet, and purchase price, ensuring a clear record of the transaction.

A Business Bill of Sale - This document is used to transfer ownership of a business. Similarities to the Tractor Bill of Sale include details on the buyer and seller, a description of what's being sold (in this case, a business instead of a tractor), and the terms of the sale.

A Real Estate Bill of Sale - Used for transactions involving real property. While the Tractor Bill of Sale pertains to personal property, both types of bills of sale serve to legally document the details of a transaction, including descriptions of what's being sold, the agreed price, and the parties’ signatures.

Dos and Don'ts

When completing the Oklahoma Tractor Bill of Sale form, it's crucial to keep certain guidelines in mind to ensure the process is both legal and effective. This document acts as a transparent record of sale, detailing the transaction between the seller and buyer regarding a tractor's change of ownership. Below are essential dos and don'ts to consider:

Do:

- Fill out the form with all necessary details, such as the make, model, year, and serial number of the tractor, as well as the selling price. This information is integral for both parties to acknowledge what is specifically being transferred.

- Ensure both the seller and buyer provide complete and accurate personal information, including full names, addresses, and contact details. This data is required to validate the identities of both parties involved in the transaction.

- Sign and date the form in the presence of a notary public if required. While not all states mandate notarization for a Bill of Sale, getting it notarized can add an extra layer of legal security and validation to the document.

- Keep copies of the completed form for both the buyer and seller. Having a record of the transaction is vital for tax reporting purposes and can also serve as proof of ownership or for warranty claims.

Don't:

- Leave any sections incomplete. Omitting information can lead to disputes or legal complications in the future, making it difficult to prove the particulars of the transaction or the condition of the tractor at the time of sale.

- Falsify any information. Misrepresenting the condition or details of the tractor, or the identities of the parties involved, is not only unethical but can also lead to legal repercussions.

- Forget to specify any additional terms or conditions that were agreed upon, such as payment plans, warranties, or the inclusion of accessories or attachments. These need to be clearly detailed to avoid any misunderstandings later on.

- Overlook the importance of verifying the tractor's identification numbers against the form. Ensuring that these numbers match is crucial for the legality of the sale and for future registration or insurance purposes.

Misconceptions

When it comes to transferring ownership of a tractor in Oklahoma, the Tractor Bill of Sale form is a key document. However, there are several misconceptions surrounding its use and requirements. It's important to clear up these misunderstandings to ensure a smooth transaction for both the buyer and the seller.

It must be notarized to be valid. Many believe that for a Tractor Bill of Sale to be considered valid in Oklahoma, it must be notarized. This isn't true. While notarization can add an extra layer of legality and protection, Oklahoma law does not mandate that this document be notarized for the sale to be legally binding.

It's the same as a title. Another common misconception is that the Tractor Bill of Sale serves the same legal function as a title. However, they serve different purposes. The Tractor Bill of Sale is a receipt that documents the transaction between the buyer and seller, while a title is a legal document that proves ownership.

Only the buyer needs a copy. Both parties benefiting from the transaction should have a copy of the Tractor Bill of Sale. Keeping a copy ensures that the seller can prove the tractor was legally sold and the buyer can demonstrate their legal ownership.

Any template will work. While there are many generic bill of sale templates available, using a form specifically designed for Oklahoma ensures that all state-required information is included. This reduces the risk of legal complications arising from missing or incorrect information.

Personal information isn't necessary. Actually, both the buyer's and seller's personal details, such as full names and addresses, are crucial. This information helps to identify the transaction parties and can be important for future title registration or if disputes arise.

Price doesn't need to be precise. Listing the exact sale price on the Tractor Bill of Sale is necessary for tax and legal purposes. An accurate sale price ensures the correct sales tax is paid and provides clear evidence of the transaction value, which can be important for future valuation or insurance claims.

Dispelling these misconceptions about the Oklahoma Tractor Bill of Sale is crucial for anyone involved in buying or selling a tractor in the state. By understanding the realities of this document, both parties can ensure a legally sound and hassle-free transaction.

Key takeaways

The Oklahoma Tractor Bill of Sale form is an essential document for both sellers and buyers during the transaction of a tractor. It serves as a legal record that proves the transfer of ownership from the seller to the buyer. Understanding how to properly fill out and use this form is vital to ensure a smooth and legally sound transaction. Here are seven key takeaways to guide you through this process:

- The form should include comprehensive details about the tractor being sold. This includes the make, model, year, condition, and any identifying numbers or marks.

- Accurate information about both the seller and the buyer is crucial. Ensure that full names, addresses, and contact information are correctly filled out for both parties.

- The sale price of the tractor must be clearly stated on the bill of sale. This helps in establishing the value of the transaction and is important for tax purposes.

- Both parties should agree on the date of the sale. This date should be accurately recorded on the form as it signifies when the ownership transfer officially takes place.

- Signatures are mandatory. The bill of sale must be signed by both the seller and the buyer. These signatures are essential for validating the document.

- A witness or notary public’s signature may be required. Depending on local laws and regulations, having the bill of sale witnessed or notarized can add an extra layer of legal protection.

- Keep copies of the completed form. Both the buyer and the seller should keep a copy of the bill of sale for their records. This document serves as a receipt and may be needed for future reference or legal purposes.

Understanding these key points ensures that the process of buying or selling a tractor in Oklahoma is carried out efficiently and legally. It provides both parties with peace of mind, knowing that the transaction is properly documented and binding.

Create Other Tractor Bill of Sale Forms for US States

Bill of Sale for a Tractor - In some jurisdictions, this form is a legal requirement for the sale of a tractor, making it an indispensable part of the transaction.

Farm Tractor Bill of Sale - When filled out completely and accurately, it provides a solid foundation for the legal transfer of the tractor, safeguarding both buyer and seller.