Blank Tractor Bill of Sale Form for Texas

When considering the sale or purchase of a tractor in Texas, the Texas Tractor Bill of Sale form plays a crucial role in ensuring the transaction is legally binding and properly documented. This essential piece of paperwork not only serves as evidence of the sale but also provides detailed information regarding the tractor, such as its make, model, year, and VIN number, establishing a clear history of ownership. Furthermore, the form outlines the agreed-upon purchase price, the sale date, and the specific terms and conditions, offering protection and peace of mind to both the seller and the buyer. Important for both parties, it aids in the smooth transfer of ownership and can be instrumental in resolving any potential disputes that may arise post-sale. Moreover, for taxation and registration purposes, this document is invaluable, ensuring compliance with Texas state laws and regulations. Thus, understanding and properly utilizing the Texas Tractor Bill of Sale form is fundamental for anyone looking to navigate the process of buying or selling a tractor in the state, safeguarding their investment and ensuring a legitimate transaction.

Example - Texas Tractor Bill of Sale Form

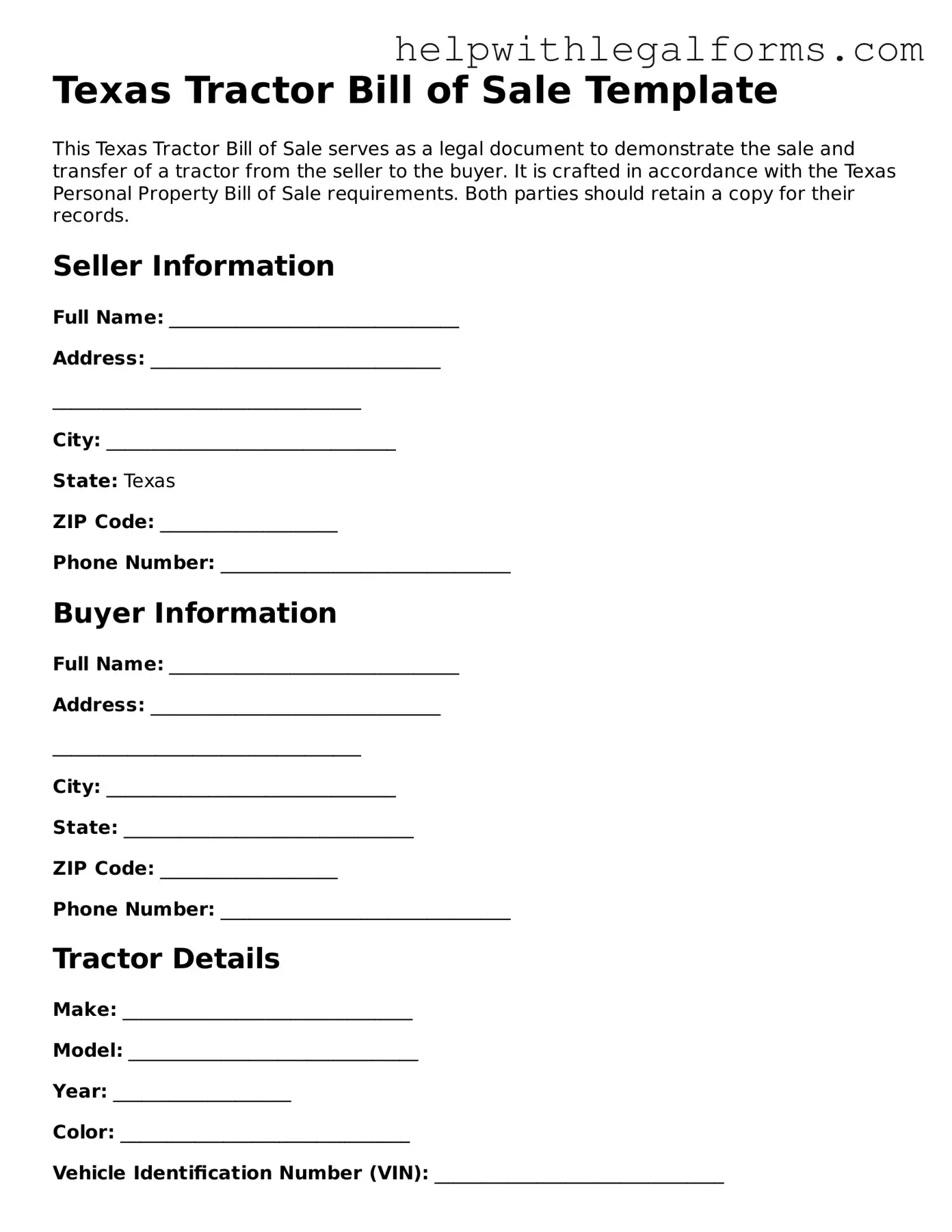

Texas Tractor Bill of Sale Template

This Texas Tractor Bill of Sale serves as a legal document to demonstrate the sale and transfer of a tractor from the seller to the buyer. It is crafted in accordance with the Texas Personal Property Bill of Sale requirements. Both parties should retain a copy for their records.

Seller Information

Full Name: _______________________________

Address: _______________________________

_________________________________

City: _______________________________

State: Texas

ZIP Code: ___________________

Phone Number: _______________________________

Buyer Information

Full Name: _______________________________

Address: _______________________________

_________________________________

City: _______________________________

State: _______________________________

ZIP Code: ___________________

Phone Number: _______________________________

Tractor Details

Make: _______________________________

Model: _______________________________

Year: ___________________

Color: _______________________________

Vehicle Identification Number (VIN): _______________________________

Odometer Reading: ___________________

Sale Information

Sale Date: ___________________

Purchase Price: $___________________

Warranties and Representations

The seller states that they are the lawful owner of the tractor and have the legal right to sell it. The tractor is sold "as is," without any warranties, unless otherwise specified:

_________________________________________________________________________

_________________________________________________________________________

The buyer accepts the tractor's condition and acknowledges receipt of the bill of sale.

Signatures

This document is not considered legally binding until signed by both the seller and the buyer.

Seller's Signature: _______________________________ Date: ___________________

Buyer's Signature: _______________________________ Date: ___________________

Witness (If Applicable)

Witness's Signature: _______________________________ Date: ___________________

Print Name: _______________________________

Notary (If Applicable)

This section to be completed by a notary public if required or desired for additional legal validation.

Notary's Signature: _______________________________ Date: ___________________

Commission Expiration: ___________________

PDF Form Attributes

| Fact Number | Description |

|---|---|

| 1 | The Texas Tractor Bill of Sale form is used to document the sale of a tractor from one party to another within the state of Texas. |

| 2 | This form serves as a legal record of the transaction, providing proof of ownership transfer. |

| 3 | It typically includes important details such as the make, model, year, and serial number of the tractor, along with the sale price. |

| 4 | Both the seller and the buyer must sign the document for it to be considered valid. |

| 5 | Witnesses or a notary public may also be required to sign, depending on local regulations. |

| 6 | The form helps in the registration process of the tractor under the new owner's name with the appropriate Texas state authorities. |

| 7 | Governing laws for this document include the Texas Uniform Commercial Code and specific requirements set forth by the Texas Department of Motor Vehicles. |

| 8 | Using the Texas Tractor Bill of Sale form can also be crucial for tax reporting purposes for both the seller and the buyer. |

| 9 | It is advisable for both parties to keep a copy of this document for their records as proof of sale and for future reference. |

Instructions on How to Fill Out Texas Tractor Bill of Sale

Once you have decided to buy or sell a tractor in Texas, completing the Tractor Bill of Sale form becomes an essential step. This legal document will record the transaction between the buyer and seller, ensuring clarity and protection for both parties. It is crucial to fill out this form accurately to avoid any potential legal issues in the future. Follow the steps below to complete the Texas Tractor Bill of Sale form correctly.

- Start with the date of the sale. Include the month, day, and year to ensure there is a clear record of when the transaction took place.

- Write the full legal names of both the buyer and the seller. Be sure to check the spelling for accuracy.

- Provide the address details for both parties. This includes the city, state, and zip code. Accurate addresses are essential for any future correspondence or legal necessities.

- List the sale price of the tractor. This should be the agreed amount between the buyer and seller. If the tractor is a gift, state this clearly instead of including a sale price.

- Describe the tractor in detail. Include the make, model, year, and identification number (VIN). This information is crucial to accurately identify the tractor being sold.

- State any additional conditions of the sale if applicable. This could include warranties, "as is" condition statements, or any other terms agreed upon by the buyer and seller.

- Both the buyer and seller must sign the form. This legally binding action confirms that both parties agree to the terms and conditions of the sale stated in the document.

- It's a good practice to have a witness sign the form or to get the document notarized, although this is not strictly required by Texas law. Doing so, however, adds another level of validation to the transaction.

After the form is fully completed and signed, both the buyer and seller should keep a copy for their records. This document serves as a proof of purchase and can be important for registration, taxation, and personal records. Ensuring you have completed the Texas Tractor Bill of Sale form correctly is key to a smooth and legally sound transaction.

Crucial Points on This Form

What is a Texas Tractor Bill of Sale form?

A Texas Tractor Bill of Sale form is a legal document that records the sale and transfer of ownership of a tractor from the seller to the buyer in the state of Texas. This form serves as proof of purchase and indicates the transaction details such as the date of sale, sale price, and specifics about the tractor including make, model, and serial number.

Why is a Texas Tractor Bill of Sale form necessary?

It is necessary for several reasons. Firstly, it legally documents the sale, which can protect both the buyer and the seller in case of disputes over ownership or the terms of the sale. Secondly, the buyer may need it for registration and titling purposes if required by law. Thirdly, it provides a written record of the sale, which can be beneficial for tax and accounting purposes.

What details should be included in a Texas Tractor Bill of Sale form?

The form should include detailed information to accurately represent the sale. This includes the names and addresses of both the buyer and the seller, the sale date, the sale price, and a thorough description of the tractor (make, model, year, condition, and VIN or serial number). It may also contain warranties or representations made about the tractor's condition.

Do both parties need to sign the Texas Tractor Bill of Sale form?

Yes, both the buyer and the seller should sign the form. Their signatures officially confirm the agreement to the terms of the sale and the accuracy of the information provided. It is also recommended to have the signatures notarized for an added layer of legal protection and authenticity.

Is notarization required for a Texas Tractor Bill of Sale form?

Notarization is not strictly required by Texas law for a Tractor Bill of Sale to be considered valid. However, having the document notarized can lend credibility to the signatures and protect against fraudulent claims, making it a prudent step in the transaction process.

How does one get a Texas Tractor Bill of Sale form?

The form can be obtained through various means. One can download templates online from legal resource websites, request a form from the Texas Department of Motor Vehicles (DMV) if available, or consult with a legal professional to draft a custom Bill of Sale tailored to the specific transaction.

Can a Texas Tractor Bill of Sale form be handwritten?

Yes, a Texas Tractor Bill of Sale form can be handwritten, provided it contains all the necessary information and is legible. Both parties should ensure the document accurately reflects the details of the sale and is free of errors before signing.

What happens after the Texas Tractor Bill of Sale form is completed?

Once completed and signed, the Bill of Sale should be kept by both the buyer and the seller as a record of the transaction. The buyer may need to present the Bill of Sale when registering the tractor with the local DMV or when obtaining insurance. It's advisable to keep the document in a safe place for future reference.

Is there any additional documentation needed besides the Texas Tractor Bill of Sale when buying or selling a tractor?

Yes, additional documentation may be required. Depending on local regulations and the specifics of the tractor, items such as a title transfer, registration forms, and proof of insurance might be needed. Buyers and sellers are encouraged to check with their local DMV or a legal professional to ensure compliance with all state-specific requirements.

Common mistakes

Filling out the Texas Tractor Bill of Sale form requires attention to detail. Avoiding common mistakes can ensure the process is smooth and legally binding. Here are four frequent errors to be mindful of:

Not verifying the buyer's and seller's information: It's crucial to double-check the accuracy of both the buyer's and seller's names, addresses, and contact details. Incorrect information can invalidate the bill of sale or cause issues in the future.

Omitting key details about the tractor: Failing to include comprehensive information about the tractor, such as its make, model, year, and identification number, might lead to disputes or confusion. Detailed description serves as proof of what is being sold and its condition.

Ignoring the need for witness signatures: Many people overlook the importance of having witnesses sign the bill of sale. While not always legally required, witness signatures provide an additional layer of authenticity and can serve as a safeguard against future claims.

Forgetting to specify the sale date and price: Clearly stating the date of the sale and the agreed-upon price is essential. These details confirm when the transaction occurred and for how much, which is important for both tax purposes and record-keeping.

Avoiding these mistakes helps ensure the Texas Tractor Bill of Sale is completed correctly and serves as a valid legal document. By paying close attention to these details, both buyer and seller can enjoy a secure and transparent transaction.

Documents used along the form

When completing a transaction involving the sale of a tractor in Texas, the Tractor Bill of Sale form is a crucial document. However, it's often part of a wider array of documents, ensuring the legality and smooth transition of ownership. These documents can vary based on the sale's context, the parties' agreement, and local regulations. Below is a list of nine other forms and documents frequently used in conjunction with the Texas Tractor Bill of Sale to safeguard both buyer and seller, providing a comprehensive legal framework for the sale.

- Certificate of Title: This document proves ownership of the tractor. It's essential to transfer the title to the buyer's name following the sale.

- UCC-1 Financing Statement: If the purchase involves financing, this form is filed to indicate a secured interest in the tractor, protecting the lender's investment.

- Odometer Disclosure Statement: While more common for vehicles, if applicable, it records the tractor's mileage at the time of sale, ensuring transparency.

- Sales Tax Form: This document is necessary to report and pay any sales tax due on the transaction to the Texas Comptroller.

- Warranty Document: If the tractor is sold with a warranty, this document details the conditions and duration of the warranty, outlining the protection offered to the buyer.

- As-Is Sales Agreement: This document clarifies that the tractor is sold in its current condition, with the buyer accepting any existing faults or damages, offering legal protection to the seller.

- Release of Liability Form: This form releases the seller from legal responsibility for what happens with the tractor after the sale, transferring all risks to the buyer.

- Proof of Insurance: While not always mandatory, buyers might need to show proof of insurance, especially if financing the tractor.

- Personal Property Bill of Sale: If additional items are sold with the tractor, such as attachments or accessories, this document records their sale, ensuring every part of the transaction is documented.

Each of these documents plays a vital role in making the tractor sale process in Texas both secure and legally compliant. They provide a structured procedure to follow, which can help in avoiding future disputes or legal complications. Always consult with a legal professional when dealing with complex transactions or if there are any doubts about the necessary documentation.

Similar forms

Vehicle Bill of Sale: Similar to the Tractor Bill of Sale, a Vehicle Bill of Sale is used to document the sale and transfer of ownership of a vehicle from one party to another. It typically includes information about the seller, the buyer, the vehicle (make, model, year, and VIN), and the sale details (date and purchase price). This document is critical for the legal transfer of ownership and may be required for registration and taxation purposes.

Boat Bill of Sale: Much like the Tractor Bill of Sale, a Boat Bill of Sale serves as a legal document that records the sale and transfer of a boat from the seller to the buyer. It includes details about the boat (such as type, make, model, year, and hull identification number), the sale (purchase price, date of sale), and the parties involved. This document is often necessary for registration, titling, and proving ownership of the boat.

Firearm Bill of Sale: A Firearm Bill of Sale is another document similar to the Tractor Bill of Sale in that it documents the sale and transfer of a firearm from a seller to a buyer. It includes crucial information such as the make, model, caliber, and serial number of the firearm, along with the personal details of both parties and the terms of the sale. This document is vital for ensuring the legal transfer of ownership and may be required by law in some jurisdictions.

General Bill of Sale: The General Bill of Sale is a more versatile document that, like the Tractor Bill of Sale, is used to record the sale and transfer of personal property from one party to another. This can include any type of personal property not specifically covered by more specialized forms (like vehicles, boats, or firearms). The document typically outlines the details of the property being sold, the identity of the buyer and seller, and the terms of the sale, including the sale date and purchase price. It serves as proof of transfer of ownership.

Dos and Don'ts

When handling the Texas Tractor Bill of Sale form, accuracy and attention to detail are paramount. This document is not just a formality; it's a legally binding record that affects the rights and obligations of both the seller and the buyer. To navigate this process smoothly, keep in mind the following dos and don'ts.

Do:

- Double-check all the details before submission. It's crucial to ensure that every piece of information is correct, including the tractor's make, model, year, and VIN (Vehicle Identification Number), along with the personal details of both the buyer and the seller.

- Have all parties sign and date the form in the presence of a notary public. This step is essential for the document to hold legal weight.

- Retain a copy of the completed form for your records. Both the buyer and the seller should keep a copy of this document to protect their interests and for future reference.

- Verify that the form complies with Texas state requirements. Though the basic information required on a Bill of Sale is generally consistent, some specifics may vary from state to state.

Don't:

- Leave any sections of the form blank. If a particular field does not apply, mark it as "N/A" (not applicable) instead of leaving it empty to avoid misunderstandings or the impression of incomplete information.

- Rely on verbal agreements. The Bill of Sale serves as a physical record of the sale and purchase details that both parties have agreed to, minimizing future disputes.

- Forge or alter information after the fact. Alterations can invalidate the document and possibly lead to legal repercussions for fraud.

- Forget to check for any liens against the tractor. Ensuring the tractor is free of any claims or liens is crucial before completing the sale to avoid legal complications for the buyer down the line.

Misconceptions

Many misconceptions surround the Texas Tractor Bill of Sale form, which can lead to confusion and potentially legal pitfalls for both the buyer and seller. It's crucial to dispel these myths to ensure a smooth and legally compliant transaction. Below are seven common misunderstandings and the truths behind them.

- Notarization is mandatory. A widespread belief is that the Tractor Bill of Sale must be notarized to be valid in Texas. While notarization strengthens the document's legal standing, Texas law does not require it for this specific type of bill of sale, unless the transaction involves a lien.

- One form fits all. Some think that a generic bill of sale suffices for every tractor sale in Texas. However, details such as the make, model, and serial number of the tractor should be explicitly mentioned to ensure the document's effectiveness and to avoid future disputes.

- Handwritten forms aren't legal. The legality of a bill of sale does not depend on whether it is typed or handwritten. However, the document must be legible, include all necessary information, and be signed by both parties to be considered valid.

- Only the buyer needs a copy. Both the buyer and the seller should keep a copy of the Bill of Sale. This document serves as proof of transaction and ownership for the buyer and as a release of liability for the seller.

- It's just a simple receipt. This misconception underestimates the Bill of Sale's importance. Besides detailing the transaction, this document can be crucial for registration, tax purposes, and proving ownership or release of liability in legal disputes.

- State-specific forms are unnecessary. While a Texas-specific form may not be legally required, using one is beneficial. A form tailored for Texas will cover specific state requirements and ensure all pertinent details are addressed.

- Additional documents aren't needed for the sale. Depending on the circumstances of the sale, additional documents such as a release of lien or proof of insurance might be needed. It's important to research and prepare all necessary paperwork to avoid legal complications down the line.

Addressing these misconceptions is essential for a legally compliant and trouble-free tractor sale in Texas. Ensure all the necessary details are correctly filled out and that both parties understand their rights and responsibilities associated with the transaction.

Key takeaways

When engaging in the sale or purchase of a tractor in Texas, the Texas Tractor Bill of Sale form plays a crucial role. This document not only serves as a record of the transaction but also offers legal protection for both the buyer and the seller. To navigate the process smoothly, here are some essential takeaways:

- Accuracy is key: Ensure all the details entered in the Texas Tractor Bill of Sale form are accurate. This includes the full names and addresses of both the buyer and the seller, the sale date, and comprehensive details about the tractor (like make, model, year, and serial number). Mistakes can lead to legal complications or disputes in the future.

- Legal requirements: Familiarize yourself with the legal requirements specific to Texas regarding the sale of a tractor. Some areas may require the bill of sale to be notarized or accompanied by other documents. Knowing these requirements ahead of time can prevent delays or issues with the transfer process.

- Verification: Before finalizing the sale, both parties should verify the information on the bill of sale. This includes double-checking the tractor's details for accuracy and ensuring that the terms of the sale are clearly outlined and agreed upon.

- Keep records: Once the bill of sale is completed and signed, it's important for both the buyer and the seller to keep copies of the document. This serves as a receipt for the transaction and can be valuable in case any questions or disputes arise later. It's also useful for tax and registration purposes.

By following these guidelines, parties involved in a tractor sale in Texas can ensure a smooth and compliant transaction process. The Texas Tractor Bill of Sale form is a critical document that provides a transparent record of the sale, offering peace of mind and legal protection to both the buyer and the seller.

Create Other Tractor Bill of Sale Forms for US States

Simple Bill of Sale for Car Georgia - The form helps to facilitate a smooth transfer of property, giving peace of mind to both parties involved in the transaction.

Farm Tractor Bill of Sale - A tractor bill of sale serves as a receipt for the transaction, ensuring a mutual understanding of the sale’s terms.

Tractor Bill of Sale - It is an invaluable asset for managing the legal aspects of transferring ownership of a piece of agricultural machinery.