Legal Business Purchase and Sale Agreement Form

Entering into the world of business acquisitions, one of the most pivotal documents encountered is the Business Purchase and Sale Agreement. This form serves as the foundational contract between a buyer and seller, outlining the terms under which a business will change hands. Its significance cannot be overstated, as it meticulously details every aspect of the transaction, from the purchase price to asset inventory, and from liabilities to the conditions precedent which must be satisfied before the deal can close. For those navigating these waters, understanding the nuanced elements of this agreement becomes essential to ensuring a smooth transition and safeguarding their interests. Whether it's a seasoned investor acquiring another venture or a first-time entrepreneur stepping into a new realm, this document plays a crucial role in shaping the future of both the business in question and the parties involved.

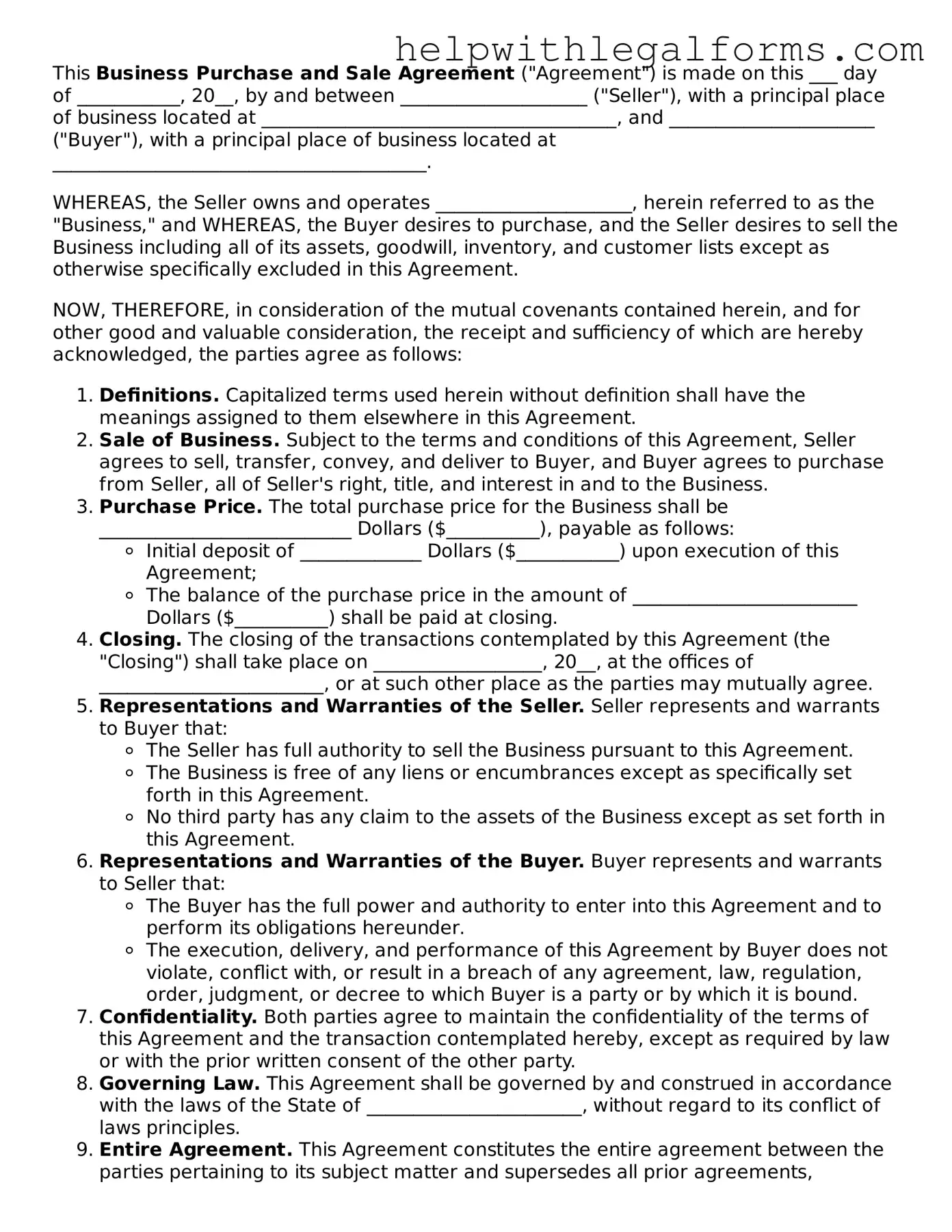

Example - Business Purchase and Sale Agreement Form

This Business Purchase and Sale Agreement ("Agreement") is made on this ___ day of ___________, 20__, by and between ____________________ ("Seller"), with a principal place of business located at ______________________________________, and ______________________ ("Buyer"), with a principal place of business located at ________________________________________.

WHEREAS, the Seller owns and operates _____________________, herein referred to as the "Business," and WHEREAS, the Buyer desires to purchase, and the Seller desires to sell the Business including all of its assets, goodwill, inventory, and customer lists except as otherwise specifically excluded in this Agreement.

NOW, THEREFORE, in consideration of the mutual covenants contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

- Definitions. Capitalized terms used herein without definition shall have the meanings assigned to them elsewhere in this Agreement.

- Sale of Business. Subject to the terms and conditions of this Agreement, Seller agrees to sell, transfer, convey, and deliver to Buyer, and Buyer agrees to purchase from Seller, all of Seller's right, title, and interest in and to the Business.

- Purchase Price. The total purchase price for the Business shall be ___________________________ Dollars ($__________), payable as follows:

- Initial deposit of _____________ Dollars ($___________) upon execution of this Agreement;

- The balance of the purchase price in the amount of ________________________ Dollars ($__________) shall be paid at closing.

- Closing. The closing of the transactions contemplated by this Agreement (the "Closing") shall take place on __________________, 20__, at the offices of ________________________, or at such other place as the parties may mutually agree.

- Representations and Warranties of the Seller. Seller represents and warrants to Buyer that:

- The Seller has full authority to sell the Business pursuant to this Agreement.

- The Business is free of any liens or encumbrances except as specifically set forth in this Agreement.

- No third party has any claim to the assets of the Business except as set forth in this Agreement.

- Representations and Warranties of the Buyer. Buyer represents and warrants to Seller that:

- The Buyer has the full power and authority to enter into this Agreement and to perform its obligations hereunder.

- The execution, delivery, and performance of this Agreement by Buyer does not violate, conflict with, or result in a breach of any agreement, law, regulation, order, judgment, or decree to which Buyer is a party or by which it is bound.

- Confidentiality. Both parties agree to maintain the confidentiality of the terms of this Agreement and the transaction contemplated hereby, except as required by law or with the prior written consent of the other party.

- Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of _______________________, without regard to its conflict of laws principles.

- Entire Agreement. This Agreement constitutes the entire agreement between the parties pertaining to its subject matter and supersedes all prior agreements, understandings, negotiations, and discussions, whether oral or written, of the parties.

- Amendments and Waivers. No amendment, modification, or waiver of any provision of this Agreement shall be effective unless in writing and signed by the party to be charged therewith.

- Notices. All notices, requests, consents, and other communications hereunder shall be in writing, shall be mailed by registered or certified mail, postage prepaid, or otherwise delivered by hand or by messenger, addressed:

- if to the Seller, at: ________________________________________;

- if to the Buyer, at: __________________________________________.

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the date first above written.

SELLER: ___________________________________

BUYER: _____________________________________

PDF Form Attributes

| Fact Number | Description |

|---|---|

| 1 | A Business Purchase and Sale Agreement is a legally binding document between the seller and the buyer, outlining the terms of the business sale. |

| 2 | This agreement includes details like the purchase price, the assets being sold, and any conditions precedent to the closing of the sale. |

| 3 | It often contains non-compete clauses, where the seller agrees not to start a new, competing business within a specified period and region. |

| 4 | Due diligence is a critical stage referenced in the agreement, allowing the buyer to verify the business's financials, legal standing, and operational status. |

| 5 | The agreement may be contingent upon the buyer obtaining financing. |

| 6 | State-specific regulations may govern the agreement, affecting its formation, execution, and enforceability. |

| 7 | Amendments to the agreement must be in writing and signed by both parties, ensuring any changes are legally binding. |

Instructions on How to Fill Out Business Purchase and Sale Agreement

Completing a Business Purchase and Sale Agreement is a significant step in the process of buying or selling a business. This document formalizes the terms of the sale, outlining the responsibilities of both the buyer and the seller. It's important to approach this task with attention to detail to ensure all aspects of the sale are properly recorded and agreed upon. The following steps will guide you through filling out this crucial document.

- Start by clearly identifying both the buyer and the seller. Include legal names, addresses, and contact information for both parties.

- Describe the business being sold. This should include the legal name of the business, its location, and a brief description of its operations and assets.

- Detail the purchase price. Specify the total amount agreed upon for the sale of the business. Include the terms of payment, such as whether it will be paid in installments or a lump sum.

- Outline any adjustments to the purchase price. This could include inventory adjustments, prorated expenses, or other financial adjustments that will be made at closing.

- Specify the closing date. This is the date when the sale will be finalized, and ownership of the business will officially transfer from the seller to the buyer.

- Discuss the representations and warranties of both the buyer and the seller. These are statements that both parties make about the business and the sale, which the other party relies on to be true.

- Include any contingencies. These are conditions that must be met for the sale to proceed, such as the buyer obtaining financing or the seller making certain repairs.

- List the included and excluded assets. Clearly state which assets of the business are included in the sale and which are not.

- Clarify any non-compete agreements. If the seller is agreeing not to open a competing business within a certain area for a specified period, detail these terms.

- Detail the terms of the transfer of leases and contracts. If the business has any ongoing leases or contracts, specify how these will be transferred to the buyer.

- Specify any post-closing agreements. Sometimes, the seller agrees to assist the buyer in operating the business for a certain period after the sale. These terms should be clearly laid out.

- Include signatures from both the buyer and the seller, as well as the date of signing, to validate the agreement.

Upon completing these steps, you'll have a comprehensive agreement that outlines the terms and conditions of the business sale. It's important to review this document carefully with all parties involved to ensure accuracy and mutual understanding before signing. This document will serve as the official record of the sale and guide the transition of ownership, making it a critical component of the business sale process.

Crucial Points on This Form

What is a Business Purchase and Sale Agreement?

A Business Purchase and Sale Agreement is a legally binding document between a seller and buyer detailing the sale and purchase of a business. It outlines the terms of the sale, including the purchase price, assets and liabilities involved, conditions precedent to the sale, and any representations or warranties made by either party.

Why is a Business Purchase and Sale Agreement important?

This agreement is essential because it clearly defines the expectations and obligations of both parties involved in the transaction. It helps prevent misunderstandings or disputes by detailing the agreement's specifics, thus providing legal protection. Furthermore, it ensures a smooth transition of ownership and operations of the business.

What should be included in a Business Purchase and Sale Agreement?

The agreement should include identification of the parties involved, description of the business being sold, purchase price and payment terms, list of assets and liabilities included in the sale, any conditions that must be met before the sale can proceed, representations and warranties of both the buyer and the seller, and the signatures of both parties.

How is the purchase price determined in the agreement?

The purchase price is often determined after both parties negotiate based on the business's current market value, its financial performance, and future earnings potential. Appraisals and financial analyses can also play a role in setting the price. The agreement should specify not only the amount but also the structure of the payment, including any deposits, installments, or earn-outs.

Are representations and warranties important in a Business Purchase and Sale Agreement?

Yes, representations and warranties are crucial as they assure the buyer about the state of the business. They cover various aspects, such as compliance with laws, the condition of assets, financial statements accuracy, and absence of undisclosed liabilities. These clauses help protect the buyer from unforeseen issues and provide a basis for recourse if the seller's statements about the business prove to be false or misleading.

What happens if there are breaches of the agreement?

If a breach occurs, the agreement should outline the recourse available to the non-breaching party. This may include termination of the agreement, a claim for damages, or specific performance requiring the breaching party to fulfill their obligations under the agreement. Mediation or arbitration clauses might also be included to resolve disputes out of court.

Can either party back out of a Business Purchase and Sale Agreement once it is signed?

Generally, once signed, neither party can back out without facing potential legal consequences unless there are provisions within the agreement for termination. Termination clauses may allow either party to withdraw under specific conditions, such as failing to meet pre-agreed conditions or mutual consent. Always review these terms closely before signing the agreement.

Common mistakes

When it comes to the crucial task of filling out a Business Purchase and Sale Agreement form, there are common errors that can significantly impact the process. Being aware of these mistakes is the first step in avoiding them, ensuring a smoother path to finalizing your business transaction.

Not fully identifying the parties involved

One of the most frequent mistakes is the failure to accurately and comprehensively identify all parties involved in the transaction. This means not only listing names but also providing clear contact information and establishing the legal status of each entity, such as whether they are operating as individuals, partnerships, or corporations. The omission of these details can lead to confusion and disputes later on.

Omitting key assets or liabilities

A detailed list of the business's assets and liabilities that are being transferred is essential. Sometimes, people neglect to include all relevant assets, such as intellectual property or physical inventory, or they fail to disclose certain liabilities, which can lead to contentious issues after the sale. It's important for both parties to meticulously review and agree upon what is included in the sale to avoid future disagreements.

Ignoring contingencies

Another common error is overlooking the need for contingencies. These are conditions that must be met for the sale to proceed. Examples include the buyer securing financing or the business passing a professional appraisal. Without these clauses, parties might find themselves legally bound to a sale that isn't in their best interests or financially feasible.

Inaccurate or incomplete representation and warranties

Lastly, inaccuracies or omissions in representations and warranties can be a grave oversight. These statements about the business's condition and legal standing are critical. They assure the buyer about what they are getting into. Neglecting to provide full and accurate disclosures or failing to understand the implications of these warranties can lead to legal disputes if problems are discovered after the sale.

Taking the time to carefully review and accurately complete the Business Purchase and Sale Agreement form is crucial. Each party must ensure that their interests are protected and that the agreement reflects the true intentions and understandings of both sides. Avoiding these common mistakes can save a great deal of time, money, and legal headaches down the road. A thorough approach to this document can help pave the way for a successful and mutually beneficial transaction.

Documents used along the form

When parties come together to buy or sell a business, the Business Purchase and Sale Agreement is a crucial document that outlines the terms of the deal. However, this agreement rarely stands alone. To ensure a smooth and legally sound transaction, several other forms and documents are often utilized in tandem with this agreement. Each of these documents plays a vital role in the transaction, addressing specific aspects of the purchase and sale process, and providing additional legal protections and clarifications for both parties involved.

- Bill of Sale: This document officially transfers ownership of the business’ assets from the seller to the buyer and serves as proof that the transaction has taken place.

- Asset Purchase Agreement: When the transaction involves the acquisition of specific assets rather than the entire business, this agreement lists the assets being purchased and the terms of their sale.

- Non-compete Agreement: To prevent the seller from starting a new, competing business within a certain timeframe and geographic area, a non-compete agreement is often included.

- Confidentiality Agreement: This ensures that sensitive information shared during the sale negotiations is not disclosed to third parties, protecting both the buyer's and seller's interests.

- Consulting Agreement: If the seller agrees to provide consulting services to the buyer after the sale, this agreement outlines the scope of work, duration, and compensation for such services.

- Employment Agreement: New employment agreements may be necessary for key employees who are critical to the business's operation and success post-transaction.

- Lease Agreements: If the business includes leased premises or equipment, transfers or new leases need to be negotiated and documented.

- Due Diligence Documents: Lists and reports generated during the due diligence process provide the buyer with a detailed understanding of the business's financial health and operational structure.

- Closing Statement: At the end of the transaction, this document itemizes the financial aspects of the deal, including the purchase price adjustments, agreed-upon closing costs, and how funds are distributed.

Each document plays a specific role in safeguarding the interests of all parties involved in the transaction. By utilizing these forms and documents alongside the Business Purchase and Sale Agreement, buyers and sellers can address the multitude of legal, financial, and operational considerations inherent in transferring ownership of a business. It is always recommended to seek legal advice to ensure that all necessary paperwork is in order, appropriately detailed, and legally binding.

Similar forms

A Real Estate Purchase Agreement – Just like a Business Purchase and Sale Agreement outlines the terms for buying or selling a business, a Real Estate Purchase Agreement does the same for real estate transactions. Both documents detail the parties involved, the purchase price, and the conditions that must be met before the sale is finalized. They serve to protect both the buyer and seller by clearly stating who is responsible for what and by when certain actions must be taken.

A Bill of Sale – This document is used to transfer ownership of personal property from one party to another. While a Business Purchase and Sale Agreement may encompass the sale of a company's assets or shares, a Bill of Sale is often used for the transfer of individual items. Nevertheless, both documents serve the function of evidencing the transfer of ownership and detailing the specifics of the transaction, such as the parties involved, description of the items being sold, and the agreed-upon price.

A Mergers and Acquisitions Agreement (M&A Agreement) – In the arena of corporate finance, this agreement facilitates the process by which companies consolidate through various types of financial transactions, including mergers, acquisitions, consolidations, tender offers, purchase of assets, and management acquisitions. Similar to the Business Purchase and Sale Agreement, M&A Agreements describe the terms of the deal, representations and warranties of the parties, pre- and post-closing covenants, conditions to closing, and the mechanisms for adjusting the purchase price.

An Asset Purchase Agreement – This specialized agreement is used when only certain assets of a business are being bought or sold, rather than the entire entity. Like the Business Purchase and Sale Agreement, it meticulously outlines the specifics of what is being bought or sold, the price, and the terms of the transaction. It often includes schedules that list the assets and liabilities being transferred, making it clear exactly what the buyer is getting and what the seller is giving up.

A Share Purchase Agreement – Focused on the sale of shares in a company rather than its physical assets or entire operation, this document still shares many similarities with the Business Purchase and Sale Agreement. It specifies the number of shares being sold, the price per share, and any representations and warranties made by the buyer and seller. It's crucial in ensuring that ownership is properly transferred and that both parties are clear on the terms of the sale.

Dos and Don'ts

When approaching the task of filling out a Business Purchase and Sale Agreement form, attention to detail and clarity are paramount. This document, crucial in transferring ownership of a business from one party to another, needs careful handling. Below, find essential dos and don'ts to guide you, ensuring both parties are protected and the agreement is executed correctly.

Do:

- Verify the accuracy of all details included, such as business names, addresses, and legal descriptions of the assets. Errors can lead to misunderstandings or legal issues down the line.

- Ensure that all financial terms, including purchase price, payment schedules, and any contingencies based on due diligence, are thoroughly outlined and agreed upon by both parties.

- Consult with legal and financial advisors before signing. These professionals can provide valuable advice to ensure the agreement meets all legal requirements and protects your interests.

- Clarify the responsibilities of both the buyer and the seller regarding liabilities, outstanding debts, and operational issues until the sale is finalized.

- Detail the exact timeline for the sale process, including any conditions that must be met for the sale to proceed, critical dates, and the expected closing date.

Don't:

- Rush the process without conducting thorough due diligence. Understanding the business's financial health, legal obligations, and any potential liabilities is crucial before finalizing the agreement.

- Ignore the need for appropriate legal and financial consultations. Skipping expert advice can result in oversights that could cost you significantly in the future.

- Leave any verbal agreements out of the written contract. All terms, conditions, and promises made during negotiations should be included in the document to be legally enforceable.

- Forget to specify how disputes will be resolved, should they arise. Including a dispute resolution mechanism within the agreement can save time and money by avoiding litigation.

- Omit any clauses on confidentiality or non-compete agreements, if applicable. Protecting your business interests and sensitive information is essential, especially in competitive industries.

Misconceptions

When considering the acquisition or sale of a business, the Purchase and Sale Agreement (PSA) serves as the cornerstone document outlining the transaction's terms and conditions. Misunderstandings around this agreement are common and can lead to significant challenges. Below are four common misconceptions about the Business Purchase and Sale Agreement form:

- One Size Fits All: Many believe a Business Purchase and Sale Agreement is a standard document that can be used universally. However, this notion does not consider the unique nature of each transaction. The agreement should be tailored to address the specific terms of the deal, including but not limited to, the assets being bought or sold, the purchase price, and any contingent liabilities. The specific needs of both the buyer and seller must be addressed to ensure a fair and legally binding agreement.

- Legalese is Necessary for Validity: A common misconception is that the agreement must be filled with legal jargon to be considered valid and enforceable. While it's critical that the agreement is legally sound, clarity and comprehensibility should never be sacrificed for complexity. Agreements that are clearly written and easily understood by all parties are less likely to result in disputes. Moreover, clarity in documentation can help expedite the negotiation process.

- Verbal Agreements Hold Equal Weight: Another misunderstanding is the belief that verbal agreements made during negotiations carry the same weight as the written agreement. In reality, the written contract holds the ultimate authority. Most jurisdictions require that agreements for the sale of business assets be in writing to be enforceable. It is vital that all negotiations and understandings are accurately reflected in the final written document.

- No Need for Due Diligence: Sometimes, parties might think that once the PSA is drafted, due diligence is a mere formality. This could not be further from the truth. Conducting a thorough due diligence process is essential to verify the accuracy of the information upon which the agreement is based. It uncovers any liabilities or risks that could impact the terms of the agreement or the decision to proceed with the transaction. Skipping this step can lead to significant legal and financial repercussions.

Understanding these misconceptions can significantly smooth the process of drafting and negotiating a Business Purchase and Sale Agreement. It emphasizes the need for comprehensive and customized documents, clear communication, thorough due diligence, and professional guidance. Such understanding not only facilitates a smoother transaction but also helps in building a solid foundation for the future success of the business involved.

Key takeaways

When dealing with a Business Purchase and Sale Agreement form, it's important to approach the task with care and attention. This document is a critical component in the process of buying or selling a business, and its proper completion is essential for a smooth transaction. Here are nine key takeaways to consider:

- Both the buyer and the seller should provide complete and accurate information about their identities, including legal names and addresses, to ensure the agreement is legally binding.

- Details about the business being sold, including its legal name, type of business, and physical address, must be clearly described to avoid any misunderstandings.

- The sale price and the terms of payment need to be explicitly outlined in the agreement to protect both parties and to ensure clarity on the financial arrangements.

- It's important to list all assets and liabilities associated with the business. This includes tangible assets like equipment and inventory, as well as intangible assets like trademarks and customer lists.

- Any contingent liabilities, such as pending lawsuits or outstanding debts, should also be disclosed in the agreement to inform the buyer and protect the seller from future claims.

- Conditions of the sale, such as obtaining necessary permits or licenses and the requirement for the seller to assist in the business transition, need to be specified to ensure a seamless changeover.

- Covenants not to compete, which prevent the seller from starting a competing business within a certain geographical area and time frame, should be discussed and agreed upon.

- The agreement should detail the closing date, location, and the documents or actions required by both parties to officially complete the sale.

- Both parties should thoroughly review the agreement before signing and consider seeking legal advice to ensure their rights and interests are protected.

Understanding and properly completing the Business Purchase and Sale Agreement form is vital for a legally sound and successful business transaction. These takeaways are intended to assist in navigating the complexities of the agreement and to help all parties involved reach a fair and transparent deal.

Other Forms

Small Business Bill of Sale Pdf - It’s an indispensable tool for record-keeping, allowing businesses to maintain an accurate archive of their asset sales and purchases.

California Motorcycle Bill of Sale - The inclusion of signatures from both parties officially finalizes the transaction, making it legally binding.