Legal Deed Form

When embarking on property transactions, individuals are often met with a variety of documents, each serving its unique purpose in the complex process of transferring property ownership. One such document, the Deed form, plays a pivotal role by officially recording and effectuating the change in ownership of real estate from one party to another. This form, marked by its comprehensive nature, encompasses crucial information including the specifics of the property being transferred, the identities of the previous and new owners, and any conditions or warranties associated with the transfer. It acts not just as a transactional instrument but as a legal testament to the shift in ownership, safeguarding the rights of all parties involved. Understanding its components, significance, and the legal implications tied to its execution can provide individuals with the clarity needed to navigate property transactions more smoothly. By examining the major aspects of the Deed form, one can appreciate its role in ensuring that property transfers are conducted with precision, legality, and mutual respect for the parties’ interests.

State-specific Deed Forms

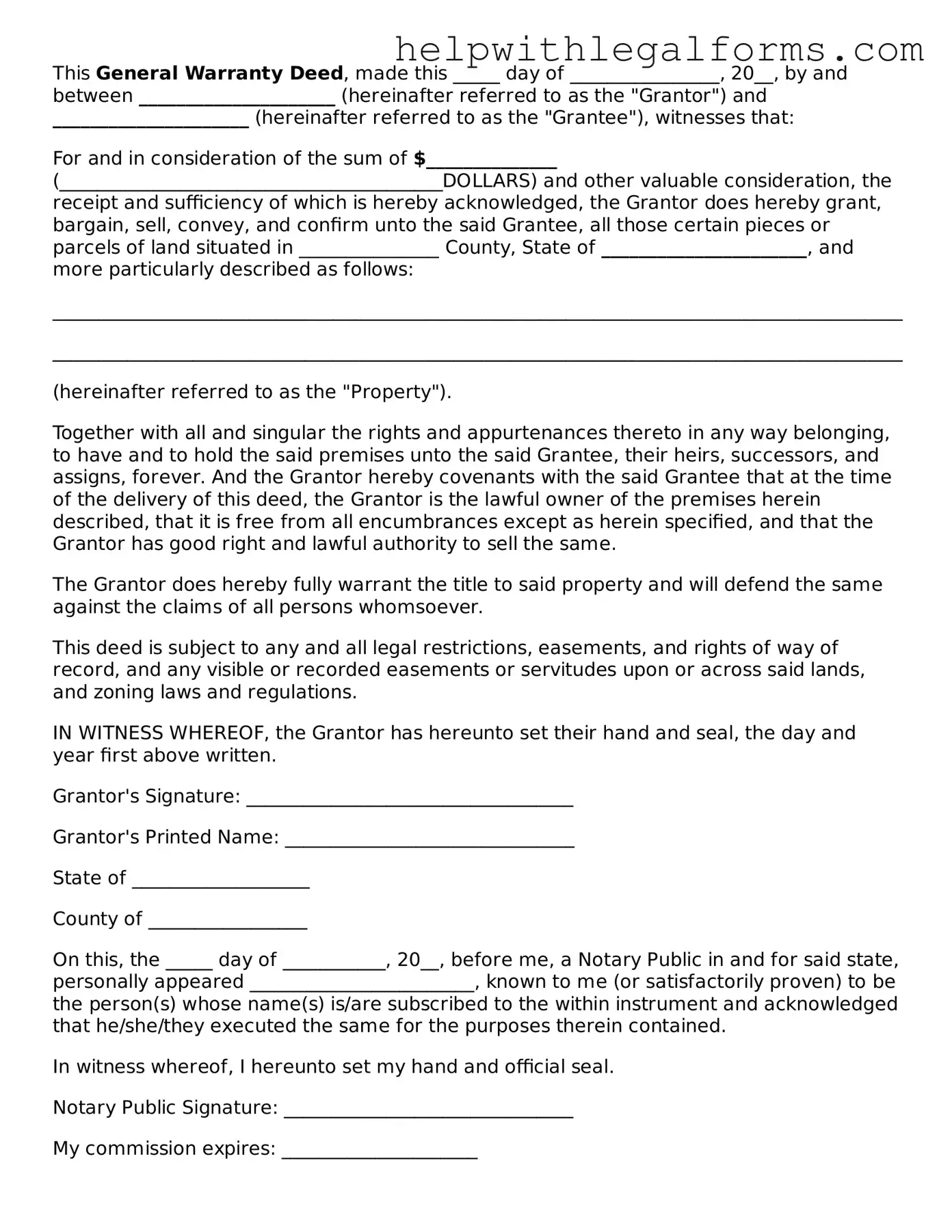

Example - Deed Form

This General Warranty Deed, made this _____ day of ________________, 20__, by and between _____________________ (hereinafter referred to as the "Grantor") and _____________________ (hereinafter referred to as the "Grantee"), witnesses that:

For and in consideration of the sum of $______________ (_________________________________________DOLLARS) and other valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Grantor does hereby grant, bargain, sell, convey, and confirm unto the said Grantee, all those certain pieces or parcels of land situated in _______________ County, State of ______________________, and more particularly described as follows:

___________________________________________________________________________________________

___________________________________________________________________________________________

(hereinafter referred to as the "Property").

Together with all and singular the rights and appurtenances thereto in any way belonging, to have and to hold the said premises unto the said Grantee, their heirs, successors, and assigns, forever. And the Grantor hereby covenants with the said Grantee that at the time of the delivery of this deed, the Grantor is the lawful owner of the premises herein described, that it is free from all encumbrances except as herein specified, and that the Grantor has good right and lawful authority to sell the same.

The Grantor does hereby fully warrant the title to said property and will defend the same against the claims of all persons whomsoever.

This deed is subject to any and all legal restrictions, easements, and rights of way of record, and any visible or recorded easements or servitudes upon or across said lands, and zoning laws and regulations.

IN WITNESS WHEREOF, the Grantor has hereunto set their hand and seal, the day and year first above written.

Grantor's Signature: ___________________________________

Grantor's Printed Name: _______________________________

State of ___________________

County of _________________

On this, the _____ day of ___________, 20__, before me, a Notary Public in and for said state, personally appeared ________________________, known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged that he/she/they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

Notary Public Signature: _______________________________

My commission expires: _____________________

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Definition | A deed is a legal document that signifies the transfer of property ownership from one party to another. |

| Types | Common types of deeds include warranty deeds, grant deeds, and quitclaim deeds, each offering different levels of protection for the buyer. |

| Essential Elements | To be considered valid, a deed must include a legal description of the property, the signature of the party transferring the property, and must be delivered to and accepted by the recipient. |

| State-Specific Forms | Deed forms often vary by state due to differing regulations and legal requirements, such as wording, format, and necessary endorsements. |

| Governing Laws | Deeds are governed by state laws where the property is located, and these laws dictate the requirements for a valid transfer of property ownership. |

| Recording | After the transfer, deeds are typically recorded with the county recorder’s office or a similar local government entity to provide public notice of the change in ownership. |

Instructions on How to Fill Out Deed

Filling out a Deed form is a necessary step in legally transferring ownership of real property from one party to another. While this task may seem daunting at first, understanding the process can simplify it greatly. It's crucial to complete the form accurately to ensure the transfer is legally binding and recognized. Here's a step-by-step guide to help you navigate through the process.

- Begin by identifying the type of Deed required for your transaction (e.g., Warranty Deed, Quitclaim Deed) as this will dictate the specific information needed.

- Gather the necessary information about the property, including its legal description (not just the address), parcel number, and any other details that uniquely identify the property.

- Obtain the names and identifying information of the current owner(s) (the grantor(s)) and the new owner(s) (the grantee(s)). This includes full legal names, marital status (if relevant), and addresses.

- Determine the consideration, which is the value exchanged for the property. This can be an amount of money, other property, or a promise to perform a service.

- Accurately fill out the grantor's and grantee's information in the designated sections of the Deed form.

- Input the legal description of the property in the section provided. Make sure this matches exactly with the legal description used in the public records.

- Include the consideration within the appropriate section to reflect the value being exchanged for the property.

- Review the completed form to ensure all information is correct and complete. Amendments may be harder to process once the Deed is recorded.

- Sign the Deed in the presence of a notary public. Depending on your state's laws, witnesses may also be required to sign.

- Record the Deed with the county recorder's office where the property is located. There may be a recording fee, which varies by county.

Once the Deed is filed with the county recorder's office, the process of transferring ownership is complete. It's important to keep a copy of the recorded Deed for personal records. This document serves as proof of ownership and may be required for future legal transactions involving the property.

Crucial Points on This Form

What is a Deed form and when is it used?

A Deed form is a legal document that represents the transfer of ownership of real property from one person or entity (the grantor) to another (the grantee). It is used when the ownership of a piece of real estate, which includes buildings and land, changes hands. The completion and recording of a Deed form are essential steps in the process of buying, selling, or otherwise transferring property rights.

What are the different types of Deeds, and how do they differ?

There are several types of Deeds, each serving different purposes and offering varying levels of protection to the grantor and grantee. The most common include:

- Warranty Deed - Provides the highest level of protection to the buyer, guaranteeing that the grantor holds clear title to the property and has the right to sell it.

- Quitclaim Deed - Offers no warranties or guarantees about the title of the property. It is often used between family members or to clear up title issues.

- Special Warranty Deed - Offers a moderate level of protection, guaranteeing the property is free from defects in title during the time the grantor owned it, but not before.

What information is typically required on a Deed form?

A Deed form usually needs to be detailed and precise, containing specific information to be legally effective, including:

- The names and addresses of the grantor and grantee.

- A clear legal description of the property being transferred.

- The type of Deed.

- Any conditions or warranties associated with the transfer.

- The signature of the grantor, and in some cases, the grantee.

- Acknowledgment by a notary public.

How does one obtain a Deed form?

Deed forms can be obtained through several means. They are available online through legal services websites, at local county clerk or recorder's offices, and often through a real estate attorney. It’s imperative to use the correct form that complies with state and local regulations to ensure the legality of the property transfer.

What happens after a Deed form is filled out?

After a Deed form is filled out, it needs to be signed and notarized according to state laws. Then, it must be filed or recorded with the appropriate county office, such as the county clerk or deeds recorder. This recording makes the document part of the public record, officially documenting the change in ownership and protecting the grantee's rights.

Common mistakes

When individuals set out to transfer property ownership through a Deed, accuracy and completeness are paramount. However, mistakes can be common, leading to delays or more significant legal challenges down the line. Here are six common errors that people often encounter when filling out the Deed form:

Not verifying the correct property description - This includes the legal description of the property, not just the address. A mistake here can result in transferring the wrong property.

Incorrectly identifying the parties - Each party must be identified clearly and correctly, including their legal names. This ensures that the right individuals are involved in the transaction.

Forgetting to have the document notarized - Most jurisdictions require that a Deed be notarized to be considered valid. Overlooking this step can invalidate the entire process.

Omitting necessary attachments - Sometimes, additional documentation is required to accompany the Deed. Failure to attach these documents can lead to processing delays.

Using incorrect or outdated forms - Laws and requirements can change. Utilizing an outdated form can mean missing new requirements or including irrelevant information.

Failure to record the Deed with the appropriate government office - After execution, the Deed needs to be officially recorded to attest the transfer of ownership. Not doing so can create legal uncertainties regarding property rights.

These errors can be avoided by carefully reviewing all the information on the Deed form, ensuring that every required field is correctly filled out, and verifying local laws and requirements. When in doubt, consulting with a professional can provide guidance and peace of mind.

Documents used along the form

When transferring property, a Deed form is crucial, but it's just one of several documents that play pivotal roles in the process. Each document serves a distinct function, ensuring the transaction adheres to legal standards and provides clarity and protection for all parties involved. Below is a list of documents commonly accompanied with a Deed form, each with its own significance in the property conveyance process.

- Title Search Report: This document provides a history of the property, including previous ownership, liens, and any encumbrances that might affect the current transaction.

- Property Tax Receipts: Recent tax receipts are required to prove that all municipal dues are cleared up to the date of the transfer.

- Mortgage Pre-Approval Letter (if buying with a mortgage): This document from a lender states the amount the buyer is approved to borrow, indicating the buyer's financial readiness to complete the purchase.

- Home Inspection Report: Before finalizing a property purchase, a detailed report on the condition of the property, highlighting any problems or potential repairs, is vital.

- Pest Inspection Report: Especially important in certain regions, this report details any past or present infestations and potential damage to the property.

- Home Insurance Binder: This document confirms that the property will be insured, a requirement by lenders before financing the purchase.

- Survey Report: A professional survey of the property defines its boundaries and dimensions, ensuring the buyer knows exactly what they're purchasing.

- Closing Statement: Prepared by the closing agent, this document itemizes all the financial transactions occurring in the deal, including costs incurred by both buyer and seller.

- Certificate of Occupancy: For newly constructed properties, this document certifies that the building complies with all building codes and is safe to occupy.

Each of these documents contributes to a seamless property transaction, offering protection and peace of mind. Understanding their importance alongside the Deed form underscores the complexity of property transfers and the value of meticulously preparing every document involved. It’s a process that underscores the significance of detail and legality in the realm of property ownership.

Similar forms

Mortgage Agreement: Just like a deed, a mortgage agreement is a legal document that signifies an agreement related to property. While a deed transfers property ownership, a mortgage agreement secures the property as collateral for a loan.

Bill of Sale: Similar to a deed in function, a bill of sale represents the transfer of ownership. However, it's typically used for personal property, such as vehicles or equipment, instead of real estate.

Lease Agreement: Although a lease agreement does not transfer ownership like a deed, it grants someone the right to use property under specific conditions, which mirrors the legal formality and significance of a deed in real estate transactions.

Title Insurance Policy: This document is linked closely to deeds since it provides a guarantee about the legal status of the ownership that the deed transfers. It ensures that the property title is free of undisclosed liens or disputes.

Quitclaim Deed: This is a specific type of deed that operates under a similar premise but does not make any guarantees about the grantor's ownership status. It transfers whatever interest the grantor may have in the property, making it closely related to the general concept of a deed.

Warranty Deed: Another variant of a deed, a warranty deed, explicitly guarantees that the grantor holds a clear title to the property and has the right to sell it. This similarity in function places it in the same category as a general deed form.

Dos and Don'ts

When filling out a Deed form, accuracy and attention to detail are crucial. The following lists outline the key do's and don'ts to help ensure the process is completed correctly and effectively.

Do's:

- Double-check property description accuracy to ensure it matches the description on the official records exactly.

- Verify all parties' names are spelled correctly and match their identification documents.

- Ensure the form is signed in the presence of a notary to confirm its authenticity.

- Keep a copy of the completed deed for personal records before filing it with the appropriate county office.

Don'ts:

- Do not leave any blanks; unanswered questions may lead to processing delays or legal complications.

- Avoid using correction fluid or making erasures; mistakes should be addressed by completing a new form to maintain legibility and formality.

- Don't forget to check state-specific requirements, as some jurisdictions may have unique stipulations for deed processing.

- Refrain from assuming that a deed doesn't need to be filed; filing the deed with the local county office is typically necessary to make the document legally binding and effective.

Misconceptions

When it comes to transferring property ownership, deeds are essential documents. However, there are several misconceptions about the deed form that often lead to confusion. Here are six common misunderstandings:

All Deeds are the Same: Many people believe that all deed forms serve the same purpose and provide the same level of protection. This is incorrect. There are several types of deeds, including warranty deeds, quitclaim deeds, and special warranty deeds, each offering different levels of assurances and rights transferred from the seller to the buyer.

A Deed Guarantees Clear Title: Some assume that holding a deed to a property automatically means the title is clear of liens or claims. In reality, the type of deed determines the extent of warranty against title defects. For instance, a warranty deed often guarantees that the grantor holds a clear title, while a quitclaim deed transfers only whatever interest the grantor has at the time, which may not be a clear title.

Deeds and Titles are the Same: Another misconception is that deed and title refer to the same document. The title is a concept that denotes the legal basis that gives someone ownership of property, while a deed is a physical document that transfers ownership of the property from one person to another.

Filling Out a Deed Form is Enough for Transfer: Simply completing a deed form does not legally transfer the property. The deed must be delivered to and accepted by the grantee. Additionally, most states require the deed to be officially recorded with a local government office to make the transfer public record and protect the new owner's interests.

Any Errors in a Deed Can Easily be Corrected: While some mistakes can be resolved with a corrective deed, ensuring accuracy when drafting and executing the original deed is crucial. Errors can lead to disputes over property boundaries, title, and ownership, which may result in litigation.

A Deed Must be Notarized or Witnessed to Be Valid: The requirements for a deed to be considered legally valid can vary significantly by jurisdiction. Most states do require that a deed be witnessed or notarized to be valid, but the specifics can differ. Some states might require only a witness, others necessitate notarization, and some demand both. Understanding the requirements in the relevant jurisdiction is essential.

Key takeaways

When dealing with the task of filling out and using a Deed form, there are several key considerations to bear in mind. These can help ensure the process goes smoothly and that the legal transfer of property is executed correctly. Below are vital takeaways to guide individuals through this process:

- Understand the Type of Deed: It’s crucial to determine the type of deed required for the transaction, such as a warranty deed, which provides the grantee with the highest level of protection, or a quitclaim deed, which transfers only the interest the grantor has in the property without any warranties.

- Correctly Identify the Parties: All parties involved must be correctly identified using their full legal names to avoid any future disputes or legal complications regarding the property’s ownership.

- Legal Description of the Property: The deed must include a complete and accurate legal description of the property being transferred. This is not the same as the property’s street address; it includes boundaries, lot numbers, and other details that legally identify the property.

- Signature Requirements: The deed must be signed by the grantor(s) in the presence of a notary public. Some states also require witnesses to sign the deed. Check your state’s requirements to ensure compliance.

- Consideration: The deed should state the consideration, or the value exchanged for the property, even if it’s a nominal amount or a gift. This aspect may have tax implications for the parties involved.

- Recording the Deed: After it is signed and notarized, the deed must be filed with the county recorder’s office or land registry office. Recording the deed makes it part of the public record and notifies all interested parties of the ownership change.

- Seek Legal Advice: Considering the complexities and legal implications of transferring property, consulting with a legal professional before finalizing a deed can prevent future problems. An attorney can ensure that the deed complies with state and local laws and that the interests of all parties are protected.

Properly addressing these considerations can safeguard the interests of all parties involved and ensure the legal transfer of property is conducted accurately and efficiently.

Other Forms

How to File for Eviction - For month-to-month leases, this form is a formal way to end the rental agreement without stating a cause, as long as proper notice is given.

Minutes of the Meeting - The inclusion of a section for reflections or feedback at the end of the meeting enriches the process of continuous improvement.