Blank Deed Form for California

In the realm of real estate, the transfer of property rights from one party to another is a critical process that requires utmost precision and adherence to legal standards to ensure that the transaction is binding and recognized by law. One essential instrument in this process, particularly within the state of California, is the California Deed form. This form, acting as a legal document, meticulously outlines the terms and conditions under which the property's ownership is transferred. The significance of this form cannot be overstated, as it encompasses a variety of types, each tailored to fit different transactional situations and requirements. From guaranteeing clear title to the property, to imposing certain limitations on the use of the property, the California Deed form serves as the backbone for the legality and legitimacy of property transfers. Not only does it facilitate a smooth transition of ownership rights, but it also plays a pivotal role in the documentation and recordation process, thereby providing a reliable reference for future transactions. The intricacies involved in selecting the right type of deed, understanding the obligations it enforces, and ensuring its proper execution make it imperative for parties involved in a real estate transaction in California to familiarize themselves with this form. Failure to accurately complete and file this document can lead to significant legal challenges, emphasizing the need for due diligence in every step of the property transfer process.

Example - California Deed Form

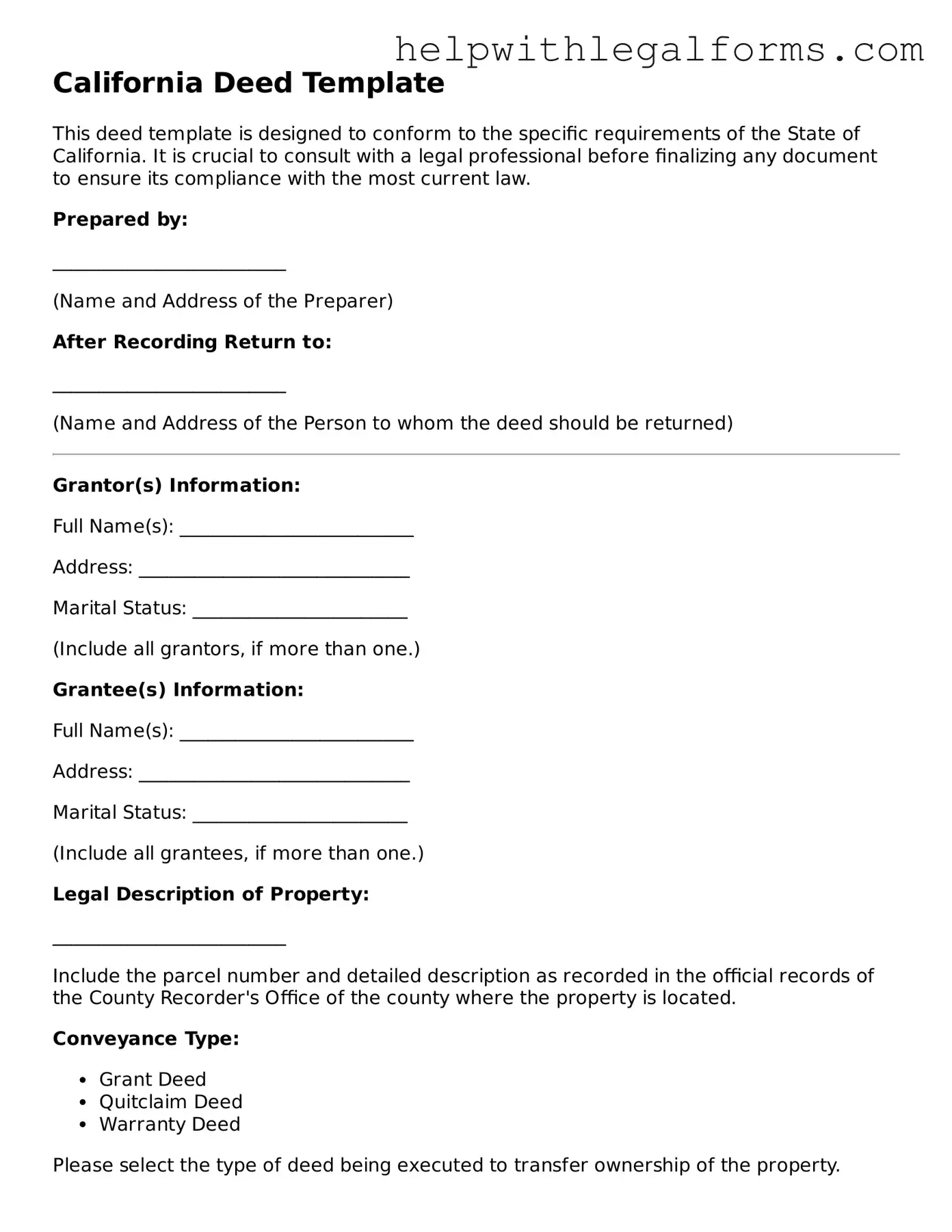

California Deed Template

This deed template is designed to conform to the specific requirements of the State of California. It is crucial to consult with a legal professional before finalizing any document to ensure its compliance with the most current law.

Prepared by:

_________________________

(Name and Address of the Preparer)

After Recording Return to:

_________________________

(Name and Address of the Person to whom the deed should be returned)

Grantor(s) Information:

Full Name(s): _________________________

Address: _____________________________

Marital Status: _______________________

(Include all grantors, if more than one.)

Grantee(s) Information:

Full Name(s): _________________________

Address: _____________________________

Marital Status: _______________________

(Include all grantees, if more than one.)

Legal Description of Property:

_________________________

Include the parcel number and detailed description as recorded in the official records of the County Recorder's Office of the county where the property is located.

Conveyance Type:

- Grant Deed

- Quitclaim Deed

- Warranty Deed

Please select the type of deed being executed to transfer ownership of the property.

Consideration:

The total amount of money being exchanged for the property is: $__________.

This amount represents the fair market value of the property or the actual consideration agreed upon by both parties.

Assessor's Parcel Number (APN):

_________________________

This number is critical for the identification of the property in state records and must be included in the deed.

Execution Date:

_________________________

This is the date on which the grantor(s) sign the deed, effectively transferring ownership.

Signatures:

The deed must be signed by all parties involved, in the presence of a notary public. The notary will acknowledge the deed with an official seal and signature, which is essential for the document to be legally binding and recorded properly.

Please ensure that the deed complies with all relevant sections of the California Civil Code and any additional requirements specific to the county in which the property is located.

State of California

County of ________________

On this day, _______________ (date), before me, ______________________ (name of notary), a Notary Public in and for said state, personally appeared _______________________, known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged that he/she/they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

_________________________ (Notary Signature)

Notary Public for the State of California

My Commission Expires: _______________

PDF Form Attributes

| Fact Number | Fact Detail |

|---|---|

| 1 | California Deed forms are used to transfer property ownership from one party to another. |

| 2 | The Grant Deed and Quitclaim Deed are two common types of deeds used in California. |

| 3 | To be legally valid, a California Deed must include a legal description of the property, the grantor's signature, and the grantee’s name. |

| 4 | The deed must be recorded with the county recorder’s office in the county where the property is located to be effective against third parties. |

| 5 | California Civil Code sections 1091 to 1093 govern the requirements and formalities of deeds in California. |

| 6 | The transfer of real property is subject to documentary transfer tax unless exempt under California law. |

| 7 | For a deed to be recorded, it must be accompanied by a Preliminary Change of Ownership Report (PCOR), as required by the California Revenue and Taxation Code. |

Instructions on How to Fill Out California Deed

Filling out a California Deed form is an important step in legally transferring ownership of property from one person to another. This document, once properly completed and recorded, makes the change in ownership official. Whether you're transferring property to a family member or selling your home, following these steps closely will ensure a smooth process. The next steps involve gathering necessary information, completing the form, and then proceeding with the recording process.

- Start by locating the most current version of the California Deed form. This can usually be found on the website of the county recorder's office where the property is located.

- Gather all necessary information about the property, including the legal description, parcel number, and current ownership details. This information can often be found on a recent property tax statement or by contacting the county recorder's office.

- Identify the type of deed transfer that is taking place. Common types include a warranty deed, which guarantees the property is free from claims, or a quitclaim deed, which transfers ownership without any guarantees.

- Complete the form by entering the preparer's information, typically the person filling out the form. Include full names and addresses of both the grantor (current owner) and the grantee (new owner).

- Enter the legal description of the property as specified in official records. This is crucial for the accuracy of the document.

- Have the grantor sign the deed in the presence of a notary public. The notary will verify the identity of the signer and affix their seal to the document, making it legally binding.

- Double-check the completed deed for accuracy and completeness. Errors or omissions can cause delays or challenges in the transfer process.

- Submit the completed and notarized deed to the county recorder's office for recording. There may be a fee associated with recording the deed, so it's advisable to check this in advance.

- Keep a copy of the recorded deed for personal records. The county recorder will typically return the original document after it has been recorded.

By carefully following these steps, you can successfully fill out and record a California Deed form, effectively transferring ownership of property. Remember, while the process may seem straightforward, attention to detail is key in ensuring that the transfer is legally valid and recognized. If you have questions or concerns, consulting with a professional familiar with real estate transactions in California can provide additional guidance.

Crucial Points on This Form

What is a California Deed form?

A California Deed form is a legal document used to transfer ownership of real property from one person or entity to another in the state of California. This form details the specifics of the transaction, including the identities of the buyer and seller, the legal description of the property, and any terms or conditions of the transfer. There are several types of deeds used in California, each serving different circumstances and providing different levels of protection to the buyer.

Who needs to use a California Deed form?

Anyone involved in the buying or selling of real property in California needs to use a California Deed form. This includes individual sellers and buyers, corporations, trusts, and other legal entities. Real estate transactions require the execution of this form to legally document the change in ownership and to protect the rights of both parties.

What are the different types of deeds in California, and when are they used?

California acknowledges several types of deeds, including:

- Grant Deeds: Used in most real estate sales to transfer property with a guarantee that the seller has not sold the property to anyone else.

- Warranty Deeds: Similar to grant deeds, but with broader guarantees including protection against any existing encumbrances not disclosed in the deed.

- Quitclaim Deeds: Transfer any interest the seller has in the property without any guarantees about the title's condition. Often used between family members or to clear up title issues.

Is a lawyer required to fill out a California Deed form?

While a lawyer is not required to fill out a California Deed form, consulting an attorney is highly recommended. Real estate transactions involve significant legal and financial implications, and a lawyer can ensure that the deed complies with California law and effectively protects your interests.

What information is needed to complete a California Deed form?

To complete a California Deed form, you'll need:

- The legal names and addresses of the seller (grantor) and the buyer (grantee).

- A legal description of the property being transferred.

- The type of deed being executed.

- The sale price of the property (if applicable).

- Signatures from all parties involved, notarized if required by law.

How do you file a California Deed form?

Once signed, a California Deed form must be filed with the County Recorder's Office in the county where the property is located. This process, known as recording, is essential for the deed to be considered valid and for the transfer of ownership to be legally recognized. There may be recording fees and other requirements specific to the county, so checking with the local Recorder's Office is advisable.

What are the consequences of not using a California Deed form in a real estate transaction?

Not using a California Deed form in a real estate transaction can result in a failure to legally transfer ownership of the property. This oversight can lead to disputes over property ownership, issues with property titles, and complications in future transactions involving the property. Utilizing the correct form and ensuring proper filing is crucial to securing legal ownership.

Can a California Deed form be used to transfer property to a trust or a business entity?

Yes, a California Deed form can be used to transfer property to a trust, a business entity, or any legal entity capable of owning property in California. The process and requirements for the transfer may vary depending on the nature of the entity receiving the property. Legal advice is beneficial in these scenarios to ensure the transfer aligns with California law and the specific goals of the transaction.

What happens if there is a mistake on a California Deed form after it has been filed?

If a mistake is discovered on a California Deed form after it has been filed, it may be necessary to correct the deed. This usually involves preparing and filing a new deed with the correct information. Depending on the nature of the mistake, a simple correction deed or a more formal process may be required. Legal guidance is recommended to address mistakes effectively and to ensure that the property's title is clear and accurate.

Common mistakes

When filling out the California Deed form, individuals often encounter complexities. This document is crucial for the transfer of property ownership and requires precision. However, common errors can lead to delays or legal complications. Below are five mistakes frequently made on this form:

-

Incorrect or Incomplete Names: One of the most common errors is not listing the full legal names of all parties involved in the transfer. This includes middle names or initials if they are part of the legal name. An incorrect or incomplete name can invalidate the deed or create issues in the property records.

-

Not Specifying the Transfer Type: The California Deed form requires specifying the type of deed being executed, such as a Grant Deed or a Quitclaim Deed. Failure to accurately indicate the deed type can lead to unintended legal consequences regarding warranties of title and ownership rights.

-

Omitting Legal Description of the Property: A precise legal description of the property being transferred is crucial. This is more detailed than the property’s address and includes boundaries and measurements. Omitting this information or inaccurately recording it can result in disputes or challenges to the property transfer.

-

Failure to Acknowledge or Notarize: In California, deeds must be acknowledged before a notary public to be valid. This process verifies the identity of the signatories and their understanding of the document’s contents. Forgetting to have the deed notarized is a significant error, rendering the document not legally binding.

-

Mishandling Tax Declarations: Depending on the circumstances of the property transfer, tax implications may vary. California requires certain declarations regarding the transfer tax to be completed on the deed. Misunderstanding or incorrectly completing these sections can lead to legal repercussions and financial liabilities.

Attention to detail and understanding the requirements for property transfers in California can prevent these errors. Consulting with a legal professional is advisable to ensure the deed is executed correctly and to protect the interests of all parties involved.

Documents used along the form

In the process of transferring property in California, a Deed form is crucial, but it's often just one piece of a larger puzzle. Various other forms and documents accompany or follow the Deed form to ensure the transaction complies with legal requirements, provides clear information about the parties involved, and secures the rights of the new property owner. Below is an overview of some of these essential forms and documents, highlighting their significance in the property transfer process.

- Preliminary Change of Ownership Report (PCOR): This document is required by the county assessor’s office and must be filed alongside the Deed. It provides detailed information about the nature of the property transfer, the parties involved, and any exemptions claimed that could affect property tax reassessment.

- Transfer Tax Declarations: Most counties require this form to calculate and pay the transfer tax that is due upon the changing of property ownership. The amount of tax depends on the property’s sale price and each county's specific rate.

- Notice of Completion: Following any construction or significant improvement prior to the sale, this document can be recorded to signal the completion of the work. It affects the rights of mechanics to file liens against the property, starting the clock on their deadlines to file.

- Property Tax Assessment Appeal Form: If the new owner believes the assessed value of their property is incorrect, this form allows them to appeal the assessment with the county. It is a critical tool for adjusting property taxes to a fair value.

- Title Insurance Policy: While not a form filed with any government body, acquiring a title insurance policy is a standard part of property transactions. It protects the buyer and lender from future claims against the property's title that weren't discovered during the initial title search.

To navigate the complex landscape of property transfer successfully, understanding and properly handling these documents in conjunction with the California Deed form is imperative. Each document serves a specific purpose, contributing to the legal and financial integrity of the transaction. By ensuring these forms are accurately completed and filed in a timely manner, parties can minimize potential legal hurdles and pave the way for a smoother property transfer process.

Similar forms

Mortgage Agreements: Both deed forms and mortgage agreements serve as pivotal documents in real estate transactions. A deed legally transfers ownership of property from one party to another, while a mortgage agreement specifies the terms under which a lender loaned money to purchase that property. Both documents are formally recorded to establish legal ownership and financial obligations.

Bill of Sale: Similar to deed forms, bills of sale are used to transfer ownership, but they typically involve personal property like cars or boats rather than real estate. Both documents detail the parties involved, a description of the item being transferred, and any warranties or conditions attached to the sale.

Lease Agreements: Lease agreements, much like deeds, play a crucial role in property transactions. However, instead of transferring ownership, a lease agreement grants use or occupancy of property under specific conditions for a predetermined period. Both documents are legally binding and detail the terms agreed upon by the parties involved.

Title Documents: Title documents and deed forms are closely linked in the real estate world. The title document is evidence of the right to ownership of the property, while the deed is the legal instrument that conveys that ownership from one party to another. Both documents are essential for validating and protecting property ownership.

Easements: An easement, much like a deed, is a legal document that grants someone the right to use another's property for a specific purpose, such as access to public utilities. While deeds transfer ownership of property, easements allow for the use of property without transferring ownership, highlighting their function in establishing rights and limitations over property.

Wills: Wills and deed forms both serve as essential legal instruments in addressing the distribution of assets. A will specifies how a person's assets will be divided upon their death, potentially including the transfer of property through instructions that can lead to the execution of a new deed. This similarity underscores their importance in estate planning and property transfer.

Power of Attorney: A Power of Attorney (POA) document and a deed share the fundamental characteristic of authorizing actions on someone else's behalf. A POA grants someone the legal authority to make decisions and act in various capacities for another person, which can include buying, selling, or managing property, requiring a deed form to finalize such transactions.

Dos and Don'ts

When transferring property in California, correctly filling out the deed form is crucial. This document, which legally transfers property from one person to another, must be completed with precision and care. Below are ten guidelines to help ensure that the process is done accurately and effectively.

What to do:

- Use black ink and write legibly to ensure the document can be read clearly and scanned properly.

- Refer to the current deed of the property to obtain the correct legal description.

- Make sure all parties involved sign the deed in the presence of a notary public to validate its authenticity.

- Double-check the spelling of all names and the accuracy of all other information on the form to prevent any future disputes or legal issues.

- Keep a copy of the signed deed for your records before filing it with the county recorder’s office.

What not to do:

- Don’t leave any fields blank on the form. If a section does not apply, write ‘N/A’ (not applicable) to indicate so.

- Don’t use correction fluid or tape; mistakes should be corrected by filling out a new form to avoid any suspicion of tampering.

- Don’t guess on legal descriptions or other crucial details; consult a legal professional or the county recorder’s office if unsure.

- Don’t forget to check whether the county requires additional forms or fees to be submitted along with the deed.

- Don’t overlook the need to report the transfer to the IRS if it falls under scenarios that require reporting.

By following these dos and don'ts, individuals can navigate the process of filling out a California Deed form more smoothly, ensuring the legal transfer of property is executed correctly and without unnecessary complications.

Misconceptions

When it comes to transferring property in California, a deed form is a critical document. However, there are several misconceptions surrounding its use and requirements. Here, we clarify some of the most common misunderstandings.

- All deeds are the same. Many people think one deed form applies universally across all situations in California. However, there are several types of deeds—such as grant deeds, quitclaim deeds, and warranty deeds—each serving different purposes and providing varying levels of protection for the buyer and seller.

- A deed and a title are the same thing. This is a common mix-up. The title is a concept that represents legal ownership, whereas a deed is the physical document that transfers this ownership from one person to another. Simply put, the deed changes who holds the title.

- You don't need a lawyer to prepare a deed. Technically, in California, you can prepare your own deed. However, mistakes in drafting or filing the deed can lead to significant legal issues down the road. Consulting with a legal professional is advised to ensure that the deed accurately reflects the agreement between the parties and complies with California law.

- Filing a deed is all you need to do to complete the transfer of property. While filing the deed with the county recorder's office is a crucial step, it's not the only requirement. Transferring property often involves other steps, such as paying transfer taxes and ensuring the property is free of encumbrances or liens that could affect the transfer.

Key takeaways

In California, transferring property can be efficiently executed with the right knowledge of how to fill out and use the deed form. Understanding the key takeaways can streamline the process, ensuring clarity and legality in property transactions.

- Understand the Different Types of Deeds: California offers various deed forms, including the General Warranty Deed, the Grant Deed, and the Quitclaim Deed. Each serves a different purpose, ranging from offering full warranty of title to transferring no title at all. Selecting the correct type of deed is crucial for the intentions of the transfer.

- Complete Details Accurately: Accuracy in filling out the form cannot be overstressed. This includes the full names of the grantor (seller) and grantee (buyer), a complete description of the property, and the parcel number. Mistakes in this information can lead to legal complications or delays in the transfer process.

- Signing Requirements: The deed must be signed by the grantor in the presence of a notary public to be legally binding. In some cases, witness signatures may also be required. These formalities are crucial for the document to be valid and recognized by law.

- Understand the Tax Implications: Transferring property can have tax implications, including reassessment of property tax and capital gains tax. The grantor and grantee should be aware of these implications and may need to report the transfer to the Internal Revenue Service (IRS) and the California State Board of Equalization.

- Recording the Deed: Once signed and notarized, the deed must be recorded with the county recorder’s office where the property is located. This step is essential for making the transaction public record, which provides protection against fraud and claims by third parties.

- Seek Professional Advice: Considering the legal and financial implications of transferring property, it’s wise to seek advice from a legal professional or a real estate expert. They can provide guidance specific to your situation and help ensure that all requirements are met.

Approaching property transfer with a solid understanding of these key points ensures a smoother, legally sound process. Whether you're transferring property to a family member or selling a piece of real estate, being well-prepared with the right deed form is the first step towards a successful transaction.

Create Other Deed Forms for US States

Property Owners Search - This form is designed to legally formalize the transfer of ownership of real estate.

New Jersey Deed Transfer Form - The legal descriptions in the Deed provide an exact delineation of the property’s boundaries.

Maryland Deed Form - It often comes accompanied by warranties that guarantee the seller has the right to transfer the property and that there are no undisclosed encumbrances.