Blank Deed Form for Colorado

In the state of Colorado, the process of transferring property is facilitated through the use of a deed form, a crucial document that serves as the legal instrument for the conveyance of real estate ownership from one party to another. This form not only embodies the official transfer but also ensures that the rights and interests of the involved parties are clearly delineated and protected under state law. The variety of deed forms available, such as warranty deeds, quitclaim deeds, and special warranty deeds, cater to different transfer scenarios, each with its own set of conditions and levels of protection for the buyer and seller. Essential elements of these forms include the precise identification of the grantor and grantee, a thorough description of the property in question, and the requisite legal language that solidifies the transfer of ownership. Moreover, the form must be duly signed, witnessed, and notarized as per Colorado's legal stipulations to be considered valid. The completion and recording of this document with the appropriate county clerk's office not only finalize the real estate transaction but also play a pivotal role in ensuring that the transfer is publicly documented and acknowledged, providing a transparent record of property ownership within the state.

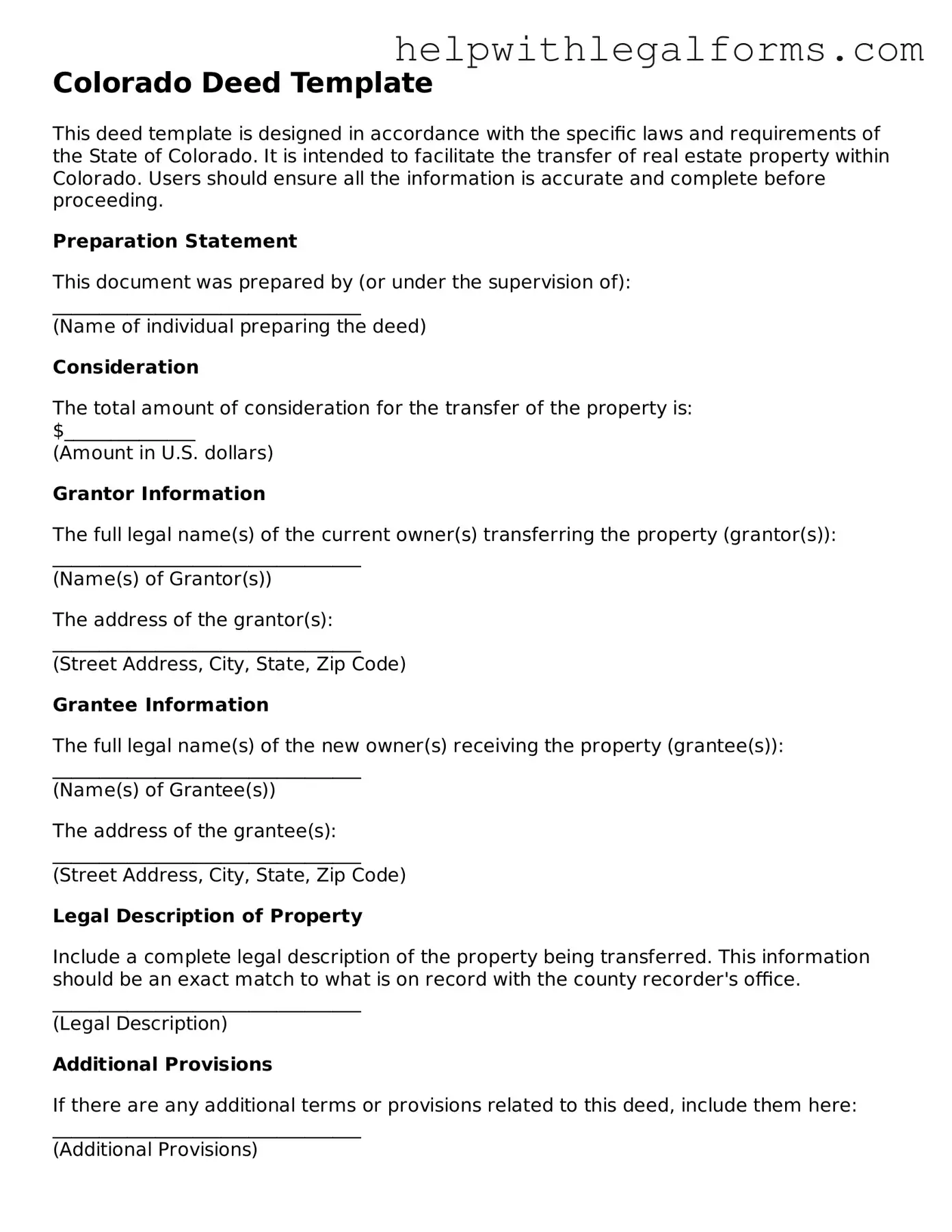

Example - Colorado Deed Form

Colorado Deed Template

This deed template is designed in accordance with the specific laws and requirements of the State of Colorado. It is intended to facilitate the transfer of real estate property within Colorado. Users should ensure all the information is accurate and complete before proceeding.

Preparation Statement

This document was prepared by (or under the supervision of):

_________________________________

(Name of individual preparing the deed)

Consideration

The total amount of consideration for the transfer of the property is:

$______________

(Amount in U.S. dollars)

Grantor Information

The full legal name(s) of the current owner(s) transferring the property (grantor(s)):

_________________________________

(Name(s) of Grantor(s))

The address of the grantor(s):

_________________________________

(Street Address, City, State, Zip Code)

Grantee Information

The full legal name(s) of the new owner(s) receiving the property (grantee(s)):

_________________________________

(Name(s) of Grantee(s))

The address of the grantee(s):

_________________________________

(Street Address, City, State, Zip Code)

Legal Description of Property

Include a complete legal description of the property being transferred. This information should be an exact match to what is on record with the county recorder's office.

_________________________________

(Legal Description)

Additional Provisions

If there are any additional terms or provisions related to this deed, include them here:

_________________________________

(Additional Provisions)

Signature Section

The grantor(s) must sign and date the deed in the presence of a notary public.

____________________________ ______________

Signature of Grantor Date

____________________________ ______________

Signature of Grantor Date

This document was acknowledged before me on ______________ (date) by _________________________ (name(s) of grantor(s)).

____________________________

Notary Public

My commission expires: ______________

Recording

After completion, this deed needs to be recorded with the County Recorder's Office in the county where the property is located to be effective and to provide public notice of the transfer.

PDF Form Attributes

| Fact | Description |

|---|---|

| Definition of a Colorado Deed Form | A legal document used to transfer property ownership in the state of Colorado. |

| Types of Colorado Deed Forms | Includes Warranty Deeds, Special Warranty Deeds, and Quitclaim Deeds, each offering different levels of protection and guarantees. |

| Required Signatures | The deed must be signed by the grantor(s) in front of a notary public to be considered valid. |

| Governing Law | Colorado deeds are governed by the Colorado Revised Statutes, Title 38 - Property - Real and Personal. |

| Recording Requirement | To formalize the transfer of ownership, the signed deed must be recorded with the County Recorder's Office in the county where the property is located. |

| Consideration Statement | A Statement of Consideration must be completed and filed with the deed, disclosing the transaction's financial details, in accordance with state requirements. |

Instructions on How to Fill Out Colorado Deed

When it comes to transferring property ownership in Colorado, filling out a deed form correctly is a crucial step. This practical task might seem daunting at first, but with a clear roadmap, the process can become straightforward and manageable. Whether you're planning to transfer property to a family member, or you're on the receiving end of such a generous act, understanding how to accurately complete the deed form is vital. Let’s walk through the steps needed to fill out this form properly, ensuring all the necessary information is captured to make the property transfer process as smooth as possible.

- Gather all necessary information: Before you begin filling out the deed form, make sure you have all the required information on hand. This includes the legal description of the property, the current owner's name(s) (as listed on the current deed), and the new owner's name(s) and address.

- Identify the type of deed: Colorado recognizes several types of deeds (e.g., warranty deeds, quit claim deeds, etc.), each serving different purposes. Determine the type of deed appropriate for your situation.

- Enter the preparer’s information: At the top of the deed form, fill in the name and address of the individual who is preparing the deed. This could be an attorney, a title company agent, or you, if you’re doing it yourself.

- Specify the grantor(s): List the name(s) of the current property owner(s), exactly as it appears on the current deed. Be sure to include the marital status of the grantor(s) if applicable.

- Specify the grantee(s): List the name(s) of the new owner(s) along with their mailing address. It is crucial to accurately record this information to ensure future correspondences reach the right person.

- Provide the legal description of the property: This is not the same as the street address. The legal description can be found on the current deed or by contacting your local county clerk’s office.

- State the consideration: Enter the amount of money being exchanged for the property, if applicable. Even if the property is a gift, a nominal amount like $10 is usually stated to fulfill legal requirements.

- Include any additional stipulations: If there are specific conditions tied to the transfer (e.g., a life estate), these should be clearly outlined in the deed.

- Grantor(s) signature(s): The current owner(s) must sign the deed in the presence of a notary public. The signature(s) must be exactly as listed in the grantor section of the deed.

- Notarize the deed: The notary public will fill out their section, officially notarizing the deed. This step is essential for the deed to be legally binding.

- Record the deed with the county: After the deed is properly filled out and notarized, it must be recorded with the county clerk or recorder’s office where the property is located. This may involve a recording fee.

Filling out a deed form in Colorado is a key part of transferring property ownership. By following these steps, you can ensure that the process is carried out efficiently and correctly, minimizing potential legal headaches in the future. Always remember, when in doubt, consult with a legal professional to guide you through the specifics of your situation.

Crucial Points on This Form

What is a Colorado Deed form?

A Colorado Deed form is a legal document used in the state of Colorado to transfer ownership of real estate from one person (the grantor) to another (the grantee). The deed must contain specific information to be valid, including the legal description of the property, the names of the grantor and grantee, and the signature of the grantor. It's also essential that the deed be recorded with the county recorder in the county where the property is located to make the transfer public record.

Are there different types of Deed forms in Colorado?

Yes, there are several types of Deed forms in Colorado, each serving a different purpose. Common types include the Warranty Deed, which provides the grantee with the highest level of protection, asserting that the grantor has clear title to the property; the Special Warranty Deed, which only guarantees the title for the period during which the grantor owned the property; and the Quitclaim Deed, which transfers only the interest the grantor has in the property, if any, without any warranties of clear title.

How do I know which Colorado Deed form to use?

Determining the right Colorado Deed form depends on the nature of the property transfer and the level of protection desired by the grantee. For transactions requiring a guarantee of clear title, a Warranty Deed is appropriate. If the property is being transferred as a gift, or between family members, and a guarantee of clear title is not as critical, a Quitclaim Deed might suffice. Always consider consulting with a real estate attorney to choose the correct form for your situation.

What information is required to complete a Colorado Deed form?

To complete a Colorado Deed form, you'll need to provide the legal description of the property (which differs from the street address), the names and addresses of the grantor and grantee, the signature of the grantor, and a notary public's acknowledgment. Depending on the deed type, additional information or disclosures may be necessary.

Is a notary required for a Colorado Deed to be valid?

Yes, for a Colorado Deed to be considered valid and legally binding, the grantor's signature must be notarized. This step is critical as it verifies the identity of the grantor and confirms that the signature on the deed is genuine. After notarization, the deed is ready to be filed with the county recorder's office.

How do I file a Colorado Deed form?

After ensuring the Colorado Deed form is completed, signed by the grantor, and notarized, the next step is to file the document with the county recorder or clerk's office in the county where the property is located. This process is known as recording and typically involves paying a filing fee. Recording the deed makes the transfer of ownership public record, which is necessary to fully protect the grantee's legal rights to the property.

What happens if a Colorado Deed is not recorded?

If a Colorado Deed is not recorded, the transfer of property ownership may not be recognized by third parties, and the grantee's claims to the property may not be fully protected. In the event of a dispute, another party could potentially claim ownership of the property. Therefore, recording the deed with the county recorder's office is a crucial step in the property transfer process to ensure the grantee's rights are safeguarded.

Common mistakes

-

Not verifying the legal description of the property. The legal description is a detailed way of describing the property, different from the street address. It includes lot number, subdivision name, and measurements. Failing to provide an accurate legal description can result in the deed being invalid.

-

Overlooking the requirement for all owners to sign. If the property is owned by more than one person, all owners must sign the deed to validly convey the property. Not having all necessary signatures can lead to disputes about the ownership of the property.

-

Using the wrong type of deed. There are several types of deeds, including warranty, quitclaim, and special warranty deeds, each serving different purposes and offering varying levels of protection to the buyer. Selecting the wrong type can inadvertently affect the rights transferred.

-

Not acknowledging the deed before a notary public. In Colorado, like in many other states, a deed must be notarized to be recorded properly. Failing to have the deed notarized can prevent it from being officially recorded, affecting the buyer's ability to prove ownership.

-

Forgetting to submit the deed to the county recorder’s office. Once the deed is completed and notarized, it needs to be filed with the county recorder’s office in the county where the property is located. Failure to record the deed can lead to challenges in establishing legal ownership and can affect the owner's rights.

Being thorough and cautious when completing the Colorado Deed form can save individuals from legal headaches down the road. Ensuring the accuracy of the legal description, obtaining all necessary signatures, selecting the appropriate type of deed, notarizing the document, and properly recording it with the relevant county are crucial steps to transferring property successfully.

Documents used along the form

When transferring property ownership in Colorado, the deed form is essential but not the only document that parties typically need to handle. Several other forms and documents play critical roles in ensuring the transaction complies with legal standards and fully reflects the parties' intentions. Understanding these documents is crucial for a smooth and legally sound transaction.

- Promissory Note: This is a vital document if the property purchase involves financing. It outlines the borrower's promise to repay the loan under agreed terms, including the interest rate and payment schedule.

- Bill of Sale: Often used in addition to the deed for transactions that include personal property (like furniture or appliances) in addition to the real estate. It details the items being transferred along with the property.

- Title Insurance Policy: This document protects the buyer and the mortgage lender against losses resulting from disputes over the property title. It’s issued after a thorough examination of public records.

- Closing Statement: An itemized list of all the transactions and fees paid by both buyer and seller. This document is crucial for understanding the financial aspects of the property transfer.

- Real Estate Transfer Declaration (TD-1000): A form required in Colorado, providing details about the property sold, including the sale price and conditions of the sale, to aid in real estate market analysis.

- Warranty Notice: If the deed is a warranty deed, this document outlines the seller's guarantees regarding the property title, including that it's free from liens or other encumbrances not disclosed in the deed.

- Loan Payoff Statement: Relevant if the seller has an outstanding mortgage on the property. It outlines the amount required to pay off the existing loan in full as of the date of sale.

Whether buying or selling property in Colorado, being prepared with the correct forms and documents is a significant first step. However, the complexities of real estate transactions often require professional guidance. Consulting with a real estate attorney can ensure that all paperwork is correctly completed and filed, protecting the interests of all parties involved.

Similar forms

Mortgage Document: Like a Deed form, a mortgage document establishes rights and responsibilities. While a Deed transfers property ownership, a mortgage document secures the property as collateral for a loan. Both documents are integral in real estate transactions, involve legal descriptions of the property, and must be signed and notarized.

Lease Agreement: This document, which outlines the terms under which one party agrees to rent property from another party, shares similarities with a Deed form in terms of real estate relevance. Both documents define conditions related to the use of property, but while a Deed form transfers ownership rights, a lease agreement grants temporary rights to use.

Bill of Sale: Typically used in the buying and selling of personal property, a bill of sale is parallel to a Deed in showcasing a transfer of ownership. Both require clear descriptions of the transferred item or property, the parties involved, and must be authenticated to be valid.

Title: A Title document certifies the ownership of an asset (often real estate or a vehicle) and is closely related to a Deed form in purpose. A Deed functions as the vehicle for transferring a Title between parties, making both critical for confirming legal ownership.

Warranty Deed: A specific type of Deed, this document provides guarantees from the seller to the buyer that the title is clear of liens or claims. It's akin to a Deed form by serving the same primary function of transferring property ownership, but with added seller assurances.

Quitclaim Deed: This variant of a Deed form transfers ownership of property without making any guarantees about the title's status, focusing solely on the interests one party has in a property. It shares the procedural resemblance with a Deed but differs in the level of protection offered to the buyer.

Trust: A Trust document establishes a fiduciary arrangement, holding assets on behalf of a beneficiary, and parallels a Deed in the aspect of transferring interests. While a Deed transfers property rights to another party, a Trust involves transferring property rights to the Trust itself, with the intent of benefiting third parties.

Dos and Don'ts

Understanding the process and requirements for completing a deed form in Colorado is crucial to ensure the transfer of property is valid and legally binding. Whether you're transferring property to a family member or selling your home, paying attention to the do's and don'ts can save you from potential headaches down the road.

Do's:

- Do thoroughly read the entire form before filling anything out, to ensure you understand all the requirements.

- Do use black ink or type your responses to maintain legibility and ensure the document is recordable.

- Do verify the legal description of the property. This is crucial and must match the description on the existing deed to avoid discrepancies.

- Do confirm the correct deed type for your situation. Colorado has several types of deeds, and each offers different levels of warranty.

- Do include all required signatories. Typically, this means all current owners must sign the deed for the transfer to be valid.

- Do notarize the deed. It's a legal requirement in Colorado for the deed to be acknowledged by a notary public to be recordable.

- Do keep a copy of the completed deed for your records. After recording, it's wise to have a personal copy for reference.

- Do check if any additional forms or filings are necessary. In some cases, additional documentation may be required by local authorities.

- Do consult with a real estate attorney if you have questions or concerns. Legal advice can clarify complexity and ensure the transfer is sound.

- Do record the deed with the county clerk's office where the property is located to make the transfer public record.

Don'ts:

- Don't attempt to fill out the form without having all the necessary information, such as the precise legal description of the property.

- Don't use white-out or make any alterations on the form after it’s been notarized, as this can invalidate the document.

- Don't forget to check the box for the marital status of the grantor(s) if required, as it can affect the transfer.

- Don't neglect to specify the manner in which the grantee (the person receiving the property) will hold title, especially if it’s being transferred to more than one person.

- Don't overlook the requirement for witnesses in addition to a notary, as some forms of deeds in Colorado may require witnesses.

- Don't submit the deed for recording without first double-checking all the details for accuracy and completeness.

- Don't ignore local county requirements, as they can vary and may have specific instructions or fees for recording the deed.

- Don't underestimate the importance of the document's clarity; unclear or illegible writing can lead to issues or delays.

- Don't hesitate to ask for help from a legal professional to ensure everything is filled out correctly.

- Don't delay in recording the deed. Delaying can lead to complications and potential disputes over property ownership.

Keeping these do's and don'ts in mind when filling out a Colorado Deed form will guide you toward a smoother property transfer process. Remember, when in doubt, seeking professional advice is always a wise decision.

Misconceptions

When it comes to transferring property ownership in Colorado, the deed form plays a crucial role. However, there are several misconceptions surrounding this document that can lead to confusion. By addressing these commonly held beliefs, individuals can feel more informed and confident when dealing with property transactions.

- All deeds are the same: People often think one deed fits all situations. However, Colorado offers various types of deeds, such as warranty deeds, quitclaim deeds, and special warranty deeds, each serving different purposes and offering different levels of protection to the buyer.

- Signing a deed transfers the property immediately: Just signing a deed does not complete the transfer process. The deed must be properly executed, often requiring notarization, and then recorded with the appropriate county’s office to legally transfer ownership.

- A deed guarantees a clear title: Not all deeds guarantee a clear title. For example, quitclaim deeds transfer ownership without any guarantees about the property’s title, while warranty deeds provide guarantees against title defects.

- Deeds don’t need to be recorded to be effective: While a deed transfer is legally valid once signed and delivered, recording it with the county ensures the transfer is public record, protecting the buyer’s interests.

- Deeds and titles are the same: A common misconception is that deeds and titles are interchangeable terms. A deed is a legal document that transfers ownership, while a title is the concept of ownership rights.

- Only physical copies of deeds are valid: Colorado acknowledges digital deeds as long as they meet state requirements for execution and recording. This includes electronic signatures and notarization, making the process more convenient.

- Deeds must be notarized in Colorado: While notarization is a common practice to prevent fraud and ensure a smooth recording process, Colorado law does not strictly require a deed to be notarized. However, not having a deed notarized could potentially impede the recording process and affect the transfer.

- You need a lawyer to create a deed: While it’s advisable to consult with a professional to ensure accuracy and legality, especially in complex cases, Colorado does not mandate the involvement of a lawyer to create a deed. Individuals can prepare their deeds, but should do so with caution and thorough research.

- Any mistake on a deed invalidates it: Errors on a deed, such as typographical errors or misstatements, can often be corrected without invalidating the entire deed. Minor mistakes may be rectified through a corrective deed, while fundamental errors might require more detailed legal interventions.

Understanding these misconceptions can facilitate smoother property transactions by setting realistic expectations and preparing individuals for the challenges they may face. Always consider consulting with a professional when in doubt to ensure the accuracy and legality of your actions.

Key takeaways

Completing and utilizing the Colorado Deed form requires attention to detail and a basic understanding of the document's purpose and legal implications. Whether you're transferring property as a gift or sale, it's crucial to approach this task with thoroughness and accuracy.

Identify the Correct Deed Form: Colorado offers different types of deeds such as warranty, special warranty, and quitclaim deeds. Each serves a different purpose, affecting the level of protection for the buyer.

Complete All Required Information: Provide complete and accurate details including the legal names of the grantor and grantee, the legal description of the property, and the sale price if applicable. Incomplete forms may be rejected.

Notarization is Mandatory: The signatures of the grantor must be notarized. This step is crucial for the deed to be legally binding and recordable.

Consider Legal Advice: Before executing a deed, consulting with a legal professional can help clarify the implications and ensure the deed aligns with your intentions. This is particularly important for complex transactions.

Review for Accuracy: Before finalizing, review the deed thoroughly to ensure all information is accurate and reflects the agreed terms of property transfer. Errors can lead to complications in the property's title.

Recording is Crucial: After the deed is executed, it must be recorded with the county recorder’s office where the property is located. Recording the deed makes it a matter of public record and helps protect the grantee’s interests.

Understand Tax Implications: Transferring property may have tax consequences for both the grantor and grantee. It's advisable to understand these implications and prepare accordingly.

Keep a Copy: Always keep a copy of the recorded deed for personal records. This document is proof of ownership and may be required for future legal or financial transactions.

Adhering to these guidelines will facilitate a smoother property transfer process and help avoid potential legal issues. It underscores the importance of due diligence and precision in legal document preparation and execution.

Create Other Deed Forms for US States

Oklahoma Property Deed - The tax implications of transferring property using a deed form vary, potentially affecting both the seller and the buyer.

Quit Claim Deed Form Georgia - Deed forms also play a role in estate planning, allowing for the transfer of property upon the death of the owner without the need for probate.

Life Estate Deed New York Form - Completing the form accurately is crucial for avoiding future disputes over the property.