Blank Deed Form for Connecticut

In the realm of property transactions in Connecticut, the deed form emerges as a crucial document, encapsulating significant aspects of ownership transfer. This form not only delineates the specifics of the property in question but also identifies the parties involved, making clear the transferor's intent to pass ownership to the transferee. With its structured format, it meticulously outlines the rights being transferred, any encumbrances on the property, and the type of deed being executed, whether it be warranty, quitclaim, or another variant, each providing different levels of protection and assurance to the buyer. The execution of this document, underscored by the requirement of witness signatures and often a notary public's seal, adheres to Connecticut's legal standards, ensuring the deed's validity and enforceability. Ultimately, the Connecticut deed form serves as a linchpin in property transactions, safeguarding the interests of all parties involved and providing a legally binding record of the change in property ownership.

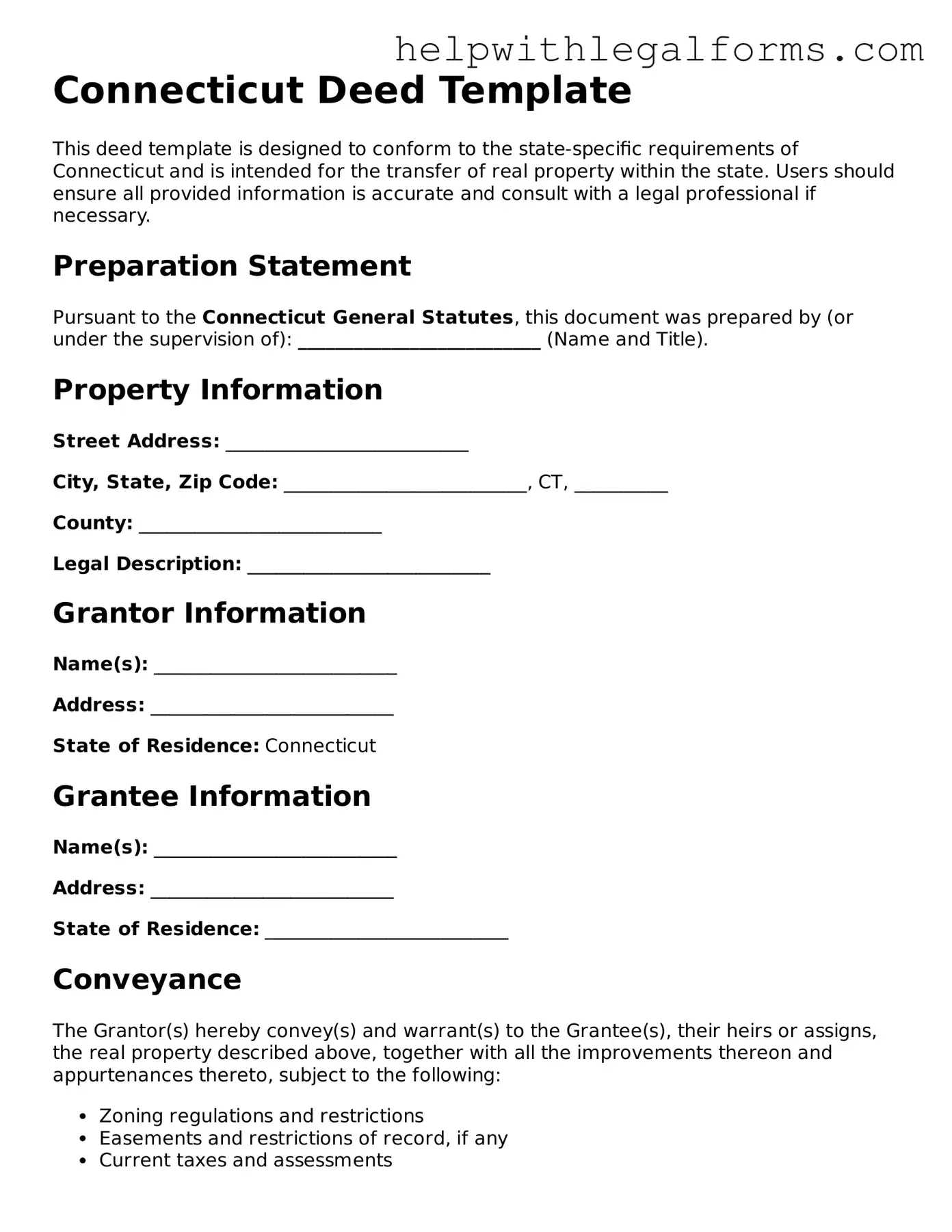

Example - Connecticut Deed Form

Connecticut Deed Template

This deed template is designed to conform to the state-specific requirements of Connecticut and is intended for the transfer of real property within the state. Users should ensure all provided information is accurate and consult with a legal professional if necessary.

Preparation Statement

Pursuant to the Connecticut General Statutes, this document was prepared by (or under the supervision of): __________________________ (Name and Title).

Property Information

Street Address: __________________________

City, State, Zip Code: __________________________, CT, __________

County: __________________________

Legal Description: __________________________

Grantor Information

Name(s): __________________________

Address: __________________________

State of Residence: Connecticut

Grantee Information

Name(s): __________________________

Address: __________________________

State of Residence: __________________________

Conveyance

The Grantor(s) hereby convey(s) and warrant(s) to the Grantee(s), their heirs or assigns, the real property described above, together with all the improvements thereon and appurtenances thereto, subject to the following:

- Zoning regulations and restrictions

- Easements and restrictions of record, if any

- Current taxes and assessments

Consideration

The total consideration paid for this conveyance of property is $________________ (USD).

Signatures

This deed is executed this ____ day of __________, 20____.

Grantor's Signature: __________________________

Grantor's Printed Name: __________________________

Grantee's Signature: __________________________

Grantee's Printed Name: __________________________

Acknowledgment

This document was acknowledged before me on this ____ day of __________, 20____, by the above-named Grantor(s).

Notary Public's Signature: __________________________

Commission Expires: __________________________

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Governing Law | The Connecticut Deed form is governed by the Connecticut General Statutes, particularly Titles 47 and 49, which provide explicit guidance on real estate transactions and the necessary requirements for a deed to be considered valid within the state. |

| Types of Deeds | In Connecticut, several types of deeds are recognized, including Warranty Deeds, Quitclaim Deeds, and Special Warranty Deeds, each offering different levels of protection and guarantees about the property's title and any encumbrances. |

| Signature Requirements | A legal requirement for all Connecticut Deed forms is that they must be signed by the grantor (the person transferring the property) in the presence of two witnesses who are not parties to the transaction. Additionally, the signature must be notarized. |

| Recording Requirement | After execution, the deed must be recorded with the Town Clerk in the municipality where the property is located. This step is crucial for the deed to be effective against third parties and to ensure a clear chain of title. |

| Consideration Statement | A valid Connecticut Deed form must include a statement of consideration, which is the value exchanged for the property transfer. This statement supports the validity of the transaction and can have implications for tax assessment and future property disputes. |

Instructions on How to Fill Out Connecticut Deed

Filling out a Connecticut Deed form is a key step in the process of transferring property ownership. Whether you're buying, selling, or otherwise transferring property, it's crucial to handle this form accurately to ensure a smooth transaction. The form legally documents the change in ownership and provides a record for both parties involved. Here’s a straightforward guide to help you complete the form correctly.

- Start by entering the date of the transaction at the top of the form.

- Write the name(s) of the grantor(s) — the current owner or owners of the property — in the designated field. Ensure the names are spelled correctly as they appear on the current deed or property records.

- Fill in the name(s) of the grantee(s) — the new owner or owners receiving the property. Again, make sure to use legal names and spell them correctly.

- Include the consideration amount, which is the price paid for the property. If the property is a gift, you may need to state that fact instead of a dollar amount.

- Provide a complete legal description of the property being transferred. This is a detailed description that often includes metes and bounds or a lot number and subdivision name, not just the street address. You may need to refer to the current deed or a property survey for this information.

- Enter any relevant details about the property or the transaction that might be required, such as restrictions or easements.

- Have the grantor(s) sign and date the form in front of a notary public. Some states may require witness signatures as well, so it’s important to know Connecticut’s specific requirements.

- The next step is for the notary public to add their acknowledgment, which includes their official seal and signature, verifying that the grantor(s) signed the document in their presence.

- Finally, file the completed deed with the appropriate local office, which in Connecticut is usually the town clerk or county recorder's office where the property is located. There may be a filing fee, which varies by locality.

Once the deed is properly filled out and filed, the property ownership transfer process is officially documented. It's advisable to keep a copy of the filed deed for your records. If at any point you feel unsure about the process or the information required, consulting with a legal professional can provide guidance and help ensure that the form is completed correctly.

Crucial Points on This Form

What is a Connecticut Deed form?

A Connecticut Deed form is a legal document used to transfer ownership of real property from one person (the seller or grantor) to another (the buyer or grantee). This form must be filled out accurately, signed by the grantor, and notarized. It is crucial for the secure transfer of property titles and interests in the state of Connecticut.

What types of Deed forms are available in Connecticut?

In Connecticut, the most common types of deed forms are the Warranty Deed, Special Warranty Deed, and Quitclaim Deed. The Warranty Deed provides the highest level of protection to the buyer, guaranteeing that the property is free from all liens and encumbrances. The Special Warranty Deed offers limited protection, assuring the buyer that the seller holds the title but only guarantees against issues during their ownership. The Quitclaim Deed offers the least protection, transferring only the interest the seller has in the property without any warranties.

What are the requirements for a Connecticut Deed to be valid?

For a Deed to be considered valid in Connecticut, it must contain the real names of both the grantor and grantee, a legal description of the property, the signature of the grantor, and an acknowledgment by a notary public. Also, the deed should be delivered to the grantee. To ensure the public record's accuracy, the deed must be filed with the town clerk in the municipality where the property is located.

How do you file a Connecticut Deed form?

After the Connecticut Deed form has been completed, signed, and notarized, it should be taken or mailed to the town clerk's office in the town where the property is located. A recording fee, which varies by town, will be required at the time of filing. It's important to make sure the document meets all local filing requirements to avoid delays. Some towns may also require additional forms or documents to accompany the deed.

Can a Connecticut Deed form be corrected if there are errors?

Yes, errors in a Connecticut Deed can be corrected, but the process requires creating and filing a new document, commonly referred to as a Correction Deed or Scrivener's Affidavit. This document will reference the original deed and detail the corrections made. Like the original deed, the Correction Deed must be signed, notarized, and filed with the town clerk in the town where the property is located. Correcting errors as soon as they are discovered is important to avoid potential legal issues or disputes over property ownership.

Common mistakes

Not Checking the Type of Deed: Connecticut offers several types of deeds — warranty, quitclaim, and special warranty. Each serves different purposes and offers varying levels of protection to the buyer. Many mistakenly assume all deeds provide the same protection and fail to choose the one that best suits their transaction.

Incorrectly Identifying the Property: A deed must include an accurate description of the property being transferred. This isn't just the address; it also involves the legal description, which might include lot numbers and boundaries. Using an incorrect or incomplete description can invalidate the deed or cause disputes in the future.

Forgetting to Include All Owners: If the property is owned jointly, all owners must be included in the deed form. Failing to do so can lead to issues with the transfer, as the exclusion of an owner’s name implies that they still retain their ownership share.

Not Getting the Form Notarized: In Connecticut, like in many other states, a deed must be notarized to be legally valid. This step verifies the identity of the signatories and confirms that they signed the document voluntarily. Overlooking this requirement can render the deed invalid.

Omitting or Making Errors in the Grantee’s Information: The grantee is the person receiving the property. Any mistakes in their name or omitting their information altogether can cause significant legal headaches and may necessitate legal action to correct.

Failure to Record the Deed: Once signed and notarized, the deed must be recorded with the appropriate Connecticut town or city’s land records office. This public recording legitimizes the change in ownership. Skipping this step can leave the transfer in legal limbo, potentially complicating future sales or transfers.

Approaching the completion of a Connecticut Deed form with care and attention to detail will help ensure that the property transfer process proceeds smoothly and legally. Common pitfalls, such as those listed above, are preventable with thoroughness and perhaps the guidance of a professional familiar with Connecticut real estate law.

Documents used along the form

When handling real estate transactions in Connecticut, the Deed form plays a pivotal role as the document that officially transfers property from one party to another. However, it's just one piece of the puzzle. A variety of other forms and documents often accompany it to ensure a smooth, legally compliant transaction. Below is a list of additional forms and documents that are commonly used alongside the Connecticut Deed form, each serving a specific purpose in the process.

- Title Search Report: This document provides a history of the property, including previous ownerships, and reveals any encumbrances or liens that may affect the title.

- Property Disclosure Form: Sellers use this form to disclose material facts about the property’s condition, such as any known defects or malfunctions, to the buyer.

- Mortgage Pre-approval Letter: Often submitted with an offer to purchase, this letter from a lender indicates the amount of money a buyer is approved to borrow.

- Sale and Purchase Agreement: This contract outlines the terms and conditions of the sale, including price, closing date, and any contingencies such as financing or inspection results.

- Flood Zone Statement: Identifies if the property lies within a flood hazard area as determined by the Federal Emergency Management Agency (FEMA).

- Home Inspection Report: A thorough assessment by a licensed inspector that identifies any issues with the property’s structure, systems, and components.

- Radon Disclosure Form: In areas where radon is a concern, this form discloses the presence of radon gas concentrations within the property.

- Lead-Based Paint Disclosure: Required for homes built before 1978, this form informs buyers about the presence of lead-based paint and any known related hazards.

- Real Estate Transfer Tax Declarations: A statement that outlines the tax implications and fees due upon transferring the property title.

- Loan Documents: If the purchase is being financed, the buyer must complete several documents from the lender, including a promissory note and mortgage agreement, which outline the terms of the loan and the property’s use as security.

Together, these documents provide a comprehensive framework to ensure all legal, financial, and informational aspects of a property transfer are properly addressed. They protect the interests of both the buyer and seller, minimize potential disputes, and help to ensure that the transfer of property complies with Connecticut state laws. Navigating through these documents can be complex and may require guidance from real estate professionals or legal advisors to ensure a smooth property transaction.

Similar forms

Mortgage Agreement: Just like a deed, a mortgage agreement represents a legal document, but in this case, it secures a loan on property. Both documents are vital in real estate transactions, delineating rights and obligations— the deed transfers ownership, while the mortgage agreement secures the loan with the property as collateral.

Bill of Sale: This document is akin to a deed as it serves as proof of a transfer of ownership from one party to another. While deeds typically relate to real property, bills of sale are used for personal property, like vehicles or appliances. Each document formalizes the transfer in writing and provides a record of the transaction.

Title Certificate: Similar to a deed, a title certificate is proof of ownership. The main difference lies in their usage; a title certificate is used for personal property, such as vehicles and boats, while a deed is used exclusively for real property. However, both are official records that validate an owner's rights to the property.

Lease Agreement: Lease agreements, like deeds, involve real estate but differ in purpose. While a deed transfers ownership rights, a lease agreement grants the right to use the property for a specified period of time in exchange for payment. Both are legally binding contracts that specify terms and conditions agreed upon by the parties involved.

Quitclaim Deed: A specific form of a deed, a quitclaim deed, also transfers ownership of property but without any warranties regarding the title. Both serve to convey property rights but differ in the level of protection offered to the grantee. Quitclaim deeds are often used between family members or to clear title discrepancies.

Warranty Deed: Another variant of a deed, a warranty deed provides guarantees about the clear title of the property being transferred. This contrasts with general deeds by offering protection against future claims or past liens. Both documents are integral to transferring property, but the level of assurance regarding the title varies.

Trust Deed: Trust deeds share similarities with general deeds; both involve the transfer of property. A trust deed, however, involves three parties and is used to secure a debt with real property. While a general deed transfers property rights outright, a trust deed places the property in a trust as collateral for a loan.

Easement Agreement: Easement agreements, similar to deeds, are legal documents granting rights over real property. An easement gives one party the right to use another's property for a specific purpose, like accessing a water source. Unlike deeds, which transfer ownership, easements grant limited use rights without ownership.

Power of Attorney: This document allows one person to act on another's behalf, encompassing a range of actions including buying or selling property, similar to how a deed transfers property rights. However, a power of attorney can cover more than real estate transactions, offering wide-ranging legal authority granted by the principal to the agent.

Dos and Don'ts

When dealing with the process of filling out the Connecticut Deed form, it's important to navigate the steps with care and attention. Here's a guide to help ensure the process is handled correctly, listing what you should and shouldn't do.

Things You Should Do

Ensure all information is accurate and current. Double-check the names, addresses, and legal descriptions of the property to prevent any issues.

Use black ink and print legibly if filling out the form by hand. This ensures the document is clear and readable, which is crucial for official records.

Consult with a legal professional if you have any doubts or questions. The complexity of property law means that professional advice can be invaluable.

Sign the form in the presence of a notary public. This step is essential for the document to be legally binding.

Keep a copy of the deed for your records. Having your own record simplifies any future transactions or clarifications.

Submit the completed form to the appropriate county office. Timely filing is crucial for the document to take effect.

Things You Shouldn't Do

Do not leave any sections blank. If a section doesn't apply, mark it as "N/A" (not applicable) to indicate that it was not overlooked.

Avoid using erasable ink or making any alterations on the form after it has been notarized, as this can raise questions about the document's authenticity.

Do not sign the document without a notary public present. Unnotarized deeds may not be legally enforceable.

Do not guess on legal descriptions or other details. Incorrect information can lead to disputes or issues with the deed's validity.

Avoid delaying the submission of the form. Prompt filing ensures your document is recorded in the public record in a timely manner.

Do not forget to verify that the submitted form has been recorded. Follow up if necessary to ensure everything is in order.

Misconceptions

When dealing with property transactions in Connecticut, the deed form is a critical document that transfers ownership from one party to another. However, several misconceptions surround its use and requirements, often leading to confusion and errors. By understanding and debunking these myths, individuals can navigate their real estate transactions more confidently and efficiently.

One size fits all: A common misconception is that one standard deed form is suitable for all transactions in Connecticut. In reality, there are several types of deed forms, such as warranty, special warranty, and quitclaim deeds, each serving different purposes and providing varying levels of protection to the buyer.

Legal representation is not necessary: Many people believe that they can complete and file a deed form in Connecticut without legal assistance. While it's technically possible, understanding the legal implications, ensuring the accuracy of the information, and adhering to state-specific requirements can be complex. Professional guidance can help avoid costly mistakes.

Signing a deed transfers property immediately: Another common belief is that once a deed is signed, the property transfer is immediate. The process, however, involves several steps including the signing, notarization, and, importantly, the recording of the deed with the local town clerk's office. Until recorded, the transfer is not considered complete.

A deed and a title are the same: It's often thought that the deed and title to a property are interchangeable terms. In reality, a deed is a legal document that transfers ownership, while a title is a concept that signifies the legal right to own, use, and sell the property. The deed helps to establish one's title.

Correction deeds are easily processed for any errors: Some may assume that correcting a mistake on a deed is a simple process of submitting a new, corrected deed. While correction deeds do exist, the process involves specific legal requirements and filings. Depending on the nature of the error, it might not be as straightforward as expected, emphasizing the importance of accuracy in the initial preparation and execution of the document.

Understanding these misconceptions about Connecticut deed forms can make a significant difference in managing real estate transactions. It emphasizes the importance of thoroughness, legal knowledge, and professional advice in these dealings, ensuring that the transfer of property is conducted smoothly and without unforeseen complications.

Key takeaways

Filling out and using the Connecticut Deed form correctly is crucial for the legal transfer of property. Being informed about the process can significantly ease the transaction. Here are five key takeaways to assist with this important document.

- Ensure all required information is complete and accurate. This includes the full names and addresses of both the seller (grantor) and buyer (grantee), a thorough description of the property, and the parcel number.

- The form must comply with Connecticut's legal requirements. This means it should include language that specifies the type of deed being executed, such as a warranty deed or a quitclaim deed, and any terms and conditions of the transfer.

- Signatures are critical. The deed requires the signature of the grantor. In Connecticut, this signature must also be notarized, meaning a notary public must witness the signing and verify the identity of the signatory.

- Consideration should be detailed in the deed. This term refers to what the grantee will give in exchange for the property, whether it is money or something else of value.

- Recording the deed is the final step. After the deed is completed and signed, it should be filed with the local town clerk's office in the county where the property is located. This officially records the transaction in the public record and completes the transfer of ownership.

Following these guidelines can lead to a smoother property transfer, providing peace of mind for both the seller and the buyer. Remember, the correctness of the form and adherence to Connecticut's specific legal requirements are fundamental to ensuring the deed is legally binding and enforceable.

Create Other Deed Forms for US States

Quit Claim Deed Form Georgia - Types of deed forms include warranty deeds, which guarantee the property is free from liens, and quitclaim deeds, which transfer ownership without any guarantees.

General Warranty Deed Colorado - Acts as a formal record of the change in property ownership, filed with the county or local jurisdiction.