Legal Corrective Deed Form

When property is transferred from one owner to another, accuracy is crucial. Mistakes in the deed can lead to problems with the title, potentially affecting ownership rights. This is where the Corrective Deed form plays a vital role. It is designed to rectify any errors made in the original property deed, ensuring that all information accurately reflects the true intentions of the parties involved. Such corrections might include misspellings of names, incorrect property descriptions, or other clerical errors that could have significant implications if left unaddressed. The process for filing a Corrective Deed varies by jurisdiction but generally requires the submission of the form along with the original deed and, in some cases, additional supporting documents to the appropriate local office. It's a straightforward yet essential tool for safeguarding property transactions and ensuring that legal ownership is precisely documented and beyond dispute.

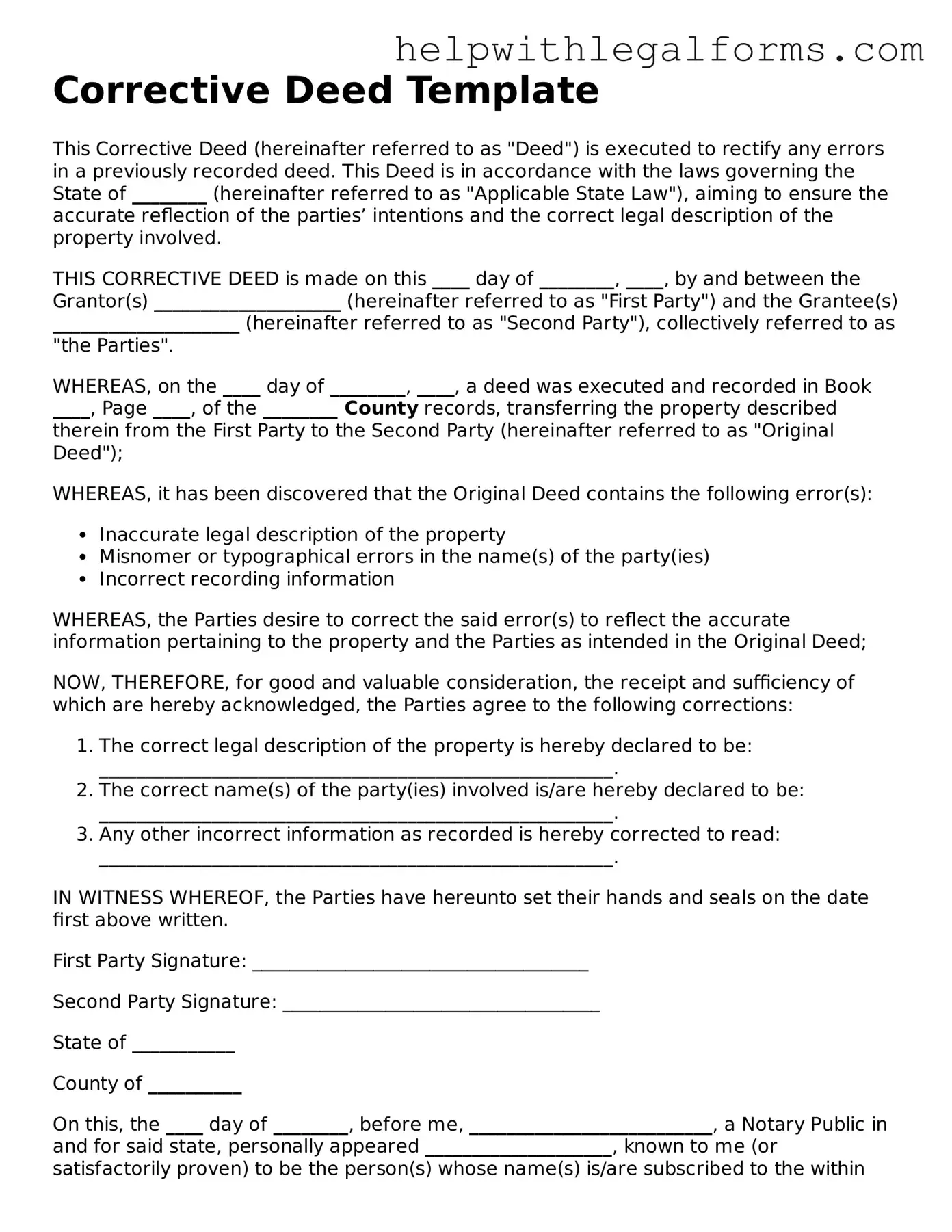

Example - Corrective Deed Form

Corrective Deed Template

This Corrective Deed (hereinafter referred to as "Deed") is executed to rectify any errors in a previously recorded deed. This Deed is in accordance with the laws governing the State of ________ (hereinafter referred to as "Applicable State Law"), aiming to ensure the accurate reflection of the parties’ intentions and the correct legal description of the property involved.

THIS CORRECTIVE DEED is made on this ____ day of ________, ____, by and between the Grantor(s) ____________________ (hereinafter referred to as "First Party") and the Grantee(s) ____________________ (hereinafter referred to as "Second Party"), collectively referred to as "the Parties".

WHEREAS, on the ____ day of ________, ____, a deed was executed and recorded in Book ____, Page ____, of the ________ County records, transferring the property described therein from the First Party to the Second Party (hereinafter referred to as "Original Deed");

WHEREAS, it has been discovered that the Original Deed contains the following error(s):

- Inaccurate legal description of the property

- Misnomer or typographical errors in the name(s) of the party(ies)

- Incorrect recording information

WHEREAS, the Parties desire to correct the said error(s) to reflect the accurate information pertaining to the property and the Parties as intended in the Original Deed;

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree to the following corrections:

- The correct legal description of the property is hereby declared to be: _______________________________________________________.

- The correct name(s) of the party(ies) involved is/are hereby declared to be: _______________________________________________________.

- Any other incorrect information as recorded is hereby corrected to read: _______________________________________________________.

IN WITNESS WHEREOF, the Parties have hereunto set their hands and seals on the date first above written.

First Party Signature: ____________________________________

Second Party Signature: __________________________________

State of ___________

County of __________

On this, the ____ day of ________, before me, __________________________, a Notary Public in and for said state, personally appeared ____________________, known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged that he/she/they executed the same for the purposes therein contained.

IN WITNESS WHEREOF, I hereunto set my hand and official seal.

Notary Public Signature: ___________________________________

My Commission Expires: __________________

PDF Form Attributes

| Fact Number | Fact Description |

|---|---|

| 1 | A Corrective Deed is used to fix mistakes in a previously recorded deed. |

| 2 | Common errors corrected include misspelled names, incorrect property descriptions, and missing signatures. |

| 3 | Both parties involved in the original deed are usually required to sign the Corrective Deed. |

| 4 | This form does not serve as a new deed but corrects the record of the existing deed. |

| 5 | The Corrective Deed must be recorded with the same office that holds the original deed. |

| 6 | There may be a fee to record the Corrective Deed, which varies by jurisdiction. |

| 7 | State-specific laws govern the use and acceptance of Corrective Deeds. |

| 8 | The legality and requirements for a Corrective Deed can vary greatly from one state to another. |

| 9 | Consulting with a legal professional is recommended to ensure the Corrective Deed is completed and recorded correctly. |

Instructions on How to Fill Out Corrective Deed

Filling out a Corrective Deed form is the next step you're likely considering to rectify any discrepancies in a previously recorded deed. It's important to correct these errors to ensure the property title is clear—meaning there's an accurate and undisputed record of ownership. This process may seem daunting, but taking it one step at a time will make it manageable. Whether the mistake was a misspelled name, incorrect property description, or any other clerical error, the Corrective Deed is the tool to amend those errors. Here is a straightforward guide to help you through this important task.

- Start by gathering the original deed that needs correction. You'll need to reference specific details from it, such as the deed book and page number where the original deed was recorded.

- Obtain a Corrective Deed form. These forms can usually be found online through your county clerk's or recorder's office website. Ensure the form is specific to your state, as requirements may vary.

- Fill in the preparer's information. This includes the name and address of the person completing the Corrective Deed form.

- Enter the current date, as this indicates when the correction is being made.

- Provide the Grantor(s) (the person or entity transferring the property) and Grantee(s) (the person or entity receiving the property) information exactly as it appears on the original deed, including any middle names or initials. This maintains consistency across documents.

- Describe the error being corrected without altering the original intent of the deed. Be clear and concise, specifying exactly what was incorrect and what the correction should be.

- List the property's legal description as it should correctly appear. This information can usually be found on the original deed or by contacting your local county clerk or recorder’s office.

- Sign and date the form in the presence of a Notary Public. The Notary Public will verify your identity and witness your signature, adding their stamp or seal to authenticate the document.

- Check if your state or county requires any additional forms or filings along with the Corrective Deed. This might include tax forms or other declarations.

- Record the Corrective Deed with the county recorder's office where the property is located. There may be a fee associated with this filing, which varies by location.

Once these steps are completed, the corrected deed will be a part of public record, clarifying any previous discrepancies and providing a clear title. This process not only corrects the recorded history of your property but also secures your peace of mind for future transactions or developments involving your property.

Crucial Points on This Form

What is a Corrective Deed?

A Corrective Deed is a legal document used to correct errors in a previously recorded deed. It serves to amend inaccuracies such as misspellings of names, incorrect property descriptions, or errors in the original deed's recording information. This deed ensures that the public record accurately reflects the intentions of the parties involved in the property transfer.

When should one use a Corrective Deed?

One should use a Corrective Deed when errors or omissions are discovered in a previously filed deed that could affect the clear transfer of property title. These can include minor clerical mistakes, incorrect legal descriptions of the property, or inaccurate party information. Correcting these errors helps in avoiding disputes or issues with property ownership in the future.

Does a Corrective Deed change the original transfer of property?

No, a Corrective Deed does not change the original transfer of property. It only corrects the errors made in the original deed without altering the intent or terms of the property transfer. The original purchase date and terms of sale remain unaffected by the corrections made through this deed.

What types of errors can be corrected with a Corrective Deed?

Errors that can be corrected with a Corrective Deed include typographical errors, misspellings, incorrect or incomplete legal descriptions of the property, and mistakes in the grantor's or grantee's names. Essentially, it can correct any clerical error that does not change the substantive rights of anyone involved.

Is a Corrective Deed legally binding?

Yes, a Corrective Deed is legally binding once it is properly executed and recorded. Recording the Corrective Deed with the appropriate county office ensures that the corrections are officially noted in the public record, making them part of the property's legal description.

What documents are needed to file a Corrective Deed?

When filing a Corrective Deed, you will need the original deed containing the error, a new deed correcting the mistake, and sometimes a statement explaining the correction. Specific requirements can vary by jurisdiction, so it's important to check with the local county recorder's office.

How does one file a Corrective Deed?

To file a Corrective Deed, you must prepare the document citing the original deed and specifically detailing the corrections. The deed must then be signed by the parties involved in the presence of a notary public. Afterward, the Corrective Deed should be submitted to the county recorder's office where the property is located for it to be part of the official property records.

Can someone file a Corrective Deed without an attorney?

While it is possible to file a Corrective Deed without an attorney, it is advisable to seek legal advice to ensure that the document is prepared and recorded correctly. An attorney can help in identifying the specific errors, drafting the Corrective Deed accurately, and navigating the local recording requirements, thereby minimizing the risk of further complications.

Common mistakes

Filling out a Corrective Deed form can often feel like navigating through a maze without a map. This crucial document is intended to amend errors in previously recorded deeds, ensuring the accuracy of legal property descriptions and ownership details. However, despite its importance, many find themselves stumbling through its completion, leading to further complications down the line. Here are nine common mistakes to avoid:

Overlooking Original Deed Errors: One of the most critical steps is thoroughly reviewing the original deed to pinpoint the exact errors that need correction. Without identifying these mistakes accurately, the corrective deed may fail to resolve the underlying issues.

Incorrect Legal Description: The legal description of the property must be precise. An incorrect legal description can lead to significant confusion and may even invalidate the corrective deed, leaving the original errors unaddressed.

Misidentifying the Type of Error: Various errors can mar a deed - from typographical mistakes to more substantial inaccuracies like incorrect parcel numbers. It's crucial to identify and categorize these errors correctly to ensure the corrective deed effectively addresses them.

Failing to Obtain Necessary Signatures: All parties involved in the original deed must sign the corrective deed. Overlooking or failing to secure these signatures can render the corrective deed null and void.

Notarization Errors: Like the original deed, a corrective deed typically requires notarization. Errors during this process, such as an incomplete notary acknowledgment, can compromise the document's legal standing.

Using Informal Language: Although the intention is to correct a previous error, the corrective deed demands the same level of formal language as the original document. Informal wording can detract from its seriousness and effectiveness.

Skipping the Recording Process: Filing the corrective deed with the appropriate county office is essential for it to take effect. Failure to properly record the document can leave the original errors in place as if the corrective deed never existed.

Ignoring State or County Requirements: Specific requirements for corrective deeds can vary significantly from one jurisdiction to another. Not adhering to local regulations may result in the denial of the corrective filing.

Lack of Professional Advice: Given the complexities involved, seeking professional legal advice can prevent many of these mistakes. A professional can offer guidance tailored to the specifics of the deed and the nature of the errors it contains.

Corrective deeds serve as valuable tools in rectifying deed errors, but their effectiveness hinges on meticulous attention to detail and adherence to legal procedures. By avoiding these common pitfalls, property owners can ensure their real estate transactions are both accurate and legally sound.

Documents used along the form

When dealing with property transactions, the Corrective Deed form plays a critical role in rectifying any mistakes made in previously recorded deeds. This vital document ensures that all details concerning the property title are accurate and legally sound. However, in the realm of real estate transactions, the Corrective Deed form often does not stand alone. A variety of other forms and documents are frequently used in tandem to ensure a seamless and legally compliant transaction process. Here are some key documents that are commonly used alongside the Corrective Deed form.

- Title Search Report: Prior to issuing a Corrective Deed, conducting a title search is essential to verify the ownership history and to check for any liens or encumbrances on the property.

- Original Deed: The deed that contains the errors needing correction is crucial, as it provides a reference point for the Corrective Deed.

- Affidavit of Property Value: This affidavit may be required in some jurisdictions to accompany a deed when filed, stating the transaction's value to assess proper taxes.

- Property Survey: A detailed map showing the property's boundaries and measurements can help identify any discrepancies needing correction in the deed.

- Sales Contract: The agreement between buyer and seller detailing the terms of the property sale can influence the corrections made in a Corrective Deed.

- Loan Documents: If the property is under mortgage, relevant loan documents should be reviewed to ensure the Corrective Deed does not affect the loan's standing.

- Homeowners Association (HOA) Documents: For properties within an HOA, these documents are important to confirm that any deed corrections comply with HOA rules and regulations.

- Warranty Deed: Serving as evidence of the seller's right to transfer property, a Warranty Deed may need to be reissued or amended in line with the Corrective Deed.

- Quitclaim Deed: Sometimes, a Quitclaim Deed is used to correct title defects by transferring any rights the grantor may have in the property without making any guarantees.

The interaction of these documents with the Corrective Deed form underscores the complexity of property law and the importance of attention to detail in real estate transactions. Whether you're a buyer, seller, or a professional assisting with a property transaction, it's essential to understand how these documents work together to ensure a legally sound transfer of property. Handling these documents with care and understanding their interplay can significantly mitigate the risks of future legal complications, ensuring a smoother property transaction process.

Similar forms

Quitclaim Deed: Similar to the Corrective Deed, a Quitclaim Deed is used to transfer property rights from one person to another without any guarantees about the property title's status. Both documents facilitate property ownership changes, but a Corrective Deed specifically addresses errors in a previously recorded deed.

Warranty Deed: A Warranty Deed also involves the transfer of property from one party to another but with assurances from the seller that the title is clear of any issues. Like a Corrective Deed, it deals with property ownership but focuses on guaranteeing a clean title, different from simply correcting previous document mistakes.

Grant Deed: This document transfers property ownership and, like a Corrective Deed, promises that the property has not been sold to someone else. However, unlike a Corrective Deed, a Grant Deed does not specifically address or correct errors in prior documents.

Deed of Trust: Used in some states as an alternative to a mortgage, a Deed of Trust involves three parties: the borrower, the lender, and the trustee. It resembles a Corrective Deed in managing property-related documents, although its primary function is to secure a loan with the property, not to correct previous document mistakes.

Special Warranty Deed: This document, while transferring property rights between parties, only guarantees the title against claims arising during the seller's ownership period. Similar to a Corrective Deed, it deals with the property title but does not address errors from all previous owners.

Assignment of Mortgage: It transfers mortgage obligations from the original borrower to another party. While not directly related to property ownership like a Corrective Deed, it involves the transfer of significant legal documents and rights, focusing on debts rather than ownership rights.

Reconveyance Deed: This document is used when a mortgage has been paid off in full, releasing the borrower from the deed of trust. Like a Corrective Deed, a Reconveyance Deed addresses changes in the legal status of property documents, specifically marking the end of the lien against the property.

Transfer on Death Deed (TODD): Enables property owners to name a beneficiary who will receive the property upon the owner's death, bypassing probate. It shares with the Corrective Deed the aspect of changing property ownership through documentation, though its specific purpose is to plan for the transfer of ownership after the owner's death, not to correct errors.

Dos and Don'ts

When preparing a Corrective Deed form, ensuring accuracy and compliance with legal requirements is crucial. Below are key dos and don'ts to consider:

Dos:Double-check all the property and personal information for accuracy. This includes the legal description of the property, the names of the grantor and grantee, and any other relevant details.

Make sure you reference the original deed. This involves including the date of the original deed and the recorder's information, such as the book and page number where it was filed.

Clearly state the purpose of the Corrective Deed. Be specific about what errors are being corrected.

Obtain signatures from all necessary parties. Depending on your state's laws, this may include not just the grantor, but also witnesses or a notary public.

Consult with a professional if you're unsure. This can be a real estate attorney or a legal document preparer who is familiar with your state's regulations.

Use the correct deed form that applies to your situation based on local laws.

File the Corrective Deed with the appropriate county office to ensure it becomes part of the public record.

Don’t overlook mistakes in the legal description of the property. This is often the reason a Corrective Deed is needed, to begin with.

Don't use unclear or ambiguous language when describing what is being corrected.

Avoid skipping the inclusion of original recording information. Failing to do so can lead to questions regarding the deed's validity.

Don't leave out any necessary signatures, as this can invalidate the deed.

Never assume state laws do not apply to your situation. Real estate laws vary widely across jurisdictions.

Don't use a generic deed form without verifying it meets local legal requirements.

Do not delay in filing the Corrective Deed. Timely recording is crucial to ensure the correction is acknowledged and effective.

Misconceptions

When discussing the topic of Corrective Deed Forms, several misconceptions frequently arise. These misunderstandings can complicate what is usually a straightforward process. By addressing these misconceptions directly, clarity can be brought to the purpose and use of Corrective Deeds in rectifying errors in previously recorded deeds.

- Misconception #1: A Corrective Deed changes the original transaction details. In truth, a Corrective Deed is intended to correct minor mistakes such as typos, misspellings, or incorrect property descriptions in the original deed without altering the essence of the transaction.

- Misconception #2: Getting a Corrective Deed is an admission of legal wrongdoing. This belief is unfounded; obtaining a Corrective Deed is merely a step towards ensuring that all recorded information reflects the true intention of the property transfer. It is more procedural than adversarial.

- Misconception #3: A Corrective Deed can be used to change ownership. The purpose of a Corrective Deed is not to transfer property but to correct errors in a previously executed and recorded deed. Any change of ownership requires a new deed.

- Misconception #4: Corrective Deeds are only necessary for large errors. Even small errors, such as a misspelled name or an incorrect lot number, can create ambiguities about property ownership and boundaries, necessitating a Corrective Deed for clarity and legal accuracy.

- Misconception #5: The process for filing a Corrective Deed is complicated and time-consuming. While the process involves precise steps, such as drafting the Corrective Deed, obtaining necessary signatures, and recording the deed with the appropriate county office, it is generally straightforward. Professional assistance can also simplify this process.

- Misconception #6: Once a Corrective Deed is filed, the original deed is voided. Filing a Corrective Deed does not void the original deed; instead, it corrects the specific error listed and becomes part of the public record alongside the original deed, clarifying the proper information.

- Misconception #7: Only the property seller can initiate a Corrective Deed. While it's common for the seller to take the lead in correcting a deed, any party to the original transaction, including the buyer or even a title insurance company, may identify the need for a correction and initiate the process of drafting and recording a Corrective Deed.

- Misconception #8: A Corrective Deed offers the same protections as a warranty deed. While a Corrective Deed can correct errors in a previously recorded deed, it does not offer new warranties regarding the title. It merely amends the existing deed to ensure the information is accurate and reflects the original intention of the parties involved.

Understanding these misconceptions about Corrective Deeds is crucial for anyone involved in property transactions. Knowledge ensures that the steps taken to correct deed errors are done with confidence and legal precision, maintaining the integrity of property records.

Key takeaways

When dealing with real estate transactions, the Corrective Deed form plays a crucial role in amending errors found in previously recorded deeds. It serves as a legal tool to correct mistakes such as typographical errors, incorrect property descriptions, or omissions of crucial information. Understanding how to properly fill out and use this document can ensure the conveyance of property titles is executed correctly and legally. Below are key takeaways regarding the Corrective Deed form:

- Before filling out the Corrective Deed form, identify the specific error(s) in the original deed that need correction. Common errors include misspelled names, incorrect property descriptions, or wrong book and page numbers of the recorded deed.

- Ensure that all parties involved in the original deed are also parties to the Corrective Deed. This includes the grantor(s) and grantee(s), as their signatures will be necessary to legalize the correction.

- The Corrective Deed must reference the original deed by its recording date, and book and page number, or any other identifying information to ensure clear connection and traceability between the documents.

- Detail the correction being made in a clear and concise manner. It's critical to specify exactly what is being corrected without leaving room for ambiguity.

- Like any legal document related to property, the Corrective Deed must be signed in the presence of a notary public to ensure its authenticity and legality.

- Once fully executed, the Corrective Deed must be recorded with the same county recorder's office where the original deed was filed. This step is vital to make the correction part of the public record, legally correcting the previous deed.

- Recording fees may apply when filing the Corrective Deed, so it’s important to check with the local recording office regarding any applicable fees to ensure proper submission.

- Keep copies of the Corrective Deed for all parties involved, including a recorded copy for personal records. This ensures that everyone has evidence of the correction should any disputes arise in the future.

- Seek legal advice if unsure about the process. Given the legal implications of real estate documents and corrections, consulting with a legal professional can provide guidance tailored to the specific situation, ensuring the Corrective Deed is correctly filled out and submitted.

Correcting a deed through a Corrective Deed form is a critical step in ensuring the accuracy of property records, thereby protecting the rights and interests of all parties involved. Paying attention to detail and following the local guidelines for submission can prevent future complications related to property ownership and title transfers.

Discover Other Types of Corrective Deed Documents

How Long Does a Quit Claim Deed Take to Process - This document acts as a legal tool to release an individual's interest in a property to another person.