Legal Deed in Lieu of Foreclosure Form

When homeowners find themselves in the precarious position of not being able to make mortgage payments, they are faced with several unnerving prospects, one of which includes the foreclosure of their home. In such challenging times, a Deed in Lieu of Foreclosure offers a semblance of control and an alternative solution. This legal document represents a mutual agreement between the lender and borrower, wherein the borrower voluntarily transfers ownership of the property back to the lender. This process, though seemingly straightforward, encompasses various critical aspects including the impact on the borrower’s credit score, potential tax implications, and the possibility of being released from the obligation to pay the remaining balance on the mortgage, commonly referred to as the deficiency. Fully understanding this form requires a comprehensive look into its prerequisites, such as the necessity for both parties to agree to the terms, the lender’s inclination to accept the property as a means to mitigate their losses, and the thorough evaluation of the property's value. Through this lens, individuals are better equipped to navigate the complexities of managing their financial hardship while possibly avoiding the more severe consequences of foreclosure.

State-specific Deed in Lieu of Foreclosure Forms

Example - Deed in Lieu of Foreclosure Form

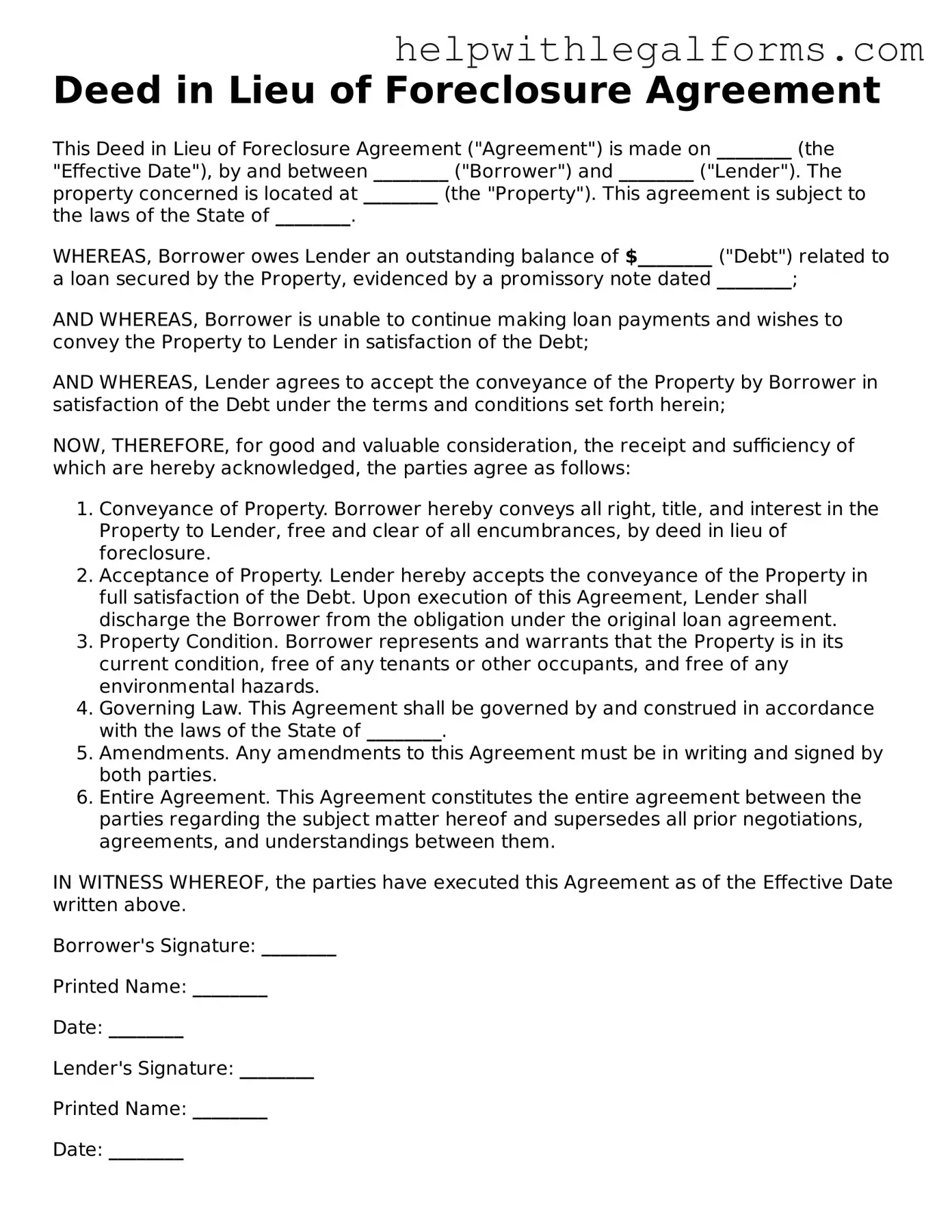

Deed in Lieu of Foreclosure Agreement

This Deed in Lieu of Foreclosure Agreement ("Agreement") is made on ________ (the "Effective Date"), by and between ________ ("Borrower") and ________ ("Lender"). The property concerned is located at ________ (the "Property"). This agreement is subject to the laws of the State of ________.

WHEREAS, Borrower owes Lender an outstanding balance of $________ ("Debt") related to a loan secured by the Property, evidenced by a promissory note dated ________;

AND WHEREAS, Borrower is unable to continue making loan payments and wishes to convey the Property to Lender in satisfaction of the Debt;

AND WHEREAS, Lender agrees to accept the conveyance of the Property by Borrower in satisfaction of the Debt under the terms and conditions set forth herein;

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

- Conveyance of Property. Borrower hereby conveys all right, title, and interest in the Property to Lender, free and clear of all encumbrances, by deed in lieu of foreclosure.

- Acceptance of Property. Lender hereby accepts the conveyance of the Property in full satisfaction of the Debt. Upon execution of this Agreement, Lender shall discharge the Borrower from the obligation under the original loan agreement.

- Property Condition. Borrower represents and warrants that the Property is in its current condition, free of any tenants or other occupants, and free of any environmental hazards.

- Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of ________.

- Amendments. Any amendments to this Agreement must be in writing and signed by both parties.

- Entire Agreement. This Agreement constitutes the entire agreement between the parties regarding the subject matter hereof and supersedes all prior negotiations, agreements, and understandings between them.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the Effective Date written above.

Borrower's Signature: ________

Printed Name: ________

Date: ________

Lender's Signature: ________

Printed Name: ________

Date: ________

PDF Form Attributes

| Fact Number | Description |

|---|---|

| 1 | A Deed in Lieu of Foreclosure is a document that allows a homeowner to transfer the ownership of their property to the lender to avoid the foreclosure process. |

| 2 | This form is used as an alternative to foreclosure, providing a way for both lender and borrower to minimize financial loss and legal expenses. |

| 3 | When a Deed in Lieu of Foreclosure is completed, the borrower is typically released from their mortgage debt obligation. |

| 4 | State-specific laws govern the execution, requirements, and implications of a Deed in Lieu of Foreclosure, making it important to consult local regulations. |

| 5 | Before acceptance, lenders may require a detailed financial package from the borrower, including a hardship letter explaining the borrower's inability to pay the mortgage. |

| 6 | Both parties should agree on how to report the deed to credit bureaus, as it can negatively affect the borrower's credit score. |

| 7 | It's essential for the borrower to seek legal advice before entering into a Deed in Lieu of Foreclosure agreement to understand all potential consequences. |

| 8 | Some states may impose a redemption period, allowing the borrower to reclaim the property under certain conditions after a Deed in Lieu of Foreclosure is executed. |

Instructions on How to Fill Out Deed in Lieu of Foreclosure

Completing a Deed in Lieu of Foreclosure form is an essential step for homeowners who have mutually agreed with their lender to transfer the property back to avoid foreclosure. This form, part of a legal procedure, requires detail and attention for accurate completion. The process can seem daunting, but with the right guidance, it is manageable. Below is a straightforward, step-by-step guide designed to assist you in filling out this form correctly.

- Identify the involved parties: Start by writing the full legal name of the borrower (you, the homeowner) and the lender (the bank or financial institution).

- Property Description: Carefully describe the property being transferred. This should include the physical address, county, and any legal descriptions that uniquely identify the property according to local property records.

- Document Reference Information: If your current mortgage deed or any related documents have identification numbers or book and page numbers recorded in the county records, include these details. This ensures a clear reference to the agreement being resolved.

- Date of Agreement: Enter the date on which the agreement for the deed in lieu of foreclosure is made.

- Statement of Intent: Write a clear statement indicating that the borrower is transferring the property to the lender willingly, in lieu of going through the foreclosure process.

- Acknowledgement of Debt: Confirm the amount of debt that is being settled by transferring the property back to the lender.

- Notarization: Sign the document in the presence of a notary public. The notary will verify your identity, witness your signature, and append his or her seal, making the document legally binding.

- Witnesses: Depending on your state’s requirement, you may need to have one or two witnesses sign the form. Check local laws to ensure you meet this requirement.

- Submission: Contact your lender for instructions on where to submit the completed form. This might be directly to the lender or to a specific attorney's office handling the case.

After completing and submitting the Deed in Lieu of Foreclosure form, your lender will process the submission and initiate any necessary follow-ups to finalize the transfer of property. It's essential to keep a copy of all documents for your records. Should questions arise later, these documents will be crucial for reference. Completing this form does not immediately resolve the entirety of your mortgage situation, but it is a significant step forward in settling your obligations and moving on from the property in question.

Crucial Points on This Form

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal document in which a homeowner voluntarily transfers ownership of their property to the lender to avoid foreclosure. This means instead of the lender going through the lengthy and costly process of foreclosing on the property, the homeowner agrees to give up their rights to the property, effectively bypassing the foreclosure process.

When should a homeowner consider a Deed in Lieu of Foreclosure?

Homeowners might consider a Deed in Lieu of Foreclosure when they are unable to make mortgage payments and foresee no viable way to continue doing so. It's often viewed as a last resort after options like loan modifications or selling the home have been explored and deemed unfeasible.

What are the benefits of a Deed in Lieu of Foreclosure for the homeowner?

For the homeowner, a Deed in Lieu of Foreclosure can reduce the emotional and financial stress of going through a foreclosure. It usually results in a less severe credit impact than a foreclosure and can sometimes include negotiations that absolve the homeowner of any further financial obligations related to the mortgage.

Are there any drawbacks to a Deed in Lieu of Foreclosure?

Yes, there are drawbacks. Accepting a Deed in Lieu of Foreclosure can still negatively impact a homeowner's credit score, though typically less than a foreclosure would. Additionally, not all lenders agree to a Deed in Lieu of Foreclosure, and there may be tax implications, as the debt relief could be considered taxable income.

How does a Deed in Lieu of Foreclosure affect a homeowner's credit score?

The impact on a homeowner's credit score can vary, but a Deed in Lieu of Foreclosure generally results in a significant negative mark. However, this mark is often less damaging than a foreclosure record. The homeowner's credit history leading up to the deed transfer also plays a significant role in the overall impact.

What steps are involved in the process of a Deed in Lieu of Foreclosure?

The process typically begins with the homeowner contacting the lender to express interest in a Deed in Lieu of Foreclosure. Documentation proving the homeowner's financial hardship is required. The lender then assesses the property value and checks for any secondary liens. If the lender agrees to proceed, both parties will work out the terms, and the homeowner will transfer the property title to the lender.

Can a lender refuse a Deed in Lieu of Foreclosure?

Yes, a lender can refuse a Deed in Lieu of Foreclosure. The decision often depends on whether the lender believes this option is in their best financial interest. Factors include the current value of the property, the amount owed on the mortgage, and the likelihood of recouping their investment through a foreclosure auction.

Is a homeowner liable for any outstanding mortgage balance after a Deed in Lieu of Foreclosure?

It depends on the terms negotiated with the lender. In some cases, the lender may agree to forgive any outstanding balance on the mortgage, known as a "deficiency waiver." However, without such an agreement, the homeowner could be held responsible for the remaining balance.

What legal advice should be sought regarding a Deed in Lieu of Foreclosure?

It's highly recommended that homeowners consult with a real estate attorney or legal advisor familiar with foreclosure laws in their state. An attorney can provide guidance on the potential implications of a Deed in Lieu of Foreclosure, negotiate with the lender on behalf of the homeowner, and ensure that the legal documents protect the homeowner's interests.

Common mistakes

When individuals face the challenge of filling out the Deed in Lieu of Foreclosure form, mistakes can easily be made. This form represents a legal agreement where a homeowner voluntarily transfers their property deed to the lender to avoid foreclosure. Understanding and avoiding common errors can streamline the process, ensuring a smoother transition for both parties. Here are six frequently made mistakes:

- Not Reviewing the Lender's Requirements Carefully: Lenders may have specific requirements or conditions that need to be fulfilled before accepting a Deed in Lieu of Foreclosure. Overlooking these requirements can lead to delays or rejection of the application.

- Failure to Consult with a Legal Professional: The process involves significant legal and financial implications. Not seeking advice from a legal professional can result in misunderstandings of one's rights and obligations, leading to potential future issues.

- Ignoring Potential Tax Implications: There can be tax consequences for the homeowner after completing a Deed in Lieu of Foreclosure. Not understanding or planning for these implications can lead to unexpected financial burdens.

- Omitting Important Information: Completing the form requires detailed and accurate information about the property and the homeowner's financial situation. Leaving out critical information or making unintentional errors can hinder the process.

- Not Negotiating the Terms: Homeowners may assume the terms presented by their lender are non-negotiable. However, there is often room for negotiation, particularly regarding the deficiency balance or other terms of the agreement.

- Failing to Secure a Release of Liability: Without a written agreement that releases the homeowner from liability for any remaining mortgage balance, they may still be responsible for the difference between the mortgage balance and the property's value.

Various other considerations also come into play, but avoiding these six common mistakes can significantly affect an individual's ability to successfully navigate the process. Here are some additional points to be mindful of:

- Ensure all negotiations and agreements with the lender are documented in writing.

- Verify that the deed transfer is correctly recorded with the local government to avoid future legal complications.

- Keep copies of all documents and correspondence related to the deed in lieu of foreclosure for personal records.

Treating the Deed in Lieu of Foreclosure process with care and diligence is crucial for homeowners seeking relief from their mortgage obligations. This approach not only facilitates a smoother process but also helps in protecting one's financial future.

Documents used along the form

When navigating the process of transferring property ownership to avoid foreclosure, utilizing a Deed in Lieu of Foreclosure form is a significant step. However, this form is often just one part of a larger packet of necessary documents. These additional forms play critical roles in ensuring the process is thorough, legally compliant, and clear to all parties involved. For individuals or entities facing the often stressful scenario of foreclosure, understanding these supplemental documents is key to a smoother transition and can offer some peace of mind during challenging times.

- Hardship Letter: This document is a personal letter written by the homeowner explaining the circumstances that led to their financial difficulties. It offers context to the lender about why the Deed in Lieu of Foreclosure is being requested and provides a human element to the proceedings, potentially making the lender more receptive to the proposal.

- Financial Statements and Proof of Income: These documents include detailed financial statements and proof of income to demonstrate the homeowner's inability to meet mortgage payments. Lenders require this information to verify the financial distress claim and assess whether a Deed in Lieu of Foreclosure is the most suitable course of action.

- Agreement of Understanding or Settlement Agreement: This comprehensive document outlines the terms and conditions agreed upon by the homeowner and the lender. It includes vital information such as any continuing liabilities, tax implications, and the official transfer of property ownership. Ensuring clarity and mutual understanding in this agreement can prevent future disputes or misunderstandings.

- Estoppel Affidavit: An Estoppel Affidavit is signed by the homeowner, confirming that they are acting voluntarily, without duress, and fully understand the terms of the Deed in Lieu of Foreclosure. This legal document is crucial for protecting both parties by affirming that all terms have been disclosed and agreed upon willingly.

Successfully navigating a Deed in Lieu of Foreclosure requires more than just a single form; it requires a holistic approach to documentation and communication. By understanding and preparing the necessary supplementary documents, individuals can ensure a more effective and seamless process. It's essential to approach these matters with care, attention to detail, and, where possible, the guidance of legal professionals to safeguard one's interests and future.

Similar forms

A Loan Modification Agreement is similar to a Deed in Lieu of Foreclosure form because both serve as alternatives to foreclosure. A Loan Modification Agreement alters the original terms of a mortgage to make it more manageable for the borrower, aiming to prevent the lender from repossessing the property. Just like a Deed in Lieu of Foreclosure, it offers a way to address financial distress related to a mortgage without going through a full foreclosure process.

A Short Sale Agreement shares similarities with a Deed in Lieu of Foreclosure form as both are options for homeowners facing foreclosure. In a short sale, the property is sold for less than the amount owed on the mortgage with the lender’s approval. This route, like a Deed in Lieu, allows the homeowner to avoid the negative impacts of a foreclosure by managing the debt in a less damaging way.

A Mortgage Release (Deed-in-Lieu of Foreclosure) is directly related to a Deed in Lieu of Foreclosure form, essentially being another term for the same legal process. This document formalizes the agreement between the borrower and the lender, where the borrower transfers the property title back to the lender to satisfy a loan that is in default and avoid foreclosure proceedings.

A Forbearance Agreement is akin to a Deed in Lieu of Foreclosure form in its purpose to prevent foreclosure. It allows borrowers facing temporary financial difficulties to reduce or suspend payments for a set period. Although it doesn't result in the transfer of property like a Deed in Lieu, it represents another strategy lenders and borrowers can use to manage loan default risks.

Dos and Don'ts

When you're faced with the possibility of losing your home, a Deed in Lieu of Foreclosure can offer a more graceful exit than going through the foreclosure process. But it's crucial to approach this document with care. Here's a straightforward guide on what you should and shouldn't do when filling out a Deed in Lieu of Foreclosure form.

What You Should Do

- Verify all property information is accurate, including the legal description of the property and your full, legal name as the property owner.

- Contact your lender to discuss the possibility of a Deed in Lieu of Foreclosure as an option for you. Communication is key.

- Seek advice from a legal professional or a housing counselor to understand the potential impacts on your finances and credit score.

- Gather and review all financial documents that demonstrate your current financial hardship. Be prepared to share these with your lender.

- Ensure the form is notarized, if required, to confirm its authenticity.

What You Shouldn't Do

- Don't sign the form without thoroughly understanding every term and condition; ask questions if something isn't clear.

- Don't omit any information that the form requests. Incomplete forms might be rejected or delay the process.

- Don't wait too long to submit the form after you've filled it out. Timeliness can be crucial in these situations.

- Don't ignore potential tax implications. A Deed in Lieu of Foreclosure might have consequences for your tax situation.

- Don't forget to confirm the receipt of the document by your lender, to ensure it doesn't get lost in the shuffle.

Misconceptions

Many homeowners facing financial difficulties often consider a Deed in Lieu of Foreclosure as a viable option to avoid the foreclosure process. However, there are several misconceptions surrounding this legal agreement that can lead to confusion. Here are six common misconceptions explained:

- It completely absolves the borrower of all financial liabilities: While a Deed in Lieu of Foreclosure can help avoid the foreclosure process, it doesn’t always mean that the borrower is free from all financial obligations. In some cases, if the property’s sale does not cover the outstanding loan balance, the lender may have the right to pursue a deficiency judgment.

- It is an easy process: Opting for a Deed in Lieu of Foreclosure might seem straightforward, but it involves a significant amount of negotiation and legal documentation. Both parties must agree to the terms, and lenders often require extensive paperwork and proof of the borrower’s financial hardship.

- It is available to all borrowers facing foreclosure: Not all borrowers will qualify for a Deed in Lieu of Foreclosure. Lenders consider this option based on the borrower's financial situation, the condition of the property, and whether any junior liens exist on the property. Lenders are not obligated to agree to a Deed in Lieu of Foreclosure simply because a borrower requests it.

- It has no impact on the borrower’s credit score: Though not as severe as a foreclosure, a Deed in Lieu of Foreclosure will still negatively impact a borrower’s credit score. It’s considered a settlement where the borrower could not fulfill their mortgage obligations, and this will reflect on their credit report for years.

- It automatically releases the borrower from the responsibility of property taxes: The agreement for a Deed in Lieu of Foreclosure primarily concerns the mortgage and the home itself. Unless explicitly stated in the agreement, any unpaid property taxes may still be the responsibility of the borrower. It's essential to address all aspects of property ownership and liabilities in the agreement.

- It’s the only alternative to foreclosure: Many borrowers believe that a Deed in Lieu of Foreclosure is their only alternative to facing foreclosure. However, there are other options such as loan modification, refinancing, or even bankruptcy that might be more suitable depending on the borrower's specific financial situation and objectives.

Understanding these misconceptions is crucial for homeowners who might be considering a Deed in Lieu of Foreclosure. It’s always recommended to seek the advice of a legal advisor to explore all possible options and to ensure that any agreement made is in the homeowner's best interest.

Key takeaways

Understanding the Deed in Lieu of Foreclosure (DIL) process is critical for homeowners facing financial difficulties. This option allows a borrower to transfer ownership of their property to the lender voluntarily, avoiding the lengthy and costly process of foreclosure. Here are key takeaways to ensure the form is completed and used effectively:

- Accuracy is Crucial: When filling out the DIL form, details matter. Ensure that all information is accurate, including personal details, the property description, and the loan account number. Inaccuracies can delay the process or invalidate the document.

- Negotiate Terms: Before agreeing to a DIL, discuss any potential terms with the lender. These could include forgiveness of any deficiency balance or a timeline for vacating the property. Understand these terms fully before proceeding.

- Seek Legal Advice: Legal guidance is invaluable in these situations. An attorney can help navigate the complexities of a DIL, review the agreement, and ensure that your rights are protected throughout the process.

- Documentation is Key: Keep meticulous records of all communication and documentation related to the DIL. This includes correspondence with the lender, the completed DIL form, and any additional agreements made. These records can be crucial if disputes arise.

- Understand the Impact: A DIL can have significant implications for your credit score and tax obligations. While it may not be as detrimental as a foreclosure, it will still affect your ability to borrow in the future. Discuss these impacts with a financial advisor.

Proceeding with a Deed in Lieu of Foreclosure is a significant decision that can offer relief to homeowners in distress. However, it's important to approach this option with caution, understanding all legal and financial implications. By paying attention to the details and seeking the appropriate advice, homeowners can navigate this process more effectively.

Discover Other Types of Deed in Lieu of Foreclosure Documents

Life Estate Deed Example - The deed ensures that property is directly transferred to the intended individuals, helping to avoid potential family disputes over inheritance.

Deed of Trust Form - This legally binding document ensures that a neutral third party can act on behalf of the lender in case of borrower default.

Corrective Deed California - This document underscores the importance of attention to detail in legal documents, which can otherwise lead to significant challenges.