Blank Deed in Lieu of Foreclosure Form for California

In California, homeowners facing the possibility of losing their homes due to financial difficulties have several options available to them, one being the Deed in Lieu of Foreclosure. This particular option offers a dignified exit for those who can no longer afford to keep up with mortgage payments. Essentially, it allows the homeowner to transfer the ownership of the property back to the lender voluntarily, thereby avoiding the traditional foreclosure process. Although this may seem like a straightforward solution, it's important to understand the implications, such as potential impacts on credit scores and tax consequences. Additionally, not everyone qualifies for this process, as lenders have specific requirements that must be met. It's also worth noting that agreements of this nature should be handled with care, often requiring legal documentation and guidance to ensure that the rights of all parties involved are protected. Given these points, it's clear that while the Deed in Lieu of Foreclosure form represents an opportunity for those struggling with their mortgage, it also necessitates a thorough understanding and careful consideration.

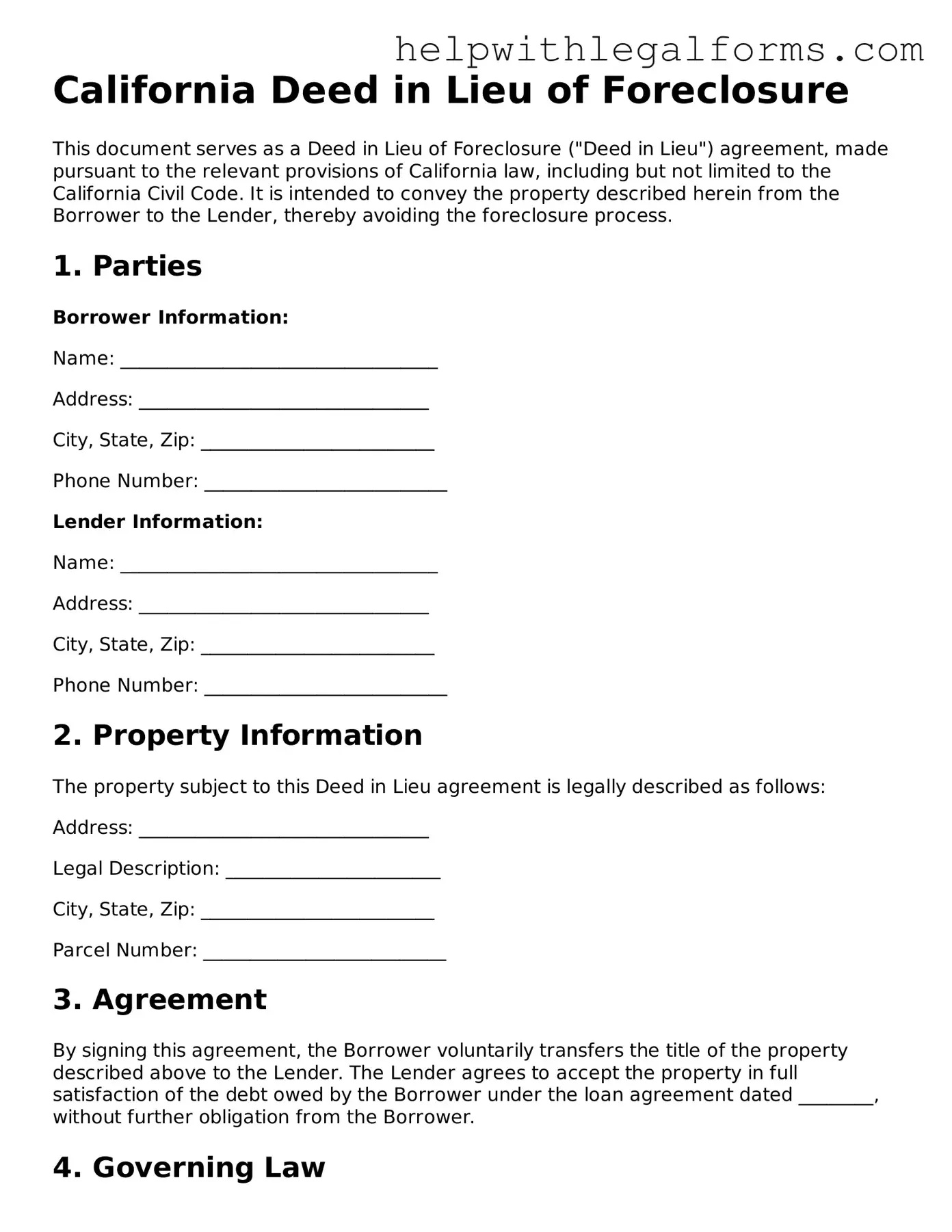

Example - California Deed in Lieu of Foreclosure Form

California Deed in Lieu of Foreclosure

This document serves as a Deed in Lieu of Foreclosure ("Deed in Lieu") agreement, made pursuant to the relevant provisions of California law, including but not limited to the California Civil Code. It is intended to convey the property described herein from the Borrower to the Lender, thereby avoiding the foreclosure process.

1. Parties

Borrower Information:

Name: __________________________________

Address: _______________________________

City, State, Zip: _________________________

Phone Number: __________________________

Lender Information:

Name: __________________________________

Address: _______________________________

City, State, Zip: _________________________

Phone Number: __________________________

2. Property Information

The property subject to this Deed in Lieu agreement is legally described as follows:

Address: _______________________________

Legal Description: _______________________

City, State, Zip: _________________________

Parcel Number: __________________________

3. Agreement

By signing this agreement, the Borrower voluntarily transfers the title of the property described above to the Lender. The Lender agrees to accept the property in full satisfaction of the debt owed by the Borrower under the loan agreement dated ________, without further obligation from the Borrower.

4. Governing Law

This Deed in Lieu shall be governed by and construed in accordance with the laws of the State of California.

5. Signatures

The parties agree to this Deed in Lieu of Foreclosure as of the dates written below.

Borrower's Signature: ____________________________ Date: ________

Lender's Signature: ______________________________ Date: ________

6. Acknowledgment

This document was acknowledged before me on ________ by the following:

Name: __________________________________ (Borrower)

Name: __________________________________ (Lender)

Notary Public: ____________________________

Commission Number: ______________________

My commission expires on: ________________

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a document where a borrower voluntarily transfers property ownership to a lender to satisfy a loan that is in default and avoid foreclosure. |

| Governing Law | In California, Deeds in Lieu of Foreclosure are governed by the state's Civil Code and foreclosure law provisions. |

| Benefits for Borrower | It may reduce the financial impact compared to a foreclosure, potentially avoiding additional fees and the public nature of foreclosure proceedings. |

| Benefits for Lender | Lenders can recover the property faster and at a lower cost than going through a traditional foreclosure process. |

| Considerations | Both parties should consider potential tax implications, the ability to negotiate any deficiency judgments, and effects on credit history. |

Instructions on How to Fill Out California Deed in Lieu of Foreclosure

Filling out a Deed in Lieu of Foreclosure form in California is a significant step for homeowners who are considering an alternative to foreclosure. This legal process allows the homeowner to transfer the ownership of their property to the lender voluntarily. It's a decision that comes at a challenging time, and knowing the correct way to fill out the form can make the process smoother. Below, you will find a step-by-step guide designed to help you complete the form accurately. After the form is filled out and submitted, the next steps will involve the lender reviewing the agreement. If the lender accepts the deed, the foreclosure process will be halted, and the property ownership will transfer to the lender as agreed.

- Begin by locating the official California Deed in Lieu of Foreclosure form. Ensure you have the most up-to-date version by visiting your lender's website or contacting them directly.

- Read the entire form carefully before filling out any information. Understanding every section will help prevent mistakes and ensure that you fully comprehend the agreement you are entering into.

- Enter the legal name(s) of the property owner(s) as listed on the property title in the space provided. This includes any middle names or initials.

- Provide the complete address of the property, including city, county, and zip code. It's crucial this matches the address as listed on your mortgage documents.

- Fill in the legal description of the property. This information can be found on your original mortgage documents or property deed. The legal description is detailed and should include lot numbers, tract number, and any other identifying information.

- Input the name of the lender (the beneficiary of the deed) in the designated area. Make sure to use the full legal name of the lending institution.

- Sign and date the form in the presence of a notary public. The notary public must witness your signature and sign the form themselves, providing their seal as authentication of the document.

- Submit the completed form to the lender according to their instructions. This may involve mailing it to a specific address, delivering it in person, or submitting it electronically, depending on the lender's requirements.

Once you've completed these steps, your role in the process of transferring your property in lieu of foreclosure to the lender is complete. It's important to keep a copy of the form for your records. The next steps will depend greatly on your lender, including their review of the deed and finalizing the transfer. During this time, maintaining communication with your lender and seeking advice from a legal advisor can provide support and guidance.

Crucial Points on This Form

What is a Deed in Lieu of Foreclosure in California?

A Deed in Lieu of Foreclosure is an alternative to the traditional foreclosure process, allowing a homeowner in California to voluntarily transfer ownership of their property to the lender. This action is typically taken to avoid the consequences of foreclosure. By choosing this path, the borrower can relieve themselves from the mortgage obligation when they're unable to continue making payments, potentially minimizing damage to their credit score compared to foreclosure.

How does a Deed in Lieu of Foreclosure affect my credit score?

While a Deed in Lieu of Foreclosure can still negatively impact your credit score, it is generally considered to be less damaging than a foreclosure. The degree to which your credit is affected depends on various factors, including your credit history and the reporting practices of your lender. It's important to consult with a financial advisor or a credit counseling service to understand the specific implications for your situation.

Can I apply for a Deed in Lieu of Foreclosure if there are other liens on my property?

Securing a Deed in Lieu of Foreclosure might be complex if there are additional liens against your property, such as second mortgages, home equity lines of credit (HELOCs), or judgment liens. Lenders typically require a clear title to accept a deed in lieu, meaning all other liens must be resolved or removed before proceeding. Sometimes, negotiations can lead to these lienholders releasing their claims, but each case varies.

What are the steps involved in applying for a Deed in Lieu of Foreclosure in California?

To start the process, homeowners should first contact their lender to express interest in pursuing a Deed in Lieu of Foreclosure. The lender will then provide specific requirements, which usually include a financial package submission demonstrating your inability to continue mortgage payments. This package contains financial statements, a hardship letter, and other relevant documents. If approved, both parties will agree on moving forward, leading to the signing of the necessary paperwork to transfer property ownership to the lender. Legal advice is highly recommended to navigate this process effectively.

Common mistakes

Filling out the California Deed in Lieu of Foreclosure Form requires careful attention to detail. Mistakes during this process can complicate a difficult situation. Here are some of the common errors people make:

Not consulting a legal or financial advisor before proceeding: Many property owners don’t seek professional advice, which can lead to misinformed decisions.

Incomplete or inaccurate information: Often, individuals leave fields blank or enter incorrect data, which can invalidate the document.

Failing to verify the outstanding mortgage balance: If the amount entered does not match the lender's records, it could lead to disputes or rejection of the form.

Omitting necessary attachments: Sometimes, individuals forget to include required documents, such as proof of financial hardship.

Not obtaining lender’s consent: A deed in lieu must be agreed upon by the lender; failing to secure this agreement renders the document ineffective.

Ignoring potential tax implications: Not considering the tax consequences of a deed in lieu can lead to unexpected financial burdens.

Overlooking liens or other encumbrances: If other liens exist against the property, they can complicate or nullify the agreement.

Signing without notarization: Many people overlook the need for a notary, which is essential to validate the document.

Incorrectly assuming the form will stop foreclosure immediately: Completing and submitting the form does not guarantee an immediate halt to foreclosure proceedings.

Being mindful of these errors and double-checking the form for accuracy and completeness can help prevent complications in the process of seeking relief through a deed in lieu of foreclosure.

Documents used along the form

In the process of managing a deed in lieu of foreclosure, various documents besides the primary form are necessary to ensure a thorough and legally sound transaction. These documents help in providing a comprehensive understanding, ensuring clarity, and addressing legal obligations for all parties involved. The list below covers some of the most commonly used documents alongside the California Deed in Lieu of Foreclosure form.

- Promissory Note: This is a written promise to pay a specified sum of money to another party under agreed terms. It outlines the borrower's obligation to repay the loan that led to the foreclosure situation.

- Loan Modification Agreement: If the borrower and lender agree to modify the terms of the existing loan to avoid foreclosure, this document outlines the new terms and conditions.

- Foreclosure Counseling Notice: The borrower might be required to receive counseling about foreclosure alternatives. This document verifies that such counseling has occurred.

- Estoppel Affidavit: Both the borrower and lender may execute this document, which clarifies the current status of the mortgage, confirms the absence of any defenses to foreclosure, and may detail the agreement concerning the deed in lieu.

- IRS Form 1099-A: This form is issued by the lender to report the acquisition or abandonment of secured property, which can have tax implications for the borrower.

- Warranty Deed: Although not always used in conjunction with a deed in lieu of foreclosure, a warranty deed may be executed to clear any remaining claims, liens, or encumbrances on the property.

- Rescission Agreement: This document offers a cooling-off period, allowing the borrower to rescind the deed in lieu of foreclosure agreement under certain conditions and within a specific timeframe.

- Deficiency Judgement Waiver: The lender may agree not to pursue a deficiency judgment against the borrower for any remaining debt that exceeds the property's value.

- Occupancy Agreement: If the borrower is allowed to remain in the property for a period post-transfer, this agreement outlines the terms of their occupancy.

Each of these documents plays a crucial role in the deed in lieu of foreclosure process, ensuring that both the borrower and lender are well-informed of their rights and obligations, and that the transaction serves the interests of both. Legal advice should always be sought to navigate the complexities of these documents and to tailor them to the specific circumstances of the loan and property involved.

Similar forms

-

Mortgage Agreement: Shares similarities with a Deed in Lieu of Foreclosure form as both documents deal with the terms and conditions related to a property's mortgage. However, while a Mortgage Agreement outlines the initial borrowing terms, a Deed in Lieu of Foreclosure involves the borrower transferring the property title back to the lender to avoid foreclosure.

-

Loan Modification Agreement: Like the Deed in Lieu of Foreclosure, this document alters the original terms of a mortgage. A Loan Modification Agreement aims to make mortgage payments more manageable for the borrower, often to avoid potential default or foreclosure, without transferring property ownership.

-

Short Sale Authorization Letter: This letter allows a mortgage borrower to sell their property for less than the outstanding mortgage balance with the lender's permission. It's similar to a Deed in Lieu of Foreclosure as both methods are used to avoid foreclosure when a borrower is unable to meet mortgage obligations. However, a Short Sale involves selling the property to a third party, whereas a Deed in Lieu transfers the property directly back to the lender.

-

Quitclaim Deed: Often used to transfer property rights between family members or to clear up title issues, a Quitclaim Deed is similar to a Deed in Lieu of Foreclosure in that it involves a property title transfer. The main difference lies in the purpose — a Quitclaim Deed does not necessarily relate to mortgage debt relief, whereas a Deed in Lieu directly addresses the avoidance of foreclosure.

Dos and Don'ts

When filling out the California Deed in Lieu of Foreclosure form, it is crucial to ensure accuracy and completeness to avoid potential complications or delays. Below are suggested dos and don'ts that can assist in navigating this process smoothly.

Do:

- Read the entire form thoroughly before beginning to fill it out, understanding each section's requirements.

- Use black or blue ink for clarity and better reproduction, if submitting a paper form.

- Provide accurate information about the property, including the legal description, which may require referencing the property's original deed.

- Ensure all parties involved, such as the borrower and lender, have their information correctly listed.

- Sign and date the form in the presence of a notary public to validate the document.

- Keep a copy of the completed form for personal records before submitting it.

- Verify that all involved parties receive a copy of the form, maintaining transparent communication.

- Consult with a legal professional or a real estate advisor if there are any uncertainties or questions about the form.

- Submit the form to the appropriate county office for recording, as required by law.

- Check for any county-specific requirements or additional forms that may need to be completed alongside the deed.

Don't:

- Leave any sections blank; if a section does not apply, note it as “N/A” (not applicable).

- Rush through filling out the form without verifying the accuracy of all information.

- Forget to notarize the document, as a lack of notarization could render the deed unenforceable.

- Ignore the legal implications of transferring property, including tax obligations and rights relinquishment.

- Use pencil or colors of ink that are not accepted for official documents, as these can cause issues with legibility or recording.

- Overlook the need to inform all lien holders about the deed in lieu of foreclosure arrangement.

- Mistype the legal description or any identifying property information, which can lead to disputes or rejection of the document.

- Assume the form submission completes the process without receiving confirmation from the county recorder’s office.

- Fail to seek advice when faced with legal jargon or complex terms that may affect the agreement's terms.

- Disregard state-specific laws and guidelines that govern the deed in lieu of foreclosure process in California.

Misconceptions

When it comes to managing the challenging scenario of avoiding foreclosure, many homeowners consider the option of a Deed in Lieu of Foreclosure. However, this process, particularly in California, is often misunderstood due to various misconceptions. Understanding these misconceptions is crucial for making informed decisions that align with one's financial and legal needs. Below are eight common misconceptions about the California Deed in Lieu of Foreclosure form explained to help clarify the facts.

It Automatically Wipes Out All Debt: Many believe that once a Deed in Lieu of Foreclosure is executed, the homeowner is completely free from all mortgage debt. This is not always the case. Depending on the agreement, some lenders may still require the payment of any deficiency balance, which is the difference between the home’s value and the remaining debt owed.

It’s a Quick Process: Some homeowners think that a Deed in Lieu of Foreclosure is a fast solution to avoid foreclosure. In reality, this process can be lengthy, often taking several months to negotiate and complete, as it involves detailed documentation and lender approval.

It’s Available to All Homeowners: Not every homeowner facing foreclosure will qualify for a Deed in Lieu of Foreclosure. Lenders typically require certain criteria to be met, including a clear title and that the homeowner has explored all other loss mitigation options. Lenders must also agree to accept the deed.

It Significantly Harms Your Credit Score: While it's true that a Deed in Lieu of Foreclosure can negatively impact your credit score, the effect is often less severe than a foreclosure. The impact varies depending on individual credit history and the presence of other financial challenges.

No Tax Implications: Some may incorrectly assume that a Deed in Lieu of Foreclosure has no tax consequences. However, if the lender forgives a portion of the debt, the homeowner may have to report this forgiven debt as taxable income, though exceptions and exclusions sometimes apply.

It Relieves You of Property Liabilities: While a Deed in Lieu can transfer ownership back to the lender, the homeowner may still be responsible for certain liabilities until the transfer is officially recorded, such as homeowners association fees or other property-related debts.

Lenders Always Prefer Foreclosure: Another misconception is that lenders would rather go through the foreclosure process than accept a Deed in Lieu of Foreclosure. In many cases, lenders prefer the latter as it can be more cost-effective and quicker than the former, despite involving negotiation and agreement on the terms.

All Lenders Follow the Same Process: Each lending institution may have its own specific requirements and processes for agreeing to a Deed in Lieu of Foreclosure. There is no one-size-fits-all approach, and homeowners should consult with their lender to understand the specific steps and documents required.

Understanding the complexities and addressing these misconceptions about the California Deed in Lieu of Foreclosure can empower homeowners to navigate this challenging process with more confidence and clarity. It emphasizes the importance of consulting legal and tax professionals to ensure that decisions are made based on accurate and personalized advice.

Key takeaways

Facing foreclosure can be a daunting experience for any homeowner. In California, one of the paths to mitigating this situation involves opting for a Deed in Lieu of Foreclosure. This legal instrument allows a homeowner to transfer the ownership of their property back to the lender, effectively avoiding the foreclosure process. While it may seem like a straightforward solution, there are several key takeaways to consider when filling out and using the California Deed in Lieu of Foreclosure form.

- Understand All Implications: Before proceeding, it's crucial for homeowners to fully comprehend the implications of a Deed in Lieu of Foreclosure. It's not just about transferring property to avoid foreclosure; it also affects one's credit score, potential tax implications, and possible deficiency judgments. Seeking advice from a legal expert can provide clarity on these matters.

- Eligibility and Lender Agreement: Not every homeowner is eligible for this option. Lenders have the discretion to accept or reject a Deed in Lieu of Foreclosure. The homeowner must negotiate with the lender, who must agree that this course of action is acceptable. This often involves demonstrating that selling the property is not viable due to market conditions or other factors.

- Completing the Form Accurately: When filling out the form, accuracy is paramount. This includes detailed information about the property, the homeowner, and the mortgage. Mistakes or omissions can delay or derail the process. Ensuring that the form is completed fully and accurately can help streamline the process.

- Seek Professional Assistance: Navigating the legal landscape of deeds and foreclosures can be challenging. It is advisable to seek the assistance of professionals—be it lawyers who specialize in real estate or financial advisors. They can provide invaluable guidance through the process, help negotiate terms with the lender, and ensure that all legal requirements are met.

In conclusion, opting for a Deed in Lieu of Foreclosure can offer a viable solution for homeowners looking to avoid the foreclosure process. However, it requires careful consideration, understanding of the legal and financial implications, and meticulous attention to detail when filling out the necessary documents. With the right guidance and knowledge, homeowners can navigate this process more effectively, potentially saving them time, preserving their credit rating to a certain extent, and offering a semblance of control over a difficult situation.

Create Other Deed in Lieu of Foreclosure Forms for US States

Foreclosure Georgia - It’s a strategic option that may preserve the homeowner's ability to obtain future loans by avoiding the severe impact of a foreclosure on credit history.

Will I Owe Money After a Deed in Lieu of Foreclosure - An agreement that enables borrowers to avoid the negative ramifications of foreclosure by surrendering the property voluntarily.