Blank Deed in Lieu of Foreclosure Form for Florida

In the state of Florida, homeowners facing the possibility of foreclosure due to financial hardship have the option to consider a Deed in Lieu of Foreclosure. This legal document serves as an alternative to the traditional foreclosure process, allowing the homeowner to transfer the ownership of their property back to the lender voluntarily. The agreement can provide a mutually beneficial resolution for both parties, potentially avoiding the lengthy and costly proceedings associated with foreclosure. It's pivotal for homeowners to understand the implications of this agreement, including the potential impact on credit scores, tax consequences, and the release of any remaining debt obligations. The form itself requires careful completion to ensure all legal requirements are met, terms are clearly defined, and both parties' interests are protected. Entering into a Deed in Lieu of Foreclosure in Florida necessitates a comprehensive understanding of the process, the conditions under which it is considered a viable option, and the legal protections available to both the borrower and lender. By opting for this route, individuals can seek to mitigate some of the financial and emotional strain that foreclosure can inflict.

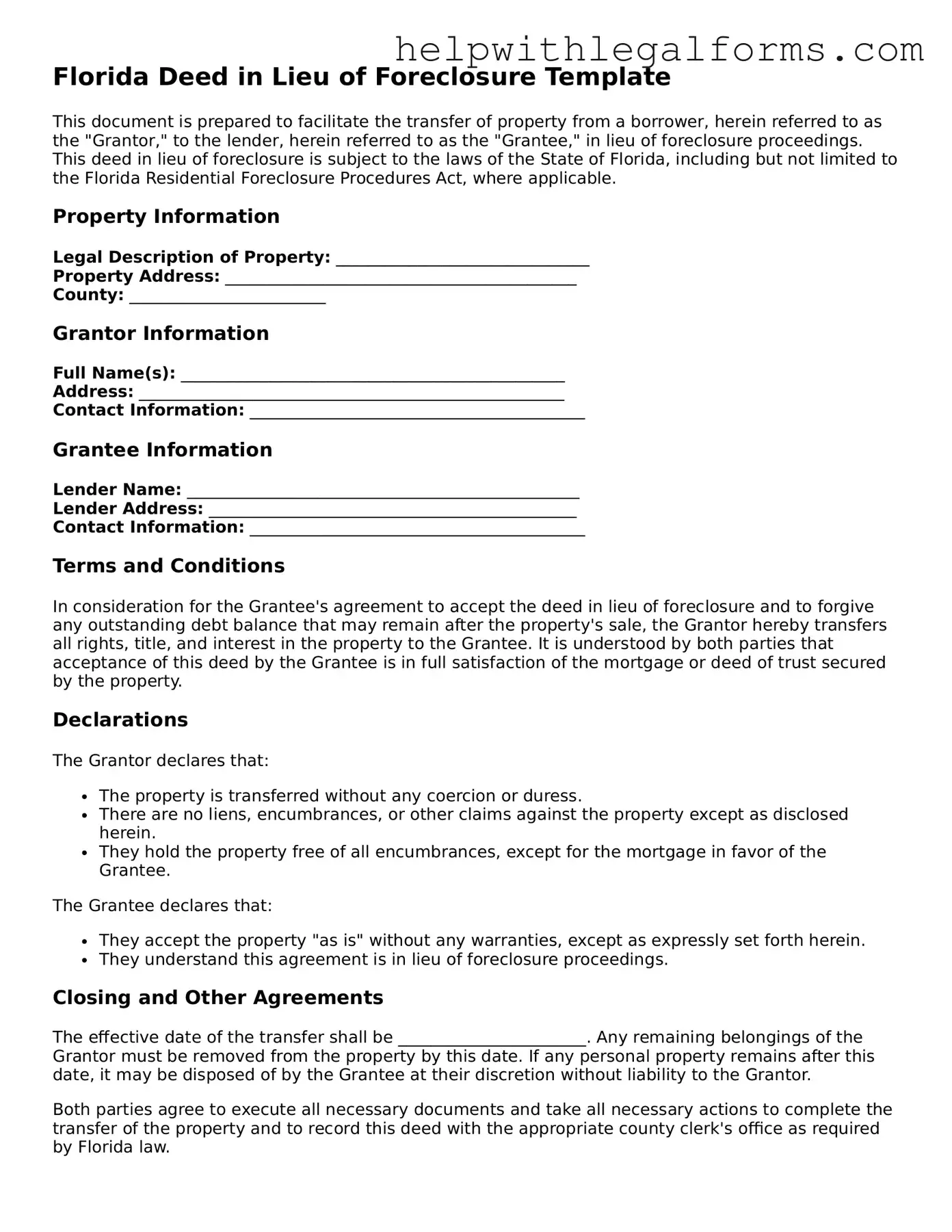

Example - Florida Deed in Lieu of Foreclosure Form

Florida Deed in Lieu of Foreclosure Template

This document is prepared to facilitate the transfer of property from a borrower, herein referred to as the "Grantor," to the lender, herein referred to as the "Grantee," in lieu of foreclosure proceedings. This deed in lieu of foreclosure is subject to the laws of the State of Florida, including but not limited to the Florida Residential Foreclosure Procedures Act, where applicable.

Property Information

Legal Description of Property: _______________________________

Property Address: ___________________________________________

County: ________________________

Grantor Information

Full Name(s): _______________________________________________

Address: ____________________________________________________

Contact Information: _________________________________________

Grantee Information

Lender Name: ________________________________________________

Lender Address: _____________________________________________

Contact Information: _________________________________________

Terms and Conditions

In consideration for the Grantee's agreement to accept the deed in lieu of foreclosure and to forgive any outstanding debt balance that may remain after the property's sale, the Grantor hereby transfers all rights, title, and interest in the property to the Grantee. It is understood by both parties that acceptance of this deed by the Grantee is in full satisfaction of the mortgage or deed of trust secured by the property.

Declarations

The Grantor declares that:

- The property is transferred without any coercion or duress.

- There are no liens, encumbrances, or other claims against the property except as disclosed herein.

- They hold the property free of all encumbrances, except for the mortgage in favor of the Grantee.

The Grantee declares that:

- They accept the property "as is" without any warranties, except as expressly set forth herein.

- They understand this agreement is in lieu of foreclosure proceedings.

Closing and Other Agreements

The effective date of the transfer shall be _______________________. Any remaining belongings of the Grantor must be removed from the property by this date. If any personal property remains after this date, it may be disposed of by the Grantee at their discretion without liability to the Grantor.

Both parties agree to execute all necessary documents and take all necessary actions to complete the transfer of the property and to record this deed with the appropriate county clerk's office as required by Florida law.

Signatures

In witness whereof, the parties have executed this deed in lieu of foreclosure on the dates written below.

Grantor Signature: ______________________________ Date: ________________

Grantee Signature: ______________________________ Date: ________________

PDF Form Attributes

| Fact Number | Fact Description |

|---|---|

| 1 | A Deed in Lieu of Foreclosure is a legal document in Florida that allows a borrower to transfer the ownership of their property back to the lender to avoid the foreclosure process. |

| 2 | This form is governed by Florida’s real estate and foreclosure laws, which are outlined in Chapters 702 to 704 of the Florida Statutes. |

| 3 | The document helps both the lender and borrower avoid the lengthy and costly process of foreclosure. |

| 4 | By accepting a Deed in Lieu of Foreclosure, the lender may forgive the remaining balance of the mortgage, but this is not guaranteed and depends on the agreement reached. |

| 5 | It is important for the borrower to ensure that the agreement with the lender includes a provision that the lender will not pursue a deficiency judgment for the difference between the sale price and the amount owed. |

| 6 | Filing the Deed in Lieu of Foreclosure needs to be done at the county recorder’s office where the property is located. |

| 7 | Before proceeding with a Deed in Lieu of Foreclosure, borrowers should seek advice from a legal advisor to understand the potential tax implications, as forgiveness of debt may be considered taxable income under federal law. |

| 8 | The process can be faster than foreclosure, allowing borrowers to more quickly alleviate the financial and emotional stress associated with losing a home. |

| 9 | This form must be completed accurately and comprehensively, ensuring all the legal descriptions of the property are clear and precise to avoid future disputes or legal issues. |

Instructions on How to Fill Out Florida Deed in Lieu of Foreclosure

When facing financial difficulties, some individuals may consider transferring their property to the lender as an alternative to foreclosure. If you reside in Florida, a Deed in Lieu of Foreclosure form is required for this process. This document serves as the agreement between you and the lender, where you voluntarily transfer the ownership of your property to avoid foreclosure proceedings. Completing this form accurately is crucial for a smooth transaction. Follow the steps below to ensure that the form is filled out correctly.

- Start by gathering all necessary information about the property, including its legal description, property address, and parcel identification number. This information can usually be found on your property tax statement or original mortgage documents.

- Identify the current owner(s) of the property as listed on the title. Make sure to spell all names correctly as they appear on the public record.

- Fill in the name(s) of the mortgage lender or financial institution that is accepting the deed in lieu of foreclosure. Verify the accurate legal name of the institution.

- Include the date the agreement is being made. This date indicates when you are transferring the property rights to the lender.

- Determine the consideration, which is the amount the lender agrees to accept the deed for. Often, this is the amount owed on the mortgage, but it may vary. Ensure this amount is clearly stated in the form.

- Accurately describe the property in the designated section. Use the legal description from your property documents, not just the street address. This description should match the one used in your original mortgage or deed.

- Review the form for a section dedicated to signatures. Make sure that all parties required to sign the Deed in Lieu of Foreclosure do so. This typically includes all listed property owners and an authorized representative from the lender.

- Check if the form requires notarization. If so, do not sign the form until you are in front of a Notary Public. The notary will witness the signatures and seal the document, making it legally binding.

- Finally, consult with the lender about the next steps for submitting the form. Some may require the original document, while others might accept a scanned copy via email or an online submission through a portal.

After you have completed and submitted the Deed in Lieu of Foreclosure form, the lender will process the document. The timeline for this can vary, but you will be notified once the transfer of property ownership has been officially recorded. Ensuring that the form is filled out accurately and thoroughly will help facilitate a smoother process for transferring your property to avoid foreclosure.

Crucial Points on This Form

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal document where a homeowner voluntarily transfers the ownership of their property to the lender. This action is taken to avoid the foreclosure process when they are unable to make mortgage payments. It's an agreement that benefits both parties: the borrower can avoid the negative impact of foreclosure on their credit score, and the lender can take possession of the property without going through lengthy and costly foreclosure proceedings.

Who qualifies for a Deed in Lieu of Foreclosure in Florida?

In Florida, not everyone may qualify for a Deed in Lieu of Foreclosure. Homeowners who are facing financial hardship due to circumstances such as loss of employment, unexpected medical bills, or divorce may be considered. Lenders typically require that the homeowner first attempt to sell the property for its fair market value and prove that the mortgage is in default or that default is imminent. Approval is at the lender's discretion and depends on several factors including the property's condition and the borrower's financial situation.

What are the steps to obtain a Deed in Lieu of Foreclosure in Florida?

The process typically begins with the homeowner contacting their lender to express interest in a Deed in Lieu of Foreclosure. A hardship letter, detailing the reasons for the financial difficulties, must be submitted along with proof of income, tax returns, and a list of assets and debts. The lender will then evaluate the property, often requiring an appraisal to determine its value. If the lender agrees to accept a Deed in Lieu of Foreclosure, both parties will sign the necessary documents, transferring property ownership to the lender. Legal advice is recommended throughout this process.

Does a Deed in Lieu of Foreclosure satisfy the mortgage debt?

In many cases, a Deed in Lieu of Foreclosure can satisfy the mortgage debt, but it depends on the agreement with the lender. Some lenders may agree to forgive any remaining debt on the mortgage, but others might require the homeowner to pay the difference if the home’s value is less than the mortgage amount. This is known as a deficiency, and the lender has the right to seek a deficiency judgment against the homeowner. It is important to have this clearly outlined in the agreement.

How does a Deed in Lieu of Foreclosure affect credit?

A Deed in Lieu of Foreclosure does have a negative impact on a homeowner's credit score, but it is generally less damaging than a foreclosure. The credit report will indicate that the mortgage was settled for less than the full amount owed, which can affect the homeowner's ability to borrow in the future. This impact can last for up to seven years, though its effect diminishes over time, especially if the homeowner takes steps to rebuild their credit.

Can a homeowner rescind a Deed in Lieu of Foreclosure once it has been signed in Florida?

Once a Deed in Lieu of Foreclosure has been signed and submitted to the lender, it is typically final, and the homeowner cannot rescind the agreement without the lender's consent. However, Florida law provides for a reflection period during which the homeowner may cancel certain contracts. If this reflection period, often referred to as a "cooling-off" period, applies to a Deed in Lieu of Foreclosure, it must be explicitly stated in the agreement. Homeowners are advised to understand these terms fully and consider all options before signing.

Common mistakes

Filling out a Deed in Lieu of Foreclosure form in Florida is a process that demands precision and awareness. People often make mistakes due to misunderstanding the form's requirements or overlooking key details. Highlighted below are ten common errors that could significantly impact the process and outcomes.

Not consulting with a lawyer first: One might think they can navigate the process alone, but legal advice is crucial to understand the implications of a deed in lieu of foreclosure.

Ignoring negotiation possibilities: Before filling out the form, it's essential to negotiate terms with the lender that may benefit both parties more than the standard conditions provided.

Failing to accurately describe the property: The legal description of the property must match public records exactly. Any discrepancy can invalidate the document.

Omitting relevant attachments: Sometimes, additional documents are required to support the deed in lieu of foreclosure. Forgetting to attach these can cause delays.

Not verifying lender information: Ensuring that the lender's details are correct is crucial. Mistakes here can lead to process complications or misdirected documents.

Overlooking the need for witness signatures: Florida law requires deed-related documents to be witnessed. Skipping this step can render the deed legally ineffective.

Skipping the notarization process: A deed in lieu of foreclosure must be notarized to confirm the authenticity of the signatures. Failure to do so invalidates the document.

Misunderstanding tax implications: There can be significant tax consequences to a deed in lieu of foreclosure. Not considering these ahead of time can lead to unpleasant surprises.

Assuming the deed eliminates all debt obligations: Sometimes, the deed in lieu of foreclosure doesn't absolve all debt related to the property. It's important to clarify this aspect.

Forgetting to obtain a release of liability: Even after the deed is processed, without a formal release, the previous owner might remain liable for certain obligations. Always secure this in writing.

Mistakes in this process can have long-lasting consequences, making it vital to approach with diligence and proper legal support. Taking the time to understand each step and ensuring accuracy in every detail can significantly ease what is often a stressful situation.

Documents used along the form

When exploring options to avoid foreclosure, homeowners may consider a Deed in Lieu of Foreclosure, especially relevant in Florida due to its distinctive real estate laws. This financial tool allows a homeowner to transfer property ownership directly back to the lender, effectively avoiding the foreclosure process. Nonetheless, it's important to understand that this route often involves additional forms and documents to ensure legal clarity and completeness. The following are commonly associated documents that help facilitate this process and safeguard the interests of all parties involved.

- Hardship Letter: This document details the homeowner's financial difficulties and explains why they are unable to continue making mortgage payments. It provides the lender with insight into the borrower's situation and the reasons behind the request for a Deed in Lieu of Foreclosure.

- Financial Statement: Completing a financial statement is crucial for the lender to assess the homeowner's financial status. It lists all assets, liabilities, income, and expenses, giving a holistic view of the borrower's capacity to manage debt.

- Agreement Not to Pursue Deficiency Judgment: Often, both parties will agree on a document stating that the lender will not pursue the balance owed on the mortgage after the property is transferred. This provides peace of mind to the homeowner, ensuring they won't be held responsible for any remaining debt.

- IRS Form 1099-C: Following a Deed in Lieu of Foreclosure, the lender may write off the debt the homeowner was unable to pay. The IRS considers this forgiven debt as taxable income. Form 1099-C is used to report the canceled debt and may have tax implications for the borrower.

- Letter of Authorization: This authorizes the lender to communicate with the homeowner's advisors, such as lawyers and real estate agents, about the loan and the property. It's essential for facilitating open communication between all parties involved.

Each of these documents plays a pivotal role in the Deed in Lieu of Foreclosure process, ensuring that both lenders and homeowners are legally protected. While avoiding foreclosure through a Deed in Lieu can offer relief to struggling homeowners, it's crucial to approach this process with a clear understanding of all related paperwork. Consulting with legal professionals or financial advisors can provide valuable guidance through this complex process, helping homeowners make informed decisions based on their specific circumstances.

Similar forms

A Mortgage Agreement is similar to a Deed in Lieu of Foreclosure because both documents are crucial in the process of purchasing or refinancing a home. While a Mortgage Agreement establishes the terms and conditions under which a lender provides funds to a borrower, a Deed in Lieu of Foreclosure comes into play if the borrower can't meet the mortgage obligations, offering an alternative to foreclosure.

A Loan Modification Agreement shares similarities with a Deed in Lieu of Foreclosure by offering a way to modify the borrower's loan terms when facing financial difficulties. Both aim to avoid foreclosure, with the former adjusting the loan's terms to make payments more manageable, and the latter transferring property ownership to the lender as a last resort.

A Foreclosure Notice is closely related to a Deed in Lieu of Foreclosure, as both pertain to the process of a lender reclaiming a property due to unpaid mortgage debts. While a Foreclosure Notice is a formal declaration that the foreclosure process is beginning, a Deed in Lieu of Foreclosure represents a voluntary agreement to transfer the property to the lender to avoid foreclosure proceedings.

A Quitclaim Deed is similar to a Deed in Lieu of Foreclosure in the way that it involves the transfer of property ownership without making any warranties about the title. The key difference is that a Deed in Lieu of Foreclosure is used specifically to resolve a default on a loan, while a Quitclaim Deed can be used in various situations where a quick transfer of property is desired without the complications of a sale.

A Short Sale Agreement also bears resemblance to a Deed in Lieu of Foreclosure because it is another alternative to foreclosure. A Short Sale Agreement allows the borrower to sell the property for less than the amount owed on the mortgage with the lender’s approval, while a Deed in Lieu of Foreclosure involves transferring the property title directly to the lender.

An Assignment of Mortgage is related to a Deed in Lieu of Foreclosure as it involves the transfer of mortgage obligations. An Assignment of Mortgage occurs when the original lender transfers the mortgage to another lender or party, while a Deed in Lieu of Foreclosure involves transferring the property’s ownership directly back to the lender to satisfy the loan default.

Dos and Don'ts

Filling out a Florida Deed in Lieu of Foreclosure form requires careful attention to detail and a thorough understanding of what is legally expected. Here is a list of ten dos and don'ts that should guide you through the process:

- Do review the mortgage agreement to verify whether a deed in lieu of foreclosure is a viable option under its terms.

- Do consult with a legal professional specializing in real estate to ensure that this step is in your best interest and to get guidance throughout the process.

- Do ensure all property owners agree to the deed in lieu of foreclosure and are ready to sign the necessary documents.

- Do reach out to the lender for their approval of a deed in lieu of foreclosure, as their agreement is essential for the process to proceed.

- Do fully understand the tax implications of a deed in lieu of foreclosure, which might lead to tax liabilities for the difference between the home's market value and the outstanding mortgage balance.

- Do accurately fill in all required fields on the form, double-checking names, property addresses, legal descriptions, and loan account numbers for errors.

- Don't omit any financial information or misrepresent your financial situation to the lender, as honesty is crucial in these negotiations.

- Don't leave any blank spaces on the form. If a section does not apply, it is appropriate to write "N/A" to indicate this to the reader.

- Don't forget to get all signatures notarized, as a deed in lieu of foreclosure form often requires notarization to be legally binding.

- Don't hesitate to ask questions. If any part of the process or form is unclear, seek clarification from a legal advisor to ensure the accuracy and legality of the document.

Misconceptions

When dealing with the process of a Deed in Lieu of Foreclosure in Florida, there are numerous misconceptions that can misdirect both homeowners and lenders. Clearing up these misunderstandings is crucial for a smoother and more informed transaction. Here are ten common misconceptions about the Florida Deed in Lieu of Foreclosure form:

Misconception 1: It's an Easy Process. Many believe that opting for a Deed in Lieu of Foreclosure is a straightforward and simple solution to avoid foreclosure. However, this process requires stringent documentation and negotiation, and not all lenders are willing to accept a deed in lieu, especially if other liens exist on the property.

Misconception 2: It Erases All Financial Liabilities. Another common misunderstanding is that once a deed in lieu is finalized, the borrower is freed from all financial liabilities associated with the mortgage. This is not always the case; depending on the agreement with the lender, the borrower might still be responsible for any deficiency—the difference between the sale price of the property and the mortgage owed.

Misconception 3: It's Always an Option. Not every homeowner facing foreclosure will qualify for a deed in lieu of foreclosure. Lenders have specific criteria for accepting a deed in lieu, including but not limited to, the borrower's financial situation, the condition of the property, and the presence of junior liens.

Misconception 4: It Greatly Damages Your Credit. While a deed in lieu of foreclosure does impact your credit score, it is typically less damaging than a foreclosure. However, the extent of the impact can vary based on individual credit histories and the lender's reporting practices.

Misconception 5: The Process Is Quick. The process can be lengthy, often taking several months to complete. It involves a lot of paperwork, negotiations, and sometimes, the lender's loss mitigation review, which can extend the timeline considerably.

Misconception 6: It Releases You from All Property Liabilities Instantly. While a deed in lieu can transfer ownership back to the lender, the process of releasing the borrower from all property-related liabilities, such as property taxes or homeowners association fees due up until the transfer, may take additional time and negotiation.

Misconception 7: There Are No Tax Implications. Contrary to what some might believe, there can be tax implications for the borrower. The IRS may consider the forgiven debt as income, which could require the borrower to pay taxes on that amount.

Misconception 8: It's Always Better Than Foreclosure. While often viewed as a preferable alternative to foreclosure due to the lower impact on credit and potentially quicker resolution, a deed in lieu might not always be the best option. For example, if there are multiple liens on the property, solving these can complicate the process.

Misconception 9: No Legal Representation Is Needed. Navigating a deed in lieu of foreclosure can be complex, involving detailed negotiations and legal documentation. As such, it is highly recommended to seek legal advice to ensure your rights are protected throughout the process.

Misconception 10: It Affects All Co-borrowers the Same. The impact of a deed in lieu of foreclosure can vary among co-borrowers depending on their individual credit and financial situations, as well as their specific agreements with the lender.

Understanding these misconceptions can help stakeholders approach the deed in lieu of foreclosure process with clearer expectations and better preparation. It's important for borrowers to consult with legal and financial professionals to fully understand their options and obligations.

Key takeaways

A Deed in Lieu of Foreclosure (DIL) is a significant legal instrument for homeowners in Florida facing financial challenges. This document serves as an alternative to foreclosure, whereby the property owner voluntarily transfers the title of their home back to the lender. It's crucial to understand the key aspects of filling out and using the Florida DIL form to ensure the process is conducted accurately and effectively. Below are the essential takeaways:

- Understand the Purpose: The DIL helps homeowners avoid the lengthy and costly process of foreclosure, potentially reducing damage to their credit scores.

- Eligibility: Not all homeowners qualify for a DIL. Lenders typically require that the property be marketable, the homeowner has experienced verifiable financial hardship, and all other loss mitigation avenues have been exhausted.

- Accurate Information: Fill out the form with precise details about the borrower and the property. Inaccuracies can delay or invalidate the agreement.

- Documentation: Supporting documents, such as financial statements, proof of income, and hardship letters, may be necessary to supplement the DIL form. These documents provide evidence of the homeowner's financial situation.

- Legal Advice: Consulting with a legal professional can provide valuable guidance through the process. An attorney can help navigate the legal intricacies and ensure that the homeowner's rights are protected.

- Negotiations: The terms of the DIL are negotiable. Homeowners can discuss aspects like relocation assistance and the possibility of obtaining a release from any deficiency judgment with their lender.

- Reporting to Credit Bureaus: How the lender reports the DIL to credit bureaus can significantly affect the homeowner's credit history. Negotiate with the lender on how the transaction will be reported.

- Government Programs: Investigate if any government programs are available to assist in the DIL process. These programs may offer additional options or protections for the homeowner.

- Final Agreement Review: Thoroughly review the final DIL agreement before signing. It's crucial to understand all terms and conditions, as signing transfers the property's title to the lender, effectively ending the homeowner’s right to the property.

Filling out and using the Florida Deed in Lieu of Foreclosure form is a complex process that requires careful attention to detail. Homeowners should take proactive steps in understanding their rights, the potential impacts on their financial future, and the legal nuances involved in the transaction. It's a difficult decision, but for some, it represents a viable path out of a challenging situation.

Create Other Deed in Lieu of Foreclosure Forms for US States

Will I Owe Money After a Deed in Lieu of Foreclosure - A legal framework that allows homeowners to transfer their property voluntarily to the lending institution to clear their debt.

Foreclosure Georgia - Transparency and full disclosure by both parties are paramount in completing a Deed in Lieu of Foreclosure to avoid future legal complications.