Blank Deed in Lieu of Foreclosure Form for Georgia

In today's real estate market, homeowners facing financial difficulties and the looming threat of foreclosure have options to consider, one of which is a Deed in Lieu of Foreclosure. This particular approach allows the homeowner to transfer the property title back to the lender voluntarily, effectively avoiding the foreclosure process. The Georgia Deed in Lieu of Foreclosure form plays a pivotal role in this process, serving as the necessary legal document that facilitates this transfer. It outlines the agreement between the homeowner and the lender, detailing the relinquishment of the property to resolve the debt. Completing this form accurately is crucial, as it ensures that the homeowner can avoid the negative consequences of a foreclosure on their credit report, while the lender can mitigate their losses more efficiently. Though it presents a potentially beneficial resolution for both parties, navigating the terms, ensuring fairness, and understanding the long-term implications require careful consideration and, often, legal guidance.

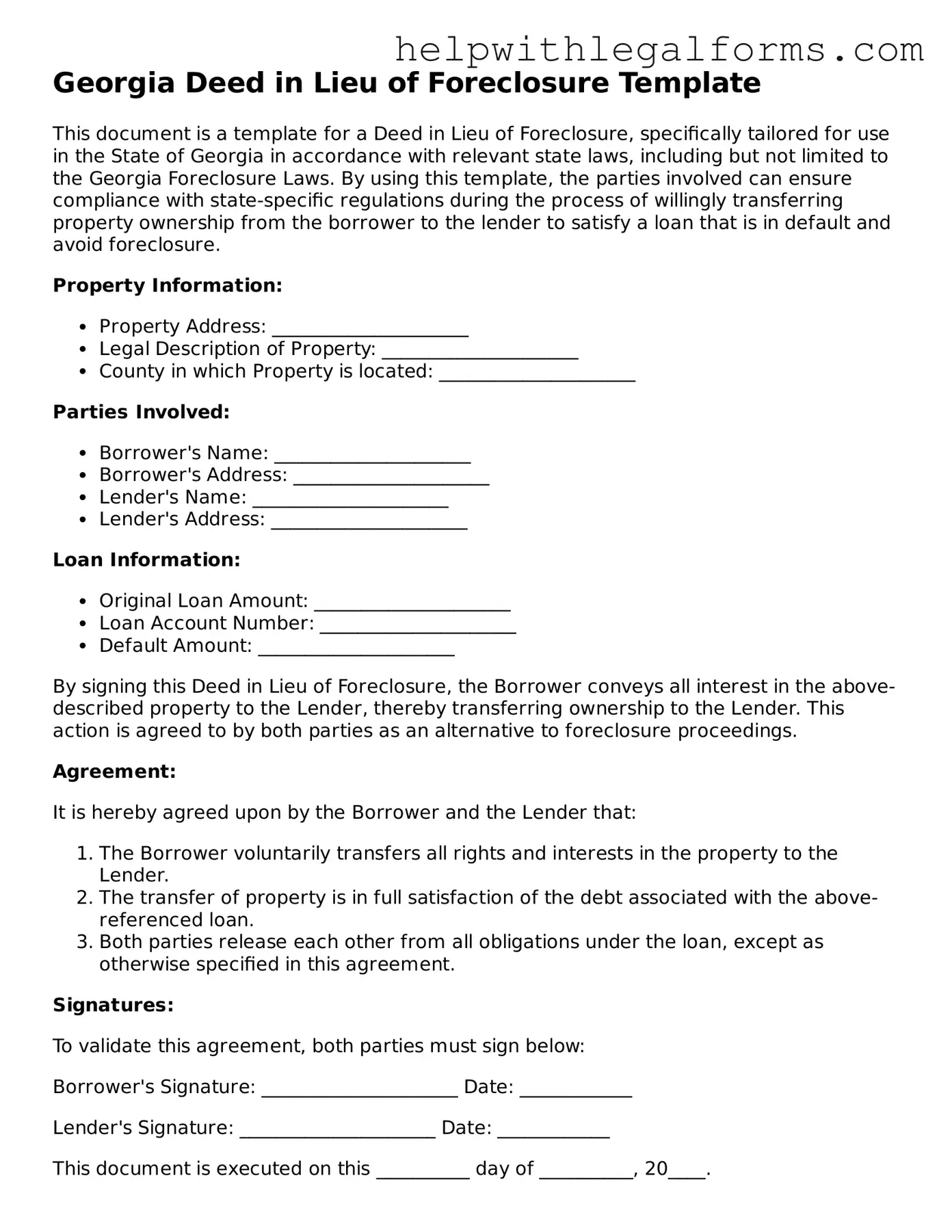

Example - Georgia Deed in Lieu of Foreclosure Form

Georgia Deed in Lieu of Foreclosure Template

This document is a template for a Deed in Lieu of Foreclosure, specifically tailored for use in the State of Georgia in accordance with relevant state laws, including but not limited to the Georgia Foreclosure Laws. By using this template, the parties involved can ensure compliance with state-specific regulations during the process of willingly transferring property ownership from the borrower to the lender to satisfy a loan that is in default and avoid foreclosure.

Property Information:

- Property Address: _____________________

- Legal Description of Property: _____________________

- County in which Property is located: _____________________

Parties Involved:

- Borrower's Name: _____________________

- Borrower's Address: _____________________

- Lender's Name: _____________________

- Lender's Address: _____________________

Loan Information:

- Original Loan Amount: _____________________

- Loan Account Number: _____________________

- Default Amount: _____________________

By signing this Deed in Lieu of Foreclosure, the Borrower conveys all interest in the above-described property to the Lender, thereby transferring ownership to the Lender. This action is agreed to by both parties as an alternative to foreclosure proceedings.

Agreement:

It is hereby agreed upon by the Borrower and the Lender that:

- The Borrower voluntarily transfers all rights and interests in the property to the Lender.

- The transfer of property is in full satisfaction of the debt associated with the above-referenced loan.

- Both parties release each other from all obligations under the loan, except as otherwise specified in this agreement.

Signatures:

To validate this agreement, both parties must sign below:

Borrower's Signature: _____________________ Date: ____________

Lender's Signature: _____________________ Date: ____________

This document is executed on this __________ day of __________, 20____.

Note: This template is provided for informational purposes only and may require customization to meet specific circumstances. It is advisable to seek legal counsel to ensure compliance with all Georgia state laws and regulations.

PDF Form Attributes

| Fact | Detail |

|---|---|

| Purpose | A Georgia Deed in Lieu of Foreclosure form is used when a borrower voluntarily transfers the ownership of their property to the lender to avoid the foreclosure process. |

| Governing Law | This form is governed by Georgia state law, particularly the provisions related to real estate and foreclosure procedures. |

| Mutual Agreement | Both the lender and the borrower must agree to the deed in lieu of foreclosure, indicating that this solution is voluntary and mutually beneficial. |

| Financial Impact | By opting for a deed in lieu of foreclosure, the borrower may avoid some of the negative credit impacts that a full foreclosure may entail. |

| Notable Requirement | It’s essential for the property to be appraised before the deed in lieu of foreclosure is completed to ensure fair dealing for both parties. |

Instructions on How to Fill Out Georgia Deed in Lieu of Foreclosure

Facing financial challenges can be overwhelming, especially when it concerns the possibility of losing one's home. In such times, a deed in lieu of foreclosure can offer a way out, allowing homeowners to transfer their home back to the lender voluntarily. This method avoids the lengthy and stressful process of foreclosure and its negative impact on credit scores. The form you're about to fill out is a critical step in this process, designed to ensure all necessary information is clearly presented and legally binding. The steps below will guide you through completing the Georgia Deed in Lieu of Foreclosure form accurately and efficiently.

- Locate the property's legal description. This information can usually be found on your original mortgage or deed. You'll need to copy this information precisely as it appears in those documents.

- Fill in your full legal name as it appears on your mortgage, as well as any co-owners' names. Ensure the spelling and order of names are consistent with your mortgage documents.

- Provide the full legal name of your lender, also known as the mortgagee. This information should match what's in your mortgage agreement.

- Enter the date you and the lender have agreed upon for the transfer of the property. This date must be carefully chosen, considering any discussions or agreements made with the lender.

- Document the loan number or account number associated with your mortgage. This unique identifier is crucial for linking the deed in lieu of foreclosure to your specific loan agreement.

- Sign and date the form in the presence of a notary public. The notary will verify your identity and witness your signature, making the document officially recognized. Both you and any co-owners must sign.

- The lender, or their authorized representative, must also sign and date the form to indicate their agreement to the terms and acceptance of the property in lieu of foreclosure.

After completing these steps, the form needs to be filed with the county recorder's office where the property is located. This step officially transfers the property title from the homeowner back to the lender, concluding the deed in lieu of foreclosure process. It's a significant step towards resolving your financial difficulties with dignity and starting anew. Remember to keep a copy of the filed document for your records and consult with a legal or financial advisor to explore other steps you can take to secure your financial future.

Crucial Points on This Form

What is a Deed in Lieu of Foreclosure in Georgia?

A Deed in Lieu of Foreclosure is a legal document in Georgia where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure. This process allows the homeowner to be released from their mortgage obligations under certain conditions.

Who can use a Deed in Lieu of Foreclosure in Georgia?

This option is available to borrowers who are unable to meet their mortgage payments and wish to avoid foreclosure. Both the lender and the borrower must agree to the deed in lieu of foreclosure for it to be valid.

What are the benefits of a Deed in Lieu of Foreclosure?

For homeowners, it can reduce the emotional and financial distress associated with foreclosure. For lenders, it offers a more straightforward and less costly alternative to the foreclosure process. Both parties might benefit from a faster resolution.

Are there any drawbacks to a Deed in Lieu of Foreclosure?

Yes, there can be drawbacks. Homeowners may lose their property without any return on their investment. It may also impact their credit score, though typically less than a foreclosure would. Additionally, there could be tax implications for the forgiven debt.

How is the process of a Deed in Lieu of Foreclosure initiated in Georgia?

The process usually starts with the borrower reaching out to the lender to express their interest in a deed in lieu of foreclosure. Both parties will then negotiate the terms, which may include vacating the property and resolving any junior liens.

What are the legal requirements for a Deed in Lieu of Foreclosure in Georgia?

The deed must be in writing and include a legal description of the property. It must be voluntarily signed by both parties and notarized. Additionally, it should be recorded in the county where the property is located to be effective.

Can a lender refuse a Deed in Lieu of Foreclosure?

Yes, a lender can refuse to accept a deed in lieu of foreclosure. The decision may depend on the lender’s policies, the specific circumstances of the borrower, or if there are junior liens on the property that complicate the transaction.

How does a Deed in Lieu of Foreclosure affect a borrower’s credit score?

While it is generally less damaging than a foreclosure, a deed in lieu of foreclosure can still negatively impact a borrower's credit score. The exact impact varies depending on the borrower's overall credit history.

Can you rescind a Deed in Lieu of Foreclosure in Georgia?

Once a deed in lieu of foreclosure is completed and recorded, it is difficult to rescind. Both parties would have to agree to undo the transaction, which is unlikely. Legal advice is recommended for anyone considering this option.

Common mistakes

Filling out the Georgia Deed in Lieu of Foreclosure form requires attention to detail and an understanding of its terms. Often, people make errors that can complicate the process significantly. Recognizing and avoiding these mistakes is crucial for a smooth transaction. Here's a look at common pitfalls:

Not verifying all parties' legal names - It is imperative to use the full legal names of all parties involved, exactly as they appear on related legal documents, to avoid discrepancies and potential rejections.

Failing to accurately describe the property - The property description must be precise and should match the description used in the original deed or property records to ensure clarity and legal accuracy.

Omitting signature witnesses or a notary public - Georgia law requires the presence of signature witnesses and a notary public to validate the authenticity of the document, a step often overlooked.

Ignoring outstanding liens or encumbrances - Prior to finalizing, it's crucial to address any other liens against the property to prevent future legal complications.

Overlooking mortgage lender consent - The mortgage lender's approval is essential for a deed in lieu of foreclosure, and failing to obtain it can invalidate the entire agreement.

Neglecting to review and comply with state laws - Each state has unique laws governing real estate transactions, including deeds in lieu of foreclosure, and non-compliance can lead to legal issues.

Lack of clarity in the agreement terms - Vague or unclear terms can lead to misunderstandings or disputes; therefore, clarity and specificity are critical.

Missing disclosure of important information - All relevant information concerning the property's condition and any financial obligations must be fully disclosed to prevent future liability.

Not consulting a real estate professional or legal advisor - Professionals can provide invaluable advice and ensure that all aspects of the deed in lieu of foreclosure are properly addressed.

Avoiding these mistakes can lead to a more straightforward and legally sound process, ultimately serving the best interests of all parties involved in the transaction. Ensuring due diligence and seeking professional advice when uncertain can prevent many common issues.

Documents used along the form

When dealing with the complexities of avoiding foreclosure through a deed in lieu of foreclosure in Georgia, it's important to understand the various documents that may be involved in the process. These documents play crucial roles in ensuring a smooth, legally sound transition from the homeowner to the lender, without the need for a traditional foreclosure. Here is a collection of forms and documents that are often used in conjunction with the Georgia Deed in Lieu of Foreclosure form.

- Hardship Letter: This document explains the homeowner's circumstances and why they are unable to continue making mortgage payments, justifying the request for a deed in lieu of foreclosure.

- Financial Statement: A detailed form that outlines the homeowner's current financial status, including income, expenses, debts, and assets.

- Mortgage Statement: Provides recent information on the mortgage, including balance and payment history. It's important for assessing the amount owed versus the property's value.

- Property Appraisal Report: An official evaluation that determines the current market value of the property. Lenders require this to decide if the property's value is sufficient to cover the owed mortgage.

- Title Search Report: This document reveals any liens or encumbrances on the property. A clean title is necessary for a deed in lieu of foreclosure to proceed.

- Agreement Not to Pursue Deficiency Judgment: Sometimes, the lender may agree not to pursue the difference between the sale value of the property and the amount owed on the mortgage. This agreement formalizes that understanding.

- IRS Form 982: This tax form may be required to report the cancellation of debt as a result of the deed in lieu of foreclosure, potentially providing tax relief under certain conditions.

- Deed in Lieu of Foreclosure Agreement: This legal document outlines the terms and conditions agreed upon by both the lender and the borrower for the deed in lieu transaction.

- Power of Attorney: Allows the homeowner to authorize someone else to act on their behalf in matters related to the deed in lieu of foreclosure.

- Settlement Statement: An itemized list of fees and costs associated with the deed in lieu transaction, provided prior to the finalization of the process.

Understanding and preparing these documents requires careful attention to detail and an awareness of one's rights and obligations. Each document serves a specific purpose, from detailing financial hardships to ensuring the property is free of liens, all contributing to the goal of a fair and legally binding resolution for both the homeowner and the lender. Engaging with these documents thoughtfully can help facilitate a smoother process and a more favorable outcome for all parties involved.

Similar forms

- Mortgage Agreement: This document establishes the initial agreement between a lender and borrower, similar to a Deed in Lieu of Foreclosure, which concludes such an agreement when the borrower can no longer meet their mortgage obligations.

- Loan Modification Agreement: A Loan Modification Agreement changes the terms of an existing mortgage, aiming to make the loan more manageable for the borrower, akin to how a Deed in Lieu of Foreclosure offers a resolution to a challenging financial situation, although through different means.

- Short Sale Approval Letter: This letter from a lender approves the sale of property for less than the amount owed on the mortgage, similar to a Deed in Lieu of Foreclosure, as both are alternatives to foreclosure that allow a borrower to avoid the full impact of defaulting on a loan.

- Quitclaim Deed: A Quitclaim Deed transfers ownership of property without warranties, similar to a Deed in Lieu of Foreclosure which also transfers property ownership from the borrower to the lender, but under circumstances of financial distress.

- Warranty Deed: This document provides a guarantee that the property is free from liens or claims, similar to how a Deed in Lieu of Foreclosure might, indirectly, as it resolves any claims a lender has due to the defaulted loan.

- Foreclosure Notice: A Foreclosure Notice is a lender's formal indication that they are proceeding with foreclosure due to default, closely related to a Deed in Lieu of Foreclosure, which can be an alternative resolution to this process.

- Power of Attorney: This document allows one person to act on behalf of another, often in financial matters. It’s similar to a Deed in Lieu of Foreclosure where a borrower grants the lender the authority to claim their property without undergoing foreclosure.

- Release of Liability: This form releases a party from being liable for certain events under specified conditions, paralleling how a Deed in Lieu of Foreclosure releases the borrower from the mortgage debt after transferring the property to the lender.

- Bankruptcy Discharge Notification: This notifies that a person's bankruptcy proceedings are complete and their debts are discharged. It's related to a Deed in Lieu of Foreclosure as both represent ways to deal with overwhelming debt, though they operate under different legal frameworks.

Dos and Don'ts

When dealing with the Georgia Deed in Lieu of Foreclosure form, there are specific actions that can facilitate a smoother process and others that may create complications or delay. Below are six dos and don'ts to consider:

Do:

Verify all information: Double-check names, addresses, legal descriptions of the property, and all necessary details for accuracy. Incorrect information can lead to delays or the invalidation of the document.

Consult with a real estate attorney: The legal implications of a deed in lieu of foreclosure are significant. Seek professional advice to understand the rights and obligations involved.

Ensure the document is notarized: A notary public must witness the signing of the document to confirm the identity of the signers, making the document legally binding.

Provide all necessary attachments: If additional documents or attachments are referenced in the deed, make sure they are completed and included at the time of submission.

Use clear and concise language: Avoid using complicated legal terms or jargon that could be misunderstood or create ambiguity in the agreement.

Keep a copy for your records: Once the deed in lieu of foreclosure is complete, keep a copy for your personal records. This will be useful for future reference and for any potential disputes.

Don't:

Sign under pressure: Do not rush into signing the document without fully understanding the terms and ensuring it is in your best interest.

Omit crucial information: Failing to include essential details such as the correct legal description of the property can result in the document being considered invalid.

Assume financial responsibilities are clear: Confirm that the agreement specifies which parties are responsible for outstanding debts or obligations related to the property.

Forget to check for liens: Before proceeding, ensure there are no other liens against the property that could affect the transfer of the title.

Overlook state-specific requirements: Real estate laws can vary greatly by state. Make sure you understand and comply with Georgia's specific requirements for a deed in lieu of foreclosure.

Delay submitting the document: Once all parties have agreed and the document is completed, submit it promptly to the relevant authority to avoid any potential issues stemming from delays.

Misconceptions

- Many think that the Georgia Deed in Lieu of Foreclosure form is a quick fix that immediately clears all outstanding debts against the property. However, this isn't always the case. Sometimes, a borrower may still owe a deficiency if the property's value doesn't cover the remaining mortgage balance.

- Another common misconception is that this form is freely available and can be easily filled out without any legal guidance. Actually, the process requires careful negotiation and precise documentation, often necessitating legal advice to ensure that the agreement is beneficial and binding.

- People often believe that once they submit a Deed in Lieu of Foreclosure, their credit will no longer suffer. While it may have a slightly less detrimental effect than a foreclosure, it still negatively impacts credit scores and remains on credit reports for seven years.

- There's a misconception that the lender always prefers foreclosure over accepting a Deed in Lieu of Foreclosure. In truth, lenders may favor this deed as it saves them the time and expense of going through the foreclosure process.

- Some assume that the Georgia Deed in Lieu of Foreclosure form can be used for any property type. This is inaccurate, as lenders are usually more inclined to accept it for residential properties rather than commercial ones, which are subject to different regulations and market conditions.

- Another false belief is that signing a Deed in Lieu of Foreclosure instantly transfers the property to the lender. The process involves several steps, including the lender's assessment of the property, agreement to the deed in lieu, and preparation of the necessary documentation.

- It's commonly misconceived that a Deed in Lieu of Foreclosure will release a borrower from all property-related debts, such as home equity loans or second mortgages. Actually, these are separate liabilities and require their own resolution.

- Lastly, many think that this deed nullifies the need for any further legal action, assuming that it resolves all issues related to the defaulted loan. The reality is different, as there may still be tax implications and other legal matters to address post-transfer.

Key takeaways

Filling out and using the Georgia Deed in Lieu of Foreclosure form involves several key considerations. Here are the takeaways for individuals navigating this process:

Understanding the Form: The Deed in Lieu of Foreclosure is used when a property owner wants to avoid foreclosure by voluntarily transferring ownership of the property to the lender.

Eligibility Criteria: Not every borrower or property qualifies for a deed in lieu of foreclosure. Lenders typically require that the property be free of other liens and that the borrower has explored all other foreclosure alternatives.

Accuracy is Key: It's crucial to fill out the form accurately, including personal information, property details, and any other required legal descriptions. Inaccuracies can delay the process or invalidate the deed transfer.

Potential Tax Implications: Transferring property through a deed in lieu of foreclosure may have tax consequences. Individuals may incur taxable income based on the difference between the loan's outstanding balance and the property's fair market value.

Seek Legal Advice: Given the legal and financial complexities involved, consulting with a legal advisor familiar with Georgia's real estate laws is advisable. They can provide guidance tailored to the individual's situation.

Understanding the Impact on Credit: While a deed in lieu of foreclosure may be less damaging to a credit score than a foreclosure, it can still have a significant negative impact. Individuals should consider this and potentially negotiate terms with the lender that could minimize the effect.

It's important for individuals to approach the Deed in Lieu of Foreclosure with a clear understanding of the process and its consequences. Being well-informed and seeking professional advice can make a significant difference in navigating this challenging situation.

Create Other Deed in Lieu of Foreclosure Forms for US States

California Voluntary Foreclosure Deed - This legal form typically requires detailed information about the property, the mortgage, and the agreement conditions between the lender and the borrower.

Will I Owe Money After a Deed in Lieu of Foreclosure - Streamlines the process for homeowners to avoid foreclosure by offering a direct way to return the property to the lender.

The Loan Servicer Might Agree to Put the Foreclosure on Hold to Give You Some Time to Sell Your Home - Avoid foreclosure through this form, which lets you transfer property ownership back to the lender as an alternative resolution.