Blank Deed in Lieu of Foreclosure Form for New York

When homeowners in New York find themselves unable to keep up with their mortgage payments, they have several options to avoid foreclosure. One such option is a Deed in Lieu of Foreclosure, a legal agreement where the borrower voluntarily transfers ownership of the property to the lender. This process not only helps homeowners avoid the lengthy and stressful foreclosure process but also minimizes the impact on their credit scores compared to a foreclosure. The form itself is a crucial document that outlines the terms of this agreement, including the transfer of property, any financial considerations, and the rights and obligations of both parties involved. It serves as a critical step for those seeking a more dignified exit from a difficult situation, offering a pathway that avoids the public record and possible eviction associated with traditional foreclosure proceedings. Understanding the major aspects of this form is essential for any homeowner navigating this path, as it lays the groundwork for resolving their mortgage crisis while providing a clear framework for the transfer of their property.

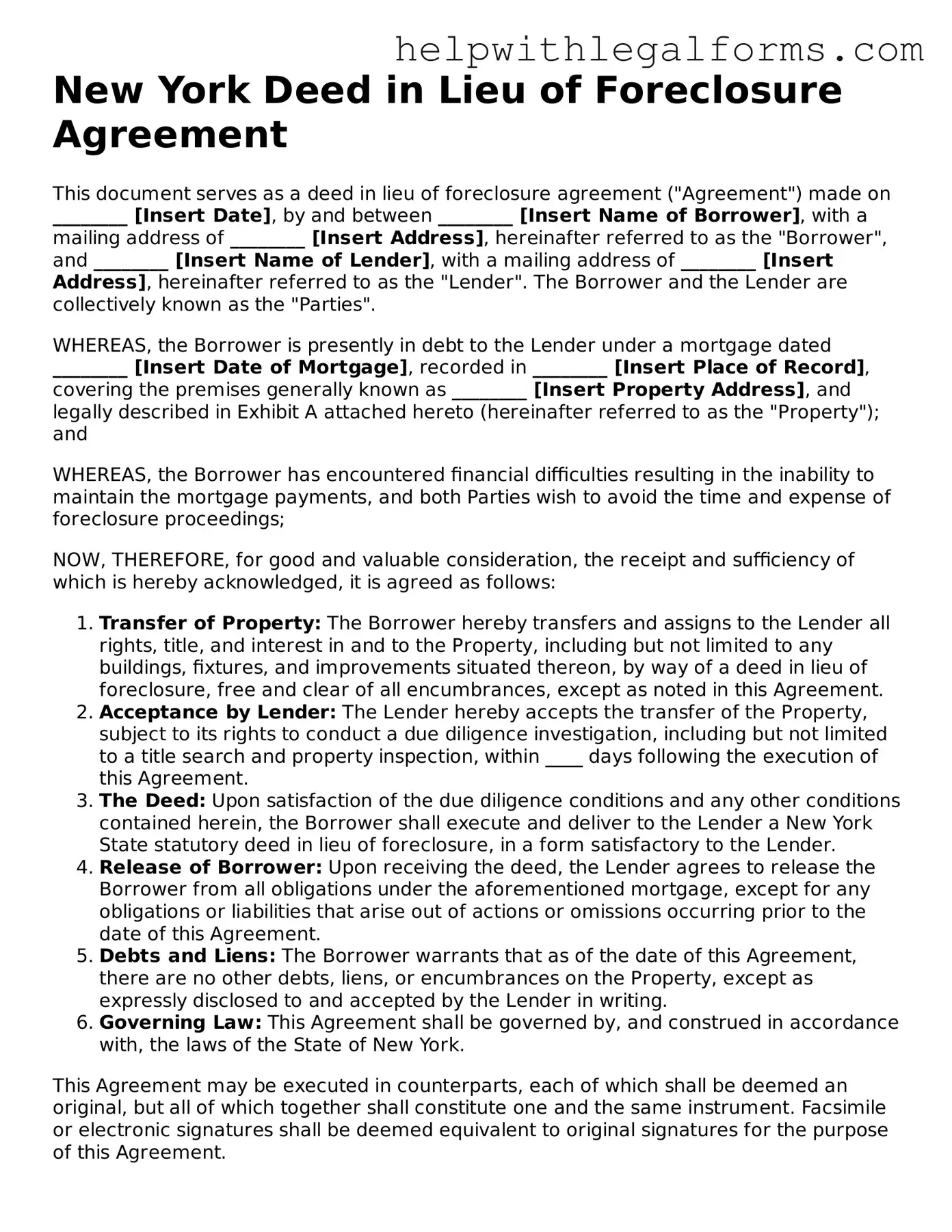

Example - New York Deed in Lieu of Foreclosure Form

New York Deed in Lieu of Foreclosure Agreement

This document serves as a deed in lieu of foreclosure agreement ("Agreement") made on ________ [Insert Date], by and between ________ [Insert Name of Borrower], with a mailing address of ________ [Insert Address], hereinafter referred to as the "Borrower", and ________ [Insert Name of Lender], with a mailing address of ________ [Insert Address], hereinafter referred to as the "Lender". The Borrower and the Lender are collectively known as the "Parties".

WHEREAS, the Borrower is presently in debt to the Lender under a mortgage dated ________ [Insert Date of Mortgage], recorded in ________ [Insert Place of Record], covering the premises generally known as ________ [Insert Property Address], and legally described in Exhibit A attached hereto (hereinafter referred to as the "Property"); and

WHEREAS, the Borrower has encountered financial difficulties resulting in the inability to maintain the mortgage payments, and both Parties wish to avoid the time and expense of foreclosure proceedings;

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, it is agreed as follows:

- Transfer of Property: The Borrower hereby transfers and assigns to the Lender all rights, title, and interest in and to the Property, including but not limited to any buildings, fixtures, and improvements situated thereon, by way of a deed in lieu of foreclosure, free and clear of all encumbrances, except as noted in this Agreement.

- Acceptance by Lender: The Lender hereby accepts the transfer of the Property, subject to its rights to conduct a due diligence investigation, including but not limited to a title search and property inspection, within ____ days following the execution of this Agreement.

- The Deed: Upon satisfaction of the due diligence conditions and any other conditions contained herein, the Borrower shall execute and deliver to the Lender a New York State statutory deed in lieu of foreclosure, in a form satisfactory to the Lender.

- Release of Borrower: Upon receiving the deed, the Lender agrees to release the Borrower from all obligations under the aforementioned mortgage, except for any obligations or liabilities that arise out of actions or omissions occurring prior to the date of this Agreement.

- Debts and Liens: The Borrower warrants that as of the date of this Agreement, there are no other debts, liens, or encumbrances on the Property, except as expressly disclosed to and accepted by the Lender in writing.

- Governing Law: This Agreement shall be governed by, and construed in accordance with, the laws of the State of New York.

This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument. Facsimile or electronic signatures shall be deemed equivalent to original signatures for the purpose of this Agreement.

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the date first above written.

__________________________

Borrower's Signature

__________________________

Lender's Signature

Exhibit A: Legal Description of the Property

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Purpose | A Deed in Lieu of Foreclosure allows a homeowner to transfer the ownership of their property to the lender voluntarily to avoid foreclosure. |

| Governing Law | New York Real Property Actions and Proceedings Law (RPAPL) |

| Eligibility | Homeowners facing foreclosure due to unpaid mortgages or property taxes may be eligible. |

| Benefits for Homeowner | Avoids the consequences of a foreclosure on the homeowner’s credit report. |

| Benefits for Lender | Reduces the time and expenses associated with the foreclosure process. |

| Document Required | A written agreement between the homeowner and the lender, detailing the terms of the deed transfer. |

| Considerations | Homeowners should consider other foreclosure alternatives and consult with legal counsel before proceeding. |

| Tax Implications | The transfer of the property might result in tax consequences for the homeowner, needing further consultation with a tax advisor. |

Instructions on How to Fill Out New York Deed in Lieu of Foreclosure

When a borrower can't meet their mortgage payments, offering a deed in lieu of foreclosure is a way to avoid the foreclosure process by transferring the ownership of the property back to the lender. This action settles the debt and eliminates the need for a lengthy and often costly foreclosure proceeding. Successfully completing the New York Deed in Lieu of Foreclosure form is crucial for this process. The form requires careful attention to detail to accurately reflect the agreement terms between the borrower and the lender. The following steps provide a guide to filling out the form properly.

- Begin by entering the date on which the agreement is being made at the top of the form.

- Fill in the full legal names of the borrower(s) as the "Grantor(s)" and the lender as the "Grantee."

- Provide the complete address of the property being transferred, including the county in which it is located. This ensures the property is correctly identified and avoids any confusion.

- Include the legal description of the property as found in previous deed documents or a property survey. This description often includes block and lot numbers or metes and bounds details.

- Specify the exact amount of the loan being settled through this deed in lieu of foreclosure. This figure should reflect the total debt owed.

- Outline any additional terms and conditions agreed upon between the borrower and the lender. This might include terms related to the forgiveness of any remaining debt, property condition, or other considerations important to either party.

- Both the borrower and the lender must sign the form in the presence of a notary public. Ensure that all parties have a clear understanding of the document's contents before signing.

- The form must then be notarized. This involves the notary public officially witnessing the signatures, confirming the identities of the signatories, and affixing a seal or stamp to the document.

- Lastly, submit the completed and notarized form to the appropriate county clerk’s office for recording. The property transfer won’t be officially recognized until this step is completed. There might be a filing fee which varies by county.

By carefully following these steps, individuals can ensure that the deed in lieu of foreclosure form is accurately completed and submitted, smoothly facilitating the property transfer process. This action not only helps in avoiding foreclosure but also in potentially preserving the borrower's credit to some extent. It's a significant step requiring agreement, clarity, and due diligence from all involved parties.

Crucial Points on This Form

What is a Deed in Lieu of Foreclosure in New York?

A Deed in Lieu of Foreclosure is a legal document that a homeowner can use to transfer ownership of their property to the lender voluntarily, to avoid the foreclosure process. In New York, this means the borrower can give the title of their home back to the mortgage lender to satisfy their mortgage debt and avoid the lengthy and costly foreclosure procedure.

How does a Deed in Lieu of Foreclosure affect my credit in New York?

While a Deed in Lieu of Foreclosure may still negatively impact your credit score, it is often less damaging than a foreclosure. By agreeing to this process, individuals show that they took proactive steps to resolve their debt, which some creditors may view more favorably. However, the specifics can vary based on individual credit history and the lender's reporting practices.

Are there any tax implications for completing a Deed in Lieu of Foreclosure in New York?

Yes, there can be significant tax implications. When a lender forgives debt in a Deed in Lieu of Foreclosure, the forgiven amount may be considered as income by the IRS and the New York State Department of Taxation and Finance. Taxpayers might be liable for taxes on this "income." It's critical to consult with a tax professional to understand the potential tax consequences.

Can all properties in New York qualify for a Deed in Lieu of Foreclosure?

Not all properties qualify for a Deed in Lieu of Foreclosure. Lenders may not agree to this process if there are second mortgages, liens, or other encumbrances on the property that would complicate the transfer of a clear title. Each lender has its own criteria for approval, and they often prefer this option for properties that can be easily sold on the market.

What are the steps to initiate a Deed in Lieu of Foreclosure in New York?

To initiate a Deed in Lieu of Foreclosure, the property owner should first communicate with their mortgage lender to express their interest in the option. This discussion typically involves providing financial information and reasons for the inability to continue making mortgage payments. If the lender is open to considering the deed in lieu, the borrower will then have to fill out the lender’s required paperwork, which may include a financial packet and a hardship letter. After reviewing the borrower's situation, if the lender agrees, both parties will sign the necessary documents to transfer ownership of the property back to the lender. It's advisable to work with a legal professional during this process to ensure that your rights are protected.

Common mistakes

When individuals face the difficult situation of not being able to make their mortgage payments, one option they might consider is a Deed in Lieu of Foreclosure. This process involves the homeowner voluntarily transferring the property title back to the lender, effectively avoiding the foreclosure process. However, when filling out the New York Deed in Lieu of Foreclosure form, several common mistakes can occur. It's essential to approach this task with care to ensure that the process proceeds smoothly and with agreement from both parties involved.

Not consulting a legal advisor: Many people attempt to complete the form without seeking advice from a professional knowledgeable in New York property law. This oversight can lead to misunderstandings of the terms and potentially disadvantageous agreements.

Incorrect property information: Including inaccurate details about the property, such as the wrong address or block and lot number, can invalidate the agreement or delay the process significantly.

Failing to acknowledge all lien holders: Not listing all parties with a legal interest in the property, such as second mortgage lenders or judgment creditors, can cause complications later on.

Not being clear about the debt being released: If the document does not explicitly state that the debt is being forgiven, homeowners might unknowingly remain liable for the balance owed beyond the property's value.

Omitting necessary attachments: Overlooking the requirement to attach documents such as the property deed or a recent mortgage statement can lead to incomplete applications that can't be processed.

Signing without notarization: Failure to have the form notarized is a critical mistake, as it won't be considered legally binding without a notary public's certification.

Not specifying maintenance and repair obligations: The form should clearly state who is responsible for the property's upkeep until the deed transfer is officially complete to avoid disputes over property condition.

Lack of clarity on personal property: Failure to specify what happens to personal property contained within the home can lead to confusion and conflict. It's essential to agree on what stays with the home and what can be removed.

Incomplete information about the contact person: The form requires a point of contact for future communications. Leaving this section incomplete can disrupt the process.

Ignoring tax implications: Many do not consider the potential tax consequences of a Deed in Lieu of Foreclosure. It's crucial to understand how forgiveness of debt may impact your tax situation.

Understanding and avoiding these common mistakes can make the process of completing a New York Deed in Lieu of Foreclosure smoother and more effective. Homeowners find themselves in better positions when they are informed and thoroughly prepared for each step of this significant financial decision.

Documents used along the form

When individuals are unable to meet their mortgage obligations, they might consider a deed in lieu of foreclosure to avoid the foreclosure process. In New York, this legal agreement allows the homeowner to transfer the deed of their property to the lender, effectively surrendering the property to avoid foreclosure. Though the Deed in Lieu of Foreclosure form is a critical document in this process, it's often accompanied by several other forms and documents to ensure a complete and legally sound transaction. Understanding these additional documents can provide a clearer picture of the process and requirements.

- Hardship Letter: This document outlines the homeowner's financial difficulties and explains why they are unable to continue making payments on their mortgage. It provides context to the lender about the borrower's situation.

- Financial Statement: Typically required along with the hardship letter, this comprehensive statement details the homeowner's income, expenses, assets, and liabilities. It offers a snapshot of the homeowner’s financial health, supporting the claim of hardship.

- Agreement Not to Pursue Deficiency Judgment: This agreement, if provided by the lender, ensures that the lender won’t seek a deficiency judgment against the borrower for the difference between the amount owed and the property’s value once the deed in lieu is executed.

- Estoppel Affidavit: This affidavit includes statements from both the borrower and lender indicating that they have not entered into any agreements, specifically any that would adversely affect the lender, beyond those disclosed within the deed in lieu of foreclosure agreement.

- Title Search Report: This report verifies that the title to the property is clear of any liens, encumbrances, or other clouds that could affect the transfer of the property. It's a crucial step in ensuring that the lender receives the title free and clear.

These documents play a vital role in the deed in lieu of foreclosure process, laying the groundwork for a smooth and transparent transaction. For homeowners considering this step, being prepared with these documents can expedite the process and provide some peace of mind during what can be a stressful time. It’s advisable for individuals to consult with a legal professional to ensure they understand each document’s purpose and how it fits into the larger process of avoiding foreclosure through a deed in lieu.

Similar forms

Mortgage Agreement: A Deed in Lieu of Foreclosure form is inherently tied to the original mortgage agreement, as it is a method to avoid foreclosure. Both documents are pivotal in property transactions, outlining the rights and obligations of the borrower and the lender. The main difference lies in their goals; while the mortgage agreement initiates the borrowing process, the Deed in Lieu of Foreclosure aims to resolve a default in a manner beneficial to both parties.

Loan Modification Agreement: Similar to the Deed in Lieu of Foreclosure, a Loan Modification Agreement is a tool used to avoid foreclosure. Both documents serve to alter the original terms of the mortgage agreement to prevent the lender from taking legal action to reclaim the property. The key distinction is that a loan modification seeks to change the terms (e.g., interest rate, payment period) to make the mortgage more manageable for the borrower, whereas a deed in lieu transfers the property ownership back to the lender.

Foreclosure Notice: The Foreclosure Notice, like the Deed in Lieu of Foreclosure, is directly linked to the foreclosure process. Both documents are critical stages in the event of a borrower's default. The foreclosure notice is a legal document that initiates the process to repossess the property, serving as a warning to the borrower, while the deed in lieu is a possible outcome where the borrower voluntarily transfers the property to the lender to avoid the completion of foreclosure.

Short Sale Agreement: Both the Deed in Lieu of Foreclosure and a Short Sale Agreement are alternatives to foreclosure. In a short sale, the property is sold for less than the outstanding mortgage balance with the lender's approval. The deed in lieu, on the other hand, involves transferring the property directly back to the lender. While each offers a different path, both aim to satisfy the debt in a way that may be less harmful to the borrower's credit than a foreclosure.

Quitclaim Deed: A Quitclaim Deed, like a Deed in Lieu of Foreclosure, is used to transfer property rights but in a broader range of contexts, not limited to default situations. Both parties using a quitclaim deed relinquish any legal claim against the other regarding the property title post-transfer. However, unlike the deed in lieu, a quitclaim deed does not inherently resolve unpaid mortgage balances or other encumbrances on the property.

Satisfaction of Mortgage: This document is similar to the Deed in Lieu of Foreclosure in the sense that both signal the end of certain obligations under the original mortgage agreement. A Satisfaction of Mortgage is issued by the lender once the mortgage is fully paid, indicating the borrower is released from their mortgage debt. The deed in lieu also concludes the mortgage agreement but does so by transferring ownership to the lender to compensate for the unpaid debt.

Dos and Don'ts

Navigating the process of a Deed in Lieu of Foreclosure in New York requires a clear understanding of the do's and don'ts to ensure the procedure is handled correctly and efficiently. Compiled below are essential guidelines to assist in filling out the form accurately.

What You Should Do

Verify all personal information, including your full name, address, and any identification numbers, for accuracy to ensure the deed is legally binding and corresponds with public records.

Consult with a legal professional or a housing counselor before proceeding. Their expertise is vital in understanding the implications of the deed and ensuring it's the best course of action for your situation.

Clearly describe the property in question, including the legal description found in your original mortgage documents, to avoid any confusion about the property being transferred.

Ensure the document is notarized. A notarized document confirms your identity as the signer and validates the signature, which is a critical step in making the document legally enforceable.

Keep a copy of the completed form for your records. Having your own record is crucial for future reference, especially in cases where disputes or discrepancies arise post-transfer.

What You Shouldn't Do

Do not overlook the potential tax implications. Transferring property through a Deed in Lieu of Foreclosure can have significant tax consequences, so it’s important to understand these before signing the document.

Avoid leaving blank sections. If a section does not apply, mark it with “N/A” (not applicable) instead of leaving it empty, to demonstrate that it was reviewed but found to be not relevant.

Do not forget to inform your mortgage lender. Secure their approval for the deed in lieu transaction, as failing to do so may result in legal complications.

Avoid rushing through the document without reviewing it thoroughly. Ensure that all the information provided is accurate and that you fully understand all clauses and their implications.

Do not attempt to hide any financial difficulties from the lender. Being transparent about your financial situation can lead to more favorable terms or alternatives to the deed in lieu.

Misconceptions

When navigating the complexities of avoiding foreclosure, many homeowners consider a Deed in Lieu of Foreclosure as a viable option. However, misconceptions surrounding the New York Deed in Lieu of Foreclosure form can create confusion and hinder informed decision-making. Let's clear up some of these misunderstandings:

It's an Easy Out for the Borrower: Many people mistakenly believe that a Deed in Lieu of Foreclosure is a simple way to escape an unaffordable mortgage. However, the process involves strict criteria and negotiations with the lender. It's not merely about handing over the keys and walking away; the lender must agree to accept the deed in lieu, which isn't always guaranteed.

It Releases You From All Financial Obligations: Another common misconception is that once the deed in lieu is completed, the borrower is free from all financial liabilities associated with the property. This isn't always the case. In some instances, if the sale of the property doesn't cover the remaining mortgage balance, the lender may have the right to pursue a deficiency judgment, depending on New York’s specific laws and the terms of the agreement.

It's Only Available for Residential Properties: While it's true that many deeds in lieu of foreclosure involve residential properties, this option can also be available for commercial properties. The process and implications can differ, but commercial property owners facing foreclosure should explore this option with their lender.

Credit Impact is Minimal: A significant misunderstanding is that a deed in lieu of foreclosure will have a minimal impact on one's credit score. In reality, it can still significantly affect your credit, similar to a foreclosure. Lenders report it to credit bureaus as a settlement for less than the owed amount, which can negatively affect credit scores. Though it may be viewed slightly more favorably than a foreclosure by future lenders, it is incorrect to assume there's little to no impact.

Understanding the nuances of a Deed in Lieu of Foreclosure in New York is crucial for homeowners considering this path. It requires careful consideration of one's financial situation, negotiations with lenders, and an understanding of the potential consequences. Consulting with a legal professional can provide valuable guidance and clarify any misunderstandings, ensuring that homeowners make informed decisions about their properties and financial futures.

Key takeaways

A Deed in Lieu of Foreclosure form is an important document for homeowners facing potential foreclosure in New York. This document allows a borrower to transfer the ownership of their property to the lender, potentially avoiding the repercussions of having a foreclosure on their credit history. While this option can offer a fresh start or a more graceful exit from a troubling financial situation, it's crucial to understand the key aspects and consequences of this process. Below are nine essential takeaways about filling out and using the New York Deed in Lieu of Foreclosure form:

- Consult with a Lawyer First: Before committing to a deed in lieu of foreclosure, seeking legal advice is strongly recommended. A lawyer can explain how the process works in New York and help determine if it's the best course of action for your situation.

- Fully Understand the Agreement: Make sure you completely comprehend the terms of the deed in lieu of foreclosure agreement. This includes any obligations that you might still have after the transfer of ownership, such as remaining debt.

- Documentation is Key: Accurately and thoroughly complete the New York Deed in Lieu of Foreclosure form. Incorrect or incomplete information can delay or disrupt the process.

- Assess Financial Implications: Understand the potential financial repercussions, such as tax liabilities for debt forgiveness or how it might affect your credit score.

- Consider the Impact on Credit Score: While a deed in lieu of foreclosure can be less damaging than a foreclosure, it still impacts your credit score negatively. Be aware of this consequence.

- Negotiate with the Lender: Some lenders may agree to not report the deed in lieu to credit bureaus as a foreclosure. It’s worth discussing this possibility to lessen the impact on your credit.

- Seek a Written Agreement: Ensure that all terms discussed with the lender, including any forgiveness of the remaining balance on your mortgage, are included in a written agreement. Verbal agreements are difficult to enforce.

- Know Your Rights: Understand your rights during this process, including any rights to revert the decision within a certain timeframe.

- Post-Completion Steps: Following the completion of a deed in lieu of foreclosure, confirm that the deed has been recorded correctly with your local county office. This step is crucial to ensuring that the property transfer is legally recognized.

Handling a deed in lieu of foreclosure with care and thorough understanding can provide relief in difficult times. However, it’s essential to make well-informed decisions and to seek professional advice to navigate this process effectively. Awareness of your responsibilities and rights can also safeguard you against potential pitfalls.

Create Other Deed in Lieu of Foreclosure Forms for US States

Will I Owe Money After a Deed in Lieu of Foreclosure - Allows borrowers in default an opportunity to avoid the lengthy and public process of foreclosure by transferring ownership to the lender.

California Voluntary Foreclosure Deed - Given its potential impacts, the decision to pursue a Deed in Lieu of Foreclosure should be made with comprehensive advice from legal counsel.

Foreclosure Georgia - The process involves multiple steps, including reaching out to the lender, submitting required documentation, and possibly consulting with housing counselors.