Blank Deed in Lieu of Foreclosure Form for Texas

In the face of financial distress, homeowners may seek alternatives to the often daunting process of foreclosure. One such alternative, gaining traction within Texas, is the utilization of a Deed in Lieu of Foreclosure agreement. This form represents a mutual agreement between a lender and a borrower, wherein the borrower willingly transfers the property title back to the lender, circumventing the traditional foreclosure process. Such an arrangement not only potentially salvages the borrower's credit rating to some degree but also allows the lender to expedite the recovery of the asset without navigating the time-consuming and expensive foreclosure proceedings. Characterized by its legal nuances, the form serves as a critical document, outlining the terms of agreement—each tailored to the specific circumstances of the borrower and lender involved. Additionally, this legal instrument ensures that the transfer of property adheres to Texas state laws, an essential factor for both parties to bear in mind. Furthermore, understanding the implications, including any potential tax consequences and the possibility of a deficiency judgment, is pivotal before entering into such an agreement. The Texas Deed in Lieu of Foreclosure form encapsulates a complex yet valuable option for those seeking an alternative to foreclosure, embodying a compromise that can offer a semblance of solace amidst financial turmoil.

Example - Texas Deed in Lieu of Foreclosure Form

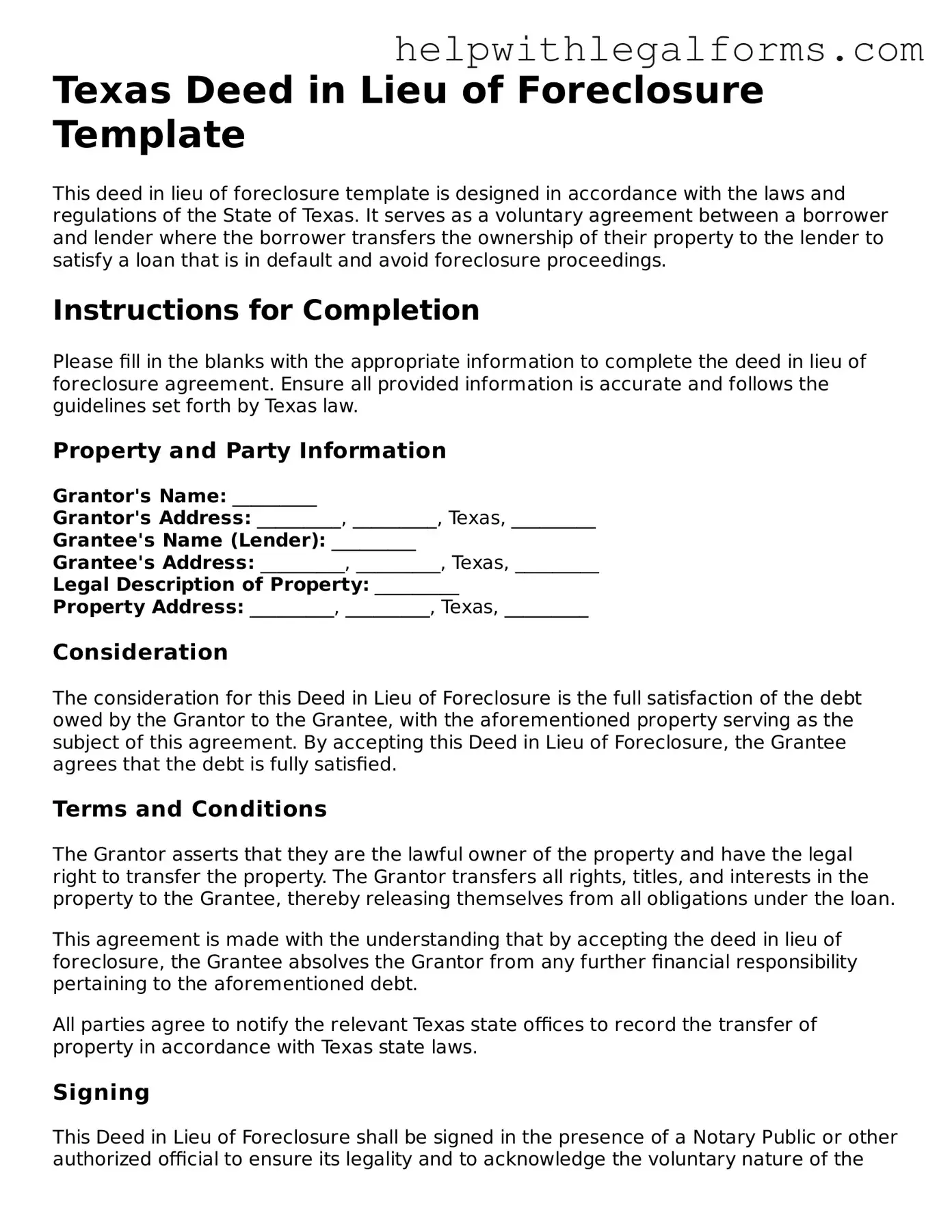

Texas Deed in Lieu of Foreclosure Template

This deed in lieu of foreclosure template is designed in accordance with the laws and regulations of the State of Texas. It serves as a voluntary agreement between a borrower and lender where the borrower transfers the ownership of their property to the lender to satisfy a loan that is in default and avoid foreclosure proceedings.

Instructions for Completion

Please fill in the blanks with the appropriate information to complete the deed in lieu of foreclosure agreement. Ensure all provided information is accurate and follows the guidelines set forth by Texas law.

Property and Party Information

Grantor's Name: _________

Grantor's Address: _________, _________, Texas, _________

Grantee's Name (Lender): _________

Grantee's Address: _________, _________, Texas, _________

Legal Description of Property: _________

Property Address: _________, _________, Texas, _________

Consideration

The consideration for this Deed in Lieu of Foreclosure is the full satisfaction of the debt owed by the Grantor to the Grantee, with the aforementioned property serving as the subject of this agreement. By accepting this Deed in Lieu of Foreclosure, the Grantee agrees that the debt is fully satisfied.

Terms and Conditions

The Grantor asserts that they are the lawful owner of the property and have the legal right to transfer the property. The Grantor transfers all rights, titles, and interests in the property to the Grantee, thereby releasing themselves from all obligations under the loan.

This agreement is made with the understanding that by accepting the deed in lieu of foreclosure, the Grantee absolves the Grantor from any further financial responsibility pertaining to the aforementioned debt.

All parties agree to notify the relevant Texas state offices to record the transfer of property in accordance with Texas state laws.

Signing

This Deed in Lieu of Foreclosure shall be signed in the presence of a Notary Public or other authorized official to ensure its legality and to acknowledge the voluntary nature of the agreement.

Grantor's Signature: _________

Date: _________

Grantee's Signature: _________

Date: _________

Notary Public's Signature and Seal: _________

This document is to be filed with the county clerk's office where the property is located to ensure legal recognition and enforcement of this agreement.

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a document where a borrower voluntarily transfers ownership of property to the lender to avoid the foreclosure process. |

| Governing Law | In Texas, Deeds in Lieu of Foreclosure are primarily governed by state property and foreclosure laws, including the Texas Property Code. |

| Financial Impact | This process may offer a way for borrowers to avoid some of the negative credit impacts associated with foreclosure. |

| Eligibility | Borrowers must generally be facing genuine financial hardship and have exhausted all other options to qualify for a deed in lieu of foreclosure. |

| Mutual Agreement | Both lender and borrower must agree to the deed in lieu of foreclosure. The lender is under no obligation to accept it. |

| Potential for Deficiency Judgments | Depending on the agreement and Texas law, borrowers may still be responsible for any difference between the sale value of the property and the amount owed. |

| Document Preparation | It's important to accurately prepare and record the Deed in Lieu of Foreclosure, adhering to Texas legal documentation standards. |

| Recording Requirements | After completion, Texas requires the deed to be recorded with the county recorder's office where the property is located to be effective. |

| Impact on Future Purchases | Completing a deed in lieu of foreclosure can impact a borrower's ability to purchase a home in the future, based on lender requirements. |

Instructions on How to Fill Out Texas Deed in Lieu of Foreclosure

Understanding the process of filling out a Texas Deed in Lieu of Foreclosure form is essential for any homeowner seeking to navigate this foreclosure alternative. This document, pivotal in transferring property ownership from the borrower to the lender without undergoing the traditional foreclosure process, requires meticulous attention to detail. The following steps have been designed to simplify this process, ensuring clarity and adherence to Texas law.

- Start by downloading the official Texas Deed in Lieu of Foreclosure form from the Texas Department of Housing and Community Affairs website or obtain a copy from a legal document provider.

- Read through the entire form before filling out any information to familiarize yourself with its requirements and stipulations.

- Enter the full legal name(s) of the property owner(s) as listed on the property title in the space provided for the Grantor(s). Ensure this information matches the public record exactly.

- In the section designated for the Grantee, input the full legal name of the lender who is taking over the property. This must also be precise and match the lender's details as publically recorded.

- Provide the full and accurate description of the property being transferred, including its legal description and physical address. This information is critical and must correspond with the details listed on the property's current deed.

- Fill in the date when the deed in lieu of foreclosure is to become effective. This date should be agreed upon by both the property owner and the lender.

- Sign and print your name in the designated section at the bottom of the form. If the property is owned jointly, all owners must sign the form.

- Have the signing of the form witnessed and notarized. This is a legal requirement to validate the form. You will need to bring a valid form of identification to the notary.

- Submit the completed form to the county land records office where the property is located for filing and official recording. A submission fee may be required.

The completion and submission of the Texas Deed in Lieu of Foreclosure form represent a significant step towards resolving a difficult financial situation in a dignified manner. With careful attention to detail and completeness, you can ensure the process is conducted efficiently and in accordance with Texas law.

Crucial Points on This Form

What is a Deed in Lieu of Foreclosure in Texas?

A Deed in Lieu of Foreclosure is an agreement where a homeowner voluntarily transfers ownership of their property to the mortgage lender. This is done to avoid the foreclosure process. In Texas, this agreement allows the borrower to be released from their mortgage obligations under certain conditions.

How does a Deed in Lieu of Foreclosure differ from a traditional foreclosure in Texas?

Unlike traditional foreclosure, a Deed in Lieu of Foreclosure avoids the need for a lender to sue the borrower in court to regain property ownership. It offers a more streamlined process that can be less damaging to the borrower's credit. Moreover, it typically involves a negotiation between the borrower and the lender, offering a potential for better terms for the borrower.

What are the benefits of choosing a Deed in Lieu of Foreclosure?

Choosing a Deed in Lieu of Foreclosure can reduce the emotional and financial stress involved with foreclosure. It can provide a faster resolution, save on legal fees, and potentially less harm to the borrower's credit score. Additionally, it may offer certain tax advantages, though it's important to consult with a tax advisor for specifics.

What are the steps involved in completing a Deed in Lieu of Foreclosure in Texas?

First, the borrower should communicate their interest in a Deed in Lieu of Foreclosure to their lender. The lender will then review the borrower's financial situation and the property value. If the lender agrees, both parties will negotiate the terms, which will include the release of borrower's obligations under the mortgage. Afterward, legal documents will be prepared to transfer property ownership to the lender. Upon completion, these documents are recorded with the county recorder’s office.

Are there any specific eligibility requirements for a Deed in Lieu of Foreclosure in Texas?

Yes, lenders typically require the property to be free of any other liens or judgments. The borrower must also demonstrate financial hardship that prevents them from making mortgage payments. Each lender may have additional criteria, so it’s important to check with your mortgage lender for their specific requirements.

Can a lender refuse a Deed in Lieu of Foreclosure?

Yes, a lender has the discretion to refuse a Deed in Lieu of Foreclosure. If the lender believes that foreclosure would result in greater financial recovery, or if there are complications such as other liens on the property, they might not agree to the deed in lieu. Furthermore, if the property's market value significantly exceeds the outstanding mortgage balance, the lender may also opt for foreclosure to potentially recover a higher amount.

Common mistakes

In Texas, a Deed in Lieu of Foreclosure is a serious legal document offering an alternative to the foreclosure process, transferring the title of a property from a homeowner to the lender. Unfortunately, people often make crucial mistakes when completing this form, which can lead to significant legal and financial consequences. Awareness and attention to detail are critical when filling out this form to ensure a smooth and agreeable transition. Below are six common errors to avoid:

- Failing to Obtain Written Agreement from the Lender: Many people assume that filling out the form is enough to seal the deal. However, the lender must agree in writing to accept the deed in lieu of foreclosure. Without this agreement, the process cannot legally proceed.

- Not Clearly Identifying All Parties: Every party involved must be correctly identified with full legal names and contact information. Mistakes or omissions can invalidate the document or cause confusion later in the process.

- Omitting Terms and Conditions: The form should include any terms and conditions agreed upon, such as the forgiveness of any remaining debt. Leaving out these details can lead to disputes or unexpected obligations.

- Ignoring Tax Implications: People often overlook the tax consequences of a deed in lieu of foreclosure. Consulting with a tax professional can prevent surprises during tax season.

- Overlooking the Need for a Notary Public: The form must be notarized to verify the identity of the signers and ensure the document's validity. Skipping this step can render the deed unenforceable.

- Submitting Incomplete or Inaccurate Documentation: It’s crucial to provide all required supporting documents in their complete and accurate form. Missing or incorrect information can delay or derail the process.

Avoiding these mistakes requires careful preparation and a clear understanding of the legal process. When in doubt, seeking the advice of a legal professional can help ensure that the deed in lieu of foreclosure is executed correctly and efficiently, protecting the interests of all parties involved.

Documents used along the form

In the realm of real estate and financial distress, parties sometimes find themselves needing to navigate the transfer of property rights to avoid the rigors of foreclosure. The Deed in Lieu of Foreclosure form in Texas serves as a critical document in this process, allowing a homeowner to transfer their property voluntarily to the lender as a means to satisfy a loan that's in default and avoid foreclosure. This can offer a more graceful exit for borrowers and a less costly recovery for lenders. However, surrounding this central document is a constellation of other forms and documents that are often used to facilitate, document, and legally confirm the arrangement. Below is a concise summary of such documents, shedding light on their utility and purpose.

- Promissory Note: This is the original agreement between the borrower and the lender where the borrower promises to repay the borrowed amount. It outlines the terms of the loan, including the interest rate, repayment schedule, and the consequences of default.

- Loan Modification Agreement: Before proceeding to a deed in lieu of foreclosure, parties often consider modifying the existing loan terms to make it easier for the borrower to make payments. This document formalizes any changes to the original promissory note terms.

- Estoppel Affidavit: This affidavit is signed by the borrower, certifying certain facts to be true, such as the absence of any liens against the property other than the mortgage, and that the borrower is acting freely and voluntarily without duress in entering into the deed in lieu of foreclosure.

- Property Appraisal Report: This report is conducted by a licensed appraiser and provides an estimation of the property's current market value. Lenders often require this to ensure the property value covers the outstanding loan balance.

- Title Report: Before accepting a deed in lieu of foreclosure, the lender will typically require a title report to identify any liens, encumbrances, or other title issues that could affect the property’s title once transferred.

- Default Notice: This document is a formal notification from the lender to the borrower indicating the loan is in default. It usually precedes foreclosure proceedings and can trigger negotiations for a deed in lieu of foreclosure.

- Settlement Agreement: If any negotiations or disputes arise in the process, parties may reach a settlement agreement detailing the resolution terms, including any financial obligations beyond the transfer of the property.

- Deed of Trust: In Texas, this document accompanies the promissory note and secures the loan by placing a lien on the property. It outlines the rights and responsibilities of each party and the procedure for foreclosure in case of default.

Ensuring a thorough understanding and proper use of these documents can substantially impact the outcomes for both lenders and borrowers navigating the complexities of a deed in lieu of foreclosure in Texas. By adequately preparing and executing these documents, parties can aim for a smoother transition during what can be a challenging financial situation, making the process more manageable and legally sound for all involved.

Similar forms

Mortgage Agreement: Similar to a Deed in Lieu of Foreclosure, a Mortgage Agreement is a document that outlines the terms and conditions under which a loan is provided for the purchase of real property. Both documents are integral to the process of financing and securing real estate, with the Deed in Lieu of Foreclosure serving as a possible resolution in case of default on the mortgage.

Loan Modification Agreement: This document, like the Deed in Lieu of Foreclosure, is used when a borrower is facing difficulty in fulfilling their loan obligations. It modifies the original loan terms to make repayment more manageable for the borrower, aiming to avoid foreclosure.

Short Sale Approval Letter: In cases where the sale price of a property may not cover the outstanding mortgage balance, a Short Sale Approval Letter is similar to a Deed in Lieu by providing an alternative solution to traditional foreclosure, allowing the property to be sold for less than the mortgage amount.

Quitclaim Deed: Like a Deed in Lieu of Foreclosure, a Quitclaim Deed transfers property ownership without selling the property. However, it conveys only the interest the grantor has at the time of the transfer, without any warranties regarding the title's quality.

Warranty Deed: This document guarantees that the property title is clear and the seller has the right to sell the property, similar to the Deed in Lieu of Foreclosure, which also involves the transfer of property ownership. However, the context of their use differs significantly.

Foreclosure Notice: A Foreclosure Notice is issued when a borrower fails to make mortgage payments, potentially leading to the lender taking legal steps to seize the property. It's related to a Deed in Lieu of Foreclosure as both documents are parts of the foreclosure process, with the latter being a voluntary surrender of property to avoid foreclosure.

Release of Lien: Much like the Deed in Lieu of Foreclosure, a Release of Lien is a document indicating that any claim or financial encumbrance on a property has been removed. The Deed in Lieu acts as a release by transferring the property to satisfy a debt.

Power of Attorney: This document authorizes a person to act on behalf of another in various circumstances, including managing real estate transactions. It is similar to a Deed in Lieu of Foreclosure in that it can be instrumental in handling property matters where the owner cannot manage directly, although it serves a broader range of purposes.

Eviction Notice: An Eviction Notice is used to inform a tenant of the intent to remove them from rented property, which somewhat parallels the concept behind a Deed in Lieu of Foreclosure. Both documents signal an end to occupancy due to failure in fulfilling agreed-upon terms, although they apply to different types of occupant relationships.

Bankruptcy Petition: This legal document is filed by an individual or business unable to repay its debts, seeking relief through bankruptcy. It's akin to a Deed in Lieu of Foreclosure because both represent legal means to manage overwhelming debt, albeit in different contexts.

Dos and Don'ts

When dealing with the Texas Deed in Lieu of Foreclosure form, it's important to navigate the process with care. This document is a legal arrangement that allows a borrower to transfer the ownership of their property to the lender as an alternative to facing foreclosure. Below are some crucial dos and don'ts to consider to ensure the process is handled correctly:

Do:- Review the form thoroughly before filling it out. Understanding every section ensures that all information provided is accurate and relevant.

- Gather all necessary documents related to your property and loan ahead of time. This includes your mortgage agreement, property deed, and any correspondence with your lender regarding financial hardship.

- Seek legal advice. Consulting with an attorney who specializes in real estate or foreclosure law can provide valuable insights and help navigate the complexities of the law.

- Consider the consequences. A deed in lieu of foreclosure might relieve you from your mortgage obligations, but it may have tax implications and affect your credit score.

- Contact your lender to discuss the possibility of a deed in lieu of foreclosure. Communication is key, and this step can also show your lender that you're taking proactive measures.

- Leave any sections blank. If a particular section does not apply, write 'N/A' or 'Not Applicable'. This shows that you have read and acknowledged each part of the form.

- Guess on details or figures. Always use accurate, verifiable information. Incorrect data can lead to delays or rejection of the deed in lieu of foreclosure agreement.

- Sign the form without a witness or notary public, as required. A deed in lieu of foreclosure must be legally recognized and authenticated to be valid.

- Overlook the importance of a clear title. Ensure there are no other liens or encumbrances on your property. The lender will likely require a title search to confirm this before proceeding.

Properly filling out the Texas Deed in Lieu of Foreclosure form requires careful attention to detail and an understanding of the legal implications. By following these dos and don'ts, you can navigate this process more smoothly, potentially avoiding the long-lasting impacts of a foreclosure on your financial health.

Misconceptions

When discussing the Texas Deed in Lieu of Foreclosure form, several misconceptions frequently arise. These misunderstandings can complicate what is essentially a method for a borrower to avoid foreclosure by voluntarily transferring their property to the lender. Clarifying these misconceptions ensures that individuals facing challenging financial circumstances can make informed decisions.

It immediately clears all financial obligations: A common misconception is that a deed in lieu of foreclosure absolves borrowers of all financial liabilities associated with the mortgage. However, if the property's value doesn't cover the mortgage balance, the lender might pursue a deficiency judgment, seeking the difference from the borrower.

It's a quick process: Many believe that this process is significantly faster than foreclosure. While it might be quicker in some cases, negotiations, documentation, and lender approval can extend the timeline, making it not as speedy as some expect.

All lenders readily accept it: Not every lender will agree to a deed in lieu of foreclosure. Lenders may opt for foreclosure if they believe it to be more financially beneficial or if there are multiple liens on the property, complicating the deed in lieu process.

It significantly impacts credit less than foreclosure: While a deed in lieu may have a slightly less detrimental effect on one's credit score compared to a foreclosure, the impact is still considerable. Credit bureaus report it as a settlement, which can substantially lower one's credit rating.

It releases the borrower from all property claims: Signing a deed in lieu of foreclosure transfers the title to the lender, but if there are other claims or liens against the property (like second mortgages, homeowners association dues, etc.), those may not be automatically resolved by this action.

The property must be in foreclosure to qualify: A homeowner does not need to be in the foreclosure process to opt for a deed in lieu. This agreement can be reached at any point when the borrower is unable to meet mortgage obligations, allowing for a preemptive approach to resolving the issue.

It's the only option aside from foreclosure: Many believe that once they're facing financial difficulties with their mortgage that their only options are a deed in lieu or foreclosure. However, loan modifications, refinancing, or even selling the property are potential alternatives to avoid foreclosure and its implications on financial history and credit.

Key takeaways

Filling out and using the Texas Deed in Lieu of Foreclosure form involves several key points that homeowners and lenders should carefully consider to ensure both parties are protected and the process is legally sound. This document provides a way for a borrower to transfer the ownership of their property to the lender to avoid the foreclosure process. It’s crucial to understand the implications and steps involved in this process:

- Voluntary Agreement: It’s essential for both parties to agree voluntarily to the deed in lieu of foreclosure. This agreement indicates that the borrower chooses to hand over the property to the lender to satisfy the mortgage debt and avoid foreclosure.

- Legal Counsel: Both the lender and the borrower should seek independent legal advice before entering into a deed in lieu of foreclosure. Legal counsel can ensure that the agreement is in the best interest of both parties and that all legal requirements are met.

- Complete Financial Disclosure: The borrower is usually required to provide a full disclosure of their financial situation. This transparency helps the lender assess whether a deed in lieu of foreclosure is the most appropriate solution.

- Title Search: A thorough title search by the lender is critical to confirm that the property is free from other liens or encumbrances. Clearing all liens is necessary to transfer a clean title to the lender.

- IRS Considerations: The forgiveness of debt through a deed in lieu of foreclosure can have tax implications for the borrower. Under certain conditions, the forgiven debt may be considered taxable income, and it’s important for the borrower to consult with a tax advisor.

- Impact on Credit Score: While a deed in lieu of foreclosure generally has a less negative impact on the borrower's credit score than a foreclosure, it still affects credit. Borrowers should consider the long-term implications on their ability to obtain future loans.

- Finalization and Recording: The completion of the deed in lieu of foreclosure process involves the signing of the agreement by both parties, notarization, and recording the deed with the county recorder’s office. Proper documentation and recording are paramount to ensure the legality of the transaction and to protect both parties’ interests.

Understanding these key points can help parties involved in a deed in lieu of foreclosure in Texas navigate the process more effectively, ensuring that the transaction is conducted fairly and within the bounds of the law.

Create Other Deed in Lieu of Foreclosure Forms for US States

Foreclosure Georgia - For homeowners underwater on their mortgages—owing more than their home's worth—a Deed in Lieu of Foreclosure offers a way out without enduring a short sale.

Deed in Lieu of Foreclosure Sample - This document outlines the agreement where the lender accepts real estate instead of pursuing foreclosure.

The Loan Servicer Might Agree to Put the Foreclosure on Hold to Give You Some Time to Sell Your Home - Document facilitating a mutual agreement between borrower and lender to transfer property ownership, avoiding foreclosure.