Legal Deed of Trust Form

Embarking on the journey of buying a home can be both thrilling and daunting, especially when navigating through the maze of legal documents involved in securing a mortgage. Among these, the Deed of Trust plays a pivotal role, essentially acting as the linchpin in home financing transactions in many states. This critical document not only earmarks the physical property as security for the loan but also lays out the terms and conditions of the borrowing arrangement, involving three parties: the borrower, the lender, and the trustee. It delineates the borrower's obligations and what would happen in the event of default, illustrating the pathway for the lender to foreclose on the property if necessary. Furthermore, it touches on various rights and responsibilities, including but not limited to insurance, property taxes, and maintenance standards. Understanding the Deed of Trust is indispensable for both borrowers and lenders, as it provides a foundation for the rights and protections accorded to each party in the property financing process.

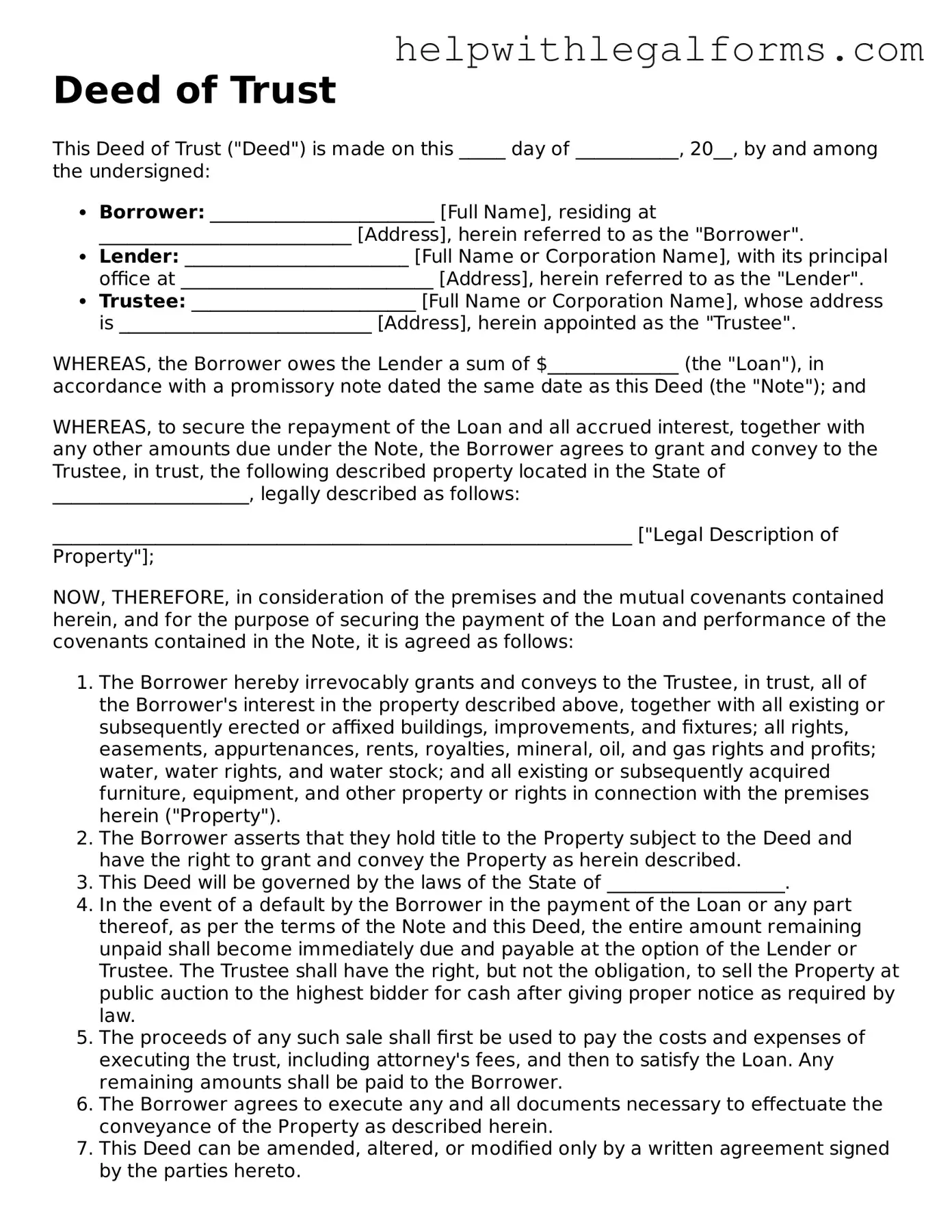

Example - Deed of Trust Form

Deed of Trust

This Deed of Trust ("Deed") is made on this _____ day of ___________, 20__, by and among the undersigned:

- Borrower: ________________________ [Full Name], residing at ___________________________ [Address], herein referred to as the "Borrower".

- Lender: ________________________ [Full Name or Corporation Name], with its principal office at ___________________________ [Address], herein referred to as the "Lender".

- Trustee: ________________________ [Full Name or Corporation Name], whose address is ___________________________ [Address], herein appointed as the "Trustee".

WHEREAS, the Borrower owes the Lender a sum of $______________ (the "Loan"), in accordance with a promissory note dated the same date as this Deed (the "Note"); and

WHEREAS, to secure the repayment of the Loan and all accrued interest, together with any other amounts due under the Note, the Borrower agrees to grant and convey to the Trustee, in trust, the following described property located in the State of _____________________, legally described as follows:

______________________________________________________________ ["Legal Description of Property"];

NOW, THEREFORE, in consideration of the premises and the mutual covenants contained herein, and for the purpose of securing the payment of the Loan and performance of the covenants contained in the Note, it is agreed as follows:

- The Borrower hereby irrevocably grants and conveys to the Trustee, in trust, all of the Borrower's interest in the property described above, together with all existing or subsequently erected or affixed buildings, improvements, and fixtures; all rights, easements, appurtenances, rents, royalties, mineral, oil, and gas rights and profits; water, water rights, and water stock; and all existing or subsequently acquired furniture, equipment, and other property or rights in connection with the premises herein ("Property").

- The Borrower asserts that they hold title to the Property subject to the Deed and have the right to grant and convey the Property as herein described.

- This Deed will be governed by the laws of the State of ___________________.

- In the event of a default by the Borrower in the payment of the Loan or any part thereof, as per the terms of the Note and this Deed, the entire amount remaining unpaid shall become immediately due and payable at the option of the Lender or Trustee. The Trustee shall have the right, but not the obligation, to sell the Property at public auction to the highest bidder for cash after giving proper notice as required by law.

- The proceeds of any such sale shall first be used to pay the costs and expenses of executing the trust, including attorney's fees, and then to satisfy the Loan. Any remaining amounts shall be paid to the Borrower.

- The Borrower agrees to execute any and all documents necessary to effectuate the conveyance of the Property as described herein.

- This Deed can be amended, altered, or modified only by a written agreement signed by the parties hereto.

- This Deed constitutes the entire agreement between the parties concerning the subject matter hereof and supersedes all prior agreements and understandings, whether written or oral.

IN WITNESS WHEREOF, the parties have executed this Deed as of the date first above written.

_________________________

Borrower's Signature

_________________________

Lender's Signature

_________________________

Trustee's Signature

PDF Form Attributes

| Fact | Description |

|---|---|

| Definition | A Deed of Trust is a document that secures a loan on real property and involves three parties: the borrower (trustor), the lender (beneficiary), and a neutral third party (trustee). |

| Parties Involved | The borrower who provides the property as security for the loan, the lender who gives the loan, and the trustee who holds the title to the security for the benefit of the lender. |

| Function | It serves to provide security for the loan by placing a lien on the property, which allows the lender to foreclose if the borrower defaults on the loan. |

| State Specificity | The use and requirements of Deeds of Trust vary by state, with some states using them in place of mortgages, impacting the foreclosure process and parties' rights. |

| Foreclosure Process | In states that use Deeds of Trust, the foreclosure process can be non-judicial, meaning it does not require court intervention, which can be faster and less costly than judicial foreclosures. |

| Governing Laws | Deeds of Trust are governed by state laws, which define how they must be executed, recorded, and foreclosed upon, and these laws vary significantly from one state to another. |

Instructions on How to Fill Out Deed of Trust

Filling out a Deed of Trust form is a critical step in securing your home loan. This document legally binds you to the agreement with your lender, specifying the terms under which you borrow and promise to repay the loan, using your property as security. It's a safeguard for all parties involved, ensuring that the borrower upholds their financial obligation or risks foreclosure. Pay close attention to each detail to ensure accuracy and prevent any legal issues down the road.

- Begin by gathering all required information: borrower's full legal name, co-borrower's name (if applicable), lender's information, and the legal description of the property being used as collateral. This may include the address, lot number, and any other identifiers.

- At the top of the form, enter the date the Deed of Trust is being executed.

- In the section designated for the parties involved, fill in the borrower's name(s) and the lender's name. Make sure these are the full legal names to avoid any future discrepancies.

- Proceed to the section where the property is described. Here, input the complete legal description of the property. This information can typically be found on your property deed or from the county recorder's office.

- Next, outline the terms of the loan, including the principal amount borrowed, the interest rate, the maturity date of the loan, and the payment schedule. These details should match those in your loan agreement.

- The Deed of Trust form will also have a section for trustees. The trustee is a neutral third party who holds onto the legal title of your property until the loan is paid off. Fill in the name and contact details of the trustee appointed by your lender.

- Review the form thoroughly. Pay special attention to sections requiring initials or additional signatures, as missing signatures can lead to processing delays.

- Sign and date the form in the presence of a notary public. Your lender and trustee may also be required to sign, depending on state law and the specifics of your agreement.

- Finally, submit the completed form as directed by your lender. This might involve returning it to them directly or filing it with the county recorder's office.

Once the form is properly filled out and submitted, the legal process of securing your home loan under the agreed terms begins. Accuracy and diligence in completing this form are paramount to protect your interests and ensure a smooth transaction. Should you have any doubts or require clarification, consider consulting with a legal advisor specialized in real property law.

Crucial Points on This Form

What is a Deed of Trust?

A Deed of Trust is a document that secures a loan on real property. It involves three parties: the borrower (trustor), the lender (beneficiary), and a third party (trustee) who holds the property's legal title as security for the loan. Should the borrower default on the loan, the trustee has the authority to sell the property to pay off the debt.

How does a Deed of Trust differ from a mortgage?

While both a Deed of Trust and a mortgage serve as security for a loan, there are key differences. A mortgage involves only the borrower and the lender. In the event of default, the lender must go through the court system to foreclose on the property. Conversely, a Deed of Trust involves a trustee and allows for non-judicial foreclosure, meaning the trustee can sell the property without court intervention if the borrower defaults.

What are the key components of a Deed of Trust?

A Deed of Trust typically includes the names of the trustor, beneficiary, and trustee; the legal description of the property being secured; the loan amount; terms and conditions of the loan, including interest rate and repayment schedule; and provisions for what happens if the borrower defaults. It may also specify the rights and obligations of each party and any other special conditions.

Is a Deed of Trust legally binding in all states?

Not all states use Deeds of Trust. Some states use mortgages as the primary method of securing a loan with real estate. Where Deeds of Trust are used, they are recognized as legally binding agreements. It's important to consult local laws to understand the specific procedures and requirements for Deeds of Trust in your state.

Common mistakes

Filling out a Deed of Trust is a significant step in securing a mortgage or loan against a property. This legal document officially records and details the agreement between the borrower, lender, and trustee, outlining the responsibilities and rights of each party involved. Unfortunately, many people encounter pitfalls during this process, leading to potential legal issues or delays. Below are nine common mistakes people make when completing a Deed of Trust form:

- Not Verifying All Names: Individuals often fail to ensure that all names on the document match their legal identification. This discrepancy can create confusion and legal challenges in the future.

- Overlooking Important Details: Skipping over sections or not thoroughly reading the entire document can lead to misunderstandings about the responsibilities and obligations it outlines, potentially causing significant issues down the road.

- Incorrect Property Description: Providing an inaccurate legal description of the property, including boundary errors or incorrect parcel numbers, can invalidate the document or cause disputes.

- Forgetting to Date the Document: Failing to include the date, or using the wrong date, can affect the enforceability of the deed and its priority among other documents.

- Failing to Notarize: Not having the document properly notarized is a common mistake. A notarized deed of trust is typically required to record the document officially with the county recorder’s office.

- Misunderstanding the Role of Parties: People often confuse the roles and responsibilities of the borrower, lender, and trustee. Clarification of each party's duties is crucial for the agreement to function as intended.

- Omitting Signatures: One of the most critical errors is the omission of necessary signatures. The document is not legally binding if any of the parties involved do not sign it.

- Neglecting to Specify Loan Terms: Not clearly stating the loan amount, interest rate, payment schedule, and maturity date can lead to legal disputes and misunderstandings between the parties.

- Overlooking Filing Requirements: Each jurisdiction may have specific filing requirements, such as including particular forms or paying certain fees. Ignoring these requirements can delay the recording of the deed or prevent it from being recognized legally.

Correctly filling out a Deed of Trust form involves careful attention to detail and an understanding of the legal implications. Avoiding the aforementioned mistakes can help ensure that the process proceeds smoothly and that the document accurately reflects the agreement between the parties involved.

Documents used along the form

When dealing with a real estate transaction, particularly when it comes to securing a mortgage, a Deed of Trust is just one vital piece of the puzzle. However, several other forms and documents often come into play to ensure everything is legally binding and properly organized. These documents can range from those that verify your financial information to ones that protect both the buyer and the lender. Understanding each of these documents can help make the real estate transaction process smoother and more transparent.

- Promissory Note: This is a key document that outlines the borrower's promise to repay the loan. It includes the amount borrowed, interest rate, and repayment terms, essentially detailing the financial obligation of the borrower to the lender.

- Mortgage Agreement: Similar to a Deed of Trust, this document secures the loan by using the property as collateral. The main distinction often depends on state laws and specific terms agreed upon by the borrower and the lender.

- Title Report: This report provides information on the property's title, including any liens, easements, or restrictions. It's crucial for ensuring the property is legally clear for sale and identifying any potential issues that could affect ownership.

- Loan Application: A comprehensive form that the borrower fills out to apply for the mortgage. It includes personal and financial information that lenders use to determine the borrower’s eligibility for the loan.

- Property Appraisal: An appraisal report gives an estimate of the property’s fair market value. Lenders require this to ensure the property is worth more than or equal to the loan amount.

- Closing Disclosure: This document outlines the final terms of the loan, including the interest rate, loan fees, and monthly payments. It is provided to the borrower at least three days before closing, giving them a chance to review the final terms.

- Homeowners Insurance Policy: Required by lenders to protect the property from damages caused by unforeseen events like fires or floods. It ensures that the property has financial protection in case of damage.

- Property Tax Records: These records prove that all property taxes have been paid up to date. It’s essential for the lender to ensure there are no outstanding taxes that could place a lien on the property.

Together, these documents form a comprehensive package that supports the Deed of Trust, ensuring that all aspects of the property sale and the mortgage agreement are legally documented and enforceable. From establishing the terms of repayment to ensuring the property is free from legal encumbrances, each document plays a crucial role in securing a transparent and safe real estate transaction for both the borrower and the lender.

Similar forms

Mortgage Agreement: Much like a Deed of Trust, a mortgage agreement serves as a legal document that secures the loan for the purchase of a property. The borrower agrees to pay back the loan over time, with the property acting as collateral. The main difference is that a mortgage typically involves two parties (the borrower and the lender), while a Deed of Trust also involves a third party (the trustee) who holds the property title until the loan is paid in full.

Promissory Note: This document complements a Deed of Trust by detailing the borrower's promise to repay the loan under specified terms, including the loan amount, interest rate, payment schedule, and maturity date. The Promissory Note represents the borrower's indebtedness, whereas the Deed of Trust provides the secured interest in the property to protect the lender.

Security Agreement: Similar to a Deed of Trust, a Security Agreement is a document that secures an interest in property (often personal property as opposed to real estate) to ensure the repayment of a loan. It grants the lender a security interest in specified assets, allowing for repossession if the borrower defaults. Both documents function to protect the lender's investment by securing assets in case the borrower fails to fulfill financial obligations.

Assignment of Rents: Although more specific in scope, an Assignment of Rents document is related to a Deed of Trust in that it can also serve as security for a real estate loan. It allows a lender to collect the income produced by the leased property, such as rental payments, in the event of a borrower's default. This assignment acts as an additional security measure, much like a Deed of Trust ensures the lender's interests are protected by holding a claim over the property until the loan is paid off.

Dos and Don'ts

Filling out a Deed of Trust form is an important process that helps in legally documenting the agreement between a borrower and lender, with a trustee holding the title to the property as security for the loan. Care must be taken to ensure the information is accurate and complete. Below are key dos and don'ts to follow:

Do:

- Review the entire form before starting to ensure you understand all requirements.

- Provide accurate information for all parties involved, including full legal names, addresses, and the legal description of the property.

- Double-check the legal description of the property against a recent property assessment or tax bill to ensure accuracy.

- Have the form reviewed by a legal professional to ensure it complies with state and local laws, avoiding costly errors or future disputes.

Don't:

- Rush through filling out the form without verifying all the information for accuracy.

- Leave any sections incomplete; always provide the requested information unless specified as optional.

- Attempt to make unauthorized changes to the form's structure or wording without legal guidance, as this could invalidate the document.

- Forget to have all parties sign and date the form in the presence of a notary public to ensure its legality and enforceability.

Misconceptions

A Deed of Trust is an essential document in real estate transactions, especially when it comes to financing a home purchase. However, there are several common misconceptions surrounding it. By clarifying these, we can better understand the role and implications of a Deed of Trust in property transactions.

- A Deed of Trust only benefits the lender. While it's true the Deed of Trust secures the lender's interest in the property, it also benefits the borrower by enabling the financing of the property purchase. This misconception overlooks the mutual protection it offers both parties in a property transaction.

- It's the same as a mortgage. Although both serve as security for a loan on real property, the Deed of Trust involves three parties - the borrower, the lender, and a trustee, whereas a mortgage involves only the borrower and the lender. This differentiation is crucial in understanding the legal and procedural nuances of each.

- Recording a Deed of Trust is optional. In fact, recording the document with the local county’s office is a critical step to ensure its enforceability and to protect the interest of all parties involved. It's not an optional step but a necessary legal requirement.

- It gives the trustee ownership of the property. The trustee holds the title to the property in a fiduciary capacity for the duration of the loan, but this does not equate to ownership. Their role is primarily to handle the foreclosure process if the borrower defaults, not to own the property.

- A Deed of Trust is a public record, so it violates privacy. While it's true that once recorded, a Deed of Trust becomes a public document, access to detailed borrower information is restricted. The public aspect ensures transparency and the recording of property rights, not to compromise privacy.

- Refinancing renders a Deed of Trust irrelevant. When you refinance your property, a new Deed of Trust is typically required to secure the new loan. The original Deed of Trust is paid off and then formally released. Thus, refinancing does not make it irrelevant; it updates the financial agreement’s security.

- Any form of default automatically leads to foreclosure. While defaulting on the loan is a serious issue, lenders and trustees often work with borrowers to find solutions before resorting to foreclosure. There are typically processes and opportunities for borrowers to address the default prior to foreclosure proceedings.

- The borrower cannot sell the property without the lender's consent. The borrower can sell the property; however, the sale proceeds must first be used to pay off the existing loan secured by the Deed of Trust. This ensures the lender's interest is satisfied before the borrower can profit from the sale.

Understanding these misconceptions can help clarify the function and importance of a Deed of Trust, fostering more informed decisions in real estate transactions.

Key takeaways

When dealing with a Deed of Trust form, it is crucial to understand its function and requirements to ensure a smooth and legally sound transaction. Below are key takeaways that potential users should consider:

- Definition: A Deed of Trust is a document that secures a loan on real property. It involves three parties: the borrower (Trustor), the lender (Beneficiary), and the trustee, who holds the title for the benefit of the lender.

- State-Specific Forms: The form and requirements for a Deed of Trust vary by state. Always use a version that complies with the laws of the state where the property is located.

- Read Carefully: Understanding every provision is crucial. This document outlines the loan terms, repayment schedule, and what happens if the borrower fails to make payments.

- Recording Is Essential: For a Deed of Trust to be effective, it must be recorded with the county recorder’s office in the county where the property is located. This process makes the document a matter of public record.

- Not a Transfer of Ownership: Signing a Deed of Trust does not transfer the ownership of the property to the lender or trustee. It merely serves as a lien against the property as security for the loan.

- Foreclosure Process: The Deed of Trust contains provisions for a non-judicial foreclosure process, meaning the lender can foreclose on the property without involving the court, should the borrower default on the loan.

- Power of Sale: One of the key elements of a Deed of Trust is the power of sale clause, which allows the trustee to sell the property to pay off the loan if the borrower defaults.

- Professional Assistance: Given the legal significance of this document, consider seeking help from a real estate lawyer or a professional legal document preparer to ensure the Deed of Trust is properly completed and filed.

Discover Other Types of Deed of Trust Documents

What Is Deed in Lieu - An agreement facilitating the transfer of property from the homeowner to the lender to avoid the formal foreclosure process.

Corrective Deed California - This document requires the same formalities as the original deed, including signatures, notarization, and recording with the appropriate office.

California Transfer on Death Deed - It is a vital estate planning tool that ensures real property is transferred to the intended person, reflecting the owner’s final wishes accurately.