Blank Deed Form for Florida

When it comes to transferring property ownership in Florida, the deed form plays a crucial role, acting as the official document that facilitates this important process. This form, utilized across the Sunshine State, comes in various types to suit different circumstances, including but not limited to warranty deeds, quitclaim deeds, and special warranty deeds. Each type serves a unique purpose, whether it's providing a full guarantee of clear title to the buyer in the case of a warranty deed, transferring interest with no guarantee in a quitclaim deed, or offering a limited guarantee with a special warranty deed. Completing and filing this document correctly is vital, as it not only executes the transfer but also ensures the legal protection of all parties involved. With Florida's property laws in mind, the deed form encompasses essential details such as the legal description of the property, the names of the current and new owners, and the signature of the person transferring the property, often requiring a witness and notarization to ensure authenticity. Understanding the specifics of the deed form is invaluable for a seamless transaction, making it a cornerstone of real estate dealings within the state.

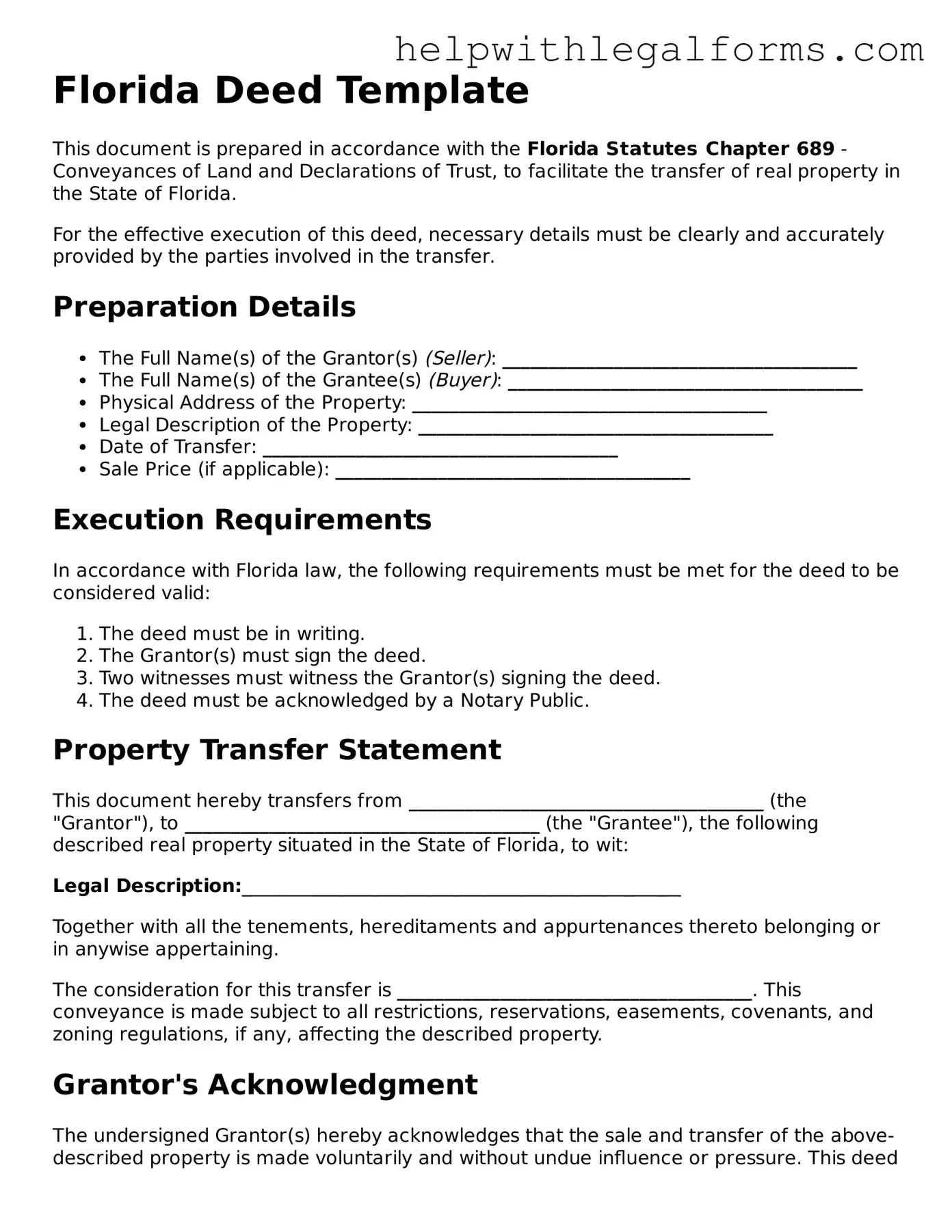

Example - Florida Deed Form

Florida Deed Template

This document is prepared in accordance with the Florida Statutes Chapter 689 - Conveyances of Land and Declarations of Trust, to facilitate the transfer of real property in the State of Florida.

For the effective execution of this deed, necessary details must be clearly and accurately provided by the parties involved in the transfer.

Preparation Details

- The Full Name(s) of the Grantor(s) (Seller): ______________________________________

- The Full Name(s) of the Grantee(s) (Buyer): ______________________________________

- Physical Address of the Property: ______________________________________

- Legal Description of the Property: ______________________________________

- Date of Transfer: ______________________________________

- Sale Price (if applicable): ______________________________________

Execution Requirements

In accordance with Florida law, the following requirements must be met for the deed to be considered valid:

- The deed must be in writing.

- The Grantor(s) must sign the deed.

- Two witnesses must witness the Grantor(s) signing the deed.

- The deed must be acknowledged by a Notary Public.

Property Transfer Statement

This document hereby transfers from ______________________________________ (the "Grantor"), to ______________________________________ (the "Grantee"), the following described real property situated in the State of Florida, to wit:

Legal Description:_______________________________________________

Together with all the tenements, hereditaments and appurtenances thereto belonging or in anywise appertaining.

The consideration for this transfer is ______________________________________. This conveyance is made subject to all restrictions, reservations, easements, covenants, and zoning regulations, if any, affecting the described property.

Grantor's Acknowledgment

The undersigned Grantor(s) hereby acknowledges that the sale and transfer of the above-described property is made voluntarily and without undue influence or pressure. This deed is executed in good faith to fully transfer the title of the described property to the Grantee(s).

Witness Acknowledgment

We, the undersigned witnesses, hereby certify that the Grantor(s) signed this document in our presence on the date ______________________________________.

Notary Public Acknowledgment

State of Florida)

County of ______________________)

On this day, before me, ______________________________________, a Notary Public in and for the State of Florida, personally appeared ______________________________________, known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged that he/she/they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal on the date ______________________________________.

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Governing Law | The Florida Deed form is governed by the laws of the State of Florida, specifically the statutes found in the Florida Statutes Chapter 689. |

| Type Varieties | Florida Deed forms come in several varieties, including but not limited to Warranty Deeds, Special Warranty Deeds, and Quitclaim Deeds. |

| Signing Requirements | For a Florida Deed to be valid, it must be signed by the grantor in the presence of two witnesses and a notary public. |

| Recording Requirement | After execution, the deed must be recorded with the Clerk of the Court in the county where the property is located to be effective against third parties. |

Instructions on How to Fill Out Florida Deed

Filling out a Florida Deed form is a critical step in the process of transferring real estate ownership. This document, when correctly completed and filed, legally transfers property from the seller to the buyer. It's a straightforward process, but attention to detail is key to ensure that the transfer is valid and legally binding. Here are the steps you'll need to follow to fill out your Florida Deed form accurately.

- Gather the necessary information, including the legal description of the property, the current owner's name (grantor), and the new owner's name (grantee).

- Check the type of deed you are preparing. This could be a warranty deed, a special warranty deed, or a quitclaim deed, each serving different purposes and offering different levels of protection to the buyer.

- Enter the date at the top of the deed. This marks the official date of the property transfer.

- Include the legal names and addresses of both the grantor and the grantee in the designated fields. Accuracy here is crucial for the validity of the deed.

- Copy the legal description of the property from the most recent deed to the property. This description must be precise, as it denotes the exact property being transferred.

- State the consideration being given for the property. This usually means the sale price but can also refer to other forms of compensation.

- The grantor(s) must sign the deed in the presence of two witnesses. Florida law requires these signatures for the deed to be legally binding.

- Take the completed deed to a notary public. The grantor's signature must be notarized to confirm the identity of the signer and the voluntary nature of the signing.

- File the signed and notarized deed with the local county recorder’s office. Filing fees will apply, and the amount varies by county.

Following these steps will help ensure that the Florida Deed form is filled out correctly, ensuring a seamless transfer of property. Remember, the details matter, from the accuracy of the legal descriptions to the requirement for witness signatures and notarization. Taking the time to do it right will protect both the grantor and the grantee and help to avoid any legal complications down the road.

Crucial Points on This Form

What is a Florida Deed form?

A Florida Deed form is a legal document that is used to transfer ownership of real estate from one person (the grantor) to another (the grantee) in the state of Florida. It must include specific information such as a legal description of the property, the names of both the grantor and grantee, and be signed by the grantor in the presence of a notary public and witnesses.

What types of Deed forms are commonly used in Florida?

There are several types of Deed forms used in Florida, each serving different purposes. The most common ones include the Warranty Deed, which provides the grantee with the highest level of protection, affirming that the grantor holds clear title to the property; the Special Warranty Deed, which only guarantees the title against claims arising during the grantor's period of ownership; and the Quitclaim Deed, which transfers any title, interest, or claim the grantor has in the property without any guarantee of clear title.

How is a Florida Deed form legally executed?

To legally execute a Florida Deed, the form must be completed with the necessary information, then signed by the grantor in the presence of two witnesses and a notary. It is crucial that the Deed is then recorded with the county clerk’s office where the property is located to ensure the transfer of ownership is public record and legally binding.

Do I need an attorney to create a Florida Deed?

While it's not legally required to have an attorney to create a Florida Deed, it is highly recommended. Real estate transactions can be complicated, and an attorney can help ensure that the Deed complies with all state legal requirements, properly conveys the property, and addresses any potential issues that might affect the transfer of title.

What happens if a Deed is not recorded in Florida?

If a Deed is not recorded in Florida, the transfer of property may not be protected against claims from third parties. This means that if the grantor sells the property to someone else who then records their Deed, the latter may have legal rights to the property even if your Deed was signed earlier. Therefore, recording the Deed with the appropriate county office is a critical step to ensure your legal ownership and protect against future claims.

Common mistakes

When filling out the Florida Deed form, it's crucial to pay close attention to each detail, ensuring that the document is completed accurately and comprehensively. Mistakes can lead to significant delays and potential legal complications. Here is a list of common errors made during this process:

Failing to use the correct type of deed: In Florida, there are several types of deeds, including warranty, special warranty, and quitclaim deeds, each serving different purposes and offering various levels of protection.

Omitting necessary legal descriptions: The deed must include a complete legal description of the property, which goes beyond just the street address, to accurately identify the property being transferred.

Forgetting to check for outstanding liens and mortgages: Not checking for or acknowledging existing encumbrances can create complications for the new owner.

Inaccurately identifying parties: Both the grantor (seller or giver) and grantee (buyer or receiver) must be correctly identified by their full legal names to ensure the deed's validity.

Not obtaining necessary signatures: The deed must be signed by all grantors involved in the transfer of property. In some cases, spouses or other parties may need to sign, even if they are not the property owners.

Skipping notarization: A critical step in legitimizing the deed is having it notarized. This process verifies the identity of the signing parties and acknowledges that they signed the document willingly.

Overlooking the need for witnesses: Florida law requires the presence of two witnesses to the signing of the deed, adding an additional layer of verification.

Neglecting to file the deed with the county: After completing the deed, it must be filed with the appropriate county office to become a matter of public record and to effectuate the legal transfer of the property.

Using incorrect or unclear language: The wording on a deed must follow certain legal conventions to accurately convey the grantor's intentions and to ensure enforceability.

Being mindful of these errors and taking steps to avoid them can help streamline the property transfer process, making it smoother and less stressful for all parties involved.

Documents used along the form

When transferring property in Florida, several documents accompany the Deed form to ensure a smooth, lawful transition of ownership. These documents each serve unique purposes, from verifying the legal description of the property to ensuring that all tax obligations are met. Understanding the function of each document can help individuals navigate through the complexities of real estate transactions with greater ease and confidence.

- Property Appraiser’s Parcel ID: This document provides the unique identifier assigned to the property by the local property appraiser's office. It is crucial for ensuring that the property described in the deed is accurately identified in public records.

- Title Insurance Policy: A title insurance policy offers protection against financial loss from defects in title to real property. It verifies that the seller has the legal right to transfer ownership and that there are no liens or encumbrances on the property that would hinder the sale.

- Closing Disclosure Form: This form is used in the closing process of a real estate purchase, providing detailed information about the mortgage loan if applicable. It outlines the terms of the loan, closing costs, and other financial details related to the purchase.

- Federal and State Tax Forms: Depending on the specifics of the real estate transaction, various tax forms may be required by federal and state authorities. These forms ensure that all tax implications of the transfer are appropriately addressed.

- Homeowners Association (HOA) Approval: If the property is located within a jurisdiction governed by a homeowners association, approval from the HOA may be required before the transfer of ownership is finalized. This document ensures compliance with community standards and regulations.

Together, these documents play integral roles in the real estate transaction process. They work in conjunction with the Deed form to establish a clear, legal, and mutually agreed upon transfer of property. Proper preparation and understanding of these documents can significantly reduce potential legal hurdles, ensuring a seamless property transaction for all parties involved.

Similar forms

-

Mortgage Agreement: Like a deed, a mortgage agreement involves real estate transactions. It documents the loan terms for property purchase, where the property itself serves as collateral. Both documents are recorded in public records, establishing legal relations and obligations.

-

Bill of Sale: This document resembles a deed in its function of transferring ownership, but it's used for personal property such as cars or boats rather than real estate. The Bill of Sale serves as proof of purchase and details the transaction between buyer and seller.

-

Title Certificate: Similar to a deed, a title certificate is proof of ownership, but it specifically pertains to vehicles. Both documents confirm the legal owner's rights and are essential for the sale or transfer of the pertinent asset.

-

Lease Agreement: A lease agreement shares similarities with a deed as it outlines the terms under which one party can use property owned by another. However, unlike a deed which transfers ownership, a lease grants the use of real estate for a specified time under certain conditions.

-

Warranty Deed: Closely related, a warranty deed is a specific type of deed that guarantees the property is free from any claims, liens, or other encumbrances. It provides the highest level of protection to the buyer, affirming the seller’s legal right to transfer the property.

-

Quitclaim Deed: This document is a form of deed that transfers any ownership, interest, or title the grantor may have in the property, without claiming or guaranteeing its validity. Quitclaim deeds are often used between family members or to clear up title issues.

Dos and Don'ts

When it comes to filling out a Florida Deed form, there are some essential dos and don'ts that can make the process smoother and help avoid common pitfalls. Below are key points to remember:

Do:Review the form carefully to understand every section. This step ensures that you know what information is required and where it should go.

Double-check the legal description of the property. This description is crucial and must be accurate to correctly identify the property being transferred.

Ensure all parties involved in the transfer are correctly identified by their full legal names. This clarity helps prevent any future disputes about who the parties to the deed are.

Sign the deed in the presence of a notary public. In Florida, notarization is a legal requirement for the deed to be considered valid.

Keep a copy of the completed deed for your records. Having your own record is essential for future reference or if any questions arise later.

Rush through filling out the form without understanding every field. Mistakes or omissions can lead to complications or even render the deed invalid.

Forget to record the deed with the county clerk's office after it's been signed and notarized. Recording is a crucial step to make the transfer of property official and public record.

By following these guidelines, you can help ensure that the process of filling out a Florida Deed form goes smoothly and effectively transfers property ownership as intended.

Misconceptions

When dealing with a Florida Deed form, several misconceptions often arise. Understanding these common misunderstandings can help streamline the process of transferring property.

All Florida Deed forms are the same: This is not true. There are different kinds of deeds, including warranty, special warranty, and quitclaim deeds. Each serves different purposes and offers varying levels of protection to the buyer.

A lawyer is not necessary for the deed transfer process: While Florida law does not require a lawyer to transfer property, having one can ensure the deed complies with all legal requirements, potentially saving time and money in the long run.

Once signed, the deed transfer is complete: A signed deed is just the first step. The document must also be notarized and recorded with the appropriate county to be effective.

Recording fees are the same across all Florida counties: Recording fees can vary by county. It’s important to check the current fees with the county where the property is located.

The deed must be witnessed by one person: Florida law requires two witnesses for the execution of a deed. This is to ensure the validity and authenticity of the document.

All parties must be present to sign the deed: While it’s ideal for all parties to be present, it’s not always necessary. Documents can be signed separately and then compiled for recording, provided all legal requirements are met.

A Notary Public can act as a witness: In Florida, a Notary Public can indeed serve as one of the two required witnesses, performing both roles during the deed execution.

Electronic signatures are not acceptable on Florida Deed forms: Electronic signatures are generally acceptable as long as the deed is executed in compliance with Florida’s electronic signature laws and all parties agree to its use.

Property descriptions are not crucial for the deed: This is incorrect. A detailed and accurate description of the property is essential for a valid deed transfer. Errors in the description can lead to disputes and complications in the future.

Filing a deed guarantees protection against future claims: While recording a deed is a crucial step in protecting one’s interest in the property, it does not absolutely guarantee against future claims. It’s advised to conduct due diligence, such as obtaining title insurance.

Understanding these misconceptions can help individuals navigate the complexities of Florida Deed forms more effectively. Accurate information is key to a smooth and legally sound transfer of property.

Key takeaways

When it comes to transferring property ownership in Florida, using the right deed form is crucial. Here are key takeaways you should consider to ensure the process is smooth and legally binding:

Understand the Different Types of Deeds: Florida recognizes several types of deeds, including Warranty, Special Warranty, and Quitclaim Deeds, each serving different purposes and levels of protection for the buyer and seller.

Ensure Accurate Information: It is essential to fill out the deed form with accurate information about the property and the parties involved. Mistakes can lead to legal complications or invalidate the deed.

Legal Description of the Property: A precise legal description of the property being transferred is required, not just the address. This includes lot, block, subdivision name, and any official records book and page number.

Signatures: The deed must be signed by all current property owners ('grantors'). Signatures typically need to be witnessed by two people and notarized to be legally effective.

Consideration: The deed should state the consideration, or value exchanged for the property's transfer, even if the property is a gift. This can affect tax implications.

File the Deed: After the deed is completed and signed, it must be filed with the Florida county clerk’s office where the property is located. Recording the deed officially transfers the ownership and protects the new owner’s rights.

Consulting a Professional: While you can fill out a deed on your own, consulting with a real estate attorney or professional is highly recommended. They can ensure that the form is correctly filled out and filed, and that the transfer adheres to Florida law.

Remember, handling property deeds is a legal process that requires precision, understanding of the law, and attentiveness to detail. Taking the time to ensure everything is correctly done can prevent future problems and disputes over property ownership.

Create Other Deed Forms for US States

New Jersey Deed Transfer Form - Ensuring all parties have a clear understanding of the Deed form’s terms and conditions is vital for a transparent transaction.

Property Owners Search - It ensures that all parties have a clear understanding of their rights and obligations concerning the property in question.