Blank Deed Form for Georgia

In the realm of property transactions within Georgia, the Georgia Deed form stands as a crucial document that legally facilitates the transfer of real estate ownership from one party to another. This form, embedded in the state's property laws, encompasses various types of deeds to cater to different transfer scenarios – each with its own set of requirements, benefits, and legal protections. The form meticulously outlines the details of the property, the identities of the old and new owners, and, importantly, any warranties or assurances provided by the seller regarding the property's condition and title. It plays a pivotal role in ensuring that all transactions are conducted transparently and with a clear record, safeguarding the interests of both parties involved. Understanding the nuances of the Georgia Deed form and its correct use is vital for anyone looking to buy, sell, or otherwise transact in real estate within the state, ensuring that property transfers are executed smoothly and with definitive legal standing.

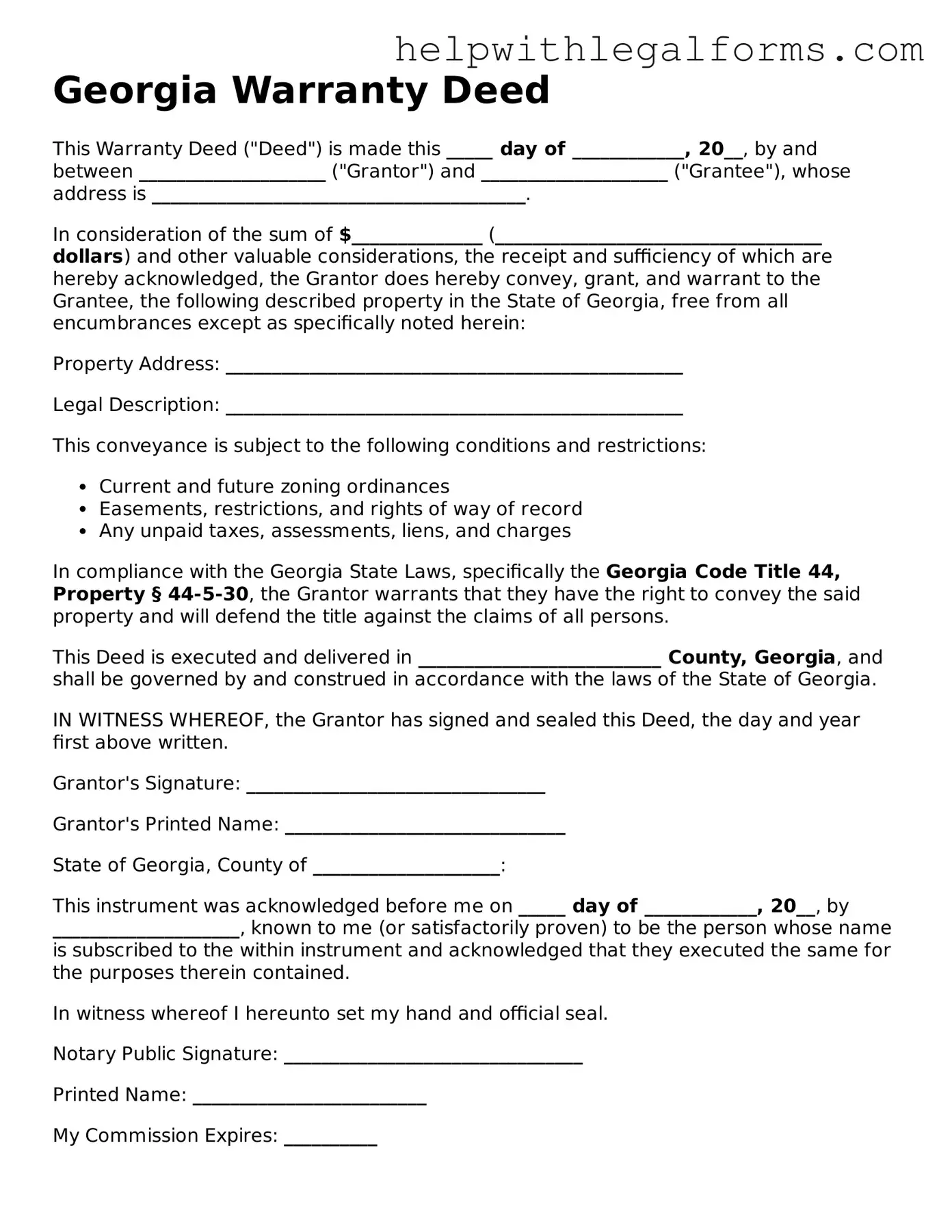

Example - Georgia Deed Form

Georgia Warranty Deed

This Warranty Deed ("Deed") is made this _____ day of ____________, 20__, by and between ____________________ ("Grantor") and ____________________ ("Grantee"), whose address is ________________________________________.

In consideration of the sum of $______________ (___________________________________ dollars) and other valuable considerations, the receipt and sufficiency of which are hereby acknowledged, the Grantor does hereby convey, grant, and warrant to the Grantee, the following described property in the State of Georgia, free from all encumbrances except as specifically noted herein:

Property Address: _________________________________________________

Legal Description: _________________________________________________

This conveyance is subject to the following conditions and restrictions:

- Current and future zoning ordinances

- Easements, restrictions, and rights of way of record

- Any unpaid taxes, assessments, liens, and charges

In compliance with the Georgia State Laws, specifically the Georgia Code Title 44, Property § 44-5-30, the Grantor warrants that they have the right to convey the said property and will defend the title against the claims of all persons.

This Deed is executed and delivered in __________________________ County, Georgia, and shall be governed by and construed in accordance with the laws of the State of Georgia.

IN WITNESS WHEREOF, the Grantor has signed and sealed this Deed, the day and year first above written.

Grantor's Signature: ________________________________

Grantor's Printed Name: ______________________________

State of Georgia, County of ____________________:

This instrument was acknowledged before me on _____ day of ____________, 20__, by ____________________, known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument and acknowledged that they executed the same for the purposes therein contained.

In witness whereof I hereunto set my hand and official seal.

Notary Public Signature: ________________________________

Printed Name: _________________________

My Commission Expires: __________

PDF Form Attributes

| Fact Number | Detail |

|---|---|

| 1 | Georgia Deed forms are used to legally transfer property in the state of Georgia. |

| 2 | The state of Georgia recognizes several types of deeds, including Warranty Deeds, Limited Warranty Deeds, and Quitclaim Deeds. |

| 3 | Warranty Deeds provide the highest level of protection for the grantee, as they guarantee clear title to the property. |

| 4 | Limited Warranty Deeds offer assurances that the seller holds clear title, but only against claims under their ownership. |

| 5 | Quitclaim Deeds transfer any interest the grantor might have in the property without any guarantee of clear title. |

| 6 | Georgia law requires all deeds to be filed with the county recorder's office where the property is located. |

| 7 | To be considered legal, a Georgia Deed must be in writing, contain a competent grantor and grantee, and be delivered and accepted. |

| 8 | Witnessing and notarization are mandatory for the deed to be recorded, as per Georgia state law. |

| 9 | The legal description of the property, including boundary details, must be clearly detailed in the deed. |

| 10 | Under Georgia law, the transfer tax must be paid when the deed is recorded, the amount of which is based on the value of the property. |

Instructions on How to Fill Out Georgia Deed

Completing a deed form is a critical step in the process of transferring property ownership in the state of Georgia. This document, when correctly filled out and recorded, officially conveys the property from the seller (grantor) to the buyer (grantee). The preparation of this form involves accuracy and attention to detail to ensure its validity and to protect the interests of all parties involved. The following instructions are tailored to guide individuals through this process, simplifying the legal requirements into clear, actionable steps. Whether you are a first-time homebuyer or a seasoned real estate investor, understanding how to properly complete a Georgia Deed form is essential.

- Gather all necessary information, including the full legal names of the grantor and grantee, the legal description of the property, and the parcel identification number.

- Identify the type of deed being executed (e.g., Warranty Deed, Quitclaim Deed), as this will determine the specific wording and clauses required.

- Obtain a legal description of the property. This can typically be found on a previous deed, in property tax documents, or by contacting the county recorder’s office.

- Enter the effective date of the transfer at the top of the form. This is the date on which the property will officially change hands.

- Fill in the grantor's information, including their legal name, marital status, and address, in the designated section.

- Provide the grantee’s information, mirroring the format used for the grantor. Include the grantee’s legal name, marital status, and address.

- Input the legal description of the property in the assigned area. Ensure accuracy, as this description dictates the exact boundaries of the property being transferred.

- State the consideration, or the value being exchanged for the property. This could be a monetary amount or other forms of value agreed upon by both parties.

- Include any other required clauses or stipulations specific to the type of deed being executed. For example, a Warranty Deed involves certain guarantees about the property's status.

- The grantor must sign the deed in the presence of a notary public and one additional witness in Georgia. Ensure that all signatures are obtained and properly notarized.

- File the completed and signed deed with the appropriate county recorder’s office to make the transfer of ownership official. A filing fee will likely be required.

Completing the Georgia Deed form is a vital step in the real estate transaction process. By adhering to the above steps, individuals can effectively navigate this legal document, paving the way for a smooth ownership transfer. Remember, the accuracy of the information provided and adherence to state-specific requirements are crucial for the document's validity. Consulting with a real estate attorney can also provide additional clarity and legal assurance throughout this process.

Crucial Points on This Form

What is a Georgia Deed form?

A Georgia Deed form is a legal document used to transfer property ownership from one party (the grantor) to another (the grantee) within the state of Georgia. This document is essential for the legal conveyance of real estate and must be correctly filled out and filed with the local county recorder's office to be valid.

Why do I need a Georgia Deed form?

You need a Georgia Deed form whenever you intend to transfer ownership of real property in Georgia. This could be due to buying or selling a property, transferring property between family members, or changing the legal status of ownership for estate planning purposes. Having a deed properly executed and recorded ensures that the official property records reflect the current ownership status.

What types of Deed forms are available in Georgia?

In Georgia, the most common types of Deed forms are General Warranty Deeds, Limited Warranty Deeds, and Quitclaim Deeds. General Warranty Deeds provide the highest level of buyer protection, guaranteeing clear title against all claims. Limited Warranty Deeds offer guarantees only against the claims of the seller and their tenure. Quitclaim Deeds transfer only the interest the seller has in the property, with no warranties regarding clear title.

How do I file a Georgia Deed form?

Once you have correctly filled out your Georgia Deed form, you need to get it signed by the grantor in the presence of a notary public. After notarization, the deed should be filed with the Clerk of the Superior Court in the county where the property is located. You might need to pay a recording fee, and it's advisable to check any specific filing requirements or procedures with the local county office.

Can I fill out a Georgia Deed form by myself?

While it is possible to fill out a Georgia Deed form by yourself, it is strongly recommended that you seek the assistance of a legal professional. This ensures that the deed complies with Georgia law and accurately reflects the intentions of the parties involved. An error in the deed could result in significant legal complications concerning property ownership.

What happens after a Georgia Deed form is filed?

After the Georgia Deed form is filed and recorded by the county recorder's office, the property's official records get updated to reflect the new ownership. The recorded deed serves as public notice of the ownership change, which is critical in protecting the grantee's rights. It is beneficial for the grantee to obtain a copy of the recorded deed for their records and future proof of ownership.

Common mistakes

Filling out a Georgia Deed form is an important step in legally transferring property ownership. However, errors during this process can lead to complications, delays, or even void the transaction. To ensure smooth sailing, be mindful of these common mistakes:

- Not Checking the Property Description: One of the most critical parts of the deed is the detailed description of the property being transferred. A mistake here can invalidate the deed or cause legal issues down the line.

- Forgetting to Verify the Grantor’s and Grantee’s Information: Ensure the names and addresses of the seller (grantor) and buyer (grantee) are correct and fully listed. Any error can throw into question who the legal parties to the transaction are.

- Ignoring the Need for Witness Signatures: Georgia law requires the presence of a witness when the grantor signs the deed. Failing to have a witness sign can render the document unenforceable.

- Omitting the Notarization: After signing, the deed must be notarized to verify the authenticity of the grantor’s signature. This step is non-negotiable for the deed to be legally binding.

- Choosing the Wrong Type of Deed: There are several types of deeds, including warranty and quitclaim deeds, each serving different purposes and offering varying levels of protection. Selecting the wrong type can have significant legal implications.

- Miscalculating Transfer Taxes or Fees: Inaccurately calculating or failing to include transfer taxes and other associated fees can delay the recording process.

- Forgetting to File with the County Recorder’s Office: Simply completing the deed does not finalize the transfer. The deed must be filed with the local county recorder’s office to become part of the public record.

- Overlooking Joint Ownership Implications: If the property is being transferred to more than one person, the deed must clearly state the manner of holding the title (e.g., joint tenants, tenants in common). This has significant implications for property rights and succession.

- Neglecting to Seek Legal Advice: Given the complexity and legal significance of property transfers, consulting with a legal professional before finalizing the deed can prevent costly errors and ensure the transaction aligns with your interests.

Avoiding these common mistakes can help ensure that the process of transferring property in Georgia is conducted accurately and legally. Always take the time to review all parts of the deed carefully and seek professional advice when needed.

Documents used along the form

When handling property transactions in Georgia, the deed form plays a crucial role. However, this document doesn't stand alone. To ensure a smooth and legally sound transaction, several other forms and documents often accompany the Georgia deed form. These auxiliary materials help to clarify, validate, and enforce the terms of the property transfer, offering protection and peace of mind to all parties involved.

- Property Disclosure Statement: This document provides buyers with important information about the property's condition, including any known defects or problems that could affect the property's value or desirability.

- Title Search Report: A comprehensive examination of public records to confirm the property's legal ownership, and to identify any liens, encumbrances, or claims against the property.

- Purchase Agreement: Often the precursor to the deed, this contract outlines the terms of the property sale, including price, conditions, and closing details.

- Loan Documents: If the purchase is being financed, the buyer will need to complete various lender-required forms, including the mortgage agreement and promissory note.

- Closing Statement: An itemized list of all the transactions and fees paid by both buyer and seller at closing, ensuring clarity and agreement on all financial aspects of the deal.

- Homeowners' Insurance Proof: Evidence that the property has adequate insurance coverage, typically required by lenders before the loan can close.

- Plat Map: A diagram showing the property's boundaries, divisions, and physical features, which can be crucial for identifying easements, right of ways, and other property details.

- Power of Attorney: A legal document that grants someone the authority to act on behalf of another person in specific legal or financial issues, used in property transactions when one party cannot be physically present to sign documents.

- Lead-Based Paint Disclosure: A required document for homes built before 1978, disclosing the presence of any known lead-based paint on the property, for the protection of the buyers.

The process of transferring property in Georgia involves more than just signing a deed. By incorporating these additional forms and documents, parties can ensure the transaction is transparent, lawful, and in accordance with both parties' expectations. Whether you're buying or selling property, understanding and preparing these documents can offer a smoother transaction and help to prevent legal complications down the line.

Similar forms

Mortgage Agreement: Similar to a deed, a mortgage agreement is a legal document that provides a lender the right to claim a property if the borrower fails to repay a loan. Both documents involve property and legal obligations.

Warranty Deed: This is a specific type of deed that guarantees the clear title of a property to the buyer, protecting them from future claims against the property. It is similar to a generic deed form in its function of transferring property rights.

Quitclaim Deed: This document transfers any ownership, interest, or title a person may have in a property, without stating the nature of the person's interest or rights, and without offering any warranty. It is related to a deed in its basic function of transferring property titles but differs in the level of protection it offers the grantee.

Trust Deed: This is a document that involves transferring the title of a property to a trustee who holds it as security for a loan, similar to a deed that involves the transfer of property rights, but with the specific purpose of securing a debt.

Lease Agreement: A lease agreement allows for the use of property for a specified period in exchange for payment. While it doesn't transfer ownership like a deed, it similarly involves the legal use and enjoyment of real estate.

Bill of Sale: This document evidences the transfer of ownership of personal property, like vehicles or furniture, from one party to another. Similar to deeds, bills of sale are important for documenting transfers of ownership, albeit of personal rather than real property.

Title Certificate: A title certificate is a document that proves ownership of a property. It is similar to a deed in that both are essential in the process of proving and transferring property ownership.

Easement Agreement: An easement agreement grants the right to use another person's land for a specific purpose. Like a deed, it involves rights related to real property, but it does not transfer ownership.

Power of Attorney: This document allows one person to make legal decisions on behalf of another. Similar to deeds, powers of attorney involve significant legal powers and responsibilities, albeit in broader contexts than just property transactions.

Land Contract: A land contract is an agreement between a buyer and a seller where the buyer pays the purchase price over time, and the title remains with the seller until full payment is made. It is related to a deed as it involves the process toward full property ownership.

Dos and Don'ts

Completing a Georgia Deed form accurately is crucial for the legal transfer of property. Below are the highly recommended dos and don'ts that individuals should keep in mind while filling out this document.

Do:

- Ensure all information is accurate and matches official documents, including the legal description of the property, the grantor's (seller's) name, and the grantee's (buyer's) name.

- Use black ink for better legibility and to meet recording standards. Documents with poor legibility may not be accepted for recording.

- Obtain a legal description of the property from a recent deed or title search. Do not rely solely on tax assessment documents as they might not provide the detailed description required for a deed.

- Sign in the presence of a notary public and, depending on the county’s requirements, the required number of witnesses. Georgia law mandates the presence of a notary and at least one witness for the deed to be legally valid.

- Record the deed at the county recorder’s office where the property is located as soon as possible. This is crucial for protecting the grantee’s interests in the property.

Don't:

- Forget to include any co-owners in the deed. All parties holding an interest in the property must be listed to ensure the transfer is legally binding on all owners.

- Overlook double-checking all names, spellings, and parcel identification numbers. Accidental errors can lead to significant legal issues or delays in the property transfer process.

- Leave any blanks on the form. If a section does not apply, mark it as “N/A” (not applicable) rather than leaving it blank to prevent unauthorized alterations.

- Use correction fluid or tape on the deed form. Mistakes should be neatly crossed out, and the correct information should be initialed by the person filling out the form.

- Attempt to file the deed without reviewing state and local guidelines. Each county may have specific requirements for filing a deed, including document formatting, fees, and additional forms.

Misconceptions

When it comes to transferring property ownership in Georgia, the deed is a crucial document. However, misconceptions about Georgia deed forms can lead to confusion or legal complications. It's essential to dispel these myths for a clearer understanding of property transactions.

All Georgia deed forms are the same: This misconception could not be further from the truth. Georgia has several types of deed forms, each serving different purposes and offering varying levels of protection to the grantor and grantee. For example, Warranty Deeds provide the highest level of protection for buyers, while Quitclaim Deeds offer minimal assurances about the property's title.

Filling out a deed form is enough to transfer property: Simply completing a Georgia deed form is not sufficient to effectuate the transfer of property. The deed must be delivered to and accepted by the grantee. Additionally, for the transfer to be considered valid and enforceable, it must be recorded with the appropriate county office in Georgia, ensuring it becomes public record.

Deed forms do not need to be notarized in Georgia: This is incorrect. Georgia law requires that deed forms be signed in the presence of a notary public and an additional witness to be legally effective. Notarization is a critical step to authenticate the document, aiding in the prevention of fraud.

You can use any generic deed form for Georgia property transactions: While generic deed forms may appear convenient, they may not comply with Georgia’s specific legal requirements or address the unique aspects of state law. Using a state-specific deed form is crucial to ensure the legality of the transaction and to protect the rights of all parties involved.

A deed and a title are the same thing: This common misunderstanding can lead to confusion during the property transaction process. In reality, a deed is a legal document that conveys the right to ownership, while the title is a concept that represents legal ownership of the property. Possessing a deed is part of the process of obtaining title, but the two are not synonymous.

Recording a deed is optional: While physically possessing a deed might seem like adequate proof of ownership, failing to record the deed with the local county office can lead to significant legal vulnerabilities. Recording acts as a public notice of the transfer of ownership, protecting the grantee's interests from subsequent claims. Not recording a deed can complicate future sales, refinancing, or legal disputes regarding property ownership.

Understanding these misconceptions about Georgia deed forms ensures that individuals are better prepared for the responsibilities and requirements of property transactions within the state. When in doubt, consulting a legal professional specialized in real estate law can provide clarity and guidance tailored to specific circumstances.

Key takeaways

Filling out and using the Georgia Deed form involves a nuanced understanding of the document's implications, legal requirements, and the steps necessary to ensure its enforceability. Here are several key takeaways to consider:

- Understand the Different Types of Deeds: Georgia recognizes several types of deeds, including Warranty Deeds, Limited Warranty Deeds, and Quitclaim Deeds. Each serves a different purpose and offers varying levels of protection for the buyer and obligations for the seller.

- Correctly Identify the Parties: The deed must accurately name the grantor (seller) and grantee (buyer). Errors in identifying parties can lead to complications or invalidate the document.

- Legal Description of the Property: The deed must include a legal description of the property being transferred. This is more detailed than a simple address and usually references lot numbers, boundary lines, and other legal identifiers.

- Ensure the Deed is Signed, Witnessed, and Notarized: For a deed to be legally binding in Georgia, it must be signed by the grantor in the presence of a notary and at least one additional witness.

- Transfer Tax: When real estate changes hands in Georgia, a transfer tax is often required. This tax is based on the property's sale price and must be considered when completing the deed.

- Recording the Deed: After it is duly signed and notarized, the deed must be recorded with the county recorder's office where the property is located. Recording the deed is crucial as it protects the grantee's interests and establishes the document's validity.

- Filling Out the Form Accurately: Any error in the deed can lead to legal disputes or challenges to the property's title. It's important to fill out the form carefully and review it thoroughly before submission.

- Consider Professional Assistance: Given the legal and financial implications of conveying property, consulting with a real estate attorney or a legal advisor for guidance on filling out the form correctly and understanding its implications can be invaluable.

- Remember the Purpose of the Deed: Finally, it's crucial to remember that a deed is a legally binding document that transfers ownership of real property from one person to another. Its execution and handling should be approached with the seriousness and accuracy such a transaction demands.

Create Other Deed Forms for US States

New Jersey Deed Transfer Form - It includes critical terms and conditions related to the property transfer, ensuring clear communication between buyer and seller.

Warranty Deed Connecticut - Within this framework, the Deed form specifies the property’s precise boundaries and identifies the grantor and grantee.

General Warranty Deed Colorado - Reflects the culmination of negotiations and agreements between buyer and seller in real estate deals.

Property Owners Search - Upon completion, the deed is often recorded with a local government or title office to establish public record of ownership.