Legal Gift Deed Form

When an individual decides to transfer property to another as a gift, the process involves not just a generous heart, but also a legal document known as a Gift Deed form. This pivotal document serves to legally record the act of giving and ensures that the property changes hands in a manner that is recognized by law. The importance of this form cannot be overstated, as it lays down the specifics of the gift, the details of the donor and the recipient, and any conditions attached to the gift. Additionally, for the gift to be deemed valid, certain legal formalities must be complied with, which typically include the requirement for the deed to be signed in the presence of a notary or witnesses. It's also critical that the document clearly states that the transfer is made willingly and without consideration, distinguishing it from a sale. This form, thus, stands as a testament to the donor's intention and helps prevent any future disputes regarding the ownership or the terms of the transfer.

State-specific Gift Deed Forms

Example - Gift Deed Form

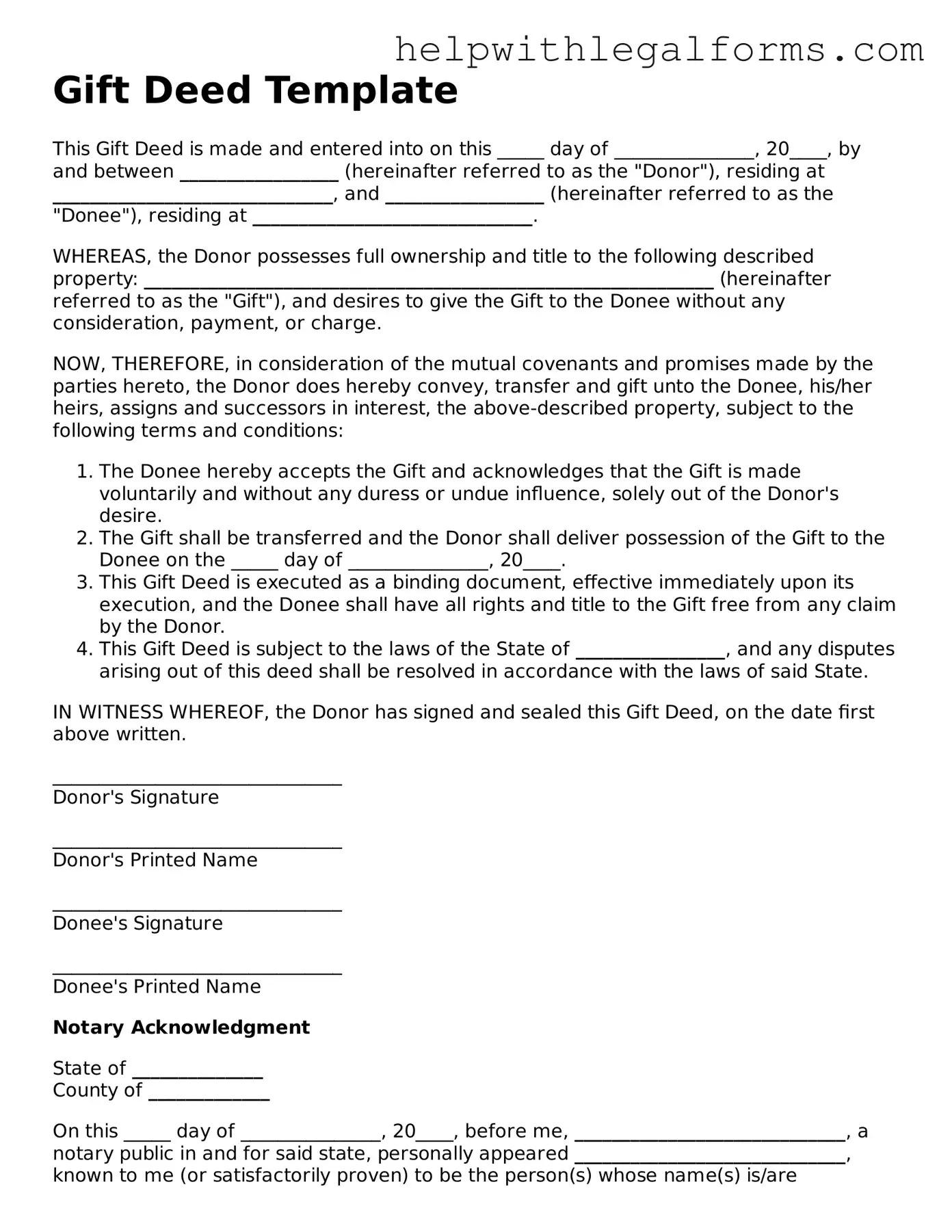

Gift Deed Template

This Gift Deed is made and entered into on this _____ day of _______________, 20____, by and between _________________ (hereinafter referred to as the "Donor"), residing at ______________________________, and _________________ (hereinafter referred to as the "Donee"), residing at ______________________________.

WHEREAS, the Donor possesses full ownership and title to the following described property: _____________________________________________________________ (hereinafter referred to as the "Gift"), and desires to give the Gift to the Donee without any consideration, payment, or charge.

NOW, THEREFORE, in consideration of the mutual covenants and promises made by the parties hereto, the Donor does hereby convey, transfer and gift unto the Donee, his/her heirs, assigns and successors in interest, the above-described property, subject to the following terms and conditions:

- The Donee hereby accepts the Gift and acknowledges that the Gift is made voluntarily and without any duress or undue influence, solely out of the Donor's desire.

- The Gift shall be transferred and the Donor shall deliver possession of the Gift to the Donee on the _____ day of _______________, 20____.

- This Gift Deed is executed as a binding document, effective immediately upon its execution, and the Donee shall have all rights and title to the Gift free from any claim by the Donor.

- This Gift Deed is subject to the laws of the State of ________________, and any disputes arising out of this deed shall be resolved in accordance with the laws of said State.

IN WITNESS WHEREOF, the Donor has signed and sealed this Gift Deed, on the date first above written.

_______________________________

Donor's Signature

_______________________________

Donor's Printed Name

_______________________________

Donee's Signature

_______________________________

Donee's Printed Name

Notary Acknowledgment

State of ______________

County of _____________

On this _____ day of _______________, 20____, before me, _____________________________, a notary public in and for said state, personally appeared _____________________________, known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged that he/she/they executed the same for the purposes therein contained.

IN WITNESS WHEREOF, I have hereunto set my hand and official seal.

_______________________________

Notary Public's Signature

My commission expires: ___________________

PDF Form Attributes

| Fact Number | Detail |

|---|---|

| 1 | A Gift Deed is a legal document that formalizes the process of giving a gift and transfers legal ownership from the donor (the person giving the gift) to the donee (the recipient). |

| 2 | This form requires the donor's and donee's full legal names and addresses to accurately identify the parties involved in the transfer. |

| 3 | The document must clearly describe the gifted property, ensuring there's no ambiguity about what is being transferred. |

| 4 | To be valid, a Gift Deed usually needs to be signed by the donor in the presence of a notary public. |

| 5 | In many states, to fully complete the gift transfer, this deed must not only be signed and notarized but also filed with the local county recorder's office. |

| 6 | The laws governing Gift Deeds vary from state to state, meaning it's crucial to consult or include state-specific provisions to ensure the deed's legality. |

| 7 | A Gift Deed once executed is irrevocable, indicating the donor's intention to make an immediate gift that cannot be taken back. |

| 8 | While a Gift Deed transfers ownership of the property to the recipient without any exchange of money, gift taxes may still apply depending on the value of the gift and the state in which the transfer occurs. |

Instructions on How to Fill Out Gift Deed

When transferring ownership of a property as a gift, a Gift Deed form is a fundamental legal instrument you'll need to accurately fill out and file. This process ensures the transaction is recognized legally, safeguarding both the giver's and the recipient's rights. Next, we'll walk through each step to fill out this form properly. While the process may seem daunting at first, it becomes straightforward once you understand what each step entails.

- Start by clearly identifying both the giver (donor) and the receiver (donee). Include full legal names, addresses, and contact information to avoid any ambiguity.

- Provide a detailed description of the property being gifted. This description should include any identifiers like serial numbers for movable property (e.g., vehicles) or legal descriptions for immovable property (e.g., real estate).

- State the relationship between the donor and donee, if applicable. This information might have legal implications, especially for tax purposes.

- Include the date when the gift deed will become effective. This is crucial for record-keeping and legal purposes.

- Clarify that the property is being transferred without any consideration. This statement confirms that the recipient is not paying for the property, distinguishing it from a sale.

- For tax purposes, certify whether the donor intends this gift to be a part of their annual gift exclusion. This detail is important for adhering to the tax regulations concerning gifts.

- Signatures are vital. Ensure that the donor, donee, and a notary public sign the document. The presence of a notary public provides additional legal weight to the document.

After completing these steps, the Gift Deed form needs to be filed with the appropriate local or state government office to make the transfer official. The specific office can vary depending on the property's nature and location, so it's important to verify with local laws to ensure the deed is filed correctly. This final step completes the process, legally transferring ownership of the property from the donor to the donee.

Crucial Points on This Form

What is a Gift Deed?

A Gift Deed is a legal document used to transfer ownership of property from one person (the donor) to another (the donee) without any exchange of money. It is commonly used to give gifts of real estate, vehicles, or other significant assets. The deed formalizes the intention of the donor and provides legal documentation of the gift.

Who can create a Gift Deed?

Any individual who holds the legal title to a piece of property and has the legal capacity can create a Gift Deed. This means the donor must be of sound mind, not under duress or undue influence, and of legal age to make decisions about their property.

Is acceptance by the donee required?

Yes, acceptance by the donee is typically required for a Gift Deed to be effective. The donee must accept the gift during the lifetime of the donor. If the donee does not accept the gift, the Gift Deed is not considered valid.

Does a Gift Deed need to be notarized or witnessed?

In most jurisdictions, a Gift Deed must be notarized and, in some cases, witnessed to ensure its validity. The requirements can vary, so it is crucial to check the specific laws in your state. Notarization and witnessing provide an additional layer of verification to the process, ensuring that the document is legally recognized.

Can a Gift Deed be revoked?

Once a Gift Deed has been accepted by the donee, it generally cannot be revoked without the donee's consent. There are exceptions, such as cases of fraud or if the deed was made under duress. However, these are rare and challenging to prove. As such, donors should be certain of their decision before transferring property via a Gift Deed.

Are there any tax implications to consider?

Giving a property as a gift can have tax implications for both the donor and the donee. In the United States, the donor may be subject to the federal gift tax if the value of the gift exceeds the annual exclusion amount. The donee may also face capital gains tax upon the sale of the gifted property, based on its fair market value at the time of the gift. Consulting with a tax professional is advisable to understand these implications fully.

What information is necessary to complete a Gift Deed?

To complete a Gift Deed, certain information is essential: the full names and addresses of the donor and donee, a legal description of the property being gifted, the date of the gift, and a statement of the donor's intent to make the gift without consideration. The document must also be signed by the donor in the presence of a notary public.

Can real estate be transferred through a Gift Deed?

Yes, real estate is one of the most common assets transferred through a Gift Deed. However, due to the significant value and legal ramifications of real estate transactions, additional legal requirements may need to be met, such as the preparation of a new deed and filing it with the local county recorder's office. It's essential to consult with a legal professional to ensure all legal requirements are satisfied.

Common mistakes

Filling out a Gift Deed form is a generous act, signifying the giver's intention to transfer ownership of property to someone else without expecting anything in return. However, the process isn’t always straightforward. People often make various mistakes during this process, which can lead to delays, legal complications, or even invalidation of the deed. Here are eight common errors:

- Ignoring state-specific requirements: Each state has its laws governing the transfer of property. Failing to adhere to these can render the deed void.

- Not including a full description of the property: A complete, clear description is crucial to identify the property being given away, including its address and legal description (boundaries, lots, etc.).

- Omitting pertinent parties' details: Every party involved must have their full legal names, current addresses, and possibly their identification numbers specified clearly.

- Forgetting to sign in the presence of a notary: A notarized signature is often required to authenticate the deed, without which the document might not be legally binding.

- Misunderstanding the tax implications: Gift deeds can have significant tax consequences for both the giver and the recipient. Overlooking these can lead to unexpected liabilities.

- Failing to specify that the gift is unconditional: A gift by definition is given without expecting anything in return. Any conditions attached could question the deed's validity.

- Lack of witnesses: While not always mandatory, having witnesses can provide an additional layer of validation to the gift deed.

- Improper filing or not filing at all: Once executed, the deed must be filed with the appropriate local government office. Failure to do so can jeopardize the legal transfer of the property.

Understanding and avoiding these mistakes can ensure that the act of giving is as joyful and fulfilling as it is intended to be. Engaging with professionals to assist in filling out the form can also mitigate potential risks and validate that the generous gift is successfully transferred.

Documents used along the form

In legal practice, the conveyance of property is often accompanied by various forms and documents to ensure compliance with applicable laws and to establish a clear record of the transaction. One such document is a Gift Deed, used when property is given from one person to another without any exchange of money. Along with a Gift Deed, several other forms and documents are frequently utilized to facilitate and document the transfer effectively. Below is a list of forms and documents that are commonly used in conjunction with a Gift Deed.

- Acknowledgment of Notary Public: This document confirms that the signed parties appeared before a Notary Public and their identities were verified. It is a critical step in authenticating the document.

- Real Property Transfer Declaration: Often required by local or state agencies, this form provides details about the property being transferred, including the property's location, value, and characteristics.

- Warranty Deed: While not always used with a Gift Deed, a Warranty Deed might be necessary if the giver guarantees the property is free from any liens or claims.

- Quitclaim Deed: Sometimes utilized along with a Gift Deed to release the giver from any future claims or interests in the property.

- Trust Agreement: If the property is being transferred into a trust, this document outlines the terms of the trust, including the trustees and beneficiaries.

- Power of Attorney: This grants someone the authority to act on behalf of the giver in matters related to the property transfer, especially if the giver is not available to sign documents in person.

- Death Certificate: Required if the transfer involves the estate of a deceased person, confirming the death and the executor’s authority to transfer property.

- Title Insurance Policy: Provides protection against future disputes over the ownership of the property or unforeseen claims against the property’s title.

- Mortgage Release Statement: If there was a mortgage on the property, this document shows that the mortgage has been paid off and the lien on the property has been released.

- Property Tax Statement: Shows the current status of property taxes, ensuring that there are no outstanding taxes due at the time of the transfer.

Using these documents in conjunction with a Gift Deed provides a comprehensive framework for the transfer of property, ensuring that all legal requirements are met and that the transaction is properly recorded. It is important for parties involved in such transactions to understand the purpose and requirement of each document, ensuring a smooth and legally sound transfer of property.

Similar forms

Will: Like a Gift Deed, a Will is a document that outlines how a person wants their property to be distributed after their death. Both documents specify the transfer of assets and intend to minimize disputes among heirs or recipients.

Trust Deed: This instrument, similar to a Gift Deed, is used to transfer property but does so by placing the property into a trust for the benefit of others. Both serve the purpose of managing and transferring assets, albeit the Gift Deed does so directly to another person while a Trust Deed involves a trust entity.

Quitclaim Deed: Often used in transferring property rights among family members or between spouses, a Quitclaim Deed like a Gift Deed, does not involve the exchange of money. However, it provides less protection for the recipient since it transfers only the rights the giver has, without guaranteeing clear title.

Warranty Deed: This document guarantees that the property title is clear and free of liens, similar to a Gift Deed, it involves the transfer of real estate. Unlike a Gift Deed, a Warranty Deed includes a guarantee about the property's title status.

Life Estate Deed: Similar to a Gift Deed, a Life Estate Deed transfers property but allows the giver (or another specified individual) to retain rights to the property for their lifetime. Both documents facilitate the process of transferring property, each with specific conditions regarding the use and control of the property.

Transfer-on-Death (TOD) Deed: Like a Gift Deed, a TOD deed enables the transfer of property but only becomes effective upon the death of the owner. It allows for the direct transfer of property to beneficiaries without going through probate, mirroring the intent of a Gift Deed to smoothly transition ownership.

Power of Attorney: Although chiefly used for giving someone the authority to make decisions on another's behalf, a Power of Attorney can involve the management or transfer of the principal's assets, similar to the property transfer objective of a Gift Deed. Both documents allow for the handling and distribution of assets under specified conditions.

Dos and Don'ts

When filling out a Gift Deed form, it's essential to proceed with precision and caution. This document plays a crucial role in transferring ownership of property from one person to another as a gift. To ensure the process goes smoothly and legally, here are several do's and don'ts to keep in mind:

- Do verify the exact legal description of the property. It's important to use the legal description found on the current deed or property tax bill to avoid any discrepancies.

- Do check for any state or local filing requirements. Rules can vary significantly, so it's critical to understand the specific requirements in the jurisdiction where the property is located.

- Do ensure all parties sign the Gift Deed in the presence of a notary public. This step is crucial for the document to be legally binding and recognized.

- Do keep a copy of the signed and notarized document for personal records. It's always wise to have your own reference in case of disputes or for future transactions.

- Do consult with a tax professional about any potential tax implications. Gifting property can have significant tax consequences, and it's important to understand these before proceeding.

- Don't leave any sections of the form blank. Incomplete forms can lead to legal complications or invalidate the deed altogether.

- Don't forget to specify any conditions of the gift if applicable. If the gift comes with conditions, these should be clearly stated in the document.

- Don't underestimate the importance of legal advice. Consulting with a legal professional can help avoid common mistakes and ensure the deed complies with all legal requirements.

- Don't neglect to file the deed with the local county clerk's office after it is signed and notarized, if required. Filing is a critical step to make the transfer of property official in public records.

Misconceptions

Gift Deeds are legal documents used to transfer property or assets from one person to another without any expectation of payment. Despite their straightforward purpose, there are many misconceptions about Gift Deed forms. Below are ten common misunderstandings, clarified to provide a better understanding of how Gift Deeds work.

- Gift Deeds are only for real estate: Many people mistakenly believe that Gift Deeds are exclusively used for transferring real estate. In reality, these forms can also be utilized to gift personal property, vehicles, and even stocks or shares.

- Gift Deeds are not legally binding: This is incorrect. Once appropriately executed, a Gift Deed is a legally binding document that transfers ownership of property from the donor (the person giving the gift) to the donee (the person receiving the gift).

- A verbal agreement is as good as a Gift Deed: Verbal agreements lack the legal standing of a written Gift Deed. For the transfer to be legally recognized, especially in the case of real estate, it must be documented and meet specific state requirements.

- Gift Deeds and Wills are the same: Gift Deeds and Wills serve different purposes. A Gift Deed transfers property while the donor is alive, whereas a Will outlines how the property should be distributed after the donor's death.

- You can retract a Gift Deed anytime: Unlike a promise or an offer of a gift, once a Gift Deed is executed and delivered, the donor cannot retract the gift without the donee's consent, especially if the donee has already taken possession or the title has been transferred.

- Gift Deeds are taxable to the recipient: While this can vary by jurisdiction, in many cases, the recipient of a gift does not bear the tax burden. Instead, the donor may be responsible for paying gift tax if the value of the gift exceeds a certain threshold.

- All states have the same requirements for Gift Deeds: The requirements for a valid Gift Deed can vary significantly from one state to another. This misconception can lead to the improper execution of a Gift Deed, making it invalid.

- Gift Deeds are effective immediately: While the intention is for immediate transfer, the actual effectiveness of a Gift Deed may depend on its delivery, acceptance by the donee, and other legal formalities being completed.

- Gift Deeds require consideration to be valid: Unlike other forms of deeds or contracts, a Gift Deed does not require consideration (payment) to be valid. The essence of a gift is that it is made voluntarily and without expecting something in return.

- No need for witnesses or notarization: This is one of the most dangerous misconceptions. Depending on state laws, having witnesses or getting the deed notarized may be necessary for the Gift Deed to be legally valid.

Understanding these misconceptions is critical for anyone considering the use of a Gift Deed to ensure the process is completed correctly and legally. It’s always advisable to consult with a legal professional experienced in property law to avoid potential pitfalls.

Key takeaways

When transferring ownership of property as a gift, it's essential to use the Gift Deed form correctly. This form is a legal document that facilitates the process, ensuring the gift is recognized by law and any necessary tax implications are addressed. The following key takeaways can help guide you through filling out and using the Gift Deed form:

- Accuracy is crucial: Ensure all information provided on the Gift Deed form is accurate and complete. This includes the full names and addresses of both the giver (donor) and the receiver (donee), as well as a detailed description of the property being gifted.

- Witness and Notarization: Most states require the Gift Deed to be signed in the presence of a notary public and, in some cases, one or two witnesses. This step is essential for the deed to be legally valid.

- Understand the Tax Implications: While gifting property, there may be tax implications for both the donor and the donee. It's important to consult with a tax professional to understand any potential liability.

- Consider the Impact on Medicaid Eligibility: Transferring property through a Gift Deed could affect the donor's eligibility for Medicaid. Professional advice should be sought to understand these implications fully.

- File with the County Recorder's Office: For the Gift Deed to be effective and enforce public record, it must be filed with the local County Recorder's Office. There might be a filing fee associated with this process.

- No Consideration Involved: A characteristic feature of a Gift Deed is that it involves the transfer of property without any exchange of money or other form of consideration. The document should clearly state that the transfer is indeed a gift.

Properly completing and using the Gift Deed form can ensure a smooth transfer of property, minimizing potential legal complications down the line. When in doubt, seeking professional legal help can provide clarity and peace of mind throughout the process.

Discover Other Types of Gift Deed Documents

Corrective Deed California - Lenders, title companies, and legal professionals often scrutinize property deeds for accuracy, making the Corrective Deed an invaluable tool.

How Long Does a Quit Claim Deed Take to Process - Despite its benefits in speed and convenience, thorough consideration is crucial due to the lack of title guarantee.