Blank Gift Deed Form for California

In the state of California, individuals seeking to transfer property to another person without any consideration, or payment, often utilize the California Gift Deed form. This document is crucial in the process, as it formalizes the act of giving and ensures that the transfer is legally binding and recognized by law. The form, which needs to be notarized to take effect, outlines the details of the property, the identity of the donor and the recipient, and the fact that the transfer is a gift. Moreover, it addresses the imperative requirement of filing with the local county recorder's office to complete the transaction, ensuring the gift is officially recorded and acknowledged. The California Gift Deed form is instrumental in helping individuals navigate the legal landscape of gifting property, providing a clear and structured way to transfer ownership without the exchange of money, while also protecting the interests of both parties involved.

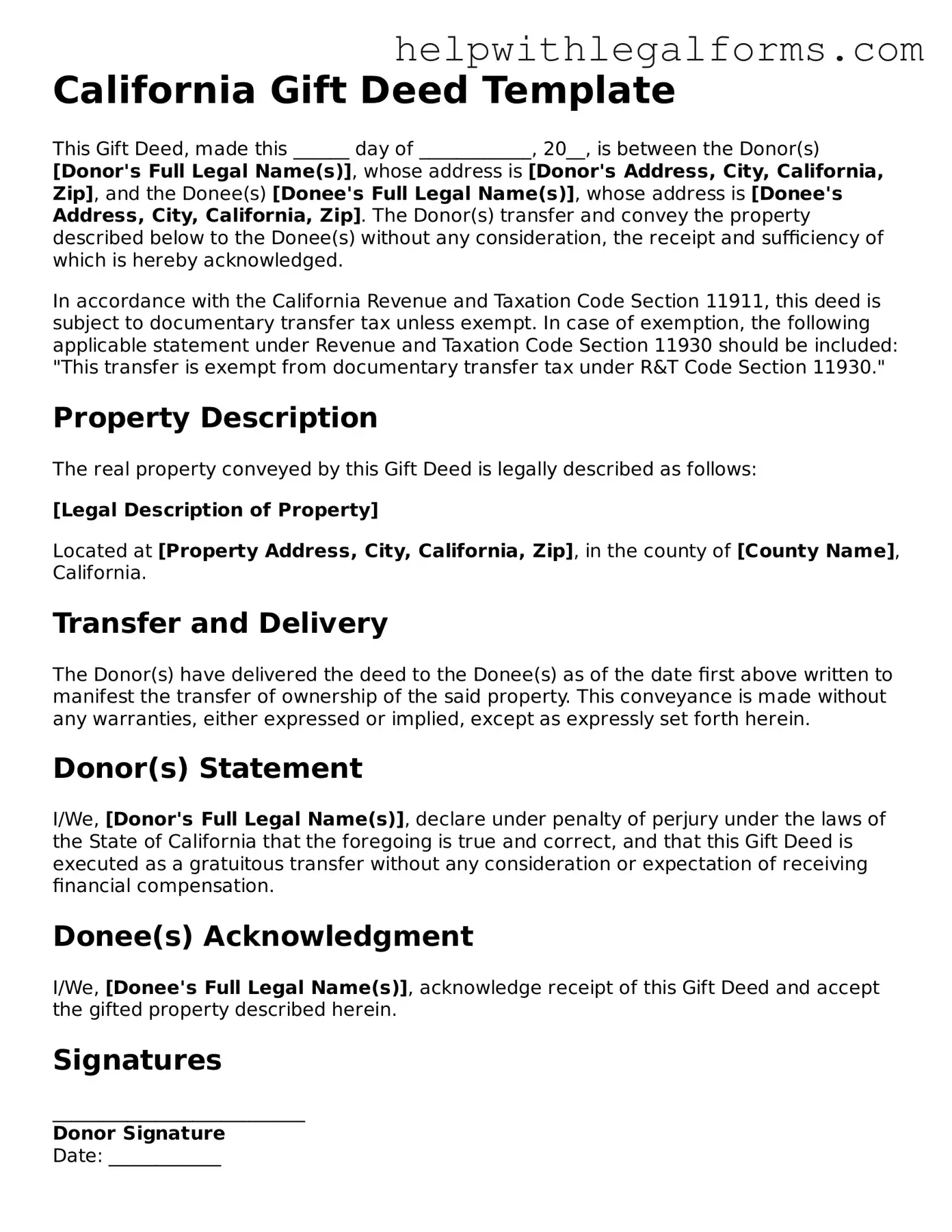

Example - California Gift Deed Form

California Gift Deed Template

This Gift Deed, made this ______ day of ____________, 20__, is between the Donor(s) [Donor's Full Legal Name(s)], whose address is [Donor's Address, City, California, Zip], and the Donee(s) [Donee's Full Legal Name(s)], whose address is [Donee's Address, City, California, Zip]. The Donor(s) transfer and convey the property described below to the Donee(s) without any consideration, the receipt and sufficiency of which is hereby acknowledged.

In accordance with the California Revenue and Taxation Code Section 11911, this deed is subject to documentary transfer tax unless exempt. In case of exemption, the following applicable statement under Revenue and Taxation Code Section 11930 should be included: "This transfer is exempt from documentary transfer tax under R&T Code Section 11930."

Property Description

The real property conveyed by this Gift Deed is legally described as follows:

[Legal Description of Property]

Located at [Property Address, City, California, Zip], in the county of [County Name], California.

Transfer and Delivery

The Donor(s) have delivered the deed to the Donee(s) as of the date first above written to manifest the transfer of ownership of the said property. This conveyance is made without any warranties, either expressed or implied, except as expressly set forth herein.

Donor(s) Statement

I/We, [Donor's Full Legal Name(s)], declare under penalty of perjury under the laws of the State of California that the foregoing is true and correct, and that this Gift Deed is executed as a gratuitous transfer without any consideration or expectation of receiving financial compensation.

Donee(s) Acknowledgment

I/We, [Donee's Full Legal Name(s)], acknowledge receipt of this Gift Deed and accept the gifted property described herein.

Signatures

___________________________

Donor Signature

Date: ____________

___________________________

Donee Signature

Date: ____________

Notary Public

This document was acknowledged before me on _________ [date] by [Name(s) of individual(s) who appeared], who is/are personally known to me or who has/have produced __________________ as identification.

___________________________

Notary Public Signature

My commission expires: ____________

PDF Form Attributes

| Fact Number | Description |

|---|---|

| 1 | A California Gift Deed form is used to transfer ownership of property from one person to another without any payment or consideration. |

| 2 | This form of deed indicates that the transfer is made as a gift, and expresses the donor's intent to make a gift of the property to the recipient. |

| 3 | Unlike other property deeds, the Gift Deed requires the donor to not receive any consideration or compensation in return. |

| 4 | To be valid, the Gift Deed must be signed by the donor in the presence of a notary public. |

| 5 | Once signed and notarized, the deed should be recorded with the county recorder's office in the county where the property is located. |

| 6 | The governing law for Gift Deeds in California is the California Civil Code, which outlines the requirements and validity of such deeds. |

| 7 | Gifting property through a Gift Deed may have tax implications for both the donor and the recipient, which should be considered before completing the transaction. |

Instructions on How to Fill Out California Gift Deed

Completing the California Gift Deed form is a straightforward process that enables an individual to transfer ownership of property to another without any exchange of money. This legal document is particularly beneficial for those looking to gift property to family members or friends. It’s important to fill out this form accurately to ensure the transfer is valid and legally binding. The steps below guide you through the necessary information and procedures to successfully complete the California Gift Deed form.

- Start by identifying the Donor (the person giving the gift) and the Donee (the person receiving the gift). Include their full legal names and addresses.

- Specify the County in California where the property is located. This is important because the form needs to be filed in the county where the property resides.

- Describe the property being gifted in detail. If it's real estate, include the physical address and legal description. This can typically be found on the property's current deed or tax bill.

- State the Relationship between the Donor and Donee, if any. This information might have implications on tax responsibilities for the Donee.

- Include any consideration paid for the gift, if applicable. In most gift deed scenarios, this amount will be $0, emphasizing the property is a gift, not a sale.

- Have the Donor sign and date the form in the presence of a Notary Public. The notarization is crucial for the document's legality.

- File the completed form with the County Recorder's Office in the county where the property is located. There may be a filing fee, which varies by county.

Once filed, the Gift Deed legally transfers the property to the Donee, free of any consideration. It’s recommended to keep copies of the filed deed for personal records. This step is the finale in the process of gifting property, ensuring the Donee assumes ownership without complications. Remember, it's essential to check with a legal professional or the County Recorder's Office if there are any uncertainties during this process.

Crucial Points on This Form

What is a California Gift Deed?

A California Gift Deed is a legal document used to transfer ownership of real property from one person (the donor) to another (the recipient) without any exchange of money or valuable consideration. This form of deed is typically used between family members or close friends when gifting property as a part of estate planning or as a generous act. Unlike other property deeds, a Gift Deed comes with the explicit understanding that the gift is irrevocable and made out of affection, regard, or for charitable reasons.

How does one execute a California Gift Deed effectively?

To effectively execute a California Gift Deed, several steps must be followed. Firstly, the deed must be in writing, clearly stating the donor's intention to make a gift of the property to the recipient. The legal description of the property being gifted must also be included. The deed needs to be signed by the donor in the presence of a notary public to ensure its validity. After notarization, it is crucial to record the deed with the County Recorder’s Office in the county where the property is located. This recording process makes the gift public record and finalizes the transfer of ownership.

Are there any tax implications when using a California Gift Deed?

Yes, there can be tax implications when using a California Gift Deed. The transfer of property as a gift may be subject to federal gift tax regulations. As of the last update, donors can gift up to a certain amount (the annual exclusion amount) to an individual each year without incurring gift tax. Amounts above this threshold may require the donor to file a federal gift tax return using IRS Form 709. However, the actual tax owed would depend on the donor's lifetime gift tax exclusion amount. It's advisable to consult with a tax professional to understand the specific implications based on individual circumstances.

Is consideration necessary for a California Gift Deed to be valid?

No, consideration is not necessary for a California Gift Deed to be valid. By definition, a gift deed is a transfer of property made voluntarily without receiving anything in return. The lack of consideration distinguishes a gift deed from other types of property transfers. For the deed to be valid, the donor must intend to make the gift and deliver the deed to the recipient, who then must accept the gift. If these conditions are met, the deed is considered valid and effective, transferring ownership of the property to the recipient without the need for consideration.

Common mistakes

The California Gift Deed form is a legal document used to transfer property from one person to another without any payment or consideration. This process might appear straightforward, but errors can easily occur if careful attention is not paid. Here are ten mistakes people often make when filling out a California Gift Deed form:

Failing to provide complete information on the donor and recipient, including full legal names, addresses, and relationships between the parties. This can lead to questions about the deed's validity.

Omitting or incorrectly stating the legal description of the property being gifted. This detail is crucial for the deed to be legally effective and to accurately record in public records.

Not having the Gift Deed notarized. California law requires most deeds to be notarized to be considered valid.

Forgetting to file the deed with the county recorder's office. If the deed is not properly recorded, future disputes may arise regarding the property ownership.

Misunderstanding the tax implications associated with gifting property. Although a Gift Deed transfers ownership, it may create tax obligations for the donor or recipient that should be carefully considered.

Assuming that a Gift Deed negates the need for a will or estate planning. While a Gift Deed transfers property immediately, comprehensive estate planning is recommended for all assets and future contingencies.

Overlooking the potential need for approval from a mortgage lender or adherence to local regulations, especially if the property is not fully paid off or has specific zoning laws.

Not specifying any conditions related to the gift, if applicable. While not common, some gifts are made with conditions attached, and these should be clearly outlined in the deed.

Using a standard form without consulting a legal professional. Each situation is unique, and generic forms may not address specific needs or legal concerns.

Ignoring the need to consult with all relevant parties, including family members or beneficiaries who might be impacted by the transfer of property.

When preparing a Gift Deed, individuals are encouraged to be diligent and thorough. Seeking the guidance of a professional can also help avoid these common mistakes, ensuring the property transfer is executed smoothly and legally.

Documents used along the form

When transferring property as a gift in California, a Gift Deed form is often not the only document you'll need to complete the transaction successfully. Several other forms and documents may be required to ensure the gift transfer is legally sound and properly recorded. These additional forms help in establishing the legal framework for the gift, as well as fulfilling state-specific recording requirements and tax implications. Here's a rundown of other forms and documents that are commonly used alongside a California Gift Deed.

- Preliminary Change of Ownership Report (PCOR): This form is filed with the county recorder's office alongside the deed. It provides the county with details of the transfer, helping to determine if the transaction is subject to reassessment under California law.

- Affidavit of Death: If the property is being transferred due to the death of the previous owner, this document is necessary to affirm the death, aiding in the transition of property ownership.

- Quitclaim Deed: While the Gift Deed transfers property without financial consideration, a Quitclaim Deed might be used in conjunction to clear any potential title issues by relinquishing any interest the giver may have in the property.

- Grant Deed: Depending on the circumstances, a Grant Deed may be required to guarantee that the property hasn’t been sold to someone else and that there are no encumbrances or liens against it, beyond what is publicly recorded.

- Trust Transfer Deed: If the property is held in a trust, this deed is used to transfer property out of, or into, a trust in California.

- Change in Ownership Statement Death of Real Property Owner: This statement is needed for the county assessor's office to reassess property taxes accurately when a property owner has passed away.

- Exemption Claim: Depending on the nature of the gift and the relationship between the giver and the receiver, an exemption claim may be filed to exclude the transfer from reassessment, which can affect property taxes.

Each of these documents plays a crucial role in the proper management and recording of a property gift in California. They ensure that all legal and tax implications are addressed, protecting both the giver and the recipient. While this list covers the most common additional documents, it's important to consult with a professional to understand all the specific requirements for your particular situation. Ensuring completeness and accuracy in this process can prevent potential legal challenges down the line.

Similar forms

Will: Like a Gift Deed, a Will specifies how an individual wants their assets to be distributed after their death. Both documents are used to transfer assets, though a Gift Deed operates during the giver's lifetime, while a Will takes effect after the individual's death.

Trust Deed: A Trust Deed, similar to a Gift Deed, involves transferring assets. The difference lies in how these assets are managed. With a Gift Deed, the transfer is direct and immediate without any conditions post-transfer, whereas a Trust Deed often involves managing the assets on behalf of another party, typically until certain conditions are met.

Quitclaim Deed: Both a Quitclaim Deed and a Gift Deed deal with transferring property rights from one person to another. The key distinction is that a Quitclaim Deed does not guarantee a clear title, and is often used between family members or close acquaintances for the transfer of ownership without a sale.

Warranty Deed: Like Gift Deeds, Warranty Deeds are used for the transfer of property. However, Warranty Deeds come with a guarantee from the seller to the buyer that the property has no undisclosed legal problems. In contrast, Gift Deeds transfer property as a gift without any warranty of title.

Power of Attorney (POA): POAs and Gift Deeds are instruments of giving. Through a POA, an individual grants someone else the authority to act on their behalf, often including the ability to transfer the individual’s assets. A Gift Deed, conversely, involves a one-time transfer of property or assets directly.

Promissory Note: A Promissory Note is an agreement to pay a certain amount of money, possibly similar to a Gift Deed if the transfer involves the fulfillment of a financial promise without exchange. The main difference is in their purpose: a Promissory Note is a vow to pay, while a Gift Deed is a document of transfer.

Life Estate Deed: This document allows the property owner to transfer their property while retaining the right to use it for their lifetime. Like Gift Deeds, Life Estate Deeds are tools for estate planning. The difference is that the former transfers ownership immediately and completely, while the latter does so conditionally and retains rights for the giver.

Transfer-on-Death (TOD) Deed: Both TOD Deeds and Gift Deeds enable the transfer of assets, but TOD Deeds only transfer the asset upon the death of the owner. This allows the owner to retain control over the asset during their lifetime, unlike a Gift Deed, where the transfer is immediate and irrevocable.

Bill of Sale: A Bill of Sale, like a Gift Deed, is used to transfer ownership of property (typically personal property as opposed to real estate) from one party to another. The main distinction is a Bill of Sale is commonly used in transactions involving payment, whereas a Gift Deed represents a transfer of ownership without consideration.

Dos and Don'ts

When completing a California Gift Deed form, it's important to proceed with care to ensure the transfer process goes smoothly and legally. A Gift Deed is a document used to transfer property ownership without any monetary exchange, often between family members or close friends. Here are nine essential dos and don'ts to keep in mind:

- Do verify that a Gift Deed is the appropriate document for your situation, considering the nature of the gift and your relationship to the recipient.

- Do ensure all parties' names are spelled correctly and match their identification documents to avoid delays or legal issues.

- Do include a detailed description of the property being gifted to eliminate any ambiguity about what is being transferred.

- Do have the Gift Deed signed in the presence of a notary public to authenticate the signatures and comply with state requirements.

- Do keep a copy of the completed Gift Deed for your records and provide another copy to the recipient for their records.

- Don't leave any sections of the form blank. If a section does not apply to your situation, mark it as "N/A" (not applicable) to indicate it was not overlooked.

- Don't forget to check if you need to file additional forms with the Gift Deed. Some counties may have specific requirements or forms that need to be completed.

- Don't overlook potential tax implications. While the deed itself transfers property without payment, the donor may need to file a gift tax return if the value of the gift exceeds the annual federal gift tax exclusion.

- Don't hesitate to seek the advice of a legal professional if you have questions or concerns about the process. It's better to get expert guidance than to make an avoidable mistake.

Misconceptions

When it comes to transferring property, few documents are as misunderstood as the California Gift Deed form. Let's peel away the layers of misconception and shed light on the truth of this frequently misinterpreted document. Here are nine common misconceptions about the California Gift Deed form:

Misconception #1: It's the same as a Will. Unlike a will, which becomes effective upon death, a Gift Deed transfers ownership of real property immediately upon execution and delivery without the need for probate.

Misconception #2: You can transfer property to anyone without tax implications. While a Gift Deed can indeed transfer real property to another party, it may trigger federal gift tax requirements and possible state tax implications. It's important to consult with a tax advisor regarding these potential costs.

Misconception #3: It allows the giver to take back the property anytime. Once a Gift Deed is executed and delivered, the giver (or donor) relinquishes all rights to the property, meaning they cannot legally reclaim the gift unless specific conditions are stated in the deed.

Misconception #4: A Gift Deed needs consideration to be valid. Unlike traditional purchase transactions that require a form of consideration (typically monetary), a Gift Deed transfers property as a gift, requiring no payment or consideration from the recipient (donee).

Misconception #5: It's valid once signed by the donor. For a Gift Deed to be legally valid in California, it must not only be signed by the donor but also acknowledged before a notary public and recorded with the county recorder's office in the county where the property is located.

Misconception #6: All Gift Deeds are irrevocable. Although most Gift Deeds are irrevocable, meaning they cannot be changed or taken back once completed, there are specific conditions under which a deed can be designed as revocable. However, this is less common and should be clearly stated in the deed itself.

Misconception #7: It's complicated and time-consuming to create. While it's true that proper legal advice is recommended when drafting any legal document, creating a Gift Deed in California doesn't have to be a complex process. With the correct information and guidance, it can be straightforward.

Misconception #8: Only real estate can be transferred with a Gift Deed. Although commonly used for the transfer of real property, a Gift Deed can also be used to transfer other types of tangible assets, though it's less common. The key is that the deed must clearly describe the gifted property.

Misconception #9: It offers no protection for the donee. While it's true that a Gift Deed, like any deed, primarily outlines the rights and responsibilities of the donor, it also serves to officially record and recognize the transfer of property. This serves as legal protection for the donee's ownership in public records.

By understanding what a Gift Deed is and what it is not, individuals can make informed decisions about transferring property and avoid common pitfalls. Whether you're considering gifting property now or planning for the future, it's crucial to get the facts straight and seek legal advice tailored to your situation.

Key takeaways

When considering the transfer of property through a gift in California, it is essential to understand the necessary steps and implications of using a Gift Deed. Here are nine key takeaways to guide you through the process:

- The Gift Deed form must be completely filled out, ensuring that all information is accurate and reflects the intentions of the parties involved. This includes the full names and addresses of both the giver (donor) and the recipient (donee).

- It is essential to clearly describe the property being gifted. This should include a legal description of the property, which is more detailed than just an address, to accurately identify it in public records.

- The document must explicitly state that no payment is expected or required in return for the property transferred, distinguishing the act as a gift.

- Both the donor and donee are required to sign the Gift Deed in the presence of a notary public. The notarization is a critical step, adding a layer of legal validity and protection against disputes.

- California law requires that the Gift Deed be filed with the County Recorder’s Office in the county where the property is located. This public recording formalizes the transfer and updates the property’s title records.

- Understand the potential tax implications of gifting property. While the Gift Deed transfers ownership, it does not necessarily exempt the donor from the federal gift tax. It’s advisable to consult with a tax professional.

- Prepare for a reappraisal of the property for property tax purposes. According to California law, the transfer of real property can trigger a reassessment, possibly affecting the property taxes charged to the donee.

- A Gift Deed is irrevocable once delivered and accepted, meaning the donor cannot change their mind and revoke the deed. Therefore, it's important to be fully committed to the transfer before executing the deed.

- Consider the long-term implications for the donee, including their responsibility for maintenance, taxes, and any mortgages or liens attached to the property. These future obligations should be thoroughly understood by all parties.

Completing and using a Gift Deed in California involves careful consideration and adherence to legal requirements. By understanding these key points, donors and donees can ensure a smooth and legally sound transfer of property.

Create Other Gift Deed Forms for US States

Transfer a Deed - This form instills confidence in both parties about the legitimacy and sincerity of the gift transaction.